国际财务管理 第五讲外汇风险管理 对外经济贸易大学国际商学院会计学系制作

国际财务管理 第五讲 外汇风险管理 对外经济贸易大学国际商学院会计学系制作

Foreign Exchange Risk Management Risk Exposure The future is unknown The value of its assets actual outcomes can or liabilities can deviate from expected change with outcome unexpected change in currency value. How much is at risk 制计价货易本孝

Foreign Exchange Risk Management Risk The future is unknown actual outcomes can deviate from expected outcome Exposure The value of its assets or liabilities can change with unexpected change in currency value. How much is at risk

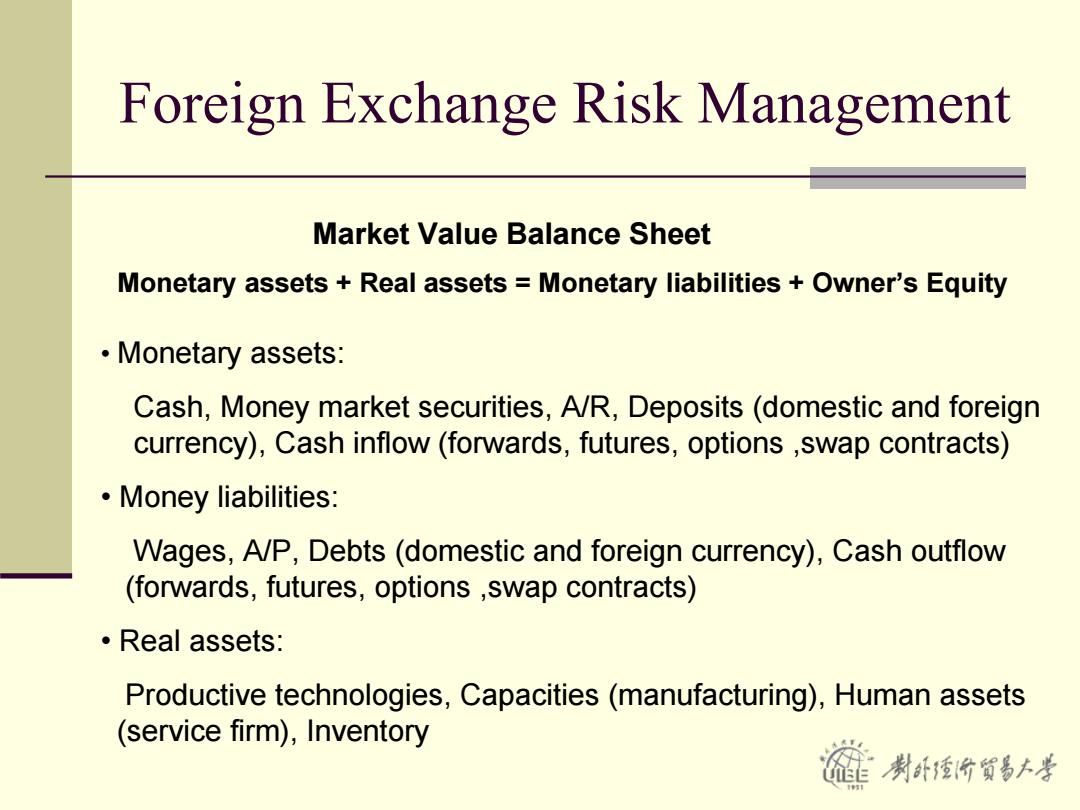

Foreign Exchange Risk Management Market Value Balance Sheet Monetary assets Real assets Monetary liabilities Owner's Equity ·Monetary assets: Cash,Money market securities,A/R,Deposits(domestic and foreign currency),Cash inflow(forwards,futures,options swap contracts) ·Money liabilities: Wages,A/P,Debts(domestic and foreign currency),Cash outflow (forwards,futures,options ,swap contracts) ·Real assets: Productive technologies,Capacities(manufacturing),Human assets (service firm),Inventory 制卧爱价贸易大岁

