SECTION I SHIPPING MARKET OUTLOOK CONTENTS ZZI9E 6E:S:80 102/60/9L lou suosyep'Mw/dny ooinos aul abpejmouxpe ol Jaquawal aseald :palbuisal si uonnqsi AllsBAlun aunue leubueys o]pasuaor Licensed to Shanghai Maritime University. EXECUTIVE SUMMARY 7 1.1 FREIGHT MARKET OVERVIEW 8 1.2 WORLD ECONOMY SEA TRADE 10 1.3 THE SHIPBUILDING MARKET 12 1.4 THE DEMOLITION MARKET 14 1.5 DRY BULK MARKET OUTLOOK 16 1.6 TANKER MARKET OUTLOOK 20 1.7 CONTAINERSHIP MARKET OUTLOOK 24 source.http://www.dlarksons.net 15/09/2014 08:45:39 36122

SECTION 1 SHIPPING MARKET OUTLOOK CONTENTS EXECUTIVE SUMMARY 7 1.1 FREIGHT MARKET OVERVIEW 8 1.2 WORLD ECONOMY & SEA TRADE 10 1.3 THE SHIPBUILDING MARKET 12 1.4 THE DEMOLITION MARKET 14 1.5 DRY BULK MARKET OUTLOOK 16 1.6 TANKER MARKET OUTLOOK 20 1.7 CONTAINERSHIP MARKET OUTLOOK 24 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

1.SHIPPING MARKET OUTLOOK EXECUTIVE SUMMARY It has been a better half-year for most parts On the supply side,deliveries fell from a of the shipping industry,as the world economy total of 165m dwt in 2011 to 108m dwt in 2013. has started to recover from the trough and We currently expect a further decline to 96m shipyard deliveries have edged back.The scale dwt in full year 2014,and 88m dwt in 2015, of this recovery is demonstrated by the Clarksea including about 50m dwt/year of bulkers;18m Index,which improved from $9,300/day during dwt/year of tankers;and 14m dwt/year of icensed to Shanghai L12603 the previous half-year(March to August 2013) containerships. to $12,800/day over the last six months,a helpful 38%increase in "take-home"cash. Meanwhile demolition,which had peaked at 58.4m dwt in 2012,fell to 46.1m dwt in 2013. The significance of this improvement is The bulker sector accounted for the most massive.The Clarksea Index is a "best scrapping last year (22.2m dwt),with fewer M南M possible"rate and in a recession few ships tankers sent to the beaches (11.1m dwt in 2013) achieve the full rate,owing to waiting time and but more demolition of containerships (8.9m other factors.So the previous half-year average dwt in 2013),led by increased scrapping of of $9,300/day put a real cash squeeze on the Panamax boxships. businesses,with little margin over OPEX for Dis tribution is contingencies. ▣ Lower deliveries and higher demolition had the result of reducing overall cargo fleet growth This 38%earnings increase has taken many from an unsustainable 9.0%in 2011 to a more vessel types out of dangerous territory,and manageable 3.8%in 2013.As a result,for the produced a positive cash flow,although of first time since 2010,fleet growth matched trade course some shiptypes fared better than others. growth,although in general structural This has contributed to the more positive oversupply remains across the major sectors sentiment in 2014,and a sense that the market is Contacting picked up markedly last year,with at last through the downturn and is now maybe 151.9m dwt ordered in full year 2013,compared 度e on the upswing. to 54.6m dwt in 2012.In the opening two months of 2014,a further 22.8m dwt was Over the last six months the world ordered. economy has taken a turn for the better,though it remains a mixed picture.OECD GDP growth 回 The tanker and bulk carrier markets both edge declined in 2012 and remained very weak in the enjoyed a spike in freight rates in the final first half of 2013,but now looks set to recover quarter of 2013,owing mainly to a seasonal as industrial production of 0.4%in 2013 is surge in cargo volumes,briefly taking earnings the sourde. expected to increase to about 4%in 2014.In the to very healthy levels,but both markets are now non-OECD countries,the story is less positive. back around where they started last year. China's industrial production growth fell to Meanwhile,although the containership charter http://www 9.7%in 2013,and was down to 8.6%in the market continued in the doldrums,the downturn opening two months of 2014.In addition, in contracting during 2012 gave way to a bout of growth in several other Asian countries have heavy ordering in 2013,particularly in the larger slowed,particularly India.Hopefully this will be size sectors. clarksons.net reversed during the year. In summary,shipping markets appear to Despite these mixed trends in the world have edged past the trough of the long recession economy,seaborne trade has continued to grow, and are finally on the upswing.However it is by 4.2%in 2012 and 3.6%in 2013.The current still a long way from a home run.If overall fleet forecast is 4.2%growth in 2014,with dry bulk growth stays close to trade growth,as current up 4.3%;containers up 6.0%;and combined oil trends suggest it will for the next couple of years and products up 2.1%.Provided there are no at least,the significant backlog of surplus 150920140845.3836122 unexpected disruptions,this solid performance tonnage could continue to make its presence felt, should provide a firm foundation as the market leaving the market vulnerable to any future moves past the trough. economic downturn Clarkson Research Services Spring 2014

Clarkson Research Services Spring 2014 7 1. SHIPPING MARKET OUTLOOK SHIPPING MARKET OUTLOOK EXECUTIVE SUMMARY ! It has been a better half-year for most parts of the shipping industry, as the world economy has started to recover from the trough and shipyard deliveries have edged back. The scale of this recovery is demonstrated by the Clarksea Index, which improved from $9,300/day during the previous half-year (March to August 2013) to $12,800/day over the last six months, a helpful 38% increase in “take-home” cash. ! The significance of this improvement is massive. The Clarksea Index is a “best possible” rate and in a recession few ships achieve the full rate, owing to waiting time and other factors. So the previous half-year average of $9,300/day put a real cash squeeze on the businesses, with little margin over OPEX for contingencies. ! This 38% earnings increase has taken many vessel types out of dangerous territory, and produced a positive cash flow, although of course some shiptypes fared better than others. This has contributed to the more positive sentiment in 2014, and a sense that the market is at last through the downturn and is now maybe on the upswing. ! Over the last six months the world economy has taken a turn for the better, though it remains a mixed picture. OECD GDP growth declined in 2012 and remained very weak in the first half of 2013, but now looks set to recover as industrial production of 0.4% in 2013 is expected to increase to about 4% in 2014. In the non-OECD countries, the story is less positive. China's industrial production growth fell to 9.7% in 2013, and was down to 8.6% in the opening two months of 2014. In addition, growth in several other Asian countries have slowed, particularly India. Hopefully this will be reversed during the year. ! Despite these mixed trends in the world economy, seaborne trade has continued to grow, by 4.2% in 2012 and 3.6% in 2013. The current forecast is 4.2% growth in 2014, with dry bulk up 4.3%; containers up 6.0%; and combined oil and products up 2.1%. Provided there are no unexpected disruptions, this solid performance should provide a firm foundation as the market moves past the trough. ! On the supply side, deliveries fell from a total of 165m dwt in 2011 to 108m dwt in 2013. We currently expect a further decline to 96m dwt in full year 2014, and 88m dwt in 2015, including about 50m dwt/year of bulkers; 18m dwt/year of tankers; and 14m dwt/year of containerships. ! Meanwhile demolition, which had peaked at 58.4m dwt in 2012, fell to 46.1m dwt in 2013. The bulker sector accounted for the most scrapping last year (22.2m dwt), with fewer tankers sent to the beaches (11.1m dwt in 2013) but more demolition of containerships (8.9m dwt in 2013), led by increased scrapping of Panamax boxships. ! Lower deliveries and higher demolition had the result of reducing overall cargo fleet growth from an unsustainable 9.0% in 2011 to a more manageable 3.8% in 2013. As a result, for the first time since 2010, fleet growth matched trade growth, although in general structural oversupply remains across the major sectors. Contacting picked up markedly last year, with 151.9m dwt ordered in full year 2013, compared to 54.6m dwt in 2012. In the opening two months of 2014, a further 22.8m dwt was ordered. ! The tanker and bulk carrier markets both enjoyed a spike in freight rates in the final quarter of 2013, owing mainly to a seasonal surge in cargo volumes, briefly taking earnings to very healthy levels, but both markets are now back around where they started last year. Meanwhile, although the containership charter market continued in the doldrums, the downturn in contracting during 2012 gave way to a bout of heavy ordering in 2013, particularly in the larger size sectors. ! In summary, shipping markets appear to have edged past the trough of the long recession and are finally on the upswing. However it is still a long way from a home run. If overall fleet growth stays close to trade growth, as current trends suggest it will for the next couple of years at least, the significant backlog of surplus tonnage could continue to make its presence felt, leaving the market vulnerable to any future economic downturn. Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

