CHAPTER 11 PRICING WITHMARKET POWER 一、QUESTIONS FOR REVIEW 1.Suppose a firm can practice perfect,first-degree price discrimination.What is the lowest price it will charge,and what will its total output be? When the firm is able to practice perfect first-degree price discrimination.each unit is sold at the reservation price of each consumer,assuming each consme purchases one unit.Bec ause e sume on pra marginal revenues simply the pri of the unit.We w that maximize profits by producing an output such that marginal revenue is equal to marginal cost.For the perfect price discriminator,that point is where the marginal cost curve intersects the demand curve.Increasing output beyond that point would imply that MR<MC,and the firm would o moneyo n each unit sol.For bwer quantities,MRMC.and the frm should increase itsouput. 2.How does a car salesperson practice price discrimination?How does the ability to discriminate correctly affect his or her earnings? The relevant range of the demand curve facing the car salesperson is bounded above by the manufacturer's suggested retail price plus the dealer's markup and bounded below by the dealer's price plus administrative and inventory overhead. By sizing up the customer,the rson determines the customers ervation price.of bargaining.als price determined. If the aalesperson has misjudged the reservation price of the customer,either the sale is lost because the customer's reservation price is bwer than the salesperson's guess or profit is lost because the customer's reservation price is higher than the correlated to Why Consumer surplus is higher under blck pricing than under monopoly pricing because more output is produced.For example,assume there are two prices P and P with P greater than P.Customers with reservation prices above P pay P. capturing surplus equal to the area bounded by the demand curve and P.This also would oc with monopoly pricing.Under blck pricing with reservation prices between Pand P capture surplus equa the demand curve,the difference between P and P and the difference between and This quantity is greater than the surplus captured under monopoly,hence block pricing.under these assumptions.improves consumer welfare

CHAPTER 11 PRICING WITH MARKET POWER 一、QUESTIONS FOR REVIEW 1. Suppose a firm can practice perfect, first-degree price discrimination. What is the lowest price it will charge, and what will its total output be? When the firm is able to practice perfect first-degree price discrimination, each unit is sold at the reservation price of each consumer, assuming each consumer purchases one unit. Because each unit is sold at the consumer’s reservation price, marginal revenue is simply the price of the last unit. We know that firms maximize profits by producing an output such that marginal revenue is equal to marginal cost. For the perfect price discriminator, that point is where the marginal cost curve intersects the demand curve. Increasing output beyond that point would imply that MR MC, and the firm should increase its output. 2. How does a car salesperson practice price discrimination? How does the ability to discriminate correctly affect his or her earnings? The relevant range of the demand curve facing the car salesperson is bounded above by the manufacturer’s suggested retail price plus the dealer’s markup and bounded below by the dealer’s price plus administrative and inventory overhead. By sizing up the customer, the salesperson determines the customer’s reservation price. Through a process of bargaining, a sales price is determined. If the salesperson has misjudged the reservation price of the customer, either the sale is lost because the customer’s reservation price is lower than the salesperson’s guess or profit is lost because the customer’s reservation price is higher than the salesperson’s guess. Thus, the salesperson’s commission is positively correlated to his or her ability to determine the reservation price of each customer. 3. Electric utilities often practice second-degree price discrimination. Why might this improve consumer welfare? Consumer surplus is higher under block pricing than under monopoly pricing because more output is produced. For example, assume there are two prices P1 and P2 , with P1 greater than P2 . Customers with reservation prices above P1 pay P1 , capturing surplus equal to the area bounded by the demand curve and P1 . This also would occur with monopoly pricing. Under block pricing, customers with reservation prices between P1 and P2 capture surplus equal to the area bounded by the demand curve, the difference between P1 and P2 , and the difference between Q1 and Q2 . This quantity is greater than the surplus captured under monopoly, hence block pricing, under these assumptions, improves consumer welfare