Foreign Exchange Risk Management Market Value Balance Sheet Monetary assets + Real assets = Monetary liabilities + Owner’s Equity • Monetary assets: Cash, Money market securities, A/R, Deposits (domestic and foreign currency), Cash inflow (forwards, futures, options ,swap contracts) • Money liabilities: Wages, A/P, Debts (domestic and foreign currency), Cash outflow (forwards, futures, options ,swap contracts) • Real assets: Productive technologies, Capacities (manufacturing), Human assets (service firm), Inventory

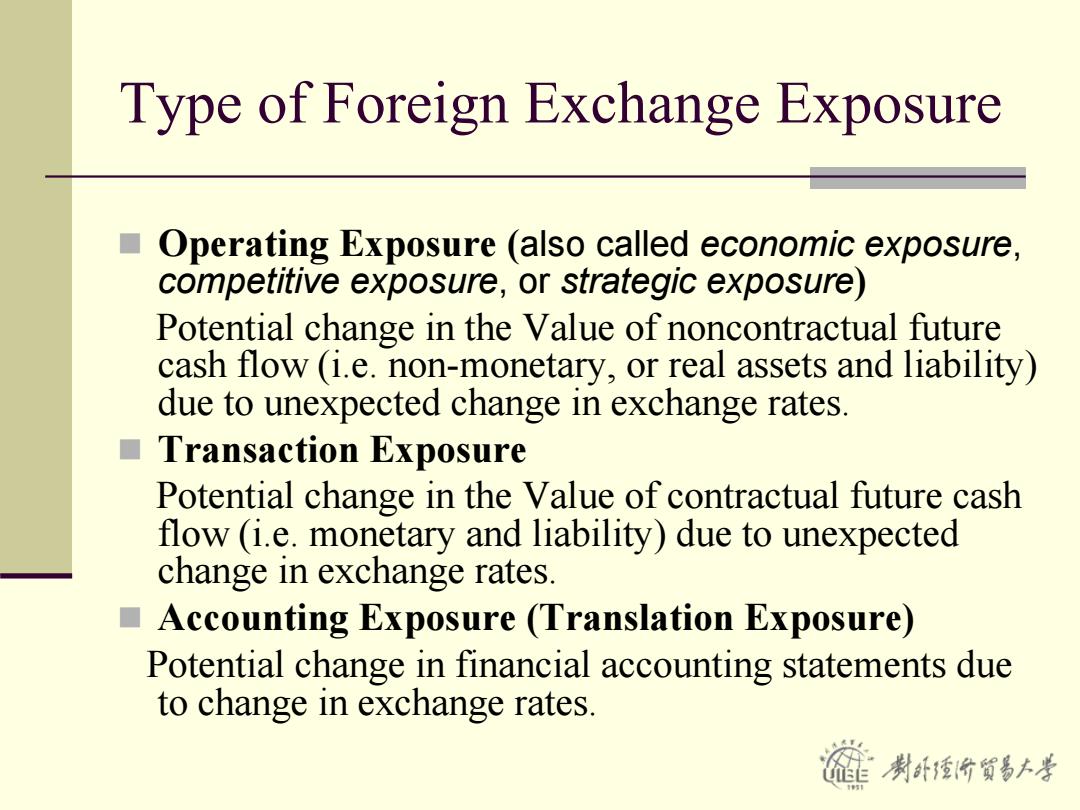

Type of Foreign Exchange Exposure Operating Exposure (also called economic exposure, competitive exposure,or strategic exposure) Potential change in the Value of noncontractual future cash flow (i.e.non-monetary,or real assets and liability) due to unexpected change in exchange rates. ■ Transaction Exposure Potential change in the Value of contractual future cash flow (i.e.monetary and liability)due to unexpected change in exchange rates. Accounting Exposure (Translation Exposure) Potential change in financial accounting statements due to change in exchange rates. 制卧价贸易大孝

Type of Foreign Exchange Exposure Operating Exposure (also called economic exposure, competitive exposure, or strategic exposure ) Potential change in the Value of noncontractual future cash flow (i.e. non-monetary, or real assets and liability) due to unexpected change in exchange rates. Transaction Exposure Potential change in the Value of contractual future cash flow (i.e. monetary and liability) due to unexpected change in exchange rates. Accounting Exposure (Translation Exposure) Potential change in financial accounting statements due to change in exchange rates

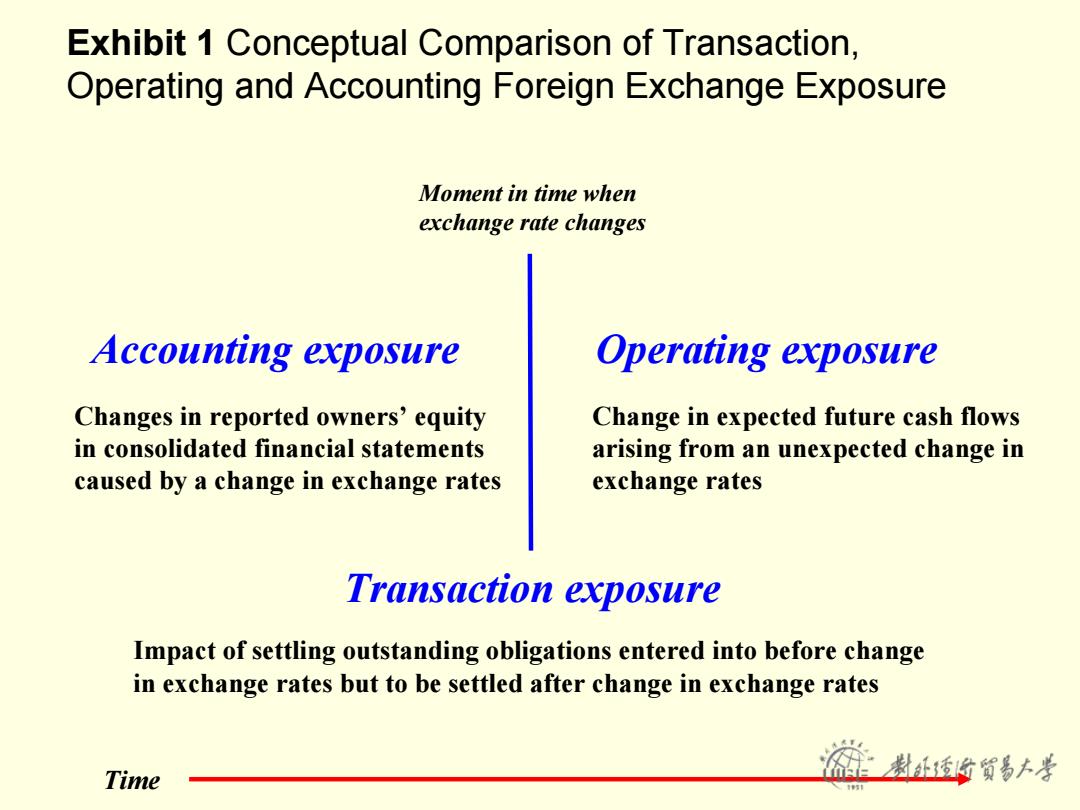

Exhibit 1 Conceptual Comparison of Transaction, Operating and Accounting Foreign Exchange Exposure Moment in time when exchange rate changes Accounting exposure Operating exposure Changes in reported owners'equity Change in expected future cash flows in consolidated financial statements arising from an unexpected change in caused by a change in exchange rates exchange rates Transaction exposure Impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange rates Time

Exhibit 1 Conceptual Comparison of Transaction, Operating and Accounting Foreign Exchange Exposure Moment in time when exchange rate changes Accounting exposure Operating exposure Changes in reported owners’ equity in consolidated financial statements caused by a change in exchange rates Change in expected future cash flows arising from an unexpected change in exchange rates Transaction exposure Impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange rates Time

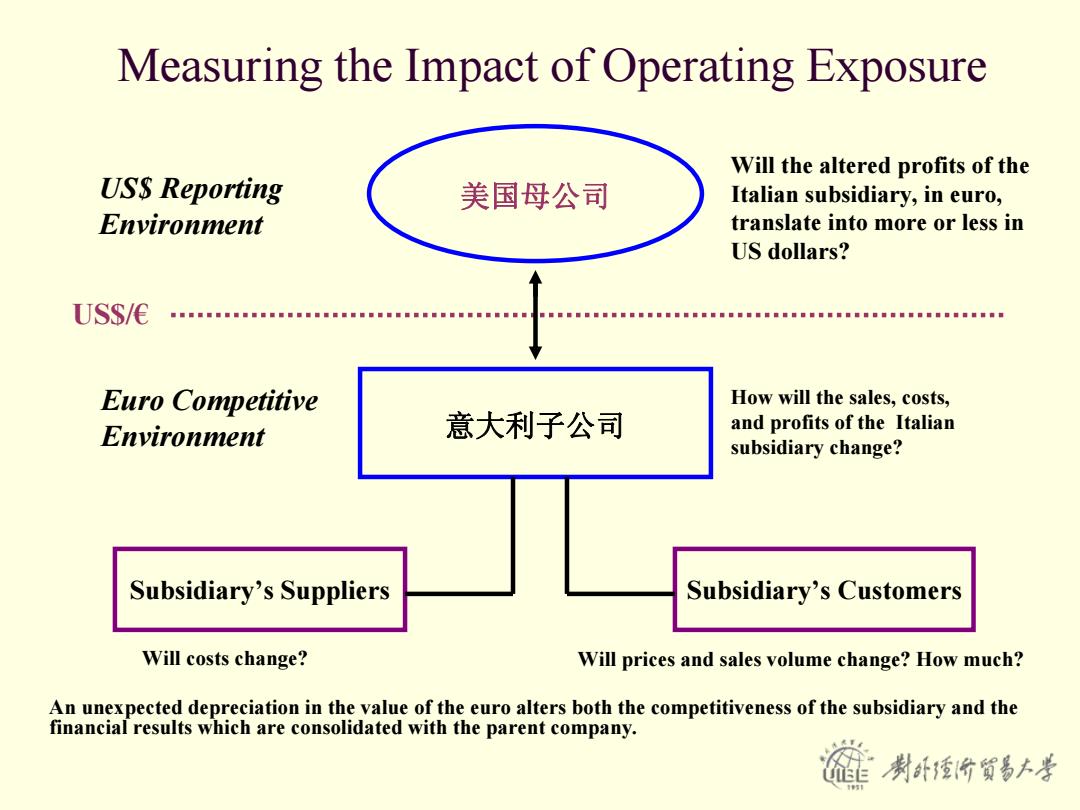

Measuring the Impact of Operating Exposure Will the altered profits of the USS Reporting 美国母公司 Italian subsidiary,in euro, Environment translate into more or less in US dollars? USS/E a... Euro Competitive How will the sales,costs, Environment 意大利子公司 and profits of the Italian subsidiary change? Subsidiary's Suppliers Subsidiary's Customers Will costs change? Will prices and sales volume change?How much? An unexpected depreciation in the value of the euro alters both the competitiveness of the subsidiary and the financial results which are consolidated with the parent company. 制卧价贸易上孝

Measuring the Impact of Operating Exposure US$ Reporting Environment 美国母公司 Will the altered profits of the Italian subsidiary, in euro, translate into more or less in US dollars? US$/€ Euro Competitive Environment 意大利子公司 How will the sales, costs, and profits of the Italian subsidiary change? Subsidiary’s Suppliers Subsidiary’s Customers Will costs change? Will prices and sales volume change? How much? An unexpected depreciation in the value of the euro alters both the competitiveness of the subsidiary and the financial results which are consolidated with the parent company

