对外经济贸易大学国际商学院 国际财务管理 平时测验 Test 1 1.Major differences between international and domestic financial management include all of the following EXCEPT: a.political risk b. foreign exchange risk C. corporate governance d.All of the factors above involve differences between international and domestic financial management. 2.The post WWII international monetary agreement that was developed in 1944 is known as the a.United Nations b.League of Nations c.Yalta Agreement d.Bretton Woods Agreement 3.Which of the following is a way in which the Euro affects markets? a.Countries within the Euro zone enjoy cheaper transaction costs. b.Currency risks and costs related to exchange rate uncertainty are reduced. c.Consumers and business enjoy price transparency and increased price-based competition. d.All of the above 4.Balance of payment(BOP)data may be important for any of the following reasons a.BOP data helps to forecast a country's market potential,especially in the short run b.The BOP is an important indicator of a country's foreign exchange rate c.Changes in a country's BOP may signal a change in controls over payment of dividends and interest d.All of the above 6.A/An is an agreement between a buyer and seller that a fixed amount of one currency will be delivered at a specified rate for some other currency. a.Eurodollar transaction b.import/Export exchange c.foreign exchange transaction d.interbank market transaction 7.Foreign exchange earn a profit by a bid-ask spread on currencies they purchase and sell.Foreign exchange on the other hand earn a profit by bringing together buyers and sellers of foreign currencies and earning a commission on each sale and purchase. a.central banks;treasuries b.dealers;brokers c.brokers;dealers d.speculators;arbitragers 8.Which of the following is NOT one of the three categories reported for foreign exchange? a.Spot transactions b.Swap transactions 1-

对外经济贸易大学国际商学院 国际财务管理 平时测验 Test 1 1. Major differences between international and domestic financial management include all of the following EXCEPT: a. political risk b. foreign exchange risk c. corporate governance d. All of the factors above involve differences between international and domestic financial management. 2. The post WWII international monetary agreement that was developed in 1944 is known as the ___________________. a. United Nations b. League of Nations c. Yalta Agreement d. Bretton Woods Agreement 3. Which of the following is a way in which the Euro affects markets? a. Countries within the Euro zone enjoy cheaper transaction costs. b. Currency risks and costs related to exchange rate uncertainty are reduced. c. Consumers and business enjoy price transparency and increased price-based competition. d. All of the above 4. Balance of payment (BOP) data may be important for any of the following reasons a. BOP data helps to forecast a country’s market potential, especially in the short run b. The BOP is an important indicator of a country’s foreign exchange rate c. Changes in a country’s BOP may signal a change in controls over payment of dividends and interest d. All of the above 6. A/An __________________ is an agreement between a buyer and seller that a fixed amount of one currency will be delivered at a specified rate for some other currency. a. Eurodollar transaction b. import/Export exchange c. foreign exchange transaction d. interbank market transaction 7. Foreign exchange _______________ earn a profit by a bid-ask spread on currencies they purchase and sell. Foreign exchange _________________, on the other hand earn a profit by bringing together buyers and sellers of foreign currencies and earning a commission on each sale and purchase. a. central banks; treasuries b. dealers; brokers c. brokers; dealers d. speculators; arbitragers 8. Which of the following is NOT one of the three categories reported for foreign exchange? a. Spot transactions b. Swap transactions - 1 -

对外经济贸易大学国际商学院 国际财务管理 平时测验 c.Strip transactions d.Futures transactions 9.A transaction in the foreign exchange market requires delivery of foreign exchange at some future date. a.spot b.forward c.swap d.currency 10.A forward contract to deliver British pounds for U.S.dollars could be described either as or a.buying dollars forward;buying pounds forward b.selling pounds forward;selling dollars forward c.selling pounds forward;buying dollars forward d.selling dollars forward;buying pounds forward 11.Most foreign exchange transactions are through the U.S.dollar.If the transaction is expressed as the foreign currency per dollar this known as whereas are expressed as dollars per foreign unit. a.European terms;indirect b.American terms:direct c.American terms;European terms d.European terms;American terms 12.The date of settlement for a foreign exchange transaction is referred to as: a.Value date b.Maturity date c.Swap date d.Transaction date 13.A foreign currency contract calls for the future delivery of a standard amount of foreign exchange at a fixed time,place,and price. a.futures b.forward c.option d.swap 14.A speculator in the futures market wishing to lock in a price at which they could a foreign currency will a futures contract. a.buy;sell b.sell;buy c.buy;buy d.None of the above 15.A speculator that has a futures contract has taken a position a.sold;long b.purchased:short c.sold;short d.purchased:sold 16 Which of the following is NOT a difference between a currency futures contract and a forward contract? a.The futures contract is marked to market daily whereas the forward contract is only due to be settled at maturity. -2-

