正在加载图片...

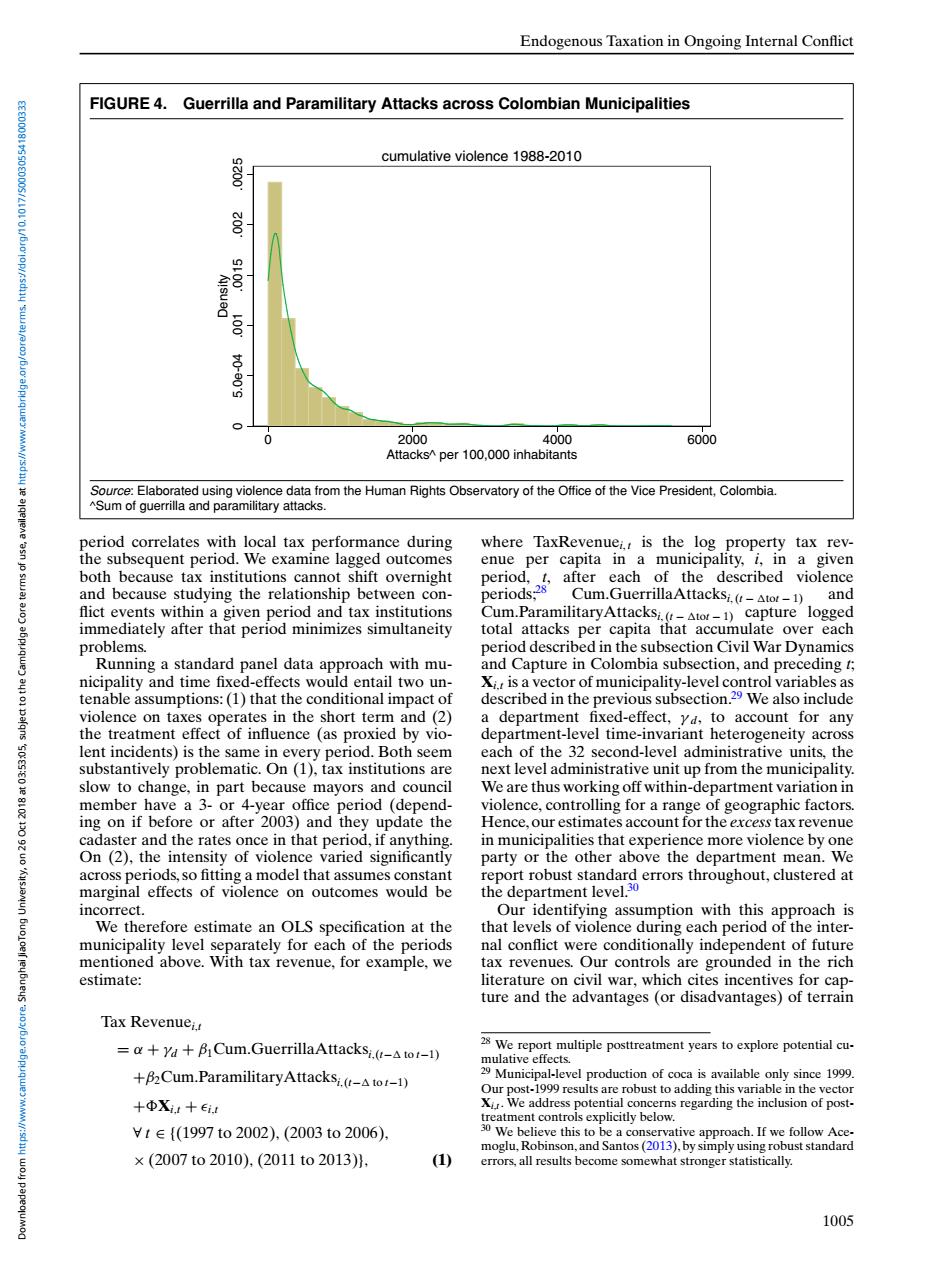

Endogenous Taxation in Ongoing Internal Conflict FIGURE 4.Guerrilla and Paramilitary Attacks across Colombian Municipalities cumulative violence 1988-2010 4500. 2700. 2000 4000 6000 Attacks^per 100,000 inhabitants Source:Elaborated using violence data from the Human Rights Observatory of the Office of the Vice President,Colombia 4号 ^Sum of guerrilla and paramilitary attacks. period correlates with local tax performance during where TaxRevenuei.is the log property tax rev- & the subsequent period.We examine lagged outcomes enue per capita in a municipality,i,in a given both because tax institutions cannot shift overnight and because studying the relationship between con- periods2 atteim acerranecksescribed violencd Cum.GuerrillaAttacksi.(-Ator-1) and flict events within a given period and tax institutions Cum.ParamilitaryAttacksi.(-Ator-1)capture logged immediately after that period minimizes simultaneity total attacks per capita that accumulate over each problems. period described in the subsection Civil War Dynamics Running a standard panel data approach with mu- and Capture in Colombia subsection,and preceding t; nicipality and time fixed-effects would entail two un- Xi.r is a vector of municipality-level control variables as tenable assumptions:(1)that the conditional impact of described in the previous subsection.29 We also include violence on taxes operates in the short term and(2) a department fixed-effect,yd,to account for any the treatment effect of influence (as proxied by vio- department-level time-invariant heterogeneity across lent incidents)is the same in every period.Both seem each of the 32 second-level administrative units.the substantively problematic.On(1),tax institutions are next level administrative unit up from the municipality. slow to change,in part because mayors and council We are thus working off within-department variation in member have a 3-or 4-year office period (depend- violence,controlling for a range of geographic factors. ing on if before or after 2003)and they update the Hence,our estimates account for the excess tax revenue cadaster and the rates once in that period,if anything. in municipalities that experience more violence by one On(2),the intensity of violence varied significantly party or the other above the department mean.We across periods,so fitting a model that assumes constant report robust standard errors throughout,clustered at marginal effects of violence on outcomes would be the department level.30 incorrect Our identifying assumption with this approach is We therefore estimate an OLS specification at the that levels of violence during each period of the inter- municipality level separately for each of the periods nal conflict were conditionally independent of future mentioned above.With tax revenue,for example,we tax revenues.Our controls are grounded in the rich estimate: literature on civil war,which cites incentives for cap- ture and the advantages (or disadvantages)of terrain Tax Revenueit =a+yd+BCum.GuerrillaAttacksi.(-A to-1) 28 We report multiple posttreatment years to explore potential cu- mulative effects. +BCum.ParamilitaryAttacksi.(-A to-1) 29 Municipal-level production of coca is available only since 1999. Our post-1999 results are robust to adding this variable in the vector +ΦXr+eit Xi.We address potential concerns regarding the inclusion of post- treatment controls explicitly below. t∈{(1997to2002),(2003to2006), 30 We believe this to be a conservative approach.If we follow Ace- moglu,Robinson,and Santos(2013),by simply using robust standard ×(2007to2010),(2011to2013)}, (1) errors,all results become somewhat stronger statistically. 