正在加载图片...

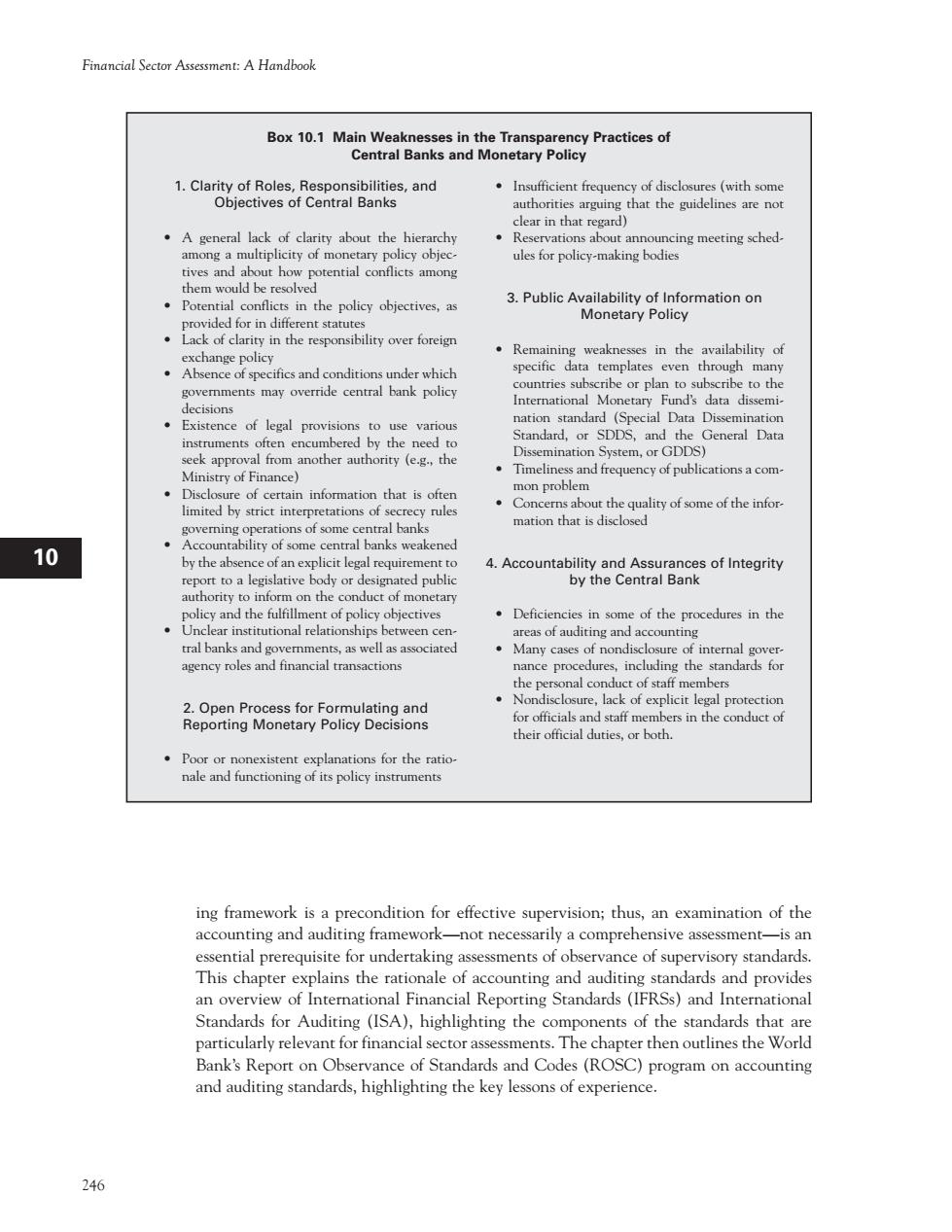

Financial Sector Assessment:A Handbook L.clargyctRoefesnataiesand lear in that e tives and Potential conflicts in the policy objectives,as 3.Public Availability of Information on Monetary Policy 。R even through man another authority(the nelin 10 albanks weakened by the a the their official duties.or both. ing framework is a precondition for effective supervision:thus,an examination of the accounting and auditing framework-not necessarily a comprehensive assessment-is an nce of supervisory standards This cha requisite for undertaking assessments of obser plains the rds Financial Rep ing Standards (IFRSs)andn Auditing (ISA)assessmen components of of the sta ls tha cularly relevant for financial sectora Bank's Report on Observan ce of Standards and Codes(ROSC)program on accounting and auditing standards,highlighting the key lessons of experience. 246 246 Financial Sector Assessment: A Handbook 1 I H G F E D C B A 12 11 10 9 8 7 6 5 4 3 2 ing framework is a precondition for effective supervision; thus, an examination of the accounting and auditing framework—not necessarily a comprehensive assessment—is an essential prerequisite for undertaking assessments of observance of supervisory standards. This chapter explains the rationale of accounting and auditing standards and provides an overview of International Financial Reporting Standards (IFRSs) and International Standards for Auditing (ISA), highlighting the components of the standards that are particularly relevant for financial sector assessments. The chapter then outlines the World Bank’s Report on Observance of Standards and Codes (ROSC) program on accounting and auditing standards, highlighting the key lessons of experience. Box 10.1 Main Weaknesses in the Transparency Practices of Central Banks and Monetary Policy 1. Clarity of Roles, Responsibilities, and Objectives of Central Banks • A general lack of clarity about the hierarchy among a multiplicity of monetary policy objectives and about how potential conflicts among them would be resolved • Potential conflicts in the policy objectives, as provided for in different statutes • Lack of clarity in the responsibility over foreign exchange policy • Absence of specifics and conditions under which governments may override central bank policy decisions • Existence of legal provisions to use various instruments often encumbered by the need to seek approval from another authority (e.g., the Ministry of Finance) • Disclosure of certain information that is often limited by strict interpretations of secrecy rules governing operations of some central banks • Accountability of some central banks weakened by the absence of an explicit legal requirement to report to a legislative body or designated public authority to inform on the conduct of monetary policy and the fulfillment of policy objectives • Unclear institutional relationships between central banks and governments, as well as associated agency roles and financial transactions 2. Open Process for Formulating and Reporting Monetary Policy Decisions • Poor or nonexistent explanations for the rationale and functioning of its policy instruments • Insufficient frequency of disclosures (with some authorities arguing that the guidelines are not clear in that regard) • Reservations about announcing meeting schedules for policy-making bodies 3. Public Availability of Information on Monetary Policy • Remaining weaknesses in the availability of specific data templates even through many countries subscribe or plan to subscribe to the International Monetary Fund’s data dissemination standard (Special Data Dissemination Standard, or SDDS, and the General Data Dissemination System, or GDDS) • Timeliness and frequency of publications a common problem • Concerns about the quality of some of the information that is disclosed 4. Accountability and Assurances of Integrity by the Central Bank • Deficiencies in some of the procedures in the areas of auditing and accounting • Many cases of nondisclosure of internal governance procedures, including the standards for the personal conduct of staff members • Nondisclosure, lack of explicit legal protection for officials and staff members in the conduct of their official duties, or both