正在加载图片...

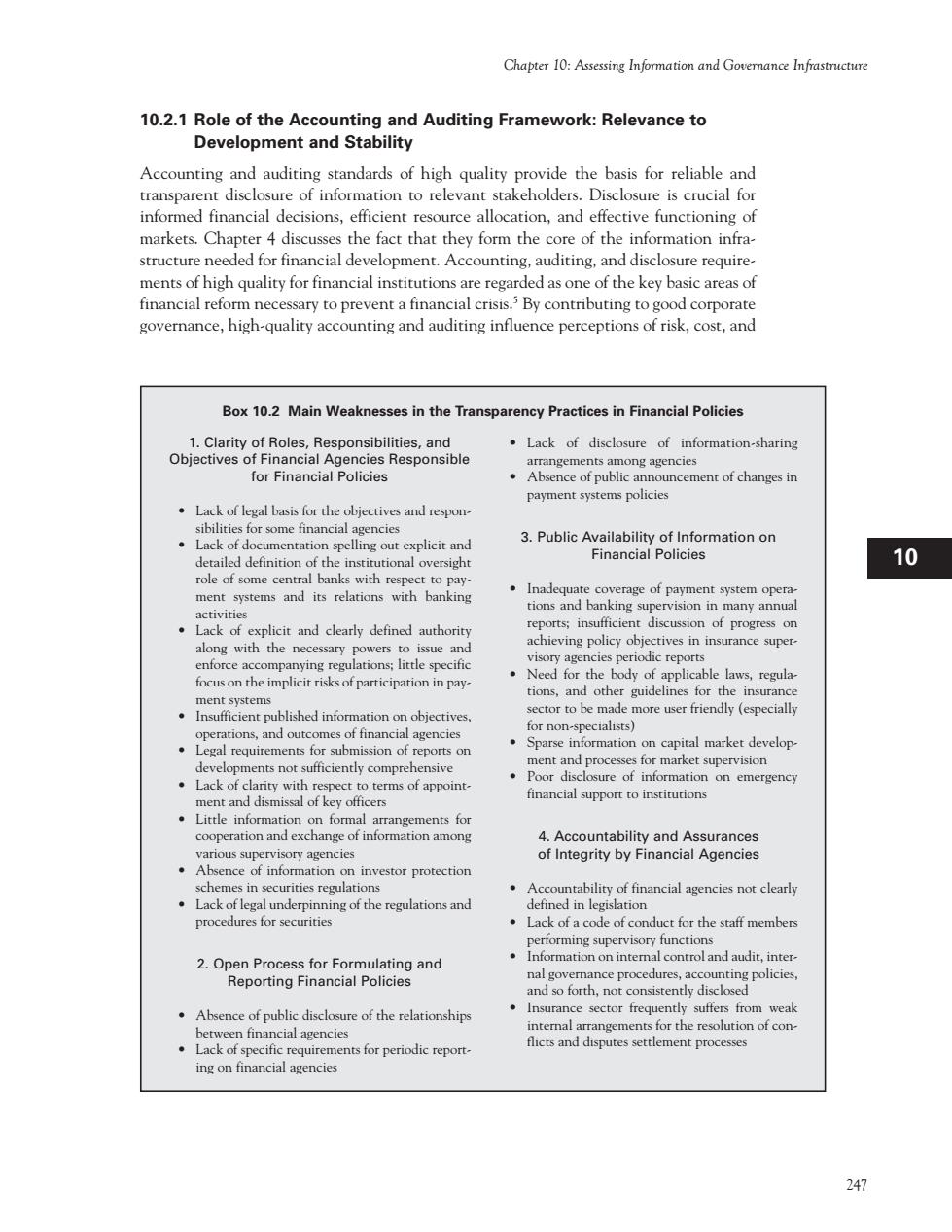

Chapter 10:Assessing Information and Govemance 10.2.1 Role of the Accou nting and Auditing Framework:Relevance to Development and Stability Accounting and auditing standards of high quality provide the basis for reliable and transparent disclosure of information to relevant stakeholders.Disclosure is crucial for informed financial decisions,efficient resource allocation,and effective functioning of markets.Chapter 4 discusses the fact that they form the core of the information infra. structure needed for financial development.Accounting,auditing,and disclosure require- ments of high quality for financial institutions are regarded as one of the key basic areas of financial reform necessary to prevent a financial crisis.By contributing to good corporate governance,high-quality accounting and auditing influence perceptions of risk,cost,and Box 10.2 Main Weaknesses in the Transparency Practices in Financial Policies Ob1.Clantyof Financial Agencies Responsible onsibilities 。ack of disclosu information sharing for Financial .Aemaggc of publ pay Lack of legal basis for the bjectives and respon. 3.Public Availabil 10 ment sytem and its relations with banking n of progres powers to isue and visory age ector to be m more user friendly (especially 。Sparse informat ncapital market develop .Pnt and proce r market s Lack of clarity with respect to terms of appoint in sal of k co vestor protection AC ntability of financial agencies not clearly 2.oegrapognd Absence of public disclosure of the relationships .hertcenfnancilenci ntemal a ing on financial agencies for periodic repor 247247 Chapter 10: Assessing Information and Governance Infrastructure 1 I H G F E D C B A 12 11 10 9 8 7 6 5 4 3 2 10.2.1 Role of the Accounting and Auditing Framework: Relevance to Development and Stability Accounting and auditing standards of high quality provide the basis for reliable and transparent disclosure of information to relevant stakeholders. Disclosure is crucial for informed financial decisions, efficient resource allocation, and effective functioning of markets. Chapter 4 discusses the fact that they form the core of the information infrastructure needed for financial development. Accounting, auditing, and disclosure requirements of high quality for financial institutions are regarded as one of the key basic areas of financial reform necessary to prevent a financial crisis.5 By contributing to good corporate governance, high-quality accounting and auditing influence perceptions of risk, cost, and Box 10.2 Main Weaknesses in the Transparency Practices in Financial Policies 1. Clarity of Roles, Responsibilities, and Objectives of Financial Agencies Responsible for Financial Policies • Lack of legal basis for the objectives and responsibilities for some financial agencies • Lack of documentation spelling out explicit and detailed definition of the institutional oversight role of some central banks with respect to payment systems and its relations with banking activities • Lack of explicit and clearly defined authority along with the necessary powers to issue and enforce accompanying regulations; little specific focus on the implicit risks of participation in payment systems • Insufficient published information on objectives, operations, and outcomes of financial agencies • Legal requirements for submission of reports on developments not sufficiently comprehensive • Lack of clarity with respect to terms of appointment and dismissal of key officers • Little information on formal arrangements for cooperation and exchange of information among various supervisory agencies • Absence of information on investor protection schemes in securities regulations • Lack of legal underpinning of the regulations and procedures for securities 2. Open Process for Formulating and Reporting Financial Policies • Absence of public disclosure of the relationships between financial agencies • Lack of specific requirements for periodic reporting on financial agencies • Lack of disclosure of information-sharing arrangements among agencies • Absence of public announcement of changes in payment systems policies 3. Public Availability of Information on Financial Policies • Inadequate coverage of payment system operations and banking supervision in many annual reports; insufficient discussion of progress on achieving policy objectives in insurance supervisory agencies periodic reports • Need for the body of applicable laws, regulations, and other guidelines for the insurance sector to be made more user friendly (especially for non-specialists) • Sparse information on capital market development and processes for market supervision • Poor disclosure of information on emergency financial support to institutions 4. Accountability and Assurances of Integrity by Financial Agencies • Accountability of financial agencies not clearly defined in legislation • Lack of a code of conduct for the staff members performing supervisory functions • Information on internal control and audit, internal governance procedures, accounting policies, and so forth, not consistently disclosed • Insurance sector frequently suffers from weak internal arrangements for the resolution of conflicts and disputes settlement processes