尉纤活价蜀高上学 国际财务管理 案例讨论 Reading Material of International Financial Management Case Study 1:Linear Sequence in Manufacturing:Singer Company Singer was one of the first United States-based companies that internationalized its operations In August 1850,I.M Singer invented a sewing ma-chine and established I.M Singer Company in New York in 1851 to manufacture and sell the machines in the United States.To protect this innovative product,Singer had applied for and obtained domestic and some foreign patents by 1851.Until 1855,the company concentrated on fine-tuning its operations in the domestic market. The first step towards internationalizing took place in 1855,when Singer Co.sold its French patent for the single thread machine to a French merchant for a combination of lump-sum payment and royalties.This proved to be a bad experience for Singer as the French merchant was reluctant to pay royalties and handled competitors'products,leading to disputes and discouraging singer from selling foreign patents to independent businessmen.By 1856,Singer stopped granting territorial rights to independents in the domestic market due to bad experiences and began establishing its own sales outlets.Independent agents were not providing user instructions to buyers and failed to offer servicing.They were also reluctant to risk their capital by providing installment payments as well as carrying large inventories. Learning from its domestic problems,singer used franchised agents as a mode of entry abroad;they sold and advertised the company's product in a given region.By 1858,Singer had independent businesspersons as foreign agents in Rio de Janeiro and elsewhere.Between September 1860 and May 1861,the company exported 127 machines to agents in Canada,Cuba,Curacao,Ger-many,Mexico,Peru,Puerto Rico, Uruguay,and Venezuela,Due to its domestic experience,Singer sped up the linear sequence,sometimes simultaneously using both franchised agents and its own sales outlets. Singer also started extending its policy of establishing sales outlets to foreign markets.By 1861,it had salaried representatives in Glasgow and London.They established additional branches in England,to each of which the machines were sold on commission.By 1862,Singer was facing competition in England from imitators. Foreign Sales of Singer machines increased steadily as the company was able to sell machines abroad at prices lower than in the United States because of the un-devaluation of the dollar.In 1863,Singer opened a sales office in Hamburg, Germany,and later in Sweden,By 1886,the European demand for Singer machines surpassed supplies and competitors to were taking advantage of Singer's inability to supply the machines.After the Civil War,the United States currency appreciated;at the same time,wages in the United States began to rise,increasing manufacturing costs and affecting firms'international competitiveness.As a result,some United States firms started establishing factories abroad. -1-

国际财务管理 案例讨论 - 1 - Reading Material of International Financial Management Case Study 1:Linear Sequence in Manufacturing: Singer Company Singer was one of the first United States-based companies that internationalized its operations In August 1850, I.M Singer invented a sewing ma-chine and established I.M Singer Company in New York in 1851 to manufacture and sell the machines in the United States. To protect this innovative product, Singer had applied for and obtained domestic and some foreign patents by 1851. Until 1855, the company concentrated on fine-tuning its operations in the domestic market. The first