链男4经降贸多大是 公司理财 PROJECT 4 The Antaeus licence Antaeus is a small,self-governing state that occupies a narrow strip of land at the southern tip of the Nereus Peninsula.It has two million inhabitants and the population is not expected increase in the foreseeable future.The economy has been growing at around 4%per annum in recent years and an OECD report suggests that this rate of growth is set to rise over the next few years.Its democratically-elected government is committed to a strategy of modernisation and has implemented a number of radical reforms in recent years,including the privatisation of state industries. Geryon plc is the only licensed cellular telephone network business operating within Antaeus.It has been much criticised as it has proved incapable of meeting the needs of an increasingly prosperous and well-educated population.The geography of the country has led to problems in establishing a reliable network and charges for using the network are high.In order to maximise its profits,Geryon plc has focused on business users who are prepared to pay high prices. The government of Antaeus is aware of these problems and so,to stimulate competition and to improve the level of service available,it has decided to grant a further licence to operate a cellular telephone network within the country.The licence will be put up for auction in two months time and will last for a period of five years.A review will take place at the end of this period in order to see whether the licence should be renewed for a further five years or whether a further auction should take place. Heracles telecommunications plc is interested in making a bid for the licence.The company currently provides cellulartelephone networks throughout Western Europe.Although this has proved to be very profitable,increasing competition and a downturn in the demand for cellular telephones in a number of Western European countries has produced gloomy forecasts of future prospects.As a result,the Board of Directors is seeking more profitable geographical areas for the company's products and services.The Special Projects Division of the company has recently produced,with the help of a number of business information agencies, information that may be useful in formulating a bid for the Antaeus licence. The following charging structure (expressed in Antaeus dollars)is currently being adopted by Geryon plc for its Antaeus customers: 1.An annual rental charge of AN$50 per cellular telephone payable in advance. 2.An airtime charge of AN$0-50 per minute for local calls and AN$3-00 per minute for international calls. Heracles telecommunications plc is considering undercutting these charges by offering: 1.An annual rental charge of AN$40 per cellular telephone payable in advance. 2.An airtime charge of AN$0-30 per minute for local calls and AN$2-50 per minute for international calls. The level of ownership of cellular telephones within the country over the next five years, within various income ranges,is predicted to be as follows: Percentage of population owning a cellular telephone 第1页共8页

公司理财 PROJECT 4 The Antaeus licence Antaeus is a small, self-governing state that occupies a narrow strip of land at the southern tip of the Nereus Peninsula. It has two million inhabitants and the population is not expected increase in the foreseeable future. The economy has been growing at around 4% per annum in recent years and an OECD report suggests that this rate of growth is set to rise over the next few years. Its democratically-elected government is committed to a strategy of modernisation and has implemented a number of radical reforms in recent years, including the privatisation of state industries. Geryon plc is the only licensed cellular telephone network business operating within Antaeus. It has been much criticised as it has proved incapable of meeting the needs of an increasingly prosperous and well-educated population. The geography of the country has led to problems in establishing a reliable network and charges for using the network are high. In order to maximise its profits, Geryon plc has focused on business users who are prepared to pay high prices. The government of Antaeus is aware of these problems and so, to stimulate competition and to improve the level of service available, it has decided to grant a further licence to operate a cellular telephone network within the country. The licence will be put up for auction in two months time and will last for a period of five years. A review will take place at the end of this period in order to see whether the licence should be renewed for a further five years or whether a further auction should take place. Heracles telecommunications plc is interested in making a bid for the licence. The company currently provides cellulartelephone networks throughout Western Europe. Although this has proved to be very profitable, increasing competition and a downturn in the demand for cellular telephones in a number of Western European countries has produced gloomy forecasts of future prospects. As a result, the Board of Directors is seeking more profitable geographical areas for the company’s products and services. The Special Projects Division of the company has recently produced, with the help of a number of business information agencies, information that may be useful in formulating a bid for the Antaeus licence. The following charging structure (expressed in Antaeus dollars) is currently being adopted by Geryon plc for its Antaeus customers: 1. An annual rental charge of AN$50 per cellular telephone payable in advance. 2. An airtime charge of AN$0·50 per minute for local calls and AN$3·00 per minute for international calls. Heracles telecommunications plc is considering undercutting these charges by offering: 1. An annual rental charge of AN$40 per cellular telephone payable in advance. 2. An airtime charge of AN$0·30 per minute for local calls and AN$2·50 per minute for international calls. The level of ownership of cellular telephones within the country over the next five years, within various income ranges, is predicted to be as follows: Percentage of population owning a cellular telephone 第 1 页 共 8 页