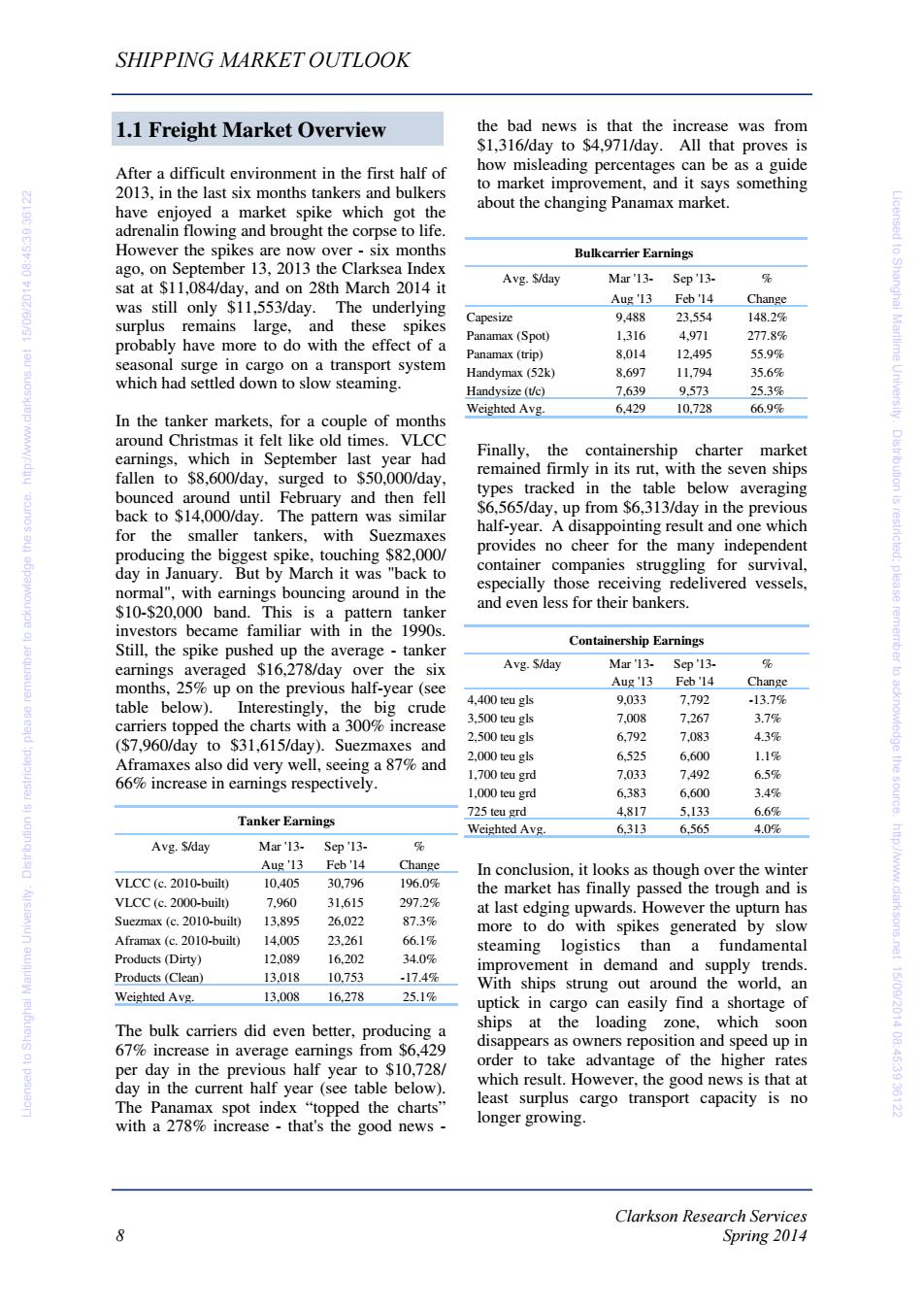

SHIPPING MARKET OUTLOOK 1.1 Freight Market Overview the bad news is that the increase was from $1,316/day to $4,971/day.All that proves is After a difficult environment in the first half of how misleading percentages can be as a guide 2013,in the last six months tankers and bulkers to market improvement,and it says something have enjoyed a market spike which got the about the changing Panamax market. adrenalin flowing and brought the corpse to life. However the spikes are now over-six months Bulkcarrier Earnings ago,on September 13,2013 the Clarksea Index % #10216031 sat at $11,084/day,and on 28th March 2014 it Avg.S/day Mar'13-Sep'13- was still only $11,553/day.The underlying Aug'13 Feb'14 Change Capesize 9,488 23.554 148.2% surplus remains large,and these spikes probably have more to do with the effect of a Panamax(Spot) 1,316 4.971 277.8% Panamax(trip) 8,014 12.495 55.9% seasonal surge in cargo on a transport system Handymax(52k) 8.697 11.794 35.6% icensed to Shanghai Maritime University which had settled down to slow steaming Handysize(t/c) 7,639 9.573 25.3% Weighted Avg 6,429 10,728 66.9% In the tanker markets,for a couple of months around Christmas it felt like old times.VLCC earnings,which in September last year had Finally, the containership charter market fallen to $8,600/day,surged to $50,000/day, remained firmly in its rut,with the seven ships bounced around until February and then fell types tracked in the table below averaging Dis tribution is back to $14,000/day.The pattern was similar S6,565/day,up from $6,313/day in the previous for the smaller tankers,with Suezmaxes half-year.A disappointing result and one which provides no cheer for the many independent producing the biggest spike,touching $82,000/ day in January.But by March it was "back to container companies struggling for survival, especially those receiving redelivered vessels, plea normal",with earnings bouncing around in the $10-$20,000 band.This is a pattern tanker and even less for their bankers. investors became familiar with in the 1990s. Still,the spike pushed up the average-tanker Containership Earnings earnings averaged $16,278/day over the six Avg.S/day Mar'13- Sep'13- % months,25%up on the previous half-year(see Aug'13 Feb'14 Change 4,400 teu gls 9.033 7.792 table below). Interestingly,the big crude -13.7% carriers topped the charts with a 300%increase 3.500 teu gls 7.008 7.267 3.7% remember to acknowledge 2.500 teu gls 6.792 7.083 ($7,960/day to $31,615/day).Suezmaxes and 4.3% Aframaxes also did very well,seeing a 87%and 2.000 teu gls 6,525 6,600 1.1% 1.700 teu grd 7.033 7.492 6.5% 66%increase in earnings respectively. 1,000 teu grd 6,383 6,600 3.4% the sourde. 725 teu grd 4,817 5.133 6.6% Tanker Earnings Weighted Avg. 6,313 6.565 4.0% Avg.$/day Mar'13- Sep'13- o Aug'13 Feb'14 Change In conclusion,it looks as though over the winter http://ww. VLCC (c.2010-built) 10.405 30.796 196.0% the market has finally passed the trough and is VLCC(c.2000-built) 7.960 31,615 297.2% at last edging upwards.However the upturn has Suezmax (c.2010-built) 13,895 26,022 87.3% more to do with spikes generated by slow Aframax (c.2010-built) 14.005 23,261 66.1% steaming logistics than a fundamental Products(Dirty) 12.089 16.202 34.0% improvement in demand and supply trends. Products(Clean) 13.018 10,753 -17.4% With ships strung out around the world,an Weighted Avg. 13.008 16.278 25.1% uptick in cargo can easily find a shortage of The bulk carriers did even better,producing a ships at the loading zone,which soon 67%increase in average earnings from $6,429 disappears as owners reposition and speed up in o]pas per day in the previous half year to $10,728/ order to take advantage of the higher rates .2218303:54:80410299051ci day in the current half year(see table below). which result.However,the good news is that at The Panamax spot index "topped the charts" least surplus cargo transport capacity is no with a 278%increase -that's the good news longer growing. Clarkson Research Services Spring 2014

Clarkson Research Services 8 Spring 2014 SHIPPING MARKET OUTLOOK After a difficult environment in the first half of 2013, in the last six months tankers and bulkers have enjoyed a market spike which got the adrenalin flowing and brought the corpse to life. However the spikes are now over - six months ago, on September 13, 2013 the Clarksea Index sat at $11,084/day, and on 28th March 2014 it was still only $11,553/day. The underlying surplus remains large, and these spikes probably have more to do with the effect of a seasonal surge in cargo on a transport system which had settled down to slow steaming. In the tanker markets, for a couple of months around Christmas it felt like old times. VLCC earnings, which in September last year had fallen to $8,600/day, surged to $50,000/day, bounced around until February and then fell back to $14,000/day. The pattern was similar for the smaller tankers, with Suezmaxes producing the biggest spike, touching $82,000/ day in January. But by March it was "back to normal", with earnings bouncing around in the $10-$20,000 band. This is a pattern tanker investors became familiar with in the 1990s. Still, the spike pushed up the average - tanker earnings averaged $16,278/day over the six months, 25% up on the previous half-year (see table below). Interestingly, the big crude carriers topped the charts with a 300% increase ($7,960/day to $31,615/day). Suezmaxes and Aframaxes also did very well, seeing a 87% and 66% increase in earnings respectively. The bulk carriers did even better, producing a 67% increase in average earnings from $6,429 per day in the previous half year to $10,728/ day in the current half year (see table below). The Panamax spot index “topped the charts” with a 278% increase - that's the good news - the bad news is that the increase was from $1,316/day to $4,971/day. All that proves is how misleading percentages can be as a guide to market improvement, and it says something about the changing Panamax market. Finally, the containership charter market remained firmly in its rut, with the seven ships types tracked in the table below averaging $6,565/day, up from $6,313/day in the previous half-year. A disappointing result and one which provides no cheer for the many independent container companies struggling for survival, especially those receiving redelivered vessels, and even less for their bankers. In conclusion, it looks as though over the winter the market has finally passed the trough and is at last edging upwards. However the upturn has more to do with spikes generated by slow steaming logistics than a fundamental improvement in demand and supply trends. With ships strung out around the world, an uptick in cargo can easily find a shortage of ships at the loading zone, which soon disappears as owners reposition and speed up in order to take advantage of the higher rates which result. However, the good news is that at least surplus cargo transport capacity is no longer growing. 1.1 Freight Market Overview Tanker Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change VLCC (c. 2010-built) 10,405 30,796 196.0% VLCC (c. 2000-built) 7,960 31,615 297.2% Suezmax (c. 2010-built) 13,895 26,022 87.3% Aframax (c. 2010-built) 14,005 23,261 66.1% Products (Dirty) 12,089 16,202 34.0% Products (Clean) 13,018 10,753 -17.4% Weighted Avg. 13,008 16,278 25.1% Bulkcarrier Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change Capesize 9,488 23,554 148.2% Panamax (Spot) 1,316 4,971 277.8% Panamax (trip) 8,014 12,495 55.9% Handymax (52k) 8,697 11,794 35.6% Handysize (t/c) 7,639 9,573 25.3% Weighted Avg. 6,429 10,728 66.9% Containership Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change 4,400 teu gls 9,033 7,792 -13.7% 3,500 teu gls 7,008 7,267 3.7% 2,500 teu gls 6,792 7,083 4.3% 2,000 teu gls 6,525 6,600 1.1% 1,700 teu grd 7,033 7,492 6.5% 1,000 teu grd 6,383 6,600 3.4% 725 teu grd 4,817 5,133 6.6% Weighted Avg. 6,313 6,565 4.0% Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