step towards internationalizing took place in 1855, when Singer Co. sold its French patent for the single thread machine to a French merchant for a combination of lump-sum payment and royalties. This proved to be a bad experience for Singer as the French merchant was reluctant to pay royalties and handled competitors’ products, leading to disputes and discouraging singer from selling foreign patents to independent businessmen. By 1856,Singer stopped granting territorial rights to independents in the domestic market due to bad experiences and began establishing its own sales outlets. Independent agents were not providing user instructions to buyers and failed to offer servicing. They were also reluctant to risk their capital by providing installment payments as well as carrying large inventories. Learning from its domestic problems, singer used franchised agents as a mode of entry abroad; they sold and advertised the company’s product in a given region. By 1858, Singer had independent businesspersons as foreign agents in Rio de Janeiro and elsewhere. Between September 1860 and May 1861, the company exported 127 machines to agents in Canada, Cuba, Curacao, Ger-many, Mexico, Peru, Puerto Rico, Uruguay, and Venezuela, Due to its domestic experience, Singer sped up the linear sequence, sometimes simultaneously using both franchised agents and its own sales outlets. Singer also started extending its policy of establishing sales outlets to foreign markets. By 1861, it had salaried representatives in Glasgow and London. They established additional branches in England, to each of which the machines were sold on commission. By 1862,Singer was facing competition in England from imitators. Foreign Sales of Singer machines increased steadily as the company was able to sell machines abroad at prices lower than in the United States because of the un-devaluation of the dollar. In 1863,Singer opened a sales office in Hamburg, Germany, and later in Sweden, By 1886,the European demand for Singer machines surpassed supplies and competitors to were taking advantage of Singer’s inability to supply the machines. After the Civil War, the United States currency appreciated; at the same time, wages in the United States began to rise, increasing manufacturing costs and affecting firms’ international competitiveness. As a result, some United States firms started establishing factories abroad

尉纤活价蜀高上学 国际财务管理 案例讨论 In 1868,Singer established a small assembly factory in Glasgow,with parts imported from the United States.The venture proved to be successful and,by 1896, Singer started replacing locally financed independent agents with salaried-plus-commission agents.By 1879,its London regional headquarters had26 offices in the United Kingdom and one each in Paris,Madrid,Brussels,Milan,Basel, Capetown,Bombay,and Auckland. By the 1880s,the company had a strong foreign sales organization,with the London regional headquarters taking the responsibility for sales in Australia,Asia, Africa,the southern part of South America,the United Kingdom,and a large part of the European continent.The Hamburg office was in charge of northern and middle Europe,while the New York office looked after sales in the Caribbean,Mexico,the northern part of South America and Canada.By 1881,the capacity in Singer's three factories in Glasgow was insufficient to meet demand.Therefore,in 1882,Singer established a modern plant in Kilbowie near Glasgow with the latest United States machine tools and with a capacity equivalent to that of its largest factory in the United States.In 1883,Singer set up