CORPORA∫E FINANCIAL MANAGEMEN」 PART V WORKING CAPITAL MANAGEMENT chapter15-17) 州经怡贸易大号 UNW原s方C等NTE3风制U方男0G0Cs

CORPORATE FINANCIAL CORPORATE FINANCIAL MANAGEMENT MANAGEMENT PART V WORKING CAPITAL MANAGEMENT (chapter 15-17)

Chapter 15 FINANCIAL FORECASTING AND WORKING CAPITAL POLICY 渊补经价货多方是 YO年NEB证事0000

Chapter 15 Chapter 15 FINANCIAL FORECASTING AND WORKING CAPITAL POLICY

Introduction Financial forecasting 2.Working capital policy 剥补楂价贸多方号 YO年NEB证事00003

Introduction Introduction 1. Financial forecasting 2. Working capital policy

1.Financial forecasting O Financial forecasting methods Percent of sales Cash budgets Pro forma statement of cash flow Computerized financial forecasting models Forecasting with financial ratios 剥外经价贫多方居 YO年N0事0E000

1.Financial forecasting 1.Financial forecasting zFinancial forecasting methods – Percent of sales – Cash budgets – Pro forma statement of cash flow – Computerized financial forecasting models – Forecasting with financial ratios

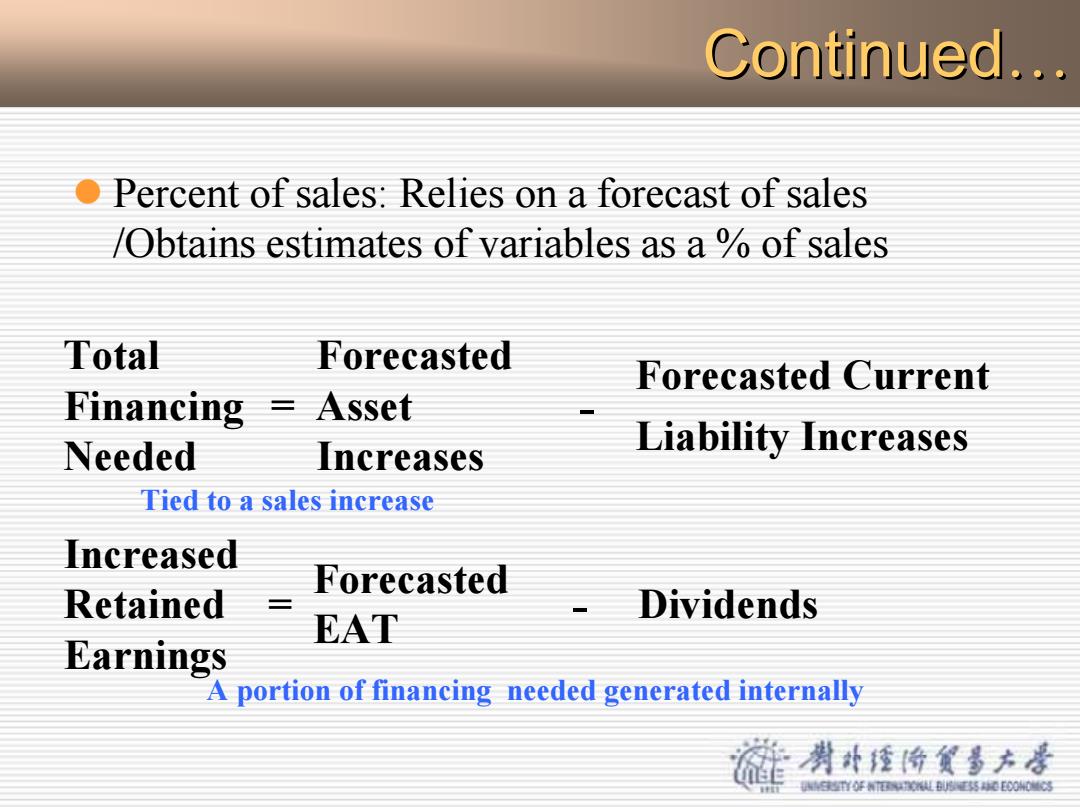

Continued... O Percent of sales:Relies on a forecast of sales /Obtains estimates of variables as a of sales Total Forecasted Forecasted Current Financing =Asset Needed Increases Liability Increases Tied to a sales increase Increased Forecasted Retained Dividends EAT Earnings A portion of financing needed generated internally 剥外经价贫多方号 YO年NEB证事0000

