链剥科经降食多大号 公司理财 PROJECT 3 Coleraine Yachts Ltd Coleraine Yachts Ltd has been successfully operating a yacht repairs and sales business since 1922.Although it began as a family-owned and family-managed business,it is now owned by a small group of wealthy individuals who have no involvement in the day-to-day management of the business.In 1994 a sister company,Coleraine Finance Ltd,was formed to provide loan finance for customers purchasing yachts from Coleraine Yachts Ltd.At the same time,Coleraine Holdings Ltd was also formed to control both the yachting and finance companies. Coleraine Finance Ltd proved to be an extremely successful venture.It expanded its areas of operations rapidly and now provides loan facilities for a variety of purposes and for a wide range of customers.In January 2002,the Board of Directors of Coleraine Holdings Ltd undertook a review of the finance and yachting operations.It was felt that the growth prospects of the finance company were very good but that future growth was being threatened by a lack of finance.The yachting operations,on the other hand,had shown no significant growth since the mid-1990.s.Indeed,Coleraine Yachts Ltd had experienced a slight decline in sales in recent years.After much debate,the Board decided that the most profitable way forward would be to concentrate on the provision of loan finance.The yacht repairs and sales operations should,therefore,be sold and the monies raised should be used to fuel further growth of the loan finance operations. The abbreviated financial statements for Coleraine Yachts Ltd for the most recent year are as follows: Balance sheet as at 31 January 2002 f000s f000s f000s Fixed assets at written down values Freehold premises 5,400 Machinery and equipment 2,550 Motor vehicles 90 8,040 Current assets Stocks 780 Trade debtors 2.200 2,980 Less:Creditors due within one year Trade creditors 1,856 Bank overdraft 530 2.386 594 8,634 Less:Creditors due beyond one year 2.100 Loan 6.534 Capital and reserves Ordinary share capital 2,000 Retained profit 4.534 第1页共9页

