裢贵华经将贸墨去号 公司理财 EXAM PAPER 2 I.True(T)or False(F).Please fill in the bracket with T or F.(15%) 1.It is hard to find exceptionally profitable projects in competitive markets.( 2.For securities with cash flows that are constant in each year but where there is no specified maturity,such as preferred stock,the present value equals the dollar amount of the annual dividend by the investor's required rate of return.( 3.Marginal cost of capital refers to the cost of the next dollar of capital to be raised.( 4.When evaluating the mutually exclusive projects,the conclusions are the same weather using IRR or NPV.( 5.Both stock split and stock dividend can increase the stockholder's equity. 6.Systematic risk can be eliminated by holding a well-diversified portfolio of shares.( 7.The major difference in profit maximization and shareholder wealth maximization are risk and timing considerations.( 8.If an investor were to have only one asset,the measure of its specific risk would be its covariance with the market. 9.If two assts have perfect negative correlation,the risk of the portfolio can be zero under one combination of the assets.( 10.The approach that will result in the best decision in the greatest number of decision is internal rate of return.( Il.Multiple Choice(15%) 1.Leto Ltd has 10 million $1-00 ordinary shares in issue that have a current market value of $2-00 per share.The company also has irredeemable loan capital in issue with a nominal value of $20 million that is quoted at $150 per $100 nominal value.The cost of ordinary shares is estimated at 15%and the rate of interest on the loan capital is 12%.The rate of corporation tax is 25%. What is the weighted average cost of capital for the company? A.13-0% 第1页共13页

公司理财 EXAM PAPER 2 I. True(T) or False(F). Please fill in the bracket with T or F. (15%) 1. It is hard to find exceptionally profitable projects in competitive markets. ( ) 2. For securities with cash flows that are constant in each year but where there is no specified maturity, such as preferred stock, the present value equals the dollar amount of the annual dividend by the investor’s required rate of return. ( ) 3. Marginal cost of capital refers to the cost of the next dollar of capital to be raised. ( ) 4. When evaluating the mutually exclusive projects, the conclusions are the same weather using IRR or NPV. ( ) 5. Both stock split and stock dividend can increase the stockholder’s equity. ( ) 6. Systematic risk can be eliminated by holding a well-diversified portfolio of shares. ( ) 7. The major difference in profit maximization and shareholder wealth maximization are risk and timing considerations. ( ) 8. If an investor were to have only one asset, the measure of its specific risk would be its covariance with the market. ( ) 9. If two assts have perfect negative correlation, the risk of the portfolio can be zero under one combination of the assets. ( ) 10. The approach that will result in the best decision in the greatest number of decision is internal rate of return. ( ) II. Multiple Choice (15%) 1. Leto Ltd has 10 million $1·00 ordinary shares in issue that have a current market value of $2·00 per share. The company also has irredeemable loan capital in issue with a nominal value of $20 million that is quoted at $150 per $100 nominal value. The cost of ordinary shares is estimated at 15% and the rate of interest on the loan capital is 12%. The rate of corporation tax is 25%. What is the weighted average cost of capital for the company? A. 13·0% 第 1 页 共 13 页

肖外径份氨多本是 公司理财 B.114% C.110% D.132%. 2. Elara Ltd is considering an investment in a new process.The new process will require an increase in stocks of $30,000 during the first year.There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year.The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000.The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value.During the first year,the net operating profit before depreciation from the new process is expected to be $180,000.The business uses the net present value method when evaluating investment proposals When undertaking the net present value calculations,what would be the estimated net cash flow during the first year of the project?(Ignore taxation) A.$85,000 B.$215,000 C.$145,000 D.$155,000. 3.Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales:long-term capital employed 2:1 Debt:equity ratio 1:4 Sales:operating profit 10:1 Corporation tax:net profit before taxation 0-2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder's funds for the period? A.167% B.200% C.25-0% 第2页共13页

公司理财 B. 11·4% C. 11·0% D. 13·2%. 2. Elara Ltd is considering an investment in a new process. The new process will require an increase in stocks of $30,000 during the first year. There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year. The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000. The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value. During the first year, the net operating profit before depreciation from the new process is expected to be $180,000. The business uses the net present value method when evaluating investment proposals. When undertaking the net present value calculations, what would be the estimated net cash flow during the first year of the project? (Ignore taxation) A. $85,000 B. $215,000 C. $145,000 D. $155,000. 3. Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales: long-term capital employed 2:1 Debt: equity ratio 1:4 Sales: operating profit 10:1 Corporation tax: net profit before taxation 0·2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder’s funds for the period? A. 16·7% B. 20·0% C. 25·0% 第 2 页 共 13 页