SHIPPING MARKET OUTLOOK ClarkSea Index Tanker Average Spot Earnings 55 $,000/d 100 $ 000/d ■■■■■ 5 -Aframax Crude 90 Tankers 80 Handy Product 6E:S5:80 L02/60/9L lou suosxe'MM/dny Tankers (Clean) 40 70 53025 60 50 201 40 30 10 20 5 10 0 6 % 8 N m 寸 0 pL-ue Source: Clarkson Research Services Source:Clarkson Research Services Figure 1.1.1 Figure 1.1.2 Bulker Average Spot Earnings Containership Earnings Index 70 $,000/d 120 93=100 110 660550540530252016 100 90 80 70 60 Licensed to Shanghai Maritime University.Distribution is restricted:please remember to acknowledge the source.http://ww.clarksons.net 15/09/2014 08:45:39 36122 50 10 40 5 0 30 90-inr a 巴2三忘三点芳E 誉马名P Source:Clarkson Research Services Source:Clarkson Research Services Figure 1.1.3 Figure 1.1.4 Clarkson Research Services Spring 2014 9

Clarkson Research Services Spring 2014 9 SHIPPING MARKET OUTLOOK Figure 1.1.3 Figure 1.1.4 Figure 1.1.1 Figure 1.1.2 05 10 15 20 25 30 35 40 45 50 55 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 $ ,000/d Source: Clarkson Research Services ClarkSea Index 0 10 20 30 40 50 60 70 80 90 100 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 $ ,000/d Source: Clarkson Research Services Tanker Average Spot Earnings Aframax Crude Tankers Handy Product Tankers (Clean) 05 10 15 20 25 30 35 40 45 50 55 60 65 70 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 $ ,000/d Source: Clarkson Research Services Bulker Average Spot Earnings 30 40 50 60 70 80 90 100 110 120 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 '93 = 100 Source: Clarkson Research Services Containership Earnings Index Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

