国际财务管理 第六讲跨国公司资本预算 对外经济贸易大学国际商学院会计学系制作

国际财务管理 第六讲 跨国公司资本预算 对外经济贸易大学国际商学院会计学系制作

Exhibit 1 Portfolio Risk Reduction Through Diversification Percent risk =Variance of portfolio return Variance of market return 100 80 Total Risk Diversifiable Risk + Market Risk (unsystematic) (systematic) 60 40 Portfolio of U.S.stocks 27% 20 Total risk Systematic risk 10 20 30 40 50 Number of stocks in portfolio By diversifying the portfolio,the variance of the portfolio's return relative to the variange of the market's return (beta)is reduced to the level of systematic risk--the risk of the market itself. 价旺南卧苦黄易大学

Exhibit 1 Portfolio Risk Reduction Through Diversification Number of stocks in portfolio 10 20 30 40 50 Percent risk 20 40 60 80 Portfolio of U.S. stocks By diversifying the portfolio, the variance of the portfolio’s return relative to the variance of the market’s return (beta) is reduced to the level of systematic risk -- the risk of the market itself. Systematic risk Total risk 27% 1 Total Risk = Diversifiable Risk + Market Risk (unsystematic) (systematic) = Variance of portfolio return Variance of market return 100

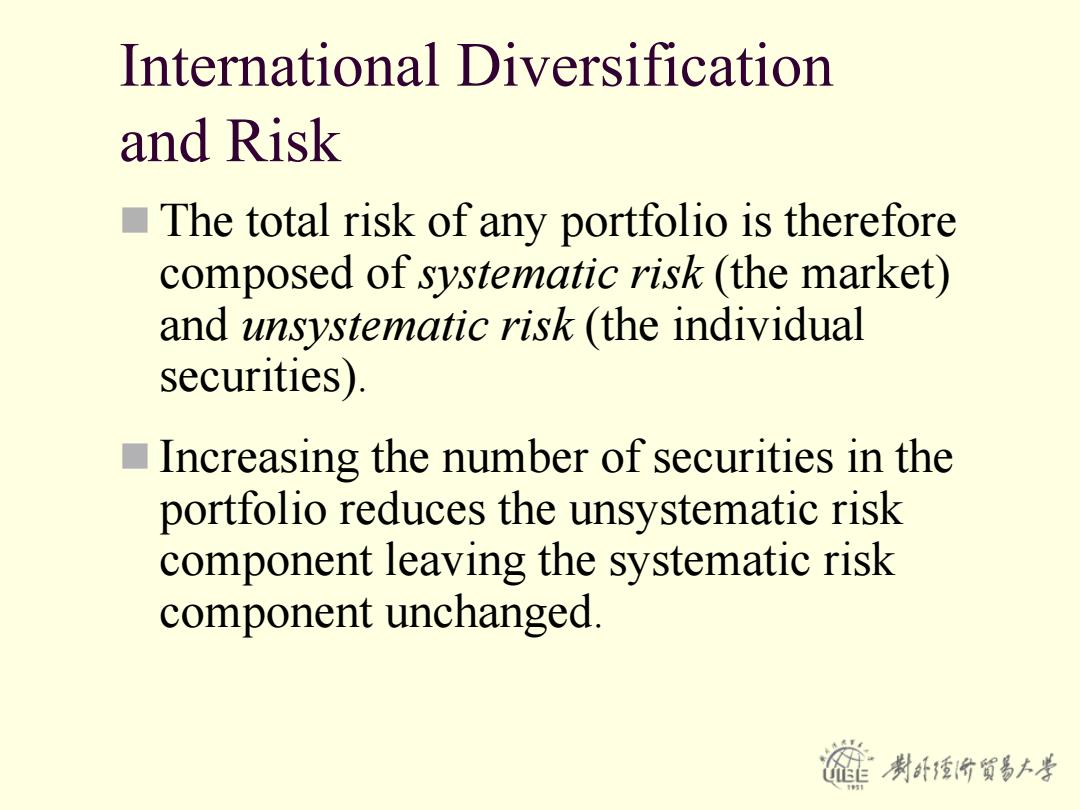

International Diversification and Risk The total risk of any portfolio is therefore composed of systematic risk (the market) and unsystematic risk (the individual securities) Increasing the number of securities in the portfolio reduces the unsystematic risk component leaving the systematic risk component unchanged 制计爱价货易大考