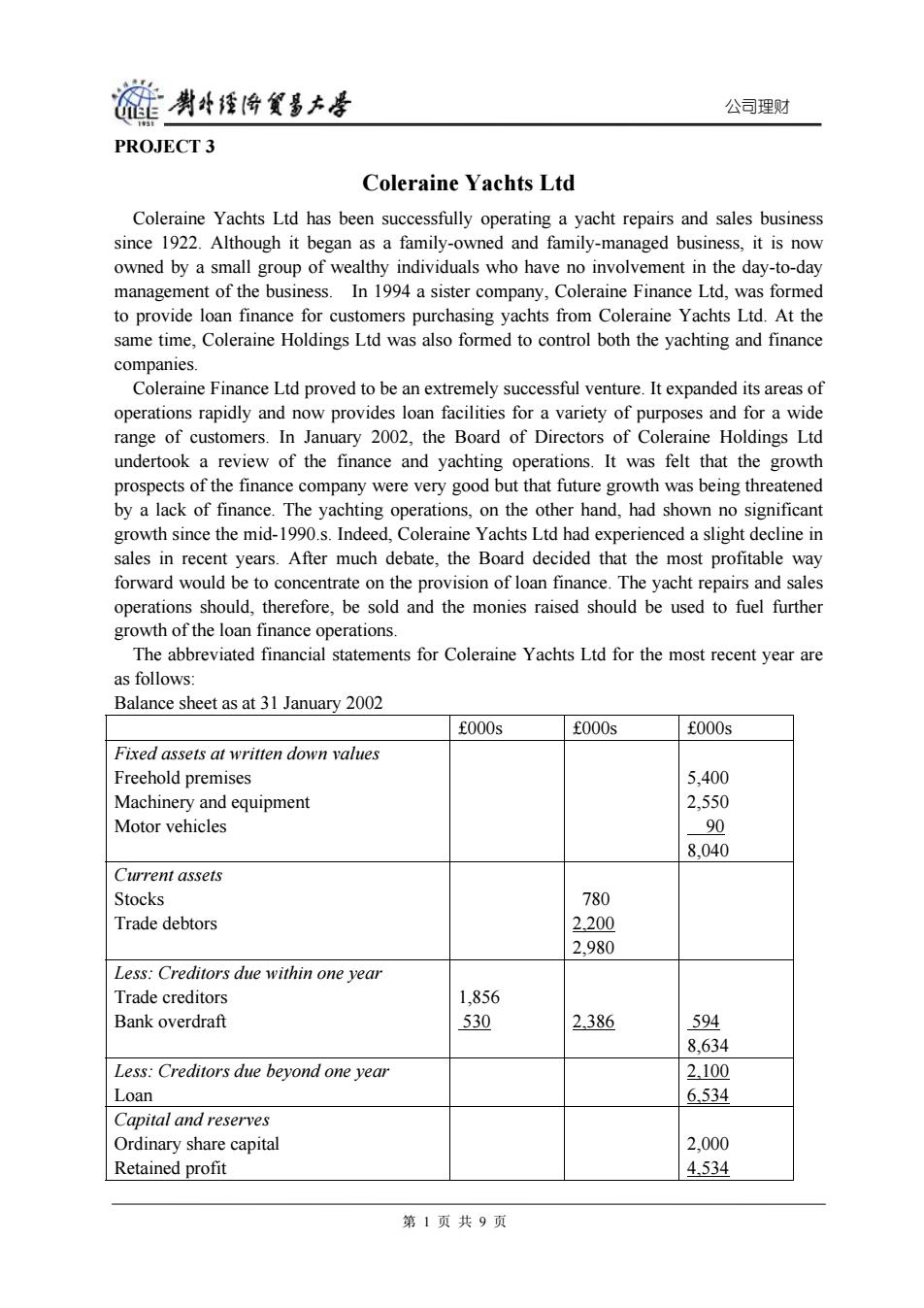

公司理财 PROJECT 3 Coleraine Yachts Ltd Coleraine Yachts Ltd has been successfully operating a yacht repairs and sales business since 1922. Although it began as a family-owned and family-managed business, it is now owned by a small group of wealthy individuals who have no involvement in the day-to-day management of the business. In 1994 a sister company, Coleraine Finance Ltd, was formed to provide loan finance for customers purchasing yachts from Coleraine Yachts Ltd. At the same time, Coleraine Holdings Ltd was also formed to control both the yachting and finance companies. Coleraine Finance Ltd proved to be an extremely successful venture. It expanded its areas of operations rapidly and now provides loan facilities for a variety of purposes and for a wide range of customers. In January 2002, the Board of Directors of Coleraine Holdings Ltd undertook a review of the finance and yachting operations. It was felt that the growth prospects of the finance company were very good but that future growth was being threatened by a lack of finance. The yachting operations, on the other hand, had shown no significant growth since the mid-1990.s. Indeed, Coleraine Yachts Ltd had experienced a slight decline in sales in recent years. After much debate, the Board decided that the most profitable way forward would be to concentrate on the provision of loan finance. The yacht repairs and sales operations should, therefore, be sold and the monies raised should be used to fuel further growth of the loan finance operations. The abbreviated financial statements for Coleraine Yachts Ltd for the most recent year are as follows: Balance sheet as at 31 January 2002 £000s £000s £000s Fixed assets at written down values Freehold premises Machinery and equipment Motor vehicles 5,400 2,550 90 8,040 Current assets Stocks Trade debtors 780 2,200 2,980 Less: Creditors due within one year Trade creditors Bank overdraft 1,856 530 2,386 594 8,634 Less: Creditors due beyond one year Loan 2,100 6,534 Capital and reserves Ordinary share capital Retained profit 2,000 4,534 第 1 页 共 9 页

旋剥经降贸多去号 公司理财 6.534 Profit and loss account for the year ended 31 January 2002 f000s 000s f000s Yacht repairs Yacht sales Total Sales 3.100 5.200 8,300 Less Operating expenses 5.810 Operating profit 2,490 Interest payable 260 Net profit 2.230 Although yacht repairs and yacht sales have experienced a slight decline in recent years,the operating profit margin for the company has remained fairly stable. News of the decision to sell the company soon reached the senior managers of Coleraine Yachts Ltd.A meeting of the managers was arranged where it was decided that a proposal for a management buy out should be developed.The managers believed that the yachting operations had been neglected in recent years.There had been very little investment in the repair yards,storage space and stocks and it was felt that sales had suffered as a result.The managers were confident that,despite the fierce competitive environment,significant sales growth was possible. The managers prepared sales forecasts for the yachting operations for the next five years on the assumption that sufficient investment would be made in the business.The forecasts were as follows: Sales for the year ended 31 January Yacht repairs Yacht sales Total Year f000s f000s f000s 2003 3,300 7,600 10,900 2004 3,700 8,183 11,883 2005 3.900 8.767 12.667 2006 4,650 9,950 14,600 2007 4,900 11,467 16,367 To achieve these sales,a rolling investment programme was needed that would involve the following outlays: Proposed investment programme Repairs and storage space Additional working capital Year ended 31 January f000s f000s 2003 2,400 240 2004 2,500 260 2005 3,600 220 2006 2,100 270 2007 4,400 280 第2页共9页