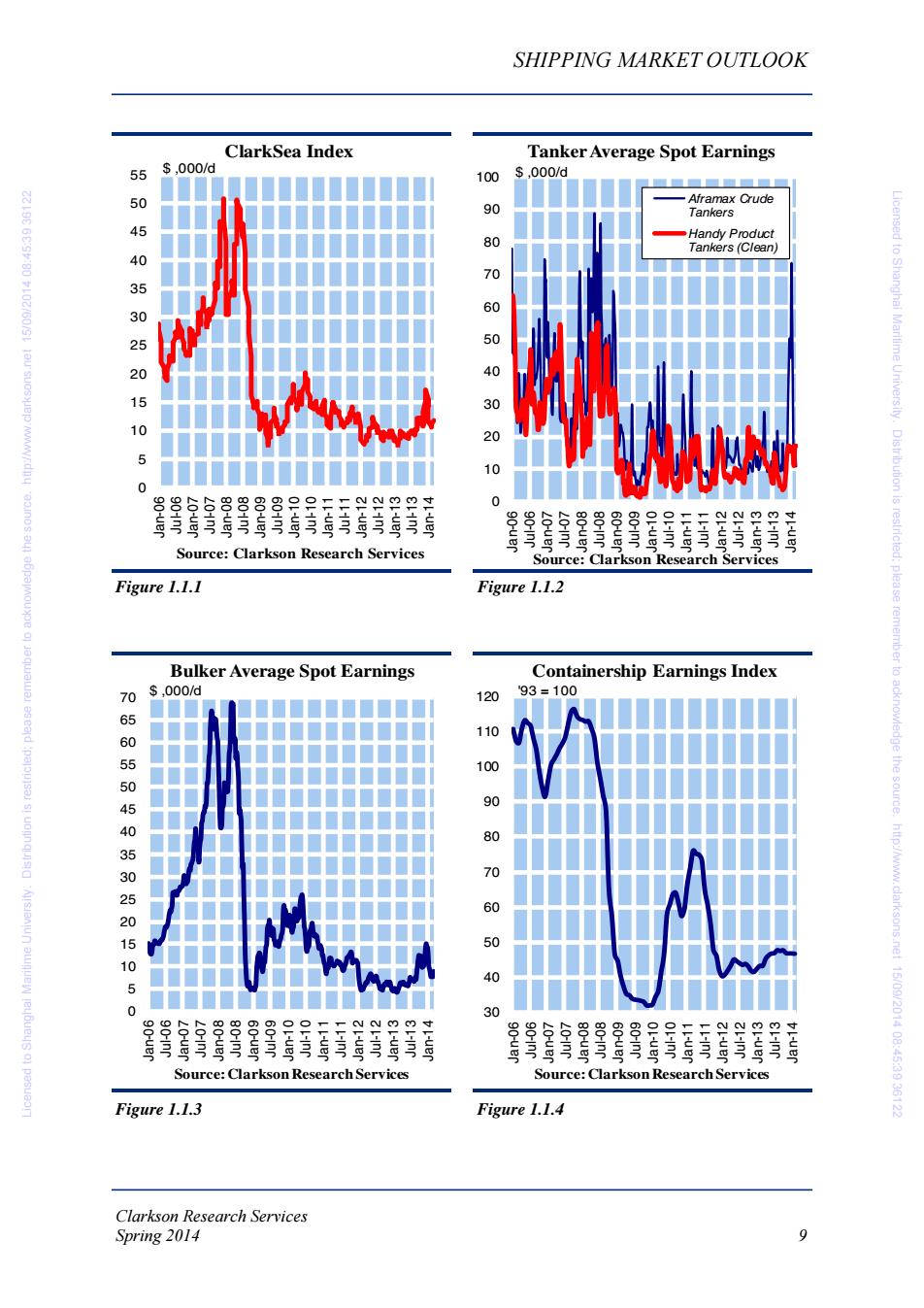

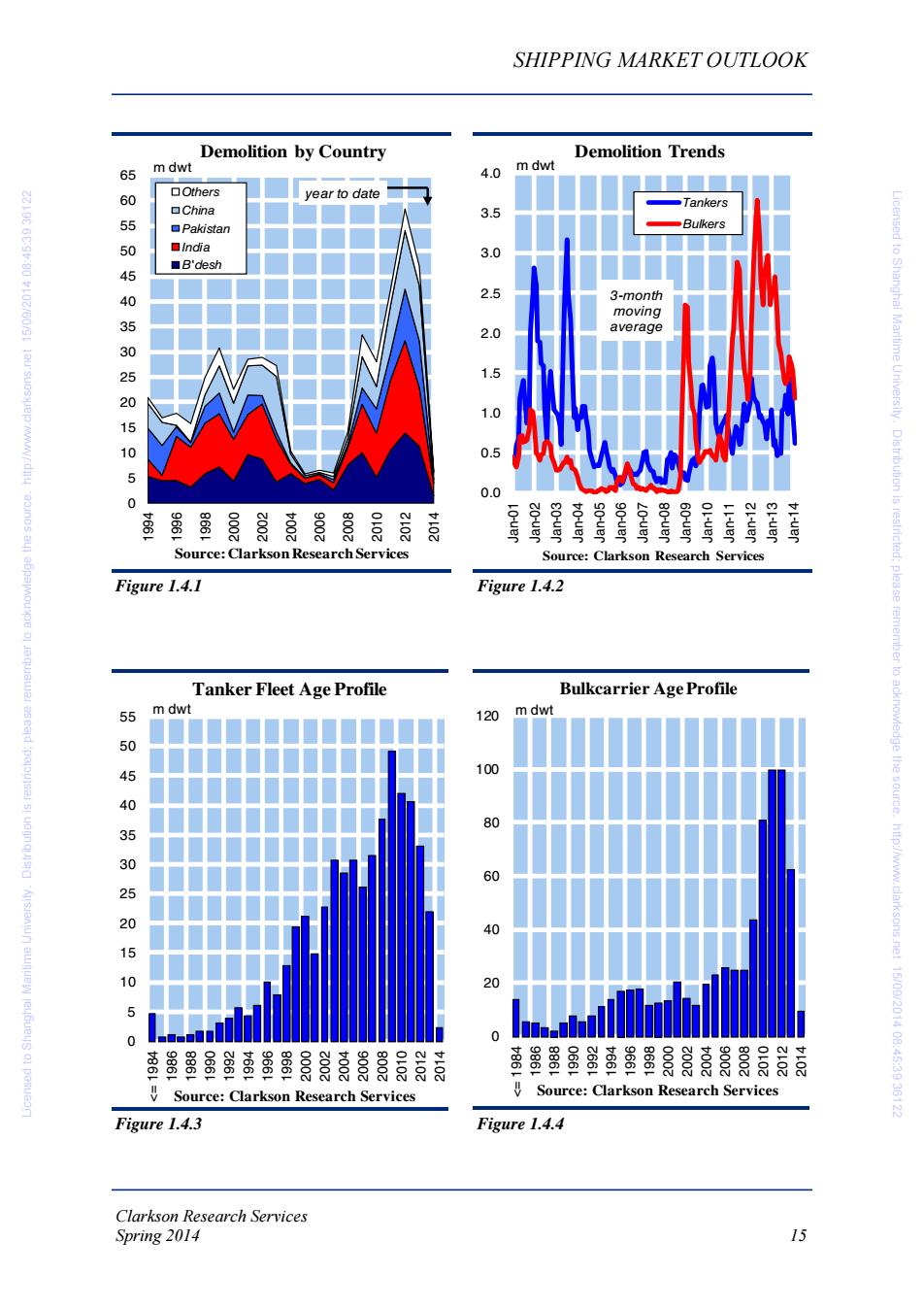

SHIPPING MARKET OUTLOOK 1.2 World Economy Sea Trade in 2015 (see table opposite).So overall,the "bounce back"in the OECD economies should Six months ago,we thought that the industrial be helpful in 2014. business cycle was bottoming out and things might be better over the coming year.Broadly In the non-OECD countries,the Chinese speaking,this turned out to be the case.In economy has slowed somewhat,but continues spring 2013,world industrial production briefly as the lead driving force in the marine market. moved into negative growth,driven by the euro Industrial production has fallen from 13.7% area crisis and weak growth in the other OECD growth in 2011 to 8.6%growth in the year to icensed to Shanghal #10216031 economies.But momentum picked up over the February 2014.Since the new leadership came summer,and by January 2014 OECD industrial into office last year,changes are taking place, production was growing at 3.8%pa.Currently including a determination to clamp down on the global economic forecasts are positive,with corruption and a changing focus of economic industrial output expected to grow by 4%in activity.China is no longer the super cheap 2014 and world GDP by 3.7%(see table 1.1 manufacturer to the world that it was 10 years Maritime Uriversity opposite).So from this perspective,after a ago.But it has large and growing consumer difficult year in 2013,the shipping industry markets.Iron ore imports continue their moves into 2014 with the prospect of better upward trajectory,and over the last two years support from the world economy.But the risks this has been reinforced by rapidly growing remain.The north Atlantic banking crisis has imports of coal and nonferrous metal ores.This Dis tribution is still not been resolved and there is the diversification is welcome for the bulk shipping potentially destabilising effect of recent industry.The main worry is the underlying developments in the Black Sea. health of the property market,the most likely source of future problems. From the OECD perspective,the good news is plea that the euro area economies are now "back in Meanwhile,the other Asian countries have not the black".In the fourth quarter of 2013,the fared so well.The industrial production of euro zone finally registered positive growth of Asia,excluding China and Japan,slumped from 0.5%,leaving GDP at year end in roughly the 6%growth in January 2013 to a 1.2%decline in remember to same place it started,but on an upward trend. January 2014.In January 2014,India's The current forecast is for sluggish GDP growth industrial production was only 0.1%higher than of 1.3%in 2014 and 1.6%in 2015.Since the a year earlier and in several other Asian euro area remains one of the largest maritime economies production was down.But the trading regions,this modest growth is at least general prospect is for a turnaround in 2014. an improvement. On balance,the economic outlook for 2014 and the sourde. The economic turnaround in the United States 2015 seems reasonably positive.The GDP is also gathering pace,helped by the housing projections in table 1.1 opposite show global market and the energy markets,which have growth gathering pace over the next two years, transformed the USA's energy balance from driven by a turnaround in the north Atlantic http://ww. decline to seemingly abundant supplies of and,hopefully,stronger growth in Asian relatively cheap natural gas and oil.The economies.Translating that into seaborne trade, business cycle bottomed out at 1.9%GDP the forecast is"steady as she goes".Projections growth in 2013,and GDP is predicted to grow in the table opposite show dry bulk trade at2.8%in2014and3.0%in2015 growing at 4.3%in 2014;the oil trade at 2.1%; and the container trade at 6.0%.That would Japan and South Korea,two other major OECD provide a solid platform for bringing the economies,picked up strongly in 2013. maritime economy closer to balance.But the Currently the forecasts for Japan over the next risks in China and the Black Sea remain.Also it two years are more muted,with 1.7%growth is six years since the last crisis,so care is .2218303:54:80410299051ci projected for 2014 and slightly less in 2015. needed to protect investments from one of those But the projections for South Korea are much economic shocks which have a habit of popping more robust,showing 3.7%in 2014 and 4.0% up every seven or eight years. Clarkson Research Services 10 Spring 2014

Clarkson Research Services 10 Spring 2014 SHIPPING MARKET OUTLOOK Six months ago, we thought that the industrial business cycle was bottoming out and things might be better over the coming year. Broadly speaking, this turned out to be the case. In spring 2013, world industrial production briefly moved into negative growth, driven by the euro area crisis and weak growth in the other OECD economies. But momentum picked up over the summer, and by January 2014 OECD industrial production was growing at 3.8% pa. Currently the global economic forecasts are positive, with industrial output expected to grow by 4% in 2014 and world GDP by 3.7% (see table 1.1 opposite). So from this perspective, after a difficult year in 2013, the shipping industry moves into 2014 with the prospect of better support from the world economy. But the risks remain. The north Atlantic banking crisis has still not been resolved and there is the potentially destabilising effect of recent developments in the Black Sea. From the OECD perspective, the good news is that the euro area economies are now “back in the black”. In the fourth quarter of 2013, the euro zone finally registered positive growth of 0.5%, leaving GDP at year end in roughly the same place it started, but on an upward trend. The current forecast is for sluggish GDP growth of 1.3% in 2014 and 1.6% in 2015. Since the euro area remains one of the largest maritime trading regions, this modest growth is at least an improvement. The economic turnaround in the United States is also gathering pace, helped by the housing market and the energy markets, which have transformed the USA’s energy balance from decline to seemingly abundant supplies of relatively cheap natural gas and oil. The business cycle bottomed out at 1.9% GDP growth in 2013, and GDP is predicted to grow at 2.8% in 2014 and 3.0% in 2015. Japan and South Korea, two other major OECD economies, picked up strongly in 2013. Currently the forecasts for Japan over the next two years are more muted, with 1.7% growth projected for 2014 and slightly less in 2015. But the projections for South Korea are much more robust, showing 3.7% in 2014 and 4.0% in 2015 (see table opposite). So overall, the “bounce back” in the OECD economies should be helpful in 2014. In the non-OECD countries, the Chinese economy has slowed somewhat, but continues as the lead driving force in the marine market. Industrial production has fallen from 13.7% growth in 2011 to 8.6% growth in the year to February 2014. Since the new leadership came into office last year, changes are taking place, including a determination to clamp down on corruption and a changing focus of economic activity. China is no longer the super cheap manufacturer to the world that it was 10 years ago. But it has large and growing consumer markets. Iron ore imports continue their upward trajectory, and over the last two years this has been reinforced by rapidly growing imports of coal and nonferrous metal ores. This diversification is welcome for the bulk shipping industry. The main worry is the underlying health of the property market, the most likely source of future problems. Meanwhile, the other Asian countries have not fared so well. The industrial production of Asia, excluding China and Japan, slumped from 6% growth in January 2013 to a 1.2% decline in January 2014. In January 2014, India’s industrial production was only 0.1% higher than a year earlier and in several other Asian economies production was down. But the general prospect is for a turnaround in 2014. On balance, the economic outlook for 2014 and 2015 seems reasonably positive. The GDP projections in table 1.1 opposite show global growth gathering pace over the next two years, driven by a turnaround in the north Atlantic and, hopefully, stronger growth in Asian economies. Translating that into seaborne trade, the forecast is “steady as she goes”. Projections in the table opposite show dry bulk trade growing at 4.3% in 2014; the oil trade at 2.1%; and the container trade at 6.0%. That would provide a solid platform for bringing the maritime economy closer to balance. But the risks in China and the Black Sea remain. Also it is six years since the last crisis, so care is needed to protect investments from one of those economic shocks which have a habit of popping up every seven or eight years. 1.2 World Economy & Sea Trade Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

