裢贵华经将贸墨去是 公司理财 PART II 1.How much will $1,000 deposited in a savings account earning a compound annual interest rate of a percent be worth at the end of the follow number of years? a.3 years. b.5 years. c.10 years. 2.If you require a 9 percent return on your investments,which would you prefer? a.$5,000 today. b.$15,000 five years from today. c.$1,000 per year for 15 years. 3.You decide to purchase a building for $30,000 by paying $5,000 down and assuming a mortgage of $25,000.The bank of offers you a 15-year mortgage requiring annual end-of-year payments of $3,188 each.The bank also requires you to pay a 3 percent loan origination fee, which will reduce the effective amount the bank lends to you.Compute the annual percentage rate of interest on this loan. 4.An investment promises to pay $6,000 at the end of each year for the next 5 years and $4,000 at the end of each year for years 6 through 10. a.If you require a 12 percent rate of return on an investment of this sort,what is the maximum amount you would pay for this investment? b.Assuming that the payments are received at the beginning of each year,what is the maximum amount you would pay for this investment,given a 12 percent required rate of return? 5.Suppose that a local savings and loan association advertises a 6 percent annual(nominal)rate of interest on regular accounts,compounded monthly,what is the effective annual percentage rate of interest paid by the savings and loan association? 6.Your mother is planning to retire this year.Her firm has offered her a lump sum retirement payment of $50,000 or a $6,000 lifetime annuity---whichever she chooses.Your mother is in 第1页共5页

公司理财 PART II 1. How much will $1,000 deposited in a savings account earning a compound annual interest rate of a percent be worth at the end of the follow number of years? a. 3 years. b. 5 years. c. 10 years. 2. If you require a 9 percent return on your investments, which would you prefer? a. $5, 000 today. b. $15, 000 five years from today. c. $1, 000 per year for 15 years. 3. You decide to purchase a building for $30, 000 by paying $5, 000 down and assuming a mortgage of $25,000. The bank of offers you a 15-year mortgage requiring annual end-of-year payments of $3,188 each. The bank also requires you to pay a 3 percent loan origination fee, which will reduce the effective amount the bank lends to you. Compute the annual percentage rate of interest on this loan. 4. An investment promises to pay $6,000 at the end of each year for the next 5 years and $4,000 at the end of each year for years 6 through 10. a. If you require a 12 percent rate of return on an investment of this sort, what is the maximum amount you would pay for this investment? b. Assuming that the payments are received at the beginning of each year, what is the maximum amount you would pay for this investment, given a 12 percent required rate of return? 5. Suppose that a local savings and loan association advertises a 6 percent annual (nominal) rate of interest on regular accounts, compounded monthly, what is the effective annual percentage rate of interest paid by the savings and loan association? 6. Your mother is planning to retire this year. Her firm has offered her a lump sum retirement payment of $50,000 or a $6,000 lifetime annuity --- whichever she chooses. Your mother is in 第 1 页 共 5 页

裢勇牛经降贸昌大是 公司理财 reasonably good health and expected to live for at last 15 more years.Which option should she choose,assuming that an 8 percent interest rate is appropriate to evaluate the annuity? 7.Determine the value of a $1,000 Canadian Pacific Limited perpetual 4 percent debenture (bond) at the following required rates of return: a.4 percent b.5 percent. c.6 percent. 8.Consider Allied Corporation's 9 percent debentures that mature on April 1,2000.Assume that the interest on these bonds is paid annually.Determine the value of a $1,000 denomination Allied Corporation bond as of April 1,1988 to an investor who holds the bond until maturity and whose required rate of return is: a.7 percent b.9 percent c.11 percent 9.What would be the value of the Allied Corporation bonds (see problem 8)at an 8 percent required rate of return if the interest were paid and compounded semiannually? 10.What is the value of a share of Litton Industries Series B $2.00 cumulative preferred stock to an investor who requires the following rate of return? a.9 percent b.10 percent c.12 percent 11.The common stock of General Land Development Company (GLDC)is expected to pay a dividend of $1.25 next year and currently sells for $25.Assume that the firm's future dividend payments are expected to grow at a constant rate for the foreseeable future.Determine the implied growth rate for GLDC's dividends(and earnings)assuming that the required rate of return by investors is 12 percent. 12.Over the past 5 years,the dividends of the Gamma Corporation have grown from $0.70 per share to the current level of $1.30 per share(Do).This growth rate(computed to one tenth of 1 percent accuracy)is expected to continue for the foreseeable future.What is the value of a share of Gamma Corporation common stock to an investor who requires a 20 percent return on her investment? 第2页共5页

