正在加载图片...

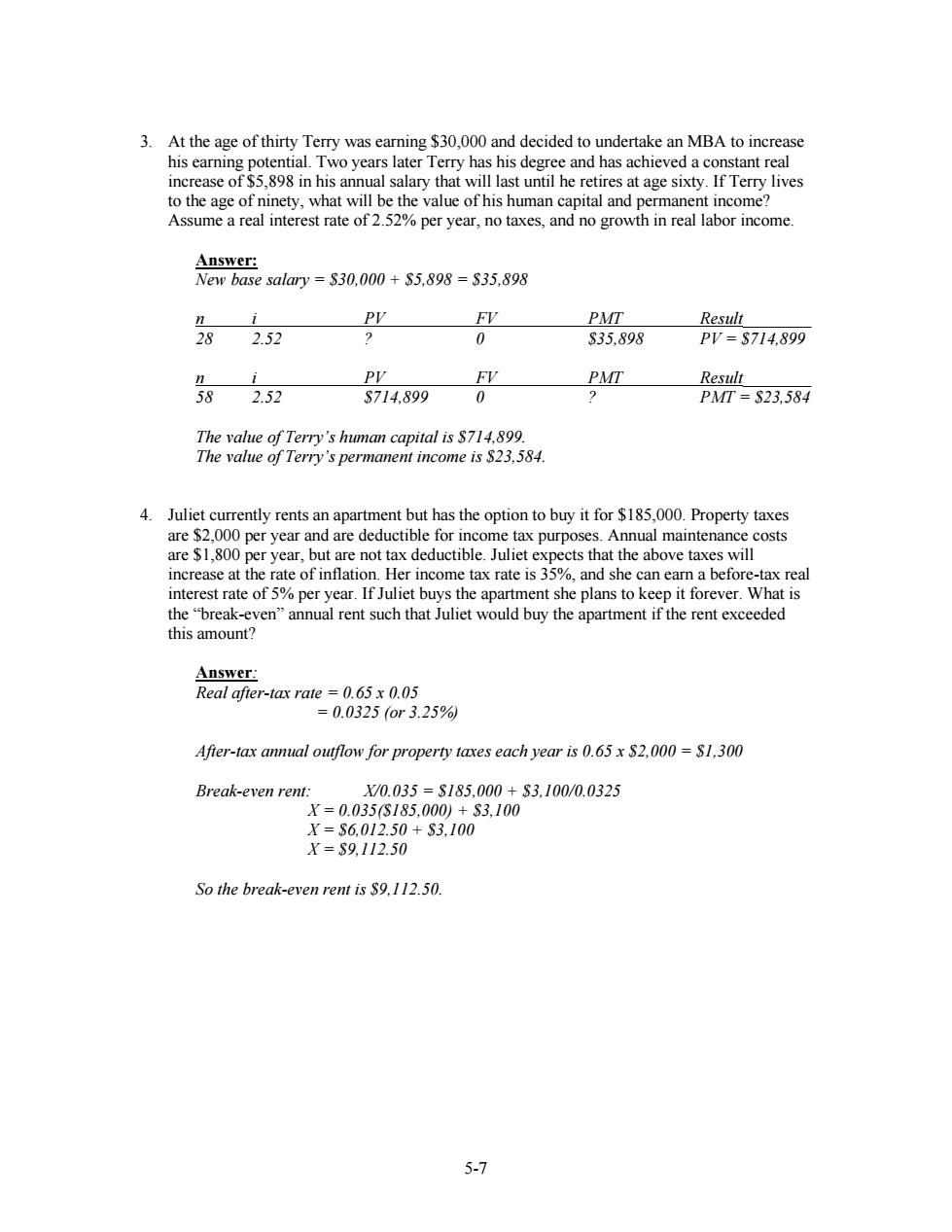

3.At the age of thirty Terry was earning $30,000 and decided to undertake an MBA to increase his earning potential.Two years later Terry has his degree and has achieved a constant real increase of $5,898 in his annual salary that will last until he retires at age sixty.If Terry lives to the age of ninety,what will be the value of his human capital and permanent income? Assume a real interest rate of 2.52%per year,no taxes,and no growth in real labor income. Answer: New base salary S30,000 S5,898=$35,898 PV FV PMT Result 28 2.52 0 S35,898 PV=S714,899 n i PV FV PMT Result 58 2.52 S714,899 0 PMT=S23,584 The value of Terry's human capital is $714,899. The value of Terry's permanent income is $23,584. 4.Juliet currently rents an apartment but has the option to buy it for $185,000.Property taxes are $2,000 per year and are deductible for income tax purposes.Annual maintenance costs are $1,800 per year,but are not tax deductible.Juliet expects that the above taxes will increase at the rate of inflation.Her income tax rate is 35%,and she can earn a before-tax real interest rate of 5%per year.If Juliet buys the apartment she plans to keep it forever.What is the"break-even"annual rent such that Juliet would buy the apartment if the rent exceeded this amount? Answer: Real after-tax rate =0.65 x 0.05 =0.0325or3.25% After-tax annual outflow for property taxes each year is 0.65x $2,000=$1,300 Break-even rent: X0.035=S185,000+S3,100/0.0325 X=0.035S185,000)+S3,100 X=S6,012.50+S3,100 X=S9.112.50 So the break-even rent is $9,112.50. 5-75-7 3. At the age of thirty Terry was earning $30,000 and decided to undertake an MBA to increase his earning potential. Two years later Terry has his degree and has achieved a constant real increase of $5,898 in his annual salary that will last until he retires at age sixty. If Terry lives to the age of ninety, what will be the value of his human capital and permanent income? Assume a real interest rate of 2.52% per year, no taxes, and no growth in real labor income. Answer: New base salary = $30,000 + $5,898 = $35,898 n i PV FV PMT Result________ 28 2.52 ? 0 $35,898 PV = $714,899 n i PV FV PMT Result________ 58 2.52 $714,899 0 ? PMT = $23,584 The value of Terry’s human capital is $714,899. The value of Terry’s permanent income is $23,584. 4. Juliet currently rents an apartment but has the option to buy it for $185,000. Property taxes are $2,000 per year and are deductible for income tax purposes. Annual maintenance costs are $1,800 per year, but are not tax deductible. Juliet expects that the above taxes will increase at the rate of inflation. Her income tax rate is 35%, and she can earn a before-tax real interest rate of 5% per year. If Juliet buys the apartment she plans to keep it forever. What is the “break-even” annual rent such that Juliet would buy the apartment if the rent exceeded this amount? Answer: Real after-tax rate = 0.65 x 0.05 = 0.0325 (or 3.25%) After-tax annual outflow for property taxes each year is 0.65 x $2,000 = $1,300 Break-even rent: X/0.035 = $185,000 + $3,100/0.0325 X = 0.035($185,000) + $3,100 X = $6,012.50 + $3,100 X = $9,112.50 So the break-even rent is $9,112.50