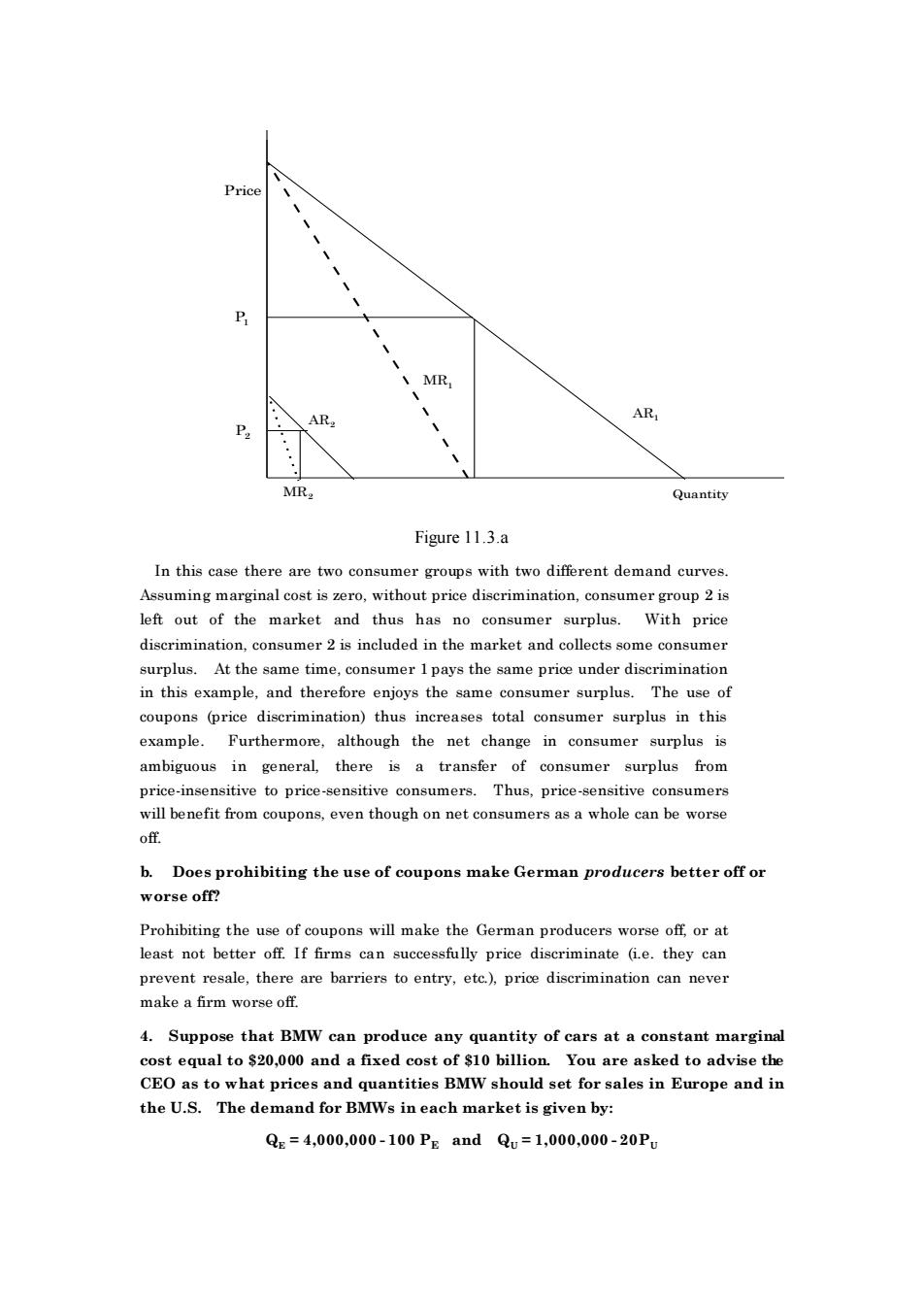

Consumer Surplus 2 Quantity Figure 11.3 4.Give some examples of third-degree price discrimination.Can third-degree price discrimination be effective if the different groups of consumers have different levels of demand but the same price elasticities? To engage in third-degree price discrimination.the producer must separate customers into distinct markets (sorting)and prevent the reselling of the product from customers in one market to customers in another market(arbitrage).Whik examples in this chapter stress the techniques for separating customers there are also techniques for preventing resale.For example,airlines restrict the use of their tickets by printing the name of the passenger on the ticket.Other examples include dividing markets by age and gender,e.g charging different prices for movie tickets to different age If cusomer in the prte markets have tho fm equation 11.2 we know that the prices are the same in all markets.While the producer can effectively separate the markets, there is little profit incentive to do so. 5.Show why optimal,third-degree price diserimination requires that marginal revenue for each group of consumers equals marginal cost.Use this condition to explain how a firm should change its prices and total output ifthe demand curve one group consumers shifted。 utward,so that marginal l revenue for that group increased. We know that firms maximize profits by choosing output so marginal revenue is equal to marginal oost.If MR for one market is greater than MC.then the firm should increase sales to maximize profit,thus lowering the price on the last unit and raising the cost of producing the last unit.Similarly,ifMRfor markets ess than MC.thefirm should de sales to maximize rofit,the reby the price on the last unit and lowering the cost of producing the last unit By equating MR and MC in each market,marginal revenue is equal in all markets