肖外径份氨多去是 公司理财 D.667% 4.The shares of Danae Ltd have a beta of 0-5 and the shares of Alcmene Ltd have a beta of 2-0. Investors have an expected rate of return of 4%from shares in Danae Ltd and the expected returns to the market are 6%. Using the Capital Asset Pricing Model,what will be the expected rate of return for investors in Alcmene Ltd? A.8% B.10% C.12% D.16% 5.Sanderling Ltd buys raw materials from suppliers on six weeks'credit,which are delivered immediately.The raw materials are held in stock for four weeks before being issued to production.The production process takes three weeks and the finished goods are held in stock for two weeks before being sold on credit.Customers are allowed eight weeks'credit and pay promptly at the end of the period. What is the length of the operating cash cycle of the business? A.9 weeks B.11 weeks C.17 weeks D.23 weeks. 6.Lisburn Ltd has three possible investment opportunities,the details of which are as follows: Initial outlay Total present value $000 $000 Project Alpha 200 265 Project Beta 250 310 Project Gamma 120 170 The company has a limited investment budget for the current year and will be unable to invest in all profitable opportunities. 第3页共13页

公司理财 D. 66·7% 4. The shares of Danae Ltd have a beta of 0·5 and the shares of Alcmene Ltd have a beta of 2·0. Investors have an expected rate of return of 4% from shares in Danae Ltd and the expected returns to the market are 6%. Using the Capital Asset Pricing Model, what will be the expected rate of return for investors in Alcmene Ltd? A. 8% B. 10% C. 12% D. 16% 5. Sanderling Ltd buys raw materials from suppliers on six weeks’ credit, which are delivered immediately. The raw materials are held in stock for four weeks before being issued to production. The production process takes three weeks and the finished goods are held in stock for two weeks before being sold on credit. Customers are allowed eight weeks’ credit and pay promptly at the end of the period. What is the length of the operating cash cycle of the business? A. 9 weeks B. 11 weeks C. 17 weeks D. 23 weeks. 6. Lisburn Ltd has three possible investment opportunities, the details of which are as follows: Initial outlay Total present value $000 $000 Project Alpha 200 265 Project Beta 250 310 Project Gamma 120 170 The company has a limited investment budget for the current year and will be unable to invest in all profitable opportunities. 第 3 页 共 13 页

裢勇牛经降贸昌大是 公司理财 Assuming that the company wishes to maximise the wealth of its shareholders,what should be the order of priority for the three projects? Order of priority Alpha Beta Gamma A.123 B.312 C.32 1 D.231 7. Larne Ltd is considering investing in a new project.The project has the following cash flows: $000 Year 0 (240) 1 120 2 140 160 4 110 5 200 The cost of capital for the company is 15%. If the cash flows in Year 3 were revised to $250,000,what would be the effect on the internal rate of return,payback period and discounted payback period of the project? Internal rate of return Payback period Discounted payback period A.Increase Decrease Decrease B.Increase No change Decrease C.Increase No change No change D.No change Decrease Decrease 8.Which one of the following statements accurately reflects an assertion of the weak form of the efficient markets hypothesis? A.Investors have access to all relevant information B.The price of a share will fluctuate randomly around its 'true value' 第4页共13页

公司理财 Assuming that the company wishes to maximise the wealth of its shareholders, what should be the order of priority for the three projects? Order of priority Alpha Beta Gamma A. 1 2 3 B. 3 1 2 C. 3 2 1 D. 2 3 1 7. Larne Ltd is considering investing in a new project. The project has the following cash flows: $000 Year 0 (240) 1 120 2 140 3 160 4 110 5 200 The cost of capital for the company is 15%. If the cash flows in Year 3 were revised to $250,000, what would be the effect on the internal rate of return, payback period and discounted payback period of the project? Internal rate of return Payback period Discounted payback period A. Increase Decrease Decrease B. Increase No change Decrease C. Increase No change No change D. No change Decrease Decrease 8. Which one of the following statements accurately reflects an assertion of the weak form of the efficient markets hypothesis? A. Investors have access to all relevant information B. The price of a share will fluctuate randomly around its ‘true value’ 第 4 页 共 13 页

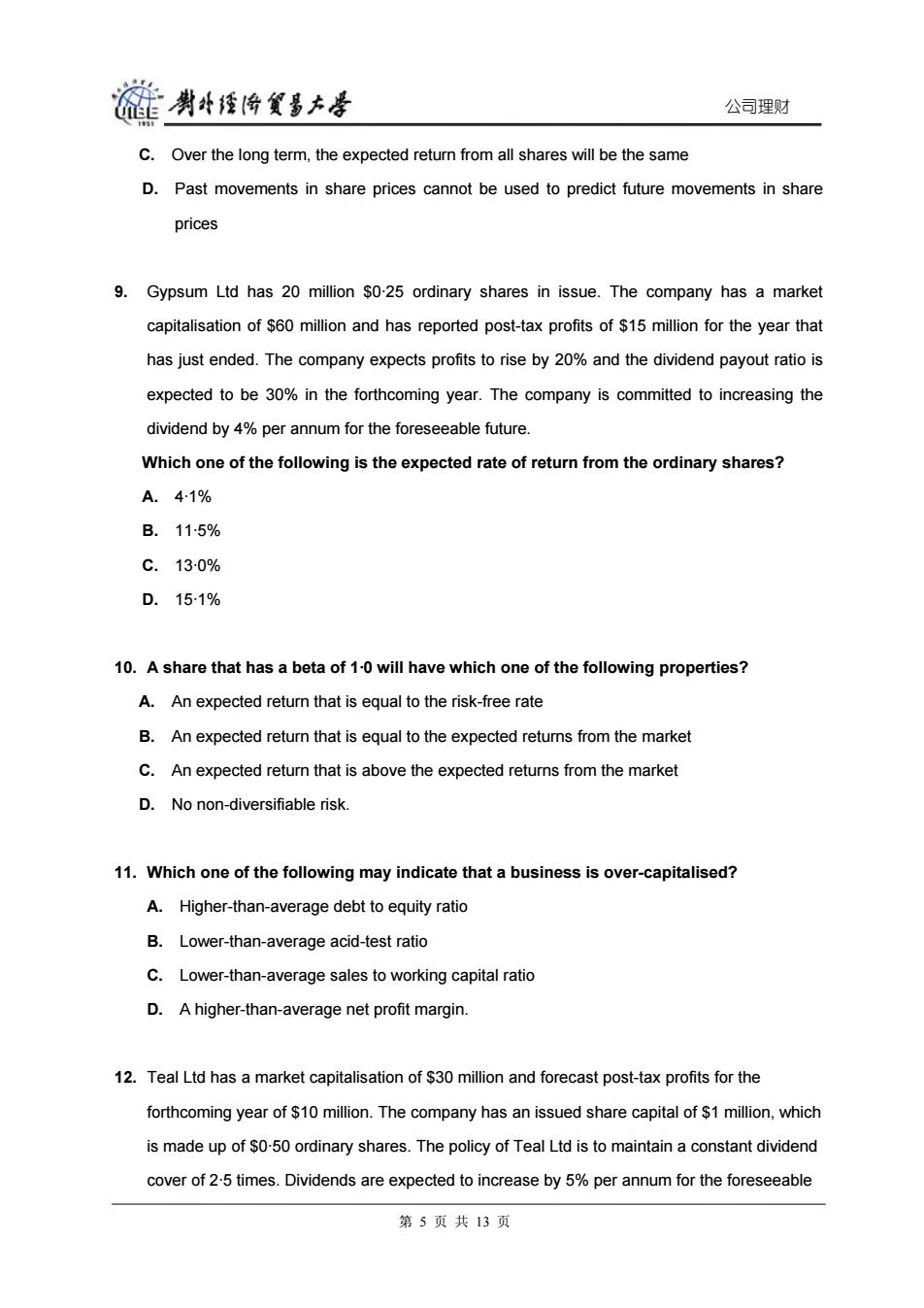

能男经哈贸多大是 公司理财 C.Over the long term,the expected return from all shares will be the same D.Past movements in share prices cannot be used to predict future movements in share prices 9.Gypsum Ltd has 20 million $0-25 ordinary shares in issue.The company has a market capitalisation of $60 million and has reported post-tax profits of $15 million for the year that has just ended.The company expects profits to rise by 20%and the dividend payout ratio is expected to be 30%in the forthcoming year.The company is committed to increasing the dividend by 4%per annum for the foreseeable future. Which one of the following is the expected rate of return from the ordinary shares? A.41% B.115% C.130% D.151% 10.A share that has a beta of 1-0 will have which one of the following properties? A.An expected return that is equal to the risk-free rate B.An expected return that is equal to the expected returns from the market C.An expected return that is above the expected returns from the market D.No non-diversifiable risk. 11.Which one of the following may indicate that a business is over-capitalised? A.Higher-than-average debt to equity ratio B.Lower-than-average acid-test ratio C.Lower-than-average sales to working capital ratio D.A higher-than-average net profit margin. 12.Teal Ltd has a market capitalisation of $30 million and forecast post-tax profits for the forthcoming year of $10 million.The company has an issued share capital of $1 million,which is made up of $0-50 ordinary shares.The policy of Teal Ltd is to maintain a constant dividend cover of 2-5 times.Dividends are expected to increase by 5%per annum for the foreseeable 第5页共13页

公司理财 C. Over the long term, the expected return from all shares will be the same D. Past movements in share prices cannot be used to predict future movements in share prices 9. Gypsum Ltd has 20 million $0·25 ordinary shares in issue. The company has a market capitalisation of $60 million and has reported post-tax profits of $15 million for the year that has just ended. The company expects profits to rise by 20% and the dividend payout ratio is expected to be 30% in the forthcoming year. The company is committed to increasing the dividend by 4% per annum for the foreseeable future. Which one of the following is the expected rate of return from the ordinary shares? A. 4·1% B. 11·5% C. 13·0% D. 15·1% 10. A share that has a beta of 1·0 will have which one of the following properties? A. An expected return that is equal to the risk-free rate B. An expected return that is equal to the expected returns from the market C. An expected return that is above the expected returns from the market D. No non-diversifiable risk. 11. Which one of the following may indicate that a business is over-capitalised? A. Higher-than-average debt to equity ratio B. Lower-than-average acid-test ratio C. Lower-than-average sales to working capital ratio D. A higher-than-average net profit margin. 12. Teal Ltd has a market capitalisation of $30 million and forecast post-tax profits for the forthcoming year of $10 million. The company has an issued share capital of $1 million, which is made up of $0·50 ordinary shares. The policy of Teal Ltd is to maintain a constant dividend cover of 2·5 times. Dividends are expected to increase by 5% per annum for the foreseeable 第 5 页 共 13 页

旋剥经降贸多去号 公司理财 future. Which of the following is the expected rate of return from the ordinary shares? a)83% b)183% c)217% d317%. 13.Which type of investment has the greatest variation in annual rate of return? a)Treasury bills b)Corporate bonds c)Large firm common stock d)Small firm common stock 14.The differences in capital structure across industries are primarily due to: A.Degree of operating risk B.Availability of non-debt tax shelters C.Ability of assets to support borrowing D.All of the above 15.Consider the following two statements concerning finance leasing. 1.The lessor is responsible for the maintenance and servicing of the asset 2.The period of the lease will cover all,or substantially all,of the useful economic life of the leased asset. Which one of the following combinations(true/false)concerning the above statements is correct? Statement 12 A.TrueTrue B.True False C.False True D.False False 第6页共13页

公司理财 future. Which of the following is the expected rate of return from the ordinary shares? a) 8·3% b) 18·3% c) 21·7% d) 31·7%. 13. Which type of investment has the greatest variation in annual rate of return? a) Treasury bills b) Corporate bonds c) Large firm common stock d) Small firm common stock 14. The differences in capital structure across industries are primarily due to: A. Degree of operating risk B. Availability of non-debt tax shelters C. Ability of assets to support borrowing D. All of the above 15. Consider the following two statements concerning finance leasing. 1. The lessor is responsible for the maintenance and servicing of the asset 2. The period of the lease will cover all, or substantially all, of the useful economic life of the leased asset. Which one of the following combinations (true/false) concerning the above statements is correct? Statement 1 2 A. True True B. True False C. False True D. False False 第 6 页 共 13 页

