正在加载图片...

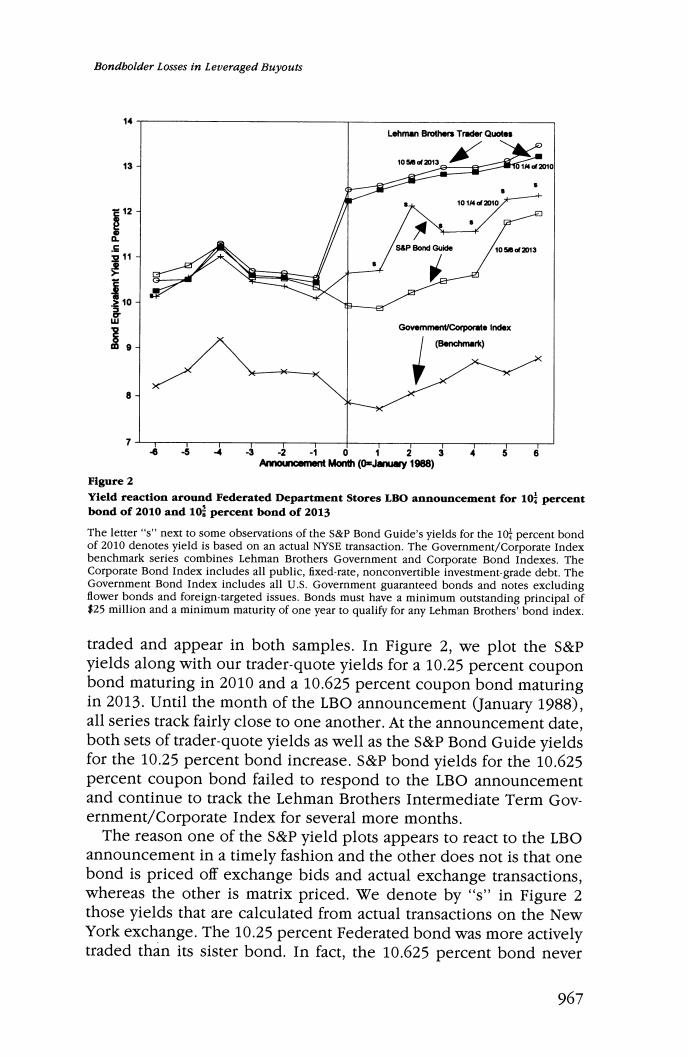

Bondbolder Losses in Leveraged Buyouts 14 Lehman Brothers Trader Quoles 13 102013 12 8d2013 11 Govemment/Corporate Index (Benchmark) 32 0 12345 Announcement Month (0=January 1988) Figure 2 Yield reaction around Federated Department Stores LBO announcement for 10 percent bond of 2010 and 10;percent bond of 2013 The letter"s"next to some observations of the s&P Bond Guide's yields for the 10 percent bond of 2010 denotes yield is based on an actual NYSE transaction.The Government/Corporate Index benchmark series combines Lehman Brothers Government and Corporate Bond Indexes.The Corporate Bond Index includes all public,fixed-rate,nonconvertible investment-grade debt.The Government Bond Index includes all U.S.Government guaranteed bonds and notes excluding flower bonds and foreign-targeted issues.Bonds must have a minimum outstanding principal of $25 million and a minimum maturity of one year to qualify for any Lehman Brothers'bond index. traded and appear in both samples.In Figure 2,we plot the s&P yields along with our trader-quote yields for a 10.25 percent coupon bond maturing in 2010 and a 10.625 percent coupon bond maturing in 2013.Until the month of the LBO announcement (January 1988), all series track fairly close to one another.At the announcement date, both sets of trader-quote yields as well as the s&P Bond Guide yields for the 10.25 percent bond increase.S&P bond yields for the 10.625 percent coupon bond failed to respond to the LBO announcement and continue to track the Lehman Brothers Intermediate Term Gov- ernment/Corporate Index for several more months. The reason one of the S&P yield plots appears to react to the LBO announcement in a timely fashion and the other does not is that one bond is priced off exchange bids and actual exchange transactions, whereas the other is matrix priced.We denote by "s"in Figure 2 those yields that are calculated from actual transactions on the New York exchange.The 10.25 percent Federated bond was more actively traded than its sister bond.In fact,the 10.625 percent bond never 967