正在加载图片...

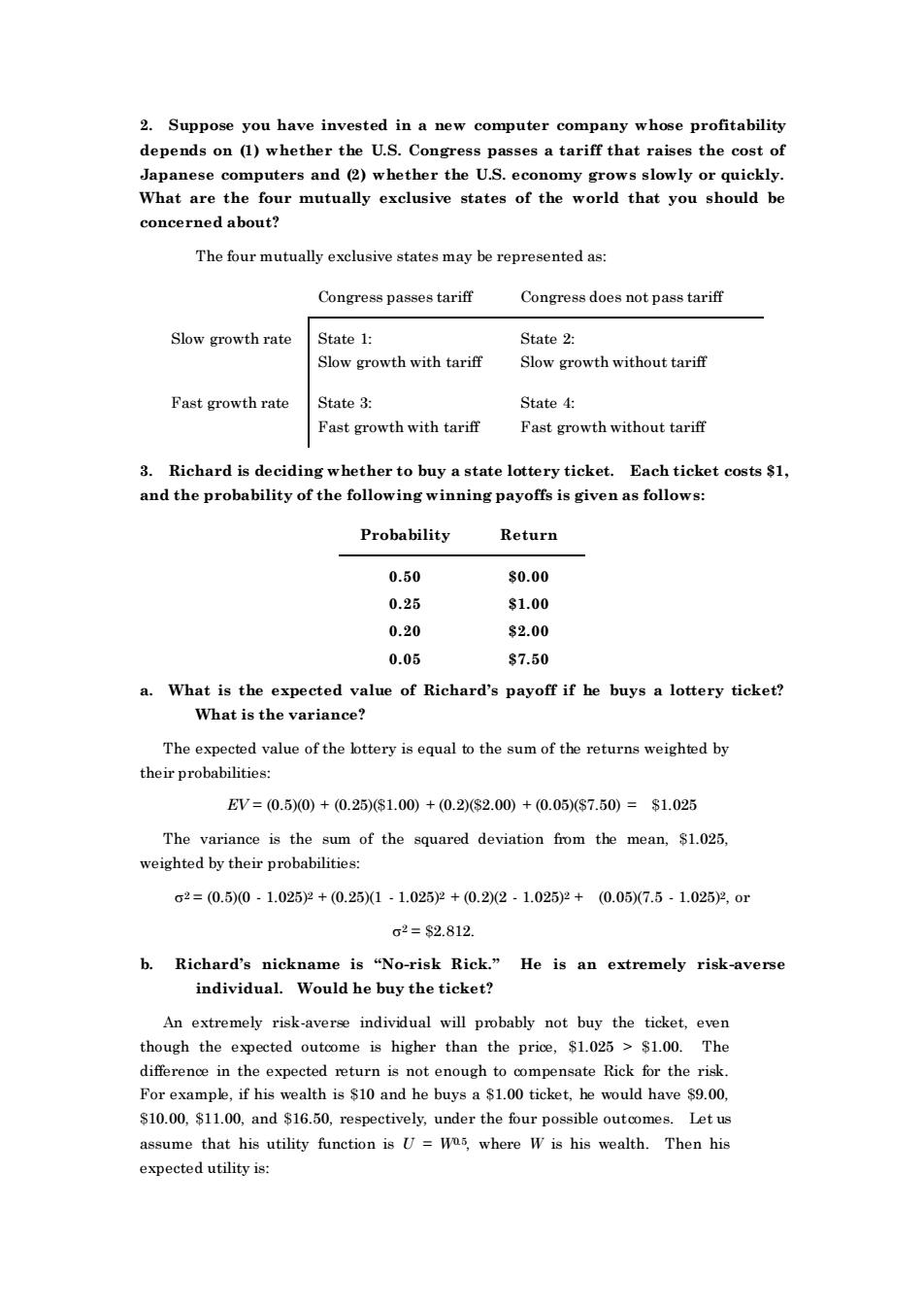

2.Suppose you have invested in a new computer company whose profitability depends on ()whether the U.S.Congress passes atarif that raises the Japanese computers and (2)whether the U.S.economy grows slowly or quickly What are the four mutually exclusive states of the world that you should be concerned about? The four mutually exclusive states may be represented as: Congress passes tariff Congress does not pass tariff Slow growth rate State 1: State 2: Slow growth with tariff Slow growth without tarif Fast growth rate State 3: State 4: ast growth with tariff Fast growth without tariff 3.Richard is deciding whether to buy astate lottery ticket.Each ticket costs$ and the probability of the following winning payoffs is given as follows: Probability Return 0.50 $0.00 0.25 $1.00 0.20 $2.00 0.05 $7.50 a.What is the expected value of Richard's payoff if he buys a lottery ticket? What is the variance? The expected value of the ttery isequal to the sum of by their probabilities EV=(0.50)+(0.25)s1.00)+(0.2(2.00)+(0.05)$7.50)=$1.025 The variance is the sum of the squared deviation from the mean,$1025 weighted by their probabilities: o2=(0.5)0·1.025)¥+(0.25(1·1.025)¥+(0.2(2·1.025)2+(0.05)(7.5-1.025)2.or o2=$2.812. b.Richard's nickname is "No-risk Rick."He is an extremely risk-averse individual.Would he buy the ticket? An extremely risk-averse individual will probably not buy the ticket,even though the expected outcome is higher than the price,$1025$1.00.The in the xpected Forexampk.ifh wl1oand be u0 ticket.be wuld have 59.0 ompens Rick for the risk $10.00,$11.00,and $16.50,respectively,under the four possible outcomes.Let us assume that his utility function is U=was,where W is his wealth.Then his expected utility is:2. Suppose you have invested in a new computer company whose profitability depends on (1) whether the U.S. Congress passes a tariff that raises the cost of Japanese computers and (2) whether the U.S. economy grows slowly or quickly. What are the four mutually exclusive states of the world that you should be concerned about? The four mutually exclusive states may be represented as: Congress passes tariff Congress does not pass tariff Slow growth rate State 1: Slow growth with tariff State 2: Slow growth without tariff Fast growth rate State 3: Fast growth with tariff State 4: Fast growth without tariff 3. Richard is deciding whether to buy a state lottery ticket. Each ticket costs $1, and the probability of the following winning payoffs is given as follows: Probability Return 0.50 $0.00 0.25 $1.00 0.20 $2.00 0.05 $7.50 a. What is the expected value of Richard’s payoff if he buys a lottery ticket? What is the variance? The expected value of the lottery is equal to the sum of the returns weighted by their probabilities: EV = (0.5)(0) + (0.25)($1.00) + (0.2)($2.00) + (0.05)($7.50) = $1.025 The variance is the sum of the squared deviation from the mean, $1.025, weighted by their probabilities: 2 = (0.5)(0 - 1.025)2 + (0.25)(1 - 1.025)2 + (0.2)(2 - 1.025)2 + (0.05)(7.5 - 1.025)2, or 2 = $2.812. b. Richard’s nickname is “No-risk Rick.” He is an extremely risk-averse individual. Would he buy the ticket? An extremely risk-averse individual will probably not buy the ticket, even though the expected outcome is higher than the price, $1.025 > $1.00. The difference in the expected return is not enough to compensate Rick for the risk. For example, if his wealth is $10 and he buys a $1.00 ticket, he would have $9.00, $10.00, $11.00, and $16.50, respectively, under the four possible outcomes. Let us assume that his utility function is U = W0.5, where W is his wealth. Then his expected utility is: