PARTIII MARKETSTRUCTUREAND COMPETITVESTRATEGY CHAPTER 10 MARKETPOWER:MONOPOLYAND MONOPSONY -QUESTIONS FOR REVIEW 1.A monopolist is producing at a point at which marginal cost exceeds marginal revenue.How should it adjust its output to increase profit? When marginal cost is greater than marginal revenue,the incremental oost of the last unit produced is greater than incre mental revenue.The firm would production thereby decreasing marginal cost and increasing marginal revenue until marginal cost is equal to marginal revenue. 2.We write the percentage markup of prices over marginal cost as (P-MC)/P. For a profit-maximizing monopolist,how does this markup depend on the elasticity of demand?Why can this markup be viewed as a measure of monopoly We can show that this mea ure of market power is equal to the negative inverse p-C- The equation implies that,as the elasticity increases(demand becomes more elastic).the inverse of elasticity decreases and the measure of market power decreases.Therefore,as elasticity increases (decreases),the firm has less(more) power to increase price above marginal cost 3.Why is there no market supply curve under conditions ofmonopoly? The monopolist's output decision depends not only on marginal cost,but alsoo the demand curve.Shifts in demand do not trace out a series of prices and quantities that we can identify as the supply curve for the firm.Instead,shifts in demand lead to changes in price.output,or both.Thus,there is no one-to-one orrespondence between the price and quantity:therefore,a monopolized market lacks a supply curve. 4.Why might a firm have monopoly power even ifit is not the only producer in the market? The degree of monopoly(or market)power enjoyed by a firm depends on the elasticity of the demand curve that it faces.As the elasticity of demand increaes ie.as the demand curve becomes flatter,the inverse of the elasticity appraches ero and the monopoly power of the firm decreases.Thus if the firm's demand

PART III MARKET STRUCTURE AND COMPETITVE STRATEGY CHAPTER 10 MARKET POWER: MONOPOLY AND MONOPSONY 一、QUESTIONS FOR REVIEW 1. A monopolist is producing at a point at which marginal cost exceeds marginal revenue. How should it adjust its output to increase profit? When marginal cost is greater than marginal revenue, the incremental cost of the last unit produced is greater than incremental revenue. The firm would increase its profit by not producing the last unit. It should continue to reduce production, thereby decreasing marginal cost and increasing marginal revenue, until marginal cost is equal to marginal revenue. 2. We write the percentage markup of prices over marginal cost as (P - MC)/P. For a profit-maximizing monopolist, how does this markup depend on the elasticity of demand? Why can this markup be viewed as a measure of monopoly power? We can show that this measure of market power is equal to the negative inverse of the price elasticity of demand. P MC P ED − = − 1 The equation implies that, as the elasticity increases (demand becomes more elastic), the inverse of elasticity decreases and the measure of market power decreases. Therefore, as elasticity increases (decreases), the firm has less (more) power to increase price above marginal cost. 3. Why is there no market supply curve under conditions of monopoly? The monopolist’s output decision depends not only on marginal cost, but also on the demand curve. Shifts in demand do not trace out a series of prices and quantities that we can identify as the supply curve for the firm. Instead, shifts in demand lead to changes in price, output, or both. Thus, there is no one -to-one correspondence between the price and the seller’s quantity; therefore, a monopolized market lacks a supply curve. 4. Why might a firm have monopoly power even if it is not the only producer in the market? The degree of monopoly (or market) power enjoyed by a firm depends on the elasticity of the demand curve that it faces. As the elasticity of demand increases, i.e., as the demand curve becomes flatter, the inverse of the elasticity approaches zero and the monopoly power of the firm decreases. Thus, if the firm’s demand

curve has any elasticity less than infinity,the firm has some monopoly power.It is only the competitive firm that faces a horizontal demand curve who has no market power 5.What are some of the different types of barriers to entry that give rise to monopoly power?Give an example ofeach. The firm's ability to exercise monopoly power depends on how easy it is for other firms to enter the industry.There are several barriers to entry,including exclusive rights (e.g.patents,copyrights and licenses)and economies of scale. These two the mostmm Exclusive rights legally granted poperty or dis tribute a goo or service economies of scale lead to"natural monopolies"because the largest producer can charge a lower price,driving competition from the market.For example,in the production of aluminum.there is evidence to suggest that there are scale economies in the conversion of bauxite to alumina.See U.S.v.Aluminum Company of America,148 F.2d416[19451.discussed in Exercise 8below.) 6.What factors determine the am oun of monopoly power an individual firmis likely to have?Explain each one briefly. Three factors determine the firm's elasticity of demand:(1)the elasticity of market demand,(2)the number of firms in the market,and(3)interaction among the firms in the market.The elasticity of market demand depends on the uniqueness of the product.ie.how easy it is for consumers to substitute away from the product.As the number offirms in the market increas the demand elaticity facing each firm increases because customers may shift to the firm's competitors The number of firms in the market is determined by how easy it is to enter the industry (the height of barriers to entry).Finally,the ability to raise the price above marginal cost depends on how other firms react to the firm's price changes. If other firms match pric changes,customers will have little incentive to switch to another supplier. 7.Why is there a social cost to monopoly power?If the gains to producers from monopoly power could be redistributed to consumers,would the social cost of monopoly power be eliminated?Explain briefly. When the firm explits its monopoly power by charging a price above marginal cost.consumers buy less at the higher price.Consumers eniy less surplus.the ethe pric they ar willing to pay and the narket e on each unit comed.Some of the captured by thel and is a deadweight loss to society.Therefore,if the gains to producers were redistributed to consumers,society would still suffer the deadweight loss. 8.Why will a monopolist's output increase ifthe government forces it to lower its price?If the government wants to set a price ceiling that maximizes the monopolist's output,what price should it set?