International Diversification and Risk The total risk of any portfolio is therefore composed of systematic risk (the market) and unsystematic risk (the individual securities). Increasing the number of securities in the portfolio reduces the unsystematic risk component leaving the systematic risk component unchanged

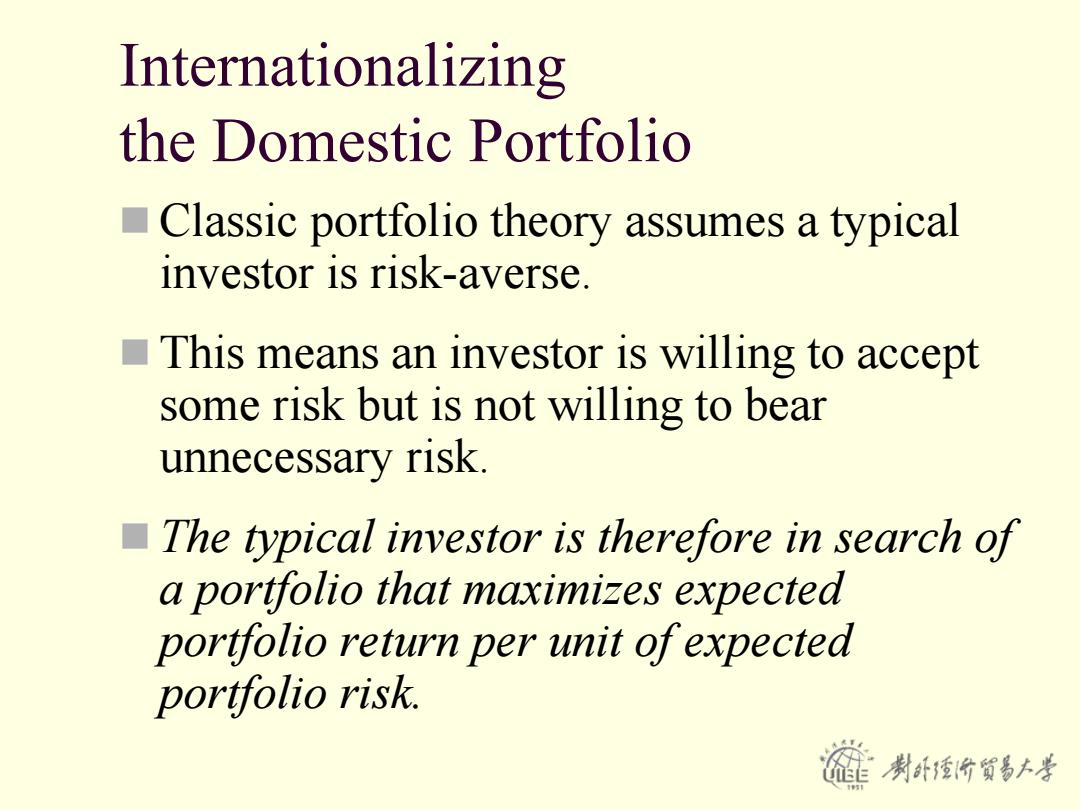

Internationalizing the Domestic Portfolio Classic portfolio theory assumes a typical investor is risk-averse. ■ This means an investor is willing to accept some risk but is not willing to bear unnecessary risk. The typical investor is therefore in search of a portfolio that maximizes expected portfolio return per unit of expected portfolio risk 制计爱价货易大考