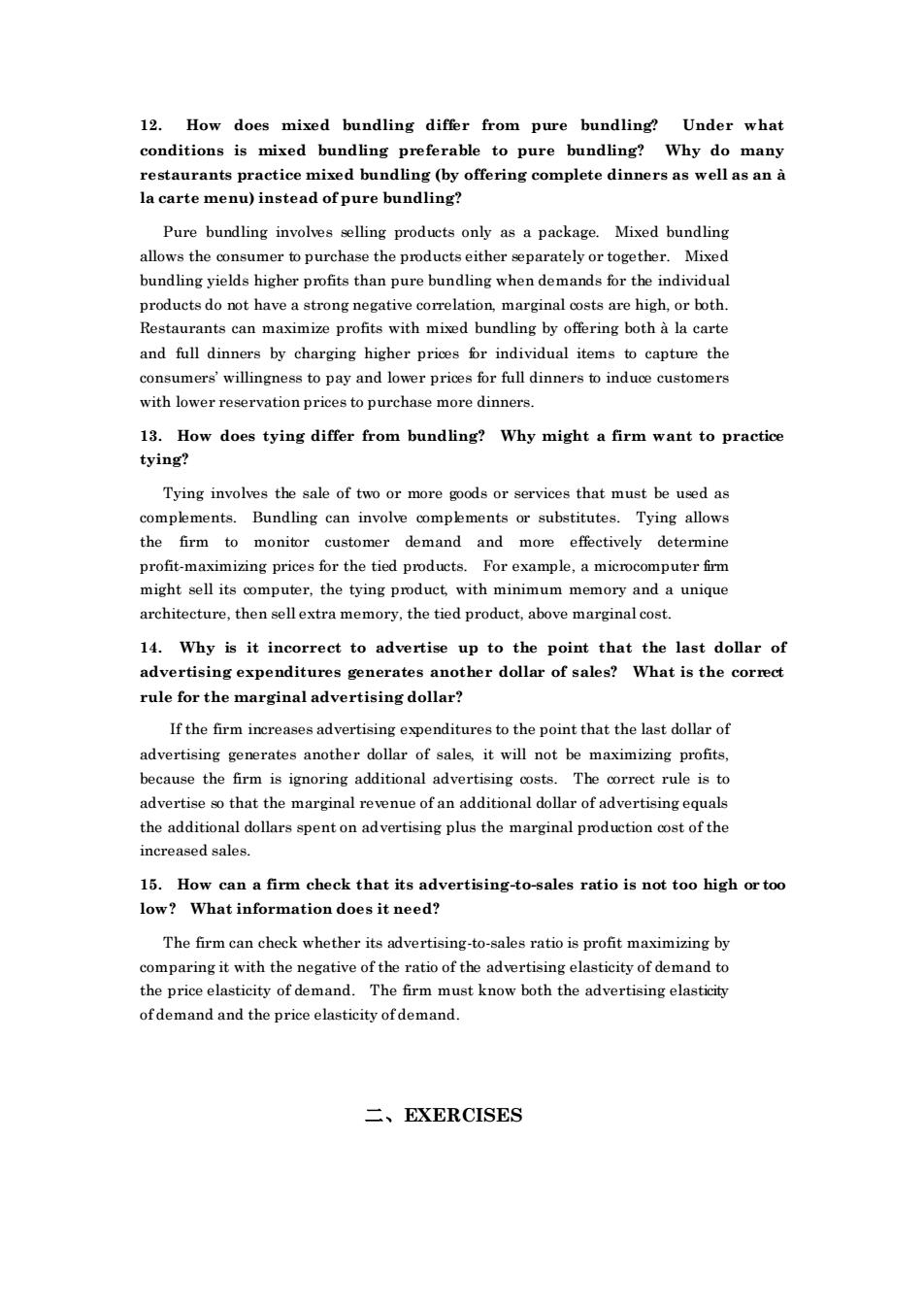

Price Quantity P1 P2 Q1 Q2 Consumer Surplus D Figure 11.3 4. Give some examples of third-degree price discrimination. Can third-degree price discrimination be effective if the different groups of consumers have different levels of demand but the same price elasticities? To engage in third-degree price discrimination, the producer must separate customers into distinct markets (sorting) and prevent the reselling of the product from customers in one market to customers in another market (arbitrage). While examples in this chapter stress the techniques for separating customers, there are also techniques for preventing resale. For example, airlines restrict the use of their tickets by printing the name of the passenger on the ticket. Other examples include dividing markets by age and gender, e.g., charging different prices for movie tickets to different age groups. If customers in the separate markets have the same price elasticities, then from equation 11.2 we know that the prices are the same in all markets. While the producer can effectively separate the markets, there is little profit incentive to do so. 5. Show why optimal, third-degree price discrimination requires that marginal revenue for each group of consumers equals marginal cost. Use this condition to explain how a firm should change its prices and total output if the demand curve for one group of consumers shifted outward, so that marginal revenue for that group increased. We know that firms maximize profits by choosing output so marginal revenue is equal to marginal cost. If MR for one market is greater than MC, then the firm should increase sales to maximize profit, thus lowering the price on the last unit and raising the cost of producing the last unit. Similarly, if MR for one market is less than MC, the firm should decrease sales to maximize profit, thereby raising the price on the last unit and lowering the cost of producing the last unit. By equating MR and MC in each market, marginal revenue is equal in all markets

If the quantity demanded increased.the marginal revenue at each price woul after the demand raise MC,the poducer sales to this market by lowering price,thus increasing output.This increase in output woul increase MC of the last unit sold.To maximize profit,the producer must increase the Mr on units sold in other markets.ie.increase price in these other markets The firm shifts sales to the market experiencing the increase in demand and away from other markets. 6.When pricing automobiles,American car companies typically charge much higher percentage markup over cost for"luxury option"items(such as leather trim,ete.)than for the car itself or for more "basic"options such as power steeringand automatic transmission.Explain why. This can be explained as an instance of third-degree price discrimination.In rdertouse the model of thrd-degreepriedisimnat n p need toasume that the of of th tota number of options produced and the production ofeach type of options affects costs in the same way.For simplicity,we can assume that there are two types of option packages,"luxury"and"basic,"and that these two types of packages are purchased by two different t s of consumers.In this case,the relationship acr oss pmoduct types MR=MR,must hold.which implies that: PR,=(1+1E)11+1E) where 1 and 2 denote the luxury and basic products types This means thatthe higher price is charged or the package with the lower elasticity of demand.Thus the pricing of automobiles can be explained if the"luxury"options are purchased by consumers with low elasticities of demand relative to consumers of more "basic' packages. 7.How is peak-load pricing a form of price discrimination?Can it make consumers better off?Give an example. Price discrimination involves eparating customers into distinct markets There are several ways of segmenting markets by customer characteristics,by geography.and by time.In peak-load pricing sellers charge different prices to customers at different times.When there is a higher quantity demanded at each :hy arging a lower price to。 with las ties grea ter than th average elasticity of the market as a whole.Most telephone companies charge a different price during normal business hours evening hours,and night and weekend hours.Callers with more elastic demand wait until the period when the charge is closest to their reservation price 8.How can a firm determine an optimal two-part tariff if it has two customers with different demand curves? (AS sume that it knows the demand curves.)

If the quantity demanded increased, the marginal revenue at each price would also increase. If MR = MC before the demand shift, MR would be greater than MC after the demand shift. To lower MR and raise MC, the producer should increase sales to this market by lowering price, thus increasing output. This increase in output would increase MC of the last unit sold. To maximize profit, the producer must increase the MR on units sold in other markets, i.e., increase price in these other markets. The firm shifts sales to the market experiencing the increase in demand and away from other markets. 6. When pricing automobiles, American car companies typically charge a much higher percentage markup over cost for “luxury option” items (such as leather trim, etc.) than for the car itself or for more “basic” options such as power steering and automatic transmission. Explain why. This can be explained as an instance of third-degree price discrimination. In order to use the model of third-degree price discrimination presented in the text, we need to assume that the costs of producing car options is a function of the total number of options produced and the production of each type of options affects costs in the same way. For simplicity, we can assume that there are two types of option packages, “luxury” and “basic,” and that these two types of packages are purchased by two different types of consumers. In this case, the relationship across product types MR1 = MR2 must hold, which implies that: P1 /P2 = (1+1/E2 ) / (1+1/E1 ) where 1 and 2 denote the luxury and basic products types. This means that the higher price is charged for the package with the lower elasticity of demand. Thus the pricing of automobiles can be explained if the “luxury” options are purchased by consumers with low elasticities of demand relative to consumers of more “basic” packages. 7. How is peak-load pricing a form of price discrimination? Can it make consumers better off? Give an example. Price discrimination involves separating customers into distinct markets. There are several ways of segmenting markets: by customer characteristics, by geography, and by time. In peak-load pricing, sellers charge different prices to customers at different times. When there is a higher quantity demanded at each price, a higher price is charged. Peak-load pricing can increase total consumer surplus by charging a lower price to customers with elasticities greater than the average elasticity of the market as a whole. Most telephone companies charge a different price during normal business hours, evening hours, and night and weekend hours. Callers with more elastic demand wait until the period when the charge is closest to their reservation price. 8. How can a firm determine an optimal two-part tariff if it has two customers with different demand curves? (Assume that it knows the demand curves.)