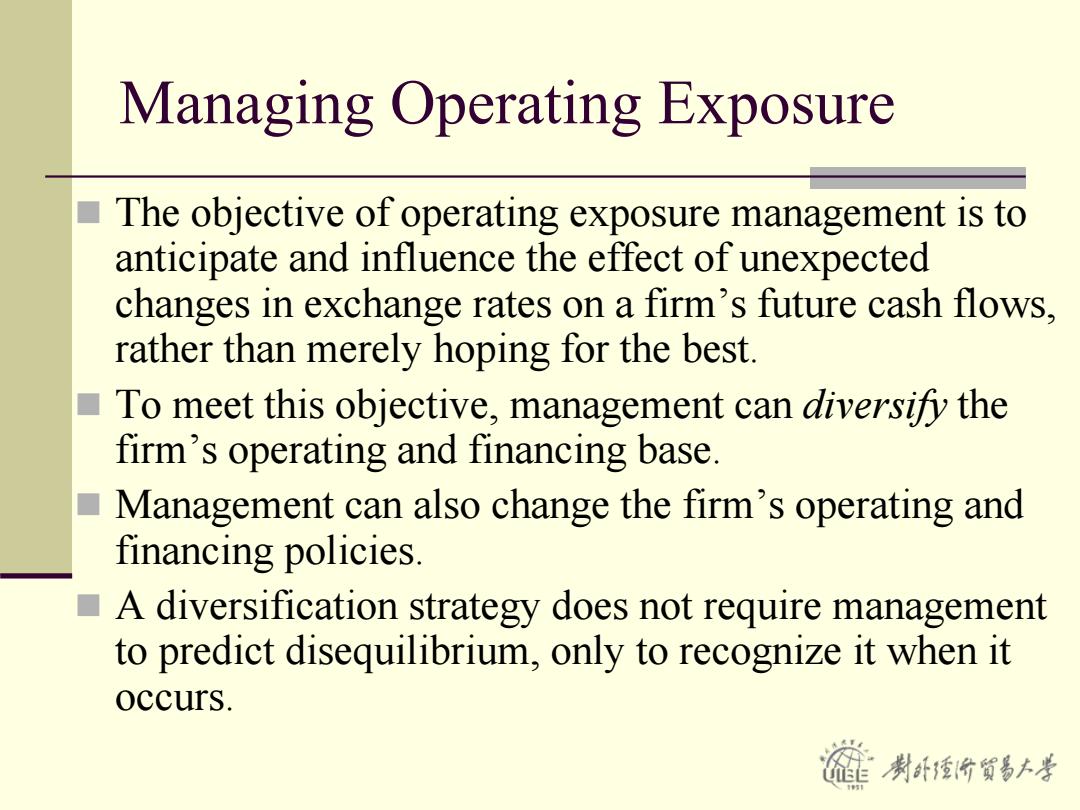

Managing Operating Exposure The objective of operating exposure management is to anticipate and influence the effect of unexpected changes in exchange rates on a firm's future cash flows, rather than merely hoping for the best. To meet this objective,management can diversifi the firm's operating and financing base. Management can also change the firm's operating and financing policies. A diversification strategy does not require management to predict disequilibrium,only to recognize it when it occurs. 制计价贸易上孝

Managing Operating Exposure The objective of operating exposure management is to anticipate and influence the effect of unexpected changes in exchange rates on a firm’s future cash flows, rather than merely hoping for the best. To meet this objective, management can diversify the firm’s operating and financing base. Management can also change the firm’s operating and financing policies. A diversification strategy does not require management to predict disequilibrium, only to recognize it when it occurs

