CHAPTER9 THEANALYSISOF COMPETITIVEMARKETS -QUESTIONS FOR REVIEW 1.What is meant by deadweight loss?Why does a price ceiling usually result in a deadweight loss? Deadweight oss refers to the benefits bst toeither consumers orproducers wher markets do not operate efficiently.The term deadweight denotes that these are benefits unavailable to any party.Aprice ceiling will tend to result in a deadweight loss because at any price below the market equilibrium price.quantity supplied will be below the market equilibrium quantity supplied,resulting in a loss of surplus to producers、Consume will pure s than the market equilibrium quantity resulting in a loss of surplus to consumers Consumers will also purchase less thar the quantity they demand at the price set by the ceiling.The surplus lost by consumers and producers is not captured by either gmoup,and surplus not captured by market participants is deadweight loss. 2.Suppose the supply curve for a good is completely inelastic.If the mposed price ilin below the market-clearing a deadweight loss result?Explain. When the supply curve is completely inelastic,the imposition of an effective price ceiling transfers all loss in producer surplus to consumers.Consumer surplus increases by the difference between the market-clearing price and the price ceiling times the market-clearing quantity.Consumers capture all decreases in total revenue.Therefore,no deadweight loss occurs 3.How can a price ceiling make consumers better off?Under what conditions might it make them worse off If the supply curve is perfectly inelastic a price ceiling will increase consume surplus.If the demand curve is inelastic,price controls may result in a net lossof consumer surplus because consumers willing to pay a higher price are unable to ourchase the price-controlled good or service.The loss of consumer su rplus is raor than th sfer of pro ducer supus to and i lastic (and supply isre tively inelastic)conumers in the aggregate will enjoy an inceas in consumer surplus. 4.Suppose the government regulates the price of a good to be no lower than some minimum level.Can such a minimum price make producers as a whole worse off?Explain Because a higher price increases revenue and decreases demand.some consumer surplus is transferred to producers but some producer revenue is lost because

CHAPTER 9 THE ANALYSIS OF COMPETITIVE MARKETS 一、QUESTIONS FOR REVIEW 1. What is meant by deadweight loss? Why does a price ceiling usually result in a deadweight loss? Deadweight loss refers to the benefits lost to either consumers or producers when markets do not operate efficiently. The term deadweight denotes that these are benefits unavailable to any party. A price ceiling will tend to result in a deadweight loss because at any price below the market equilibrium price, quantity supplied will be below the market equilibrium quantity supplied, resulting in a loss of surplus to producers. Consumers will purchase less than the market equilibrium quantity, resulting in a loss of surplus to consumers. Consumers will also purchase less than the quantity they demand at the price set by the ceiling. The surplus lost by consumers and producers is not captured by either group, and surplus not captured by market participants is deadweight loss. 2. Suppose the supply curve for a good is completely inelastic. If the government imposed a price ceiling below the market -clearing level, would a deadweight loss result? Explain. When the supply curve is completely inelastic, the imposition of an effective price ceiling transfers all loss in producer surplus to consumers. Consumer surplus increases by the difference between the market-clearing price and the price ceiling times the market-clearing quantity. Consumers capture all decreases in total revenue. Therefore, no deadweight loss occurs. 3. How can a price ceiling make consumers better off? Under what conditions might it make them worse off? If the supply curve is perfectly inelastic a price ceiling will increase consumer surplus. If the demand curve is inelastic, price controls may result in a net loss of consumer surplus because consumers willing to pay a higher price are unable to purchase the price-controlled good or service. The loss of consumer surplus is greater than the transfer of producer surplus to consumers. If demand is elastic (and supply is relatively inelastic) consumers in the aggregate will enjoy an increase in consumer surplus. 4. Suppose the government regulates the price of a good to be no lower than some minimum level. Can such a minimum price make producers as a whole worse off? Explain. Because a higher price increases revenue and decreases demand, some consumer surplus is transferred to producers but some producer revenue is lost because

consumers purchase less.The problem with a price floor or minimum price is that the price goes up,producers incur extra cost to produce more than what consumers are willing to purchase at these higher prices.These extra costs can overwhelm gains captured in increased revenues.Thus unless all producers decrease production,a minimum price can make producers as a whole worse off 5.How are production limits used in practice to raise the prices of the following goods r services (a)taxi rides (b)drink o bar,(c)wheat or corn? Municipal authorities usually regulate the number of taxis through the issuance of licenses.When the number of taxis is less than it would be without regulation. those taxis in the market may charge a higher-than-competitive price. State authorities usually regulate the number of liquor licenses.By requiring that any bar or restaurant that serves alcohol have a liquor license and then limiting the number oflicenes available,the State limits entry by new bars and restaurant This limitation allows those establishments that have a license to charge a highe price for alcoholic beverages. Federal authorities usually regulate the number of acres of wheat or corn in production by creating acreage limitation programs that give farmers financial incentives to leave some of their acreage idle.This reduces supply,driving up the price of wheat or corn. 6.Suppose the gove ent wants to increase farmers'incomes.Why do price supports or acreage limitation programs cost society more than simply giving farmers money? Price supports and acreage limitations cost society more than the dollar cost of these programs because the higher price that results in either case will reduce quantity demanded and hence consumer sumplus.leading to a deadweight loss because the farmer is not able toc apt ure the lost s urplus. Giving the farmers money does not result in any deadweight bss but is merelya redistribution of surplus from one group to the other. 7.Suppose the government wants to limit imports of a certain good.Is it preferable to use an import quota or a tariff?Why? Changes in domestic consumer and producer surpluses are the same under import quotas and tariffs.There will be a loss in (domestic)total surplus in either ease.However,with a tariff,the go ernment can colkct revenue equal to the tarif the quantity of imports and these revenue can be domestic economy to offset the domestic deadweight lss by,for example,reducing taxes.Thus,there is less of a loss to the domestic society as a whole.With the import quota,foreign producers can capture the difference between the domestic and world price times the quantity of imports.Therefore,with an import quota there is