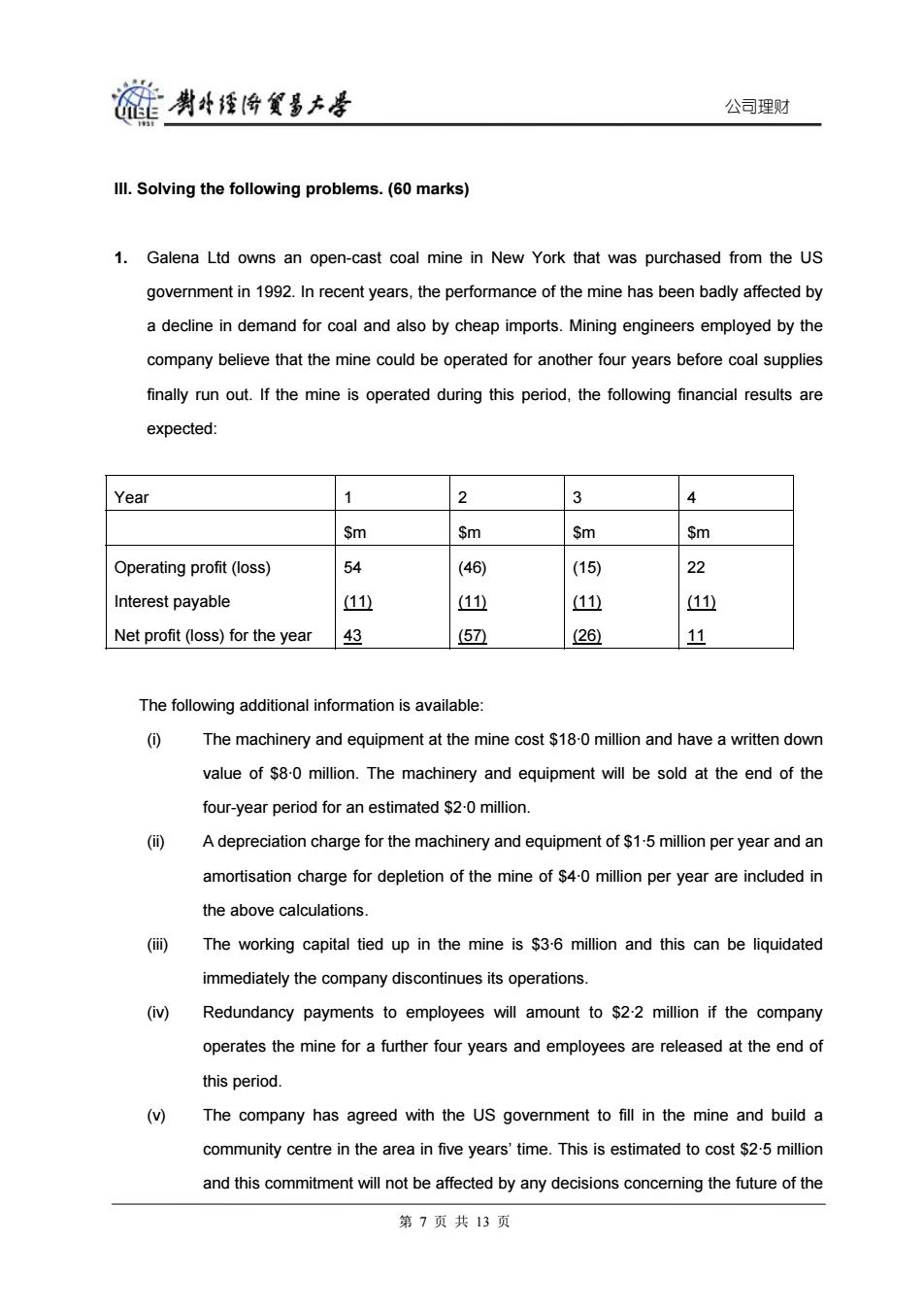

旋剥经降贸多大号 公司理财 Ill.Solving the following problems.(60 marks) 1.Galena Ltd owns an open-cast coal mine in New York that was purchased from the US government in 1992.In recent years,the performance of the mine has been badly affected by a decline in demand for coal and also by cheap imports.Mining engineers employed by the company believe that the mine could be operated for another four years before coal supplies finally run out.If the mine is operated during this period,the following financial results are expected: Year 2 3 4 $m Sm Sm Sm Operating profit (loss) 54 (46) (15) 22 Interest payable (11 11) (11) (11 Net profit (loss)for the year 43 (57 (26) 11 The following additional information is available: (0 The machinery and equipment at the mine cost $18-0 million and have a written down value of $8-0 million.The machinery and equipment will be sold at the end of the four-year period for an estimated $2-0 million. ( A depreciation charge for the machinery and equipment of $1-5 million per year and an amortisation charge for depletion of the mine of $4-0 million per year are included in the above calculations. (m) The working capital tied up in the mine is $3-6 million and this can be liquidated immediately the company discontinues its operations. () Redundancy payments to employees will amount to $2.2 million if the company operates the mine for a further four years and employees are released at the end of this period. () The company has agreed with the US government to fill in the mine and build a community centre in the area in five years'time.This is estimated to cost $2.5 million and this commitment will not be affected by any decisions concerning the future of the 第7页共13页