对外经济贸易大学国际商学院 国际财务管理 平时测验 c. Strip transactions d. Futures transactions 9. A ________ transaction in the foreign exchange market requires delivery of foreign exchange at some future date. a. spot b. forward c. swap d. currency 10. A forward contract to deliver British pounds for U.S. dollars could be described either as ______ or _______________. a. buying dollars forward; buying pounds forward b. selling pounds forward; selling dollars forward c. selling pounds forward; buying dollars forward d. selling dollars forward; buying pounds forward 11. Most foreign exchange transactions are through the U.S. dollar. If the transaction is expressed as the foreign currency per dollar this known as _____________ whereas ___________ are expressed as dollars per foreign unit. a. European terms; indirect b. American terms; direct c. American terms; European terms d. European terms; American terms 12. The date of settlement for a foreign exchange transaction is referred to as: a. Value date b. Maturity date c. Swap date d. Transaction date 13. A foreign currency ___________ contract calls for the future delivery of a standard amount of foreign exchange at a fixed time, place, and price. a. futures b. forward c. option d. swap 14. A speculator in the futures market wishing to lock in a price at which they could _______ a foreign currency will ________ a futures contract. a. buy; sell b. sell; buy c. buy; buy d. None of the above 15. A speculator that has ______ a futures contract has taken a ________ position. a. sold; long b. purchased; short c. sold; short d. purchased; sold 16 Which of the following is NOT a difference between a currency futures contract and a forward contract? a. The futures contract is marked to market daily whereas the forward contract is only due to be settled at maturity. - 2 -