manufacturing plants in Canada and Australia,Through experience,Singer learned that it could manufacture more cost effectively in Scotland than in the United States for sales in Europe and other markets. Source:World Investment Report 1996,UNCTAD,p 77. Case Study 2:MCI's New Extension:Merging with British Telecom Gives the American Upstart the Muscle to attack Local Phone Markets. For more than two decades,scrappy long-distance carrier MCI has clamped onto AT&T like a demented terrier on a mailman's ankles and refused to let go.It was MCI's antitrust charges against the old Ma Bell that led to the breakup of AT&T's telephone monopoly.Now MCI is joining forces with British Telecommunications-Britain's formerly state-owned telephone company-to form an empire with the clout to go phone-to-phone around the world with AT&T and other giants. In what would be the largest foreign buyout of a US company if regulators approve it(an uncertain prospect,given likely resistance from rivals like AT&T).BT agreed Nov.3 to pay about $21 billion for the 80%of MCI it does not already own.The merged company,to be called Concert,taking the name of a joint venture between the two,would have $42billion in revenues and match AT&T in market value.The new colossus,boasts MCI chairman Bert Roberts,"will trump the competition as we open up communications markets both domestically and around the world." Roberts is referring to the first of two trends that are driving the telecommunications industry toward consolidation.Deregulation-in the U.S.,Western Europe and increasingly in South America and Asia-is turning cozy,inefficient -2-

国际财务管理 案例讨论 - 2 - In 1868, Singer established a small assembly factory in Glasgow, with parts imported from the United States. The venture proved to be successful and, by 1896, Singer started replacing locally financed independent agents with salaried-plus-commission agents. By 1879, its London regional headquarters had26 offices in the United Kingdom and one each in Paris, Madrid, Brussels, Milan, Basel, Capetown, Bombay, and Auckland. By the 1880s, the company had a strong foreign sales organization, with the London regional headquarters taking the responsibility for sales in Australia, Asia, Africa, the southern part of South America, the United Kingdom, and a large part of the European continent. The Hamburg office was in charge of northern and middle Europe, while the New York office looked after sales in the Caribbean, Mexico, the northern part of South America and Canada. By 1881, the capacity in Singer’s three factories in Glasgow was insufficient to meet demand. Therefore, in 1882, Singer established a modern plant in Kilbowie near Glasgow with the latest United States machine tools and with a capacity equivalent to that of its largest factory in the United States. In 1883, Singer set up manufacturing plants in Canada and Australia, Through experience, Singer learned that it could manufacture more cost effectively in Scotland than in the United States for sales in Europe and other markets. Source: World Investment Report 1996,UNCTAD, p 77. Case Study 2:MCI’s New Extension: Merging with British Telecom Gives the American Upstart the Muscle to attack Local Phone Markets. For more than two decades, scrappy long-distance carrier MCI has clamped onto AT&T like a demented terrier on a mailman’s ankles and refused to let go. It was MCI’s antitrust charges against the old Ma Bell that led to the breakup of AT&T’s telephone monopoly. Now MCI is joining forces with British Telecommunications-Britain’s formerly state-owned telephone company-to