15.401 Recitation 7:CAPM

15.401 Recitation 7: CAPM

Learning Objectives Review of Concepts O CAPM O Beta and SML O Alpha ▣Examples O The frontier O CML and SML 2010/Yichuan Liu 2

Learning Objectives R i ev ew of Concepts oCAPM oBeta and SML oAlpha Examples oThe frontier oCML and SML 2010 / Yichuan Liu 2

Review:efficient frontier From Portfolio Choice... The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency portfolio and the risk-free asset.The proportion depends on investors'risk preferences. 2010/Yichuan Liu 3

‐ Review: efficient frontier From Portfolio Portfolio Choice… Choice… The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency tangency portfolio portfolio and the risk‐free asset. The proportion depends on investors’ risk preferences. 2010 / Yichuan Liu 3

Review:CAPM Since each investor holds the tangency portfolio as part of his/her overall portfolio,the market portfolio must coincide with the tangency portfolio. Idea of CAPM:the contribution of a single risky asset to the risk of the market portfolio must be proportional to its risk premium. In other words,investors are compensated for exposure to systematic risk. ldiosyncratic risk is not compensated because they can be diversified away. 2010/Yichuan Liu

Review: CAPM Since each investor investor holds the tangency tangency portfolio portfolio as part of his/her overall portfolio, the market portfolio must coincide with the tangency portfolio. Idea of CAPM: the contribution of a single risky asset to the risk of the market portfolio must be proportional proportional to its risk premium premium. In other words, investors are compensated for exposure to systematic risk. Idiosyncratic risk is not compensated because they can be diversified away. 2010 / Yichuan Liu 4

