正在加载图片...

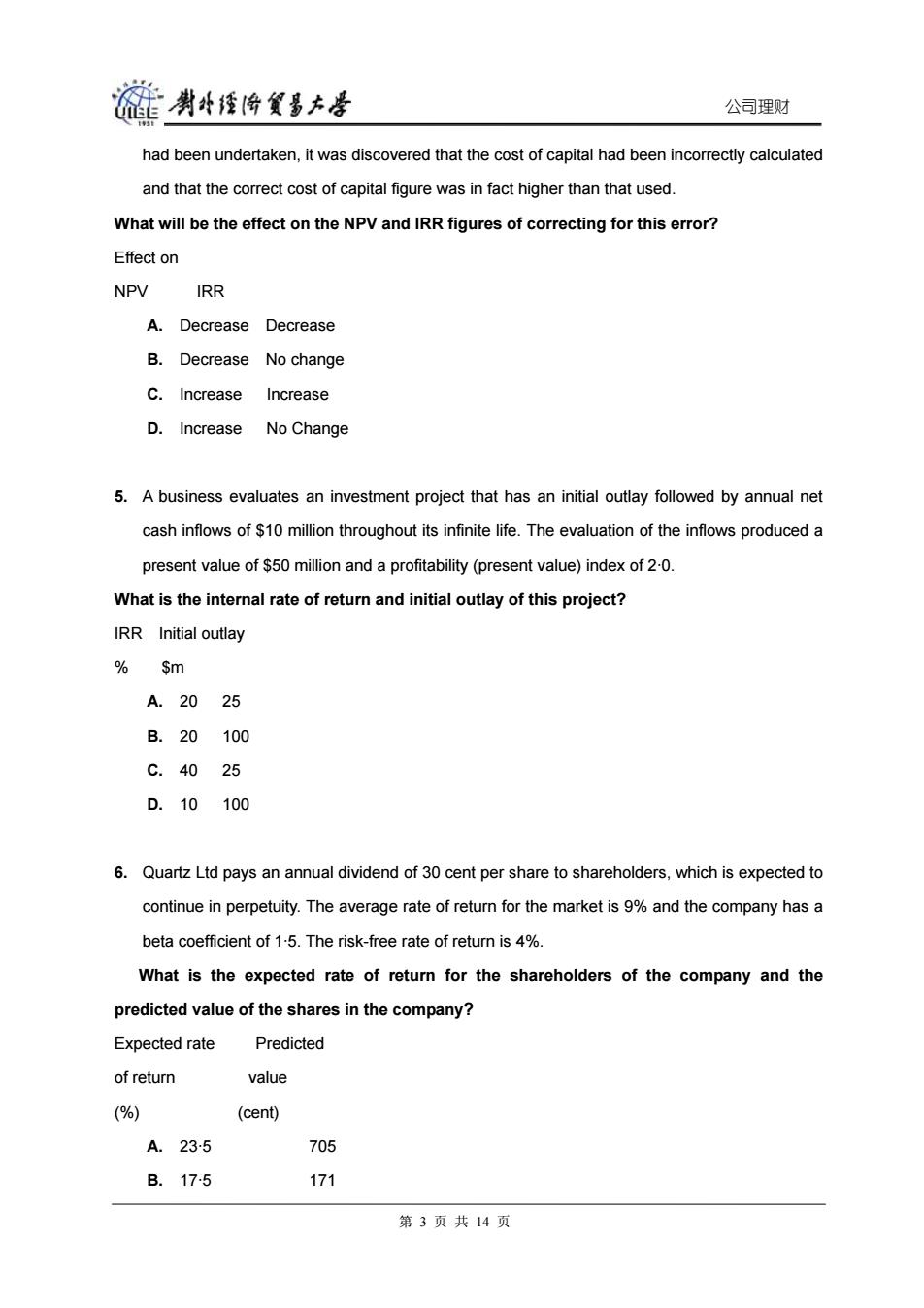

旋剥经降贸墨去号 公司理财 had been undertaken,it was discovered that the cost of capital had been incorrectly calculated and that the correct cost of capital figure was in fact higher than that used. What will be the effect on the NPV and IRR figures of correcting for this error? Effect on NPV IRR A.Decrease Decrease B.Decrease No change C.Increase Increase D.Increase No Change 5.A business evaluates an investment project that has an initial outlay followed by annual net cash inflows of $10 million throughout its infinite life.The evaluation of the inflows produced a present value of $50 million and a profitability (present value)index of 2-0. What is the internal rate of return and initial outlay of this project? IRR Initial outlay % Sm A.20 25 B.20 100 C.4025 D.10100 6.Quartz Ltd pays an annual dividend of 30 cent per share to shareholders,which is expected to continue in perpetuity.The average rate of return for the market is 9%and the company has a beta coefficient of 1-5.The risk-free rate of return is 4%. What is the expected rate of return for the shareholders of the company and the predicted value of the shares in the company? Expected rate Predicted of return value (%) (cent) A.235 705 B.175 171 第3页共14页公司理财 had been undertaken, it was discovered that the cost of capital had been incorrectly calculated and that the correct cost of capital figure was in fact higher than that used. What will be the effect on the NPV and IRR figures of correcting for this error? Effect on NPV IRR A. Decrease Decrease B. Decrease No change C. Increase Increase D. Increase No Change 5. A business evaluates an investment project that has an initial outlay followed by annual net cash inflows of $10 million throughout its infinite life. The evaluation of the inflows produced a present value of $50 million and a profitability (present value) index of 2·0. What is the internal rate of return and initial outlay of this project? IRR Initial outlay % $m A. 20 25 B. 20 100 C. 40 25 D. 10 100 6. Quartz Ltd pays an annual dividend of 30 cent per share to shareholders, which is expected to continue in perpetuity. The average rate of return for the market is 9% and the company has a beta coefficient of 1·5. The risk-free rate of return is 4%. What is the expected rate of return for the shareholders of the company and the predicted value of the shares in the company? Expected rate Predicted of return value (%) (cent) A. 23·5 705 B. 17·5 171 第 3 页 共 14 页