form an empire with the clout to go phone-to-phone around the world with AT&T and other giants. In what would be the largest foreign buyout of a US company if regulators approve it (an uncertain prospect, given likely resistance from rivals like AT&T).BT agreed Nov. 3 to pay about $21 billion for the 80%of MCI it does not already own. The merged company,to be called Concert,taking the name of a joint venture between the two, would have $42billion in revenues and match AT&T in market value. The new colossus, boasts MCI chairman Bert Roberts, “will trump the competition as we open up communications markets both domestically and around the world.” Roberts is referring to the first of two trends that are driving the telecommunications industry toward consolidation. Deregulation-in the U.S., Western Europe and increasingly in South America and Asia-is turning cozy, inefficient

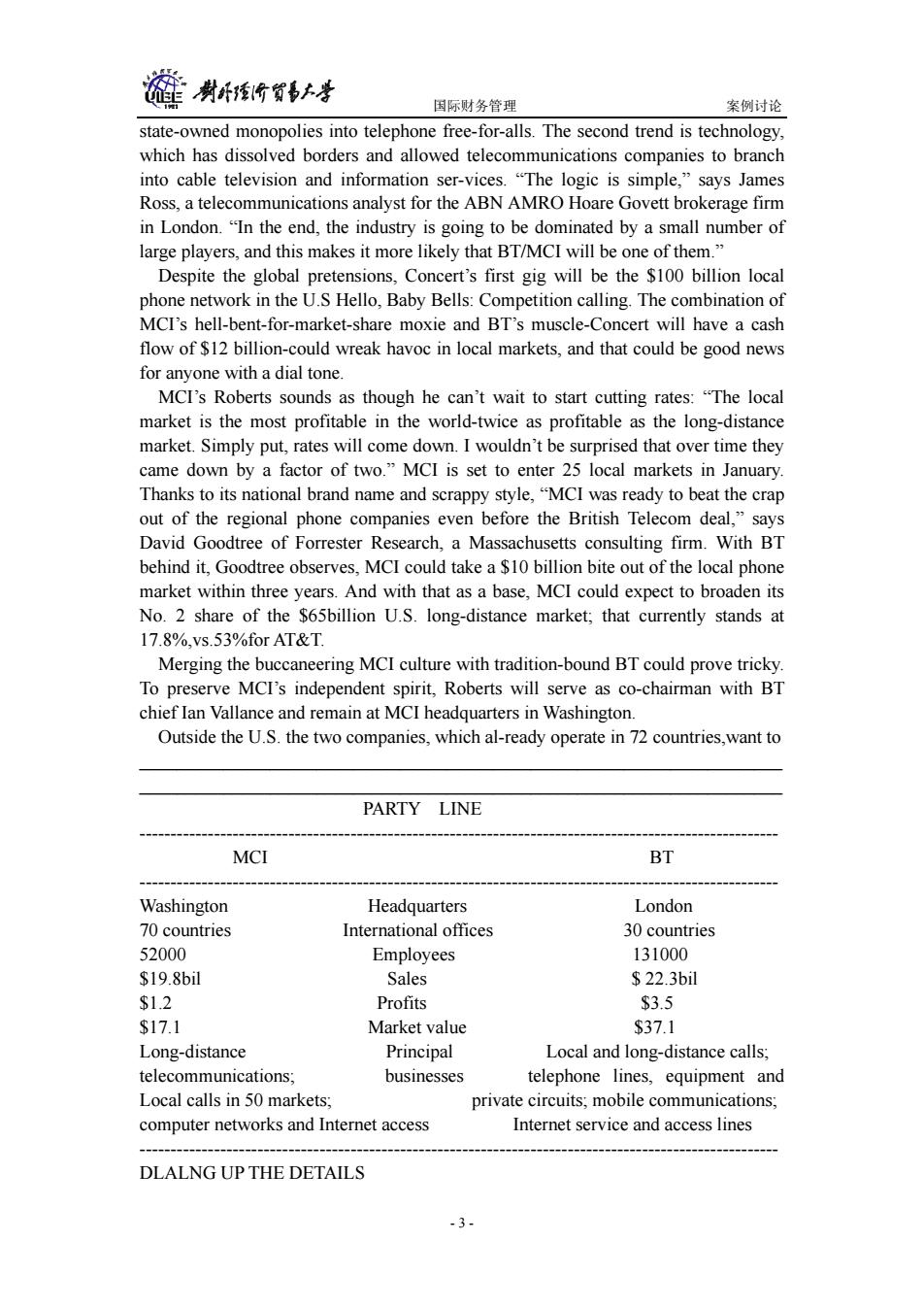

国际财务管理 案例讨论 state-owned monopolies into telephone free-for-alls.The second trend is technology, which has dissolved borders and allowed telecommunications companies to branch into cable television and information ser-vices."The logic is simple,"says James Ross,a telecommunications analyst for the ABN AMRO Hoare Govett brokerage firm in London."In the end,the industry is going to be dominated by a small number of large players,and this makes it more likely that BT/MCI will be one of them." Despite the global pretensions,Concert's first gig will be the $100 billion local phone network in the U.S Hello,Baby Bells:Competition calling.The combination of MCI's hell-bent-for-market-share moxie and BT's muscle-Concert will have a cash flow of $12 billion-could wreak havoc in local markets,and that could be good news for anyone with a dial tone. MCI's Roberts sounds as though he can't wait to start cutting rates:"The local market is the most profitable in the world-twice as profitable as the long-distance market.Simply put,rates will come down.I wouldn't be surprised that over time they came down by a factor of two."MCI is set to enter 25 local markets in January. Thanks to its national brand name and scrappy style,"MCI was ready to beat the crap out of the regional phone companies even before the British Telecom deal,"says David Goodtree of Forrester Research,a Massachusetts consulting firm.With BT behind it,Goodtree observes,MCI could take a $10 billion bite out of the local phone market within three years.And with that as a base,MCI could expect to broaden its No.2 share of the $65billion U.S.long-distance market;that currently stands at 17.8%,Vs.53%for AT&T. Merging the buccaneering MCI culture with tradition-bound BT could prove tricky. To preserve MCI's independent spirit,Roberts will serve as co-chairman with BT chief Ian Vallance and remain at MCI headquarters in Washington. Outside the U.S.the two companies,which al-ready operate in 72 countries,want to PARTY LINE MCI BT Washington Headquarters London 70 countries International offices 30 countries 52000 Employees 131000 $19.8bil Sales $22.3bil $1.2 Profits $3.5 $17.1 Market value $37.1 Long-distance Principal Local and long-distance calls; telecommunications; businesses telephone lines,equipment and Local calls in 50 markets; private circuits;mobile communications; computer networks and Internet access Internet service and access lines DLALNG UP THE DETAILS -3