If all customers had the same demand curve,the firm would set a price equal to marginal cost ad t consumer surplus When consumers have firm is faced with the following problem.If it sets the user fee equal to the larger consumer surplus.the firm will earn profits only from the consumers with the larger consumer surplus because the second group of consumers will not purchase any of the good.On the other hand,if the fee equal to the small consumer surplus,the firm will earn revenues from both types of consumers. 9.Why is the pricing of a Gillette safety razor a form of a two-part tariff?Must Gillette be a monopoly producer of its blades as well as its razors?Suppose you were advising Gillette on how to determine the two parts of the tariff.What procedure would you suggest? By selling the razor and the blades separately.the pricing of a Gillette safety razor can be thought of as a two-part tariff where the entry fee is the cost of the cazor and the age foo is the st of the blades Gillette does not ned tobe monopoly producer of its blades.In the simplest case where all consumers have identical demand curves,Gillette should set the blade price to marginal cost.and the razor cost to total consumer surplus for each consumer.Since blade price is set to marginal cost it does not matter if Gillette has a monopoly or not.The determination of the two parts of the tariff bec more complicated the reater the variety of consumers with different demands and there is no simple formula to calculate the optimal two part tariff.The key point to consider is that as the entry fee becomes smaller,the number ofentrants will rise,and the profit from the entry fee will fall.Arriving at the optimal two part tariff might involve some amountof iteration over different entry and usage fees 10.In the town of Woodland,California there are many dentists but only one eye doctor.Are senior citizens more likely to be offered discount prices for dental exams or for eye exams?Why. The dental market is competitive,whereas the eye doctor is a local monopolist. Only firms with market power can practice price discrimination,which implies eenior citizens are more likely to be offered discount prices from the eve doctor Each dentist is already charging a price equal to marginal cost so they are not able to ofer a discount 11.Why did MGM bundle Gone with the Wind and Getting Gertie's Garter?Wha characteristic of demands is needed for bundling to increase profits? Loews bundled its film Gone with the Wind and Getting Gertie's Garter to maximize revenues.Because Loews coul not price discriminate by charging a different price to each customer acoording to the customers price elasticity,it chose to bundle the two films and charge theaters for showing both films.The price would havebeen the combinedeservation prices of th last theater that ow wanted to attract. Of course,this tactic would only maximize revenues if demands for the two films were negatively correlated,as discussed in the chapter

If all customers had the same demand curve, the firm would set a price equal to marginal cost and a fee equal to consumer surplus. When consumers have different demand curves and, therefore, different levels of consumer surplus, the firm is faced with the following problem. If it sets the user fee equal to the larger consumer surplus, the firm will earn profits only from the consumers with the larger consumer surplus because the second group of consumers will not purchase any of the good. On the other hand, if the firm sets the fee equal to the smaller consumer surplus, the firm will earn revenues from both types of consumers. 9. Why is the pricing of a Gillette safety razor a form of a two-part tariff? Must Gillette be a monopoly producer of its blades as well as its razors? Suppose you were advising Gillette on how to determine the two parts of the tariff. What procedure would you suggest? By selling the razor and the blades separately, the pricing of a Gillette safety razor can be thought of as a two-part tariff, where the entry fee is the cost of the razor and the usage fee is the cost of the blades. Gillette does not need to be a monopoly producer of its blades. In the simplest case where all consumers have identical demand curves, Gillette should set the blade price to marginal cost, and the razor cost to total consumer surplus for each consumer. Since blade price is set to marginal cost it does not matter if Gillette has a monopoly or not. The determination of the two parts of the tariff becomes more complicated the greater the variety of consumers with different demands, and there is no simple formula to calculate the optimal two part tariff. The key point to consider is that as the entry fee becomes smaller, the number of entrants will rise, and the profit from the entry fee will fall. Arriving at the optimal two part tariff might involve some amount of iteration over different entry and usage fees. 10. In the town of Woodland, California there are many dentists but only one eye doctor. Are senior citizens more likely to be offered discount prices for dental exams or for eye exams? Why. The dental market is competitive, whereas the eye doctor is a local monopolist. Only firms with market power can practice price discrimination, which implies senior citizens are more likely to be offered discount prices from the eye doctor. Each dentist is already charging a price equal to marginal cost so they are not able to offer a discount. 11. Why did MGM bundle Gone with the Wind and Getting Gertie’s Garter? What characteristic of demands is needed for bundling to increase profits? Loews bundled its film Gone with the Wind and Getting Gertie’s Garter to maximize revenues. Because Loews could not price discriminate by charging a different price to each customer according to the customer’s price elasticity, it chose to bundle the two films and charge theaters for showing both films. The price would have been the combined reservation prices of the last theater that Loews wanted to attract. Of course, this tactic would only maximize revenues if demands for the two films were negatively correlated, as discussed in the chapter

12.How does mixed bundling differ from pure bundling?Under what conditions is mixed bundling preferable to pure bundling? Why do many restaurants practice mixed bundling(by offering complete dinners as well as an a la carte menu)instead ofpure bundling? Pure bundling involves selling products only as a package.Mixed bundling allows the consumer to purchase the products either separately or together.Mixed bundling yields higher profits than pure bundling when demands for the individual e a strong negativ s are high or both taurants can maximize profits with mixed bundling by offering both a la carte and full dinners by charging higher prices for individual items to capture the consumers'willingness to pay and lower prices for full dinners to induce customers with lower reservation prices to purchase more dinners. 13.How does tying differ from bundling?Why might a firm want to practice tying? Tying involves the sale of two that must beused as complements s.Bundling can involve complments or substitutes. Tying allows the firm to monitor customer demand and more effectively determine profit-maximizing prices for the tied products.For example,a microcomputer firm might sell its computer,the tying product with minimum memory and a unique architecture.then slextra memory.the tied product.above marginal cost. 14.Why is it incorreet to advertise up to the point that the last dollar of advertising expenditures generates another dollar of sales?What is the cor rule for the marginal advertising dollar? If the firm increases advertising expenditures to the point that the last dollar of advertising generates another dollar of sales.it will not be maximizing profits. because the firm is ignoring additional advertising costs.The correct rule is to advertise so that the marginal revenue of an additional dollar of adv the addi rtisingeq increased sales 15.How can a firm check that its advertising-to-sales ratio is not too high or too low?What information does it need? The firm can check whether its advertising-to-sales ratio is profit maximizing by comparing it with the negative of the ratio of the advertising elasticity of demand to the price elasticity of demand.The firm must know both the advertising elasticity ofde and and the price elasticity ofdemand. 二、EXERCISES