curve has any elasticity less than infinity, the firm has some monopoly power. It is only the competitive firm that faces a horizontal demand curve who has no market power. 5. What are some of the different types of barriers to entry that give rise to monopoly power? Give an example of each. The firm’s ability to exercise monopoly power depends on how easy it is for other firms to enter the industry. There are several barriers to entry, including exclusive rights (e.g., patents, copyrights, and licenses) and economies of scale. These two barriers to entry are the most common. Exclusive rights are legally granted property rights to produce or distribute a good or service. Positive economies of scale lead to “natural monopolies” because the largest producer can charge a lower price, driving competition from the market. For example, in the production of aluminum, there is evidence to suggest that there are scale economies in the conversion of bauxite to alumina. (See U.S. v. Aluminum Company of America, 148 F.2d 416 [1945], discussed in Exercise 8, below.) 6. What factors determine the amount of monopoly power an individual firm is likely to have? Explain each one briefly. Three factors determine the firm’s elasticity of demand: (1) the elasticity of market demand, (2) the number of firms in the market, and (3) interaction among the firms in the market. The elasticity of market demand depends on the uniqueness of the product, i.e., how easy it is for consumers to substitute away from the product. As the number of firms in the market increases, the demand elasticity facing each firm increases because customers may shift to the firm’s competitors. The number of firms in the market is determined by how easy it is to enter the industry (the height of barriers to entry). Finally, the ability to raise the price above marginal cost depends on how other firms react to the firm’s price changes. If other firms match price changes, customers will have little incentive to switch to another supplier. 7. Why is there a social cost to monopoly power? If the gains to producers from monopoly power could be redistributed to consumers, would the social cost of monopoly power be eliminated? Explain briefly. When the firm exploits its monopoly power by charging a price above marginal cost, consumers buy less at the higher price. Consumers enjoy less surplus, the difference between the price they are willing to pay and the market price on each unit consumed. Some of the lost consumer surplus is not captured by the seller and is a deadweight loss to society. Therefore, if the gains to producers were redistributed to consumers, society would still suffer the deadweight loss. 8. Why will a monopolist’s output increase if the government forces it to lower its price? If the government wants to set a price ceiling that maximizes the monopolist’s output, what price should it set?

By restricting price to be below the monopolist's profit-maximizing price,the overnment can change the hap e of the firm's marginal revenue, MR,curve When a price ceiling is imposed,MR is equal to the price ceiling for all quantities lower than the quantity demanded at the price ceiling.If the government wants to maximize output,it should set a price equal to marginal cost,or in other words set price at the point where the demand curve and the marginal oost curve intersect. Prices bebw this level induce the firm to decrease production assuming the marginal st curve is upward sloping.The regulator's problem is to determine the shape of the monopolist's marginal cost curve.This task is difficult given the monopolist's incentive to hide or distort this information. 9.How should a monopsonist decide how much ofa product to buy?Willit buv more or less than a competitive buver?Explain brielly. The marginal expenditure is the change in the total expenditure as the purchased quantity changes.For a with the marginal expenditure is equal to the average expenditure (price). For a monopsonist,the marginal expenditure curve lies above the average expenditure curve because the decision to buy an extra unit raises the price that must be paid for all units.including the last unit.All firms shoul buy inputs so that the marginal value of the last unit is equal to the marginal expenditur re on that unit.This is true for both the mpetitive buyer and th onist However,because the monopsonist's marginal expenditure curve lies above the average expenditure curve and because the marginal value curve is downward sloping.the monopsonist buys less than a firm would buy in a competitive market. 10.What is meant by the term "monopsony power'?Why might a firm have monopsony power even ifit is not the only buyer in the market? refers to the buyer's ability to affect the price of a good.This power ena the buye er to pu chas ethe goodfor a lwer price,as competitive factor market Any buyer facing an upward-sloping factor supply curve has some monopsony power.In a competitive market the seller faces a perfectly-elastic market demand curve and the buyer faces a perfectly-elastic market supply curve.Thus any characteristic of the market (e.g.when there are a mall number of buyers or if buyers engage in ollusive behavior)that leads toa less-than-perfectly-elastic supply curve gives the buyer some monopsony power. 11.What are some sources of monopsony power?What determines the amount of monopsony power an individual firm is likely to have? The individual firm's monopsony power depends on the characteristics of the "buying-side"of the market.There are three characteristics that enhance monopsony power:(1)the elasticity ofmarket supply.(2)the number of buvers and (3)how the buyers interact.First,if market supply is very inelastic,then the buyer will enjoy more monopsony power.When supply is very elas c marginal expenditure and average expenditure do not differ by much,so price will be closer to the competitive price.Second,the fewer the number of buyers,the greater the

By restricting price to be below the monopolist’s profit-maximizing price, the government can change the shape of the firm’s marginal revenue, MR, curve. When a price ceiling is imposed, MR is equal to the price ceiling for all quantities lower than the quantity demanded at the price ceiling. If the government wants to maximize output, it should set a price equal to marginal cost, or in other words set price at the point where the demand curve and the marginal cost curve intersect. Prices below this level induce the firm to decrease production, assuming the marginal cost curve is upward sloping. The regulator’s problem is to determine the shape of the monopolist’s marginal cost curve. This task is difficult given the monopolist’s incentive to hide or distort this information. 9. How should a monopsonist decide how much of a product to buy? Will it buy more or less than a competitive buyer? Explain briefly. The marginal expenditure is the change in the total expenditure as the purchased quantity changes. For a firm competing with many firms for inputs, the marginal expenditure is equal to the average expenditure (price). For a monopsonist, the marginal expenditure curve lies above the average expenditure curve because the decision to buy an extra unit raises the price that must be paid for all units, including the last unit. All firms should buy inputs so that the marginal value of the last unit is equal to the marginal expenditure on that unit. This is true for both the competitive buyer and the monopsonist. However, because the monopsonist’s marginal expenditure curve lies above the average expenditure curve and because the marginal value curve is downward sloping, the monopsonist buys less than a firm would buy in a competitive market. 10. What is meant by the term “monopsony power”? Why might a firm have monopsony power even if it is not the only buyer in the market? Monopsony power refers to the buyer’s ability to affect the price of a good. This power enables the buyer to purchase the good for a lower price, as compared to a competitive factor market. Any buyer facing an upward-sloping factor supply curve has some monopsony power. In a competitive market, the seller faces a perfectly-elastic market demand curve and the buyer faces a perfectly-elastic market supply curve. Thus, any characteristic of the market (e.g., when there are a small number of buyers or if buyers engage in collusive behavior) that leads to a less-than-perfectly-elastic supply curve gives the buyer some monopsony power. 11. What are some sources of monopsony power? What determines the amount of monopsony power an individual firm is likely to have? The individual firm’s monopsony power depends on the characteristics of the “buying-side” of the market. There are three characteristics that enhance monopsony power: (1) the elasticity of market supply, (2) the number of buyers, and (3) how the buyers interact. First, if market supply is very inelastic, then the buyer will enjoy more monopsony power. When supply is very elastic, marginal expenditure and average expenditure do not differ by much, so price will be closer to the competitive price. Second, the fewer the number of buyers, the greater the

