正在加载图片...

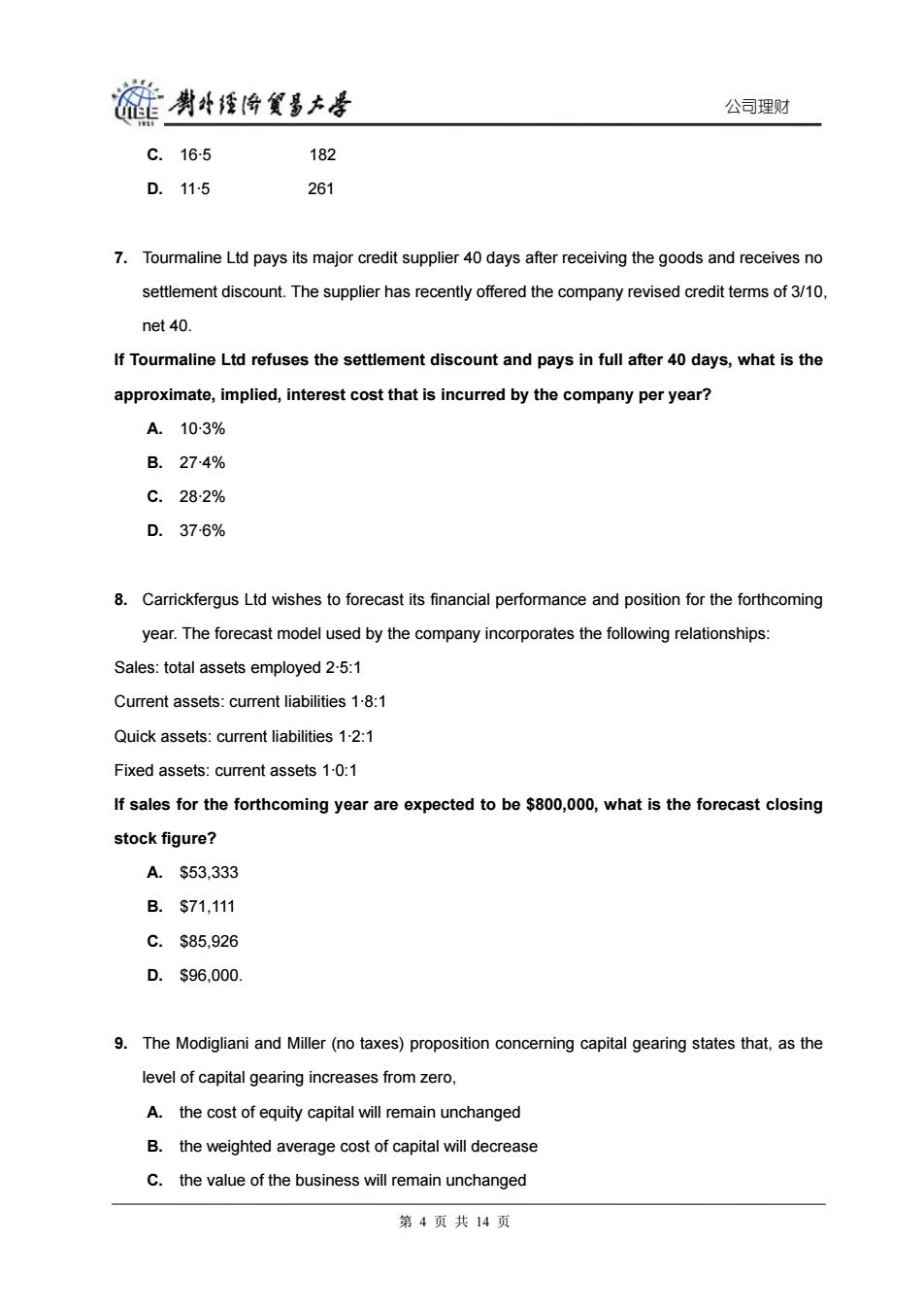

肖的经份贸多去是 公司理财 C.165 182 D.115 261 7.Tourmaline Ltd pays its major credit supplier 40 days after receiving the goods and receives no settlement discount.The supplier has recently offered the company revised credit terms of 3/10, net 40. If Tourmaline Ltd refuses the settlement discount and pays in full after 40 days,what is the approximate,implied,interest cost that is incurred by the company per year? A.103% B.274% C.282% D.376% 8.Carrickfergus Ltd wishes to forecast its financial performance and position for the forthcoming year.The forecast model used by the company incorporates the following relationships: Sales:total assets employed 2-5:1 Current assets:current liabilities 1-8:1 Quick assets:current liabilities 1-2:1 Fixed assets:current assets 1-0:1 If sales for the forthcoming year are expected to be $800,000,what is the forecast closing stock figure? A.$53,333 B.$71,111 C.$85,926 D.$96,000. 9.The Modigliani and Miller(no taxes)proposition concerning capital gearing states that,as the level of capital gearing increases from zero, A.the cost of equity capital will remain unchanged B.the weighted average cost of capital will decrease C.the value of the business will remain unchanged 第4页共14页公司理财 C. 16·5 182 D. 11·5 261 7. Tourmaline Ltd pays its major credit supplier 40 days after receiving the goods and receives no settlement discount. The supplier has recently offered the company revised credit terms of 3/10, net 40. If Tourmaline Ltd refuses the settlement discount and pays in full after 40 days, what is the approximate, implied, interest cost that is incurred by the company per year? A. 10·3% B. 27·4% C. 28·2% D. 37·6% 8. Carrickfergus Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales: total assets employed 2·5:1 Current assets: current liabilities 1·8:1 Quick assets: current liabilities 1·2:1 Fixed assets: current assets 1·0:1 If sales for the forthcoming year are expected to be $800,000, what is the forecast closing stock figure? A. $53,333 B. $71,111 C. $85,926 D. $96,000. 9. The Modigliani and Miller (no taxes) proposition concerning capital gearing states that, as the level of capital gearing increases from zero, A. the cost of equity capital will remain unchanged B. the weighted average cost of capital will decrease C. the value of the business will remain unchanged 第 4 页 共 14 页