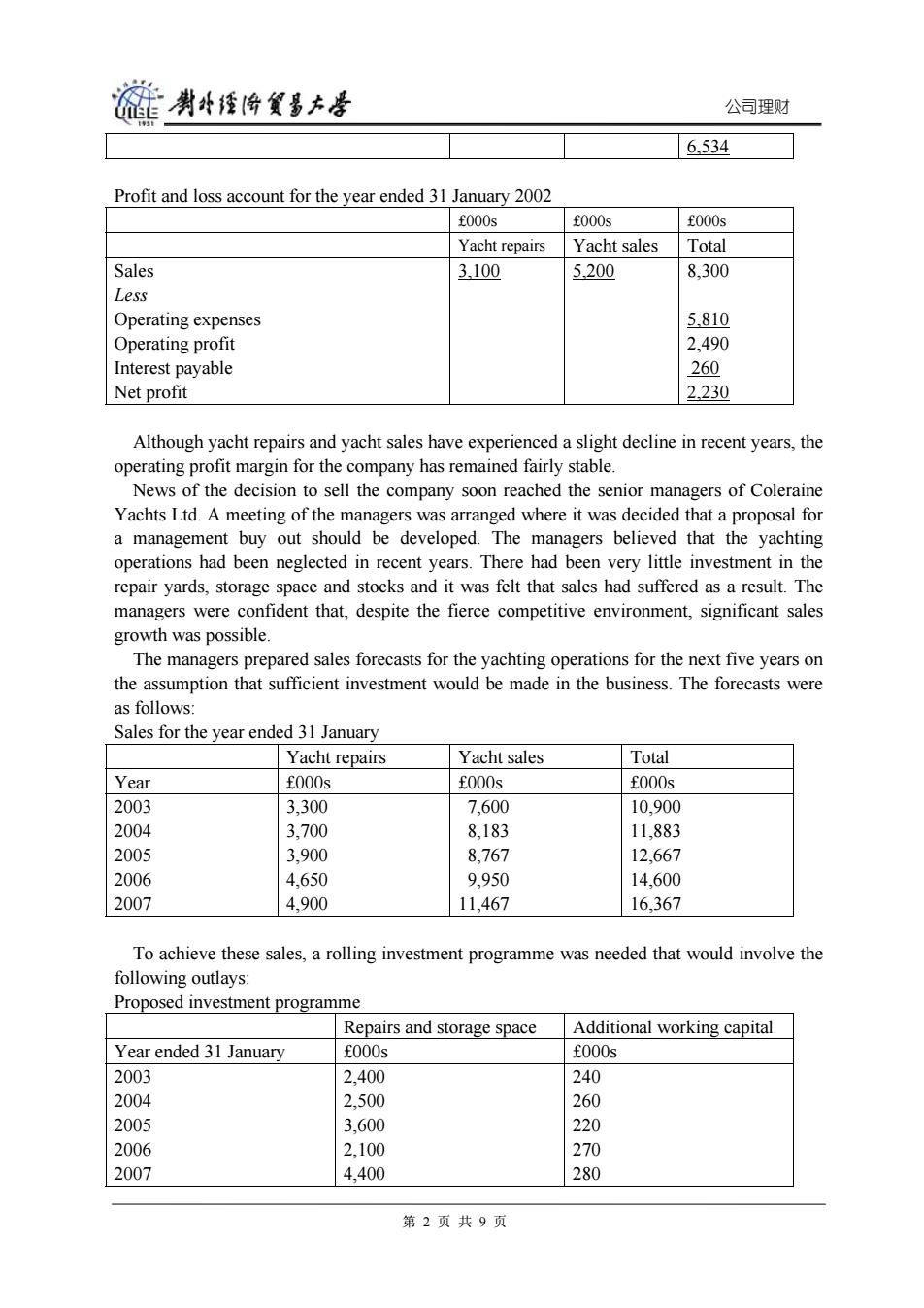

公司理财 6,534 Profit and loss account for the year ended 31 January 2002 £000s £000s £000s Yacht repairs Yacht sales Total Sales Less Operating expenses Operating profit Interest payable Net profit 3,100 5,200 8,300 5,810 2,490 260 2,230 Although yacht repairs and yacht sales have experienced a slight decline in recent years, the operating profit margin for the company has remained fairly stable. News of the decision to sell the company soon reached the senior managers of Coleraine Yachts Ltd. A meeting of the managers was arranged where it was decided that a proposal for a management buy out should be developed. The managers believed that the yachting operations had been neglected in recent years. There had been very little investment in the repair yards, storage space and stocks and it was felt that sales had suffered as a result. The managers were confident that, despite the fierce competitive environment, significant sales growth was possible. The managers prepared sales forecasts for the yachting operations for the next five years on the assumption that sufficient investment would be made in the business. The forecasts were as follows: Sales for the year ended 31 January Yacht repairs Yacht sales Total Year £000s £000s £000s 2003 2004 2005 2006 2007 3,300 3,700 3,900 4,650 4,900 7,600 8,183 8,767 9,950 11,467 10,900 11,883 12,667 14,600 16,367 To achieve these sales, a rolling investment programme was needed that would involve the following outlays: Proposed investment programme Repairs and storage space Additional working capital Year ended 31 January £000s £000s 2003 2004 2005 2006 2007 2,400 2,500 3,600 2,100 4,400 240 260 220 270 280 第 2 页 共 9 页

潮外经舍餐多卡是 公司理财 The proposed investments in repairs and storage space would be written off over a 10-year period using the straight-line method of depreciation.A breakdown of the operating expenses for the most recent year revealed that the depreciation charge was currently f350,000 per annum,which is in line with depreciation charges in recent years.The managers believed that the additional depreciation resulting from the investment programme could be offset by savings elsewhere and so operating profit margins would not be affected. The managers were aware that a financial backer was needed for the management buyout proposal.They decided,therefore,to approach Ballymena Investments Ltd,a venture capital business,with their buyout proposal and with forecasts concerning sales and the proposed investment programme for the next five years.At the first meeting between the managers and the venture capital company representatives,the likely buyout price was discussed.It was believed that the Board of Directors of Coleraine Holdings Ltd would accept a price based on a multiple of either 10 or11 times the most recent operating profit.For the agreed buyout price, all the assets relating to the yachting operation would be transferred,however,the outstanding loans would remain with the holding company. Ballymena Investments Ltd were asked to invest f15m in exchange for 70 per cent of the ordinary shares in Coleraine Yachts Ltd.The managers would invest f2,410,000m in return for the remaining 30 per cent of the share capital.Any further finance needed to acquire the company would take the form of 10 per cent loan capital for a ten-year period,which the managers believed would be provided by the bank.If the company were to be sold during the loan period,the amount of loan outstanding would be repayable immediately.The net cash flows generated by the company would be used to repay the loan capital and there would be no dividends payable in the first five years following the acquisition. The directors of Ballymena Investments Ltd met to discuss the proposal made by the managers of Coleraine Yachts Ltd.Little was known about the managers involved in the buy out proposal.Tom Ards,the general manager of Coleraine Yachts Ltd,led the management group.It was known that he had been with the business for five years and before this,had owned a car sales business.It was also known that the other members of the management team had been with the company for an average of twenty-five years.However,much more information would be needed before a final decision could be made.Ballymena Investments Ltd placed great emphasis on the management team when evaluating investment proposals. The Senior Investment Analyst of the company was fond of saying that it was better to invest in a first-class management team with a second-class product than vice versa. If Ballymena Investments Ltd agreed to invest in the proposal,the preferred investment period would be five years.The venture capitalist would then look to sell its stake in the business at a selling price of between 12 and 14 times the most recent operating profits.A.trade sale.to another business in the yachting industry was considered to be the most likely exit route.Ballymena Investments Ltd evaluates new investment proposals using the internal rate of return method and has a cost of capital of 26 per cent. All workings should be to the nearest f000. Ignore taxation. 第3页共9页