12. How does mixed bundling differ from pure bundling? Under what conditions is mixed bundling preferable to pure bundling? Why do many restaurants practice mixed bundling (by offering complete dinners as well as an à la carte menu) instead of pure bundling? Pure bundling involves selling products only as a package. Mixed bundling allows the consumer to purchase the products either separately or together. Mixed bundling yields higher profits than pure bundling when demands for the individual products do not have a strong negative correlation, marginal costs are high, or both. Restaurants can maximize profits with mixed bundling by offering both à la carte and full dinners by charging higher prices for individual items to capture the consumers’ willingness to pay and lower prices for full dinners to induce customers with lower reservation prices to purchase more dinners. 13. How does tying differ from bundling? Why might a firm want to practice tying? Tying involves the sale of two or more goods or services that must be used as complements. Bundling can involve complements or substitutes. Tying allows the firm to monitor customer demand and more effectively determine profit-maximizing prices for the tied products. For example, a microcomputer firm might sell its computer, the tying product, with minimum memory and a unique architecture, then sell extra memory, the tied product, above marginal cost. 14. Why is it incorrect to advertise up to the point that the last dollar of advertising expenditures generates another dollar of sales? What is the correct rule for the marginal advertising dollar? If the firm increases advertising expenditures to the point that the last dollar of advertising generates another dollar of sales, it will not be maximizing profits, because the firm is ignoring additional advertising costs. The correct rule is to advertise so that the marginal revenue of an additional dollar of advertising equals the additional dollars spent on advertising plus the marginal production cost of the increased sales. 15. How can a firm check that its advertising-to-sales ratio is not too high or too low? What information does it need? The firm can check whether its advertising-to-sales ratio is profit maximizing by comparing it with the negative of the ratio of the advertising elasticity of demand to the price elasticity of demand. The firm must know both the advertising elasticity of demand and the price elasticity of demand. 二、EXERCISES

1.Price discrimination requires the ability to sort customers and the ability to Explain how the following can function as price reeminagomes and diseus botorig a.Requiring airline travelers to spend at least one Saturday night away from home to qualify for a low fare. The requirement of staying over Saturday night separates business travelers who prefer to return for the weekend,from tourists,who travel on the weekend Arbitrage is not possible when the ticket specifies the name ofthe traveler. b.Insisting on delivering cement to buvers and basing prices on buvers' locations. By basing prices on the buyers location by geography Prices may then include transportation charges.These costs vary from customer to customer.The customer pays for these transportation charges whether delivery is received at the buyer's location or at the cement plant.Since cement is heavy and bulky.transportation charges may be large.This pricing strategy leads to "based-point-pri systems,"where all cment the same base point and calculate transportation charges from this base point.Individual custome are then quoted the same price.Forexample.in FTCv.Cement Institute,333 U.S 683 [19481.the Court found that sealed bids by eleven companies for a 6.000-barrel government order in 1936 all quoted $3.286854 per barrel. c.Selling food processors along with coupons that can be sent to the manufacturer to obtain a $10 rebate. s mers are ls demand and do not request the rebate:and (2)customers who are more price sensitive,ie.,those who have a higher demand elasticity and do request the rebate. The latter group could buy the food processors,send in the rebate coupons and 四” of arbitrage,selers could limit the numbe of re s per d.Offering temporary price cuts on bathroom tissue. A temporary price cut on bathroom tissue is a form of intertemporal price discrimination.During the price cut,price-sensitive consumers buy greater quantities of tissue than they would otherwise.Non-price-sensitive consumers buy the same amount of tissue that they would buy without the price cut.Arbitrage is possible,but the profits on reselling bathroom tissue probably cannot compensate for the cos of storage,transportation,and resale e.Charging high-income patients more than low-income patients for plastic surgery The plastic surgeon might not be able to separate high-income patients from low-income patients,but he or she can guess.One strategy is to quote a high price

1. Price discrimination requires the ability to sort customers and the ability to prevent arbitrage. Explain how the following can function as price discrimination schemes and discuss both sorting and arbitrage: a. Requiring airline travelers to spend at least one Saturday night away from home to qualify for a low fare. The requirement of staying over Saturday night separates business travelers, who prefer to return for the weekend, from tourists, who travel on the weekend. Arbitrage is not possible when the ticket specifies the name of the traveler. b. Insisting on delivering cement to buyers and basing prices on buyers’ locations. By basing prices on the buyer’s location, customers are sorted by geography. Prices may then include transportation charges. These costs vary from customer to customer. The customer pays for these transportation charges whether delivery is received at the buyer’s location or at the cement plant. Since cement is heavy and bulky, transportation charges may be large. This pricing strategy leads to “based-point-price systems,” where all cement producers use the same base point and calculate transportation charges from this base point. Individual customers are then quoted the same price. For example, in FTC v. Cement Institute, 333 U.S. 683 [1948], the Court found that sealed bids by eleven companies for a 6,000-barrel government order in 1936 all quoted $3.286854 per barrel. c. Selling food processors along with coupons that can be sent to the manufacturer to obtain a $10 rebate. Rebate coupons with food processors separate consumers into two groups: (1) customers who are less price sensitive, i.e., those who have a lower elasticity of demand and do not request the rebate; and (2) customers who are more price sensitive, i.e., those who have a higher demand elasticity and do request the rebate. The latter group could buy the food processors, send in the rebate coupons, and resell the processors at a price just below the retail price without the rebate. To prevent this type of arbitrage, sellers could limit the number of rebates per household. d. Offering temporary price cuts on bathroom tissue. A temporary price cut on bathroom tissue is a form of intertemporal price discrimination. During the price cut, price-sensitive consumers buy greater quantities of tissue than they would otherwise. Non-price-sensitive consumers buy the same amount of tissue that they would buy without the price cut. Arbitrage is possible, but the profits on reselling bathroom tissue probably cannot compensate for the cost of storage, transportation, and resale. e. Charging high-income patients more than low-income patients for plastic surgery. The plastic surgeon might not be able to separate high-income patients from low-income patients, but he or she can guess. One strategy is to quote a high price

initially,observe the patient's reaction,and then negotiate the final price.Many medical insurance policies do not over elective plastic surgery.Since plasti surgery cannot be transferred from low-income patients to high-income patients, arbitrage does not present a problem. 2.Ifthe demand for drive-in movies is more elastic for couples than for single individuals,it will be optimal for theaters to charge one admission fee for the driver ofthe car and an extra fee for passengers.True or False? Explain. is a charge for the car plus the driver and the usage fee is a charge for each additional passenger other than the driver.Assume that the marginal cost of showing the movie is zero,i.e.,all costs are fixed and do not vary with the number of cars.The theater should set its entry fee to capture the consumer surplus of the driver.a single viewer,and should charge a positive price for each passenger. 3.In Example 11.1,we saw how producers of processed foods and related consumer goods use coupons asa means of price diserimination.Although coupons are widely used in the United States,that is not the case in other countries.In Germany,coupons are illegal. a.Does prohibiting the use of coupons in Germany make German consumers better off or worse off? In general.we cannot tell whether consumers will be better off or worse off Total umer surplus can e or decre with price discrimination depending on th number of different price charged and the o consumer demand Note,for example,that the use of coupons can increase the market size and therefore increase the total surplus of the market.Depending on the relative demand curves of the consumer groups and the producer's marginal eost curve,the increase in total surplus can be big enough to incre ase both pr ducer surplus and consumer surplus. Consider the simple example depicte in Figure 11.3.a