monopsony power.Third,if buyers are able to collude and/or they do not compete very aggressively with each other then each will enjoy more monopsony power ony power?If the gains to buy yers from e social cost of monopsony power be eliminated?Explain briefly. With monopsony power,the price is lower and the quantity is less than under competitive buying conditions.Because of the lower price and reduced sales. sellers lose revenue.Only part of this lost revenue is transferred to the buver as consumer surplus weight ss persists This inefficiency will remain because quantity is reduced bebw the level where price is equal to marginal cost. 13.How do the antitrust laws limit market power in the United States?Give examples ofmajor provisions ofthe laws. Antitrust laws.which are subject to interpretation by the courts.limit market ower by poribngafirm'behavior in attempting to of the Sherman Act of trade,including any attempt tofi prices by buyers or sellers.Section 2 of the Sherman Act prohibits behavior that leads to monopolization.The Clayton Act.with the Robinson-Patman Act. prohibits price discrimination and exelusive dealing(sellers prohibiting buyers from buying goods from other sellers).The Clayton Act also limits merge s when they .The Federal Trade Act make it illegal to use unfair or deceptive practices. 14.Explain briefly how the U.S.antitrust lawsare actually enforced Antitrust laws are enforced in three ways:(1)through the Antitrust Divisiono the Justice Department,whenever firms violate federal statutes,(2)through the Federal Trade Commission.whenever firms violate the Federal Trade Commission Act,and (3)through civil suits.The Justice Department can seek to impose fines or jail tem eek to ni e the fir as it did n its case against A.T.&T.The FTC can seek a voluntary understanding to comply with the law or a formal Commission order.Individuals or companies can sue in federal court for awards equal to three times the damage arising from the anti-competitive behavior. 二、EXERCISES 1.Will an increase in the demand for a monopolist's product always result in a higher price?Explain.Will anincrease in the supply facinga mon sonist buyer always result in a lower price?Explain

monopsony power. Third, if buyers are able to collude and/or they do not compete very aggressively with each other then each will enjoy more monopsony power. 12. Why is there a social cost to monopsony power? If the gains to buyers from monopsony power could be redistributed to sellers, would the social cost of monopsony power be eliminated? Explain briefly. With monopsony power, the price is lower and the quantity is less than under competitive buying conditions. Because of the lower price and reduced sales, sellers lose revenue. Only part of this lost revenue is transferred to the buyer as consumer surplus, and the net loss in total surplus is deadweight loss. Even if the consumer surplus could be redistributed to sellers, the deadweight loss persists. This inefficiency will remain because quantity is reduced below the level where price is equal to marginal cost. 13. How do the antitrust laws limit market power in the United States? Give examples of major provisions of the laws. Antitrust laws, which are subject to interpretation by the courts, limit market power by proscribing a firm’s behavior in attempting to maximize profit. Section 1 of the Sherman Act prohibits every restraint of trade, including any attempt to fix prices by buyers or sellers. Section 2 of the Sherman Act prohibits behavior that leads to monopolization. The Clayton Act, with the Robinson-Patman Act, prohibits price discrimination and exclusive dealing (sellers prohibiting buyers from buying goods from other sellers). The Clayton Act also limits mergers when they could substantially lessen competition. The Federal Trade Commission Act makes it illegal to use unfair or deceptive practices. 14. Explain briefly how the U.S. antitrust laws are actually enforced. Antitrust laws are enforced in three ways: (1) through the Antitrust Division of the Justice Department, whenever firms violate federal statutes, (2) through the Federal Trade Commission, whenever firms violate the Federal Trade Commission Act, and (3) through civil suits. The Justice Department can seek to impose fines or jail terms on managers or owners involved or seek to reorganize the firm, as it did in its case against A.T.& T. The FTC can seek a voluntary understanding to comply with the law or a formal Commission order. Individuals or companies can sue in federal court for awards equal to three times the damage arising from the anti-competitive behavior. 二、EXERCISES 1. Will an increase in the demand for a monopolist’s product always result in a higher price? Explain. Will an increase in the supply facing a monopsonist buyer always result in a lower price? Explain

