ADVANCED MACROECONOMICS Lecture 3a Ramsey Model 电子科大经管学院马捷

ADVANCED MACROECONOMICS Lecture 3a Ramsey Model 电子科大经管学院 马捷 1

Contents Introduction Mathematical Framework Graphical Representation ·Policy Effects 电子科大经管学院马捷 2 元元元元元

Contents Introduction Mathematical Framework Graphical Representation Policy Effects 电子科大经管学院 马捷 2

Introduction Extension to the Solow-Swan model: Agents choose consumption and investment optimally to maximize their individual utility. Endogenous labor supply 电子科大经管学院马捷 3 元元元元

Introduction Extension to the Solow-Swan model: • Agents choose consumption and investment optimally to maximize their individual utility. • Endogenous labor supply 电子科大经管学院 马捷 3

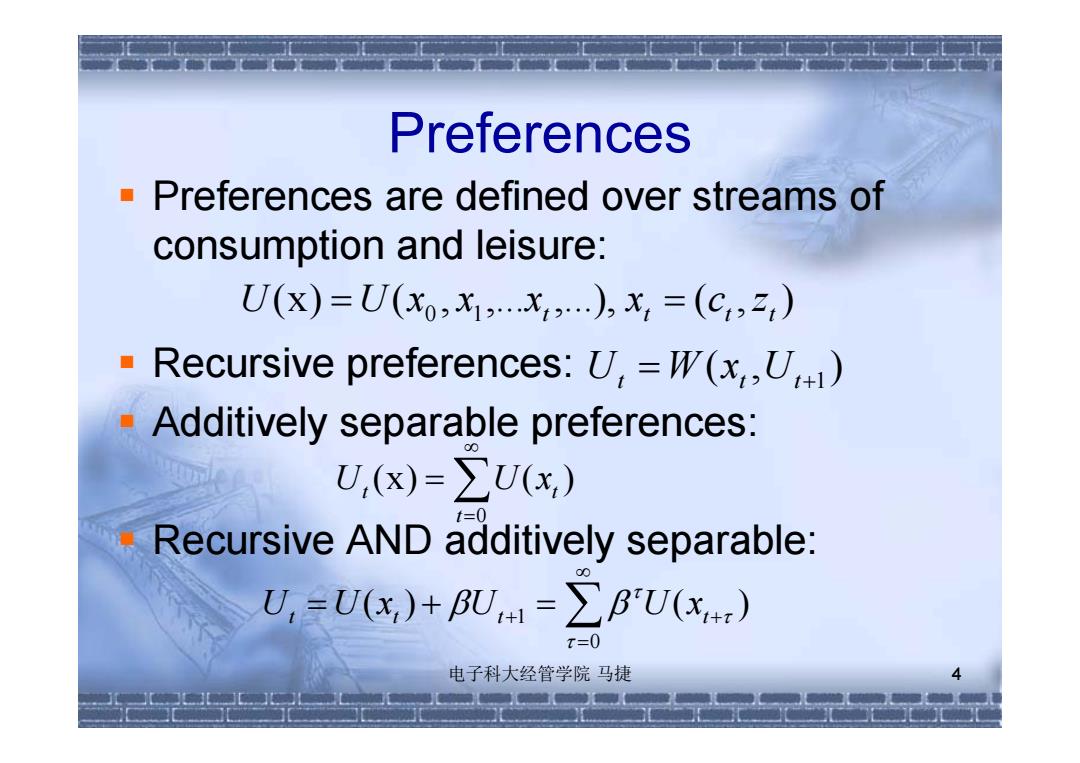

Preferences Preferences are defined over streams of consumption and leisure: U(X)=U(x0,x1,x…),x,=(C,2) Recursive preferences:U,=W(x,,U) Additively separable preferences: U,(x)=∑U(x,) Recursive AND additively separable: U,=U(x,)+BU,+1=∑BU(x+) T=0 电子科大经管学院马捷 元元兄

Preferences Preferences are defined over streams of consumption and leisure: Recursive preferences: Additively separable preferences: Recursive AND additively separable: 电子科大经管学院 马捷 4 (x) ( , ,... ,...), ( , ) 0 1 t t t t U U x x x x c z ( , ) t t Ut1 U W x 0 (x) ( ) t t t U U x 0 1 ( ) ( ) t t t t U U x U U x

