正在加载图片...

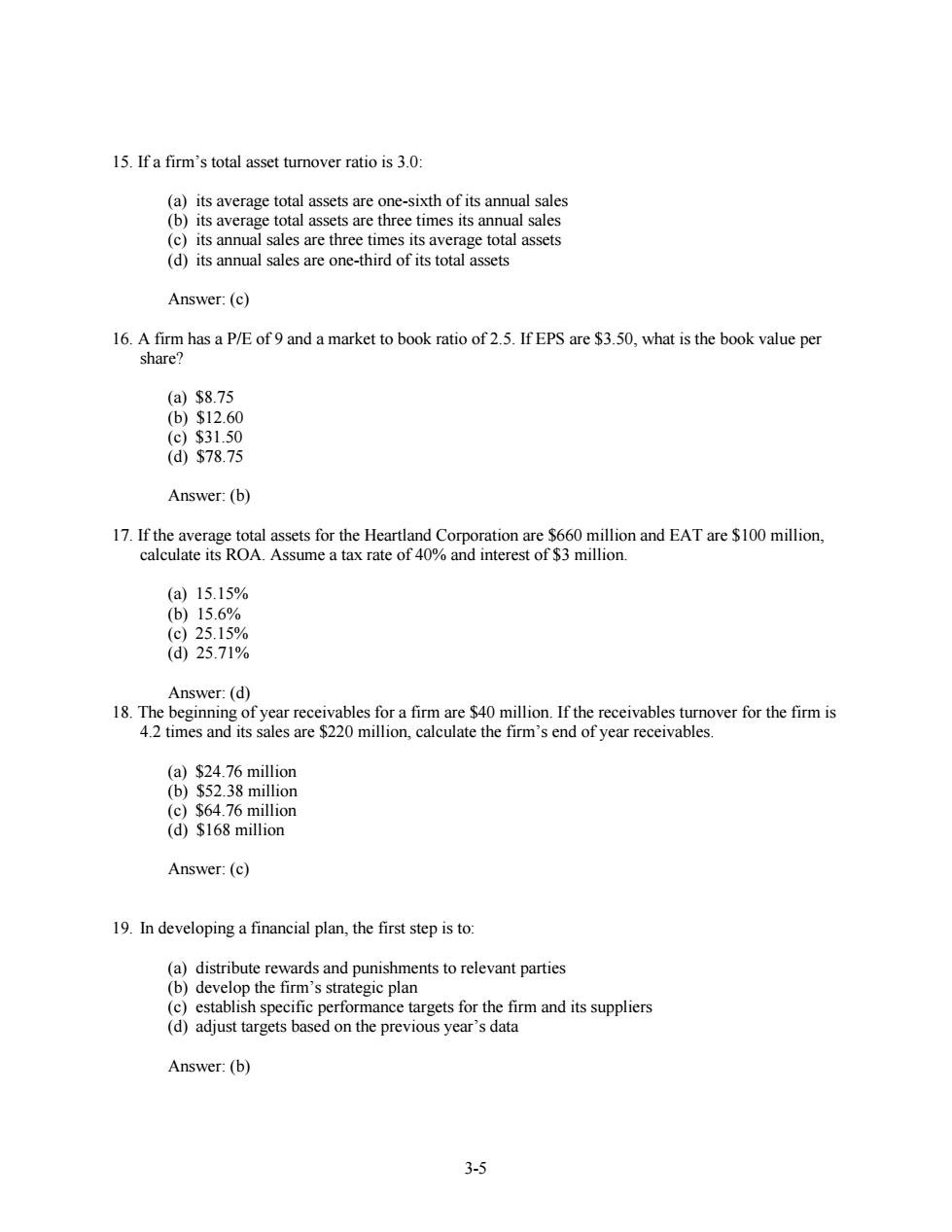

15.If a firm's total asset turnover ratio is 3.0: (a)its average total assets are one-sixth of its annual sales (b)its average total assets are three times its annual sales (c)its annual sales are three times its average total assets (d)its annual sales are one-third of its total assets Answer:(c) 16.A firm has a P/E of 9 and a market to book ratio of 2.5.If EPS are $3.50,what is the book value per share? (a)$8.75 (b)$12.60 (c)$31.50 (d$78.75 Answer:(b) 17.If the average total assets for the Heartland Corporation are $660 million and EAT are $100 million, calculate its ROA.Assume a tax rate of 40%and interest of $3 million. (a15.15% (b)15.6% (c)25.15% (d)25.71% Answer:(d) 18.The beginning of year receivables for a firm are $40 million.If the receivables turnover for the firm is 4.2 times and its sales are $220 million,calculate the firm's end of year receivables. (a)$24.76 million (b)$52.38 million (c)$64.76 million (d)$168 million Answer:(c) 19.In developing a financial plan,the first step is to: (a)distribute rewards and punishments to relevant parties (b)develop the firm's strategic plan (c)establish specific performance targets for the firm and its suppliers (d)adjust targets based on the previous year's data Answer:(b) 3-53-5 15. If a firm’s total asset turnover ratio is 3.0: (a) its average total assets are one-sixth of its annual sales (b) its average total assets are three times its annual sales (c) its annual sales are three times its average total assets (d) its annual sales are one-third of its total assets Answer: (c) 16. A firm has a P/E of 9 and a market to book ratio of 2.5. If EPS are $3.50, what is the book value per share? (a) $8.75 (b) $12.60 (c) $31.50 (d) $78.75 Answer: (b) 17. If the average total assets for the Heartland Corporation are $660 million and EAT are $100 million, calculate its ROA. Assume a tax rate of 40% and interest of $3 million. (a) 15.15% (b) 15.6% (c) 25.15% (d) 25.71% Answer: (d) 18. The beginning of year receivables for a firm are $40 million. If the receivables turnover for the firm is 4.2 times and its sales are $220 million, calculate the firm’s end of year receivables. (a) $24.76 million (b) $52.38 million (c) $64.76 million (d) $168 million Answer: (c) 19. In developing a financial plan, the first step is to: (a) distribute rewards and punishments to relevant parties (b) develop the firm’s strategic plan (c) establish specific performance targets for the firm and its suppliers (d) adjust targets based on the previous year’s data Answer: (b)