consumers purchase less. The problem with a price floor or minimum price is that it sends the wrong signal to producers. Thinking that more should be produced as the price goes up, producers incur extra cost to produce more than what consumers are willing to purchase at these higher prices. These extra costs can overwhelm gains captured in increased revenues. Thus, unless all producers decrease production, a minimum price can make producers as a whole worse off. 5. How are production limits used in practice to raise the prices of the following goods or services: (a) taxi rides, (b) drinks in a restaurant or bar, (c) wheat or corn? Municipal authorities usually regulate the number of taxis through the issuance of licenses. When the number of taxis is less than it would be without regulation, those taxis in the market may charge a higher-than-competitive price. State authorities usually regulate the number of liquor licenses. By requiring that any bar or restaurant that serves alcohol have a liquor license and then limiting the number of licenses available, the State limits entry by new bars and restaurants. This limitation allows those establishments that have a license to charge a higher price for alcoholic beverages. Federal authorities usually regulate the number of acres of wheat or corn in production by creating acreage limitation programs that give farmers financial incentives to leave some of their acreage idle. This reduces supply, driving up the price of wheat or corn. 6. Suppose the government wants to increase farmers’ incomes. Why do price supports or acreage limitation programs cost society more than simply giving farmers money? Price supports and acreage limitations cost society more than the dollar cost of these programs because the higher price that results in either case will reduce quantity demanded and hence consumer surplus, leading to a deadweight loss because the farmer is not able to capture the lost surplus. Giving the farmers money does not result in any deadweight loss, but is merely a redistribution of surplus from one group to the other. 7. Suppose the government wants to limit imports of a certain good. Is it preferable to use an import quota or a tariff? Why? Changes in domestic consumer and producer surpluses are the same under import quotas and tariffs. There will be a loss in (domestic) total surplus in either case. However, with a tariff, the government can collect revenue equal to the tariff times the quantity of imports and these revenues can be redistributed in the domestic economy to offset the domestic deadweight loss by, for example, reducing taxes. Thus, there is less of a loss to the domestic society as a whole. With the import quota, foreign producers can capture the difference between the domestic and world price times the quantity of imports. Therefore, with an import quota, there is

a loss to the domestic society as a whole.If the national government is trving to increase welfare,it should usea tariff. 8.The burden of a tax is shared by pr oduce mers. Under what producers pay most of it?What determines the share of a subsidy that benefits consumers? The burden of a tax and the benefits of a subsidy depend on the elasticities of demand and supply.If the ratio of the elasticity of demand to the elasticity of supply is small.the burden of the tax falls mainly on onsumers On the other hand. f the ratio of the the burde of the tax falls mainly on producers.Similarly,the benefit of a subsidy accrues mostly to consumers (producers)if the ratio of the elasticity of demand to the elasticity ofsupply is small (large). 9.Why does a tax create a deadweight loss?What determines the size of this loss? A tax reates deadweight ss by artificially increasing price above thefree market evel thus reducing quantity.This reduction in dema reduces consumer as well as producer surplus.The size of the deadweight loss depends on the elasticities of supply and demand.As the elasticity of demand increases and the elasticity of supply decreases,ie.,as supply becomes more inelastic,the deadweight loss becomes larger. 二、EXERCISES 1.In 1996,the U.S.Congress raised the minimum wage from $4.25 per hour to 5.15 per hou Some p ole sug gested that a governm ent subsidy ould help This exercise examine omics of minimum wage and wage subsidies.Suppose the supply of low-skilled labor is given by LS 10w,where LS is the quantity of low-skilled labor (in millions of persons employed each year)and w is the wage rate(in dollars per hour).The demand for labor is given by L=80-10w a.What will the free market wage rate and employment level be?Suppose the government sets minimum wage of$5 per hour.How many people would then be employed? In a free-market equilibrium,L8=LD.Solving yields w=$4 and Ls=LD=40.If the minimum wage is $5.then Ls=50 and LD=30.The number of people employed will be given by the labor demand,so employers will hire 30 million workers. Figure 9.La

a loss to the domestic society as a whole. If the national government is trying to increase welfare, it should use a tariff. 8. The burden of a tax is shared by producers and consumers. Under what conditions will consumers pay most of the tax? Under what conditions will producers pay most of it? What determines the share of a subsidy that benefits consumers? The burden of a tax and the benefits of a subsidy depend on the elasticities of demand and supply. If the ratio of the elasticity of demand to the elasticity of supply is small, the burden of the tax falls mainly on consumers. On the other hand, if the ratio of the elasticity of demand to the elasticity of supply is large, the burden of the tax falls mainly on producers. Similarly, the benefit of a subsidy accrues mostly to consumers (producers) if the ratio of the elasticity of demand to the elasticity of supply is small (large). 9. Why does a tax create a deadweight loss? What determines the size of this loss? A tax creates deadweight loss by artificially increasing price above the free market level, thus reducing the equilibrium quantity. This reduction in demand reduces consumer as well as producer surplus. The size of the deadweight loss depends on the elasticities of supply and demand. As the elasticity of demand increases and the elasticity of supply decreases, i.e., as supply becomes more inelastic, the deadweight loss becomes larger. 二、EXERCISES 1. In 1996, the U.S. Congress raised the minimum wage from $4.25 per hour to $5.15 per hour. Some people suggested that a government subsidy could help employers finance the higher wage. This exercise examines the economics of a minimum wage and wage subsidies. Suppose the supply of low-skilled labor is given by L w S = 10 , where L S is the quantity of low-skilled labor (in millions of persons employed each year) and w is the wage rate (in dollars per hour). The demand for labor is given by L w D = 80 - 10 . a. What will the free market wage rate and employment level be? Suppose the government sets a minimum wage of $5 per hour. How many people would then be employed? In a free-market equilibrium, LS = LD. Solving yields w = $4 and LS = LD = 40. If the minimum wage is $5, then LS = 50 and LD = 30. The number of people employed will be given by the labor demand, so employers will hire 30 million workers. Figure 9.1.a