公司理财 The proposed investments in repairs and storage space would be written off over a 10-year period using the straight-line method of depreciation. A breakdown of the operating expenses for the most recent year revealed that the depreciation charge was currently £350,000 per annum, which is in line with depreciation charges in recent years. The managers believed that the additional depreciation resulting from the investment programme could be offset by savings elsewhere and so operating profit margins would not be affected. The managers were aware that a financial backer was needed for the management buyout proposal. They decided, therefore, to approach Ballymena Investments Ltd, a venture capital business, with their buyout proposal and with forecasts concerning sales and the proposed investment programme for the next five years. At the first meeting between the managers and the venture capital company representatives, the likely buyout price was discussed. It was believed that the Board of Directors of Coleraine Holdings Ltd would accept a price based on a multiple of either 10 or11 times the most recent operating profit. For the agreed buyout price, all the assets relating to the yachting operation would be transferred, however, the outstanding loans would remain with the holding company. Ballymena Investments Ltd were asked to invest £15m in exchange for 70 per cent of the ordinary shares in Coleraine Yachts Ltd. The managers would invest £2,410,000m in return for the remaining 30 per cent of the share capital. Any further finance needed to acquire the company would take the form of 10 per cent loan capital for a ten-year period, which the managers believed would be provided by the bank. If the company were to be sold during the loan period, the amount of loan outstanding would be repayable immediately. The net cash flows generated by the company would be used to repay the loan capital and there would be no dividends payable in the first five years following the acquisition. The directors of Ballymena Investments Ltd met to discuss the proposal made by the managers of Coleraine Yachts Ltd. Little was known about the managers involved in the buy out proposal. Tom Ards, the general manager of Coleraine Yachts Ltd, led the management group. It was known that he had been with the business for five years and before this, had owned a car sales business. It was also known that the other members of the management team had been with the company for an average of twenty-five years. However, much more information would be needed before a final decision could be made. Ballymena Investments Ltd placed great emphasis on the management team when evaluating investment proposals. The Senior Investment Analyst of the company was fond of saying that it was better to invest in a first-class management team with a second-class product than vice versa. If Ballymena Investments Ltd agreed to invest in the proposal, the preferred investment period would be five years. The venture capitalist would then look to sell its stake in the business at a selling price of between 12 and 14 times the most recent operating profits. A .trade sale. to another business in the yachting industry was considered to be the most likely exit route. Ballymena Investments Ltd evaluates new investment proposals using the internal rate of return method and has a cost of capital of 26 per cent. All workings should be to the nearest £000. Ignore taxation. 第 3 页 共 9 页

爸剥斗煙怜食多本学 公司理财 Required: Consider the investment proposal from the perspective of Ballymena Investments Ltd. (a)Prepare calculations that will provide Ballymena Investments Ltd with an initial screening of the investment proposal.In preparing the calculations,you should take account of any uncertainty involved in the proposal and you should clearly state any assumptions that you have made.(30 marks) (b)Identify and discuss the additional information that is critical to a full consideration of the investment and the key issues that should be considered in relation to the information already provided.(10 marks) (c)Identify and discuss the attributes that a management team should possess in order to be attractive to a venture capitalist.(5 marks) (d)Provide a preliminary evaluation of the financial proposal for consideration by the directors of Ballymena Investments Ltd.(5 marks) (50 marks) SUGGESTED ANSWERS FOR PROJECT Coleraine Yachts Ltd The case study could be answered in various ways.The points made below should, therefore,be regarded as indicative 1 (a)Internal rate of return This part should include an internal rate of return (IRR)calculation for the investment proposal.The IRR calculations shown below rest on the following key points and assumptions: 1.The purchase price of the company is based on 10 times the operating profit for the most recent year. 2.The selling price of the company at the end of five years is based on the lower end of the range mentioned(i.e.12 times the operating profit). 3.The operating profit margin stays constant throughout the investment period and is the same as that in the most recent year. 4.Sales forecasts and investment programme costs are as shown in the case study. As the cash generated by the business will be used to repay the loan,a calculation of the cash available each year to repay the loan is required. Cash available to repay loan Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Sales 10.900 11.883 12.667 14.600 16.367 Operating profit* 3,270 3,565 3,800 4,380 4,910 第4页共9页

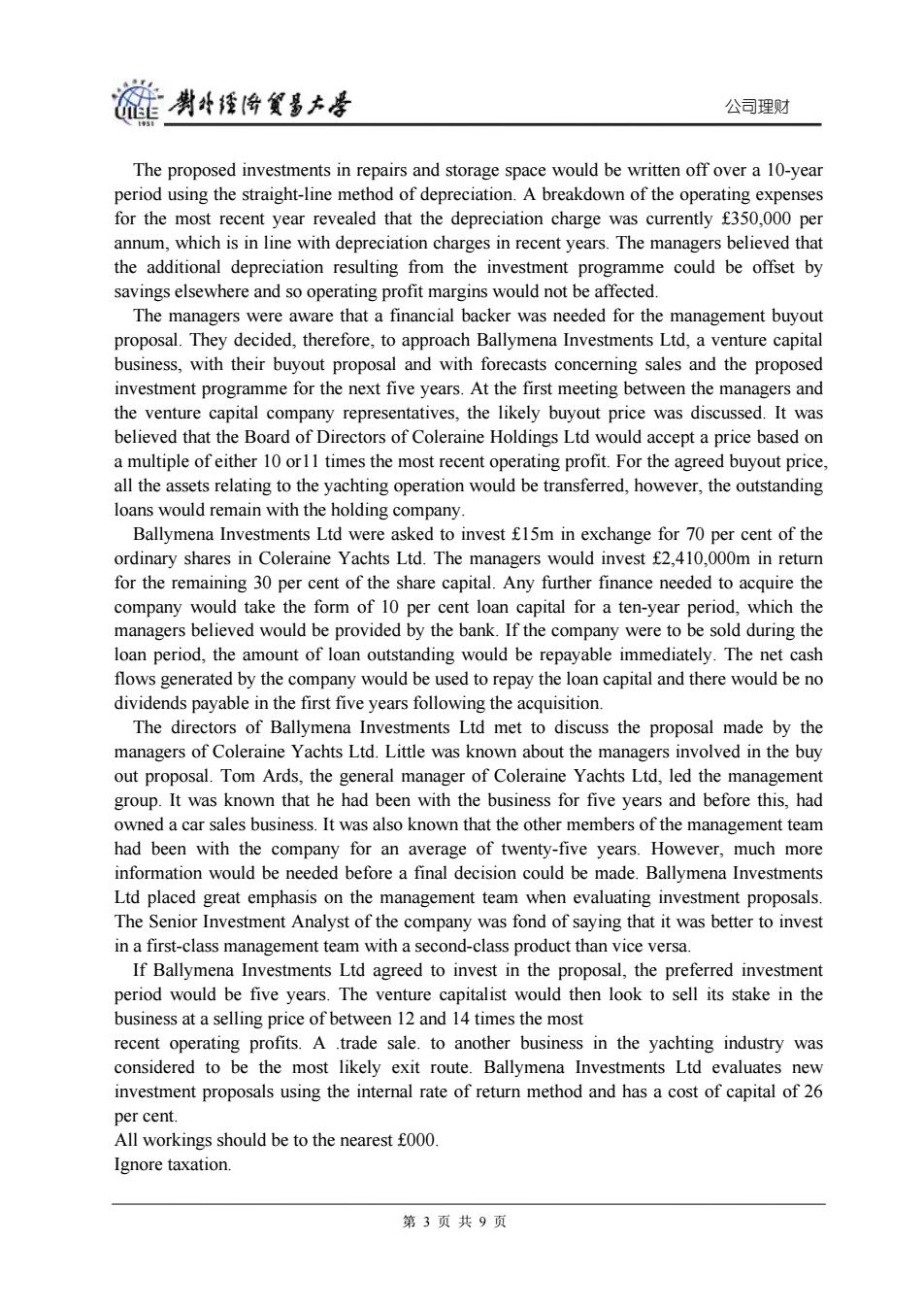

公司理财 Required: Consider the investment proposal from the perspective of Ballymena Investments Ltd. (a) Prepare calculations that will provide Ballymena Investments Ltd with an initial screening of the investment proposal. In preparing the calculations, you should take account of any uncertainty involved in the proposal and you should clearly state any assumptions that you have made. (30 marks) (b) Identify and discuss the additional information that is critical to a full consideration of the investment and the key issues that should be considered in relation to the information already provided. (10 marks) (c) Identify and discuss the attributes that a management team should possess in order to be attractive to a venture capitalist. (5 marks) (d) Provide a preliminary evaluation of the financial proposal for consideration by the directors of Ballymena Investments Ltd. (5 marks) (50 marks) SUGGESTED ANSWERS FOR PROJECT Coleraine Yachts Ltd The case study could be answered in various ways. The points made below should, therefore, be regarded as indicative. 1 (a) Internal rate of return This part should include an internal rate of return (IRR) calculation for the investment proposal. The IRR calculations shown below rest on the following key points and assumptions: 1. The purchase price of the company is based on 10 times the operating profit for the most recent year. 2. The selling price of the company at the end of five years is based on the lower end of the range mentioned (i.e. 12 times the operating profit). 3. The operating profit margin stays constant throughout the investment period and is the same as that in the most recent year. 4. Sales forecasts and investment programme costs are as shown in the case study. As the cash generated by the business will be used to repay the loan, a calculation of the cash available each year to repay the loan is required. Cash available to repay loan Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Sales Operating profit* 10,900 3,270 11,883 3,565 12,667 3,800 14,600 4,380 16,367 4,910 第 4 页 共 9 页