国际财务管理 案例讨论 - 3 - state-owned monopolies into telephone free-for-alls. The second trend is technology, which has dissolved borders and allowed telecommunications companies to branch into cable television and information ser-vices. “The logic is simple,” says James Ross, a telecommunications analyst for the ABN AMRO Hoare Govett brokerage firm in London. “In the end, the industry is going to be dominated by a small number of large players, and this makes it more likely that BT/MCI will be one of them.” Despite the global pretensions, Concert’s first gig will be the $100 billion local phone network in the U.S Hello, Baby Bells: Competition calling. The combination of MCI’s hell-bent-for-market-share moxie and BT’s muscle-Concert will have a cash flow of $12 billion-could wreak havoc in local markets, and that could be good news for anyone with a dial tone. MCI’s Roberts sounds as though he can’t wait to start cutting rates: “The local market is the most profitable in the world-twice as profitable as the long-distance market. Simply put, rates will come down. I wouldn’t be surprised that over time they came down by a factor of two.” MCI is set to enter 25 local markets in January. Thanks to its national brand name and scrappy style, “MCI was ready to beat the crap out of the regional phone companies even before the British Telecom deal,” says David Goodtree of Forrester Research, a Massachusetts consulting firm. With BT behind it, Goodtree observes, MCI could take a $10 billion bite out of the local phone market within three years. And with that as a base, MCI could expect to broaden its No. 2 share of the $65billion U.S. long-distance market; that currently stands at 17.8%,vs.53%for AT&T. Merging the buccaneering MCI culture with tradition-bound BT could prove tricky. To preserve MCI’s independent spirit, Roberts will serve as co-chairman with BT chief Ian Vallance and remain at MCI headquarters in Washington. Outside the U.S. the two companies, which al-ready operate in 72 countries,want to _____________________________________________________________________ _____________________________________________________________________ PARTY LINE ------------------------------------------------------------------------------------------------------- MCI BT ------------------------------------------------------------------------------------------------------- Washington Headquarters London 70 countries International offices 30 countries 52000 Employees 131000 $19.8bil Sales $ 22.3bil $1.2 Profits $3.5 $17.1 Market value $37.1 Long-distance Principal Local and long-distance calls; telecommunications; businesses telephone lines, equipment and Local calls in 50 markets; private circuits; mobile communications; computer networks and Internet access Internet service and access lines ------------------------------------------------------------------------------------------------------- DLALNG UP THE DETAILS

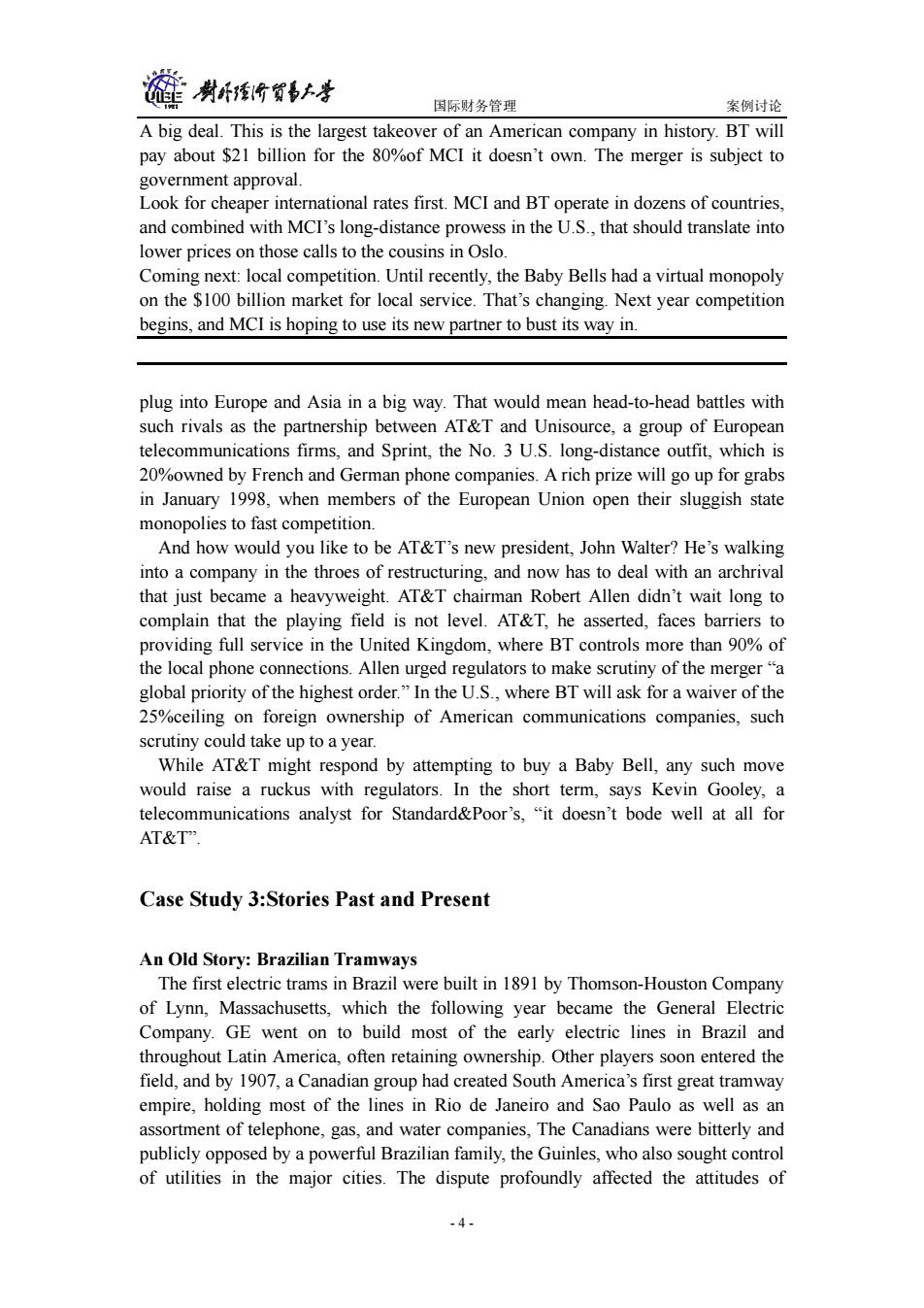

尉纤活价贸品上孝 国际财务管理 案例讨论 A big deal.This is the largest takeover of an American company in history.BT will pay about $21 billion for the 80%of MCI it doesn't own.The merger is subject to government approval. Look for cheaper international rates first.MCI and BT operate in dozens of countries, and combined with MCI's long-distance prowess in the U.S.,that should translate into lower prices on those calls to the cousins in Oslo. Coming next:local competition.Until recently,the Baby Bells had a virtual monopoly on the $100 billion market for local service.That's changing.Next year competition begins,and MCI is hoping to use its new partner to bust its way in. plug into Europe and Asia in a big way.That would mean head-to-head battles with such rivals as the partnership between AT&T and Unisource,a group of European