公司理财 reasonably good health and expected to live for at last 15 more years. Which option should she choose, assuming that an 8 percent interest rate is appropriate to evaluate the annuity? 7. Determine the value of a $1,000 Canadian Pacific Limited perpetual 4 percent debenture (bond) at the following required rates of return: a. 4 percent b. 5 percent. c. 6 percent. 8. Consider Allied Corporation’s 9 percent debentures that mature on April 1, 2000. Assume that the interest on these bonds is paid annually. Determine the value of a $1,000 denomination Allied Corporation bond as of April 1, 1988 to an investor who holds the bond until maturity and whose required rate of return is: a. 7 percent b. 9 percent c. 11 percent 9. What would be the value of the Allied Corporation bonds (see problem 8) at an 8 percent required rate of return if the interest were paid and compounded semiannually? 10. What is the value of a share of Litton Industries Series B $2.00 cumulative preferred stock to an investor who requires the following rate of return? a. 9 percent b. 10 percent c. 12 percent 11. The common stock of General Land Development Company (GLDC) is expected to pay a dividend of $1.25 next year and currently sells for $25. Assume that the firm’s future dividend payments are expected to grow at a constant rate for the foreseeable future. Determine the implied growth rate for GLDC’s dividends (and earnings) assuming that the required rate of return by investors is 12 percent. 12. Over the past 5 years, the dividends of the Gamma Corporation have grown from $0.70 per share to the current level of $1.30 per share (D0). This growth rate (computed to one tenth of 1 percent accuracy) is expected to continue for the foreseeable future. What is the value of a share of Gamma Corporation common stock to an investor who requires a 20 percent return on her investment? 第 2 页 共 5 页

裢典降餐多产孝 公司理财 13.Over the past 10years,the dividends of Party Time,Inc.have grown at an annual rate of 15 percent.The current(Do)dividend is $3 per share.This dividend is expected to grow to 3.40 next year,then grow at an annual rate of 10 percent for the following 2 years and 6 percent per year thereafter.You require a 15 percent rate of return on this stock. a)What would you be willing to pay for a share of Party Time stock today? b)What price would you anticipate the stock selling for at the beginning of year 3? c)If you anticipate selling the stock at the end of 2 years,how much would you pay for it today? 14.The chairman of Haller Industries told a meeting of financial analysts that he expects the firm's earning and dividends to double over the next 6 years.The firm's current(that is,as of year 0) earnings and dividends per share are $4.00 and $2.00 respectively. a)Estimate the compound annual dividend growth rate over the 6-year period to the nearest whole percent). b)Forecast Heller's earnings and dividend per share for each of the next 6 years,assuming that they grow at the rate determined in Part a. c) Based on the constant growth dividend valuation model.determine the current value of a share of Heller Industries common stock to an investor who requires an 18 percent rate of return. 15.Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000.The bonds scheduled to mature at the end of 14 years.The company has the option to call the bonds in 8 years at a premium of 12 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time.If you require a pretax return of 10 percent on bonds of this risk,how much would you pay for one of these bonds today? 16.You have estimated the following probability distributions of expected future returns for Stock X and Y: Stock X Stock Y 第3页共5页

公司理财 13. Over the past 10years, the dividends of Party Time, Inc. have grown at an annual rate of 15 percent. The current (D0) dividend is $3 per share. This dividend is expected to grow to 3.40 next year, then grow at an annual rate of 10 percent for the following 2 years and 6 percent per year thereafter. You require a 15 percent rate of return on this stock. a) What would you be willing to pay for a share of Party Time stock today? b) What price would you anticipate the stock selling for at the beginning of year 3? c) If you anticipate selling the stock at the end of 2 years, how much would you pay for it today? 14. The chairman of Haller Industries told a meeting of financial analysts that he expects the firm’s earning and dividends to double over the next 6 years. The firm’s current (that is, as of year 0) earnings and dividends per share are $4.00 and $2.00 respectively. a) Estimate the compound annual dividend growth rate over the 6-year period ( to the nearest whole percent). b) Forecast Heller’s earnings and dividend per share for each of the next 6 years, assuming that they grow at the rate determined in Part a. c) Based on the constant growth dividend valuation model, determine the current value of a share of Heller Industries common stock to an investor who requires an 18 percent rate of return. 15. Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000. The bonds scheduled to mature at the end of 14 years. The company has the option to call the bonds in 8 years at a premium of 12 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time. If you require a pretax return of 10 percent on bonds of this risk, how much would you pay for one of these bonds today? 16. You have estimated the following probability distributions of expected future returns for Stock X and Y: Stock X Stock Y 第 3 页 共 5 页

