正在加载图片...

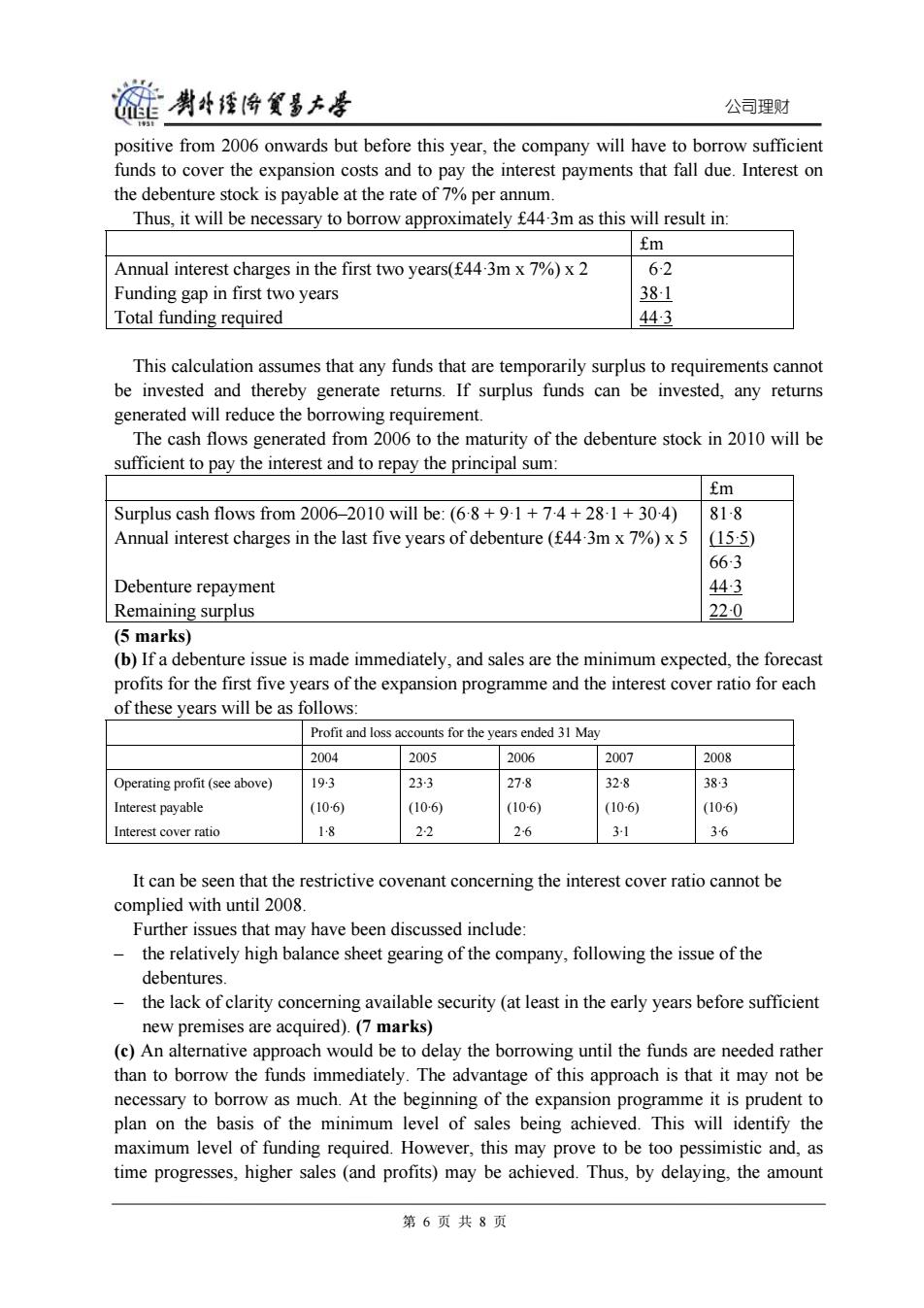

醛肖经海食多大是 公司理财 positive from 2006 onwards but before this year,the company will have to borrow sufficient funds to cover the expansion costs and to pay the interest payments that fall due.Interest on the debenture stock is payable at the rate of 7%per annum. Thus,it will be necessary to borrow approximately f44-3m as this will result in: fm Annual interest charges in the first two years(f44.3m x 7%)x 2 62 Funding gap in first two years 381 Total funding required 443 This calculation assumes that any funds that are temporarily surplus to requirements cannot be invested and thereby generate returns.If surplus funds can be invested,any returns generated will reduce the borrowing requirement. The cash flows generated from 2006 to the maturity of the debenture stock in 2010 will be sufficient to pay the interest and to repay the principal sum: fm Surplus cash flows from 2006-2010 will be:(68+9-1+74+28-1+30-4) 81-8 Annual interest charges in the last five years of debenture(f44.3m x 7%)x 5 155) 663 Debenture repayment 443 Remaining surplus 22-0 (5 marks) (b)If a debenture issue is made immediately,and sales are the minimum expected,the forecast profits for the first five years of the expansion programme and the interest cover ratio for each of these years will be as follows: Profit and loss accounts for the years ended 31 May 2004 2005 2006 2007 2008 Operating profit (see above) 193 233 27-8 32-8 383 Interest payable (106) (106) (10-6) (10-6) (10-6) Interest cover ratio 18 22 26 31 36 It can be seen that the restrictive covenant concerning the interest cover ratio cannot be complied with until 2008. Further issues that may have been discussed include: the relatively high balance sheet gearing of the company,following the issue of the debentures. the lack of clarity concerning available security (at least in the early years before sufficient new premises are acquired).(7 marks) (c)An alternative approach would be to delay the borrowing until the funds are needed rather than to borrow the funds immediately.The advantage of this approach is that it may not be necessary to borrow as much.At the beginning of the expansion programme it is prudent to plan on the basis of the minimum level of sales being achieved.This will identify the maximum level of funding required.However,this may prove to be too pessimistic and,as time progresses,higher sales (and profits)may be achieved.Thus,by delaying,the amount 第6页共8页公司理财 