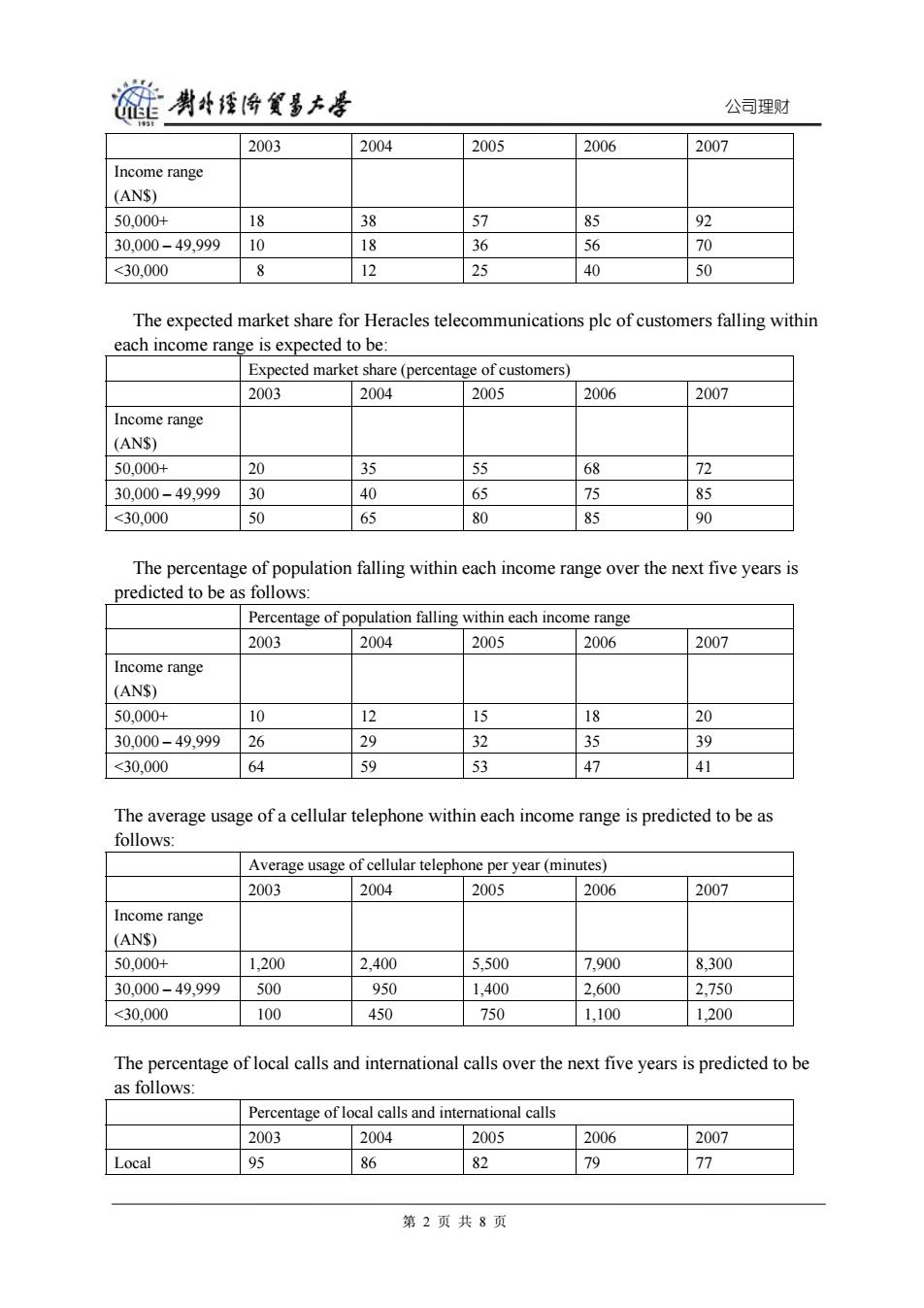

旋剥华吟食多大号 公司理财 2003 2004 2005 2006 2007 Income range (ANS) 50.000+ 18 38 57 85 92 30.000-49.999 10 18 36 56 70 <30,000 8 12 25 40 50 The expected market share for Heracles telecommunications plc of customers falling within each income range is expected to be: Expected market share(percentage of customers) 2003 2004 2005 2006 2007 Income range (ANS) 50,000+ 20 35 55 68 72 30,000-49,999 30 40 65 75 85 <30.000 50 65 80 85 90 The percentage of population falling within each income range over the next five years is predicted to be as follows: Percentage of population falling within each income range 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 10 12 15 18 20 30.000-49.999 26 29 32 35 39 <30,000 64 59 53 47 41 The average usage of a cellular telephone within each income range is predicted to be as follows: Average usage of cellular telephone per year(minutes) 2003 2004 2005 2006 2007 Income range (ANS) 50.000+ 1,200 2,400 5,500 7,900 8,300 30.000-49.999 500 950 1,400 2.600 2,750 <30.000 100 450 750 1,100 1,200 The percentage of local calls and international calls over the next five years is predicted to be as follows: Percentage of local calls and international calls 2003 2004 2005 2006 2007 Local 95 86 82 79 77 第2页共8页

公司理财 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 18 38 57 85 92 30,000 – 49,999 10 18 36 56 70 <30,000 8 12 25 40 50 The expected market share for Heracles telecommunications plc of customers falling within each income range is expected to be: Expected market share (percentage of customers) 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 20 35 55 68 72 30,000 – 49,999 30 40 65 75 85 <30,000 50 65 80 85 90 The percentage of population falling within each income range over the next five years is predicted to be as follows: Percentage of population falling within each income range 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 10 12 15 18 20 30,000 – 49,999 26 29 32 35 39 <30,000 64 59 53 47 41 The average usage of a cellular telephone within each income range is predicted to be as follows: Average usage of cellular telephone per year (minutes) 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 1,200 2,400 5,500 7,900 8,300 30,000 – 49,999 500 ,950 1,400 2,600 2,750 <30,000 100 450 750 1,100 1,200 The percentage of local calls and international calls over the next five years is predicted to be as follows: Percentage of local calls and international calls 2003 2004 2005 2006 2007 Local 95 86 82 79 77 第 2 页 共 8 页

碰肖经降贸多大是 公司理财 International 5 14 18 21 23 Nearly all of the international calls are expected to be made by customers within the AN$50,000+income range. The following costs of establishing a new cellular network have been estimated: 1.Eight cell sites each costing between AN$200,000 and AN$250,000 will be required.The cost of these cell sites will be incurred during the first year of operations. 2.The cost of a cellular phone is AN$300,which will be borne by the company rather than the customer. 3.The cost of offices and other buildings will be AN$950,000 and will be incurred during the first year of operations.These offices will be sold soon after the end of the licence period for between AN$800,000 and AN$900,000. 4.Marketing and promotional operations will have a budget equal to 10%of sales revenue. 5.The variable costs of operating the system(excluding the marketing costs mentioned above) are expected to be 40%of sales revenue. 6.The annual fixed costs of operating the system are expected to be AN$2 million.However, this figure will rise in steps of AN$300,000 for every 10,000 customers (or part of this figure) above a customer base of 100,000. 7.Working capital is estimated at 8%of sales revenue.The working capital investment will be released soon after the end of the licence period. The Board of Directors of Heracles telecommunications plc met recently to consider the licence bid and three key issues arose.FIrstly,it became apparent that the above figures do not really take account of the possibility that Geryon plc will respond to the new competition by cutting its own charges.However,the continuing problems with the reliability of the network, high operating costs and a poor reputation among customers was likely or prevent Geryon plc from responding effectively within the first three years of the new licence period.Thereafter, Geryon plc could respond by matching the prices of Heracles telecommunications plc and this could result in Geryon plc obtaining a market share of up to 50%of those customers within the AN$50,000+range,although a more likely figure would be around 40%. Secondly,it was by no means certain that Heracles telecommunications plc could avoid the technical problems that have dogged Geryon plc.Although the Technical Director was confident that the problems could be solved using technology developed by the company, some of his key staff did not agree.If the technology owned by the company is inadequate, new technology costing between AN$5 million and AN$6 million in the first year will have to be purchased. Thirdly,the company has recently been approached by Antaeus Telephone Inc,which also has an interest in the forthcoming licence bid.Antaeus Telephones Inc was formed in 1997 as part of the government's privatization programme.Although owned by private shareholders, the company enjoys a monopoly over the fixed line network that was formerly under state control.Antaeus Telephones Inc has proposed a joint bid with Heracles telecommunications plc for the new licence and,assuming the bid is successful,would expect the revenues and costs of the cellular network to be shared equally.Antaeus Telephones Inc has a reputation for being overstaffed and inefficient,however,it is trying to shed this image and now wishes to 第3页共8页