SHIPPING MARKET OUTLOOK Industrial Production Seaborne Trades 1993-2014 30 %p.a. 5.0 bn tonnes ■■■■■■■■■■■■■■■ Coal 25 4.5 Iron Ore Pacific-S/SE Asia India Grain ☐Minor Bulks 20 4.0 Oil Products Crude Oil 6E:S5:80 102/60/9L lou suosxB'MM/dny 15 3.5 10 3.0 从 2.5 2.0 -5 -10 Atlantic-US Europe 0 -15 0.5 -20 0.0 5 每每 80-uer 墨国員囂意昌眉局食 Licensed to Shanghai Maritime University.Distribution is restricted:please Source: Clarkson Research Services Source:Clarkson Research Services Figure 1.2.1 Figure 1.2.2 GDP(%yoy) 201120122013(e)2014(fD2015(f) Seaborne Trades Forecast 201020112012 OECD 1.6 1.4 1.3 2.2 2.3 (mt/mTEU) 2013(e)2014(fD Iron Ore 991 1.052 1.109 1.186 1.295 USA 1.8 2.8 1.9 2.8 3.0 10.4% 6.296 5.4% 6.9% 9.2% Japan -0.6 1.4 1.7 1.7 1.0 Coking Coal 235 223 235 265 279 European Union 1.7-0.3 0.01.3 1.6 25.3% -5.4% 5.8% 12.4% 5.4% Steam Coal 665 724 827 849 885 Germany 3.1 0.9 0.5 1.6 1.4 12.8% 8.8% 14% 2.7% 4.2% remember to acknowledge the sourde. France 1.7 0.0 0.2 0.9 1.5 Grains inc.s'beans 343 345 370 377 385 UK 0.9 0.3 1.7 2.2 2.4 6.9% 0.6% 7.2% 1.8% 2.3% Italy 0.4 -2.5 -1.8 0.6 1.1 Other Bulks 1,359 1.484 1,546 1,632 1,649 1360692●% 4.3 1.5 2.0 2.5 4.2% 5.6% Russia 3.4 11% Total Dry Bulk 3.5943.828 4,087 4,308 4,494 China 9.3 7.7 7.7 7.5 7.3 Trades (mt) 12.6%6.5% 6.8% 5.4% 4.3% Asian NIEs 4.5 6.2 5.0 5.4 5.5 Crude 1,867 1,857 1,901 1,863 1,887 South Korea 3.7 2.0 2.8 3.7 4.0 3.0% -0.50 2.4 -2.0% 12% 3.9 Products 886 914 927 971 Taiwan 1.006 4.1 1.3 2.2 3.8 6.8% 3.2% 1.4% 4.8% 3.6% Hong Kong SAR 4.9 4.5 3.0 4.4 4.4 Total Oil Trades 2.7532.771 2,828 2.834 2.893 Singapore 5.2 13 3.5 3.4 3.6 (mt) 4.2% 0.69% 2.1% 0.2% 2.1% Thailand 0.1 6.5 3.1 5.2 5.0 Container Trade 94 100 101 102 106 Malaysia 5.1 5.6 4.7 4.9 5.2 Europe Asia 294 313 330 345 368 India 7.7 3.2 4.4 5.4 6.4 N.America 47 48 49 50 53 Africa 5.3 4.8 5.1 6.1 5.8 Others 111 112 118 122 128 S&C America 4.5 3.0 2.6 3.0 3.3 Total (mTEU lifts) 545 573 598 619 654 138 3.9 Total Container 148 153 160 170 http://ww.clarksons.net 15/09/2014 08:45:39 36122 WORLD 3.9 3.1 3.0 3.7 Trade (mTEU) 13.1%7.2% 3.1% 5.0% 6.0% Forecast,Source:IMF (Jan 2014) Table 1.1 Economic Growth Table 1.2 Seaborne Trade Clarkson Research Services Spring 2014 11

Clarkson Research Services Spring 2014 11 SHIPPING MARKET OUTLOOK Table 1.1 Economic Growth Table 1.2 Seaborne Trade Figure 1.2.1 Figure 1.2.2 -20 -15 -10 -505 10 15 20 25 30 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 % p.a. Source: Clarkson Research Services Industrial Production Pacific - S/SE Asia & India Atlantic - US & Europe 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 (f) bn tonnes Source: Clarkson Research Services Seaborne Trades 1993-2014 Iron Ore Coal Grain Minor Bulks Oil Products Crude Oil GDP (% yoy) 2011 2012 2013(e) 2014(f) 2015(f) OECD 1.6 1.4 1.3 2.2 2.3 USA 1.8 2.8 1.9 2.8 3.0 Japan -0.6 1.4 1.7 1.7 1.0 European Union 1.7 -0.3 0.0 1.3 1.6 Germany 3.1 0.9 0.5 1.6 1.4 France 1.7 0.0 0.2 0.9 1.5 UK 0.9 0.3 1.7 2.2 2.4 Italy 0.4 -2.5 -1.8 0.6 1.1 Russia 4.3 3.4 1.5 2.0 2.5 China 9.3 7.7 7.7 7.5 7.3 Asian NIEs 4.5 6.2 5.0 5.4 5.5 South Korea 3.7 2.0 2.8 3.7 4.0 Taiwan 4.1 1.3 2.2 3.8 3.9 Hong Kong SAR 4.9 4.5 3.0 4.4 4.4 Singapore 5.2 1.3 3.5 3.4 3.6 Thailand 0.1 6.5 3.1 5.2 5.0 Malaysia 5.1 5.6 4.7 4.9 5.2 India 7.7 3.2 4.4 5.4 6.4 Africa 5.3 4.8 5.1 6.1 5.8 S & C America 4.5 3.0 2.6 3.0 3.3 WORLD 3.9 3.1 3.0 3.7 3.9 * Forecast, Source: IMF (Jan 2014) 2010 2011 2012 2013 ( e )2014 ( f) Iron Ore 991 1,052 1,109 1,186 1,295 10.4% 6.2% 5.4% 6.9% 9.2% Coking Coal 235 223 235 265 279 25.3% -5.4% 5.8% 12.4% 5.4% Steam Coal 665 724 827 849 885 12.8% 8.8% 14% 2.7% 4.2% Grains inc. s'beans 343 345 370 377 385 6.9% 0.6% 7.2% 1.8% 2.3% Other Bulks 1,359 1,484 1,546 1,632 1,649 13.6% 9.2% 4.2% 5.6% 1.1% 3,594 3,828 4,087 4,308 4,494 12.6% 6.5% 6.8% 5.4% 4.3% Crude 1,867 1,857 1,901 1,863 1,887 3.0% -0.5% 2.4% -2.0% 1.2% Products 886 914 927 971 1,006 6.8% 3.2% 1.4% 4.8% 3.6% 2,753 2,771 2,828 2,834 2,893 4.2% 0.6% 2.1% 0.2% 2.1% Container Trade Europe 94 100 101 102 106 Asia 294 313 330 345 368 N.America 47 48 49 50 53 Others 111 112 118 122 128 Total (mTEU lifts) 545 573 598 619 654 138 148 153 160 170 13.1% 7.2% 3.1% 5.0% 6.0% Seaborne Trades (mt / mTEU) Total Dry Bulk Trades (mt ) Total Oil Trades (mt) Total Container Trade (mTEU ) Forecast Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