Continued Continued… z Percent of sales: Relies on a forecast of sales /Obtains estimates of variables as a % of sales Forecasted Current Liability Increases - Forecasted Asset Increases = Total Financing Needed Tied to a sales increase - Dividends Forecasted EAT = Increased Retained Earnings A portion of financing needed generated internally

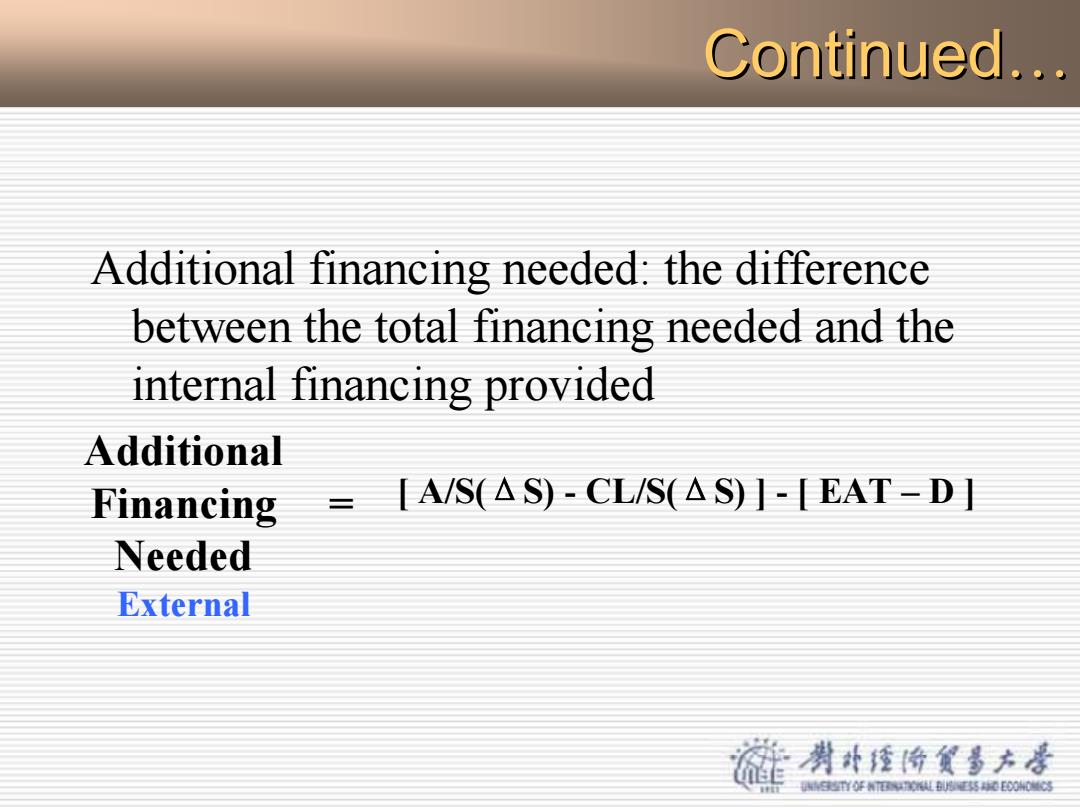

Continued... Additional financing needed:the difference between the total financing needed and the internal financing provided Additional Financing [A/S(△S)-CL/S(△S)」EAT-D」 Needed External 渊外经价货多方居 YO年NEB证事0000

Continued Continued… Additional financing needed: the difference between the total financing needed and the internal financing provided Additional Financing Needed = External [ A/S(ΔS) - CL/S(ΔS) ] - [ EAT – D ]

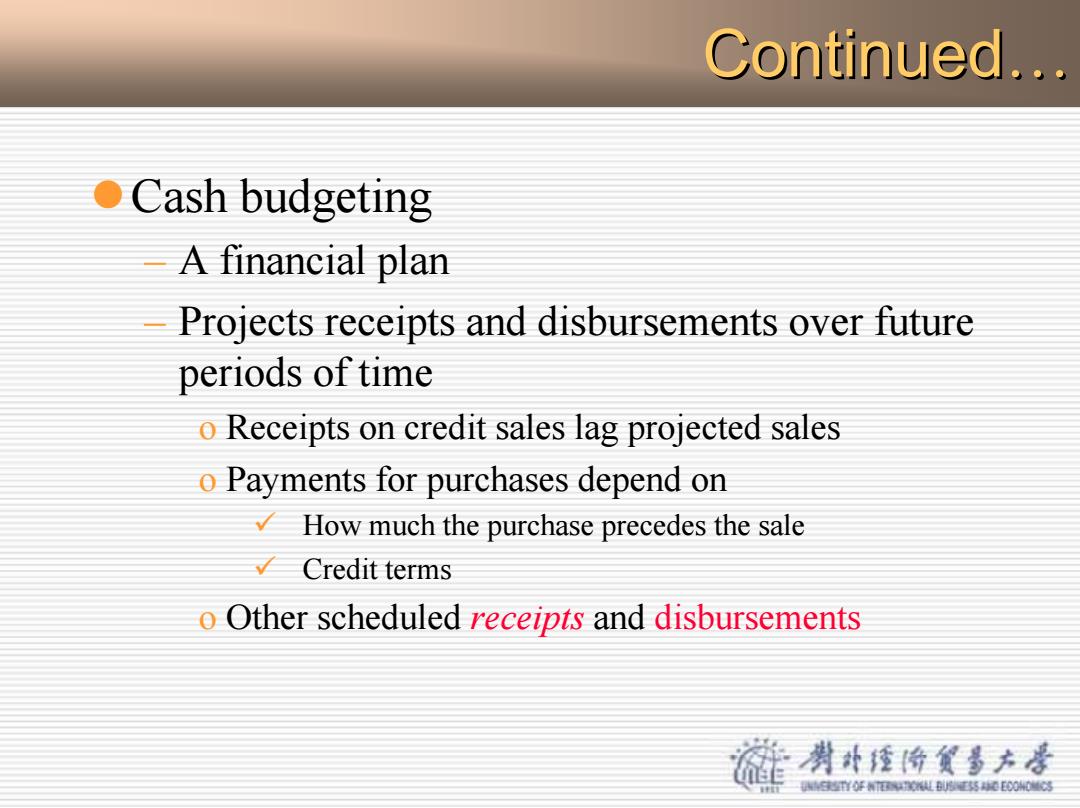

Continued... O Cash budgeting A financial plan Projects receipts and disbursements over future periods of time o Receipts on credit sales lag projected sales o Payments for purchases depend on How much the purchase precedes the sale Credit terms o Other scheduled receipts and disbursements 渊补楂价贸多方号 YO年N0事0E000

Continued Continued… zCash budgeting – A financial plan – Projects receipts and disbursements over future periods of time o Receipts on credit sales lag projected sales o Payments for purchases depend on 9 How much the purchase precedes the sale 9 Credit terms o Other scheduled receipts and disbursements