公司理财 International 5 14 18 21 23 Nearly all of the international calls are expected to be made by customers within the AN$50,000+ income range. The following costs of establishing a new cellular network have been estimated: 1. Eight cell sites each costing between AN$200,000 and AN$250,000 will be required. The cost of these cell sites will be incurred during the first year of operations. 2. The cost of a cellular phone is AN$300, which will be borne by the company rather than the customer. 3. The cost of offices and other buildings will be AN$950,000 and will be incurred during the first year of operations. These offices will be sold soon after the end of the licence period for between AN$800,000 and AN$900,000. 4. Marketing and promotional operations will have a budget equal to 10% of sales revenue. 5. The variable costs of operating the system (excluding the marketing costs mentioned above) are expected to be 40% of sales revenue. 6. The annual fixed costs of operating the system are expected to be AN$2 million. However, this figure will rise in steps of AN$300,000 for every 10,000 customers (or part of this figure) above a customer base of 100,000. 7. Working capital is estimated at 8% of sales revenue. The working capital investment will be released soon after the end of the licence period. The Board of Directors of Heracles telecommunications plc met recently to consider the licence bid and three key issues arose. FIrstly, it became apparent that the above figures do not really take account of the possibility that Geryon plc will respond to the new competition by cutting its own charges. However, the continuing problems with the reliability of the network, high operating costs and a poor reputation among customers was likely or prevent Geryon plc from responding effectively within the first three years of the new licence period. Thereafter, Geryon plc could respond by matching the prices of Heracles telecommunications plc and this could result in Geryon plc obtaining a market share of up to 50% of those customers within the AN$50,000+ range, although a more likely figure would be around 40%. Secondly, it was by no means certain that Heracles telecommunications plc could avoid the technical problems that have dogged Geryon plc. Although the Technical Director was confident that the problems could be solved using technology developed by the company, some of his key staff did not agree. If the technology owned by the company is inadequate, new technology costing between AN$5 million and AN$6 million in the first year will have to be purchased. Thirdly, the company has recently been approached by Antaeus Telephone Inc, which also has an interest in the forthcoming licence bid. Antaeus Telephones Inc was formed in 1997 as part of the government’s privatization programme. Although owned by private shareholders, the company enjoys a monopoly over the fixed line network that was formerly under state control. Antaeus Telephones Inc has proposed a joint bid with Heracles telecommunications plc for the new licence and, assuming the bid is successful, would expect the revenues and costs of the cellular network to be shared equally. Antaeus Telephones Inc has a reputation for being overstaffed and inefficient, however, it is trying to shed this image and now wishes to 第 3 页 共 8 页

链男母经降贸多大量 公司理财 branch out into new areas of operations. The Antaeus licence has excited much interest within the telecommunications industry and competition for the licence is expected to be stiff.Investments analysts specialising in the telecommunications sector believe that the successful bidder will have to pay between ANS 650-720 million in order to secure the licence. The Board of Directors of Heracles telecommunications plc has decided to meet in the near future to discuss the bid further.The company has a cost of capital of 12%. Required: Prepare a report to the Board of Directors of Heracles telecommunications plc concerning the forthcoming bid.In the report,you should: (a)suggest,with reasons,a guide price for the licence that the directors should consider as a basis for further discussion.(33 marks) (b)identify and discuss any significant factors that are not included in your answer to (a) above and which should be taken into account before a final decision is made.(7 marks) (c)discuss the issues that should be taken into account when deciding upon the joint bid proposal from Antaeus Telephones Inc.(10 marks) Notes: 1.In answering part(a)all key workings and assumptions must be clearly stated. 2.Workings should be in AN$000's and should be to one decimal place. 3.Ignore taxation. (50 marks) SUGGESTED ANSWERS FOR PROJECT The Antaeus licence The case study could be answered in various ways.The points made below should, therefore,be regarded as indicative. (a)Suggested price This part should include a net present value (NPV)calculation.The price paid for the licence should not exceed the net present value of the future cash flows if the wealth of shareholders is to be kept intact. The NPV calculations set out below rest on the following key assumptions: 1.The cost of each cell site will be AN$225,000(i.e.the middle of the range stated in the case study). 2.The offices and other buildings will be sold for AN$850,000(i.e.the middle of the range stated in the case study)andwill be sold in the sixth year. 3.The market share of those in the income range AN$50,000+that is retained by Geryon plc is 40%(i.e.the most likely figure)in the final two years of the licence. 第4页共8页

公司理财 branch out into new areas of operations. The Antaeus licence has excited much interest within the telecommunications industry and competition for the licence is expected to be stiff. Investments analysts specialising in the telecommunications sector believe that the successful bidder will have to pay between AN$ 650 – 720 million in order to secure the licence. The Board of Directors of Heracles telecommunications plc has decided to meet in the near future to discuss the bid further. The company has a cost of capital of 12%. Required: Prepare a report to the Board of Directors of Heracles telecommunications plc concerning the forthcoming bid. In the report, you should: (a) suggest, with reasons, a guide price for the licence that the directors should consider as a basis for further discussion. (33 marks) (b) identify and discuss any significant factors that are not included in your answer to (a) above and which should be taken into account before a final decision is made. (7 marks) (c) discuss the issues that should be taken into account when deciding upon the joint bid proposal from Antaeus Telephones Inc. (10 marks) Notes: 1. In answering part (a) all key workings and assumptions must be clearly stated. 2. Workings should be in AN$000’s and should be to one decimal place. 3. Ignore taxation. (50 marks) SUGGESTED ANSWERS FOR PROJECT The Antaeus licence The case study could be answered in various ways. The points made below should, therefore, be regarded as indicative. (a) Suggested price This part should include a net present value (NPV) calculation. The price paid for the licence should not exceed the net present value of the future cash flows if the wealth of shareholders is to be kept intact. The NPV calculations set out below rest on the following key assumptions: 1. The cost of each cell site will be AN$225,000 (i.e. the middle of the range stated in the case study). 2. The offices and other buildings will be sold for AN$850,000 (i.e. the middle of the range stated in the case study) andwill be sold in the sixth year. 3. The market share of those in the income range AN$50,000+ that is retained by Geryon plc is 40% (i.e. the most likely figure) in the final two years of the licence. 第 4 页 共 8 页