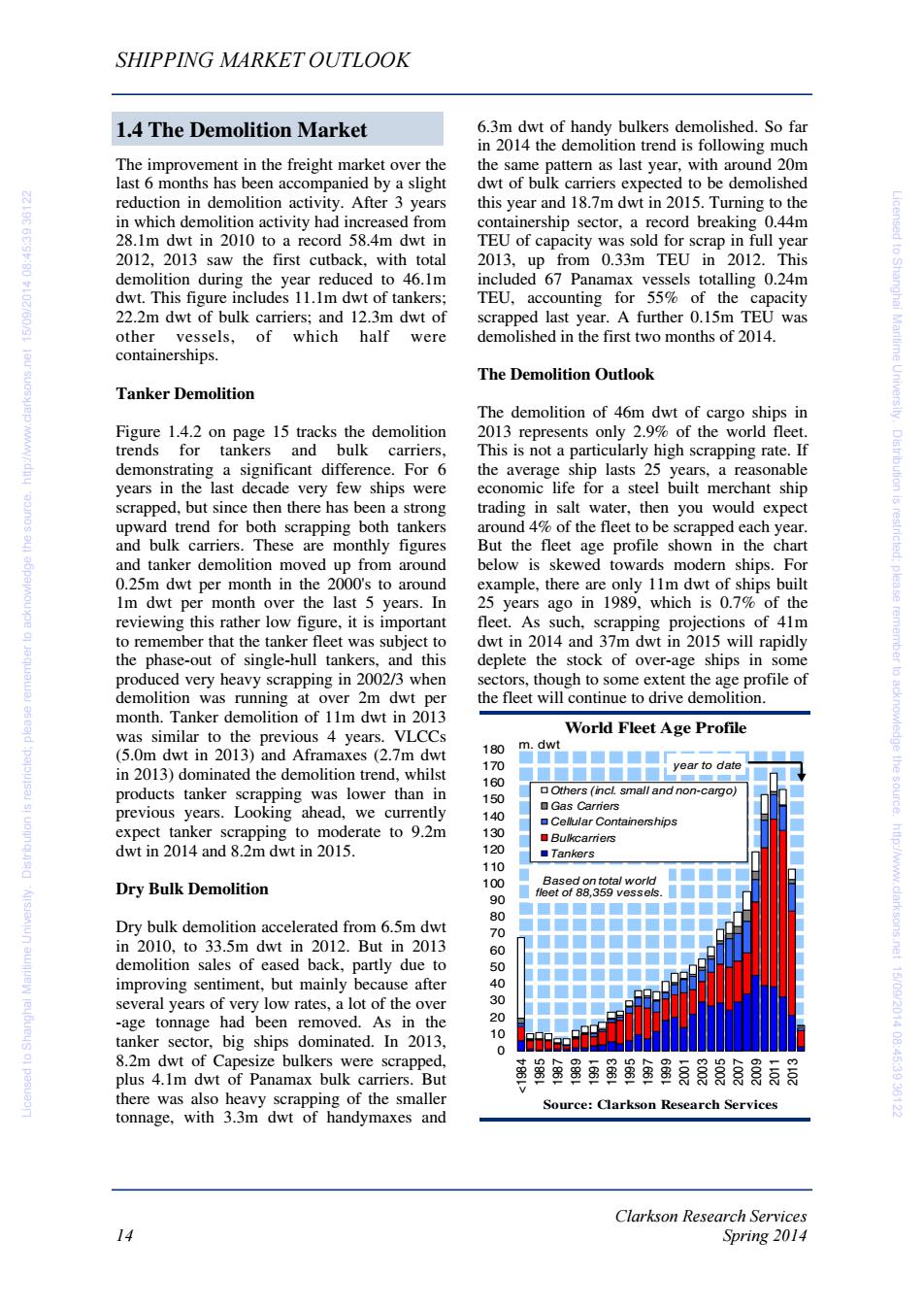

SHIPPING MARKET OUTLOOK 1.3 The Shipbuilding Market Shipbuilding Prices Six months ago,we thought the shipyards were The upturn in shipbuilding prices supported this coping surprisingly well with a market which,a turnaround in investor sentiment.The few years earlier,had looked potentially newbuilding price index for the tankers and disastrous.The orderbook has shrunk by about bulkers (figure 1.3.4)shows the almost 25%from 397m dwt at end 2011 to 296m dwt continuous price fall from the market peak in in February 2014,and deliveries are down 35% 2008,when the tanker index stood at 252 and from 165m dwt in 2011 to 108m dwt in 2013. the bulk carrier index at 248,down to a trough icensed to Shanghal 112/030 So the orderbook represents about three years of 148 for tankers and 124 for bulkers in work. January 2013.But in September 2013 the downward trend was reversed and since then However,deadweight is not a particularly good prices have increased by about 10% measure of shipyard capacity,and when the calculation is repeated in compensated gross For example,a VLCC was quoted at $90 Maritime University. tons (CGT),we estimate that world shipyard million in September 2013,but by March 2014 output has fallen by 20%since the peak in the price had increased by 25%to $99.5 2010.The smaller reduction reflects the switch million.Similarly,an Aframax tanker increased in product mix from bulk carriers,which have a from $49 million to $54.5 million,and a low work content,towards gas tankers, Panamax bulk carrier from $27 million to $29.5 Dis tribution is containerships and offshore vessels which have million.This price surge was supported by the a relatively higher work content and CGT. upturn in demand as investors returned from the holidays in 2013.But the shipyards seem to Shipbuilding Orderbook and Contracting have managed their marketing very well,and succeeded in convincing the market that there plea Over the last six months ordering activity by were few early berths available,especially in owners has increased,with contracts reaching the quality yards which most investors prefer. 151.9 m dwt in 2013,almost 3 times as much as The availability of shipyard credit and cash 2012 when only 54.6m dwt was ordered.This from institutional investors also helped,as did remember to seems to have been driven by the signs of the limited alternative investment opportunities recovery in the OECD countries;the freight rate for owners who“sat tight”during the boom and "spikes"in the tanker and bulk carrier markets; accumulated cash. the availability of investment funds,both from institutional investors and shipbuilding credit Looking Ahead schemes;and investors'perception that prices acknowledge the sourde. have bottomed out. Six months ago we noted the positive effect which the prospective global upturn was The resulting orders surged well ahead of having,combined with the reduced growth rate deliveries.For example,contracts of 36.2m of the world fleet.We also noted the interest in dwt of tankers in 2013 (including 15.3m dwt of eco-ships and the success of the yards in http://ww. VLCCs tonnage)were 50%greater than pushing prices upwards.But we were deliveries of 21.4m dwt.In the dry bulk market concerned that a much smaller orderbook, it was a similar story,with 82.3m dwt of bulker combined with surplus yard capacity might orders (including 39.3m dwt of Capesize make this "price blip"temporary.This analysis tonnage)compared with 62.4m dwt of under-estimated the success of the yards in deliveries.The containership sector also shared managing the situation,helped by strong in the contracting boom,with 22.2m dwt of demand from a market which has moved contracts,(mainly for the bigger ships of decisively into investment mode,as 8,000+TEU.Including orders for vessels of up demonstrated by the near record orders last to 19,000 TEU),compared with deliveries of year.This positive sentiment seems well .2218303:54:80410299051ci 16.8m dwt.So,the shipyards were able to founded in the short-term,but we still believe replenish the orderbook which is now 10% caution is needed in the current market higher than at the beginning of 2013. environment. Clarkson Research Services 12 Spring 2014

Clarkson Research Services 12 Spring 2014 SHIPPING MARKET OUTLOOK Six months ago, we thought the shipyards were coping surprisingly well with a market which, a few years earlier, had looked potentially disastrous. The orderbook has shrunk by about 25% from 397m dwt at end 2011 to 296m dwt in February 2014, and deliveries are down 35% from 165m dwt in 2011 to 108m dwt in 2013. So the orderbook represents about three years work. However, deadweight is not a particularly good measure of shipyard capacity, and when the calculation is repeated in compensated gross tons (CGT), we estimate that world shipyard output has fallen by 20% since the peak in 2010. The smaller reduction reflects the switch in product mix from bulk carriers, which have a low work content, towards gas tankers, containerships and offshore vessels which have a relatively higher work content and CGT. Shipbuilding Orderbook and Contracting Over the last six months ordering activity by owners has increased, with contracts reaching 151.9 m dwt in 2013, almost 3 times as much as 2012 when only 54.6m dwt was ordered. This seems to have been driven by the signs of recovery in the OECD countries; the freight rate “spikes” in the tanker and bulk carrier markets; the availability of investment funds, both from institutional investors and shipbuilding credit schemes; and investors’ perception that prices have bottomed out. The resulting orders surged well ahead of deliveries. For example, contracts of 36.2m dwt of tankers in 2013 (including 15.3m dwt of VLCCs tonnage) were 50% greater than deliveries of 21.4m dwt. In the dry bulk market it was a similar story, with 82.3m dwt of bulker orders (including 39.3m dwt of Capesize tonnage) compared with 62.4m dwt of deliveries. The containership sector also shared in the contracting boom, with 22.2m dwt of contracts, (mainly for the bigger ships of 8,000+ TEU. Including orders for vessels of up to 19,000 TEU), compared with deliveries of 16.8m dwt. So, the shipyards were able to replenish the orderbook which is now 10% higher than at the beginning of 2013. Shipbuilding Prices The upturn in shipbuilding prices supported this turnaround in investor sentiment. The newbuilding price index for the tankers and bulkers (figure 1.3.4) shows the almost continuous price fall from the market peak in 2008, when the tanker index stood at 252 and the bulk carrier index at 248, down to a trough of 148 for tankers and 124 for bulkers in January 2013. But in September 2013 the downward trend was reversed and since then prices have increased by about 10%. For example, a VLCC was quoted at $90 million in September 2013, but by March 2014 the price had increased by 25% to $99.5 million. Similarly, an Aframax tanker increased from $49 million to $54.5 million, and a Panamax bulk carrier from $27 million to $29.5 million. This price surge was supported by the upturn in demand as investors returned from the holidays in 2013. But the shipyards seem to have managed their marketing very well, and succeeded in convincing the market that there were few early berths available, especially in the quality yards which most investors prefer. The availability of shipyard credit and cash from institutional investors also helped, as did the limited alternative investment opportunities for owners who “sat tight” during the boom and accumulated cash. Looking Ahead Six months ago we noted the positive effect which the prospective global upturn was having, combined with the reduced growth rate of the world fleet. We also noted the interest in eco-ships and the success of the yards in pushing prices upwards. But we were concerned that a much smaller orderbook, combined with surplus yard capacity might make this “price blip” temporary. This analysis under-estimated the success of the yards in managing the situation, helped by strong demand from a market which has moved decisively into investment mode, as demonstrated by the near record orders last year. This positive sentiment seems well founded in the short-term, but we still believe caution is needed in the current market environment. 1.3 The Shipbuilding Market Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

