正在加载图片...

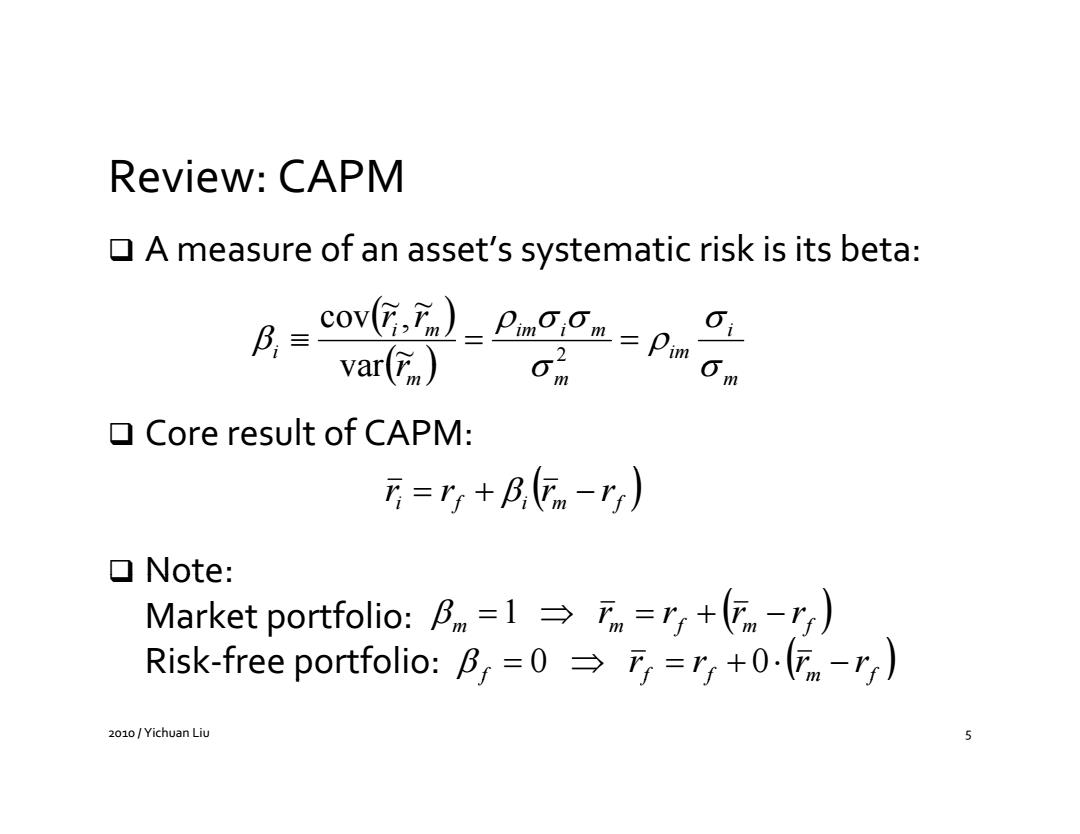

Review:CAPM A measure of an asset's systematic risk is its beta: Cov(mcon-pw var(tm) ▣Core result of CAPM: 万=r5+B,m-r) ▣Note: Market portfolio:Bnm=1→万n=ry+(m-r) Risk-free portfolio:B=0=+0.") 2010/Yichuan Liu Review: CAPM A measure measure of an asset’s systematic systematic risk is its beta: ~ cov~ ri , rm im i m i i 2 im var~ rm m m Core result of CAPM: ri rf irm rf Note: Market portfolio: 1 r r r rf m m f m Risk‐free portfolio: f 0 rf rf 0 rm rf f 2010 / Yichuan Liu 5