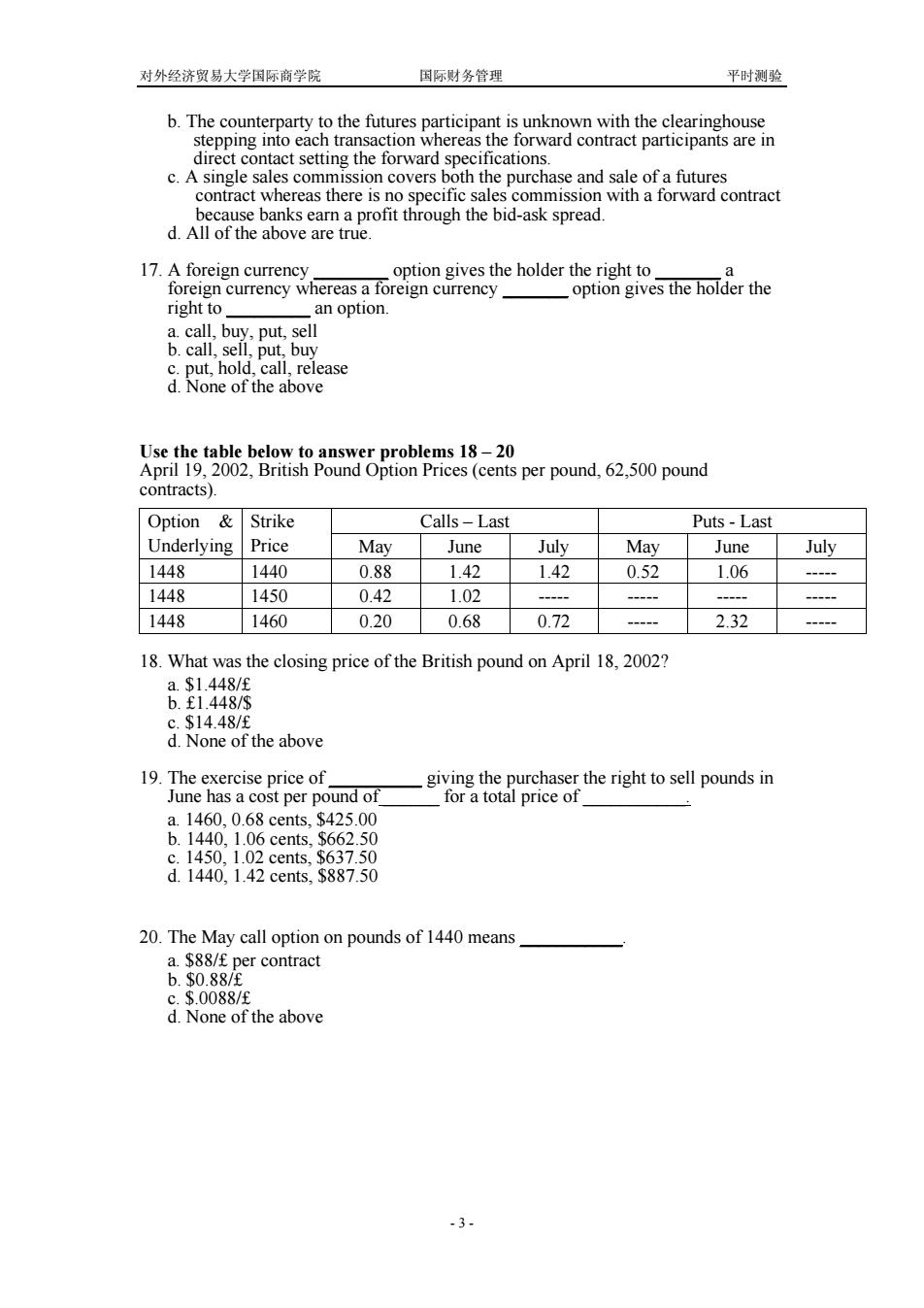

对外经济贸易大学国际商学院 国际财务管理 平时测验 b.The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications. c.A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread. d.All of the above are true. 17.A foreign currency option gives the holder the right to foreign currency whereas a foreign currency option gives the holder the right to an option a.call,buy,put,sell b.call,sell,put,buy c.put,hold,call,release d.None of the above Use the table below to answer problems 18-20 April 19,2002,British Pound Option Prices(cents per pound,62,500 pound contracts). Option & Strike Calls-Last Puts-Last Underlying Price May June July May June July 1448 1440 0.88 1.42 1.42 0.52 1.06 1448 1450 0.42 1.02 --- 1448 1460 0.20 0.68 0.72 2.32 18.What was the closing price of the British pound on April 18,2002? a.$1.448/E b.£1.448/$ c.$14.48/E d.None of the above 19.The exercise price of giving the purchaser the right to sell pounds in June has a cost per pound of for a total price of a.1460,0.68 cents,$425.00 b.1440,1.06 cents,.$662.50 c.1450,1.02 cents,.$637.50 d.1440,1.42 cents,.$887.50 20.The May call option on pounds of 1440 means a.$88/f per contract b.$0.88/E c.$.0088/E d.None of the above -3-

对外经济贸易大学国际商学院 国际财务管理 平时测验 b. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications. c. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread. d. All of the above are true. 17. A foreign currency ________ option gives the holder the right to _______ a foreign currency whereas a foreign currency _______ option gives the holder the right to _________ an option. a. call, buy, put, sell b. call, sell, put, buy c. put, hold, call, release d. None of the above Use the table below to answer problems 18 – 20 April 19, 2002, British Pound Option Prices (cents per pound, 62,500 pound contracts). Option & Calls – Last Puts - Last Underlying Strike Price May June July May June July 1448 1440 0.88 1.42 1.42 0.52 1.06 ----- 1448 1450 0.42 1.02 ----- ----- ----- ----- 1448 1460 0.20 0.68 0.72 ----- 2.32 ----- 18. What was the closing price of the British pound on April 18, 2002? a. $1.448/£ b. £1.448/$ c. $14.48/£ d. None of the above 19. The exercise price of __________ giving the purchaser the right to sell pounds in June has a cost per pound of ______ for a total price of ___________. a. 1460, 0.68 cents, $425.00 b. 1440, 1.06 cents, $662.50 c. 1450, 1.02 cents, $637.50 d. 1440, 1.42 cents, $887.50 20. The May call option on pounds of 1440 means ___________. a. $88/£ per contract b. $0.88/£ c. $.0088/£ d. None of the above - 3 -