正在加载图片...

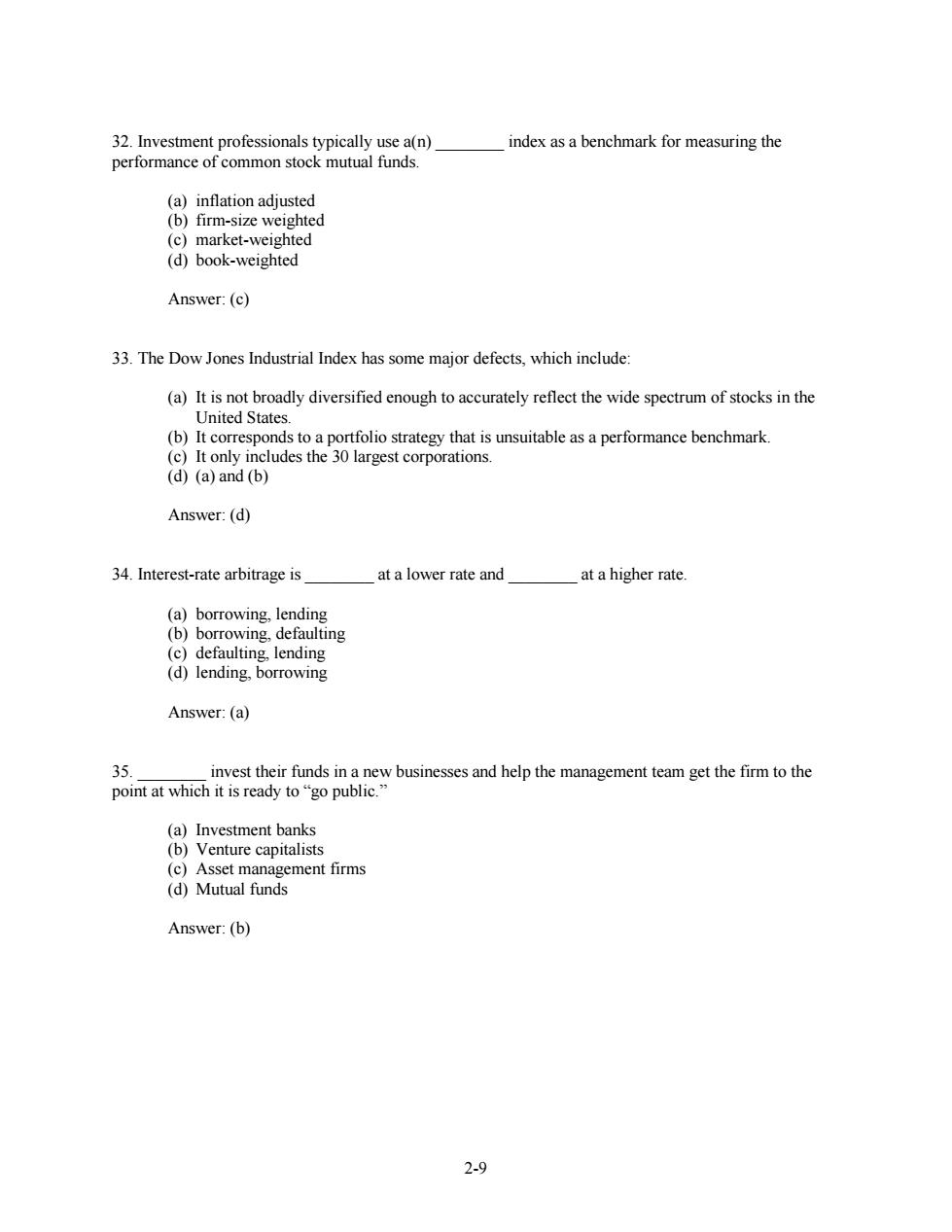

32.Investment professionals typically use a(n) index as a benchmark for measuring the performance of common stock mutual funds. (a)inflation adjusted (b)firm-size weighted (c)market-weighted (d)book-weighted Answer:(c) 33.The Dow Jones Industrial Index has some major defects,which include: (a)It is not broadly diversified enough to accurately reflect the wide spectrum of stocks in the United States. (b)It corresponds to a portfolio strategy that is unsuitable as a performance benchmark. (c)It only includes the 30 largest corporations. (d)(a)and (b) Answer:(d) 34.Interest-rate arbitrage is at a lower rate and at a higher rate. (a)borrowing,lending (b)borrowing,defaulting (c)defaulting,lending (d)lending,borrowing Answer:(a) 35. invest their funds in a new businesses and help the management team get the firm to the point at which it is ready to“go public..” (a)Investment banks (b)Venture capitalists (c)Asset management firms (d)Mutual funds Answer:(b) 2-92-9 32. Investment professionals typically use a(n) ________ index as a benchmark for measuring the performance of common stock mutual funds. (a) inflation adjusted (b) firm-size weighted (c) market-weighted (d) book-weighted Answer: (c) 33. The Dow Jones Industrial Index has some major defects, which include: (a) It is not broadly diversified enough to accurately reflect the wide spectrum of stocks in the United States. (b) It corresponds to a portfolio strategy that is unsuitable as a performance benchmark. (c) It only includes the 30 largest corporations. (d) (a) and (b) Answer: (d) 34. Interest-rate arbitrage is ________ at a lower rate and ________ at a higher rate. (a) borrowing, lending (b) borrowing, defaulting (c) defaulting, lending (d) lending, borrowing Answer: (a) 35. ________ invest their funds in a new businesses and help the management team get the firm to the point at which it is ready to “go public.” (a) Investment banks (b) Venture capitalists (c) Asset management firms (d) Mutual funds Answer: (b)