正在加载图片...

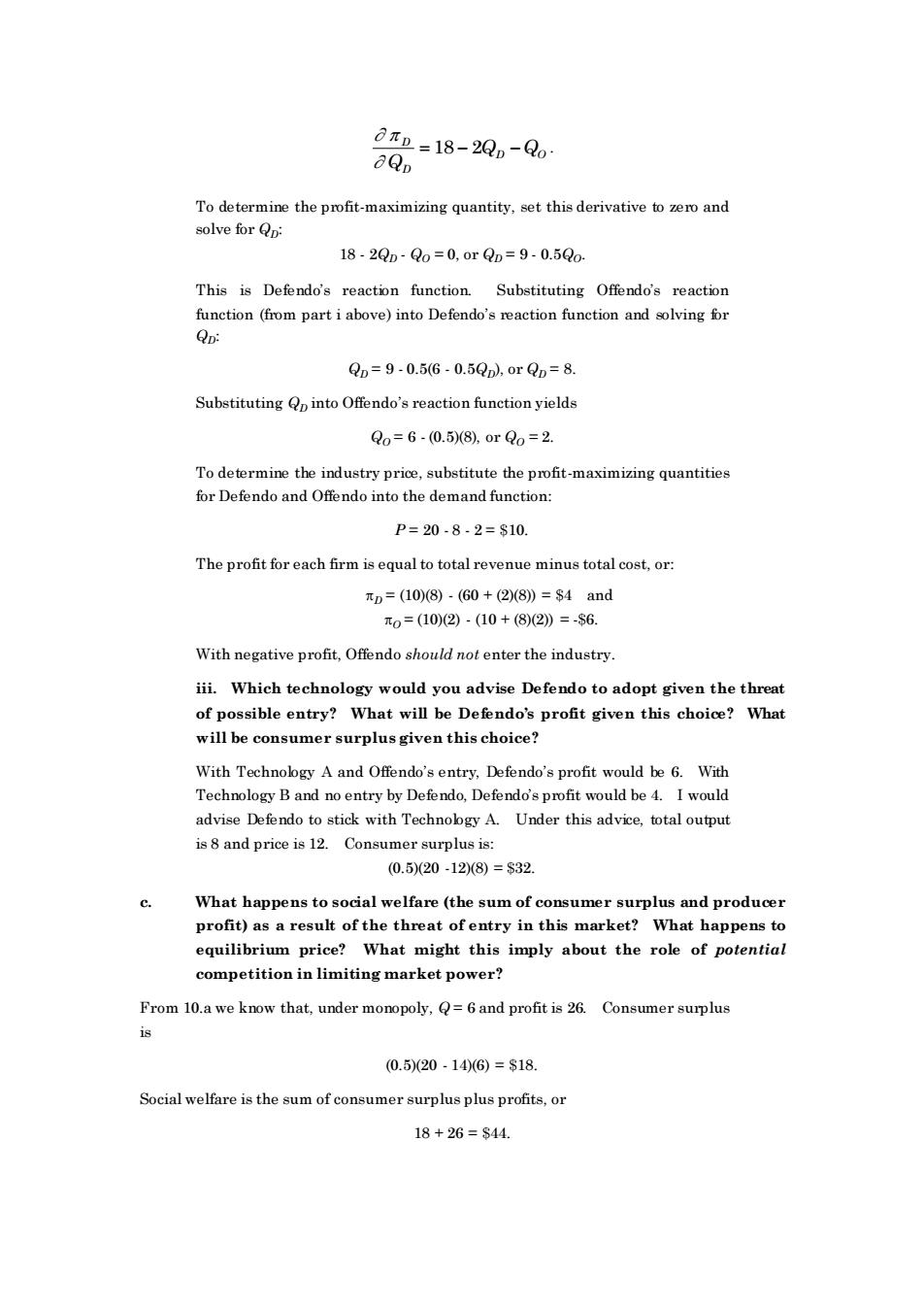

dπ 2=18-2Qo-Q0 To determin the quantity.t this solve forQp 18.2Qm-Qo=0,0rQo=9.0.5Qo This is Defendo's reaction function.Substituting Offendo's reaction function (from part i above)into Defendo's reaction function and solving for Qp: Qo=9.0.56.0.5Q.orQ=8. Substituting n into Offendo's reaction function yields Q0=6.0.58.orQ0=2. for Defendo and Offendo into the demand function: P=20.8.2=$10 The profit for each firm isequal to total revenue minus total cos or D=(10)8)·(60+(②8)》=$4 and 元o=(10)(2②·(10+(8)2)=-$6. With negative profit,Offendo should not enter the industry. iii.Which technology would you advise Defendo to adopt given the threat of possible entry?What will be Defendo's profit given this choice?What will be consumer surplus given this choice? ould be 6.With 'sprofit would be 4. 1woul advise Defendo to stick with Technobgy A.Under this advice,total output is8 and price is 12.Consumer surplus is: (0.5)20.12(8)=S32. What happens to social welfare (the sum of consumer surplus and producer profit)as a result of the threat of entry in this market?What happens to m price?What might this imply about the of potential competition in limiting market power? From 10.a we know that,under monopoly,Q=6 and profit is 26.Consumer surplus s 0.520-140G=$18. Social welfare is the sum of consumer surplus plus profits,or 18+26=S44 D D D O Q = 18 − 2Q −Q . To determine the profit-maximizing quantity, set this derivative to zero and solve for QD: 18 - 2QD - QO = 0, or QD = 9 - 0.5QO. This is Defendo’s reaction function. Substituting Offendo’s reaction function (from part i above) into Defendo’s reaction function and solving for QD: QD = 9 - 0.5(6 - 0.5QD), or QD = 8. Substituting QD into Offendo’s reaction function yields QO = 6 - (0.5)(8), or QO = 2. To determine the industry price, substitute the profit-maximizing quantities for Defendo and Offendo into the demand function: P = 20 - 8 - 2 = $10. The profit for each firm is equal to total revenue minus total cost, or: D = (10)(8) - (60 + (2)(8)) = $4 and O = (10)(2) - (10 + (8)(2)) = -$6. With negative profit, Offendo should not enter the industry. iii. Which technology would you advise Defendo to adopt given the threat of possible entry? What will be Defendo’s profit given this choice? What will be consumer surplus given this choice? With Technology A and Offendo’s entry, Defendo’s profit would be 6. With Technology B and no entry by Defendo, Defendo’s profit would be 4. I would advise Defendo to stick with Technology A. Under this advice, total output is 8 and price is 12. Consumer surplus is: (0.5)(20 -12)(8) = $32. c. What happens to social welfare (the sum of consumer surplus and producer profit) as a result of the threat of entry in this market? What happens to equilibrium price? What might this imply about the role of potential competition in limiting market power? From 10.a we know that, under monopoly, Q = 6 and profit is 26. Consumer surplus is (0.5)(20 - 14)(6) = $18. Social welfare is the sum of consumer surplus plus profits, or 18 + 26 = $44