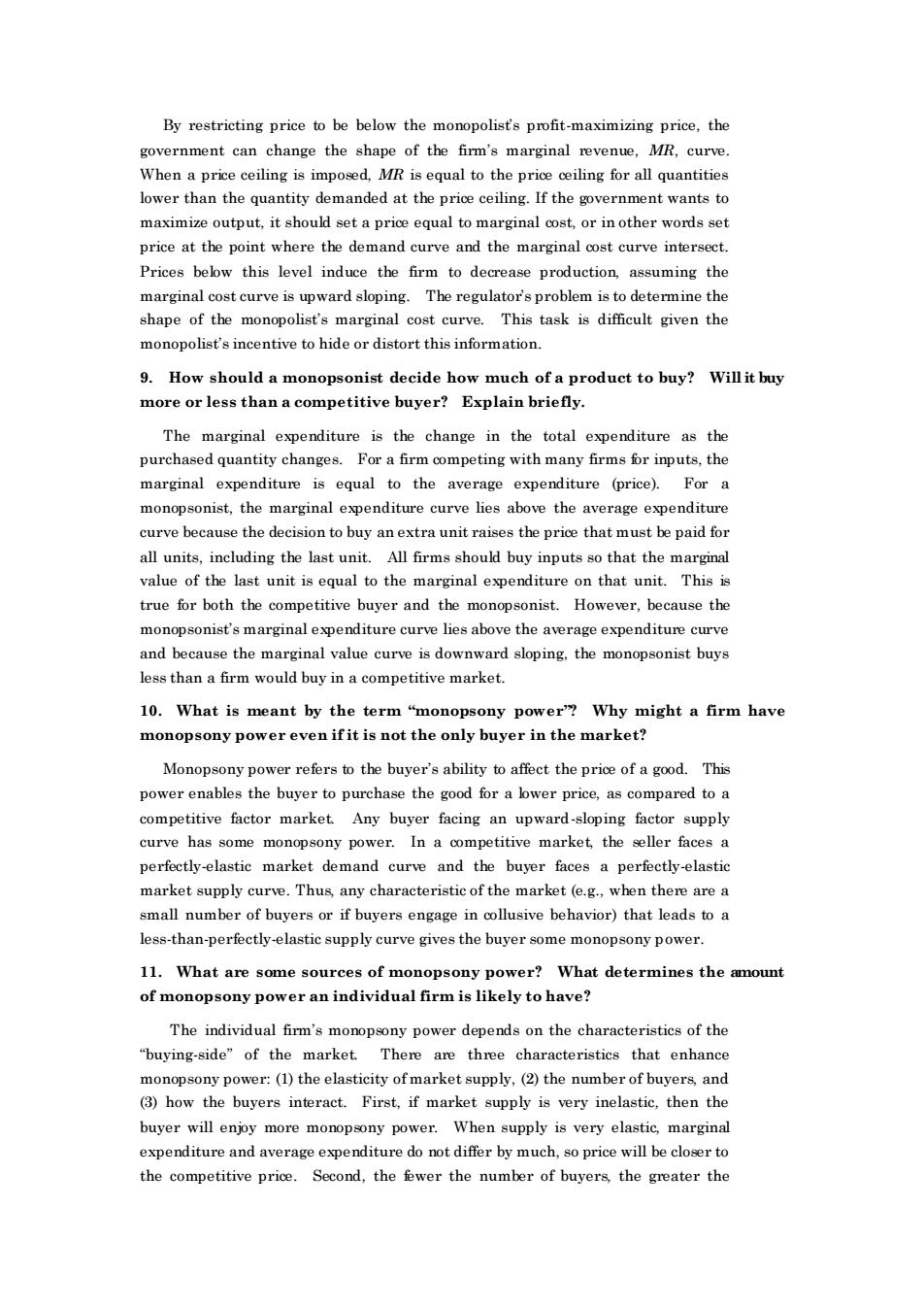

As illustrated in Figure 10.4b in the textbook.an increase in demand need not a higher price.Under the conditions portrayed in Figure 10. the monopolist supplies different quantities at the same price.Similarly,an increase in supply facing the monopsonist need not alays result in a higher price. Suppose the average expenditure curve shifts from AE to Al2,as illustrated in Figure 10.1.With the shift in the average expenditure curve.the marginal expenditure curve shifts from ME to ME.The ME curve intersects the marginal e(demand curve)at resulting in a price of P.When the AE cu shifts,the ME curve intersec the marginal e curve at Q2 rest ulting in th same price at P. Price ME MV Q: Quantity Figure 10.1 2.Caterpillar Tractor,one of the largest producers of farm machinery in the world,has hired you to advise them on pricing policy.One of the things the company would like to know is how much a 5 percent increase in price is likely to reduce sales.What would you need to know to help the company with this problem?Explain why these facts are important. As a large producer of farm equipment.caterpillar tractor has market power and should consider the entire demand curve when choosing As their advisor,you should focuson the determination of the elasticity of demand for each product.There are three important factors to be considered.First,how similar are the products offered by Caterpillar's competitors?If they are close substitutes,a small increase in price could induce customers to switch to the competition.,what is the age of the existingstock of tractors?With an older popu on of tractors,a 5 percent price increase in uces a s aller drop demand.Finally,because farm tractors are a capital input in agricultura production what is the expected profitability of the agricultural sector?If farm incomes are expected to fall,an increase in tractor prices induces a greater decline in demand than one would estimate with informationon only past sales and prices

As illustrated in Figure 10.4b in the textbook, an increase in demand need not always result in a higher price. Under the conditions portrayed in Figure 10.4b, the monopolist supplies different quantities at the same price. Similarly, an increase in supply facing the monopsonist need not always result in a higher price. Suppose the average expenditure curve shifts from AE1 to AE2 , as illustrated in Figure 10.1. With the shift in the average expenditure curve, the marginal expenditure curve shifts from ME1 to ME2 . The ME1 curve intersects the marginal value curve (demand curve) at Q1 , resulting in a price of P. When the AE curve shifts, the ME2 curve intersects the marginal value curve at Q2 resulting in the same price at P. Price Quantity ME1 AE1 ME2 AE2 P Q1 Q2 MV Figure 10.1 2. Caterpillar Tractor, one of the largest producers of farm machinery in the world, has hired you to advise them on pricing policy. One of the things the company would like to know is how much a 5 percent increase in price is likely to reduce sales. What would you need to know to help the company with this problem? Explain why these facts are important. As a large producer of farm equipment, Caterpillar Tractor has market power and should consider the entire demand curve when choosing prices for its products. As their advisor, you should focus on the determination of the elasticity of demand for each product. There are three important factors to be considered. First, how similar are the products offered by Caterpillar’s competitors? If they are close substitutes, a small increase in price could induce customers to switch to the competition. Secondly, what is the age of the existing stock of tractors? With an older population of tractors, a 5 percent price increase induces a smaller drop in demand. Finally, because farm tractors are a capital input in agricultural production, what is the expected profitability of the agricultural sector? If farm incomes are expected to fall, an increase in tractor prices induces a greater decline in demand than one would estimate with information on only past sales and prices