telecommunications firms,and Sprint,the No.3 U.S.long-distance outfit,which is 20%owned by French and German phone companies.A rich prize will go up for grabs in January 1998,when members of the European Union open their sluggish state monopolies to fast competition. And how would you like to be AT&T's new president,John Walter?He's walking into a company in the throes of restructuring,and now has to deal with an archrival that just became a heavyweight.AT&T chairman Robert Allen didn't wait long to complain that the playing field is not level.AT&T,he asserted,faces barriers to providing full service in the United Kingdom,where BT controls more than 90%of the local phone connections.Allen urged regulators to make scrutiny of the merger"a global priority of the highest order."In the U.S.,where BT will ask for a waiver of the 25%ceiling on foreign ownership of American communications companies,such scrutiny could take up to a year. While AT&T might respond by attempting to buy a Baby Bell,any such move would raise a ruckus with regulators.In the short term,says Kevin Gooley,a telecommunications analyst for Standard&Poor's,"it doesn't bode well at all for AT&T" Case Study 3:Stories Past and Present An Old Story:Brazilian Tramways The first electric trams in Brazil were built in 1891 by Thomson-Houston Company of Lynn,Massachusetts,which the following year became the General Electric Company.GE went on to build most of the early electric lines in Brazil and throughout Latin America,often retaining ownership.Other players soon entered the field,and by 1907,a Canadian group had created South America's first great tramway empire,holding most of the lines in Rio de Janeiro and Sao Paulo as well as an assortment of telephone,gas,and water companies,The Canadians were bitterly and publicly opposed by a powerful Brazilian family,the Guinles,who also sought control of utilities in the major cities.The dispute profoundly affected the attitudes of -4

国际财务管理 案例讨论 - 4 - A big deal. This is the largest takeover of an American company in history. BT will pay about $21 billion for the 80%of MCI it doesn’t own. The merger is subject to government approval. Look for cheaper international rates first. MCI and BT operate in dozens of countries, and combined with MCI’s long-distance prowess in the U.S., that should translate into lower prices on those calls to the cousins in Oslo. Coming next: local competition. Until recently, the Baby Bells had a virtual monopoly on the $100 billion market for local service. That’s changing. Next year competition begins, and MCI is hoping to use its new partner to bust its way in. plug into Europe and Asia in a big way. That would mean head-to-head battles with such rivals as the partnership between AT&T and Unisource, a group of European telecommunications firms, and Sprint, the No. 3 U.S. long-distance outfit, which is 20%owned by French and German phone companies. A rich prize will go up for grabs in January 1998, when members of the European Union open their sluggish state monopolies to fast competition. And how would you like to be AT&T’s new president, John Walter? He’s walking into a company in the throes of restructuring, and now has to deal with an archrival that just became a heavyweight. AT&T chairman Robert Allen didn’t wait long to complain that the playing field is not level. AT&T, he asserted, faces barriers to providing full service in the United Kingdom, where BT controls more than 90% of the local phone connections. Allen urged regulators to make scrutiny of the merger “a global priority of the highest order.” In