1005Endogenous Taxation in Ongoing Internal Conflict FIGURE 4. Guerrilla and Paramilitary Attacks across Colombian Municipalities 0 5.0e-04 .001 .0015 .002 .0025 Density 0 2000 4000 6000 Attacks^ per 100,000 inhabitants cumulative violence 1988-2010 Source: Elaborated using violence data from the Human Rights Observatory of the Office of the Vice President, Colombia. ^Sum of guerrilla and paramilitary attacks. period correlates with local tax performance during the subsequent period. We examine lagged outcomes both because tax institutions cannot shift overnight and because studying the relationship between conflict events within a given period and tax institutions immediately after that period minimizes simultaneity problems. Running a standard panel data approach with municipality and time fixed-effects would entail two untenable assumptions: (1) that the conditional impact of violence on taxes operates in the short term and (2) the treatment effect of influence (as proxied by violent incidents) is the same in every period. Both seem substantively problematic. On (1), tax institutions are slow to change, in part because mayors and council member have a 3- or 4-year office period (depending on if before or after 2003) and they update the cadaster and the rates once in that period, if anything. On (2), the intensity of violence varied significantly across periods, so fitting a model that assumes constant marginal effects of violence on outcomes would be incorrect. We therefore estimate an OLS specification at the municipality level separately for each of the periods mentioned above. With tax revenue, for example, we estimate: Tax Revenuei,t = α + γd + β1Cum.GuerrillaAttacksi,(t− to t−1) +β2Cum.ParamilitaryAttacksi,(t− to t−1) +Xi,t + i,t ∀ t ∈ {(1997 to 2002),(2003 to 2006), × (2007 to 2010),(2011 to 2013)}, (1) where TaxRevenuei, t is the log property tax revenue per capita in a municipality, i, in a given period, t, after each of the described violence periods;28 Cum.GuerrillaAttacksi, (t − tot − 1) and Cum.ParamilitaryAttacksi, (t − tot − 1) capture logged total attacks per capita that accumulate over each period described in the subsection Civil War Dynamics and Capture in Colombia subsection, and preceding t; Xi,t is a vector of municipality-level control variables as described in the previous subsection.29 We also include a department fixed-effect, γ d, to account for any department-level time-invariant heterogeneity across each of the 32 second-level administrative units, the next level administrative unit up from the municipality. We are thus working off within-department variation in violence, controlling for a range of geographic factors. Hence, our estimates account for the excesstax revenue in municipalities that experience more violence by one party or the other above the department mean. We report robust standard errors throughout, clustered at the department level.30 Our identifying assumption with this approach is that levels of violence during each period of the internal conflict were conditionally independent of future tax revenues. Our controls are grounded in the rich literature on civil war, which cites incentives for capture and the advantages (or disadvantages) of terrain 28 We report multiple posttreatment years to explore potential cumulative effects. 29 Municipal-level production of coca is available only since 1999. Our post-1999 results are robust to adding this variable in the vector Xi,t . We address potential concerns regarding the inclusion of posttreatment controls explicitly below. 30 We believe this to be a conservative approach. If we follow Acemoglu, Robinson, and Santos (2013), by simply using robust standard errors, all results become somewhat stronger statistically. 1005 Downloaded from https://www.cambridge.org/core. Shanghai JiaoTong University, on 26 Oct 2018 at 03:53:05, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/S0003055418000333