Internationalizing the Domestic Portfolio Classic portfolio theory assumes a typical investor is risk-averse. This means an investor is willing to accept some risk but is not willing to bear unnecessary risk. The typical investor is therefore in search of a portfolio that maximizes expected portfolio return per unit of expected portfolio risk

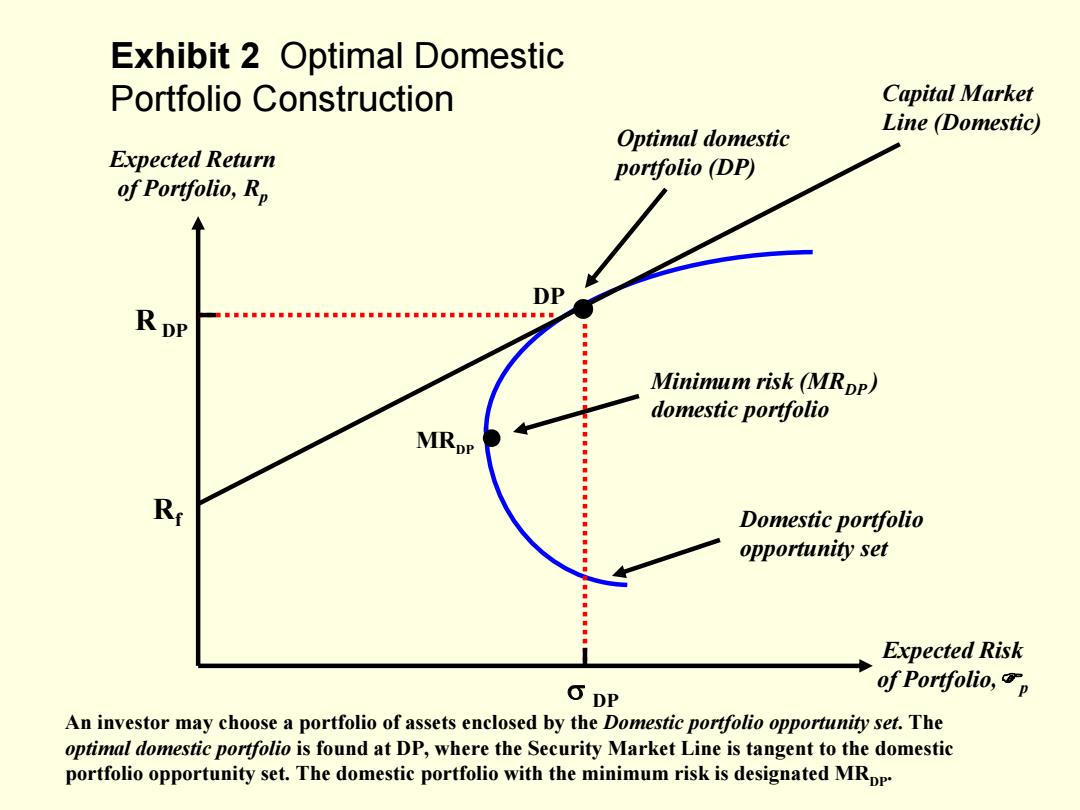

Exhibit 2 Optimal Domestic Portfolio Construction Capital Market Optimal domestic Line (Domestic) Expected Return portfolio (DP) of Portfolio,Rp DP R DP ◆ ◆ Minimum risk(MRDP) domestic portfolio MRpP ◆ Ri Domestic portfolio ◆ opportunity set Expected Risk DP of Portfolio,.⊙p An investor may choose a portfolio of assets enclosed by the Domestic portfolio opportunity set.The optimal domestic portfolio is found at DP,where the Security Market Line is tangent to the domestic portfolio opportunity set.The domestic portfolio with the minimum risk is designated MRpp

Exhibit 2 Optimal Domestic Portfolio Construction Expected Return of Portfolio, Rp Expected Risk of Portfolio,)p Domestic portfolio opportunity set Rf • DP σ DP R DP An investor may choose a portfolio of assets enclosed by the Domestic portfolio opportunity set. The optimal domestic portfolio is found at DP, where the Security Market Line is tangent to the domestic portfolio opportunity set. The domestic portfolio with the minimum risk is designated MRDP . Capital Market Line (Domestic) • Minimum risk (MRDP ) domestic portfolio MRDP Optimal domestic portfolio (DP)

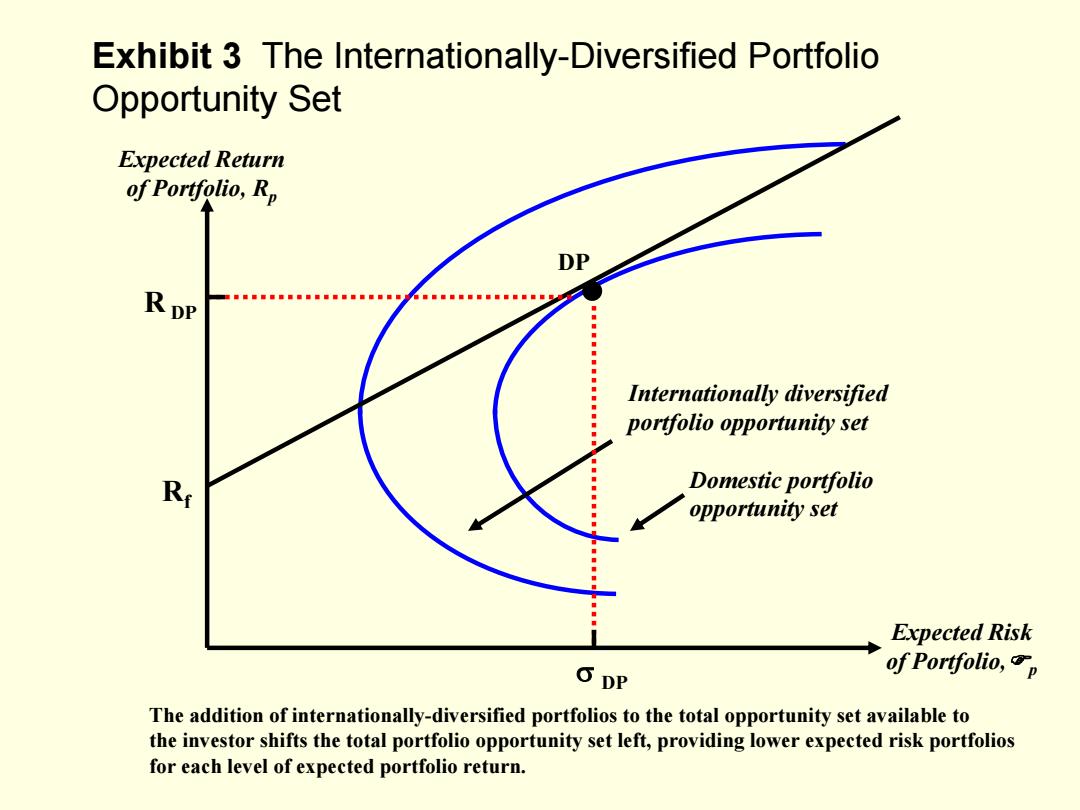

Exhibit 3 The Internationally-Diversified Portfolio Opportunity Set Expected Return of Portfolio,Rp DP R DP Internationally diversified portfolio opportunity set R Domestic portfolio ◆ opportunity set Expected Risk DP of Portfolio, The addition of internationally-diversified portfolios to the total opportunity set available to the investor shifts the total portfolio opportunity set left,providing lower expected risk portfolios for each level of expected portfolio return

