Supply Chain Management Homework 1 ◆ Homework submission deadline:20:00,2014-October-24 ■ The homework must be completed and submitted on an individual basis.If two or more students submit identical homework solutions,each student will get only a fraction of the grade for this assignment. Late policy:first late day will reduce your assignment grade by 40%.Additional days will reduce the entire homework grade to 0.If you have a special circumstance,please contact jianjun.gao@vip.163.com ahead of the submission deadline. Submission Policy:Please email your answer to jianjun.gao@vip.163.com.The title of your email should be in the following format "SCM-id-name",e.g.,"SCM-10000000-Zhangxiaoguang". Question 1(20) Find an industry or company you are familiar with.Analyze its supply chain structure(roles,flows, products).What is the competitive strategy of this company?Are the supply chain strategy and competitive strategy matched?If they are not consistent,what is your suggestion?Please identify the circle process and the pull/push process of its supply chain. Question 2(30) (2a)A distributor has heard that one of the major manufacturers from which it buys is considering going direct to the consumer.What can the distributor do about this?What advantages can it offer the manufacturer that the manufacturer is unlikely to be able to reproduce? (2b)Amazon sells books,music,electronics,software,toys,and home improvement products online.In which product category does going online offer the greatest advantage compared to a retail store chain?In which product category does the online channel offer the smallest advantage (or a potential cost disadvantage)compared to a retail store chain?Why? Question 3(50) Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged.Their current market sizes are as shown in Table 5-9.All demand is in millions of units.Sleekfon has three production facilities in Europe(EU),North America,and South America.Sturdyfon also has three production facilities in Europe(EU),North America,and Rest of Asia/Australia.The capacity (in millions of units),annual fixed cost(in millions of $)and variable production costs($per unit)for each plant are as shown in Table 5-10. Transportation costs between regions are as shown in Table 5-11.All transportation costs are shown in per unit.Duties are applied on each unit based on the fixed cost per unit capacity,variable cost per unit, and transportation cost.Thus,a unit currently shipped from North America to Africa has a fixed cost per unit of capacity of $5.00,a variable production cost of $5.50,and a transportation cost of $2.20.The 25 percent import duty is thus applied on $12.70(5.00 +5.50+2.20)to give a total cost on import of $15.88. For the questions below,assume that market demand is as in Table 5-9.The merged company has estimated that scaling back a 20-million-unit plant to 10 million units saves 30 percent in fixed costs Variable costs at a scaled-back plant are unaffected.Shutting a plant down(either 10 million or 20 million units)saves 80 percent in fixed costs.Fixed costs are only partially recovered because of severance and other costs associated with a shutdown

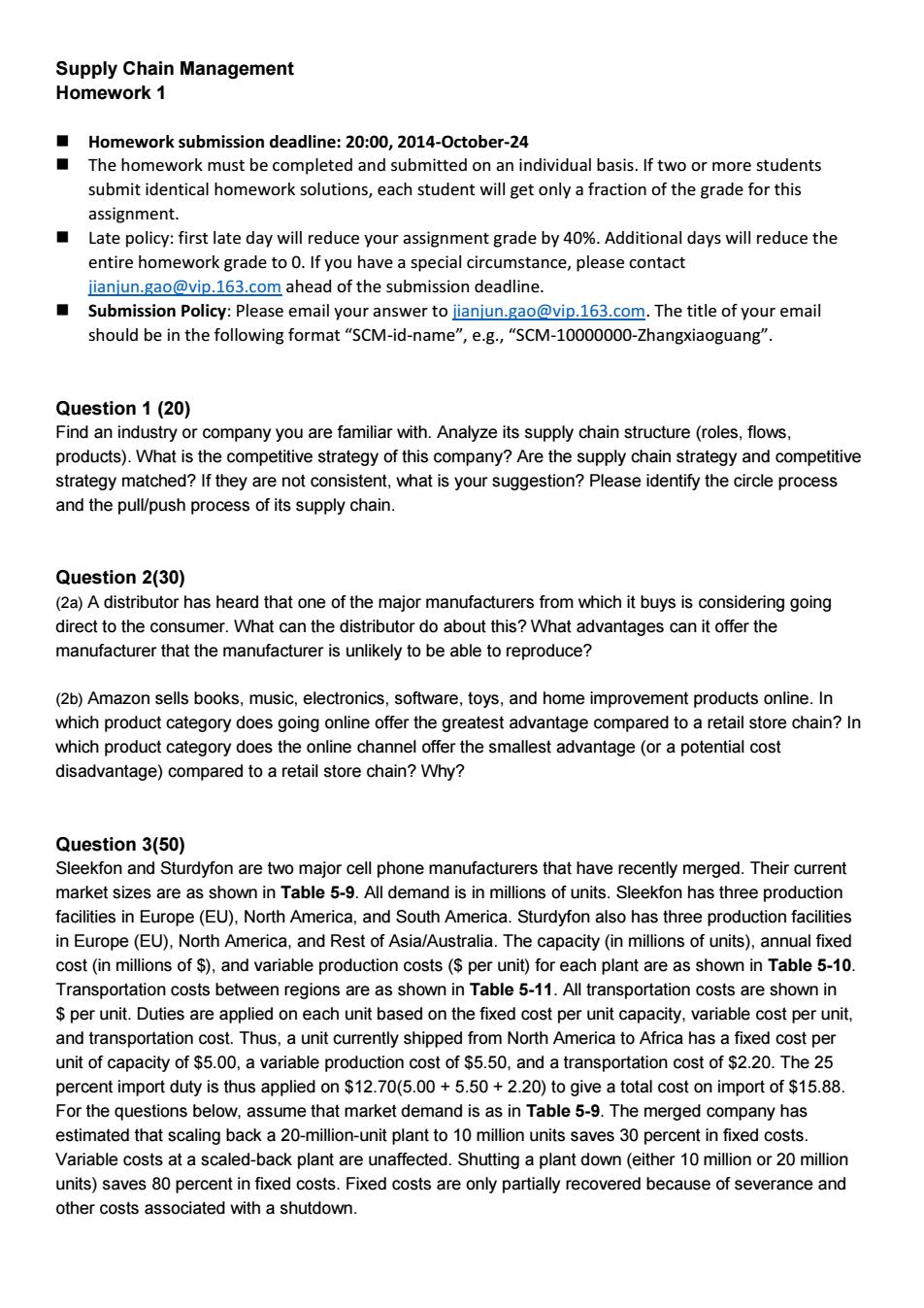

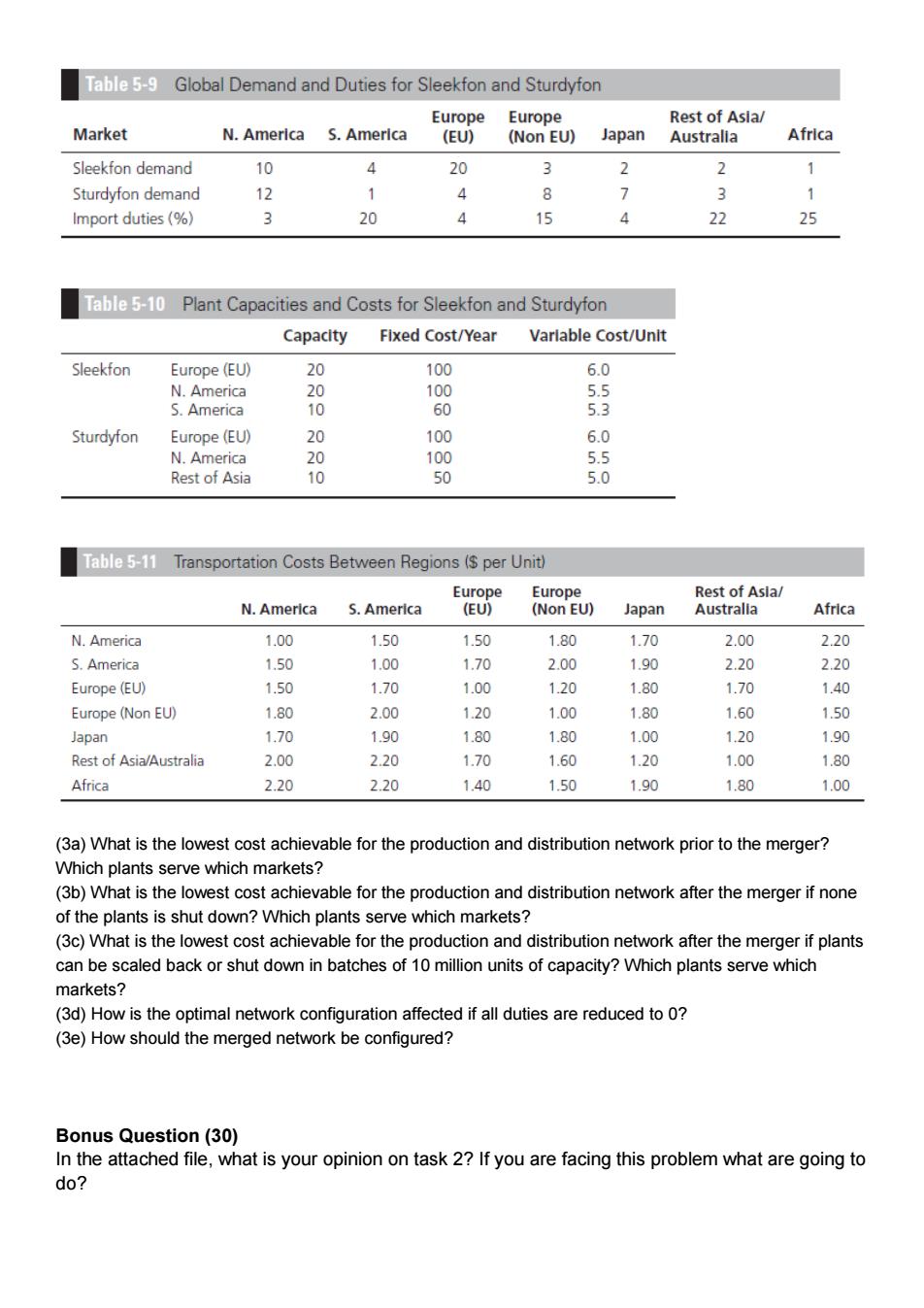

Supply Chain Management Homework 1 Homework submission deadline: 20:00, 2014-October-24 The homework must be completed and submitted on an individual basis. If two or more students submit identical homework solutions, each student will get only a fraction of the grade for this assignment. Late policy: first late day will reduce your assignment grade by 40%. Additional days will reduce the entire homework grade to 0. If you have a special circumstance, please contact jianjun.gao@vip.163.com ahead of the submission deadline. Submission Policy: Please email your answer to jianjun.gao@vip.163.com. The title of your email should be in the following format “SCM-id-name”, e.g., “SCM-10000000-Zhangxiaoguang”. Question 1 (20) Find an industry or company you are familiar with. Analyze its supply chain structure (roles, flows, products). What is the competitive strategy of this company? Are the supply chain strategy and competitive strategy matched? If they are not consistent, what is your suggestion? Please identify the circle process and the pull/push process of its supply chain. Question 2(30) (2a) A distributor has heard that one of the major manufacturers from which it buys is considering going direct to the consumer. What can the distributor do about this? What advantages can it offer the manufacturer that the manufacturer is unlikely to be able to reproduce? (2b) Amazon sells books, music, electronics, software, toys, and home improvement products online. In which product category does going online offer the greatest advantage compared to a retail store chain? In which product category does the online channel offer the smallest advantage (or a potential cost disadvantage) compared to a retail store chain? Why? Question 3(50) Sleekfon and Sturdyfon are two major cell phone manufacturers that have recently merged. Their current market sizes are as shown in Table 5-9. All demand is in millions of units. Sleekfon has three production facilities in Europe (EU), North America, and South America. Sturdyfon also has three production facilities in Europe (EU), North America, and Rest of Asia/Australia. The capacity (in millions of units), annual fixed cost (in millions of $), and variable production costs ($ per unit) for each plant are as shown in Table 5-10. Transportation costs between regions are as shown in Table 5-11. All transportation costs are shown in $ per unit. Duties are applied on each unit based on the fixed cost per unit capacity, variable cost per unit, and transportation cost. Thus, a unit currently shipped from North America to Africa has a fixed cost per unit of capacity of $5.00, a variable production cost of $5.50, and a transportation cost of $2.20. The 25 percent import duty is thus applied on $12.70(5.00 + 5.50 + 2.20) to give a total cost on import of $15.88. For the questions below, assume that market demand is as in Table 5-9. The merged company has estimated that scaling back a 20-million-unit plant to 10 million units saves 30 percent in fixed costs. Variable costs at a scaled-back plant are unaffected. Shutting a plant down (either 10 million or 20 million units) saves 80 percent in fixed costs. Fixed costs are only partially recovered because of severance and other costs associated with a shutdown

Table 5-9 Global Demand and Duties for Sleekfon and Sturdyfon Europe Europe Rest of Asla/ Market N.America S.Amerlca (EU) (Non EU) Japan Australia Africa Sleekfon demand 10 4 20 3 2 2 1 Sturdyfon demand 12 1 4 8 > 3 1 Import duties(%) 20 15 22 25 Table 5-10 Plant Capacities and Costs for Sleekfon and Sturdyfon Capacity Flxed Cost/Year Varlable Cost/Unlt Sleekfon Europe (EU) 20 100 6.0 N.America 20 100 5.5 S.America 10 60 5.3 Sturdyfon Europe (EU) 20 100 6.0 N.America 20 100 5.5 Rest of Asia 10 50 5.0 Table 5-11 Transportation Costs Between Regions($per Unit) Europe Europe Rest of Asla/ N.America S.America (EU) (Non EU) Japan Australla Africa N.America 1.00 1.50 1.50 1.80 1.70 2.00 2.20 S.America 1.50 1.00 1.70 2.00 1.90 2.20 2.20 Europe(EU) 1.50 1.70 1.00 1.20 1.80 1.70 1.40 Europe (Non EU) 1.80 2.00 1.20 1.00 1.80 1.60 1.50 Japan 1.70 1.90 1.80 1.80 1.00 1.20 1.90 Rest of Asia/Australia 2.00 2.20 1.70 1.60 1.20 1.00 1.80 Africa 2.20 2.20 1.40 1.50 1.90 1.80 1.00 (3a)What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? (3b)What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down?Which plants serve which markets? (3c)What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity?Which plants serve which markets? (3d)How is the optimal network configuration affected if all duties are reduced to 0? (3e)How should the merged network be configured? Bonus Question(30) In the attached file,what is your opinion on task 2?If you are facing this problem what are going to do?

(3a) What is the lowest cost achievable for the production and distribution network prior to the merger? Which plants serve which markets? (3b) What is the lowest cost achievable for the production and distribution network after the merger if none of the plants is shut down? Which plants serve which markets? (3c) What is the lowest cost achievable for the production and distribution network after the merger if plants can be scaled back or shut down in batches of 10 million units of capacity? Which plants serve which markets? (3d) How is the optimal network configuration affected if all duties are reduced to 0? (3e) How should the merged network be configured? Bonus Question (30) In the attached file, what is your opinion on task 2? If you are facing this problem what are going to do?

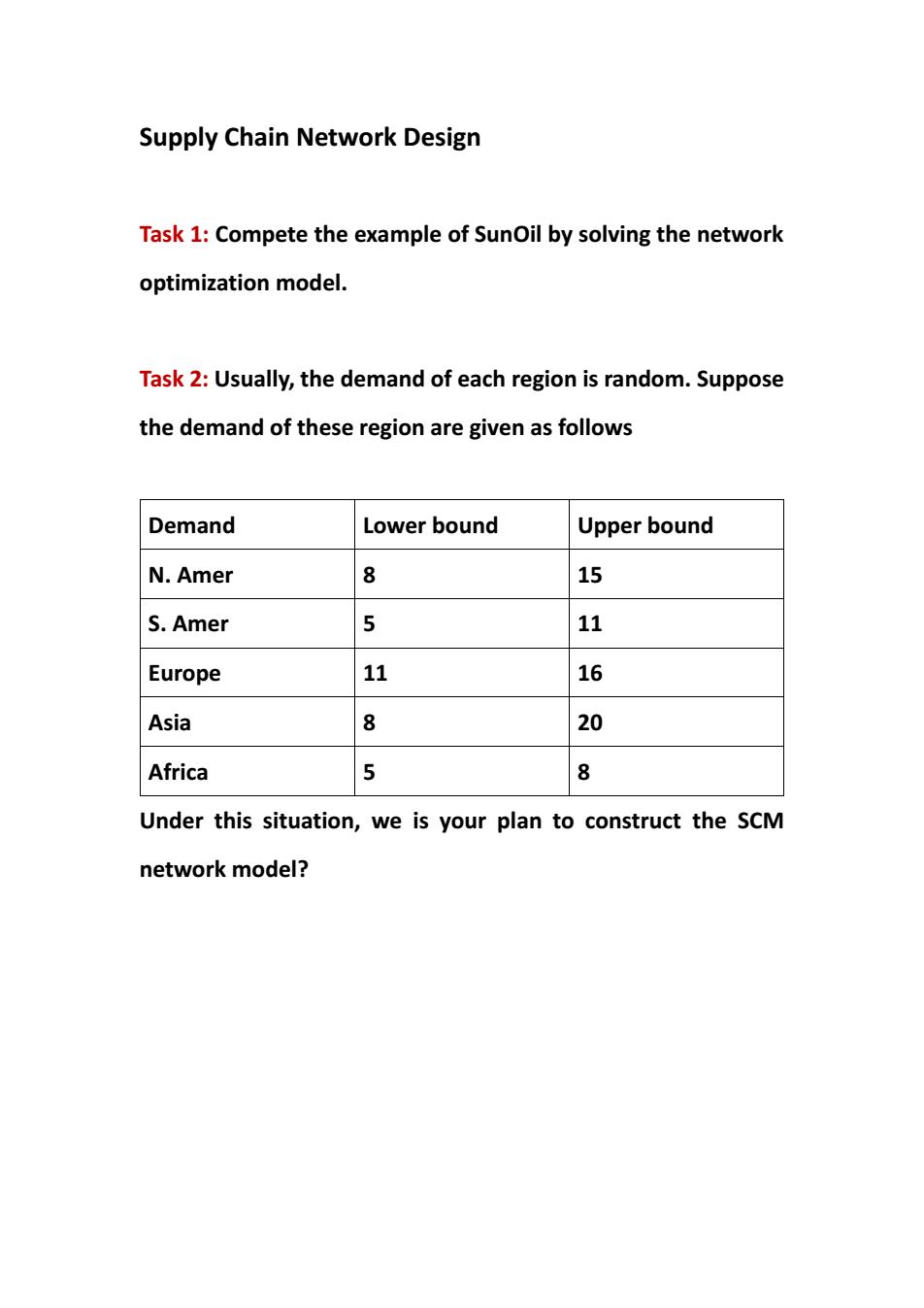

Supply Chain Network Design Task 1:Compete the example of SunOil by solving the network optimization model. Task 2:Usually,the demand of each region is random.Suppose the demand of these region are given as follows Demand Lower bound Upper bound N.Amer 8 15 S.Amer 5 11 Europe 11 16 Asia 8 20 Africa 5 8 Under this situation,we is your plan to construct the SCM network model?

Supply Chain Network Design Task 1: Compete the example of SunOil by solving the network optimization model. Task 2: Usually, the demand of each region is random. Suppose the demand of these region are given as follows Demand Lower bound Upper bound N. Amer 8 15 S. Amer 5 11 Europe 11 16 Asia 8 20 Africa 5 8 Under this situation, we is your plan to construct the SCM network model?