SHIPPING MARKET OUTLOOK Bulk Contracting Orderbook Shipbuilding Deliveries 560 m dwt 200 m dwt 520 Bulkers Forecast 480 ▣Tankers 175 ▣Combos Z2I9E 6E:S:80 102/60/9L lou suosxe'MM/dny 440 Orderbook 150 400 Others ▣Combos 360 125 ■Tankers Bulkers 20 100 2 year to date 75 50 80 0 00a0030000-L 点 Source:Clarkson Research Services Source:Clarkson Research Services Figure 1.3.1 Figure 1.3.2 Orderbook as of Fleet Newbuilding Price Index of fleet Index 100% 275 ■国■■■ 90% Containers 250 Bulkers ●Bulkers 80% Tankers 225 .Tankers 200 60% 175 150 100 Licensed to Shanghai Maritime University.Distribution is restricted:please remember to acknowledge the source.http://ww.clarksons.net 15/09/2014 08:45:39 36122 75 0% g 令g 50 每 66uc7 LO-uer Source:Clarkson Research Services Source: Clarkson Research Services Figure 1.3.3 Figure 1.3.4 Clarkson Research Services Spring 2014 13

Clarkson Research Services Spring 2014 13 SHIPPING MARKET OUTLOOK Figure 1.3.3 Figure 1.3.4 Figure 1.3.1 Figure 1.3.2 0 40 80 120 160 200 240 280 320 360 400 440 480 520 560 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 m dwt Source: Clarkson Research Services Bulk Contracting & Orderbook Bulkers Tankers Combos Orderbook year to date 0 25 50 75 100 125 150 175 200 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014(f) m dwt Source: Clarkson Research Services Shipbuilding Deliveries Others Combos Tankers Bulkers Forecast 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 % of fleet Source: Clarkson Research Services Orderbook as % of Fleet Containers Bulkers Tankers 50 75 100 125 150 175 200 225 250 275 Jan-87 Jan-89 Jan-91 Jan-93 Jan-95 Jan-97 Jan-99 Jan-01 Jan-03 Jan-05 Jan-07 Jan-09 Jan-11 Jan-13 Index Source: Clarkson Research Services Newbuilding Price Index Bulkers Tankers Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