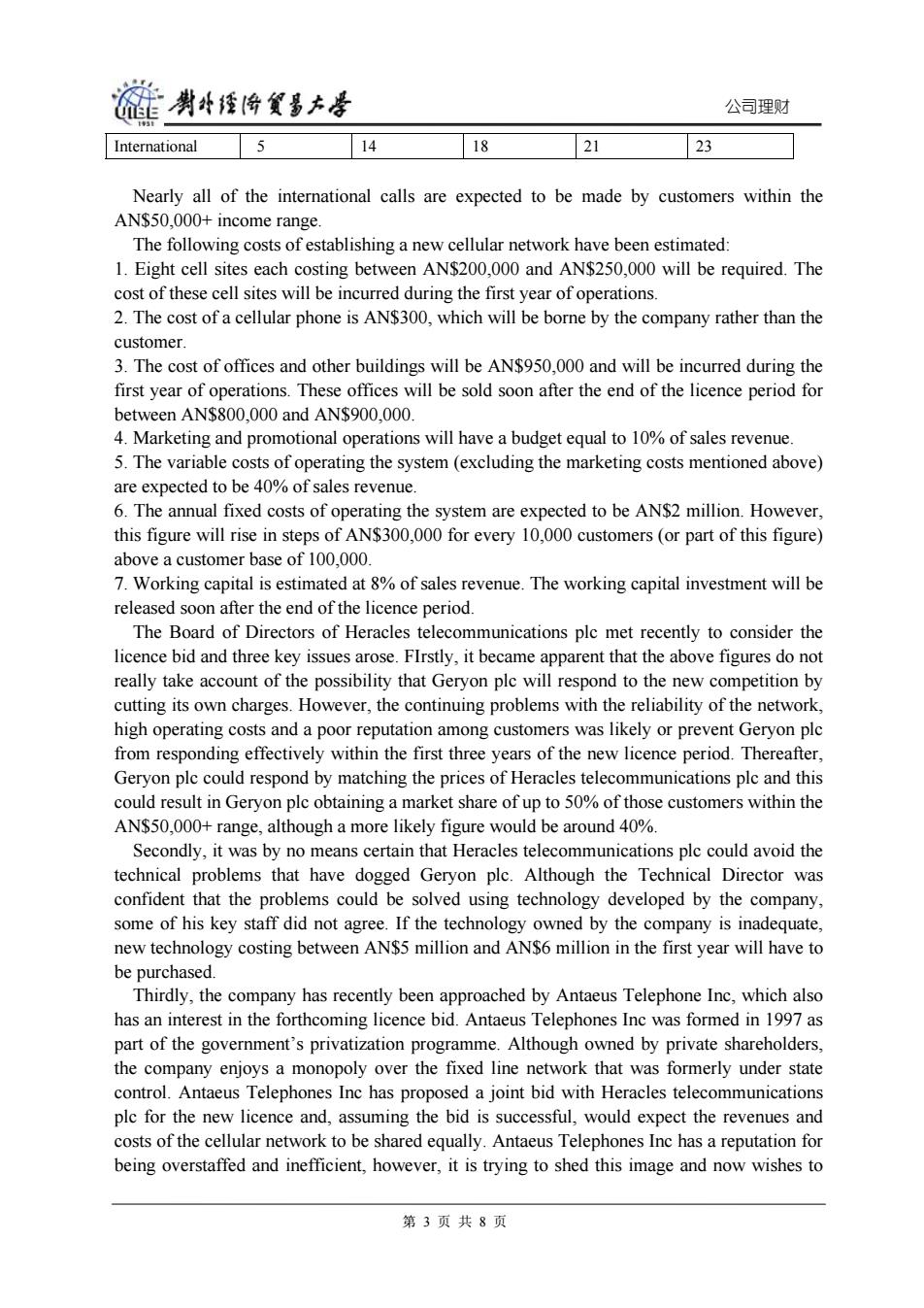

莲勇哈餐多产孝 公司理财 4.No investment in new technology will be required (i.e.the Technical Director's judgement is correct). 5.All international phone calls are made by customers in the income range AN$50,000+. 6.There will be no benefits accruing after the five-year period of the licence. (10 marks) NPV calculations 2003 2004 2005 2006 2007 2008 AN$000's AN$000's AN$000's AN$000's AN$000's AN$000's Rental charges 2.960-0 6,6288 18232.4 31,888-0 42,156-0 Airtime charge 7.4184 70.9047 470.622-7 1.440.0233 1.992.8303 10.3784 77.5335 488.8551 1.471.9113 2.034.9863 Cell sites (1,800-0) Phones (22,200-0) (49,716-0) (136,743-0) (239,160-0) (316,170-0) Buildings (950-0) 850-0 Marketing (1,037-8) (7,7534) (48,885-6) (147,191-1) (203,4986) (10%sales) Variable costs (4,1514) (31,0134) (195,5420) (588,764-5) (813,9945) (40%sales) Fixed costs (2.000-0) (4,100-0) (12,800-0) (23.000-0) (30.800-0) Working capital (8303) (53724) (32.9057 (78.644:5 (45.046-0 162.798-9 (32.9695) (97,9552) (426.876-3) (1,076,760-1) (1,409,509-1) 163,6489 Net cash flows (22,591-1) (20,421-7) 61,9788 395,151-2 625,477-2 163,6489 Disc.Rate 12% 0-89 0-80 0-71 0-64 0-57 0-51 PV (20,106-1) (163374) 44.004.9 252.8968 356,522-0 83.4609 NPV 700.441-1 The NPV figure above represents the maximum amount that should be paid.Candidates may suggest a lower price supported by reasons.However,if the views of investment analysts are to be believed,a figure close to the NPV figure may have to be paid for the bid to stand a chance of success.(23 marks) Workings The workings necessary for the above NPV analysis will include the following: 1.The predicted population numbers falling within each income range are: Population within each income range 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 200.000 240.000 300.000 360.000 400.000 30.000-49.999 520.000 580.000 640.000 700.000 780.000 <30.000 1,280.000 1.180.000 1,060.000 940.000 820.000 2.The predicted population numbers owning a cellular telephone are: 第5页共8页

公司理财 4. No investment in new technology will be required (i.e. the Technical Director’s judgement is correct). 5. All international phone calls are made by customers in the income range AN$50,000+. 6. There will be no benefits accruing after the five-year period of the licence. (10 marks) NPV calculations 2003 AN$000’s 2004 AN$000’s 2005 AN$000’s 2006 AN$000’s 2007 AN$000’s 2008 AN$000’s Rental charges Airtime charge Cell sites Phones Buildings Marketing (10% sales) Variable costs (40% sales) Fixed costs Working capital Net cash flows Disc. Rate 12% PV NPV 2,960·0 7,418·4 10,378·4 (1,800·0) (22,200·0) (950·0) (1,037·8) (4,151·4) (2,000·0) (830·3) (32,969·5) (22,591·1) 0·89 (20,106·1) 700,441·1 6,628·8 70,904·7 77,533·5 (49,716·0) (7,753·4) (31,013·4) (4,100·0) (5,372·4) (97,955·2) (20,421·7) 0·80 (16,337·4) 18,232.4 470,622·7 488,855·1 (136,743·0) (48,885·6) (195,542·0) (12,800·0) (32,905·7) (426,876·3) 61,978·8 0·71 44,004·9 31,888·0 1,440,023·3 1,471,911·3 (239,160·0) (147,191·1) (588,764·5) (23,000·0) (78,644·5) (1,076,760·1) 395,151·2 0·64 252,896·8 42,156·0 1,992,830·3 2,034,986·3 (316,170·0) (203,498·6) (813,994·5) (30,800·0) (45,046·0) (1,409,509·1) 625,477·2 0·57 356,522·0 850·0 162,798·9 163,648·9 163,648·9 0·51 83,460·9 The NPV figure above represents the maximum amount that should be paid. Candidates may suggest a lower price supported by reasons. However, if the views of investment analysts are to be believed, a figure close to the NPV figure may have to be paid for the bid to stand a chance of success. (23 marks) Workings The workings necessary for the above NPV analysis will include the following: 1. The predicted population numbers falling within each income range are: Population within each income range 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 200,000 240,000 300,000 360,000 400,000 30,000 – 49,999 520,000 580,000 640,000 700,000 780,000 <30,000 1,280,000 1,180,000 1,060,000 940,000 820,000 2. The predicted population numbers owning a cellular telephone are: 第 5 页 共 8 页

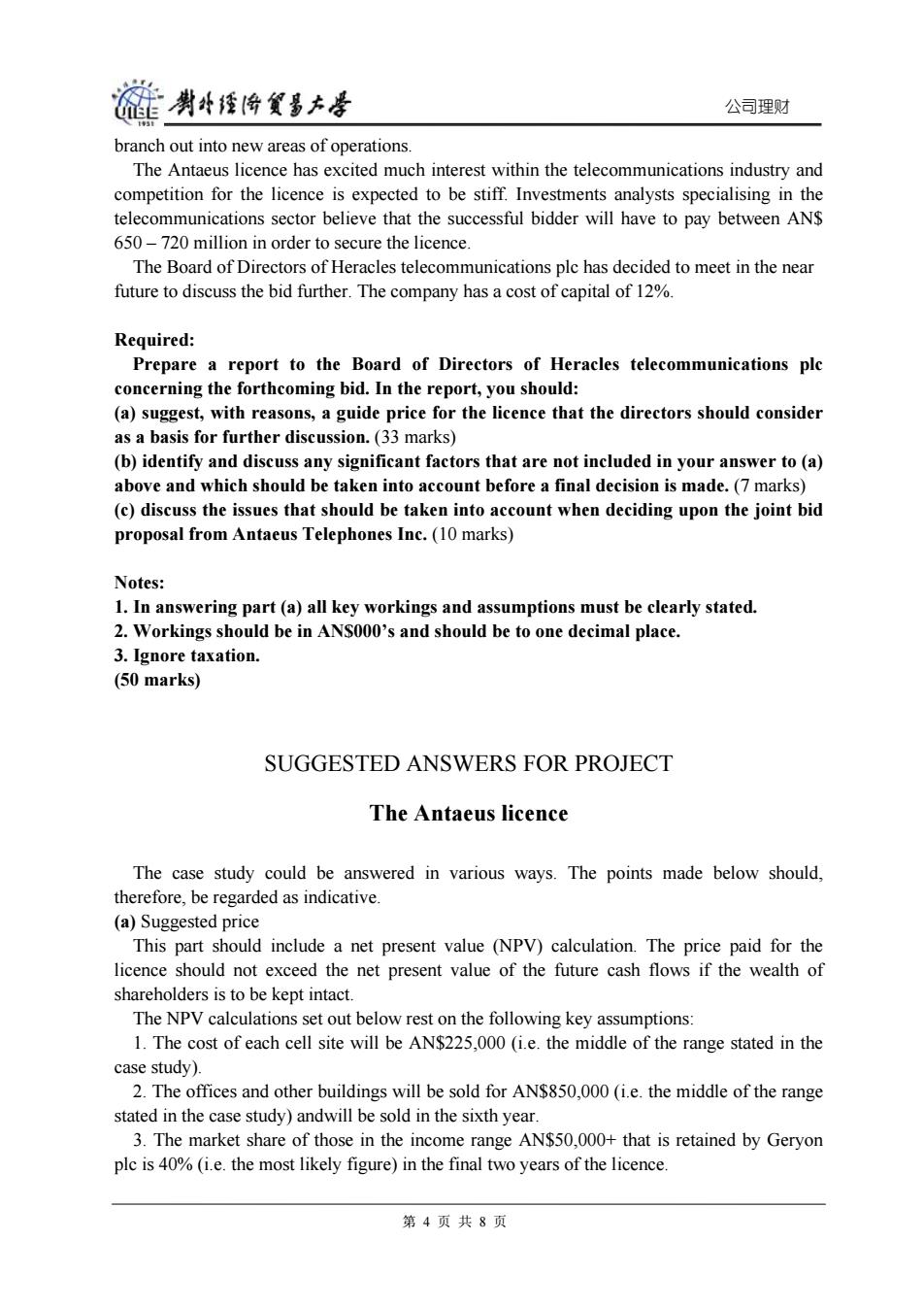

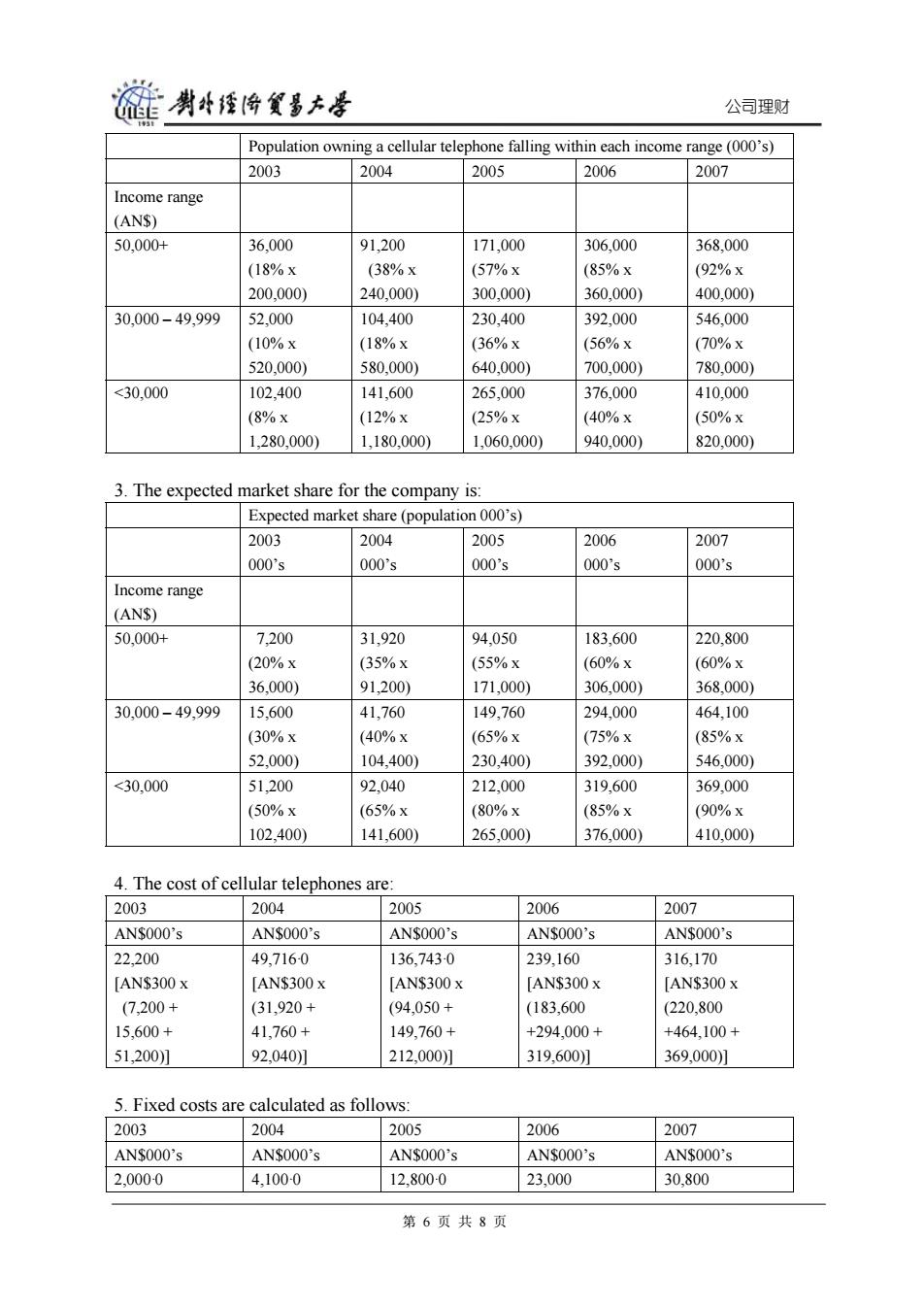

链勇牛经将贸多本圣 公司理财 Population owning a cellular telephone falling within each income range(000's) 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 36.000 91.200 171.000 306.000 368.000 (18%x (38%x (57%x (85%x (92%x 200.000) 240.000) 300,000) 360.000) 400.000) 30.000-49.999 52.000 104.400 230,400 392,000 546,000 (10%x (18%x (36%x (56%X (70%x 520,000) 580,000) 640.000) 700,000) 780,000) <30.000 102.400 141.600 265.000 376,000 410.000 (8%x (12%x (25%x (40%x (50%x 1.280.000) 1,180,000) 1,060,000) 940,000) 820,000) 3.The expected market share for the company is: Expected market share(population 000's) 2003 2004 2005 2006 2007 000's 000's 000's 000's 000's Income range (AN$) 50,000+ 7.200 31920 94.050 183.600 220,800 (20%x (35%x (55%x (60%x (60%x 36,000) 91,200) 171,000) 306,000) 368,000) 30.000-49.999 15.600 41.760 149.760 294.000 464.100 (30%X (40%x (65%x (75%x (85%x 52,000) 104,400) 230,400) 392,000) 546,000) <30.000 51.200 92.040 212.000 319.600 369.000 (50%X (65%x (80%x (85%x (90%x 102.400) 141.600) 265.000) 376,000) 410,000) 4.The cost of cellular telephones are: 2003 2004 2005 2006 2007 AN$000's AN$000's AN$000's AN$000's AN$000's 22,200 49.716-0 136.743-0 239.160 316.170 [AN$300x [AN$300x [AN$300x [AN$300X [AN$300x (7,200+ (31,920+ (94,050+ (183,600 (220.800 15,600+ 41,760+ 149,760+ +294.000+ +464.100+ 51,200] 92,040)] 212,000)] 319,600)] 369,000)] 5.Fixed costs are calculated as follows: 2003 2004 2005 2006 2007 AN$000's AN$000's AN$000's AN$000's AN$000's 2,0000 4.100-0 12.800-0 23,000 30,800 第6页共8页

公司理财 Population owning a cellular telephone falling within each income range (000’s) 2003 2004 2005 2006 2007 Income range (AN$) 50,000+ 36,000 (18% x 200,000) 91,200 (38% x 240,000) 171,000 (57% x 300,000) 306,000 (85% x 360,000) 368,000 (92% x 400,000) 30,000 – 49,999 52,000 (10% x 520,000) 104,400 (18% x 580,000) 230,400 (36% x 640,000) 392,000 (56% x 700,000) 546,000 (70% x 780,000) <30,000 102,400 (8% x 1,280,000) 141,600 (12% x 1,180,000) 265,000 (25% x 1,060,000) 376,000 (40% x 940,000) 410,000 (50% x 820,000) 3. The expected market share for the company is: Expected market share (population 000’s) 2003 000’s 2004 000’s 2005 000’s 2006 000’s 2007 000’s Income range (AN$) 50,000+ 7,200 (20% x 36,000) 31,920 (35% x 91,200) 94,050 (55% x 171,000) 183,600 (60% x 306,000) 220,800 (60% x 368,000) 30,000 – 49,999 15,600 (30% x 52,000) 41,760 (40% x 104,400) 149,760 (65% x 230,400) 294,000 (75% x 392,000) 464,100 (85% x 546,000) <30,000 51,200 (50% x 102,400) 92,040 (65% x 141,600) 212,000 (80% x 265,000) 319,600 (85% x 376,000) 369,000 (90% x 410,000) 4. The cost of cellular telephones are: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s 22,200 [AN$300 x (7,200 + 15,600 + 51,200)] 49,716·0 [AN$300 x (31,920 + 41,760 + 92,040)] 136,743·0 [AN$300 x (94,050 + 149,760 + 212,000)] 239,160 [AN$300 x (183,600 +294,000 + 319,600)] 316,170 [AN$300 x (220,800 +464,100 + 369,000)] 5. Fixed costs are calculated as follows: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s 2,000·0 4,100·0 12,800·0 23,000 30,800 第 6 页 共 8 页