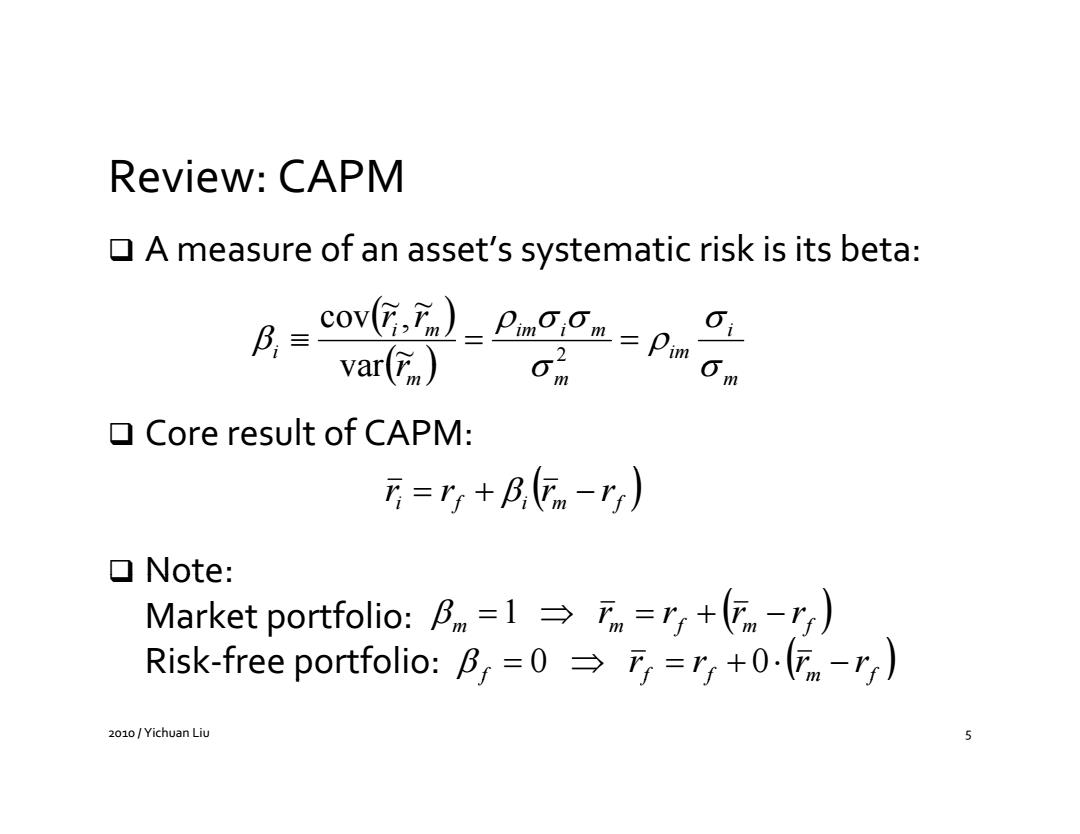

Review:CAPM A measure of an asset's systematic risk is its beta: Cov(mcon-pw var(tm) ▣Core result of CAPM: 万=r5+B,m-r) ▣Note: Market portfolio:Bnm=1→万n=ry+(m-r) Risk-free portfolio:B=0=+0.") 2010/Yichuan Liu

Review: CAPM A measure measure of an asset’s systematic systematic risk is its beta: ~ cov~ ri , rm im i m i i 2 im var~ rm m m Core result of CAPM: ri rf irm rf Note: Market portfolio: 1 r r r rf m m f m Risk‐free portfolio: f 0 rf rf 0 rm rf f 2010 / Yichuan Liu 5

Review:SML Graph of=r+-r,)in (beta,return)space is a straight line called the Security Market Line: SML 0 1 If CAPM holds,every asset must be on the SML. 2010/Yichuan Liu 6

, Review: SML Graph of ri rf irm rf Graph in (beta, return) return) space is a straight line called the Security Market Line: SML rm rf 0 1 β If CAPM holds, every asset must be on the SML. 2010 / Yichuan Liu 6

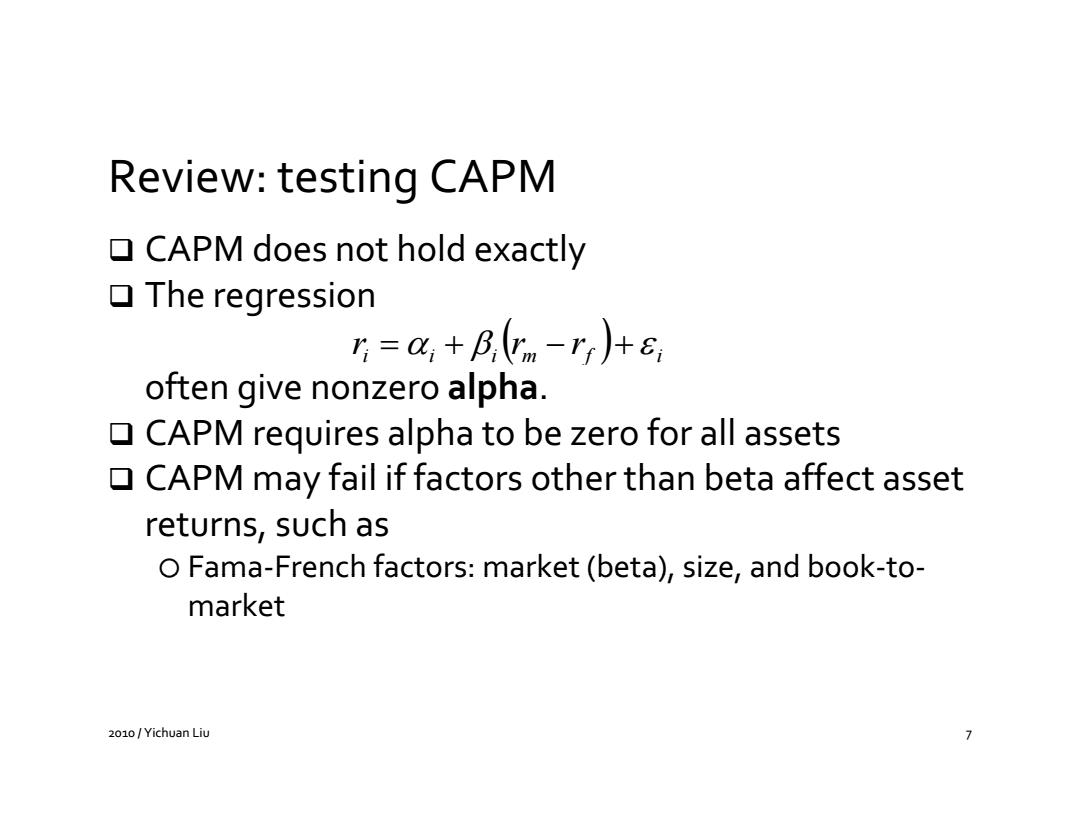

Review:testing CAPM CAPM does not hold exactly ▣The regression =a,+B,(m-r)+E often give nonzero alpha. CAPM requires alpha to be zero for all assets CAPM may fail if factors other than beta affect asset returns,such as O Fama-French factors:market(beta),size,and book-to- market 2010/Yichuan Liu