3.A monopolist firm faces a demand with constant elasticity of-2.0.It has a constant marginal cost of $20 per unit and sets a price to maximize profit.If marginal Icost should increase by 25 percent,would the price charged also rise by 25 percent? Yes.The monopolist's pricing rule as a function of the elasticity of demand for its product is: or alternatively MC P=7 In this example E=-2.0.so 1/E=-1/2:price should then be set so that P= MC =2MC Therefore,if MC rises by 25 percent,then price will also rise by 25 percent When MC=$20.P=$40.When MC rises to $20(1.25)=$25,the price rises to $50,a 25 percent increase. 4.A firm faces the following average revenue(demand)curve: P=120-0.02Q where Q is weekly production and P is price,measured in cents per unit.The firm's cost function is given by C=60Q+25,000.Assume that the firm maximizes profits. a.What is the level ofproduction,price,and total profit perweek? The profit-ma四g0upu此found by sctting margina9"o mmal to margina ost Giver linear demand c rm, 20.0.02Q,we know that the marginal revenue curve will have twice the slope of the demand curve Thus,the marginal revenue curve for the firm is MR =120.0.04Q.Marginal oost is simply the slope of the total cost curve.The slope of TC=60Q+25.000 is 60.s MC equals 60.Setting MR=MC to determine the profit-maximizing quantity: 120.0.04Q=60.0or Q=1,500

3. A monopolist firm faces a demand with constant elasticity of -2.0. It has a constant marginal cost of $20 per unit and sets a price to maximize profit. If marginal cost should increase by 25 percent, would the price charged also rise by 25 percent? Yes. The monopolist’s pricing rule as a function of the elasticity of demand for its product is: (P - MC) P = - 1 Ed or alternatively, P = MC 1 + 1 Ed In this example Ed = -2.0, so 1/Ed = -1/2; price should then be set so that: P = MC 1 2 = 2MC Therefore, if MC rises by 25 percent, then price will also rise by 25 percent. When MC = $20, P = $40. When MC rises to $20(1.25) = $25, the price rises to $50, a 25 percent increase. 4. A firm faces the following average revenue (demand) curve: P = 120 - 0.02Q where Q is weekly production and P is price, measured in cents per unit. The firm’s cost function is given by C = 60Q + 25,000. Assume that the firm maximizes profits. a. What is the level of production, price, and total profit per week? The profit-maximizing output is found by setting marginal revenue equal to marginal cost. Given a linear demand curve in inverse form, P = 120 - 0.02Q, we know that the marginal revenue curve will have twice the slope of the demand curve. Thus, the marginal revenue curve for the firm is MR = 120 - 0.04Q. Marginal cost is simply the slope of the total cost curve. The slope of TC = 60Q + 25,000 is 60, so MC equals 60. Setting MR = MC to determine the profit-maximizing quantity: 120 - 0.04Q = 60, or Q = 1,500

Substituting the profit-maximizing quantity into the inverse demand function to determine the price: P=120.(0.021,500)=90 cents Profitequals total revenue minus total cost: 元=(901,500)-(25,000+(601,500).or 元=$200 per week. b.If the government decides to levy a tax of 14 cents per unit on this product what will be the new level of production,price,and profit? Suppose initially that the consumers must pay the tax to the government. Since the total price (including the tax)consumers woul be willing to pay remains unchanged,we know that the demand function is p*+T=120.0.02Q or p*=120.0.02Q.T where is the price recived by the suppliers Because the tax increases the price of each unit,total revenue for the moropolist decreases by T and marginal revenue,the revenue on each additional unit,decreases by 7. MR=120-0.04Q-T where T=14 cents.To determine the profit-maximizing level of output with the tax,equate marginal revenue with marginal cost: 120.0.04Q-14=60,or Q=1,150 units Substituting into the demand function to determine price p*=120-(0.021,150)-14=83 cents Profit is total revenue minus total cos π=830150)-(600,150)+25,000)-1450 cents,o $14.50 per week. Note:The price facing theco after the imposition of the tax is 97cent The monopolist receives 83 cents.Therefore,the consumer and the monopolist each pay 7 cents of the tax If the monopolist had to pay the tax instead of the consumer,we would arrive at the same result.The monopolist's cost function would then be TC=60Q+25,000+TQ=(60+T)Q+25,000. The slope of the cost function is(60+T so MC=60+T.We set this MC to the marginal revenue function from part (a) 120.0.04Q=60+14,o

Substituting the profit-maximizing quantity into the inverse demand function to determine the price: P = 120 - (0.02)(1,500) = 90 cents. Profit equals total revenue minus total cost: = (90)(1,500) - (25,000 + (60)(1,500)), or = $200 per week. b. If the government decides to levy a tax of 14 cents per unit on this product, what will be the new level of production, price, and profit? Suppose initially that the consumers must pay the tax to the government. Since the total price (including the tax) consumers would be willing to pay remains unchanged, we know that the demand function is P* + T = 120 - 0.02Q, or P* = 120 - 0.02Q - T, where P* is the price received by the suppliers. Because the tax increases the price of each unit, total revenue for the monopolist decreases by TQ, and marginal revenue, the revenue on each additional unit, decreases by T: MR = 120 - 0.04Q - T where T = 14 cents. To determine the profit-maximizing level of output with the tax, equate marginal revenue with marginal cost: 120 - 0.04Q - 14 = 60, or Q = 1,150 units. Substituting Q into the demand function to determine price: P* = 120 - (0.02)(1,150) - 14 = 83 cents. Profit is total revenue minus total cost: = (83)(1,150)− ((60)(1,150) + 25,000)= 1450 cents, or $14.50 per week. Note: The price facing the consumer after the imposition of the tax is 97 cents. The monopolist receives 83 cents. Therefore, the consumer and the monopolist each pay 7 cents of the tax. If the monopolist had to pay the tax instead of the consumer, we would arrive at the same result. The monopolist’s cost function would then be TC = 60Q + 25,000 + TQ = (60 + T)Q + 25,000. The slope of the cost function is (60 + T), so MC = 60 + T. We set this MC to the marginal revenue function from part (a): 120 - 0.04Q = 60 + 14, or