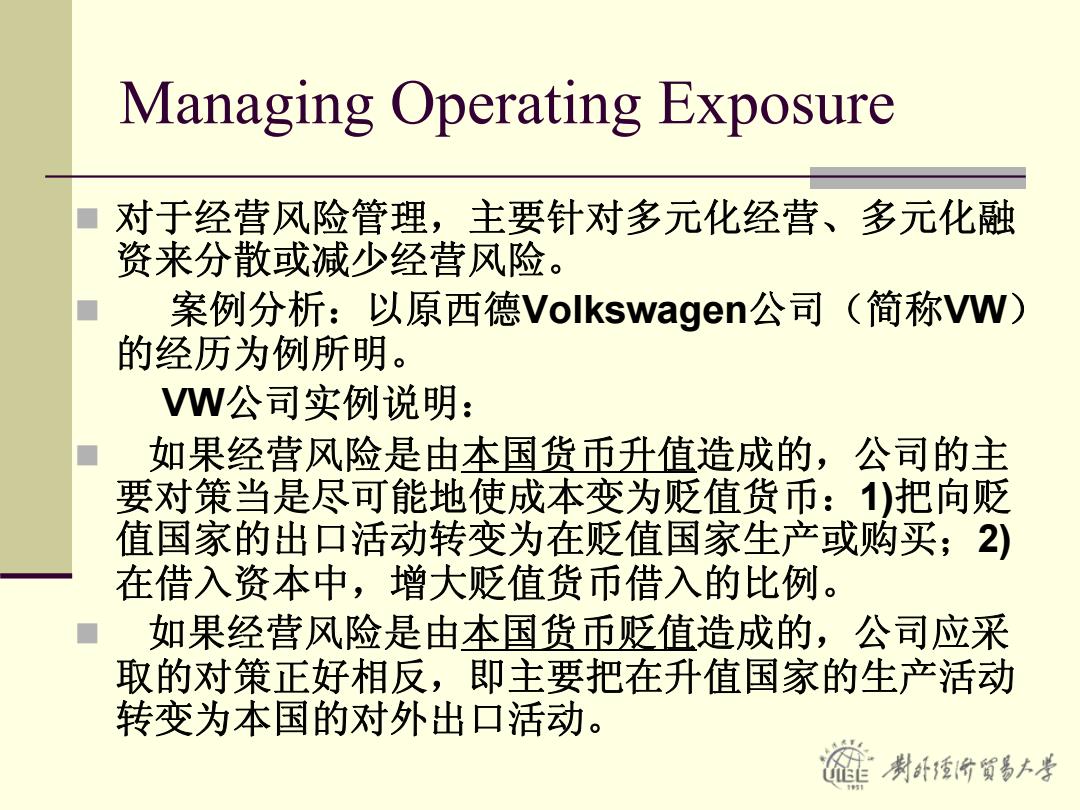

Managing Operating Exposure 对于经营风险管理,主要针对多元化经营、多元化融 资来分散或减少经营风险。 案例分析:以原西德Volkswagen公司(简称VW) 的经历为例所明。 VW公司实例说明: 如果经营风险是由本国货币升值造成的,公司的主 要对策当是尽可能地使成本变为贬值货币:)把向贬 值国家的出口活动转变为在贬值国家生产或购买;2) 在借入资本中,增大贬值货币借入的比例。 如果经营风险是由本国货币贬值造成的,公司应采 取的对策正好相反,即主要把在升值国家的生产活动 转变为本国的对外出口活动。 制计爱价贸易本考

对于经营风险管理,主要针对多元化经营、多元化融 资来分散或减少经营风险。 案例分析:以原西德Volkswagen公司(简称VW) 的经历为例所明。 VW公司实例说明: 如果经营风险是由本国货币升值造成的,公司的主 要对策当是尽可能地使成本变为贬值货币:1)把向贬 值国家的出口活动转变为在贬值国家生产或购买;2) 在借入资本中,增大贬值货币借入的比例。 如果经营风险是由本国货币贬值造成的,公司应采 取的对策正好相反,即主要把在升值国家的生产活动 转变为本国的对外出口活动。 Managing Operating Exposure

Managing Transaction Exposure Transaction exposure measures gains or losses that arise from the settlement of existing financial obligations whose terms are stated in a foreign currency. The most common example of transaction exposure arises when a firm has a receivable or payable denominated in a foreign currency. 制计爱价货易大考

