正在加载图片...

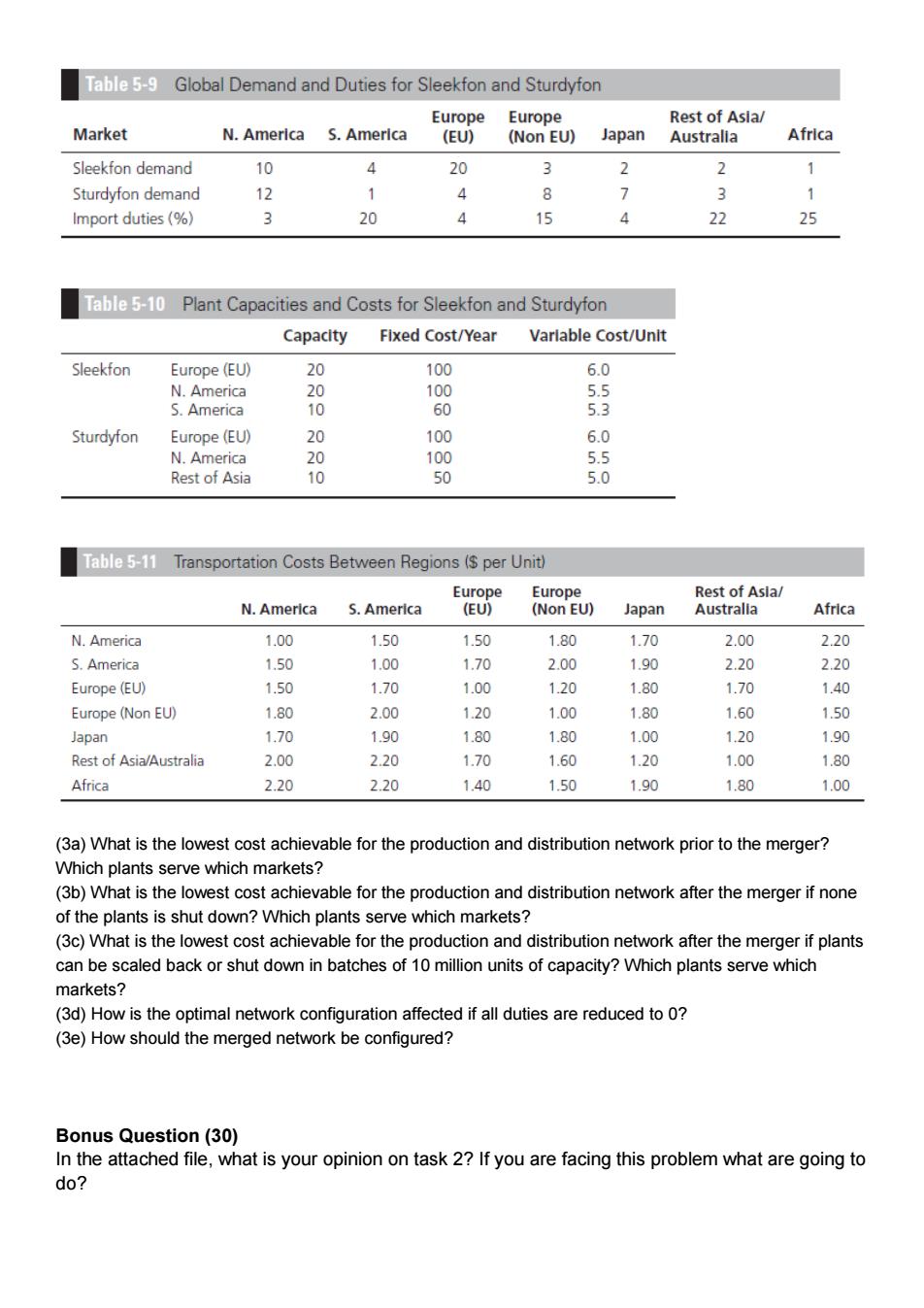

Table 5-9 Global Demand and Duties for Sleekfon and Sturdyfon Europe Europe Rest of Asla/ Market N.America S.Amerlca (EU) (Non EU) Japan Australia Africa Sleekfon demand 10 4 20 3 2 2 1 Sturdyfon demand 12 1 4 8 > 3 1 Import duties(%) 20 15 22 25 Table 5-10 Plant Capacities and Costs for Sleekfon and Sturdyfon Capacity Flxed Cost/Year Varlable Cost/Unlt Sleekfon Europe (EU) 20 100 6.0 N.America 20 100 5.5 S.America 10 60 5.3 Sturdyfon Europe (EU) 20 100 6.0 N.America 20 100 5.5 Rest of Asia 10 50 5.0 Table 5-11 Transportation Costs Between Regions($per Unit) Europe Europe Rest of Asla/ N.America S.America (EU) (Non EU) Japan Australla Africa N.America 1.00 1.50 1.50 1.80 1.70 2.00 2.20 S.America 1.50 1.00 1.70 2.00 1.90 2.20 2.20 Europe(EU) 1.50 1.70 1.00 1.20 1.80 1.70 1.40 Europe (Non EU) 1.80 2.00 1.20 1.00 1.80 1.60 1.50 Japan 1.70 1.90 1.80 1.80 1.00 1.20 1.90 Rest of Asia/Australia 2.00 2.20 1.70 1.60 1.20 1.00 1.80 Africa 2.20 2.20 1.40 1.50 1.90 1.80 1.00 (3a)What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? (3b)What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down?Which plants serve which markets? (3c)What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity?Which plants serve which markets? (3d)How is the optimal network configuration affected if all duties are reduced to 0? (3e)How should the merged network be configured? Bonus Question(30) In the attached file,what is your opinion on task 2?If you are facing this problem what are going to do?(3a) What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? (3b) What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down? Which plants serve which markets? (3c) What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity? Which plants serve which markets? (3d) How is the optimal network configuration affected if all duties are reduced to 0? (3e) How should the merged network be configured? Bonus Question (30) In the attached file, what is your opinion on task 2? If you are facing this problem what are going to do?