Exhibit 3 The Internationally-Diversified Portfolio Opportunity Set Expected Return of Portfolio, Rp Expected Risk of Portfolio,)p Domestic portfolio opportunity set Internationally diversified portfolio opportunity set Rf • DP σ DP R DP The addition of internationally-diversified portfolios to the total opportunity set available to the investor shifts the total portfolio opportunity set left, providing lower expected risk portfolios for each level of expected portfolio return

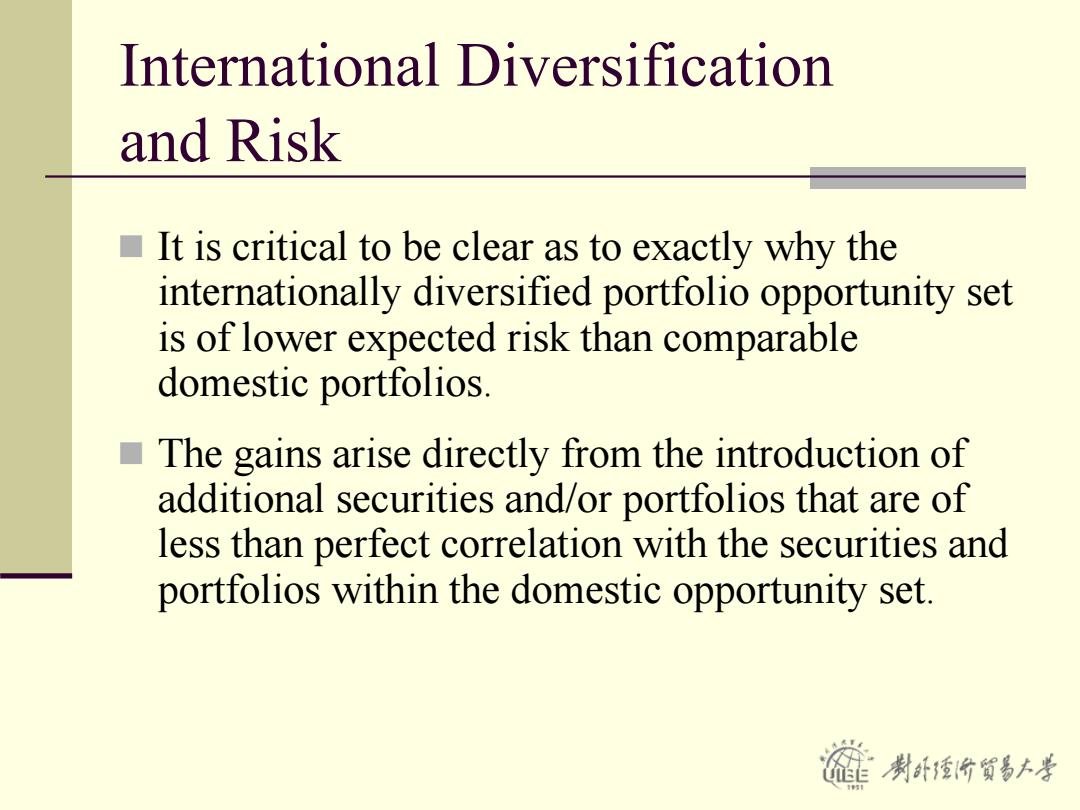

International Diversification and Risk It is critical to be clear as to exactly why the internationally diversified portfolio opportunity set is of lower expected risk than comparable domestic portfolios. ■ The gains arise directly from the introduction of additional securities and/or portfolios that are of less than perfect correlation with the securities and portfolios within the domestic opportunity set. 制计香价蜀易上孝

International Diversification and Risk It is critical to be clear as to exactly why the internationally diversified portfolio opportunity set is of lower expected risk than comparable domestic portfolios. The gains arise directly from the introduction of additional securities and/or portfolios that are of less than perfect correlation with the securities and portfolios within the domestic opportunity set

