正在加载图片...

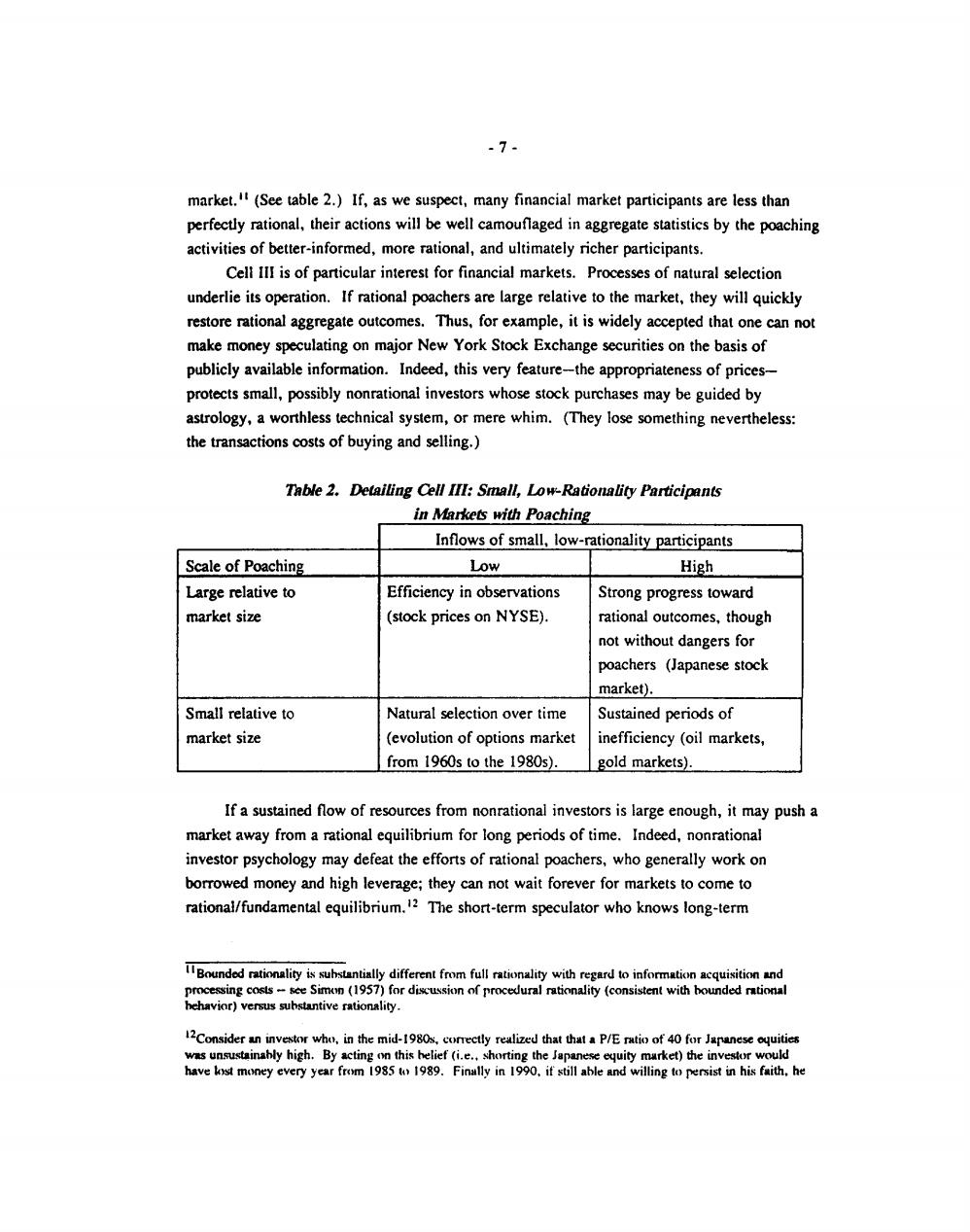

-7- market.(See table 2.)If,as we suspect,many financial market participants are less than perfectly rational,their actions will be well camouflaged in aggregate statistics by the poaching activities of better-informed,more rational,and ultimately richer participants. Cell III is of particular interest for financial markets.Processes of natural selection underlie its operation.If rational poachers are large relative to the market,they will quickly restore rational aggregate outcomes.Thus,for example,it is widely accepted that one can not make money speculating on major New York Stock Exchange securities on the basis of publicly available information.Indeed,this very feature-the appropriateness of prices- protects small,possibly nonrational investors whose stock purchases may be guided by astrology,a worthless technical system,or mere whim.(They lose something nevertheless: the transactions costs of buying and selling. Table 2.Detailing Cell III:Small,Low-Rationality Participants in Markets with Poaching Inflows of small,low-rationality participants Scale of Poaching Low High Large relative to Efficiency in observations Strong progress toward market size (stock prices on NYSE). rational outcomes,though not without dangers for poachers (Japanese stock market). Small relative to Natural selection over time Sustained periods of market size (evolution of options market inefficiency (oil markets, from 1960s to the 1980s). gold markets). If a sustained flow of resources from nonrational investors is large enough,it may push a market away from a rational equilibrium for long periods of time.Indeed,nonrational investor psychology may defeat the efforts of rational poachers,who generally work on borrowed money and high leverage;they can not wait forever for markets to come to rational/fundamental equilibrium.12 The short-term speculator who knows long-term Bounded rationlity is sustntilly different from full rationity withetoinformtion acqsition nd processing costs-see Simon (1957)for discussion of procedural rationality (consistent with bounded rational hehavior)versus suhstantive rationality. 12Consider a investor who.in the mid-1980s,comrectly realized that thatP/E ratio of 40 forJaesequities was unsustainably high.By acting on this helief(i.e..shorting the Japanese equity market)the investor would have kst money every year from 19851989.Finally in 1990.if still able and willing to persist in his faith,he