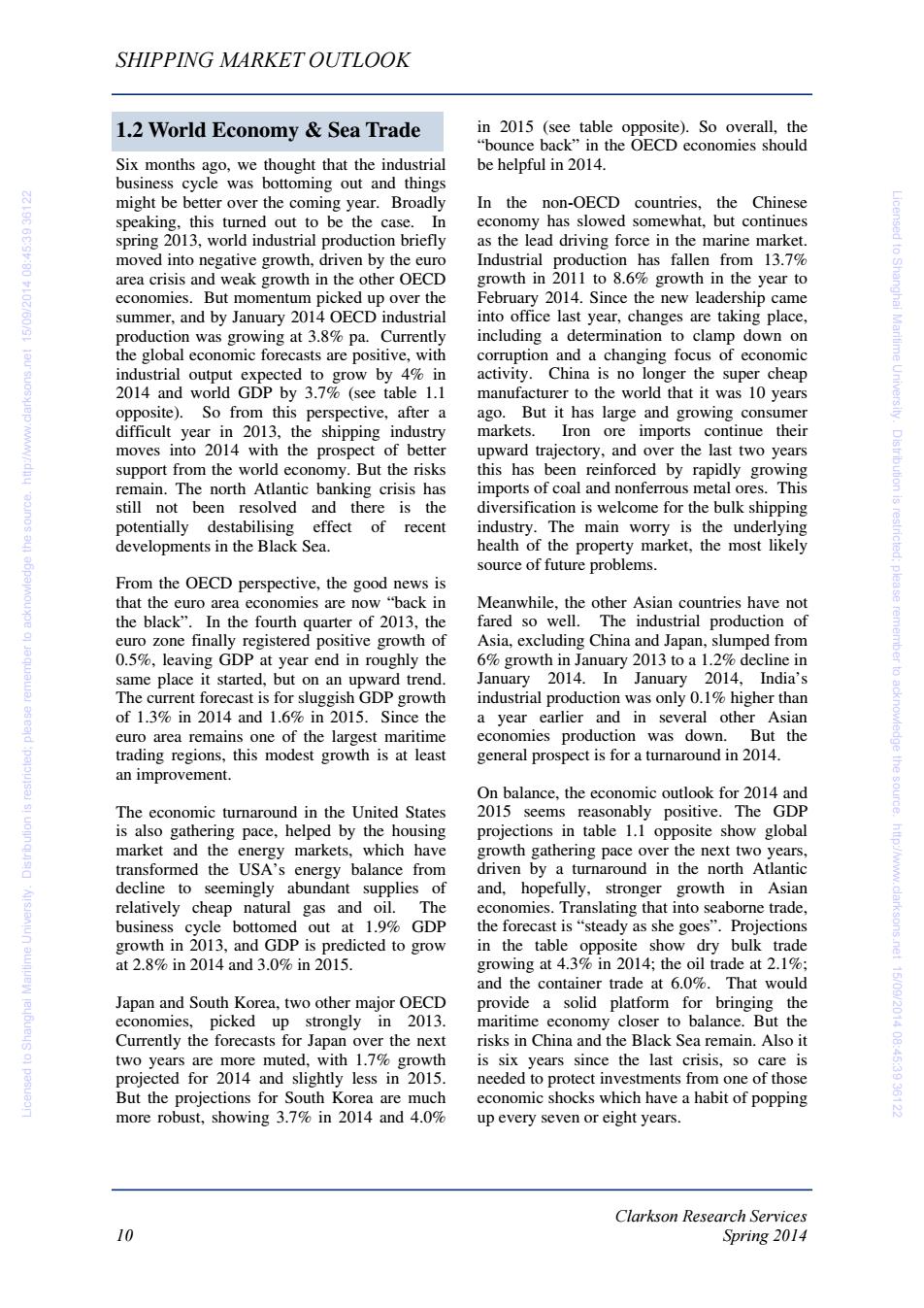

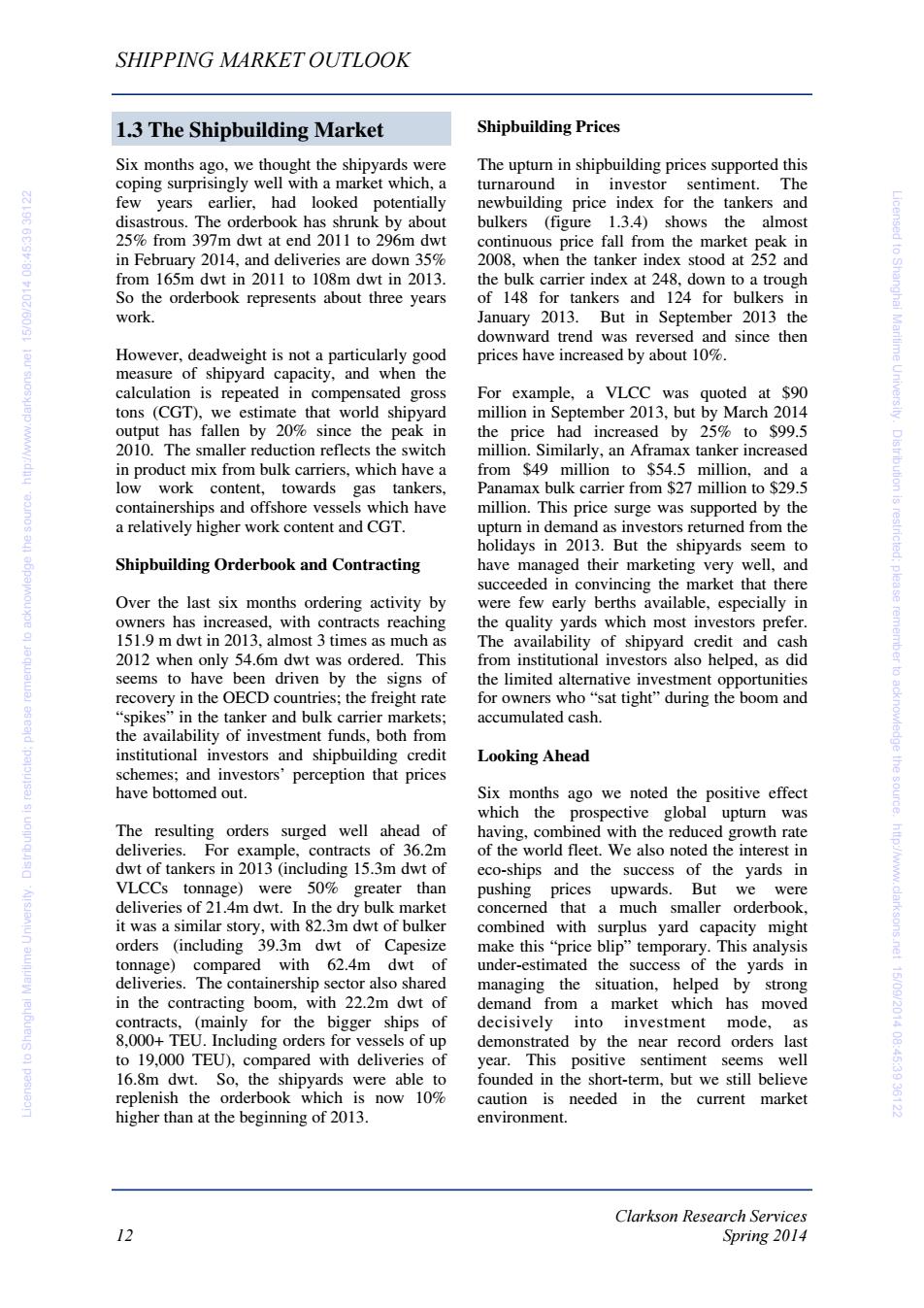

SHIPPING MARKET OUTLOOK 1.4 The Demolition Market 6.3m dwt of handy bulkers demolished.So far in 2014 the demolition trend is following much The improvement in the freight market over the the same pattern as last year,with around 20m last 6 months has been accompanied by a slight dwt of bulk carriers expected to be demolished 的 reduction in demolition activity.After 3 years this year and 18.7m dwt in 2015.Turning to the in which demolition activity had increased from containership sector,a record breaking 0.44m 28.1m dwt in 2010 to a record 58.4m dwt in TEU of capacity was sold for scrap in full year 2012,2013 saw the first cutback,with total 2013,up from 0.33m TEU in 2012.This demolition during the year reduced to 46.1m included 67 Panamax vessels totalling 0.24m Licensed to Shanghal #10216031 dwt.This figure includes 11.1m dwt of tankers; TEU,accounting for 55%of the capacity 22.2m dwt of bulk carriers;and 12.3m dwt of scrapped last year.A further 0.15m TEU was other vessels,of which half were demolished in the first two months of 2014. containerships. The Demolition Outlook Tanker Demolition The demolition of 46m dwt of cargo ships in Figure 1.4.2 on page 15 tracks the demolition 2013 represents only 2.9%of the world fleet. trends for tankers and bulk carriers, This is not a particularly high scrapping rate.If demonstrating a significant difference.For 6 the average ship lasts 25 years,a reasonable years in the last decade very few ships were economic life for a steel built merchant ship Dis tribution is scrapped,but since then there has been a strong trading in salt water,then you would expect upward trend for both scrapping both tankers around 4%of the fleet to be scrapped each year. and bulk carriers.These are monthly figures But the fleet age profile shown in the chart and tanker demolition moved up from around below is skewed towards modern ships.For 0.25m dwt per month in the 2000's to around example,there are only 11m dwt of ships built plea 1m dwt per month over the last 5 years.In 25 years ago in 1989,which is 0.7%of the reviewing this rather low figure,it is important fleet.As such,scrapping projections of 41m to remember that the tanker fleet was subject to dwt in 2014 and 37m dwt in 2015 will rapidly the phase-out of single-hull tankers,and this deplete the stock of over-age ships in some remember to produced very heavy scrapping in 2002/3 when sectors,though to some extent the age profile of demolition was running at over 2m dwt per the fleet will continue to drive demolition. month.Tanker demolition of 11m dwt in 2013 was similar to the previous 4 years.VLCCs World Fleet Age Profile (5.0m dwt in 2013)and Aframaxes(2.7m dwt 180 m dwt 170 in 2013)dominated the demolition trend,whilst year to date 160 products tanker scrapping was lower than in Others (incl.small and non-cargo) 150 previous years.Looking ahead,we currently 口Gas Carriers 140 Cellular Containerships expect tanker scrapping to moderate to 9.2m 130 Bulkcarriers dwt in 2014 and 8.2m dwt in 2015. 120 Tankers 110 Ba total Dry Bulk Demolition 100 leet of 88.359 vess 90 80 Dry bulk demolition accelerated from 6.5m dwt 70 in 2010,to 33.5m dwt in 2012.But in 2013 60 demolition sales of eased back,partly due to 50 improving sentiment,but mainly because after 40 several years of very low rates,a lot of the over 30 -age tonnage had been removed.As in the 20 10 acknowledge the source.http://www.clarksons.net 15/09/2014 08:45:3936122 tanker sector,big ships dominated.In 2013, 0 8.2m dwt of Capesize bulkers were scrapped, plus 4.1m dwt of Panamax bulk carriers.But 虽⑧显西虽虽⑧虽急食晨食晨点局 there was also heavy scrapping of the smaller Source:Clarkson Research Services tonnage,with 3.3m dwt of handymaxes and Clarkson Research Services 14 Spring 2014

Clarkson Research Services 14 Spring 2014 SHIPPING MARKET OUTLOOK The improvement in the freight market over the last 6 months has been accompanied by a slight reduction in demolition activity. After 3 years in which demolition activity had increased from 28.1m dwt in 2010 to a record 58.4m dwt in 2012, 2013 saw the first cutback, with total demolition during the year reduced to 46.1m dwt. This figure includes 11.1m dwt of tankers; 22.2m dwt of bulk carriers; and 12.3m dwt of other vessels, of which half were containerships. Tanker Demolition Figure 1.4.2 on page 15 tracks the demolition trends for tankers and bulk carriers, demonstrating a significant difference. For 6 years in the last decade very few ships were scrapped, but since then there has been a strong upward trend for both scrapping both tankers and bulk carriers. These are monthly figures and tanker demolition moved up from around 0.25m dwt per month in the 2000's to around 1m dwt per month over the last 5 years. In reviewing this rather low figure, it is important to remember that the tanker fleet was subject to the phase-out of single-hull tankers, and this produced very heavy scrapping in 2002/3 when demolition was running at over 2m dwt per month. Tanker demolition of 11m dwt in 2013 was similar to the previous 4 years. VLCCs (5.0m dwt in 2013) and Aframaxes (2.7m dwt in 2013) dominated the demolition trend, whilst products tanker scrapping was lower than in previous years. Looking ahead, we currently expect tanker scrapping to moderate to 9.2m dwt in 2014 and 8.2m dwt in 2015. Dry Bulk Demolition Dry bulk demolition accelerated from 6.5m dwt in 2010, to 33.5m dwt in 2012. But in 2013 demolition sales of eased back, partly due to improving sentiment, but mainly because after several years of very low rates, a lot of the over -age tonnage had been removed. As in the tanker sector, big ships dominated. In 2013, 8.2m dwt of Capesize bulkers were scrapped, plus 4.1m dwt of Panamax bulk carriers. But there was also heavy scrapping of the smaller tonnage, with 3.3m dwt of handymaxes and 6.3m dwt of handy bulkers demolished. So far in 2014 the demolition trend is following much the same pattern as last year, with around 20m dwt of bulk carriers expected to be demolished this year and 18.7m dwt in 2015. Turning to the containership sector, a record breaking 0.44m TEU of capacity was sold for scrap in full year 2013, up from 0.33m TEU in 2012. This included 67 Panamax vessels totalling 0.24m TEU, accounting for 55% of the capacity scrapped last year. A further 0.15m TEU was demolished in the first two months of 2014. The Demolition Outlook The demolition of 46m dwt of cargo ships in 2013 represents only 2.9% of the world fleet. This is not a particularly high scrapping rate. If the average ship lasts 25 years, a reasonable economic life for a steel built merchant ship trading in salt water, then you would expect around 4% of the fleet to be scrapped each year. But the fleet age profile shown in the chart below is skewed towards modern ships. For example, there are only 11m dwt of ships built 25 years ago in 1989, which is 0.7% of the fleet. As such, scrapping projections of 41m dwt in 2014 and 37m dwt in 2015 will rapidly deplete the stock of over-age ships in some sectors, though to some extent the age profile of the fleet will continue to drive demolition. 1.4 The Demolition Market 0 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 160 170 180 <1984 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 m. dwt Source: Clarkson Research Services World Fleet Age Profile Others (incl. small and non-cargo) Gas Carriers Cellular Containerships Bulkcarriers Tankers year to date Based on total world fleet of 88,359 vessels. Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122

SHIPPING MARKET OUTLOOK Demolition by Country Demolition Trends m dwt 4.0 m dwt % ▣Others year to date China Tankers 3.5 55 口Pakistan Bulkers ZI9E 6E:S5:80 102/60/9L lou suosxB'MM/dny India 3.0 ■B'desh 45 40 2.5 3-month moving 35 2.0 average 05520 5 1.0 15 10 0.5 5 0.0 鸟 Source:Clarkson Research Services Source:Clarkson Research Services Figure 1.4.1 Figure 1.4.2 Tanker Fleet Age Profile Bulkcarrier Age Profile 55 m dwt 120 m dwt 50 45 100 40 80 6 30 60 25 20 40 Licensed to Shanghai Maritime University.Distribution is restricted:please remember to acknowledge the source.http://www.clarksons.net 15/09/2014 08:45:39 36122 15 20 0 Source:Clarkson Research Services Source:Clarkson Research Services Figure 1.4.3 Figure 1.4.4 Clarkson Research Services Spring 2014 15

Clarkson Research Services Spring 2014 15 SHIPPING MARKET OUTLOOK Figure 1.4.3 Figure 1.4.4 Figure 1.4.1 Figure 1.4.2 05 10 15 20 25 30 35 40 45 50 55 60 65 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 m dwt Source: Clarkson Research Services Demolition by Country Others China Pakistan India B'desh year to date 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 m dwt Source: Clarkson Research Services Demolition Trends Tankers Bulkers 3-month moving average 05 10 15 20 25 30 35 40 45 50 55 <= 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 m dwt Source: Clarkson Research Services Tanker Fleet Age Profile 0 20 40 60 80 100 120 <= 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 m dwt Source: Clarkson Research Services Bulkcarrier Age Profile Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122