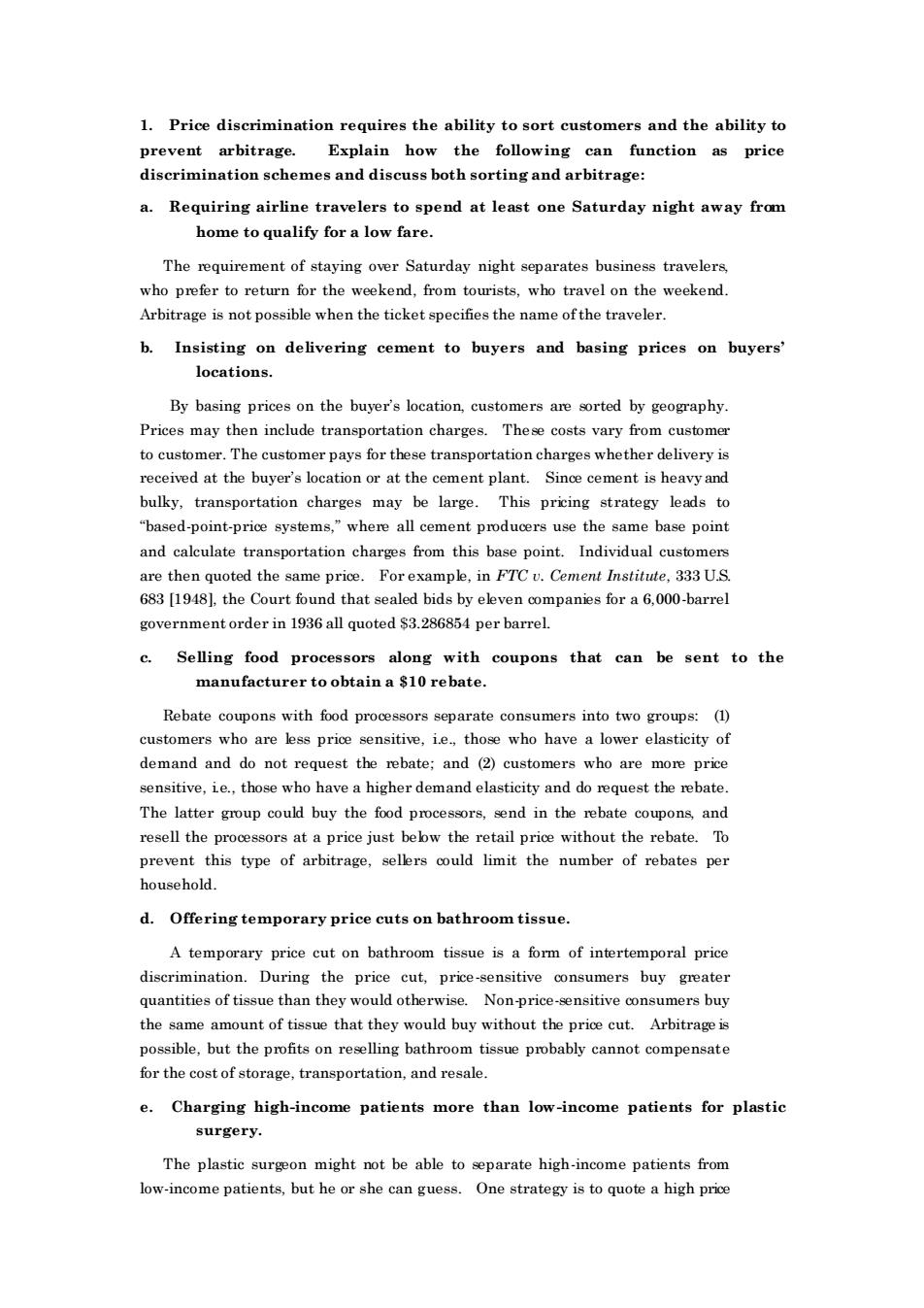

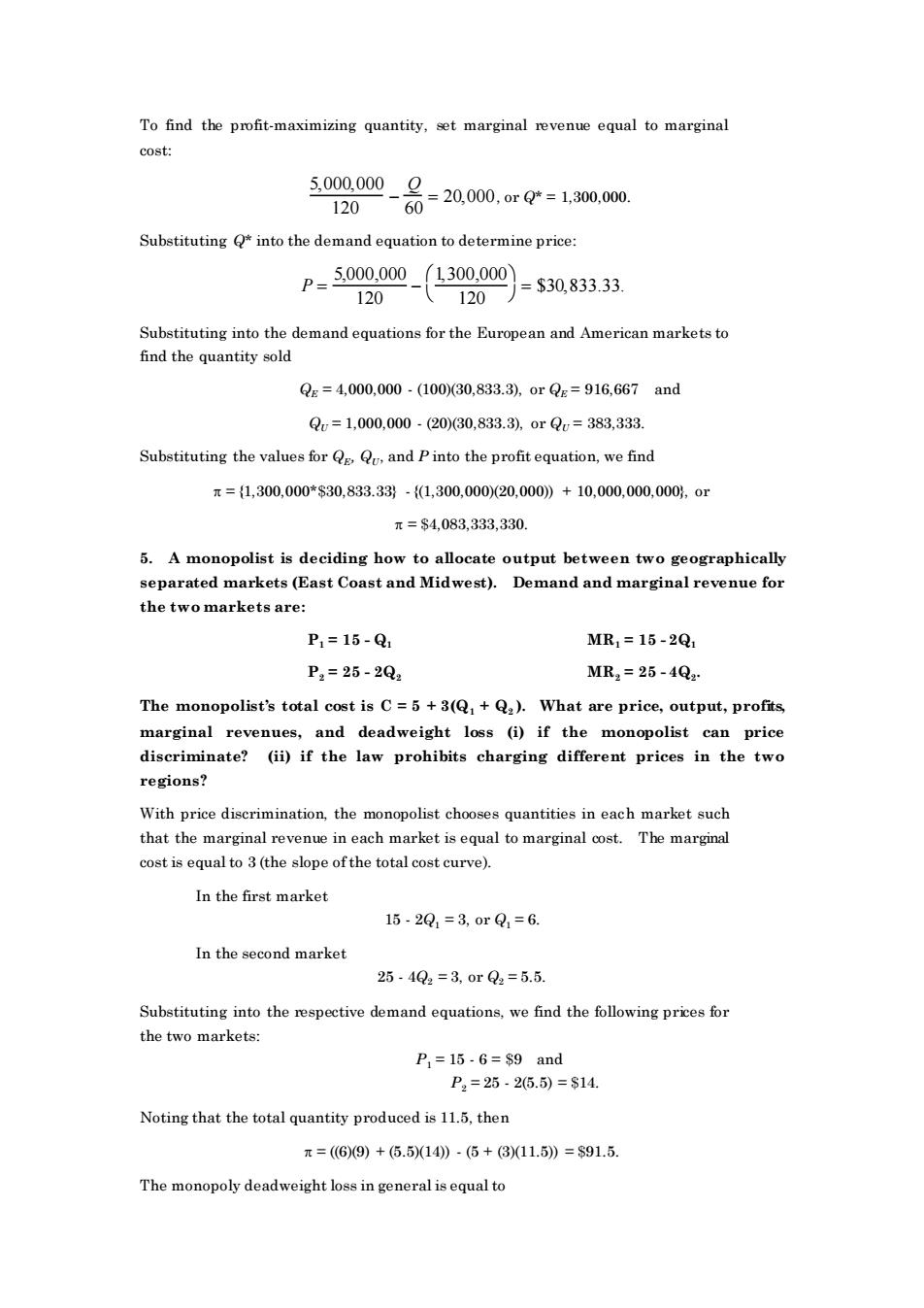

initially, observe the patient’s reaction, and then negotiate the final price. Many medical insurance policies do not cover elective plastic surgery. Since plastic surgery cannot be transferred from low-income patients to high-income patients, arbitrage does not present a problem. 2. If the demand for drive-in movies is more elastic for couples than for single individuals, it will be optimal for theaters to charge one admission fee for the driver of the car and an extra fee for passengers. True or False? Explain. True. Approach this question as a two-part tariff problem where the entry fee is a charge for the car plus the driver and the usage fee is a charge for each additional passenger other than the driver. Assume that the marginal cost of showing the movie is zero, i.e., all costs are fixed and do not vary with the number of cars. The theater should set its entry fee to capture the consumer surplus of the driver, a single viewer, and should charge a positive price for each passenger. 3. In Example 11.1, we saw how producers of processed foods and related consumer goods use coupons as a means of price discrimination. Although coupons are widely used in the United States, that is not the case in other countries. In Germany, coupons are illegal. a. Does prohibiting the use of coupons in Germany make German consumers better off or worse off? In general, we cannot tell whether consumers will be better off or worse off. Total consumer surplus can increase or decrease with price discrimination, depending on the number of different prices charged and the distribution of consumer demand. Note, for example, that the use of coupons can increase the market size and therefore increase the total surplus of the market. Depending on the relative demand curves of the consumer groups and the producer’s marginal cost curve, the increase in total surplus can be big enough to increase both producer surplus and consumer surplus. Consider the simple example depicted in Figure 11.3.a

Pric P .MR AR AR, MR Quantity Figure11.3.a left out of the market and thus has no consumer surplus.With price discrimination,consumer 2 is included in the market and collects some consumer surplus.At the same time,consumer 1 pavs the same price under discrimination in this example,and therefore enjoys the same consu ner surplus.The use of coupons ediscrimination)thu example.Furthermore,although the net change