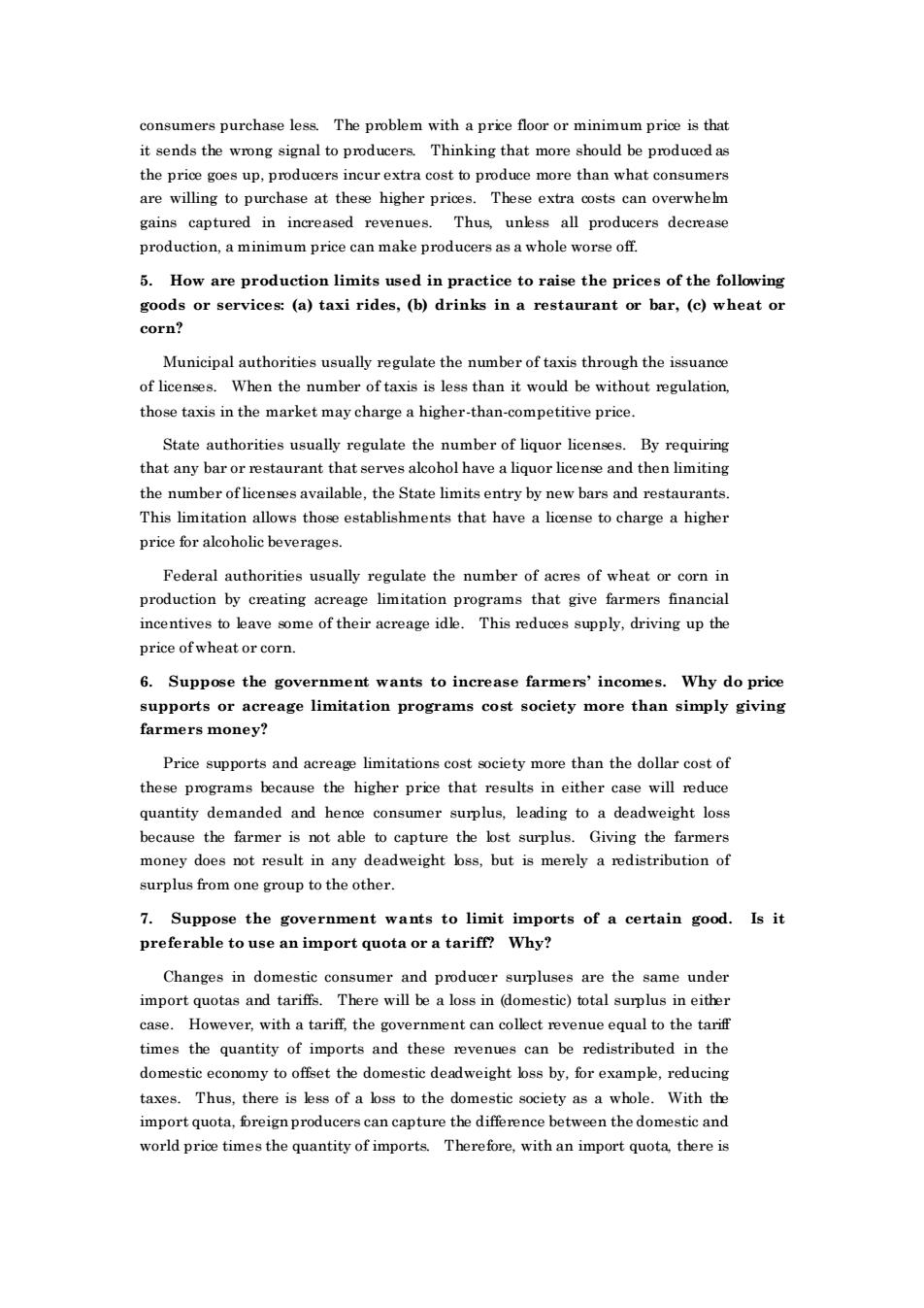

b.Suppose that instead of a minimum wage,the government pays a subsidy of $1 per hour for each employee What will the total level of employment be now?What will the equilibrium wage rate be? Let w denote the wage received by the employee. Then the employer receiving the $1 subsidy per worker hour only pays w-1 for each worker hour.As shown in Figure 9.1.b.the labor demand curve shifts to: LD=80.10(w-1)=90.10w where w represents the wage received by the employee The new equilibrium will be given by the intersection of the old supply curve with the new demand curve,and therefore,90-10w**=10w**,or w**=$4.5 per hour and L=10(4.5)=45 million persons employed.The real cost to the employer is $3.5 per hour. ,L-10m (subsidy) D-90-10m 4045 80 90 Figure 9.1.b 2.Suppose the market for widgets can be deseribed by the following equations: Demand:P=10-Q Supply:P=Q-4 where P is the price in dollars per unit and Qis the quantity in thousands of units. a.What is the equilibrium price and quantity? To find the equilibrium price and quantity,equate supply and demand and solve for Qgo 10.Q=Q.4,orQe=7 Substitute into either the demand equation or the supply equation to obtain Pro. Pg0=10.7=3 or PE0=7.4=3. b. Suppose the gover ment imposes a tax of $l per unit to reduce consumption and raise government revenues

b. Suppose that instead of a minimum wage, the government pays a subsidy of $1 per hour for each employee. What will the total level of employment be now? What will the equilibrium wage rate be? Let w denote the wage received by the employee. Then the employer receiving the $1 subsidy per worker hour only pays w-1 for each worker hour. As shown in Figure 9.1.b, the labor demand curve shifts to: LD = 80 - 10 (w-1) = 90 - 10w, where w represents the wage received by the employee. The new equilibrium will be given by the intersection of the old supply curve with the new demand curve, and therefore, 90-10W** = 10W**, or w** = $4.5 per hour and L** = 10(4.5) = 45 million persons employed. The real cost to the employer is $3.5 per hour. W L = 10w s 9 8 4.5 4 40 45 80 90 wage and employment after subsidy L = 90-10w D (subsidy) L = 80-10w D L Figure 9.1.b 2. Suppose the market for widgets can be described by the following equations: Demand: P = 10 - Q Supply: P = Q - 4 where P is the price in dollars per unit and Q is the quantity in thousands of units. a. What is the equilibrium price and quantity? To find the equilibrium price and quantity, equate supply and demand and solve for QEQ: 10 - Q = Q - 4, or QEQ = 7. Substitute QEQ into either the demand equation or the supply equation to obtain PEQ. PEQ = 10 - 7 = 3, or PEQ = 7 - 4 = 3. b. Suppose the government imposes a tax of $1 per unit to reduce widget consumption and raise government revenues. What will the new

equilibrium quantity be?What price will the buyer pay?What amount per unit will the sellerreceive? With the imposition of tax per unit,the demand curveor widgets shifts inward.At each price.the consumer wishes to buy ess Algebraically,the now demand function is: P=9.Q The new equilibrium quantity is found in the same way as in(2a): 9.Q=Q-4orQ*=6.5. To determine the price the buyer pays P,substituteinto the demand equation: P=10.6.5=3.50 To determine the price the seller receives,Ps,substitute into the supply equation: P=6.54=$2.50. Suppose the govm of heart about the importance of widgets to the erican public. The tax is remove ed and a subsidy of $1 per unit is granted to widget producers.What will the equilibrium quantity be? What price will the buyer pay?What amount per unit (including the subsidy)will the seller receive?What will be the total cost to the government? The original supply curve for widgets wasP=Q4 With a subsidy of e supply curve fo Rememb er that th With a subsidy,the margina cost curve shifts down by the amount ofthe subsidy.The new supply function is: P=Q.5. To obtain the new equilibrium quantity,set the new supply curve equal to the demand curve: Q.5=10.Q.0rQ=7.5 The buyer pays P=$250,and receives that price plus the subsidy,ie $.50.With and a subsidy of $100.the otal cos of the subsidy to the government will be $7,50 3.Japanese rice producers have extremely high production costs,in part due to the high opportunity cost of land and to their inability to take advantage of