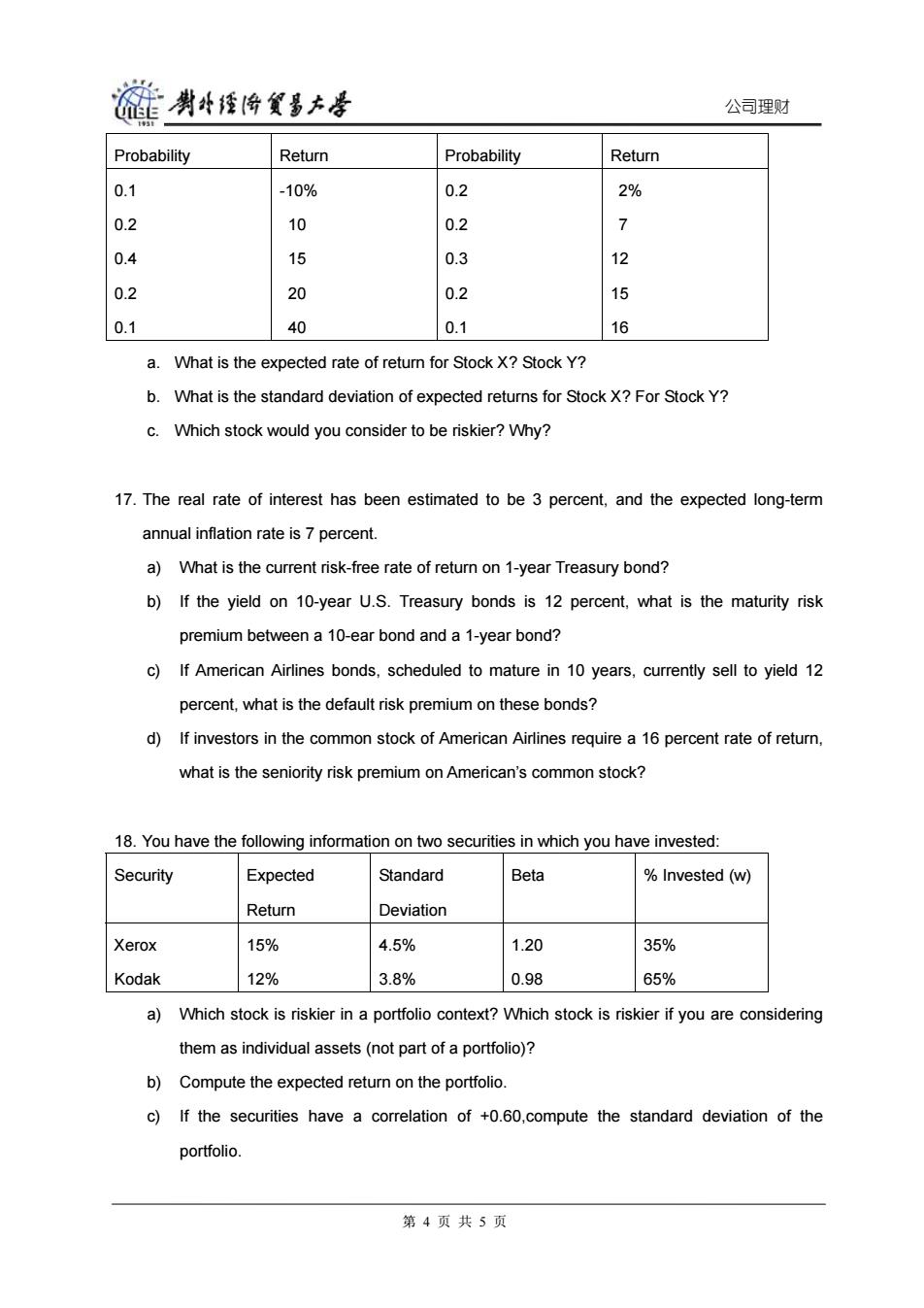

旋剥经降贸多去号 公司理财 Probability Return Probability Return 0.1 -10% 0.2 2% 0.2 10 0.2 7 0.4 15 0.3 12 0.2 20 0.2 15 0.1 40 0.1 16 a. What is the expected rate of return for Stock X?Stock Y? b.What is the standard deviation of expected returns for Stock X?For Stock Y? c.Which stock would you consider to be riskier?Why? 17.The real rate of interest has been estimated to be 3 percent,and the expected long-term annual inflation rate is 7 percent. a)What is the current risk-free rate of return on 1-year Treasury bond? b)If the yield on 10-year U.S.Treasury bonds is 12 percent,what is the maturity risk premium between a 10-ear bond and a 1-year bond? c)If American Airlines bonds,scheduled to mature in 10 years,currently sell to yield 12 percent,what is the default risk premium on these bonds? d)If investors in the common stock of American Airlines require a 16 percent rate of return, what is the seniority risk premium on American's common stock? 18.You have the following information on two securities in which you have invested: Security Expected Standard Beta Invested (w) Return Deviation Xerox 15% 4.5% 1.20 35% Kodak 12% 3.8% 0.98 65% a) Which stock is riskier in a portfolio context?Which stock is riskier if you are considering them as individual assets(not part of a portfolio)? b)Compute the expected return on the portfolio. c)If the securities have a correlation of +0.60,compute the standard deviation of the portfolio. 第4页共5页

