正在加载图片...

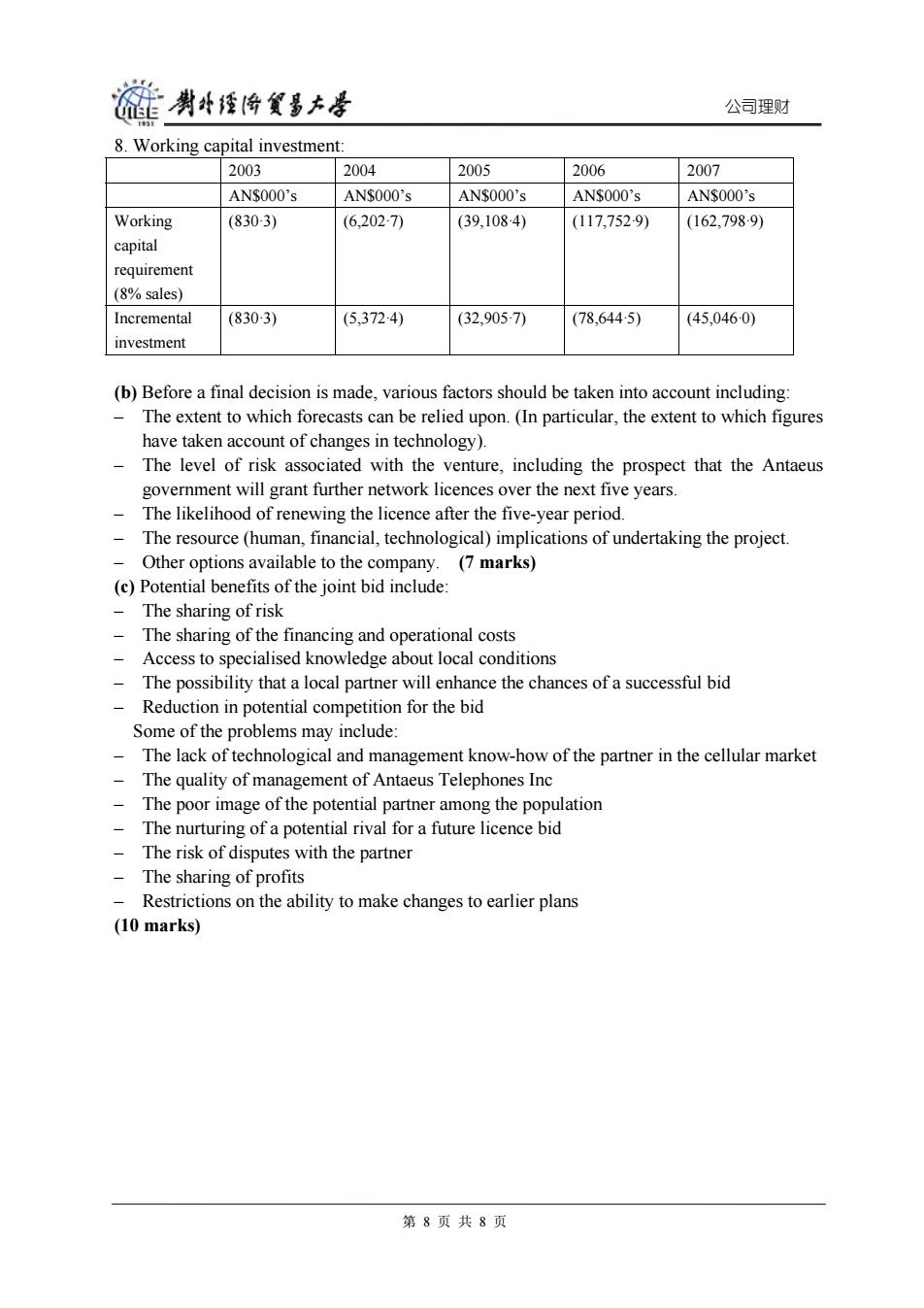

碰肖经海食多大号 公司理财 8.Working capital investment: 2003 2004 2005 2006 2007 AN$000's AN$000's AN$000's AN$000's AN$000's Working (830-3) (6,202-7) (39,1084) (117,752-9) (162,7989) capital requirement (8%sales) Incremental (830-3) (5,3724) (32,905-7) (78.6445) (45,046·0) investment (b)Before a final decision is made,various factors should be taken into account including: The extent to which forecasts can be relied upon.(In particular,the extent to which figures have taken account of changes in technology). The level of risk associated with the venture,including the prospect that the Antaeus government will grant further network licences over the next five years. The likelihood of renewing the licence after the five-year period. The resource (human,financial,technological)implications of undertaking the project. Other options available to the company.(7 marks) (c)Potential benefits of the joint bid include: The sharing of risk The sharing of the financing and operational costs Access to specialised knowledge about local conditions The possibility that a local partner will enhance the chances of a successful bid Reduction in potential competition for the bid Some of the problems may include: The lack of technological and management know-how of the partner in the cellular market The quality of management of Antaeus Telephones Inc The poor image of the potential partner among the population The nurturing of a potential rival for a future licence bid The risk of disputes with the partner The sharing of profits Restrictions on the ability to make changes to earlier plans (10 marks) 第8页共8页公司理财 8. Working capital investment: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s Working capital requirement (8% sales) (830·3) (6,202·7) (39,108·4) (117,752·9) (162,798·9) Incremental investment (830·3) (5,372·4) (32,905·7) (78,644·5) (45,046·0) (b) Before a final decision is made, various factors should be taken into account including: – The extent to which forecasts can be relied upon. (In particular, the extent to which figures have taken account of changes in technology). – The level of risk associated with the venture, including the prospect that the Antaeus government will grant further network licences over the next five years. – The likelihood of renewing the licence after the five-year period. – The resource (human, financial, technological) implications of undertaking the project. – Other options available to the company. (7 marks) (c) Potential benefits of the joint bid include: – The sharing of risk – The sharing of the financing and operational costs – Access to specialised knowledge about local conditions – The possibility that a local partner will enhance the chances of a successful bid – Reduction in potential competition for the bid Some of the problems may include: – The lack of technological and management know-how of the partner in the cellular market – The quality of management of Antaeus Telephones Inc – The poor image of the potential partner among the population – The nurturing of a potential rival for a future licence bid – The risk of disputes with the partner – The sharing of profits – Restrictions on the ability to make changes to earlier plans (10 marks) 第 8 页 共 8 页