Q=1,150. Thus,it does not matter who ends the tax payment to the vernment.The burdenofthe tax is reflected in the price ofthe good. 5.The following table shows the demand curve facing a monopolist who produces at a constant marginal cost of $10 Price Quantity 0 16 2 12 10 8 20 6 24 4 28 2 32 0 36 a.Calculate the firm's marginal revenue curve. To find the marginal revenue curw we first derive the inverse demand curve curve the .The of the inverse demand curveisthe change in price divided by the change in quantity Fo example,a decrease in price from 18 to 16 yields an increase in quantity from 0 to 4. Therer the sopeand the demand curveis P=18-0.50 The marginal revenue curve corresponding to a linear demand curve is a line with the same interept as the inverse demand curve and a slope that is twice as steep.Therefore,the marginal revenue curve is MR=18-Q. b.What are the firm's profit-maximizing output and price?What is its profit? The monopolist's maximizing output occurs where marginal revenue equals marginal cost.Marginal cost is a constant $10.Setting MR equal to MC to determine the profit-maximizing quantity: 18-Q=10.orQ=8. To find the profit-maximizing price,substitute this quantity into the demand equation: P=18-0.5)8)=$14. Total revenue is price times quantity: TR=04)8)=S112

Q = 1,150. Thus, it does not matter who sends the tax payment to the government. The burden of the tax is reflected in the price of the good. 5. The following table shows the demand curve facing a monopolist who produces at a constant marginal cost of $10. Price Quantity 18 0 16 4 14 8 12 12 10 16 8 20 6 24 4 28 2 32 0 36 a. Calculate the firm’s marginal revenue curve. To find the marginal revenue curve, we first derive the inverse demand curve. The intercept of the inverse demand curve on the price axis is 18. The slope of the inverse demand curve is the change in price divided by the change in quantity. For example, a decrease in price from 18 to 16 yields an increase in quantity from 0 to 4. Therefore, the slope is − 1 2 and the demand curve is P = 18 − 0.5Q. The marginal revenue curve corresponding to a linear demand curve is a line with the same intercept as the inverse demand curve and a slope that is twice as steep. Therefore, the marginal revenue curve is MR = 18 - Q. b. What are the firm’s profit-maximizing output and price? What is its profit? The monopolist’s maximizing output occurs where marginal revenue equals marginal cost. Marginal cost is a constant $10. Setting MR equal to MC to determine the profit-maximizing quantity: 18 - Q = 10, or Q = 8. To find the profit-maximizing price, substitute this quantity into the demand equation: P = 18− (0.5)(8) = $14. Total revenue is price times quantity: TR = (14)(8) = $112

The profit of the firm is total revenue minus total cost,and total cost is equal to average cost times the kvel of ouput produed.Since marginal cos isconstan average variable cost is equal to marginal cost.Ignoring any fixed costs,total cost is 100 or 80,and profit is 112-80=$32 c.What would the equilibrium price and quantity be in a competitive industry? Setting the expre for price equal toamarginal cot of10 18-0.50=10→2=16→P=10. Note the increase in the equilibrium quantity compared to the monopoly solution. d.What would the social gain be if this monopolist were forced to produce and price at the competitive equilibrium?Who would gain and lose as a result? The social gain arises from the elimination ofdeadweight loss.Deadweight lss in this case is equal to the triangle above the onstant marginal cos eurve,below the demand curve.and between the quanti es8 and 16.or numerically (14-10)(16-8M.5=$16. Consumers gain this deadweight lss plus the monopolist's profit of $32.The monopolist's profits are reduced toro,and the consumer surplus increases by $48. 6.Suppose that an industry is characterized as follows: C=100+2Q Firmtotal cost finction MC=40 Frm marginal cost function P=90-20 Industry demand curve MR=90-4Q a.If there is only one firm in the industry,find the monopoly price,quantity, and level of profit. If there is only one firm in the industry,then the firm will act like a monopolist and produce at the point where marginal revenue is equal to marginal cost. MC=4Q=90-4Q=MR Q=11.25 For a quantity of 11.25.the firm will charge a price P=90-2*11.25=67.50 The1 evel of67.50*11.25-10-2*11.25*11.25=s406.25. b.Find the price,quantity,and level of profit if the industry is competitive

The profit of the firm is total revenue minus total cost, and total cost is equal to average cost times the level of output produced. Since marginal cost is constant, average variable cost is equal to marginal cost. Ignoring any fixed costs, total cost is 10Q or 80, and profit is 112 − 80 = $32. c. What would the equilibrium price and quantity be in a competitive industry? For a competitive industry, price would equal marginal cost at equilibrium. Setting the expression for price equal to a marginal cost of 10: 18 − 0.5Q =10 Q = 16 P =10. Note the increase in the equilibrium quantity compared to the monopoly solution. d. What would the social gain be if this monopolist were forced to produce and price at the competitive equilibrium? Who would gain and lose as a result? The social gain arises from the elimination of deadweight loss. Deadweight loss in this case is equal to the triangle above the constant marginal cost curve, below the demand curve, and between the quantities 8 and 16, or numerically (14-10)(16-8)(.5)=$16. Consumers gain this deadweight loss plus the monopolist’s profit of $32. The monopolist’s profits are reduced to zero, and the consumer surplus increases by $48. 6. Suppose that an industry is characterized as follows: C = 100 + 2Q 2 Firm total cost function MC = 4Q Firm marginal cost function P = 90 − 2Q Industry demand curve MR = 90 − 4Q Industry marginal revenue curve . a. If there is only one firm in the industry, find the monopoly price, quantity, and level of profit. If there is only one firm in the industry, then the firm will act like a monopolist and produce at the point where marginal revenue is equal to marginal cost: MC=4Q=90-4Q=MR Q=11.25. For a quantity of 11.25, the firm will charge a price P=90-2*11.25=$67.50. The level of profit is $67.50*11.25-100-2*11.25*11.25=$406.25. b. Find the price, quantity, and level of profit if the industry is competitive