链男好降食事大号 公司理财 [AN$2,000 [ANS2,000 [AN$2,000 [AN$2,000 +(ANS300 +(AN$300 +(AN$300 +(ANS300 x7] x36)] x70] x96)】 6.Predicted airtime income is: 2003 2004 2005 2006 2007 AN$000's AN$000's ANS000's AN$000's AN$000's Income range AN$50.000+ 2.4624 19.7649 127.249-7 343.7543 423,339-8 Local (1,200x (2,400x (5,500x (7,900x (8,300x0-77x 0-95x 0-86x 0-82X 0-79x 220.800x 7,200x 31,920x 94,050x 183,600x AN$030) AN$0-30) AN$030) AN$0-30) AN$0·30) AN$50.000+ 1,080-0 26,8128 232,773-8 761,481-0 1,053,7680 International (1,200x 2.400x (5,500x (7.900x (8,300x0-23x 0-05x 014x 0-18x 0-21x 220,800x 7,200x 31,920x 94.050X 183.600x AN$2-50) AN$2-50) AN$2-50) AN$2-50) AN$2-50) AN$30,000- 2,340-0 11,901-6 62,899-2 229,320-0 382,882-5 49,999 (500x (950x (1,400x (2,600x (2,750x 15.600x 41,760x 149.760x 294.000x 464,100x AN$0-30) AN$0-30) ANS0-30) AN$0-30) AN$0-30) <AN$30.000 1,536-0 12,4254 47.700 105.468-0 132.840-0 (100x (450x (750x (1,100x (1,200x 51.200x 92,040x 212.000x 319.600x 369.000x ANS0-30) AN$0-30) AN$0-30) AN$0-30) ANS0-30) Tota 17,4184 70.9047 470.622-7 1.440.0233 1.992.830-3 7.Predicted rental income: 2003 2004 2005 2006 2007 ANS000's AN$000's ANS000's AN$000's AN$000's Income range AN$50,000+ 2880 1,276-8 3.762-0 7,3440 8,8320 (AN$40 x (AN$40 x (AN$40 x (ANS40 x (ANS40 x 7.200) 31,920) 94,050) 183.600) 220.800) AN$30,000- 624-0 -1,6704 5,990-4 11.760-0 18,564-0 49,999 (AN$40 x (ANS40 x (AN$40 x (ANS40 x (ANS40 x 15,600) 41,760) 149,760) 294,000) 464,100) <AN$30.000 2.048-0 3,681-6 8.480-0 12.7840 14,760-0 (AN$40 x (AN$40 x (AN$40 x (AN$40 x (ANS40 x 51,200) 92,040) 212,000) 319.600) 369.000) Total 2,960-0 6,6288 18,232-4 31,8880 42,156-0 第7页共8页

公司理财 [AN$2,000 + (AN$300 x 7)] [AN$2,000 + (AN$300 x 36)] [AN$2,000 + (AN$300 x 70)] [AN$2,000 + (AN$300 x 96)] 6. Predicted airtime income is: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s Income range AN$50,000+ Local ,2,462·4 (1,200 x 0·95 x 7,200 x AN$0·30) 19,764·9 (2,400 x 0·86 x 31,920 x AN$0·30) 127,249·7 (5,500 x 0·82 x 94,050 x AN$0·30) 343,754·3 (7,900 x 0·79 x 183,600 x AN$0·30) 423,339·8 (8,300 x0·77x 220,800 x AN$0·30) AN$50,000+ International ,1,080·0 (1,200 x 0·05 x 7,200 x AN$2·50) 26,812·8 (2,400 x 0·14 x 31,920 x AN$2·50) 232,773·8 (5,500 x 0·18 x 94,050 x AN$2·50) 761,481·0 (7,900 x 0·21 x 183,600 x AN$2·50) 1,053,768·0 (8,300 x0·23 x 220,800 x AN$2·50) AN$30,000– 49,999 2,340·0 (500 x 15,600 x AN$0·30) 11,901·6 (950 x 41,760 x AN$0·30) 62,899·2 (1,400 x 149,760 x AN$0·30) 229,320·0 (2,600 x 294,000 x AN$0·30) 382,882·5 (2,750 x 464,100 x AN$0·30) <AN$30,000 1,536·0 (100 x 51,200 x AN$0·30) 12,425·4 (450 x 92,040 x AN$0·30) 47,700 (750 x 212,000 x AN$0·30) 105,468·0 (1,100 x 319,600 x AN$0·30) 132,840·0 (1,200 x 369,000 x AN$0·30) Tota l 7,418·4 70,904·7 470,622·7 1,440,023·3 1,992,830·3 7. Predicted rental income: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s Income range AN$50,000+ ,288·0 (AN$40 x 7,200) 1,276·8 (AN$40 x 31,920) 3,762·0 (AN$40 x 94,050) 7,344·0 (AN$40 x 183,600) 8,832·0 (AN$40 x 220,800) AN$30,000– 49,999 624·0 (AN$40 x 15,600) –1,670·4 (AN$40 x 41,760) 5,990·4 (AN$40 x 149,760) 11,760·0 (AN$40 x 294,000) 18,564·0 (AN$40 x 464,100) <AN$30,000 2,048·0 (AN$40 x 51,200) 3,681·6 (AN$40 x 92,040) 8,480·0 (AN$40 x 212,000) 12,784·0 (AN$40 x 319,600) 14,760·0 (AN$40 x 369,000) Total 2,960·0 6,628·8 18,232·4 31,888·0 42,156·0 第 7 页 共 8 页