in consumer surplus is ambiguous in general,there is a transfer of consumer surplus from price-insensitive to price-sensitive consumers.Thus,price-sensitive consumers will benefit from coupons,even though on net consumers as a whole can be worse b.Does prohibiting the use of coupons make German producers better off or worse off? Prohibiting the use of coupons will make the German producers worse off,or at least not better off.If firms can successfully price discriminate (i.e.they can prevent resale,there are barriers to entry,etc.).price discrimination can never make a firm worse off. 4.Suppose that BMW can antity of cars at a c onstant marginal equal to$20,000 and a fixed st of 10 billion u ar sked to advise the CEO as to wha at prices and quantities BMW shor ld set for sales in Europe and in the U.S.The demand for BMWs in each market is given by: Qe=4,000,000-100 PE and Qu=1,000,000-20Pu

AR1 MR1 AR2 P1 P2 MR2 Price Quantity Figure 11.3.a In this case there are two consumer groups with two different demand curves. Assuming marginal cost is zero, without price discrimination, consumer group 2 is left out of the market and thus has no consumer surplus. With price discrimination, consumer 2 is included in the market and collects some consumer surplus. At the same time, consumer 1 pays the same price under discrimination in this example, and therefore enjoys the same consumer surplus. The use of coupons (price discrimination) thus increases total consumer surplus in this example. Furthermore, although the net change in consumer surplus is ambiguous in general, there is a transfer of consumer surplus from price-insensitive to price-sensitive consumers. Thus, price-sensitive consumers will benefit from coupons, even though on net consumers as a whole can be worse off. b. Does prohibiting the use of coupons make German producers better off or worse off? Prohibiting the use of coupons will make the German producers worse off, or at least not better off. If firms can successfully price discriminate (i.e. they can prevent resale, there are barriers to entry, etc.), price discrimination can never make a firm worse off. 4. Suppose that BMW can produce any quantity of cars at a constant marginal cost equal to $20,000 and a fixed cost of $10 billion. You are asked to advise the CEO as to what prices and quantities BMW should set for sales in Europe and in the U.S. The demand for BMWs in each market is given by: QE = 4,000,000 - 100 PE and QU = 1,000,000 - 20PU