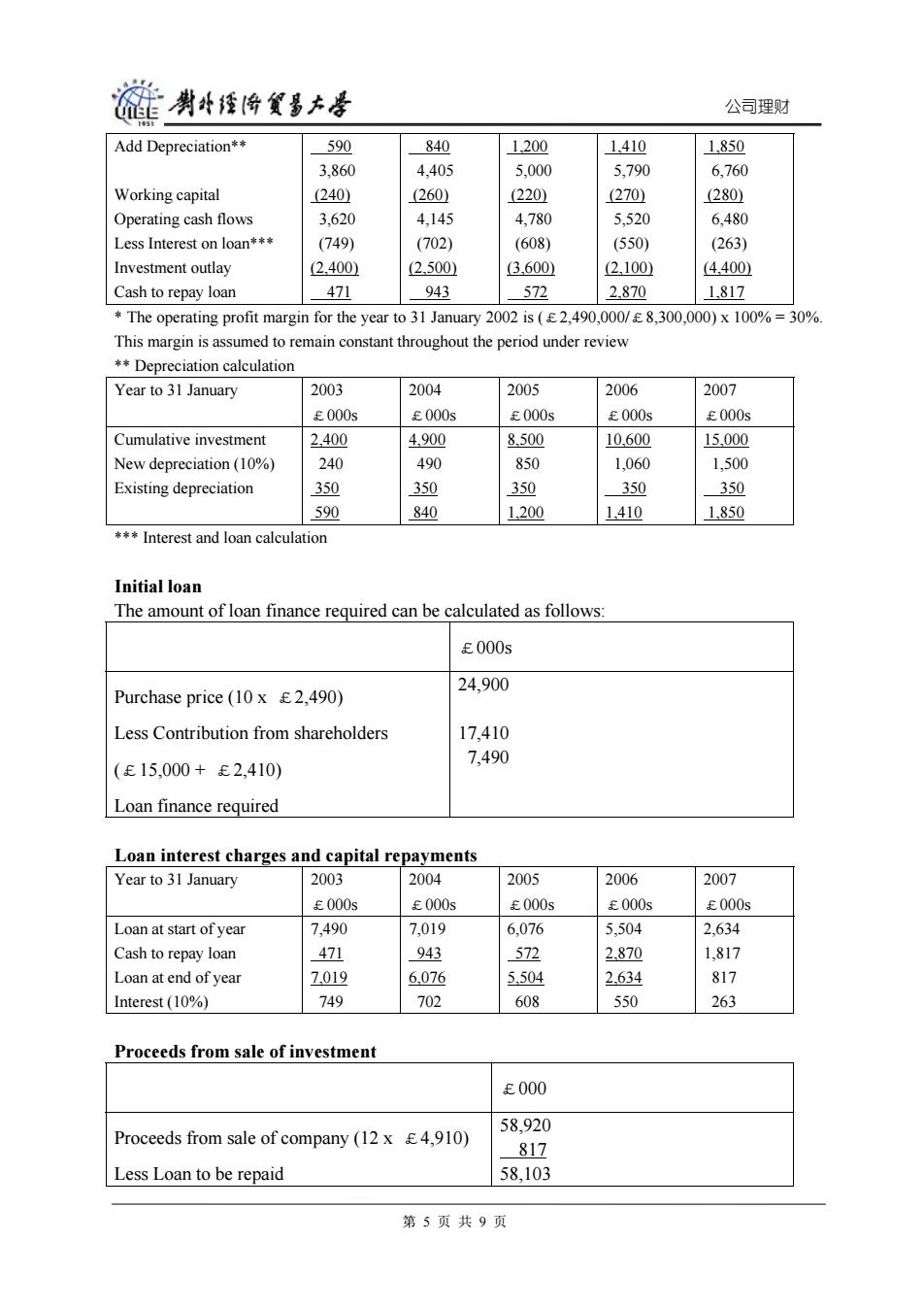

链黄科特倚食事大香 公司理财 Add Depreciation** 590 840 1.200 1.410 1.850 3.860 4.405 5.000 5,790 6,760 Working capital (240) (260) (220 (270) (280) Operating cash flows 3.620 4,145 4,780 5.520 6.480 Less Interest on loan*** (749) (702) (608) (550) (263) Investment outlay (2.400 (2.500 (3,600) (2.100 (4.400 Cash to repay loan 471 943 572 2.870 1.817 The operating profit margin for the year to 31 January 2002 is(2,490,000/E8,300,000)x 100%=30%. This margin is assumed to remain constant throughout the period under review **Depreciation calculation Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Cumulative investment 2.400 4.900 8.500 10.600 15,000 New depreciation(10%) 240 490 850 1.060 1,500 Existing depreciation 350 350 350 350 350 590 840 1.200 1.410 1.850 **Interest and loan calculation Initial loan The amount of loan finance required can be calculated as follows: £000s 24,900 Purchase price(10 x E2,490) Less Contribution from shareholders 17,410 7,490 (£15,000+£2,410) Loan finance required Loan interest charges and capital repayments Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Loan at start of year 7,490 7,019 6.076 5,504 2,634 Cash to repay loan 471 943 572 2.870 1,817 Loan at end of year 7.019 6.076 5.504 2.634 817 Interest(10%) 749 702 608 550 263 Proceeds from sale of investment £000 58,920 Proceeds from sale of company (12 x 4,910) 817 Less Loan to be repaid 58,103 第5页共9页

公司理财 Add Depreciation** Working capital Operating cash flows Less Interest on loan*** Investment outlay Cash to repay loan 590 3,860 (240) 3,620 (749) (2,400) 471 840 4,405 (260) 4,145 (702) (2,500) 943 1,200 5,000 (220) 4,780 (608) (3,600) 572 1,410 5,790 (270) 5,520 (550) (2,100) 2,870 1,850 6,760 (280) 6,480 (263) (4,400) 1,817 * The operating profit margin for the year to 31 January 2002 is (£2,490,000/£8,300,000) x 100% = 30%. This margin is assumed to remain constant throughout the period under review ** Depreciation calculation Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Cumulative investment New depreciation (10%) Existing depreciation 2,400 240 350 590 4,900 490 350 840 8,500 850 350 1,200 10,600 1,060 350 1,410 15,000 1,500 350 1,850 *** Interest and loan calculation Initial loan The amount of loan finance required can be calculated as follows: £000s Purchase price (10 x £2,490) Less Contribution from shareholders (£15,000 + £2,410) Loan finance required 24,900 17,410 7,490 Loan interest charges and capital repayments Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Loan at start of year Cash to repay loan Loan at end of year Interest (10%) 7,490 471 7,019 749 7,019 943 6,076 702 6,076 572 5,504 608 5,504 2,870 2,634 550 2,634 1,817 817 263 Proceeds from sale of investment £000 Proceeds from sale of company (12 x £4,910) Less Loan to be repaid 58,920 817 58,103 第 5 页 共 9 页