公司理财 III. Solving the following problems. (60 marks) 1. Galena Ltd owns an open-cast coal mine in New York that was purchased from the US government in 1992. In recent years, the performance of the mine has been badly affected by a decline in demand for coal and also by cheap imports. Mining engineers employed by the company believe that the mine could be operated for another four years before coal supplies finally run out. If the mine is operated during this period, the following financial results are expected: Year 1 2 3 4 $m $m $m $m Operating profit (loss) Interest payable Net profit (loss) for the year 54 (11) 43 (46) (11) (57) (15) (11) (26) 22 (11) 11 The following additional information is available: (i) The machinery and equipment at the mine cost $18·0 million and have a written down value of $8·0 million. The machinery and equipment will be sold at the end of the four-year period for an estimated $2·0 million. (ii) A depreciation charge for the machinery and equipment of $1·5 million per year and an amortisation charge for depletion of the mine of $4·0 million per year are included in the above calculations. (iii) The working capital tied up in the mine is $3·6 million and this can be liquidated immediately the company discontinues its operations. (iv) Redundancy payments to employees will amount to $2·2 million if the company operates the mine for a further four years and employees are released at the end of this period. (v) The company has agreed with the US government to fill in the mine and build a community centre in the area in five years’ time. This is estimated to cost $2·5 million and this commitment will not be affected by any decisions concerning the future of the 第 7 页 共 13 页