公司理财 Probability Return Probability Return 0.1 0.2 0.4 0.2 0.1 -10% 10 15 20 40 0.2 0.2 0.3 0.2 0.1 2% 7 12 15 16 a. What is the expected rate of return for Stock X? Stock Y? b. What is the standard deviation of expected returns for Stock X? For Stock Y? c. Which stock would you consider to be riskier? Why? 17. The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation rate is 7 percent. a) What is the current risk-free rate of return on 1-year Treasury bond? b) If the yield on 10-year U.S. Treasury bonds is 12 percent, what is the maturity risk premium between a 10-ear bond and a 1-year bond? c) If American Airlines bonds, scheduled to mature in 10 years, currently sell to yield 12 percent, what is the default risk premium on these bonds? d) If investors in the common stock of American Airlines require a 16 percent rate of return, what is the seniority risk premium on American’s common stock? 18. You have the following information on two securities in which you have invested: Security Expected Return Standard Deviation Beta % Invested (w) Xerox Kodak 15% 12% 4.5% 3.8% 1.20 0.98 35% 65% a) Which stock is riskier in a portfolio context? Which stock is riskier if you are considering them as individual assets (not part of a portfolio)? b) Compute the expected return on the portfolio. c) If the securities have a correlation of +0.60,compute the standard deviation of the portfolio. 第 4 页 共 5 页