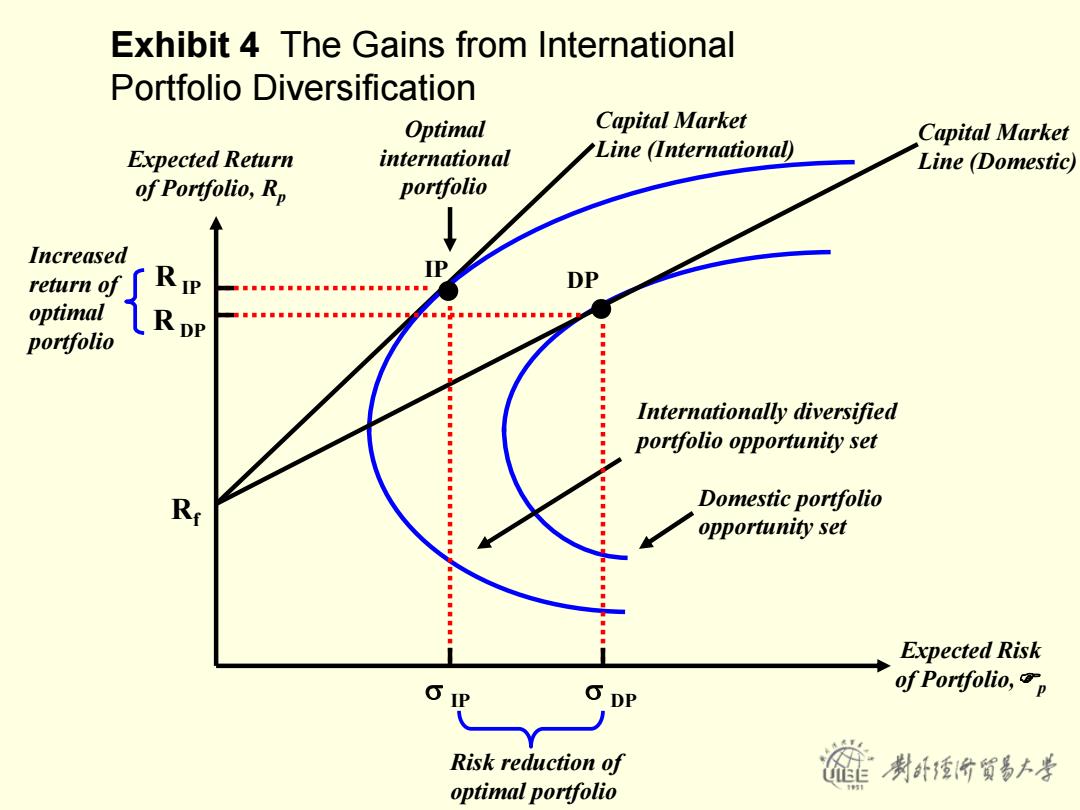

Exhibit 4 The Gains from International Portfolio Diversification Optimal Capital Market Capital Market Expected Return international Line (International) Line (Domestic) of Portfolio,Rp portfolio ↓ Increased return of R P DP optimal ◆ portfolio ◆ Internationally diversified portfolio opportunity set Rr ◆ ◆ Domestic portfolio opportunity set ◆ Expected Risk O DP of Portfolio,p Risk reduction of 制卧价贸易大岁 optimal portfolio

Exhibit 4 The Gains from International Portfolio Diversification Expected Return of Portfolio, Rp Expected Risk of Portfolio,)p Domestic portfolio opportunity set Internationally diversified portfolio opportunity set Rf • •DP IP σ IP σ DP R IP R DP Risk reduction of optimal portfolio Increased return of optimal portfolio Capital Market Line (Domestic) Capital Market Line (International) Optimal international portfolio

International Diversification and Risk An investor can reduce investment risk by holding risky assets in a portfolio. As long as the asset returns are not perfectly positively correlated,the investor can reduce risk,because some of the fluctuations of the asset returns will offset each other. 制计爱价货易大考

International Diversification and Risk An investor can reduce investment risk by holding risky assets in a portfolio. As long as the asset returns are not perfectly positively correlated, the investor can reduce risk, because some of the fluctuations of the asset returns will offset each other