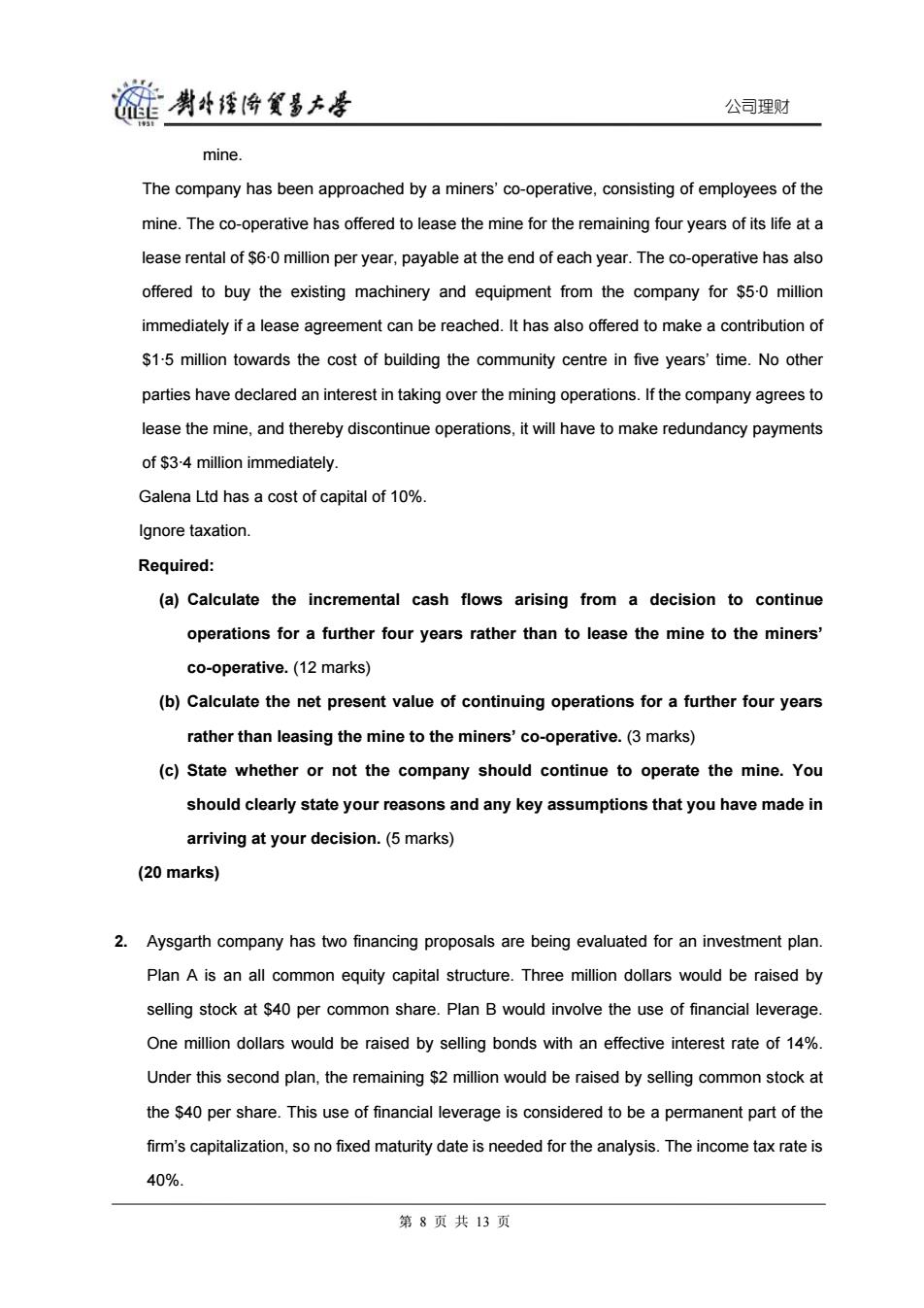

莲剥科经降父多大号 公司理财 mine. The company has been approached by a miners'co-operative,consisting of employees of the mine.The co-operative has offered to lease the mine for the remaining four years of its life at a lease rental of $6-0 million per year,payable at the end of each year.The co-operative has also offered to buy the existing machinery and equipment from the company for $50 million immediately if a lease agreement can be reached.It has also offered to make a contribution of $1-5 million towards the cost of building the community centre in five years'time.No other parties have declared an interest in taking over the mining operations.If the company agrees to lease the mine,and thereby discontinue operations,it will have to make redundancy payments of $3.4 million immediately. Galena Ltd has a cost of capital of 10% Ignore taxation. Required: (a)Calculate the incremental cash flows arising from a decision to continue operations for a further four years rather than to lease the mine to the miners' co-operative.(12 marks) (b)Calculate the net present value of continuing operations for a further four years rather than leasing the mine to the miners'co-operative.(3 marks) (c)State whether or not the company should continue to operate the mine.You should clearly state your reasons and any key assumptions that you have made in arriving at your decision.(5 marks) (20 marks) 2.Aysgarth company has two financing proposals are being evaluated for an investment plan. Plan A is an all common equity capital structure.Three million dollars would be raised by selling stock at $40 per common share.Plan B would involve the use of financial leverage. One million dollars would be raised by selling bonds with an effective interest rate of 14%. Under this second plan,the remaining $2 million would be raised by selling common stock at the $40 per share.This use of financial leverage is considered to be a permanent part of the firm's capitalization,so no fixed maturity date is needed for the analysis.The income tax rate is 40%. 第8页共13页

公司理财 mine. The company has been approached by a miners’ co-operative, consisting of employees of the mine. The co-operative has offered to lease the mine for the remaining four years of its life at a lease rental of $6·0 million per year, payable at the end of each year. The co-operative has also offered to buy the existing machinery and equipment from the company for $5·0 million immediately if a lease agreement can be reached. It has also offered to make a contribution of $1·5 million towards the cost of building the community centre in five years’ time. No other parties have declared an interest in taking over the mining operations. If the company agrees to lease the mine, and thereby discontinue operations, it will have to make redundancy payments of $3·4 million immediately. Galena Ltd has a cost of capital of 10%. Ignore taxation. Required: (a) Calculate the incremental cash flows arising from a decision to continue operations for a further four years rather than to lease the mine to the miners’ co-operative. (12 marks) (b) Calculate the net present value of continuing operations for a further four years rather than leasing the mine to the miners’ co-operative. (3 marks) (c) State whether or not the company should continue to operate the mine. You should clearly state your reasons and any key assumptions that you have made in arriving at your decision. (5 marks) (20 marks) 2. Aysgarth company has two financing proposals are being evaluated for an investment plan. Plan A is an all common equity capital structure. Three million dollars would be raised by selling stock at $40 per common share. Plan B would involve the use of financial leverage. One million dollars would be raised by selling bonds with an effective interest rate of 14%. Under this second plan, the remaining $2 million would be raised by selling common stock at the $40 per share. This use of financial leverage is considered to be a permanent part of the firm’s capitalization, so no fixed maturity date is needed for the analysis. The income tax rate is 40%. 第 8 页 共 13 页