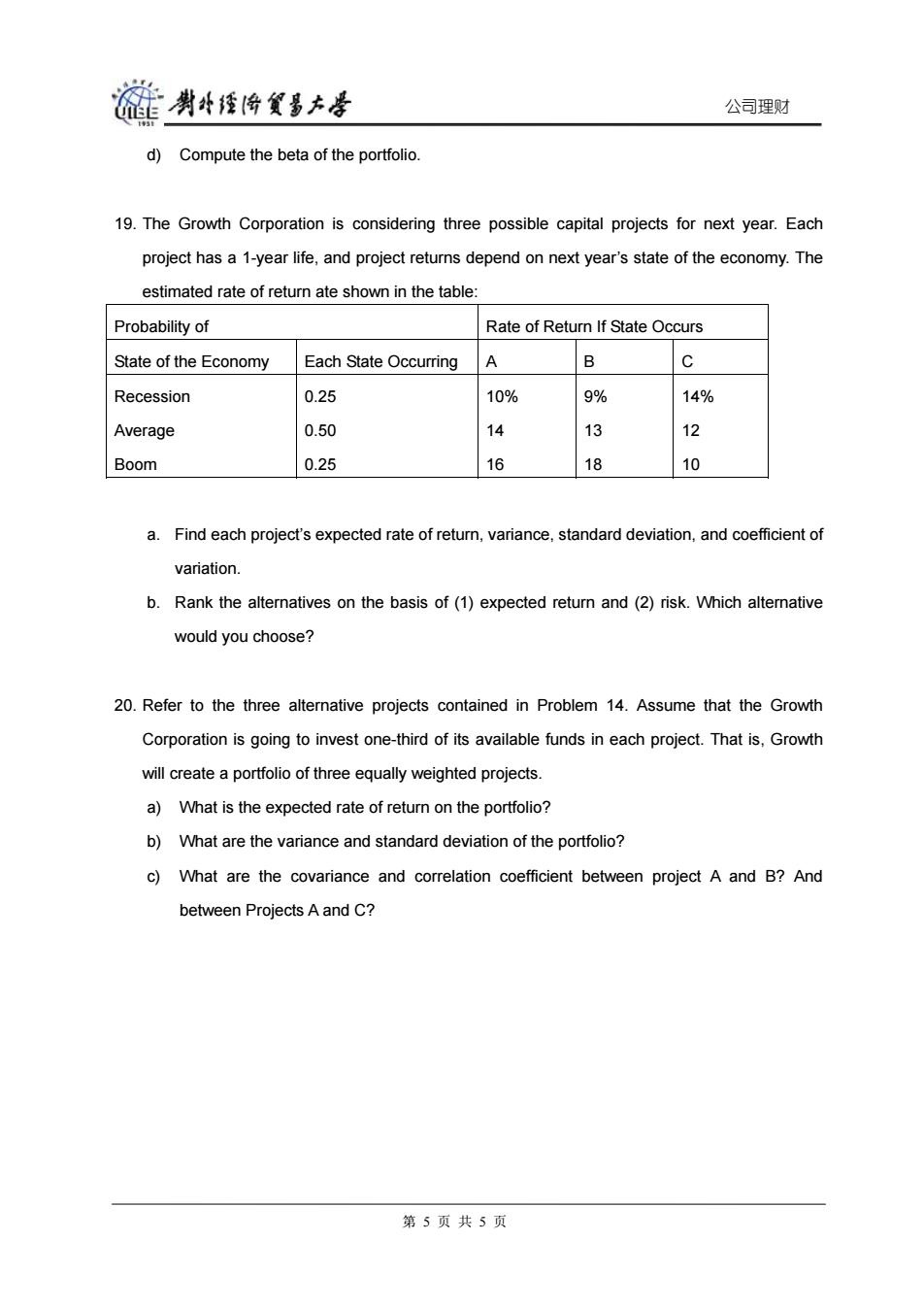

莲喇母透悔贸男大岸 公司理财 d)Compute the beta of the portfolio. 19.The Growth Corporation is considering three possible capital projects for next year.Each project has a 1-year life,and project returns depend on next year's state of the economy.The estimated rate of return ate shown in the table: Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B C Recession 0.25 10% 9% 14% Average 0.50 14 13 12 Boom 0.25 16 18 10 a.Find each project's expected rate of return,variance.standard deviation,and coefficient of variation b.Rank the alternatives on the basis of(1)expected return and(2)risk.Which alternative would you choose? 20.Refer to the three alternative projects contained in Problem 14.Assume that the Growth Corporation is going to invest one-third of its available funds in each project.That is,Growth will create a portfolio of three equally weighted projects. a)What is the expected rate of return on the portfolio? b)What are the variance and standard deviation of the portfolio? c)What are the covariance and correlation coefficient between project A and B?And between Projects A and C? 第5页共5页

公司理财 d) Compute the beta of the portfolio. 19. The Growth Corporation is considering three possible capital projects for next year. Each project has a 1-year life, and project returns depend on next year’s state of the economy. The estimated rate of return ate shown in the table: Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B C Recession Average Boom 0.25 0.50 0.25 10% 14 16 9% 13 18 14% 12 10 a. Find each project’s expected rate of return, variance, standard deviation, and coefficient of variation. b. Rank the alternatives on the basis of (1) expected return and (2) risk. Which alternative would you choose? 20. Refer to the three alternative projects contained in Problem 14. Assume that the Growth Corporation is going to invest one-third of its available funds in each project. That is, Growth will create a portfolio of three equally weighted projects. a) What is the expected rate of return on the portfolio? b) What are the variance and standard deviation of the portfolio? c) What are the covariance and correlation coefficient between project A and B? And between Projects A and C? 第 5 页 共 5 页