the U.S., where BT will ask for a waiver of the 25%ceiling on foreign ownership of American communications companies, such scrutiny could take up to a year. While AT&T might respond by attempting to buy a Baby Bell, any such move would raise a ruckus with regulators. In the short term, says Kevin Gooley, a telecommunications analyst for Standard&Poor’s, “it doesn’t bode well at all for AT&T”. Case Study 3:Stories Past and Present An Old Story: Brazilian Tramways The first electric trams in Brazil were built in 1891 by Thomson-Houston Company of Lynn, Massachusetts, which the following year became the General Electric Company. GE went on to build most of the early electric lines in Brazil and throughout Latin America, often retaining ownership. Other players soon entered the field, and by 1907, a Canadian group had created South America’s first great tramway empire, holding most of the lines in Rio de Janeiro and Sao Paulo as well as an assortment of telephone, gas, and water companies, The Canadians were bitterly and publicly opposed by a powerful Brazilian family, the Guinles, who also sought control of utilities in the major cities. The dispute profoundly affected the attitudes of

尉纤活价蜀高上学 国际财务管理 案例讨论 Brazilians to-ward foreign-owned tramways.As a result of street riots and large-scale destruction of equipment in the city of Salvador,the Canadians curtailed their expansion efforts and in 1912 consolidated their as-sets into Brazilian Traction,Light Power. American Foreign Power,the GE affiliate,eventually joined the fray and acquired 333 utilities in Brazil alone,with tramway systems in 13 Brazilian cities.By 1933 however,rising anti-Yankee sentiment led to freezing of tram fares at their 1909level. A number of small companies shut down.Others switched to closed cars to increase fare collections.These cars were distinctly unpopular with risers because of the heat (and perhaps because of the better fare collection). Still,on the eve of World War II,North American companies operated roughly two-thirds of Brazil's tramway systems.The lethal combination of parts shortages, increased hydroelectric power costs,and the effect of inflation on fixed fares led companies to cut back on service and,in some cases,to leave the business.In 1947, Brazilian Traction sold its Sao Paulo system to the municipal transport board,which then proceeded to raise fares by 250%.Rioting citizens pleaded for the foreigners and low rates.But,by 1950,a new president had vowed to rid Brazil of foreign corporations.AFP and most other foreign investors were quite willing by this point to sell their unprofitable tram systems to the Brazil 1960,only Brazilian Traction's Rio system remained foreign owned;this last holdout went the way of the rest when it was acquired by the state in January 1965. A recent story:Bangkok Toll Road To help relieve Bangkok's horrible traffic congestion,a Japanese-led consortium was granted a 30-year concession to build a 12-mile toll road in the city.Just as part of the road was about to be opened in 1993,the Thai Expressway and Rapid Transit Authority(ETA)balked at the 30-baht toll had been specified in the contract. Hesitating to absorb the proposed 10-baht toll reduction,the private consortium delayed opening the completed sections of road,and it halted further construction when its lenders suspended credit.Claiming to fear riots on the part of frustrated motorists who were angered at being unable to use the expressway.The ETA obtained a court order to force the road open and insisted on reopening negotiations to settle this and a number