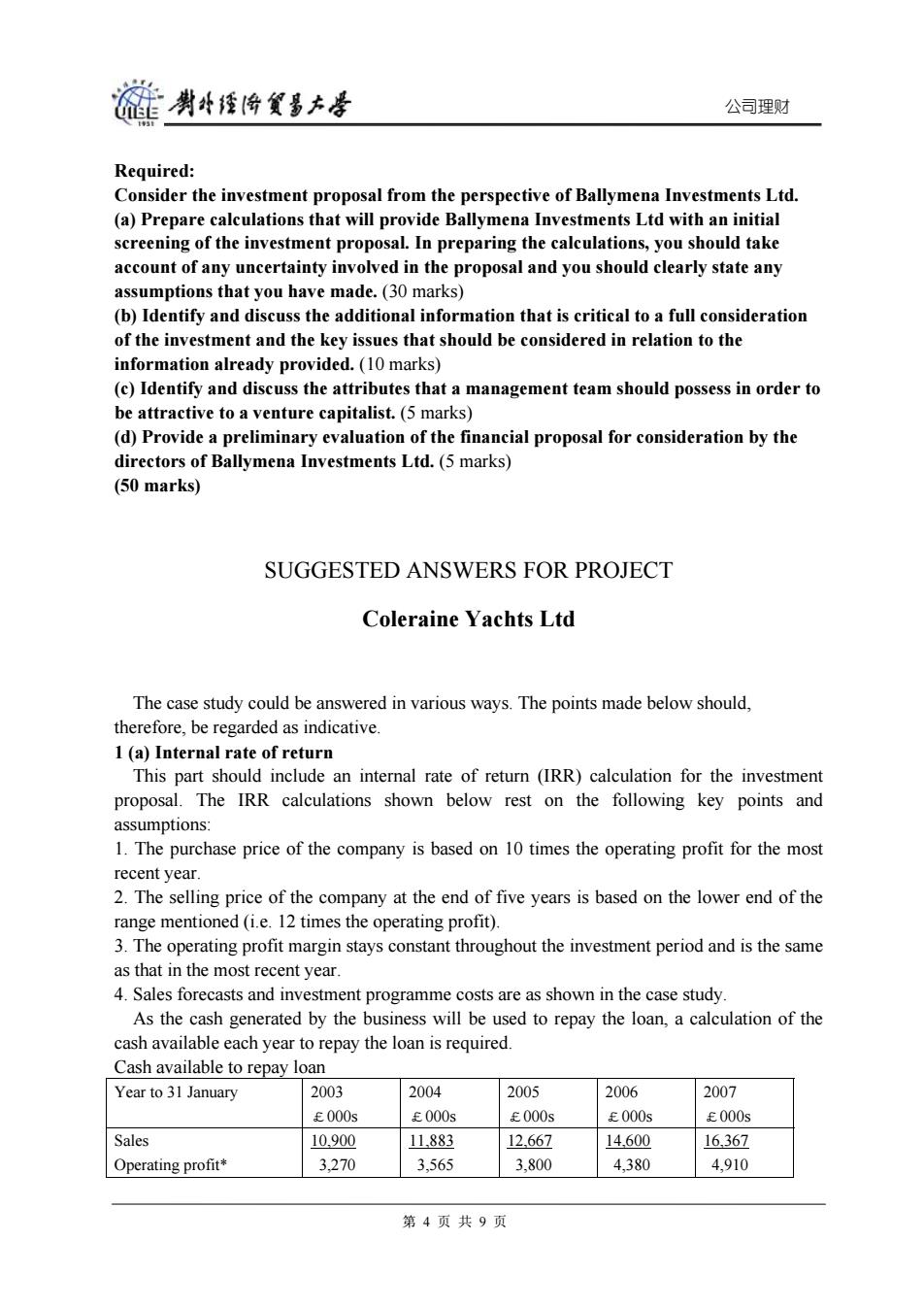

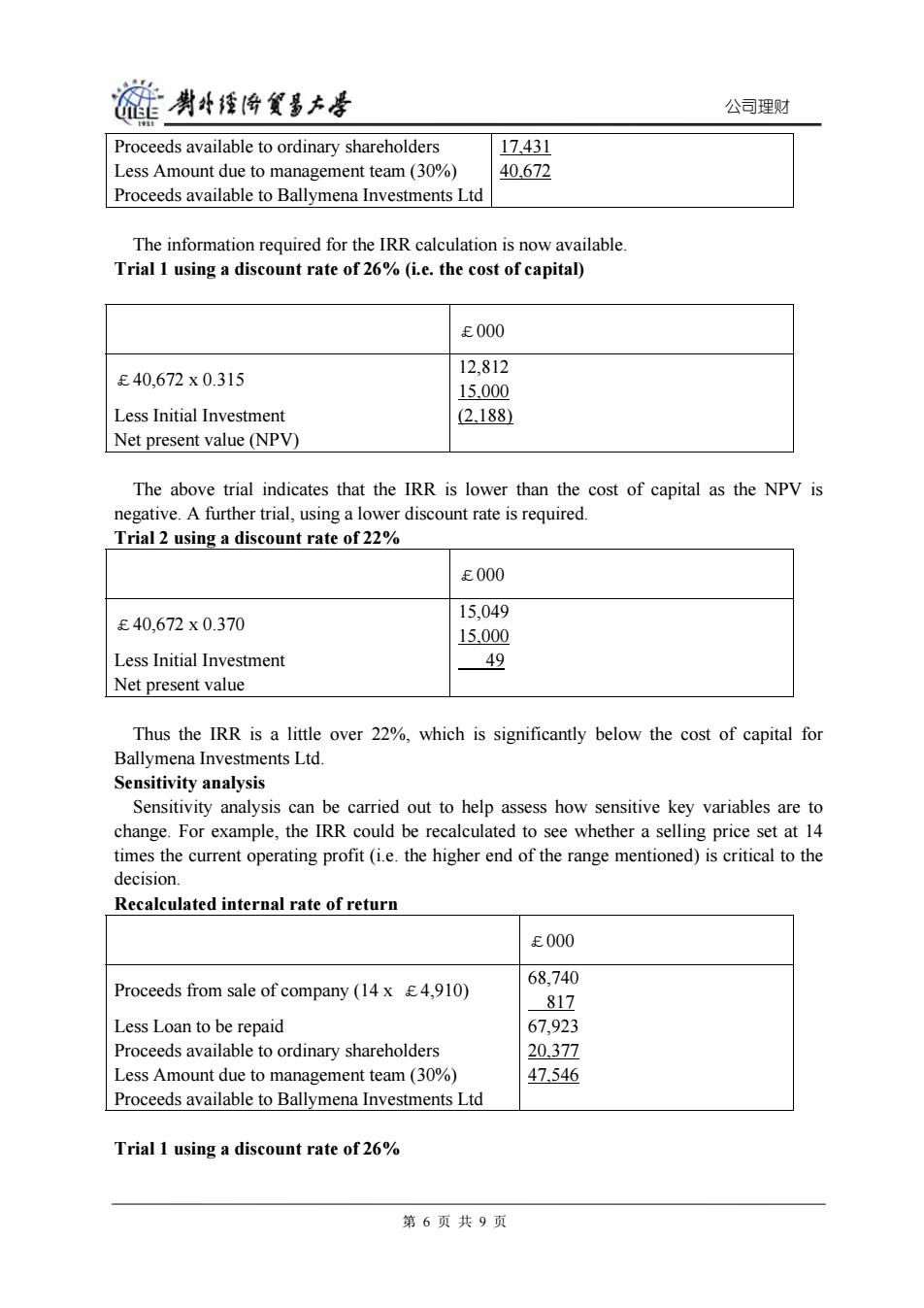

链黄科特倚食事大香 公司理财 Proceeds available to ordinary shareholders 17.431 Less Amount due to management team(30%) 40.672 Proceeds available to Ballymena Investments Ltd The information required for the IRR calculation is now available. Trial 1 using a discount rate of 26%(i.e.the cost of capital) £000 12,812 £40,672x0.315 15.000 Less Initial Investment 2.188) Net present value (NPV) The above trial indicates that the IRR is lower than the cost of capital as the NPV is negative.A further trial,using a lower discount rate is required. Trial 2 using a discount rate of 22% £000 15.049 £40,672x0.370 15,000 Less Initial Investment 49 Net present value Thus the IRR is a little over 22%,which is significantly below the cost of capital for Ballymena Investments Ltd. Sensitivity analysis Sensitivity analysis can be carried out to help assess how sensitive key variables are to change.For example,the IRR could be recalculated to see whether a selling price set at 14 times the current operating profit (i.e.the higher end of the range mentioned)is critical to the decision. Recalculated internal rate of return £000 68,740 Proceeds from sale of company (14 x E4,910) 817 Less Loan to be repaid 67,923 Proceeds available to ordinary shareholders 20.377 Less Amount due to management team(30%) 47.546 Proceeds available to Ballymena Investments Ltd Trial 1 using a discount rate of 26% 第6页共9页