positive from 2006 onwards but before this year, the company will have to borrow sufficient funds to cover the expansion costs and to pay the interest payments that fall due. Interest on the debenture stock is payable at the rate of 7% per annum. Thus, it will be necessary to borrow approximately £44·3m as this will result in: £m Annual interest charges in the first two years(£44·3m x 7%) x 2 Funding gap in first two years Total funding required 6·2 38·1 44·3 This calculation assumes that any funds that are temporarily surplus to requirements cannot be invested and thereby generate returns. If surplus funds can be invested, any returns generated will reduce the borrowing requirement. The cash flows generated from 2006 to the maturity of the debenture stock in 2010 will be sufficient to pay the interest and to repay the principal sum: £m Surplus cash flows from 2006–2010 will be: (6·8 + 9·1 + 7·4 + 28·1 + 30·4) Annual interest charges in the last five years of debenture (£44·3m x 7%) x 5 Debenture repayment Remaining surplus 81·8 (15·5) 66·3 44·3 22·0 (5 marks) (b) If a debenture issue is made immediately, and sales are the minimum expected, the forecast profits for the first five years of the expansion programme and the interest cover ratio for each of these years will be as follows: Profit and loss accounts for the years ended 31 May 2004 2005 2006 2007 2008 Operating profit (see above) Interest payable Interest cover ratio 19·3 (10·6) 1·8 23·3 (10·6) 2·2 27·8 (10·6) 2·6 32·8 (10·6) 3·1 38·3 (10·6) 3·6 It can be seen that the restrictive covenant concerning the interest cover ratio cannot be complied with until 2008. Further issues that may have been discussed include: – the relatively high balance sheet gearing of the company, following the issue of the debentures. – the lack of clarity concerning available security (at least in the early years before sufficient new premises are acquired). (7 marks) (c) An alternative approach would be to delay the borrowing until the funds are needed rather than to borrow the funds immediately. The advantage of this approach is that it may not be necessary to borrow as much. At the beginning of the expansion programme it is prudent to plan on the basis of the minimum level of sales being achieved. This will identify the maximum level of funding required. However, this may prove to be too pessimistic and, as time progresses, higher sales (and profits) may be achieved. Thus, by delaying, the amount 第 6 页 共 8 页