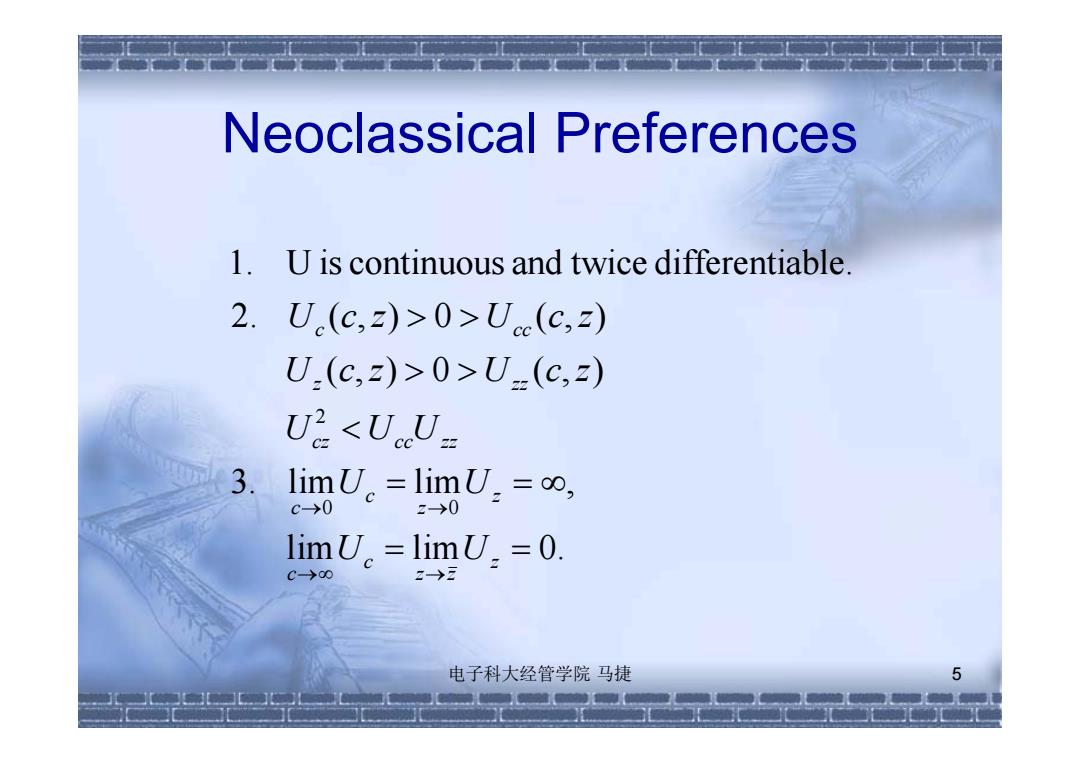

Neoclassical Preferences 1.U is continuous and twice differentiable 2.U.(c,z)>0>U(c,z) U(c,z)>0>U(c,z) Ui<UoU= 3. limU.=limU.=0, c→0 z→0 limU。=limU.=0. C-→00 2→2 电子科大经管学院马捷 5 元元元元元

Neoclassical Preferences 电子科大经管学院 马捷 5 lim lim 0. 3. lim lim , ( , ) 0 ( , ) 2. ( , ) 0 ( , ) 1. U is continuous and twice differentiable. 0 0 2 z z z c c z z c c cz cc zz z zz c cc U U U U U U U U c z U c z U c z U c z

Technology and Constraints Time constraint:+=1 Resource constraint:c,+i,<y Neoclassical technology y,=F(k,)=1f(K),K,=k,/1 Change in capital k+1=(1-δ)k,+i, →C,+k+1≤F(k,l)+(1-δ)k, 电子科大经管学院马捷 6

Technology and Constraints Time constraint: Resource constraint: Neoclassical technology Change in capital 电子科大经管学院 马捷 6 z t l t z 1 t t t c i y t t t t t t t t y F ( k ,l ) l f ( ), k / l t t t k k i ( 1 ) 1 t t t t t c k F ( k , l ) ( 1 ) k 1

The Ramsey Problem Choose maxU=∑B'U(c,l-l,) t=0 s.t.C,+k+1≤F(k,l)+(1-6)k,t≥0, C,k+1≥0,1,∈[0,1] ko>0 is given. 电子科大经管学院马捷