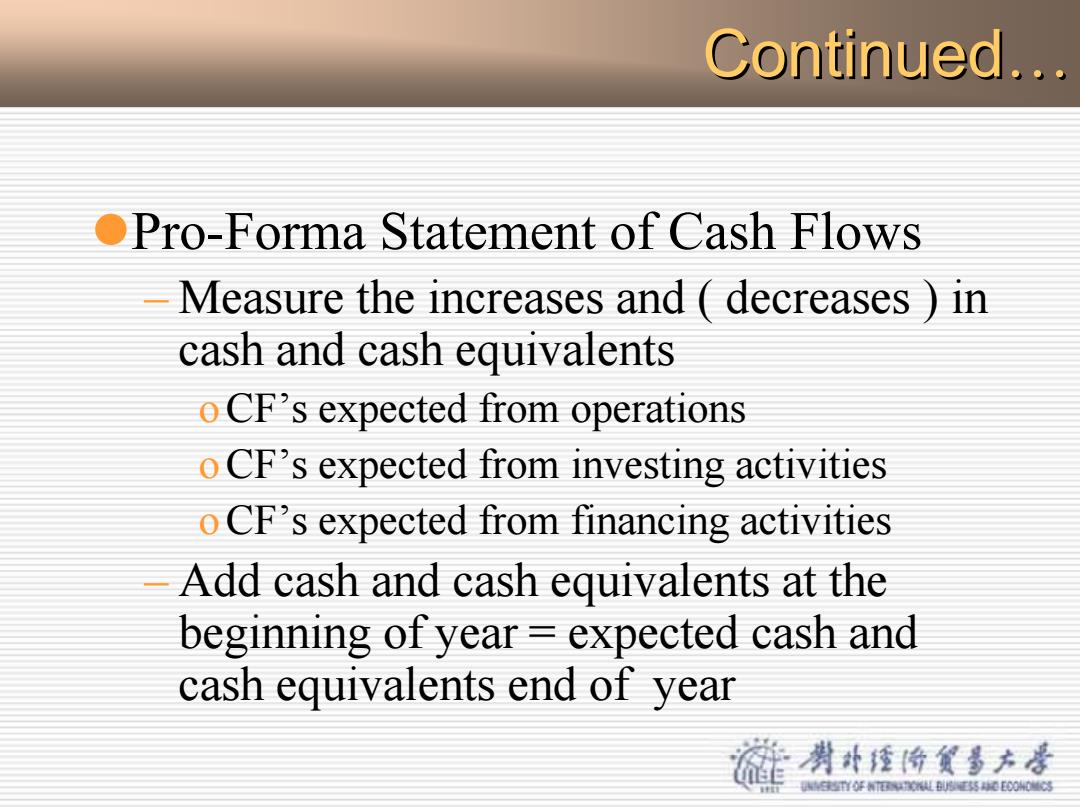

Continued... OPro-Forma Statement of Cash Flows Measure the increases and decreases in cash and cash equivalents o CF's expected from operations o CF's expected from investing activities o CF's expected from financing activities Add cash and cash equivalents at the beginning of year expected cash and cash equivalents end of year 渊外经价货多方是 YO年NEB证事0000

Continued Continued… zPro-Forma Statement of Cash Flows – Measure the increases and ( decreases ) in cash and cash equivalents oCF’s expected from operations oCF’s expected from investing activities oCF’s expected from financing activities – Add cash and cash equivalents at the beginning of year = expected cash and cash equivalents end of year

Continued... OComputerized Forecasting and Financial Planning Deterministic model Uses single-value forecasts of each financial variable Probabilistic models Utilize probability distributions for input data Optimization models Choose the optimal levels of some variables 剥外经份贫多方号 YO年N0事0E000

Continued Continued… zComputerized Forecasting and Financial Planning – Deterministic model Uses single-value forecasts of each financial variable – Probabilistic models Utilize probability distributions for input data – Optimization models Choose the optimal levels of some variables

Continued... O Forecasting With Financial Ratios Forecasting bankruptcy with discriminant analysis(5 ratios) o Net working capital/Total assets o Retained earnings/Total assets o EBIT/Total assets o Market value equity/Book value total debt o Sales/Total assets 渊外经价货多方是 YO年NEB证事00003

Continued Continued… zForecasting With Financial Ratios – Forecasting bankruptcy with discriminant analysis(5 ratios) o Net working capital/ Total assets o Retained earnings/ Total assets o EBIT/ Total assets o Market value equity/ Book value total debt o Sales/ Total assets