正在加载图片...

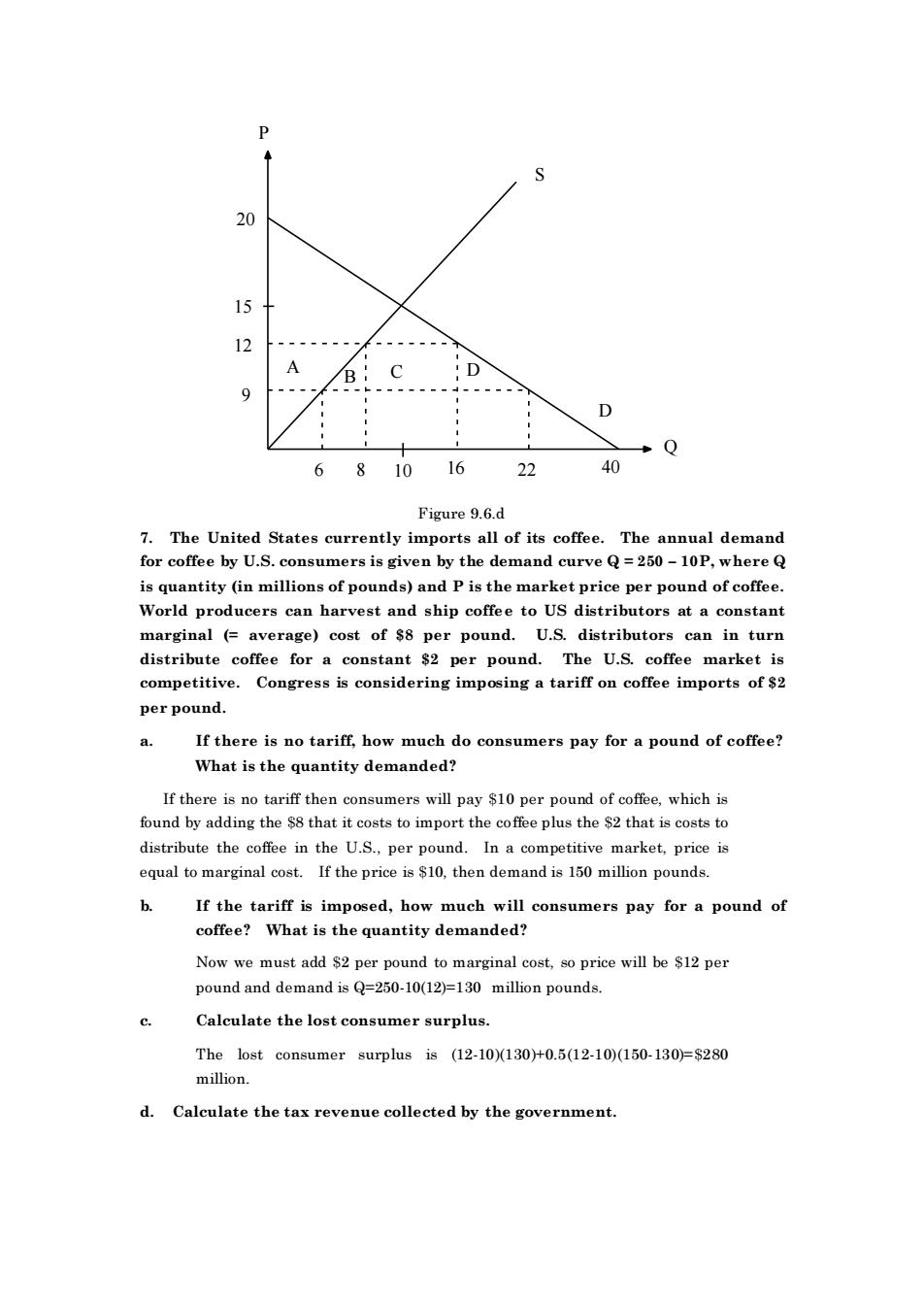

12 A 、8, 'D →Q 68 16 22 40 Figure 9.6d ortsall of its coffee.The annual demand is quantity (in millions of pounds)and P is the market price per pound of coffee. World producers can harvest and ship coffee to US distributors at a constant marginal (average)cost of S8 per pound.U.S.distributors can in turn distribute coffee for a constant $2 per pound.The U.S.coffee market is competiti e.Congress is considering imposing a tariff on coffee imports of$ per pound. a. If there is no tariff,how much do consumers pay for a pound of coffee? What is the quantity demanded? If there is no tariff then consumers will pay $10 per pound of coffee,which is found by adding the $8 that it costs to import the coffee plus the $2 that is costs to distribute the coffee in the U.S.per pound.Ina co etitive market price is equal to marginal cost.If the price is$then demand is 150 million pounds b If the tariff is imposed,how much will consumers pay for a pound of coffee?What is the quantity demanded? Now we must add $2 per pound to marginal cost,so price will be $12 per pound and demand is Q=250-10(12)=130 million pounds. Calculate the lost consumer surplus. The lost consumer surplus is (12-10X(130)+0.5(12-10)(150-130)=$280 million. d.Calculate the tax revenue collected by the government6 8 10 16 22 9 12 15 S D Q P A B C D 20 40 Figure 9.6.d 7. The United States currently imports all of its coffee. The annual demand for coffee by U.S. consumers is given by the demand curve Q = 250 – 10P, where Q is quantity (in millions of pounds) and P is the market price per pound of coffee. World producers can harvest and ship coffee to US distributors at a constant marginal (= average) cost of $8 per pound. U.S. distributors can in turn distribute coffee for a constant $2 per pound. The U.S. coffee market is competitive. Congress is considering imposing a tariff on coffee imports of $2 per pound. a. If there is no tariff, how much do consumers pay for a pound of coffee? What is the quantity demanded? If there is no tariff then consumers will pay $10 per pound of coffee, which is found by adding the $8 that it costs to import the coffee plus the $2 that is costs to distribute the coffee in the U.S., per pound. In a competitive market, price is equal to marginal cost. If the price is $10, then demand is 150 million pounds. b. If the tariff is imposed, how much will consumers pay for a pound of coffee? What is the quantity demanded? Now we must add $2 per pound to marginal cost, so price will be $12 per pound and demand is Q=250-10(12)=130 million pounds. c. Calculate the lost consumer surplus. The lost consumer surplus is (12-10)(130)+0.5(12-10)(150-130)=$280 million. d. Calculate the tax revenue collected by the government