Managing Transaction Exposure Transaction exposure measures gains or losses that arise from the settlement of existing financial obligations whose terms are stated in a foreign currency. The most common example of transaction exposure arises when a firm has a receivable or payable denominated in a foreign currency

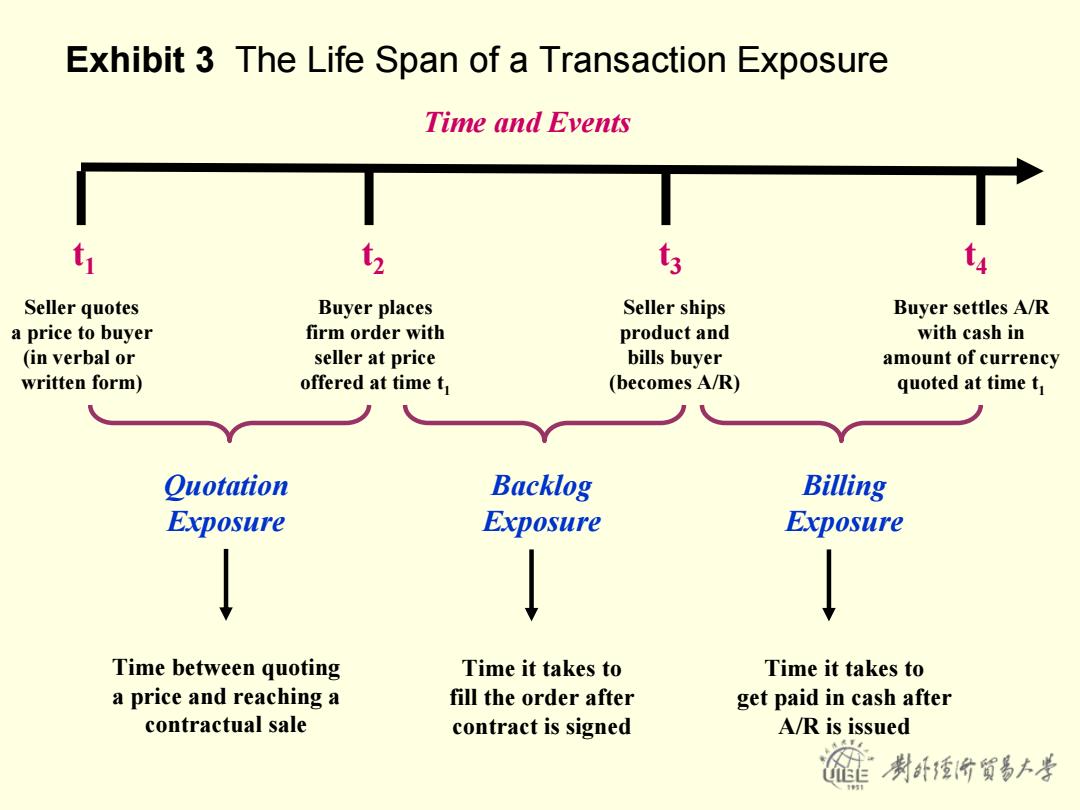

Exhibit 3 The Life Span of a Transaction Exposure Time and Events Seller quotes Buyer places Seller ships Buyer settles A/R a price to buyer firm order with product and with cash in (in verbal or seller at price bills buyer amount of currency written form) offered at time t (becomes A/R) quoted at time t Quotation Backlog Billing Exposure Exposure Exposure Time between quoting Time it takes to Time it takes to a price and reaching a fill the order after get paid in cash after contractual sale contract is signed A/R is issued

Exhibit 3 The Life Span of a Transaction Exposure Time and Events t1 t2 t3 t4 Seller quotes a price to buyer (in verbal or written form) Buyer places firm order with seller at price offered at time t1 Seller ships product and bills buyer (becomes A/R) Buyer settles A/R with cash in amount of currency quoted at time t1 Quotation Exposure Backlog Exposure Billing Exposure Time between quoting a price and reaching a contractual sale Time it takes to fill the order after contract is signed Time it takes to get paid in cash after A/R is issued