JIAOTONG UNIVERSITY 196 Supply Chain Management Lecture 4 Supply Chain Drivers and Metrics Instructor(s) Prof.Jianjun Gao Department of Automation School of Electronic Information and Electrical Engineering SCM by J.J.Gao SEIEE AU406

Supply Chain Management Instructor(s) SEIEE AU406 + - SCM by J. J. Gao Supply Chain Drivers and Metrics Prof. Jianjun Gao Department of Automation School of Electronic Information and Electrical Engineering Lecture 4

Outline Financial Measure of the Performance Drivers of supply chain performance A framework for structuring drivers Facilities Inventory Transportation Information Sourcing Pricing SEIEE AU406 3-2

+ - SEIEE AU406 3-2 Outline Financial Measure of the Performance Drivers of supply chain performance A framework for structuring drivers Facilities Inventory Transportation Information Sourcing Pricing

Financial Measure of the Performance Recall that growing the supply chain surplus is the ultimate goal of a supply chain management a In the following part,we define important financial measures that are reported by a firm and impacted by supply chain performance In later sections,we then link supply chain drivers and associated metrics to the various financial measures SEIEE AU406 3

+ - SEIEE AU406 Financial Measure of the Performance Recall that growing the supply chain surplus is the ultimate goal of a supply chain management In the following part, we define important financial measures that are reported by a firm and impacted by supply chain performance In later sections, we then link supply chain drivers and associated metrics to the various financial measures 3

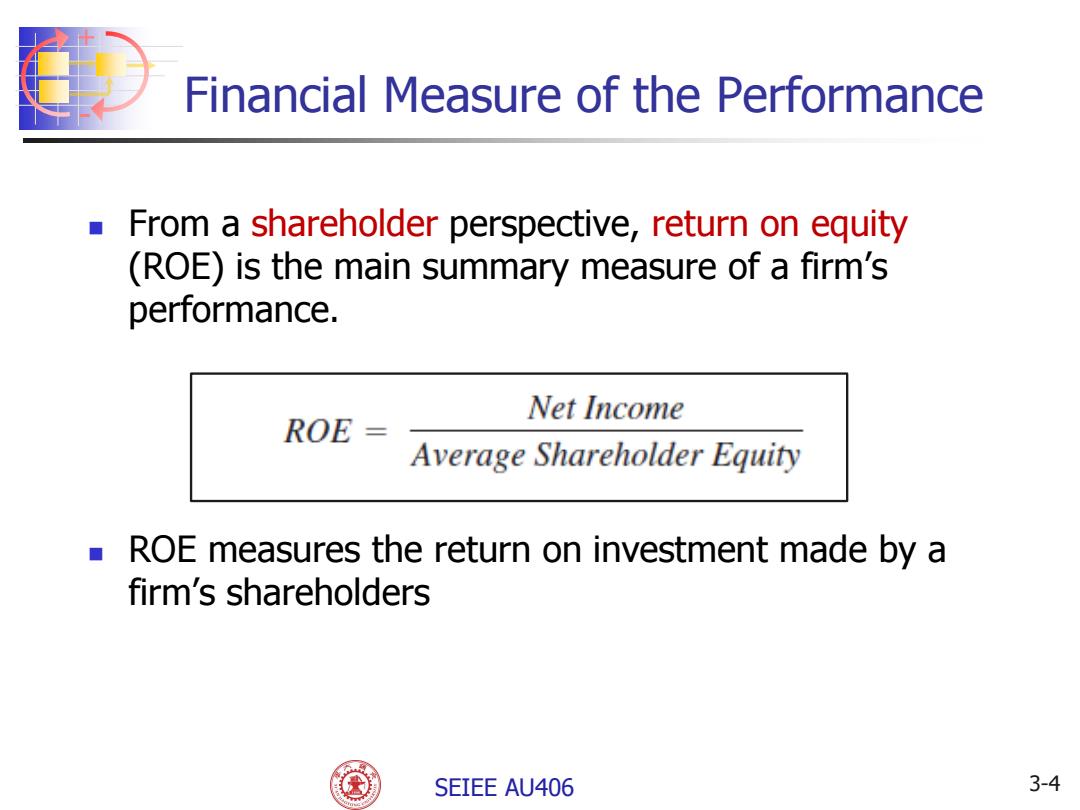

Financial Measure of the Performance ■ From a shareholder perspective,return on equity (ROE)is the main summary measure of a firm's performance. Net Income ROE= Average Shareholder Equity ROE measures the return on investment made by a firm's shareholders SEIEE AU406 3-4

+ - SEIEE AU406 From a shareholder perspective, return on equity (ROE) is the main summary measure of a firm’s performance. 3-4 Financial Measure of the Performance ROE measures the return on investment made by a firm’s shareholders

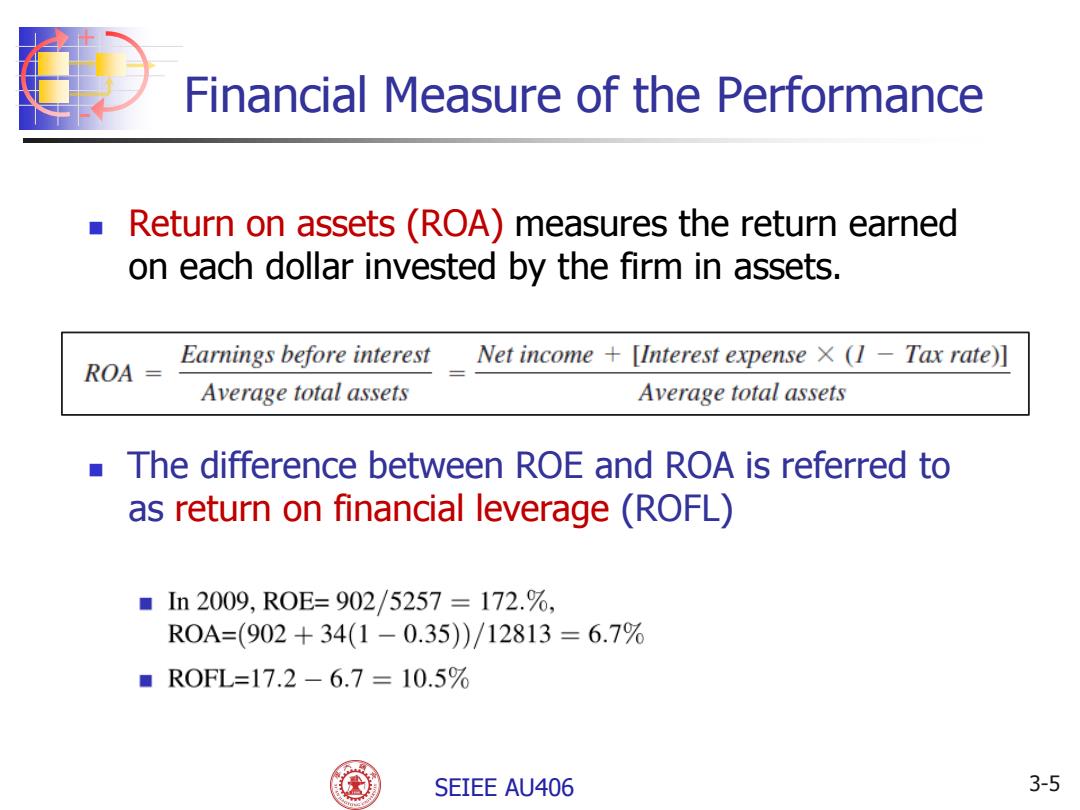

Financial Measure of the Performance Return on assets(ROA)measures the return earned on each dollar invested by the firm in assets. Earnings before interest Net income [Interest expense x (1 -Tax rate)] ROA Average total assets Average total assets The difference between ROE and ROA is referred to as return on financial leverage (ROFL) ■In2009,R0E=902/5257=172.%, R0A=(902+34(1-0.35)/12813=6.7% ■R0FL=17.2-6.7=10.5% SEIEE AU406 3-5

+ - SEIEE AU406 Return on assets (ROA) measures the return earned on each dollar invested by the firm in assets. 3-5 Financial Measure of the Performance The difference between ROE and ROA is referred to as return on financial leverage (ROFL)

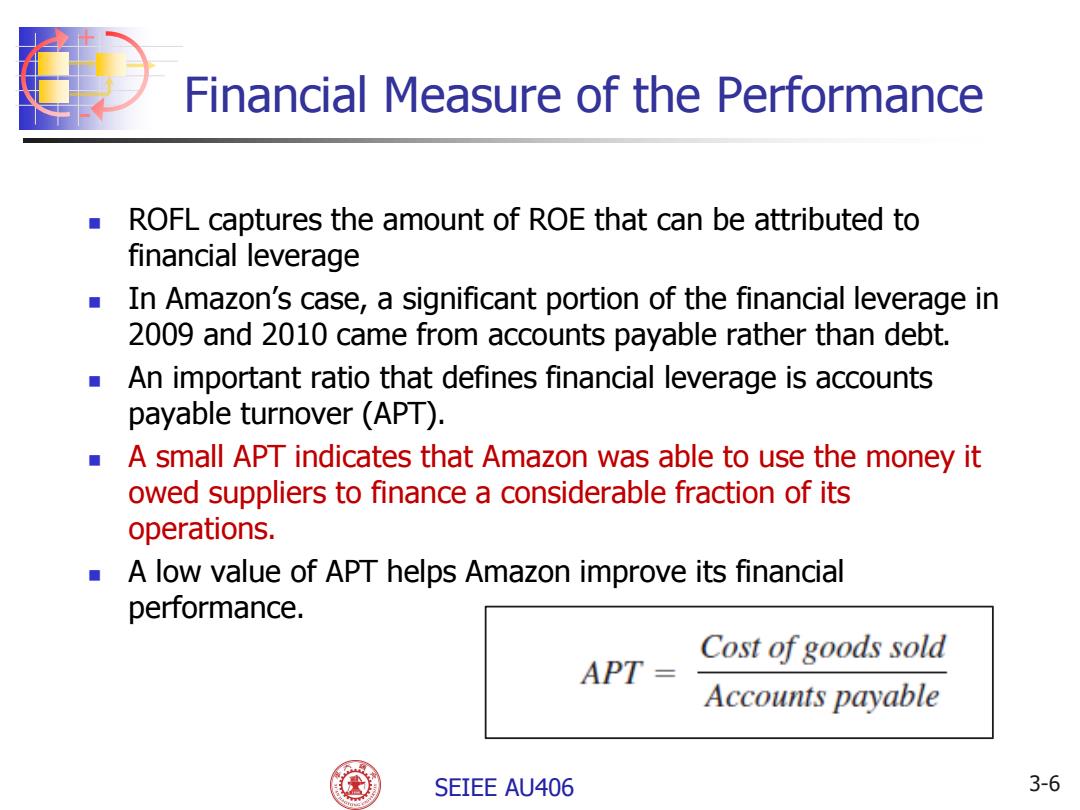

Financial Measure of the Performance ROFL captures the amount of ROE that can be attributed to financial leverage In Amazon's case,a significant portion of the financial leverage in 2009 and 2010 came from accounts payable rather than debt. ■ An important ratio that defines financial leverage is accounts payable turnover (APT). s A small APT indicates that Amazon was able to use the money it owed suppliers to finance a considerable fraction of its operations. A low value of APT helps Amazon improve its financial performance. Cost of goods sold APT= Accounts payable SEIEE AU406 3-6

+ - SEIEE AU406 ROFL captures the amount of ROE that can be attributed to financial leverage In Amazon’s case, a significant portion of the financial leverage in 2009 and 2010 came from accounts payable rather than debt. An important ratio that defines financial leverage is accounts payable turnover (APT). A small APT indicates that Amazon was able to use the money it owed suppliers to finance a considerable fraction of its operations. A low value of APT helps Amazon improve its financial performance. 3-6 Financial Measure of the Performance

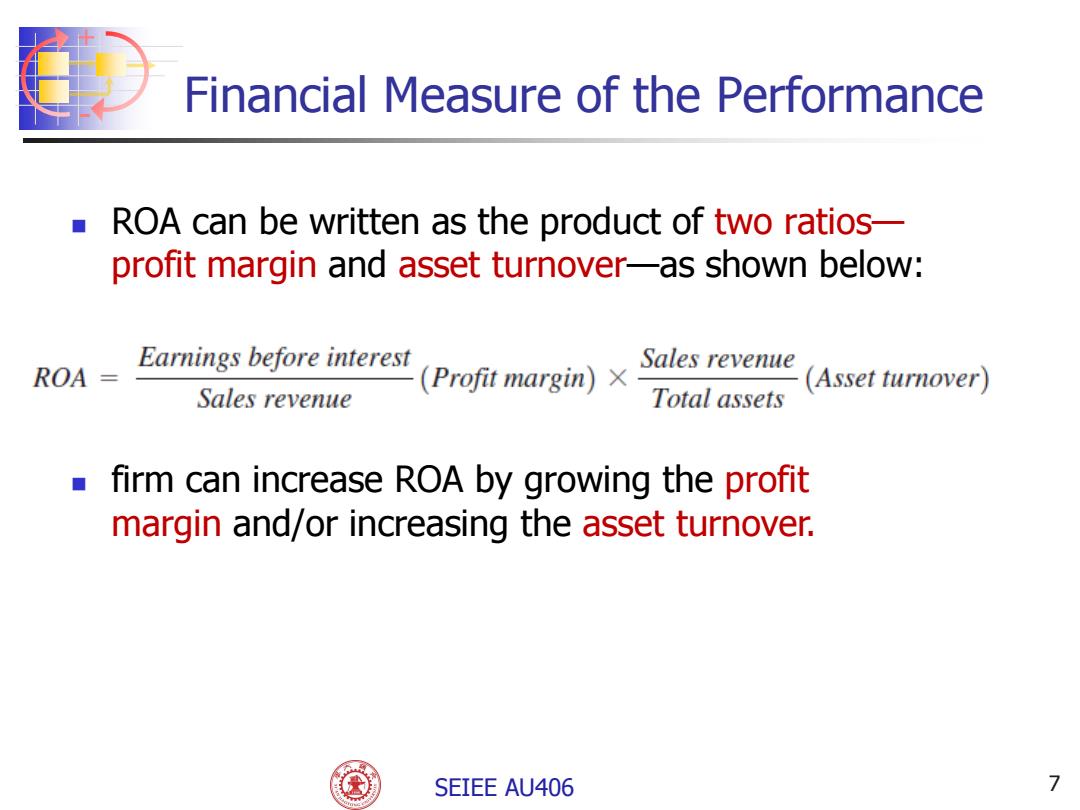

Financial Measure of the Performance ROA can be written as the product of two ratios- profit margin and asset turnover-as shown below: ROA Earnings before interest (Profit margin) Sales revenue (Asset turnover) Sales revenue Total assets firm can increase ROA by growing the profit margin and/or increasing the asset turnover. SEIEE AU406 7

+ - SEIEE AU406 ROA can be written as the product of two ratios— profit margin and asset turnover—as shown below: 7 Financial Measure of the Performance firm can increase ROA by growing the profit margin and/or increasing the asset turnover

Financial Measure of the Performance Profit margin can be improved by getting better prices or by reducing the various expenses incurred. A responsive supply chain can allow a firm to provide high value to a customer,thus potentially getting higher prices. Good supply chain management can also allow a firm to decrease the expenses incurred to serve customer demand. 国 In Amazon case,a significant expense is outbound shipping cost.(reducing this cost helps to improve profit margin) SEIEE AU406 8

+ - SEIEE AU406 Profit margin can be improved by getting better prices or by reducing the various expenses incurred. A responsive supply chain can allow a firm to provide high value to a customer, thus potentially getting higher prices. Good supply chain management can also allow a firm to decrease the expenses incurred to serve customer demand. In Amazon case, a significant expense is outbound shipping cost. (reducing this cost helps to improve profit margin) 8 Financial Measure of the Performance

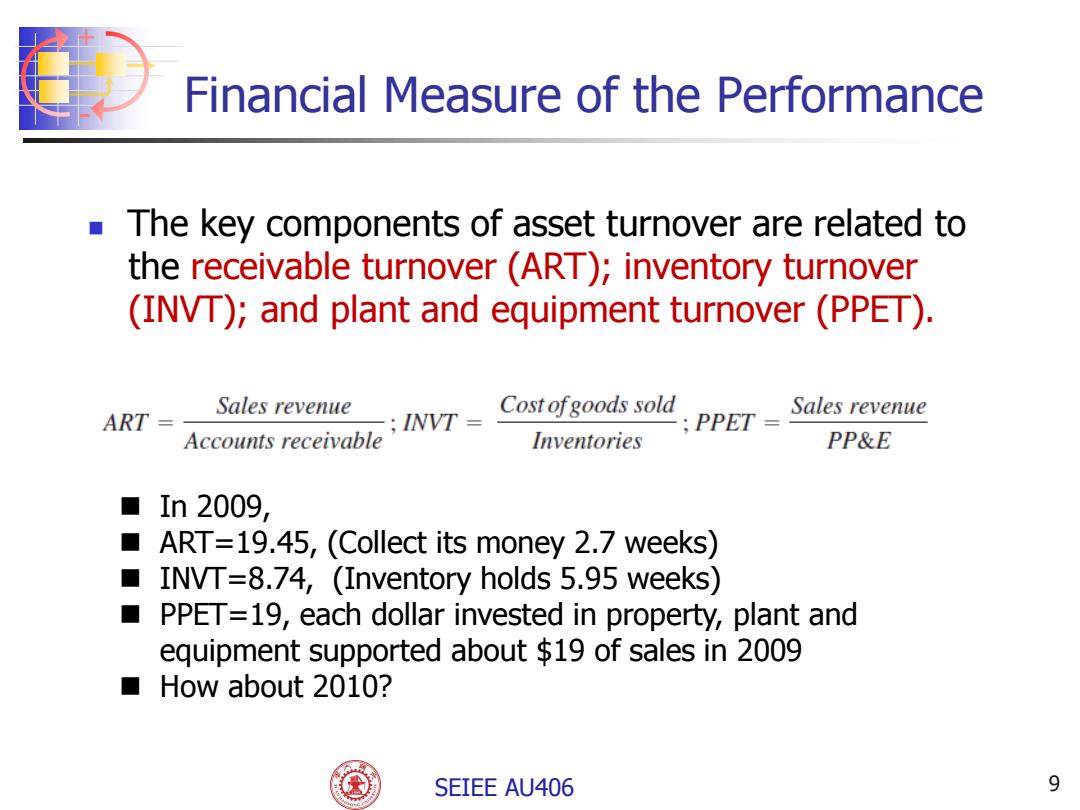

Financial Measure of the Performance The key components of asset turnover are related to the receivable turnover (ART);inventory turnover (INVT);and plant and equipment turnover(PPET). Sales revenue Cost ofgoods sold Sales revenue ART INVT= PPET Accounts receivable Inventories PP&E ■ In2009, ■ ART=19.45,(Collect its money 2.7 weeks) ■ INVT=8.74,(Inventory holds 5.95 weeks) ■ PPET=19,each dollar invested in property,plant and equipment supported about $19 of sales in 2009 ■ How about 2010? SEIEE AU406 9

+ - SEIEE AU406 The key components of asset turnover are related to the receivable turnover (ART); inventory turnover (INVT); and plant and equipment turnover (PPET). 9 Financial Measure of the Performance In 2009, ART=19.45, (Collect its money 2.7 weeks) INVT=8.74, (Inventory holds 5.95 weeks) PPET=19, each dollar invested in property, plant and equipment supported about $19 of sales in 2009 How about 2010?

Drivers of Supply Chain Performance Facilities places where inventory is stored,assembled,or fabricated production sites and storage sites Inventory raw materials,WIP,finished goods within a supply chain ·inventory policies Transportation moving inventory from point to point in a supply chain combinations of transportation modes and routes SEIEE AU406 10

+ - SEIEE AU406 10 Drivers of Supply Chain Performance Facilities places where inventory is stored, assembled, or fabricated production sites and storage sites Inventory raw materials, WIP, finished goods within a supply chain inventory policies Transportation moving inventory from point to point in a supply chain combinations of transportation modes and routes