equilibrium quantity be? What price will the buyer pay? What amount per unit will the seller receive? With the imposition of a $1.00 tax per unit, the demand curve for widgets shifts inward. At each price, the consumer wishes to buy less. Algebraically, the new demand function is: P = 9 - Q. The new equilibrium quantity is found in the same way as in (2a): 9 - Q = Q - 4, or Q* = 6.5. To determine the price the buyer pays, PB * , substitute Q* into the demand equation: PB * = 10 - 6.5 = $3.50. To determine the price the seller receives, PS * , substitute Q* into the supply equation: PS * = 6.5 - 4 = $2.50. c. Suppose the government has a change of heart about the importance of widgets to the happiness of the American public. The tax is removed and a subsidy of $1 per unit is granted to widget producers. What will the equilibrium quantity be? What price will the buyer pay? What amount per unit (including the subsidy) will the seller receive? What will be the total cost to the government? The original supply curve for widgets was P = Q - 4. With a subsidy of $1.00 to widget producers, the supply curve for widgets shifts outward. Remember that the supply curve for a firm is its marginal cost curve. With a subsidy, the marginal cost curve shifts down by the amount of the subsidy. The new supply function is: P = Q - 5. To obtain the new equilibrium quantity, set the new supply curve equal to the demand curve: Q - 5 = 10 - Q, or Q = 7.5. The buyer pays P = $2.50, and the seller receives that price plus the subsidy, i.e., $3.50. With quantity of 7,500 and a subsidy of $1.00, the total cost of the subsidy to the government will be $7,500. 3. Japanese rice producers have extremely high production costs, in part due to the high opportunity cost of land and to their inability to take advantage of

economies of large-scale production.Analyze two policies intended to maintain Japanese rice produetion (1)aper-pound subsidy tofarmers for ench pound of rice produced,or (2)a per-pound tariff on imported rice. supply-and-demand diagrams the equilibrium price and quantity,domestic rice production,government revenue or deficit,and deadweight loss from each policy. Which policy is the Japanese government likely to prefer?Which policy are Japanese farmers likely to prefer? nd domestie der by the buyers.a nd Pis the equilibrium prie without the subsidy,assumingno imports.With the subsidy,buyers demand Q.Farmers gain amounts equivalent to areas Aand B.This is the increase in producer surplus.Consumers gain areas Cand F This is the increase in consumer suplus. area +C+F+E equa Figure 9.3b sho ment pays ws the gainsand price,and Po is the equilibrium price.With the tariff,assumed to be equal toP Pu buyers demand Qn farmers supply Qp and Qr-Qp is imported.Farmers requivalont to area A.Consupers b areB C:thig is the er surplus. adw is equal to Band C Pri B D Quantity Figure 9.3.a

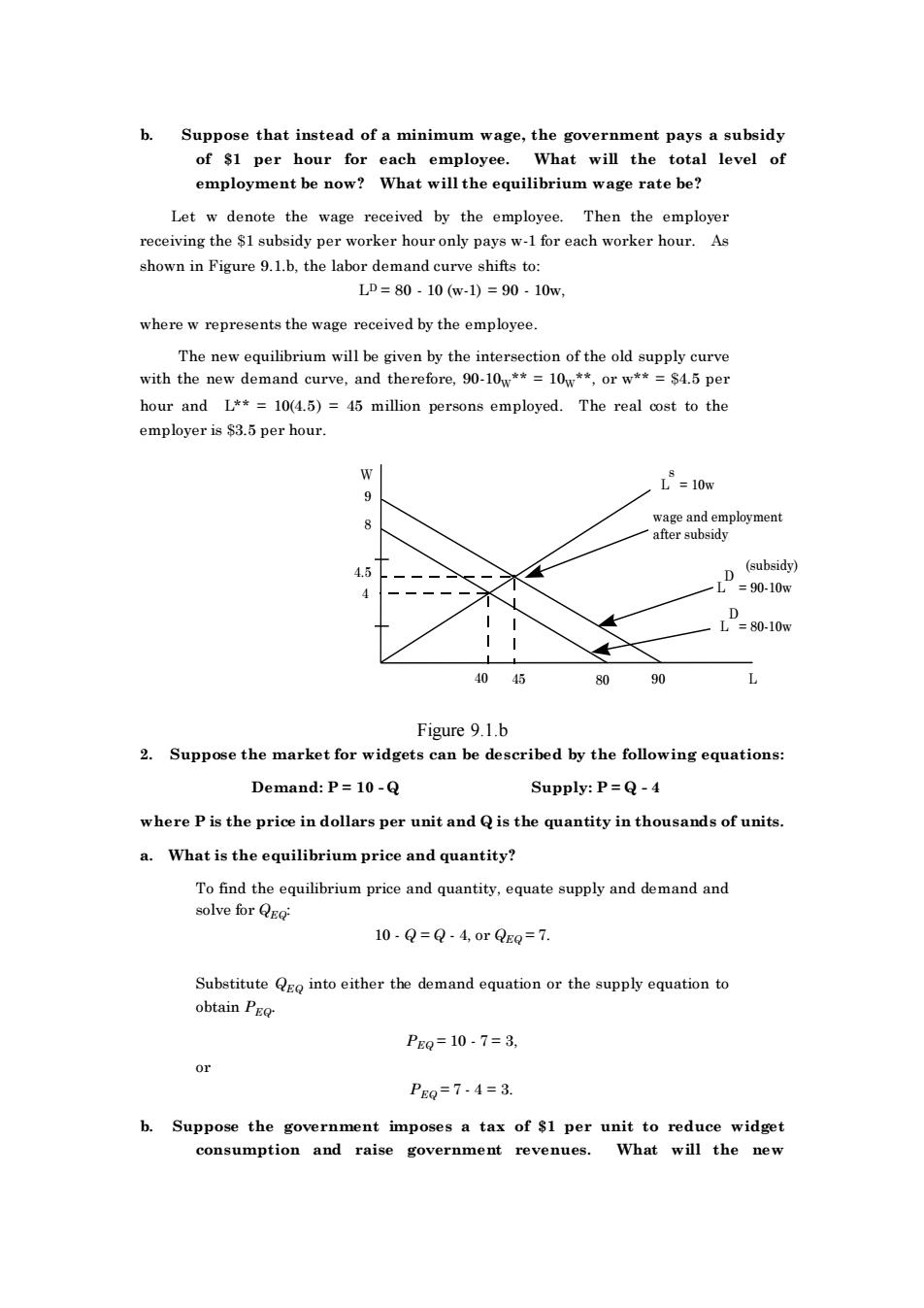

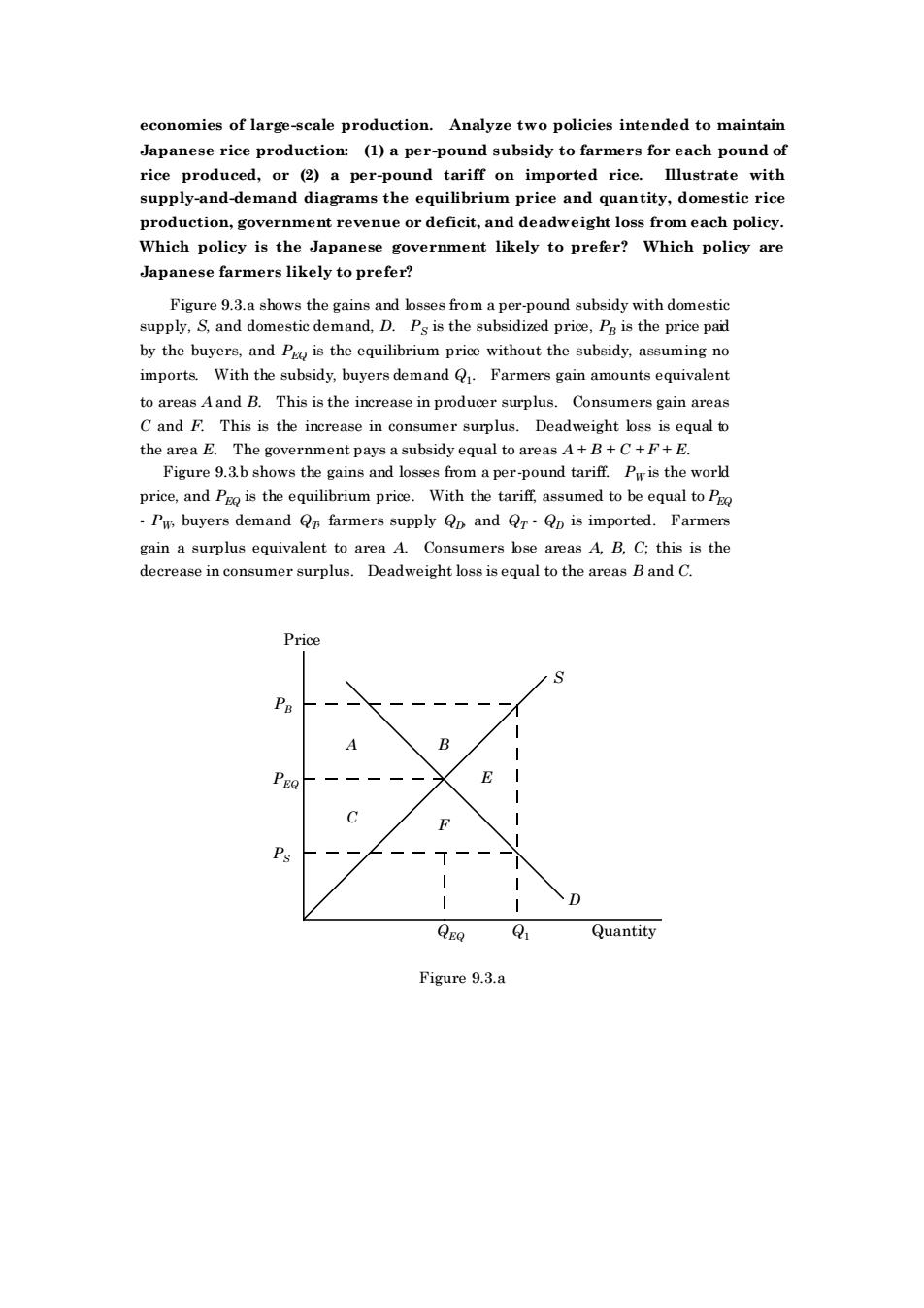

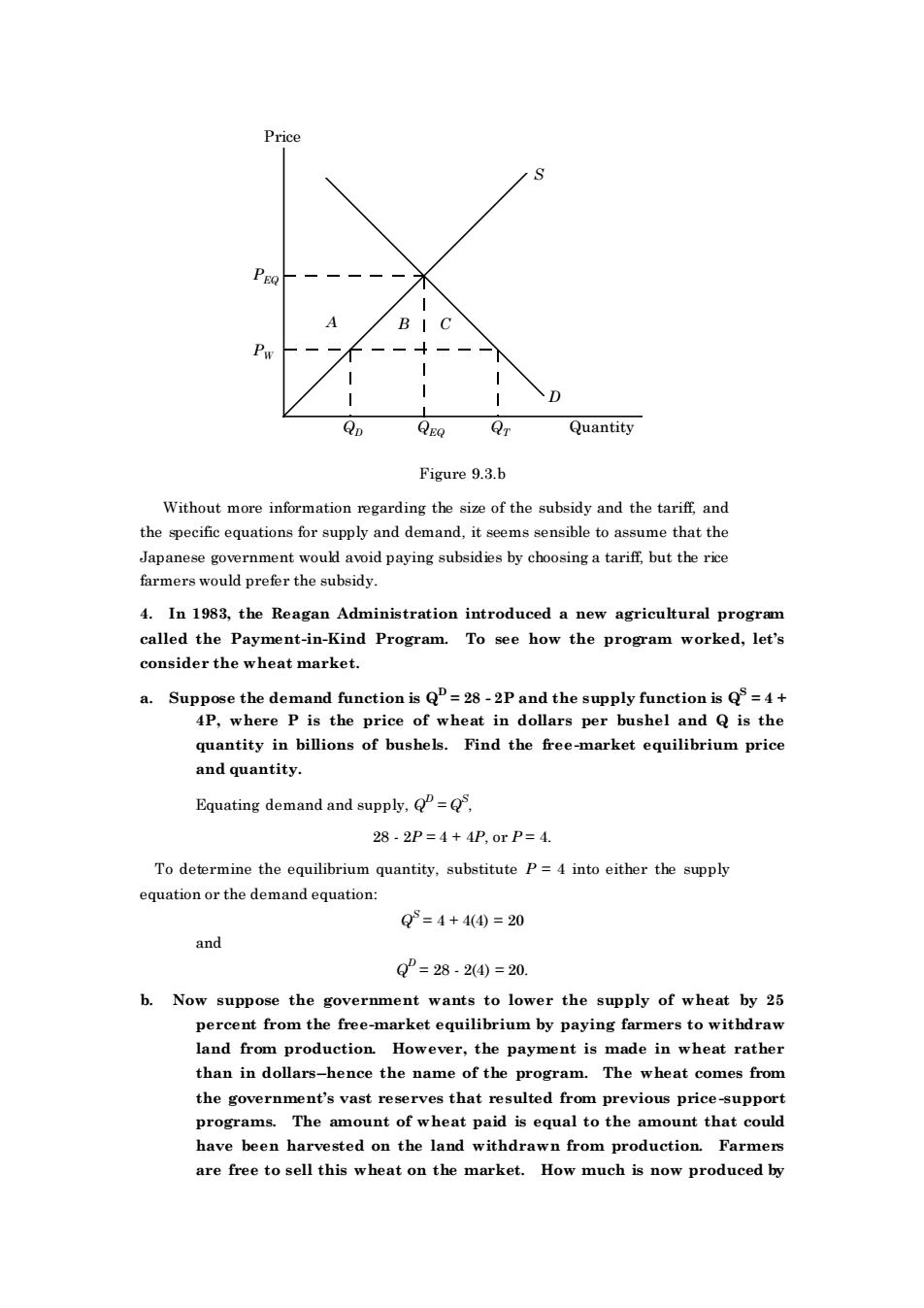

economies of large-scale production. Analyze two policies intended to maintain Japanese rice production: (1) a per-pound subsidy to farmers for each pound of rice produced, or (2) a per-pound tariff on imported rice. Illustrate with supply-and-demand diagrams the equilibrium price and quantity, domestic rice production, government revenue or deficit, and deadweight loss from each policy. Which policy is the Japanese government likely to prefer? Which policy are Japanese farmers likely to prefer? Figure 9.3.a shows the gains and losses from a per-pound subsidy with domestic supply, S, and domestic demand, D. PS is the subsidized price, PB is the price paid by the buyers, and PEQ is the equilibrium price without the subsidy, assuming no imports. With the subsidy, buyers demand Q1 . Farmers gain amounts equivalent to areas A and B. This is the increase in producer surplus. Consumers gain areas C and F. This is the increase in consumer surplus. Deadweight loss is equal to the area E. The government pays a subsidy equal to areas A + B + C + F + E. Figure 9.3.b shows the gains and losses from a per-pound tariff. PW is the world price, and PEQ is the equilibrium price. With the tariff, assumed to be equal to PEQ - PW, buyers demand QT, farmers supply QD, and QT - QD is imported. Farmers gain a surplus equivalent to area A. Consumers lose areas A, B, C; this is the decrease in consumer surplus. Deadweight loss is equal to the areas B and C. Price Quantity S D PB PEQ PS A C B E F QEQ Q1 Figure 9.3.a

C D Quantity Figure 9.3.b Without more information egarding thesize of the subsidy and the tarif,and the specific equations for supply and demand,it seems sensible to assume that the Japanese government would avoid paying subsidies by choosing a tariff,but the rice farmers would prefer the subsidy 4.In 1983,the Reagan Administration introduced a new agricultural program called the Payment-in-Kind Program. To see how the program worked,let's consider the wheat market. a.Suppose the demand function is =28-2P and the supply function is=4+ 4P,where P is the price of wheat in dollars per bushel and Q is the quantity in billions of bushels.Find the free-market equilibrium price and quantitv. Equating demand and supply,= 28.2P=4+4P,orP=4 To determine the equilibrium quantity,substitute P=4 into either the supply equation or the demand equation Q=4+44)=20 and Q°=28-2④=20. b.Now suppose the government wants to lower the supply of wheat by 25 percent from the free-market equilibrium by paying farmers to withdraw land from production.However,the payment is made in wheat rather than in dollars-hence the name of the program.The wheat comes from the government's vast reserves that resulted from previous price-support programs.The amount of wheat paid is equal to the amount that could have been harvested on the land withdrawn from production.Farmers are free to sell this wheat on the market.How much is now produced by

Price S D PEQ PW A B C QD QEQ QT Quantity Figure 9.3.b Without more information regarding the size of the subsidy and the tariff, and the specific equations for supply and demand, it seems sensible to assume that the Japanese government would avoid paying subsidies by choosing a tariff, but the rice farmers would prefer the subsidy. 4. In 1983, the Reagan Administration introduced a new agricultural program called the Payment-in-Kind Program. To see how the program worked, let’s consider the wheat market. a. Suppose the demand function is QD = 28 - 2P and the supply function is QS = 4 + 4P, where P is the price of wheat in dollars per bushel and Q is the quantity in billions of bushels. Find the free-market equilibrium price and quantity. Equating demand and supply, Q D = QS , 28 - 2P = 4 + 4P, or P = 4. To determine the equilibrium quantity, substitute P = 4 into either the supply equation or the demand equation: Q S = 4 + 4(4) = 20 and Q D = 28 - 2(4) = 20. b. Now suppose the government wants to lower the supply of wheat by 25 percent from the free-market equilibrium by paying farmers to withdraw land from production. However, the payment is made in wheat rather than in dollars-hence the name of the program. The wheat comes from the government’s vast reserves that resulted from previous price-support programs. The amount of wheat paid is equal to the amount that could have been harvested on the land withdrawn from production. Farmers are free to sell this wheat on the market. How much is now produced by

farmers?How much is indirectly supplied to the market by the government?What is the new market price?How much do the farmers gain?Do consumers gain or lose? Because the free market supply by farmers is 20 billion bushels.the 25 percent reduction required by the new Payment-In-Kind(PIK)Program would imply that the farmers now produce 15 billion bushels.To encourage farmers to withdraw their land from cultivation.the overnment must give them5billion bushels which they sell on the market Because the total supply to the market is still 20 billion bushels,the market price does not ch ange;it remains at $4 per bushel.The farmers gain $20 billion, equal to ($4)(5 billion bushels).from the PIK Program,because they incur no costs in supplying the wheat (which they received from the government)to the market. The PIK program does not affect consumers in the wheat market,because they purchase the same amount at the same price as they did in the free market case c.Had the goverament not given the wheat back to would have stored or destroyed it.Do taxpayers gain from the program? Wha potential problems does the program create? Taxpayers gain because the government is not required to store the wheat. Although everyone seems to gain from the PIK program,it can only last while there are government wheat reserves.The PIK program assumes that the land removed Po业nmtd pmdiction when如arehouted cannot be done,consumers may eventually pay morefor wheat-based product 5.About 100 million Year.and tho pounds of jeny bn ae consum in the United State e has been about 50 cents per pound. However,jelly bear producers feel that their incomes are too low,and they have convinced the government that price supports are in order.The government will therefore buy up as many jelly beans as necessary to keep the price at $1per pound.However government ec 101 ists a worried about impaet of th s program,because they have no estimates ofthe elasticities ofjelly bean demand or supply. a.Could this program cost the government more than $50 million per year? Under what conditions?Could it cost less than $50 million per year? Under what conditions?Illustrate with a diagram. If the quantities demanded and supplied are very responsive to price changes then a government program that doubles the price of ielly beans could easily cost more than $50 million this case,the change in pri will au a large chango in quantity supplied,and a large change in quantity demanded.In Figure 9.5.ai the cost of the program is (Qs-QD)$1.Given Qs-QD is larger than 50 million,then the government will pay more than 50 million dollars.If instead supply and demand were relatively price inelastic.then the change in price would result in ery small changes in quantity supplied and quantity demanded and (Qs-Qo)woul be less than50 million,as illustrated in figure9.5.a.i

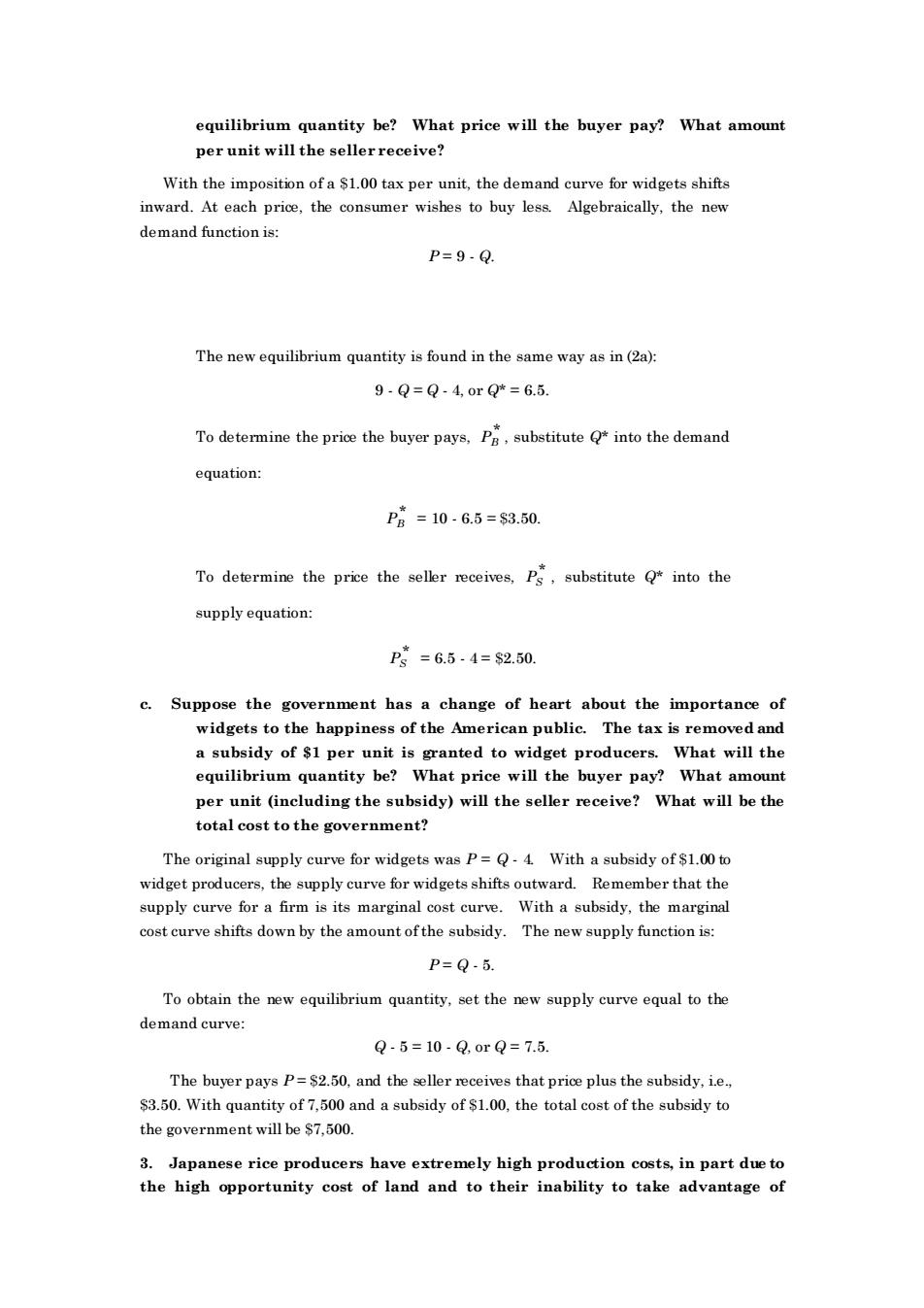

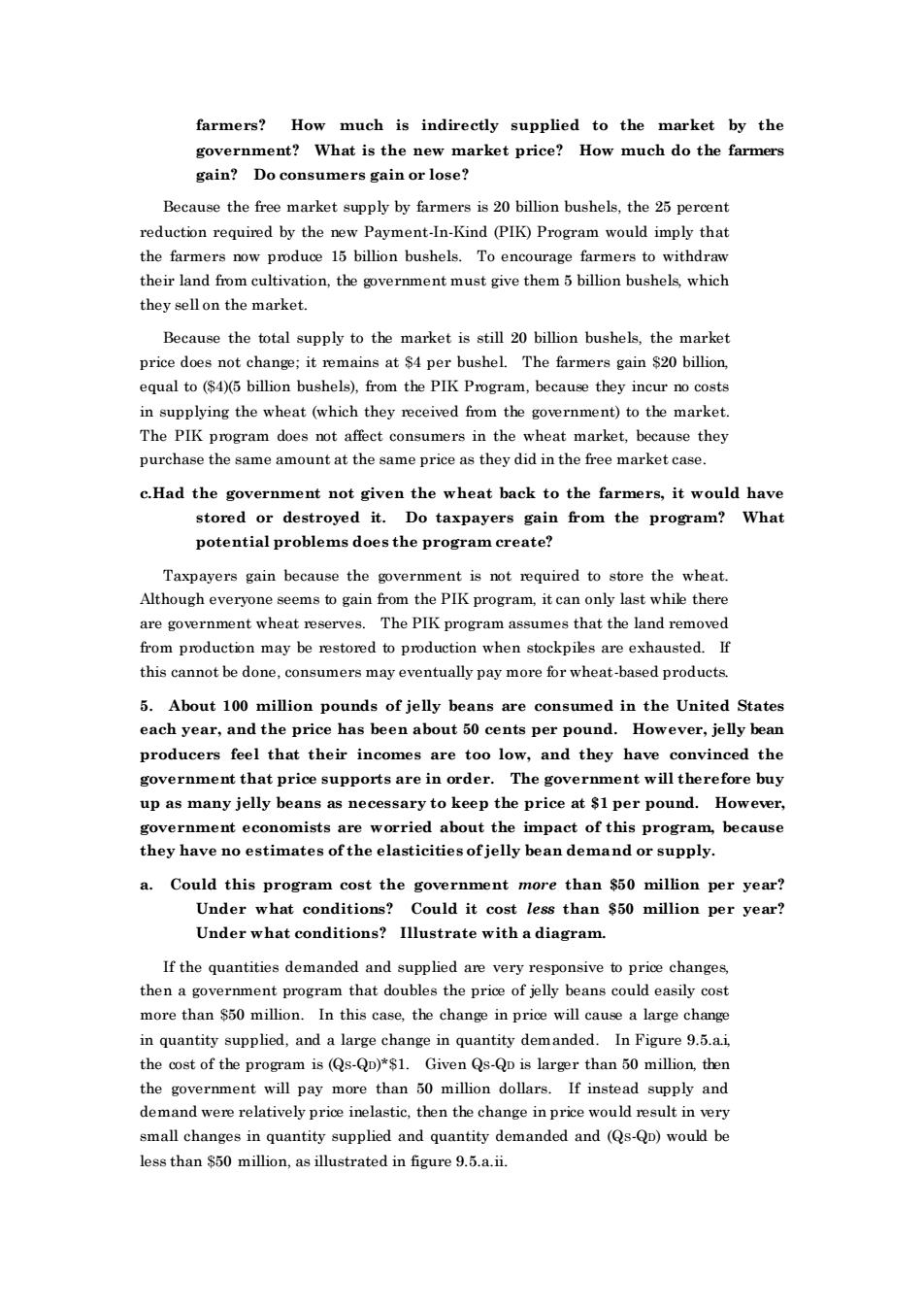

farmers? How much is indirectly supplied to the market by the government? What is the new market price? How much do the farmers gain? Do consumers gain or lose? Because the free market supply by farmers is 20 billion bushels, the 25 percent reduction required by the new Payment-In-Kind (PIK) Program would imply that the farmers now produce 15 billion bushels. To encourage farmers to withdraw their land from cultivation, the government must give them 5 billion bushels, which they sell on the market. Because the total supply to the market is still 20 billion bushels, the market price does not change; it remains at $4 per bushel. The farmers gain $20 billion, equal to ($4)(5 billion bushels), from the PIK Program, because they incur no costs in supplying the wheat (which they received from the government) to the market. The PIK program does not affect consumers in the wheat market, because they purchase the same amount at the same price as they did in the free market case. c.Had the government not given the wheat back to the farmers, it would have stored or destroyed it. Do taxpayers gain from the program? What potential problems does the program create? Taxpayers gain because the government is not required to store the wheat. Although everyone seems to gain from the PIK program, it can only last while there are government wheat reserves. The PIK program assumes that the land removed from production may be restored to production when stockpiles are exhausted. If this cannot be done, consumers may eventually pay more for wheat-based products. 5. About 100 million pounds of jelly beans are consumed in the United States each year, and the price has been about 50 cents per pound. However, jelly bean producers feel that their incomes are too low, and they have convinced the government that price supports are in order. The government will therefore buy up as many jelly beans as necessary to keep the price at $1 per pound. However, government economists are worried about the impact of this program, because they have no estimates of the elasticities of jelly bean demand or supply. a. Could this program cost the government more than $50 million per year? Under what conditions? Could it cost less than $50 million per year? Under what conditions? Illustrate with a diagram. If the quantities demanded and supplied are very responsive to price changes, then a government program that doubles the price of jelly beans could easily cost more than $50 million. In this case, the change in price will cause a large change in quantity supplied, and a large change in quantity demanded. In Figure 9.5.a.i, the cost of the program is (QS-QD)*$1. Given QS-QD is larger than 50 million, then the government will pay more than 50 million dollars. If instead supply and demand were relatively price inelastic, then the change in price would result in very small changes in quantity supplied and quantity demanded and (QS-QD) would be less than $50 million, as illustrated in figure 9.5.a.ii

b.Could this program cost consumers (in terms of lost consumer surplus)more than $50 million per year?Under what conditions?Could i cos consumers less than $50 milli on per year? Under what conditions Again,use a diagram to illustrate. When the demand curve is perfectly inelastic,the loss in consumer surplus is $50 million,equal to ($0.5)(100 million pounds).This represents the highest possible loss in consumer surplus.If the demand curve has any elasticity at all the loss in consumer surplus would be less then $50 million.In Figure 9.5.b,the loss in ner surplu is area A plus area B if the demand curve e is D and only area A ifthe demand curve is D P 1.00 50 0 →Q Q 100 Qs Figure9.5.a.i Figure9.5.a.ii Figure9.5.b

b. Could this program cost consumers (in terms of lost consumer surplus) more than $50 million per year? Under what conditions? Could it cost consumers less than $50 million per year? Under what conditions? Again, use a diagram to illustrate. When the demand curve is perfectly inelastic, the loss in consumer surplus is $50 million, equal to ($0.5)(100 million pounds). This represents the highest possible loss in consumer surplus. If the demand curve has any elasticity at all, the loss in consumer surplus would be less then $50 million. In Figure 9.5.b, the loss in consumer surplus is area A plus area B if the demand curve is D and only area A if the demand curve is D’. Q P QD QS 1.00 .50 100 D S Figure 9.5.a.i Figure 9.5.a.ii Figure 9.5.b

6.In Exercise 4 of Chapter 2.we examined a vegetable fiber traded in a competitive world market and imported into the United States at a world price of $9 per pound.U.S.domestic supply and demand for various price levels are shown in the following table. Price U.S.Supply U.S.Demand (million pounds) (million pounds) 3 2 6 28 9 6 8 16 10 10 18 12 4 Answer the following about the U.S.market: a.Confirm that the demand curve is given by and that the supply curve is given by☒ To find the equation for demand,we need to find a linear function QD=a+ table Second,we substitute for b and one point,e.g.(15.10).into our linear function to solve for the constant.a: 10=a-215),ora=40. Therefore,p=40-2P. Similarly,we may solve for the supply equation s=c+dPpassing through two points such)and 2).The sloped.is △g_4-2_2 P6-33 Solving for e: 4=c+()6ore=0 Therofor.Q-(p b.Confirm that if there were no restrictions on trade,the U.S.would import 16 million pounds

6. In Exercise 4 of Chapter 2, we examined a vegetable fiber traded in a competitive world market and imported into the United States at a world price of $9 per pound. U.S. domestic supply and demand for various price levels are shown in the following table. Price U.S. Supply (million pounds) U.S. Demand (million pounds) 3 2 34 6 4 28 9 6 22 12 8 16 15 10 10 18 12 4 Answer the following about the U.S. market: a. Confirm that the demand curve is given by , and that the supply curve is given by . To find the equation for demand, we need to find a linear function QD= a + bP such that the line it represents passes through two of the points in the table such as (15,10) and (12,16). First, the slope, b, is equal to the “rise” divided by the “run,” Second, we substitute for b and one point, e.g., (15, 10), into our linear function to solve for the constant, a: 10 = a − 2(15) , or a = 40. Therefore, QD = 40 − 2P. Similarly, we may solve for the supply equation QS= c + dP passing through two points such as (6,4) and (3,2). The slope, d, is Q P = 4 − 2 6 − 3 = 2 3 . Solving for c: 4 = c + 2 3 (6), or c = 0. Therefore, QS = 2 3 P. b. Confirm that if there were no restrictions on trade, the U.S. would import 16 million pounds