The Ramsey Problem 电子科大经管学院 马捷 7 0 . , 0, [ 0,1], . . ( , ) ( 1 ) , 0, max ( ,1 ) Choose , 0 1 1 0 0 1 0 k is given c k l s t c k F k l k t U U c l c ,l ,k t t t t t t t t t t t t t t t t

Optimal Control ·The Lagrangian: 00 L,=∑B'U(c,1-l,)+∑4,[F(k,l,)+(1-6)k,-C,-k+] t=0 t=0 Let=u,B'and define Hamiltonian as: H,=H(k,k+1,C,,) 三U(c,1-1,)+,[F(k,l)+(1-δ)k,-C,-k+]→ L。=∑B{U(c,1-1,)+,[F(k,)+(1-6)k,-c,-k+1]} 1=0 00 ∑BH,orL,=H,+L4l t=0 电子科大经管学院马捷 8

Optimal Control The Lagrangian: 电子科大经管学院 马捷 8 0 1 0 0 ( ,1 ) [ ( , ) ( 1 ) ] t t t t t t t t t t t L U c l F k l k c k 1 0 0 0 1 1 1 ( ,1 ) [ ( , ) ( 1 ) ] ( ,1 ) [ ( , ) ( 1 ) ] ( , , , , ) Let / : t t t t t t t t t t t t t t t t t t t t t t t t t t t t t t t t t H or H U c l F k l k c k U c l F k l k c k H H k k c l and define Hamiltonia n as L L L

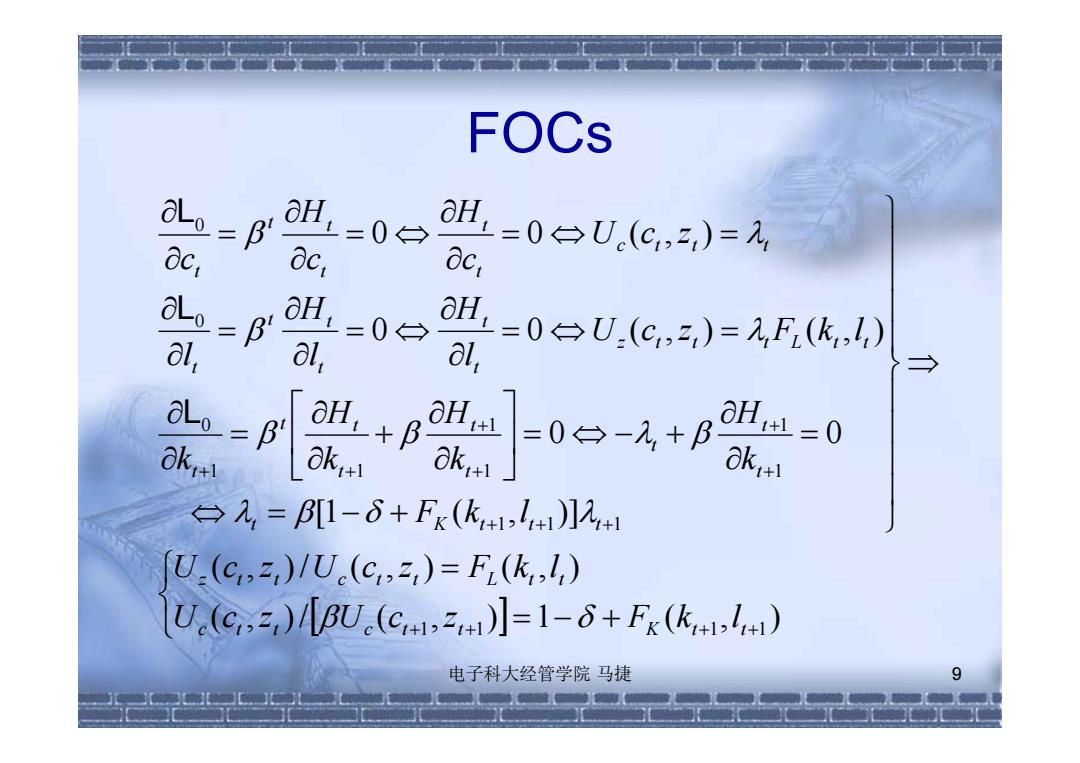

FOCs H,≥0宁 0c 0c. H,=0⊙U,(C,2)=元 Oc. al, aH,=0户 al, =0台U(c,)=,F(k,) al, → aLo=β L=0 k ak+1 =0台-A+Bk 台=[1-δ+Fx(k+1,+)]2+1 U(C,2,)/U(C,2,)=F(k,,) U.(C,)[BU.(c41,41)】=1-6+Fx(k+,l4) 电子科大经管学院马捷 9