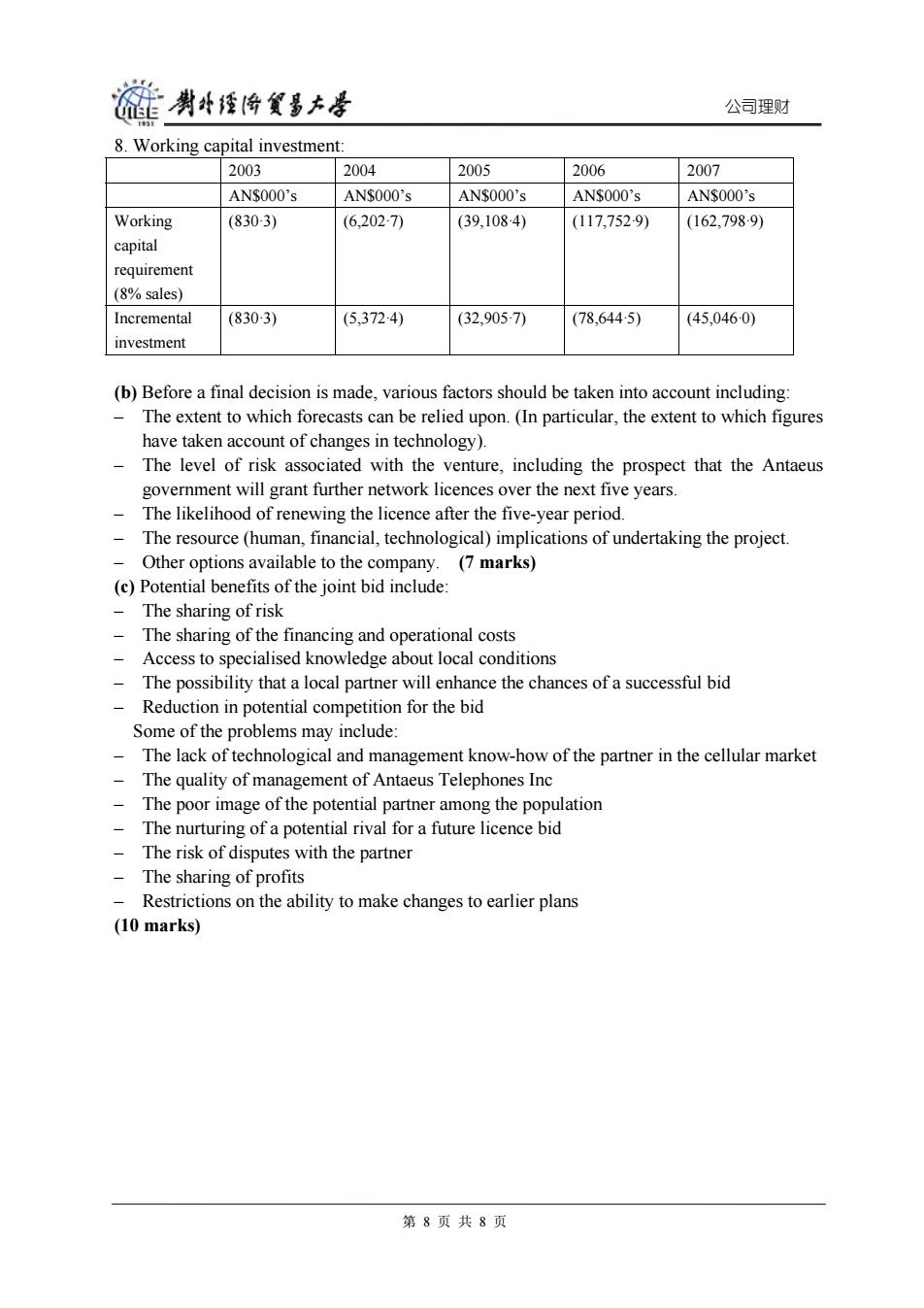

碰肖经海食多大号 公司理财 8.Working capital investment: 2003 2004 2005 2006 2007 AN$000's AN$000's AN$000's AN$000's AN$000's Working (830-3) (6,202-7) (39,1084) (117,752-9) (162,7989) capital requirement (8%sales) Incremental (830-3) (5,3724) (32,905-7) (78.6445) (45,046·0) investment (b)Before a final decision is made,various factors should be taken into account including: The extent to which forecasts can be relied upon.(In particular,the extent to which figures have taken account of changes in technology). The level of risk associated with the venture,including the prospect that the Antaeus government will grant further network licences over the next five years. The likelihood of renewing the licence after the five-year period. The resource (human,financial,technological)implications of undertaking the project. Other options available to the company.(7 marks) (c)Potential benefits of the joint bid include: The sharing of risk The sharing of the financing and operational costs Access to specialised knowledge about local conditions The possibility that a local partner will enhance the chances of a successful bid Reduction in potential competition for the bid Some of the problems may include: The lack of technological and management know-how of the partner in the cellular market The quality of management of Antaeus Telephones Inc The poor image of the potential partner among the population The nurturing of a potential rival for a future licence bid The risk of disputes with the partner The sharing of profits Restrictions on the ability to make changes to earlier plans (10 marks) 第8页共8页

公司理财 8. Working capital investment: 2003 2004 2005 2006 2007 AN$000’s AN$000’s AN$000’s AN$000’s AN$000’s Working capital requirement (8% sales) (830·3) (6,202·7) (39,108·4) (117,752·9) (162,798·9) Incremental investment (830·3) (5,372·4) (32,905·7) (78,644·5) (45,046·0) (b) Before a final decision is made, various factors should be taken into account including: – The extent to which forecasts can be relied upon. (In particular, the extent to which figures have taken account of changes in technology). – The level of risk associated with the venture, including the prospect that the Antaeus government will grant further network licences over the next five years. – The likelihood of renewing the licence after the five-year period. – The resource (human, financial, technological) implications of undertaking the project. – Other options available to the company. (7 marks) (c) Potential benefits of the joint bid include: – The sharing of risk – The sharing of the financing and operational costs – Access to specialised knowledge about local conditions – The possibility that a local partner will enhance the chances of a successful bid – Reduction in potential competition for the bid Some of the problems may include: – The lack of technological and management know-how of the partner in the cellular market – The quality of management of Antaeus Telephones Inc – The poor image of the potential partner among the population – The nurturing of a potential rival for a future licence bid – The risk of disputes with the partner – The sharing of profits – Restrictions on the ability to make changes to earlier plans (10 marks) 第 8 页 共 8 页