where the subscript e denotes Europe and the subscript U denotes the United States.Assume that BMW can restrict U.S.sales to authorized BMW dealers only a.What quantity of BMWs should the firm sell in each market,and what will the price be in each market?What will the total profit be? With separate markets,BMW chooses the appropriate levels of and Q to maximize profits,where profits are: π=TR-TC=(gP+QP)-g+Q20,000+10,000,000,000} Solve for Pa and P using the demand equations,and substitute the expressions into the profitequation: x=g(400m-8+e(0om-9-{g,+)20m+100,0m,0o. 100 20Y Differentiating and setting each derivative to zero to determine the profit-maximizing quantities: 0.0r10,0.cm and 10 Substituting and into their respective demand equations we may determine the price ofcars in each market: 1,000,000=4,000,000-100P。orPe=s30,000and 300,000=1,000.000.20PorP=$35.000. Substituting the values for Q.Q.Pe and P into the profit equation,we have x=《1.000,000(S30,000)+(300,000(35,000y·《1,300,000)20,000)+10.000.000,000.or 元=$4.5 billion. b.If BMW were forced to charge the same price in each market,what would be the qu antity sold in each market,the equi riu price,and the company profit? If BMW charged the same price in both markets,we substitute Q=+into the demand equation and write the new demand curve as 120 -120 Since the marginal revenue curve has twice the slope of the demand curve MR5000000_g 120

where the subscript E denotes Europe and the subscript U denotes the United States. Assume that BMW can restrict U.S. sales to authorized BMW dealers only. a. What quantity of BMWs should the firm sell in each market, and what will the price be in each market? What will the total profit be? With separate markets, BMW chooses the appropriate levels of QE and QU to maximize profits, where profits are: = TR− TC= QEPE + QUPU ( )− QE + QU ( )20,000 +10,000,000,000. Solve for PE and PU using the demand equations, and substitute the expressions into the profit equation: = QE 4 0, 000 − QE 100 + QU 5 0, 000 − QU 2 0 − QE + QU ( )2 0, 000 + 1 0,000,000,000. Differentiating and setting each derivative to zero to determine the profit-maximizing quantities: QE = 4 0,000 − QE 5 0 − 2 0, 000 = 0, or QE = 1,000,000 cars and QU = 5 0, 000 − QU 1 0 − 2 0, 000 = 0, o r QU = 300, 000 cars. Substituting QE and QU into their respective demand equations, we may determine the price of cars in each market: 1,000,000 = 4,000,000 - 100PE , or PE = $30,000 and 300,000 = 1,000,000 - 20PU, or PU = $35,000. Substituting the values for QE , QU, PE , and PU into the profit equation, we have = {(1,000,000)($30,000) + (300,000)($35,000)} - {(1,300,000)(20,000)) + 10,000,000,000}, or = $4.5 billion. b. If BMW were forced to charge the same price in each market, what would be the quantity sold in each market, the equilibrium price, and the company’s profit? If BMW charged the same price in both markets, we substitute Q = QE + QU into the demand equation and write the new demand curve as Q = 5,000,000 - 120P, or in inverse for as P = 5,000,000 120 − Q 120 . Since the marginal revenue curve has twice the slope of the demand curve: MR = 5,000,000 120 − Q 60

To find the profit-maximizing quantity,set marginal revenue equal to marginal cost: 300.00_g=20,00,org=130,000 120 60 Substitutinginto the demand equation to determine price: P=300.00 (1300,000 =$30,833.33 120 .120 Substituting into the demand equations for the European and American markets to find the quantity sold Qs=4,000,000-(100(30,833.3),orQs=916,667and Q=1,000,000-(20)30,833.3).0rQc=383,333. Substituting the values for Q and Pinto the profit equation,we find π={1.300.000*$30.833.33-1,300.000)20.000)+10.000.000.000.0r π=$4.083.333,330 5.A monopolist is deciding how to allocate output between two geographically ast and Midwest).Den aand and marginal revenue for P,=15-Q MR=15-2Q P2=25-202 MR2=25-4Qg The monopolist's total cost is C=5+3(+).What are price,output,profits marginal revenues,and deadweight loss (i)if the monopolist can price discriminate?(ii)if the law prohibits charging different prices in the two regions? With price discrimination.the monopolist chooses quantities in each market such that the marginl reven in cost is equal to 3(the slope ofthe total cost curve). In the first market 15.201=3,0rQ1=6. In the second market 25.49=3,0r22=5.5. Substituting into the respective demand equations,we find the following prices for the two markets: P,=15.6=s9and P2=2526.5)=$14 Noting that the total quantity produced is 11.5.then T=(6)9)+(5.514)-(6+(811.5)=s91.5 The monopoly deadweight loss in general is equal to

To find the profit-maximizing quantity, set marginal revenue equal to marginal cost: 5,000,000 120 − Q 60 = 20,000 , or Q* = 1,300,000. Substituting Q* into the demand equation to determine price: P = 5,000,000 120 − 1,300,000 120 = $30,833.33. Substituting into the demand equations for the European and American markets to find the quantity sold QE = 4,000,000 - (100)(30,833.3), or QE = 916,667 and QU = 1,000,000 - (20)(30,833.3), or QU = 383,333. Substituting the values for QE , QU, and P into the profit equation, we find = {1,300,000*$30,833.33} - {(1,300,000)(20,000)) + 10,000,000,000}, or = $4,083,333,330. 5. A monopolist is deciding how to allocate output between two geographically separated markets (East Coast and Midwest). Demand and marginal revenue for the two markets are: P1 = 15 - Q1 MR1 = 15 - 2Q1 P2 = 25 - 2Q2 MR2 = 25 - 4Q2 . The monopolist’s total cost is C = 5 + 3(Q1 + Q2 ). What are price, output, profits, marginal revenues, and deadweight loss (i) if the monopolist can price discriminate? (ii) if the law prohibits charging different prices in the two regions? With price discrimination, the monopolist chooses quantities in each market such that the marginal revenue in each market is equal to marginal cost. The marginal cost is equal to 3 (the slope of the total cost curve). In the first market 15 - 2Q1 = 3, or Q1 = 6. In the second market 25 - 4Q2 = 3, or Q2 = 5.5. Substituting into the respective demand equations, we find the following prices for the two markets: P1 = 15 - 6 = $9 and P2 = 25 - 2(5.5) = $14. Noting that the total quantity produced is 11.5, then = ((6)(9) + (5.5)(14)) - (5 + (3)(11.5)) = $91.5. The monopoly deadweight loss in general is equal to