f Review: testing CAPM CAPM does not hold exactly exactly The regression ri i irm rf i often give nonzero alpha. CAPM requires alpha to be zero for all assets CAPM may f i al if f t ac ors other than b t e a affect asset returns, such as oFama‐French factors: factors: market (beta), (beta), size, and book‐to‐ market 2010 / Yichuan Liu 7

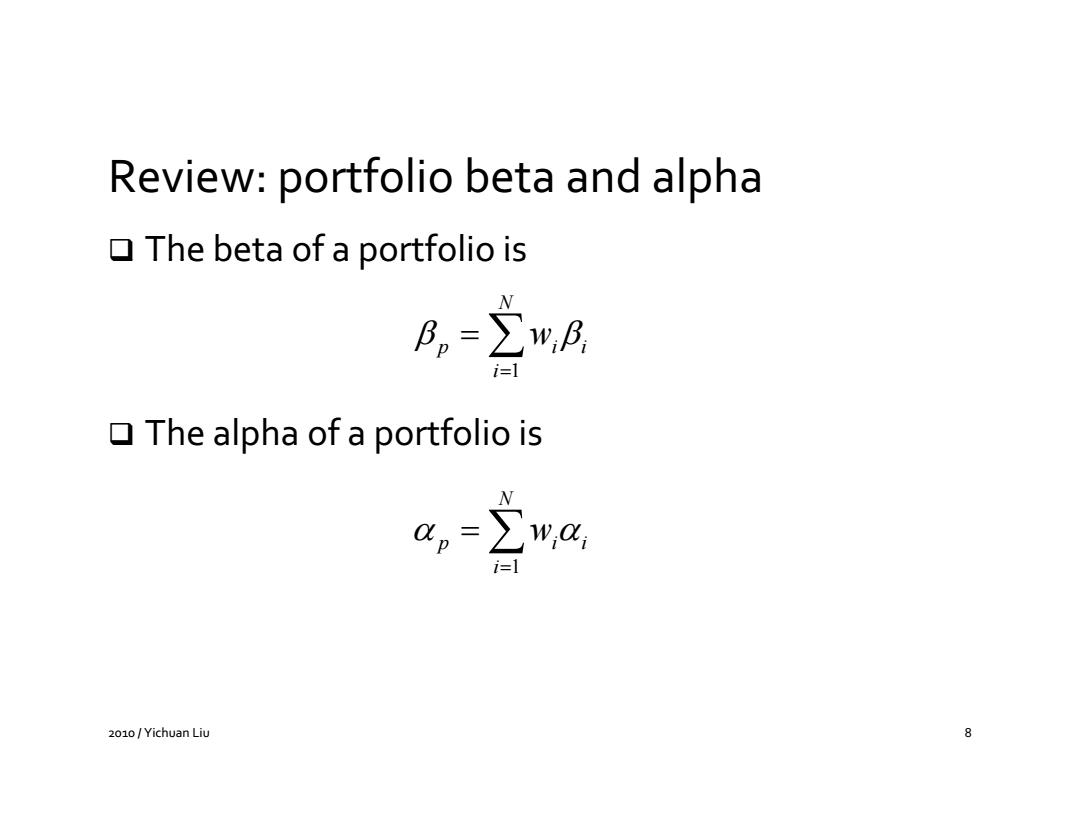

Review:portfolio beta and alpha The beta of a portfolio is B,=立A The alpha of a portfolio is ap=∑w,a i-1 2010/Yichuan Liu 8

Review: portfolio beta and alpha The beta of a portfolio portfolio is N p wii i1 The alpha of a portfolio is N p wii i1 2010 / Yichuan Liu 8

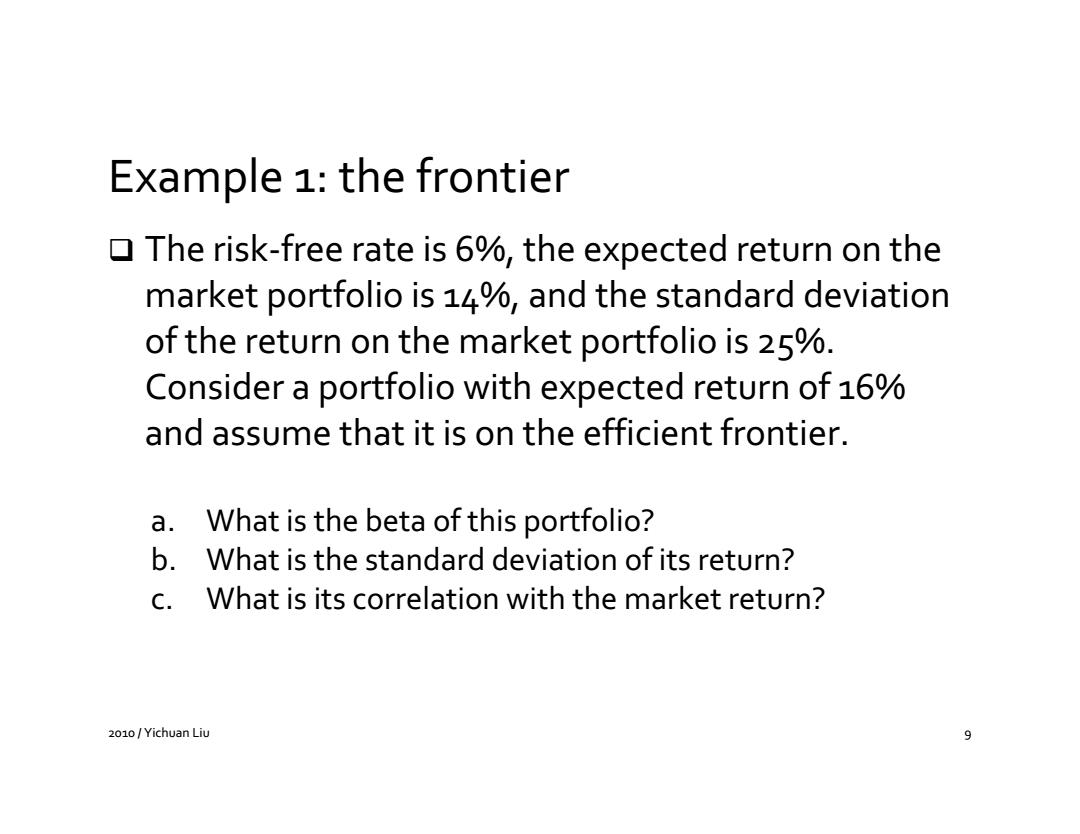

Example 1:the frontier The risk-free rate is 6%,the expected return on the market portfolio is 14%,and the standard deviation of the return on the market portfolio is 25%. Consider a portfolio with expected return of 16% and assume that it is on the efficient frontier. a. What is the beta of this portfolio? b.What is the standard deviation of its return? c.What is its correlation with the market return? 2010/Yichuan Liu

Example 1: the frontier The risk‐free rate is 6%, the expected expected return on the market portfolio is 14%, and the standard deviation of the return on the market portfolio is 25%. Consider a portfolio with expected return of 16% and assume that it is on the efficient frontier. a. What is the beta of this portfolio? b. What is the standard deviation of its return? c. What is its correlation with the market return? 2010 / Yichuan Liu 9

Example 1:the frontier ▣Answer: a.To=I+Bp(Fa-r) 0.16=0.06+Bn(0.14-0.06) B。=1.25 b.Since the portfolio is on the efficient frontier,it is a combination of the risk-free asset(w)and the market portfolio (1-w): 0.16=0.06w+0.141-w) w=-0.25 2010/Yichuan Liu 10

Example 1: the frontier Answer: a. rp rf p rm rf 0.16 0.06 0.14 0.06 p 1.25 p b. Since the portfolio is on the efficient frontier, it is a combination of the risk‐free asset (w) and the market portfolio (1‐w): 0.16 0.06w 0.141 w w 0.25 2010 / Yichuan Liu 10