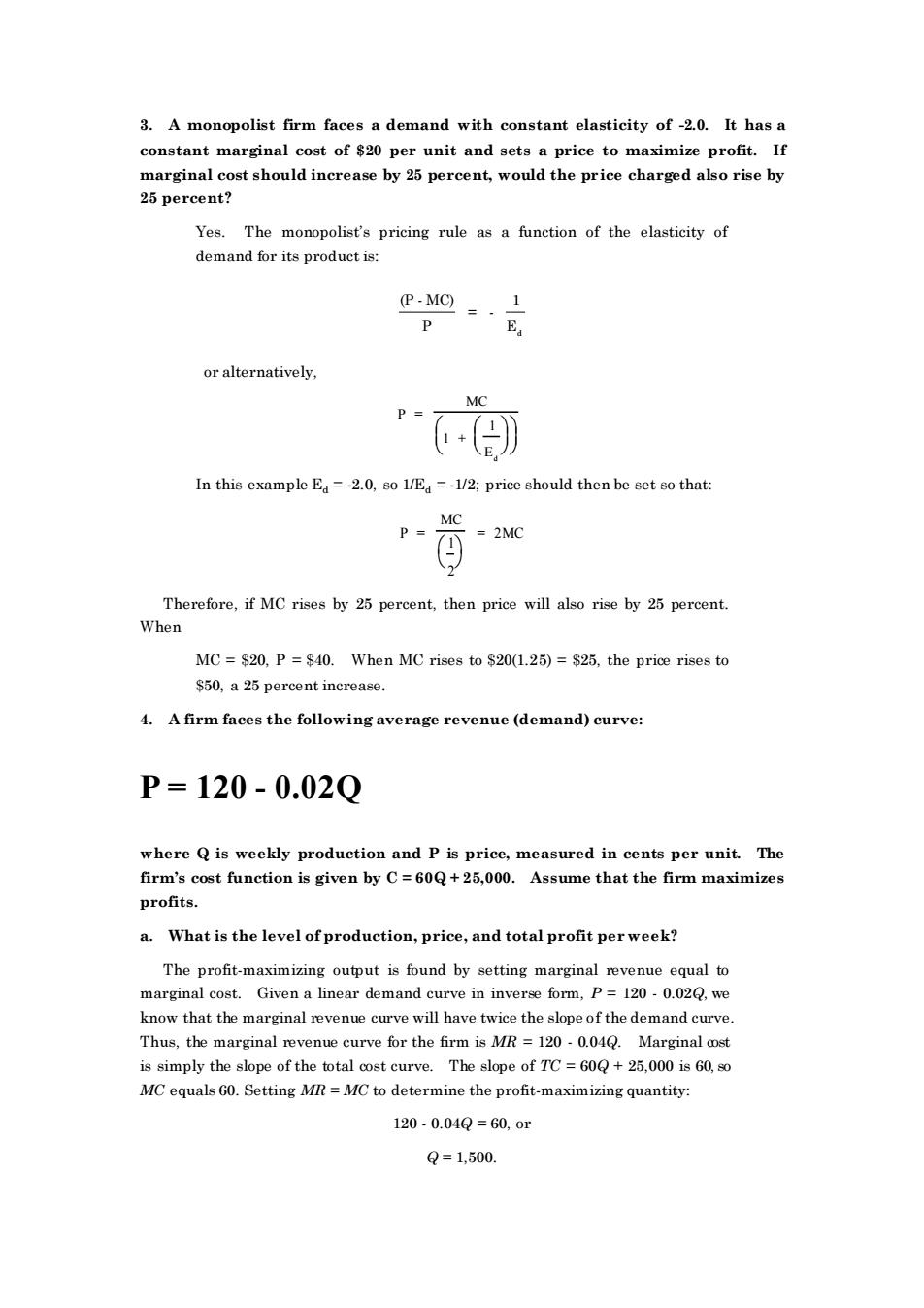

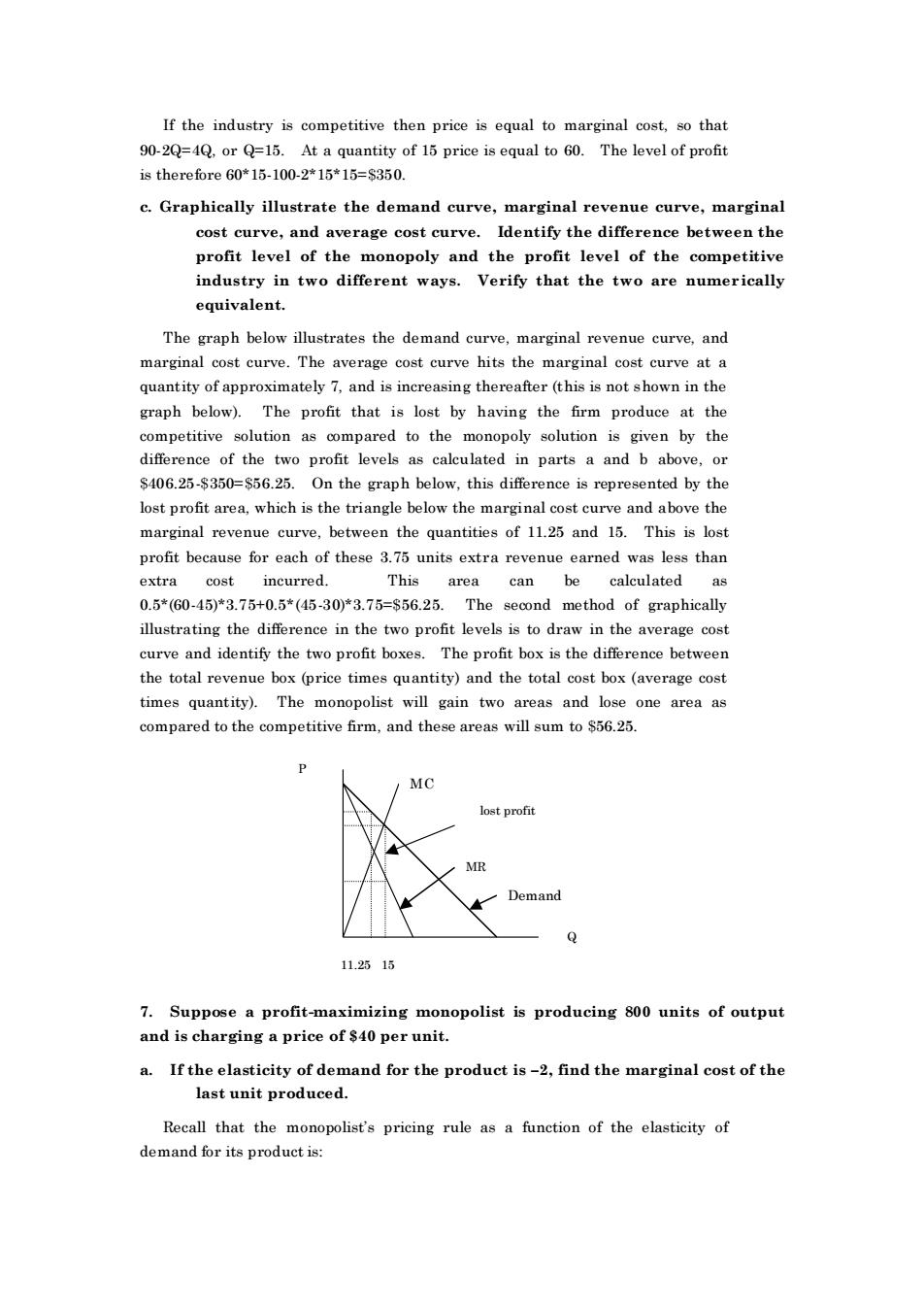

If the industry is competitive then price is equal to marginal cost,so that is therefore60*15-100-2*15*15=$350 e.Graphically illustrate the demand curve,marginal revenue curve,marginal cost curve,and average cost curve.Identify the difference between the profit level of the monopoly and the profit level of the competitive industry in two different ways.Verify that the two are numerically equivalent. The graph below illustrates the demand curve,marginal revenue curve,and marginal.The hita the e marginal cos curve at a quantity of approximately 7,and is increasing thereafter (this is not shown in the graph below).The profit that is lost by having the firm produce at the competitive solution as compared to the monopoly solution is given by the difference of the two profit levels as calculated in parts a and b above,or 406.25-350=56.25.On the graph below,this diffo ented by lost profit area,which is the triangle below the marginal cost curve and above the marginal revenue curve.between the quantities of 11.25 and 15.This is lost profit because for each of these 3.75 units extra revenue earned was less than extra cost incurred. This area can be calculated 0.5*(60-45)*3.75+0.5*(45-30*3.75=s56.25.The ond method of graphically illustrating the difference in the two profit levels is to draw in the average cost curve and identify the two profit boxes.The profit box is the difference between the total revenue box (price times quantity)and the total cost box(average cost times quantity).The monopolist will gain two areas and lose one area as compared to the competitive firm,and these areas will sum to $56.25. loet profit 11.2515 7.Suppose a profit-maximizing monopolist is producing 800 units of output and is charging a price of $40 per unit. a.If the elasticity of demand for the product is-2,find the marginal cost of the last unit produced Recall that the monopolist's pricing rule as a function of the elasticity of demand for its product is

If the industry is competitive then price is equal to marginal cost, so that 90-2Q=4Q, or Q=15. At a quantity of 15 price is equal to 60. The level of profit is therefore 60*15-100-2*15*15=$350. c. Graphically illustrate the demand curve, marginal revenue curve, marginal cost curve, and average cost curve. Identify the difference between the profit level of the monopoly and the profit level of the competitive industry in two different ways. Verify that the two are numer ically equivalent. The graph below illustrates the demand curve, marginal revenue curve, and marginal cost curve. The average cost curve hits the marginal cost curve at a quantity of approximately 7, and is increasing thereafter (this is not shown in the graph below). The profit that is lost by having the firm produce at the competitive solution as compared to the monopoly solution is given by the difference of the two profit levels as calculated in parts a and b above, or $406.25-$350=$56.25. On the graph below, this difference is represented by the lost profit area, which is the triangle below the marginal cost curve and above the marginal revenue curve, between the quantities of 11.25 and 15. This is lost profit because for each of these 3.75 units extra revenue earned was less than extra cost incurred. This area can be calculated as 0.5*(60-45)*3.75+0.5*(45-30)*3.75=$56.25. The second method of graphically illustrating the difference in the two profit levels is to draw in the average cost curve and identify the two profit boxes. The profit box is the difference between the total revenue box (price times quantity) and the total cost box (average cost times quantity). The monopolist will gain two areas and lose one area as compared to the competitive firm, and these areas will sum to $56.25. M C MR Demand 11.25 15 lost profit Q P 7. Suppose a profit-maximizing monopolist is producing 800 units of output and is charging a price of $40 per unit. a. If the elasticity of demand for the product is –2, find the marginal cost of the last unit produced. Recall that the monopolist’s pricing rule as a function of the elasticity of demand for its product is: