CORPORATE FINANCIAL MANAGEMEN」 PART IV CAPITAL STRUCTURE AND DIVIDEND POLICY (chapter 12-14) 州经怡贸易大号 UNW原s方C等NTE3风制U方减男0G0CS

CORPORATE FINANCIAL CORPORATE FINANCIAL MANAGEMENT MANAGEMENT PART IV CAPITAL STRUCTURE AND DIVIDEND POLICY (chapter 12-14)

Chapter 12 CAPITAL STRUCTURE CONCEPTS 剥动楂份货多方是 YO年NEB证事0000

Chapter 12 Chapter 12 CAPITAL STRUCTURE CONCEPTS

Introduction 1.Concepts 2.Capital structure Theory 剥动楂份货多方是 YO年NEB证事00003

Introduction Introduction 1. Concepts 2. Capital structure Theory

1.Concepts Capital Structure Vs.Financial Structure Capital Structure Financial Structure Permanent s-t debt Total current liabilities L-T debt L-T debt P/S P/S C/S C/S 渊外校份贫多方号 YO年NEB证事0000

4 zCapital Structure Vs. Financial Structure 1. Concepts Capital Structure Permanent s-t debt L-T debt P/S C/S Financial Structure Total current liabilities L-T debt P/S C/S

Continued... OCapital Structure Terminology Optimal capital structure o Minimizes a firm's weighted cost of capital o Maximizes the value of the firm Target capital structure o Capital structure at which the firm plans to operate Debt capacity o Amount of debt in the firm's optimal capital structure 渊补楂价贸多方号 YO年N0事0E000

Continued… zCapital Structure Terminology – Optimal capital structure o Minimizes a firm’s weighted cost of capital o Maximizes the value of the firm – Target capital structure o Capital structure at which the firm plans to operate – Debt capacity o Amount of debt in the firm’s optimal capital structure

Continued... O Capital Structure Assumptions Firm's investment policy is held constant Capital structure changes the distribution of the firm's EBIT among the firm's claimants Debtholders Preferred stockholders Common stockholders Constant investment policy leaving the debt capacity of the firm unchanged 渊外经价货多六居 YO年NEB证事0000

Continued… zCapital Structure Assumptions – Firm’s investment policy is held constant – Capital structure changes the distribution of the firm’s EBIT among the firm’s claimants Debtholders Preferred stockholders Common stockholders – Constant investment policy leaving the debt capacity of the firm unchanged

2.Capital Structure Theory 问题的提出:资本结构 一企业面临的财务决 策,研究资本结构(债务/资产)与资本成本 (企业价值)之间的关系 课堂案例分讨论 9:美国航空和皇冠公司 肖补楂价货多方是 YO年NEB证事0000

2. Capital Structure Theory Capital Structure Theory z 问题的提出:资本结构 ⎯⎯ 企业面临的财务决 策,研究资本结构(债务/资产)与资本成本 (企业价值)之间的关系 9: 美国航空和皇冠公司

Continued 理论指导实践:资本结构一一个颇有争议的 论题 Theoretical Perspectives on Capital Structure and Firm Valuation(早期资本结构理论, 1958年前) o Net Income Theory o Net Operating Income Theory o Tradition Theory 剥外楂价餐多方誉 YO年NEB证事0000

Continued z 理论指导实践:资本结构——一个颇有争议的 论题 – Theoretical Perspectives on Capital Structure and Firm Valuation (早期资本结构理论, 1958年前) o Net Income Theory o Net Operating Income Theory o Tradition Theory

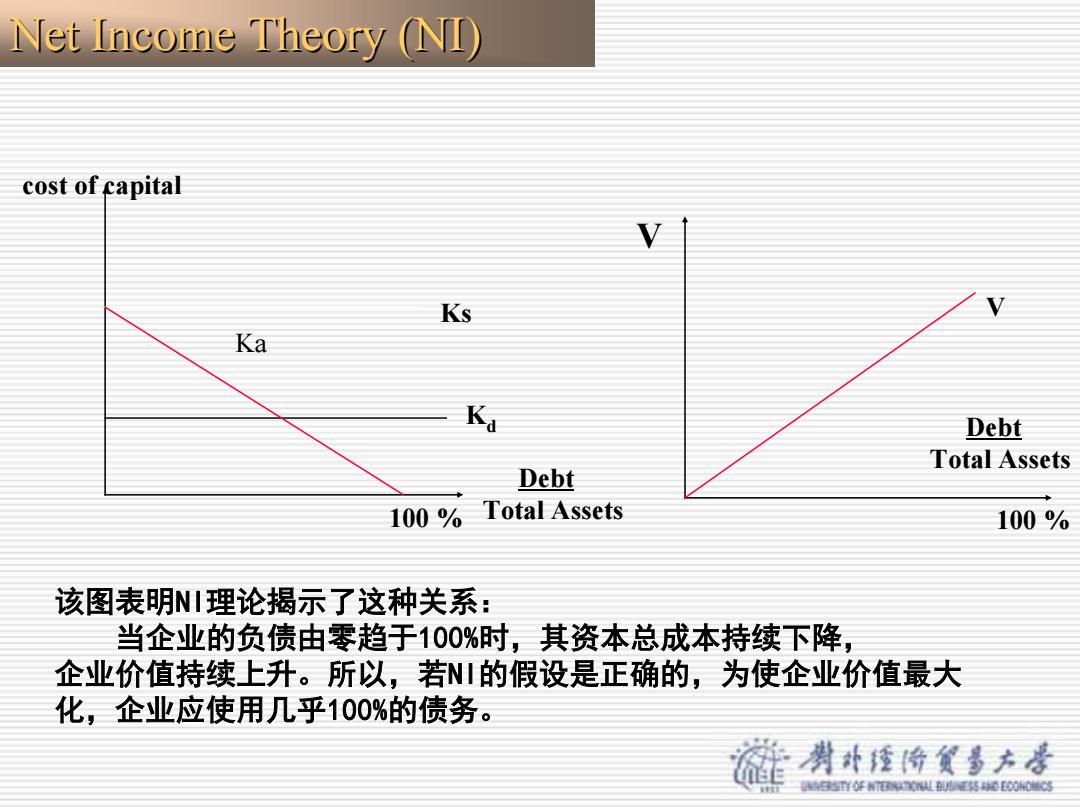

Net Income Theory (NI cost of capital Ks Ka K Debt Total Assets Debt 100 Total Assets 100% 该图表明NI理论揭示了这种关系: 当企业的负债由零趋于100%时,其资本总成本持续下降, 企业价值持续上升。所以,若N川的假设是正确的,为使企业价值最大 化,企业应使用几乎100%的债务。 渊外经价货多方是 YO年NEB证事00003

该图表明NI理论揭示了这种关系: 当企业的负债由零趋于100%时,其资本总成本持续下降, 企业价值持续上升。所以,若NI的假设是正确的,为使企业价值最大 化,企业应使用几乎100%的债务。 100 % Ks Kd Ka cost of capital Debt Total Assets V V Debt Total Assets 100 % Net Income Theory (NI) Net Income Theory (NI)

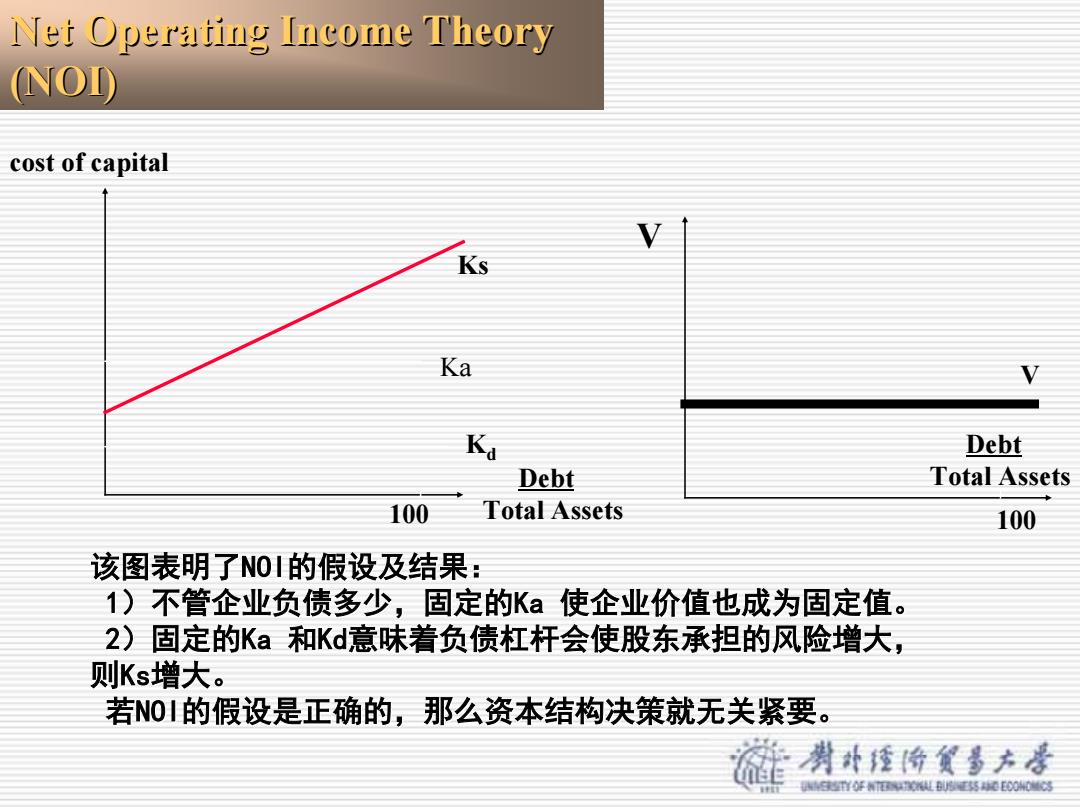

Net Operating Income Theory OI cost of capital Ka Ka Debt Debt Total Assets 100 Total Assets 100 该图表明了NO1的假设及结果: 1)不管企业负债多少,固定的Ka使企业价值也成为固定值。 2)固定的Ka和Kd意味着负债杠杆会使股东承担的风险增大, 则Ks增大。 若NO1的假设是正确的,那么资本结构决策就无关紧要。 渊补楂价货多方是 YO年NEB证事00003

该图表明了NOI的假设及结果: 1)不管企业负债多少,固定的Ka 使企业价值也成为固定值。 2)固定的Ka 和Kd意味着负债杠杆会使股东承担的风险增大, 则Ks增大。 若NOI的假设是正确的,那么资本结构决策就无关紧要。 100 Ks Kd Ka cost of capital Debt Total Assets V Debt Total Assets 100 V Net Operating Income Theory Net Operating Income Theory (NOI)