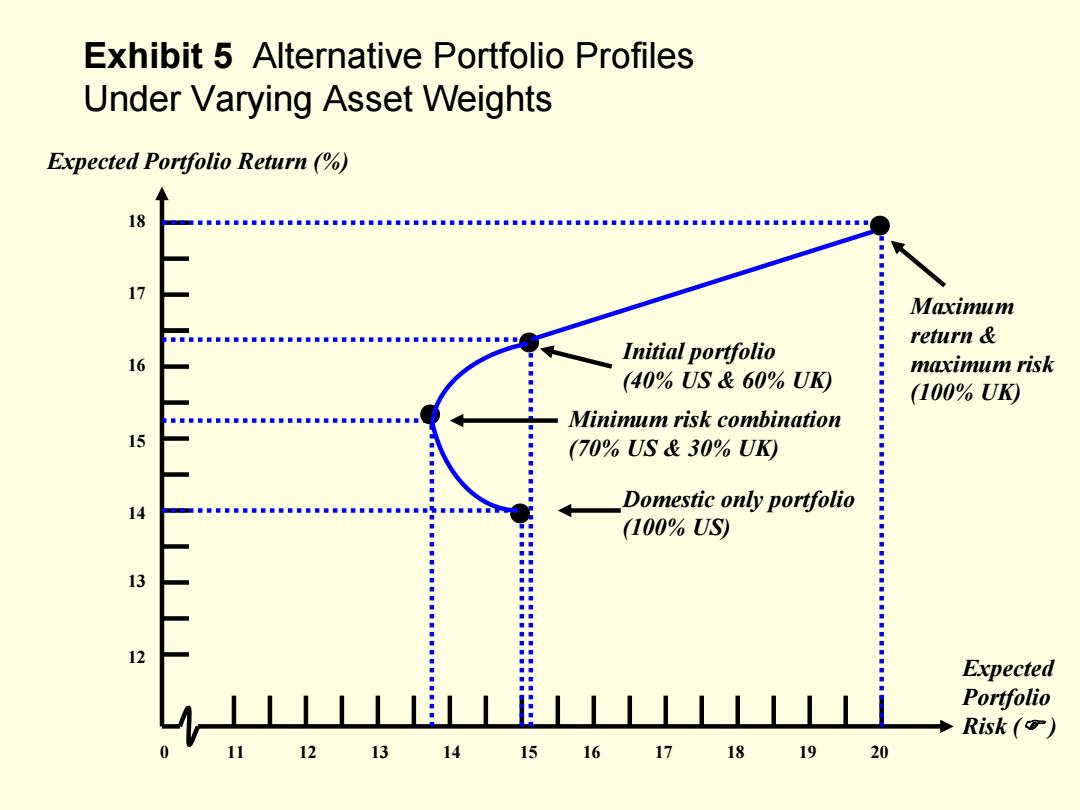

Exhibit 5 Alternative Portfolio Profiles Under Varying Asset Weights Expected Portfolio Return (% 18 17 Maximum 1ss■■■■■■图■。■■。s■■■■■■■图■。■■■■■■。 return 16 Initial portfolio maximum risk (40%US&60%U) (100%UK) Minimum risk combination 15 ◆ (70%US&30%UK) 14 Domestic only portfolio 100%US 13 ◆ ◆ 12 一,1。 1 Expected Portfolio Risk(©》 12 13 14 15 16 17 18 19 20

Exhibit 5 Alternative Portfolio Profiles Under Varying Asset Weights 0 11 12 13 14 15 16 17 18 19 20 Expected Portfolio Risk () ) Expected Portfolio Return (%) 12 13 14 15 16 17 18 • • • • Maximum return & maximum risk (100% UK) Initial portfolio (40% US & 60% UK) Minimum risk combination (70% US & 30% UK) Domestic only portfolio (100% US)