of other outstanding issues,Kumagai Gumi,the lead investor, reportedly with more than $100 million exposure,cried foul,publicly accusing the Thai government of nationalizing the project,Eventually,Kumagai sold its 65% interest.And all this occurred I occurred in a country that is viewed as being very hospitable to foreign direct investments. Source:Reprinted Permission of Harvard Business Review From "Is Foreign Infrastructure Still Risky?"by Louis T.Wells and Eric S.Gleason.Sep./Oct. 1995.Copyright1995by the President and Fellows of Harvard College.;all rights reserved. -5-

国际财务管理 案例讨论 - 5 - Brazilians to-ward foreign-owned tramways. As a result of street riots and large-scale destruction of equipment in the city of Salvador, the Canadians curtailed their expansion efforts and in 1912 consolidated their as-sets into Brazilian Traction, Light Power. American Foreign Power, the GE affiliate, eventually joined the fray and acquired 333 utilities in Brazil alone, with tramway systems in 13 Brazilian cities. By 1933, however, rising anti-Yankee sentiment led to freezing of tram fares at their 1909level. A number of small companies shut down. Others switched to closed cars to increase fare collections. These cars were distinctly unpopular with risers because of the heat (and perhaps because of the better fare collection). Still, on the eve of World War II, North American companies operated roughly two-thirds of Brazil’s tramway systems. The lethal combination of parts shortages, increased hydroelectric power costs, and the effect of inflation on fixed fares led companies to cut back on service and,in some cases, to leave the business. In 1947, Brazilian Traction sold its Sao Paulo system to the municipal transport board, which then proceeded to raise fares by 250%.Rioting citizens pleaded for the foreigners and low rates. But, by 1950, a new president had vowed to rid Brazil of foreign corporations. AFP and most other foreign investors were quite willing by this point to sell their unprofitable tram systems to the Brazil 1960, only Brazilian Traction’s Rio system remained foreign owned; this last holdout went the way of the rest when it was acquired by the state in January 1965. A recent story: Bangkok Toll Road To help relieve Bangkok’s horrible traffic congestion, a Japanese-led consortium was granted a 30-year concession to build a 12-mile toll road in the city. Just as part of the road was about to be opened in 1993, the Thai Expressway and Rapid Transit Authority(ETA) balked at the 30-baht toll had been specified in the contract. Hesitating to absorb the proposed 10-baht toll reduction, the private consortium delayed opening the completed sections of road, and it halted further construction when its lenders suspended credit. Claiming to fear riots on the part of frustrated motorists who were angered at being unable to use the expressway. The ETA obtained a court order to force the road open and insisted on reopening negotiations to settle this and a number of other outstanding issues, Kumagai Gumi, the lead investor, reportedly with more than $100 million exposure, cried foul, publicly accusing the Thai government of nationalizing the project, Eventually, Kumagai sold its 65% interest. And all this occurred I occurred in a country that is viewed as being very hospitable to foreign direct investments. Source: Reprinted Permission of Harvard Business Review From “Is Foreign Infrastructure Still Risky?” by Louis T. Wells and Eric S. Gleason. Sep./Oct. 1995.Copyright1995by the President and Fellows of Harvard College.;all rights reserved