FOCs 电子科大经管学院 马捷 9 ( , )/ ( , ) 1 ( , ) ( , )/ ( , ) ( , ) [1 ( , )] 0 0 0 0 ( , ) ( , ) 0 0 ( , ) 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 c t t c t t K t t z t t c t t L t t t K t t t t t t t t t t t t z t t t L t t t t t t t t c t t t t t t t t t U c z U c z F k l U c z U c z F k l F k l k H k H k H k U c z F k l l H l H l U c z c H c H c L L L

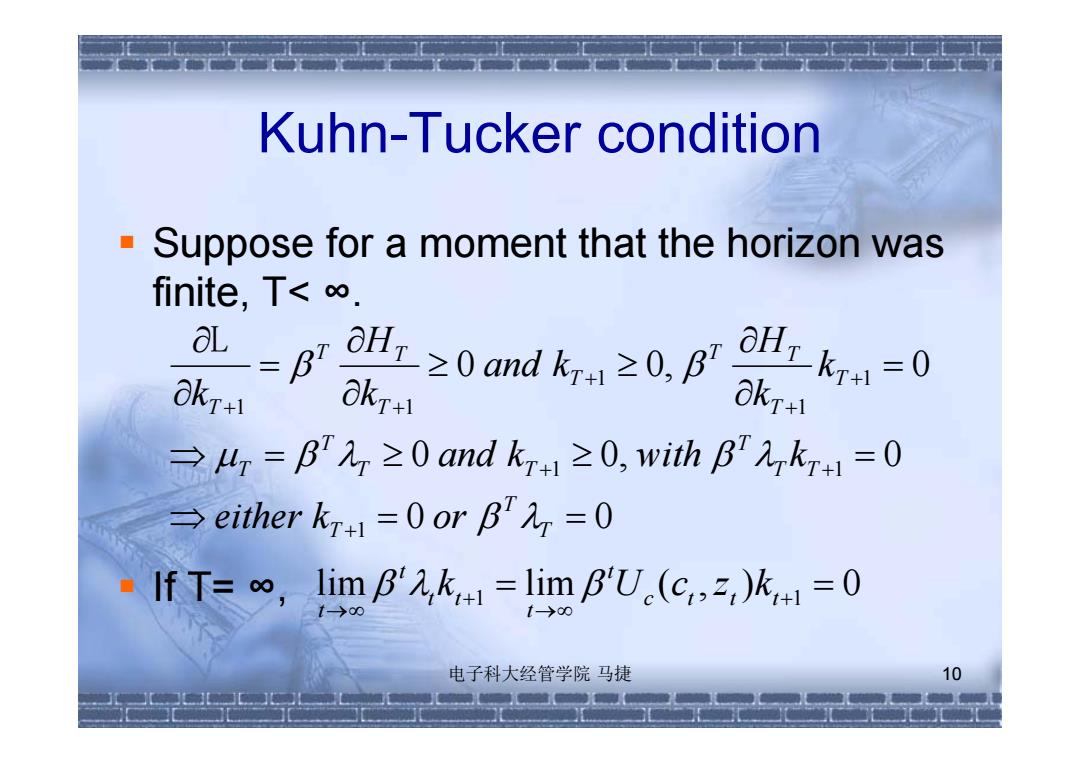

Kuhn-Tucker condition Suppose for a moment that the horizon was finite,T<o. L 8kT =BT L≥0amdk1≥0,p HTk=0 KT+ →47=B7≥0andk7+1≥0,with B",2k+1=0 →either k+1=0orB,=0 IfT=∞,limB,k+1=limB'Uc(c,2,)k+1=0 电子科大经管学院马捷 10

Kuhn-Tucker condition Suppose for a moment that the horizon was finite, T< ∞. If T= ∞, 电子科大经管学院 马捷 10 0 0 0 0, 0 0 0, 0 1 1 1 1 1 1 1 1 T T T T T T T T T T T T T T T T T T T either k or and k with k k k H and k k H k L lim lim ( , ) 0 1 1 c t t t t t t t t t k U c z k