链喇4经降发事大培 公司理财 Required: (a)Find the EBIT indifference level associated with the two financing plans.(6 marks) (b)Prepare an EBIT-EPS analysis chart for this situation.(4maks) (c)A detailed financial analysis of the firm's prospects suggests that long-term EBIT will be between $480,000 and $600,000 annually.Taking this into consideration, which financing plan would you recommend?(5marks) (d)What will be the degree of financial leverage at the difference point?(5 marks) (20 marks) 3.Fluorspar Ltd manufactures motor parts for a range of leading motor-car companies.It has recently appointed a new Finance Director who has concluded that the business does not exert sufficient control over its stocks.Within the first few weeks of taking up the new job,she found evidence of both overstocking and understocking of many items.She has decided to bring the matter to the attention of the Board of Directors as she believes that they are not fully aware of the cost of these stock control problems.She believes that the longer term solution to these problems is to adopt a just-in-time approach for many items.However,in the short term she has started to implement stock management models to help minimize costs. As a starting point,the company has implemented the Economic Order Quantity model to the management of its stock of exhaust pipes.Although this has already proved beneficial,the business has now received an offer from a supplier of one particular type of exhaust pipe.The supplier has offered Fluorspar Ltd a discount of 2-5%on the cost of each exhaust pipe for order sizes of 200 or more and a discount of 4%for order sizes of 400 or more.Each exhaust pipe costs $60 to purchase and the cost of holding one exhaust pipe in stock is estimated at $80 per year.The ordering cost is $50 and the annual sales demand is 8,000 exhaust pipes,which accrues evenly over the year. Required: (a)Identify and discuss the types of cost that may be incurred by the business when holding: (0 too much stock;and (间 too little stock;(7 marks) (b)Calculate the appropriate order size for the exhaust pipes that will minimize the total 第9页共13页

公司理财 Required: (a) Find the EBIT indifference level associated with the two financing plans. (6 marks) (b) Prepare an EBIT-EPS analysis chart for this situation. (4maks) (c) A detailed financial analysis of the firm’s prospects suggests that long-term EBIT will be between $480,000 and $600,000 annually. Taking this into consideration, which financing plan would you recommend? (5marks) (d) What will be the degree of financial leverage at the difference point? (5 marks) (20 marks) 3. Fluorspar Ltd manufactures motor parts for a range of leading motor-car companies. It has recently appointed a new Finance Director who has concluded that the business does not exert sufficient control over its stocks. Within the first few weeks of taking up the new job, she found evidence of both overstocking and understocking of many items. She has decided to bring the matter to the attention of the Board of Directors as she believes that they are not fully aware of the cost of these stock control problems. She believes that the longer term solution to these problems is to adopt a just-in-time approach for many items. However, in the short term she has started to implement stock management models to help minimize costs. As a starting point, the company has implemented the Economic Order Quantity model to the management of its stock of exhaust pipes. Although this has already proved beneficial, the business has now received an offer from a supplier of one particular type of exhaust pipe. The supplier has offered Fluorspar Ltd a discount of 2·5% on the cost of each exhaust pipe for order sizes of 200 or more and a discount of 4% for order sizes of 400 or more. Each exhaust pipe costs $60 to purchase and the cost of holding one exhaust pipe in stock is estimated at $80 per year. The ordering cost is $50 and the annual sales demand is 8,000 exhaust pipes, which accrues evenly over the year. Required: (a) Identify and discuss the types of cost that may be incurred by the business when holding: (i) too much stock; and (ii) too little stock; (7 marks) (b) Calculate the appropriate order size for the exhaust pipes that will minimize the total 第 9 页 共 13 页

裢勇牛经降贸多大是 公司理财 annual costs associated with the purchase of this item.(13 marks) (20 marks) ANSWERS FOR EXAM PAPER 2 I.(10%,1 mark each) 1.T2.T3.T 4.F 5.F 6.F7.T8.F 9.T10.F Il.(30%,two marks each) 1.B2.C 3.A 4.B 5.B 6.D 7.B 8.D 9.c 10.B 11.C12.B 13.D 14.D 15.C Ill.(60%,20marks each) 1.(a)Incremental cash flows Year 0 2 3 5 Sm $m $m $m $m $m Operating profit 540 (46-0) (15-0) 22-0 (loss) Add Depreciation 55 55 55 55 and amortisation 59-5 (40-5) (95) 275 (4 Operating cash marks) 第10页共13页

公司理财 annual costs associated with the purchase of this item. (13 marks) (20 marks) ANSWERS FOR EXAM PAPER 2 I. (10%, 1 mark each) 1. T 2. T 3. T 4. F 5. F 6. F 7. T 8. F 9. T 10. F II. (30%, two marks each) 1. B 2. C 3. A 4. B 5. B 6. D 7. B 8. D 9. C 10. B 11. C 12. B 13. D 14. D 15. C III. (60%, 20marks each) 1. (a) Incremental cash flows Year 0 $m 1 $m 2 $m 3 $m 4 $m 5 $m Operating profit (loss) Add Depreciation and amortisation Operating cash 54·0 5·5 59·5 (46·0) 5·5 (40·5) (15·0) 5·5 (9·5) 22·0 5·5 27·5 (4 marks) 第 10 页 共 13 页