正在加载图片...

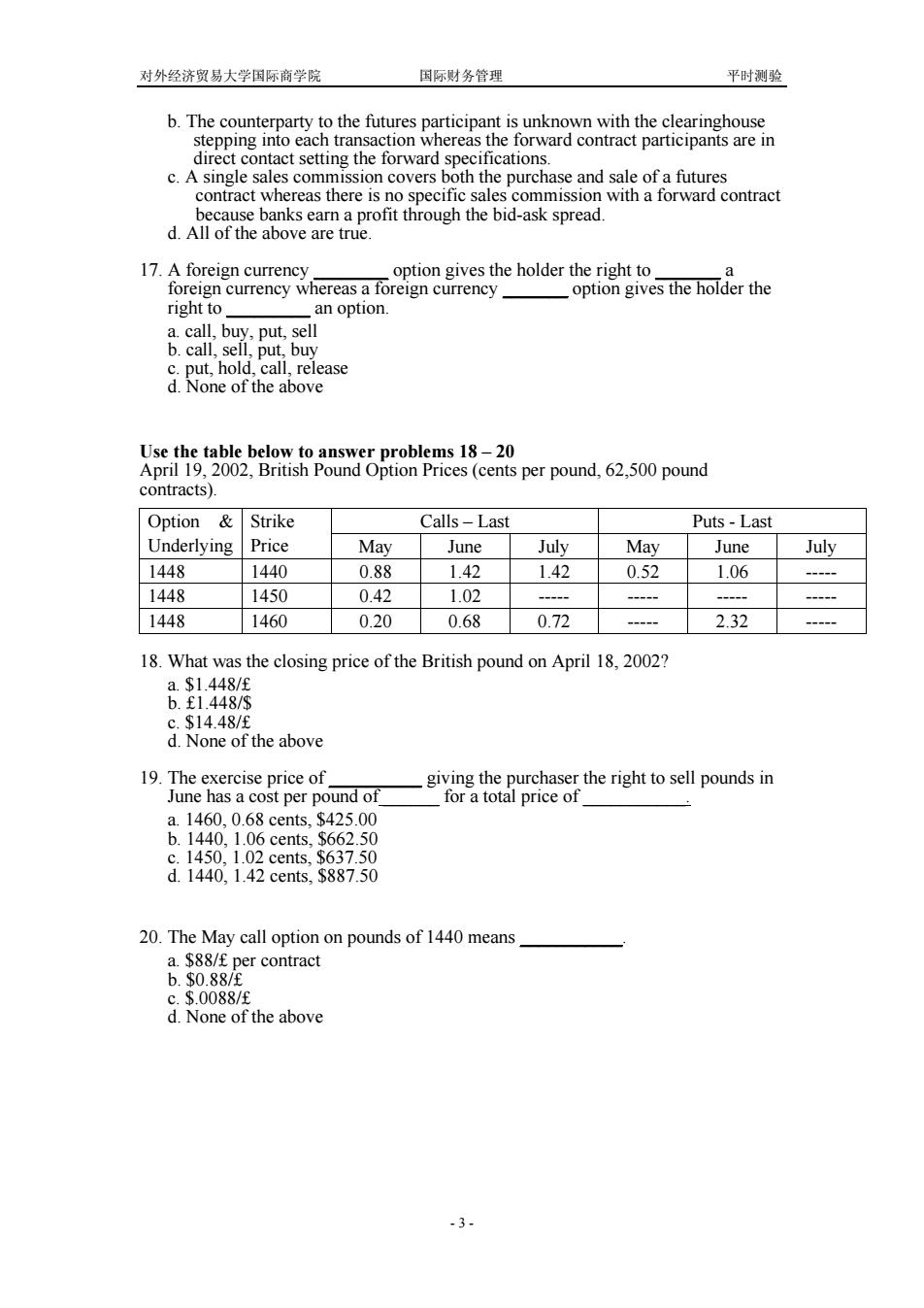

对外经济贸易大学国际商学院 国际财务管理 平时测验 b.The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications. c.A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread. d.All of the above are true. 17.A foreign currency option gives the holder the right to foreign currency whereas a foreign currency option gives the holder the right to an option a.call,buy,put,sell b.call,sell,put,buy c.put,hold,call,release d.None of the above Use the table below to answer problems 18-20 April 19,2002,British Pound Option Prices(cents per pound,62,500 pound contracts). Option & Strike Calls-Last Puts-Last Underlying Price May June July May June July 1448 1440 0.88 1.42 1.42 0.52 1.06 1448 1450 0.42 1.02 --- 1448 1460 0.20 0.68 0.72 2.32 18.What was the closing price of the British pound on April 18,2002? a.$1.448/E b.£1.448/$ c.$14.48/E d.None of the above 19.The exercise price of giving the purchaser the right to sell pounds in June has a cost per pound of for a total price of a.1460,0.68 cents,$425.00 b.1440,1.06 cents,.$662.50 c.1450,1.02 cents,.$637.50 d.1440,1.42 cents,.$887.50 20.The May call option on pounds of 1440 means a.$88/f per contract b.$0.88/E c.$.0088/E d.None of the above -3-对外经济贸易大学国际商学院 国际财务管理 平时测验 b. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications. c. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread. d. All of the above are true. 17. A foreign currency ________ option gives the holder the right to _______ a foreign currency whereas a foreign currency _______ option gives the holder the right to _________ an option. a. call, buy, put, sell b. call, sell, put, buy c. put, hold, call, release d. None of the above Use the table below to answer problems 18 – 20 April 19, 2002, British Pound Option Prices (cents per pound, 62,500 pound contracts). Option & Calls – Last Puts - Last Underlying Strike Price May June July May June July 1448 1440 0.88 1.42 1.42 0.52 1.06 ----- 1448 1450 0.42 1.02 ----- ----- ----- ----- 1448 1460 0.20 0.68 0.72 ----- 2.32 ----- 18. What was the closing price of the British pound on April 18, 2002? a. $1.448/£ b. £1.448/$ c. $14.48/£ d. None of the above 19. The exercise price of __________ giving the purchaser the right to sell pounds in June has a cost per pound of ______ for a total price of ___________. a. 1460, 0.68 cents, $425.00 b. 1440, 1.06 cents, $662.50 c. 1450, 1.02 cents, $637.50 d. 1440, 1.42 cents, $887.50 20. The May call option on pounds of 1440 means ___________. a. $88/£ per contract b. $0.88/£ c. $.0088/£ d. None of the above - 3 -