公司理财 Proceeds available to ordinary shareholders Less Amount due to management team (30%) Proceeds available to Ballymena Investments Ltd 17,431 40,672 The information required for the IRR calculation is now available. Trial 1 using a discount rate of 26% (i.e. the cost of capital) £000 £40,672 x 0.315 Less Initial Investment Net present value (NPV) 12,812 15,000 (2,188) The above trial indicates that the IRR is lower than the cost of capital as the NPV is negative. A further trial, using a lower discount rate is required. Trial 2 using a discount rate of 22% £000 £40,672 x 0.370 Less Initial Investment Net present value 15,049 15,000 49 Thus the IRR is a little over 22%, which is significantly below the cost of capital for Ballymena Investments Ltd. Sensitivity analysis Sensitivity analysis can be carried out to help assess how sensitive key variables are to change. For example, the IRR could be recalculated to see whether a selling price set at 14 times the current operating profit (i.e. the higher end of the range mentioned) is critical to the decision. Recalculated internal rate of return £000 Proceeds from sale of company (14 x £4,910) Less Loan to be repaid Proceeds available to ordinary shareholders Less Amount due to management team (30%) Proceeds available to Ballymena Investments Ltd 68,740 817 67,923 20,377 47,546 Trial 1 using a discount rate of 26% 第 6 页 共 9 页

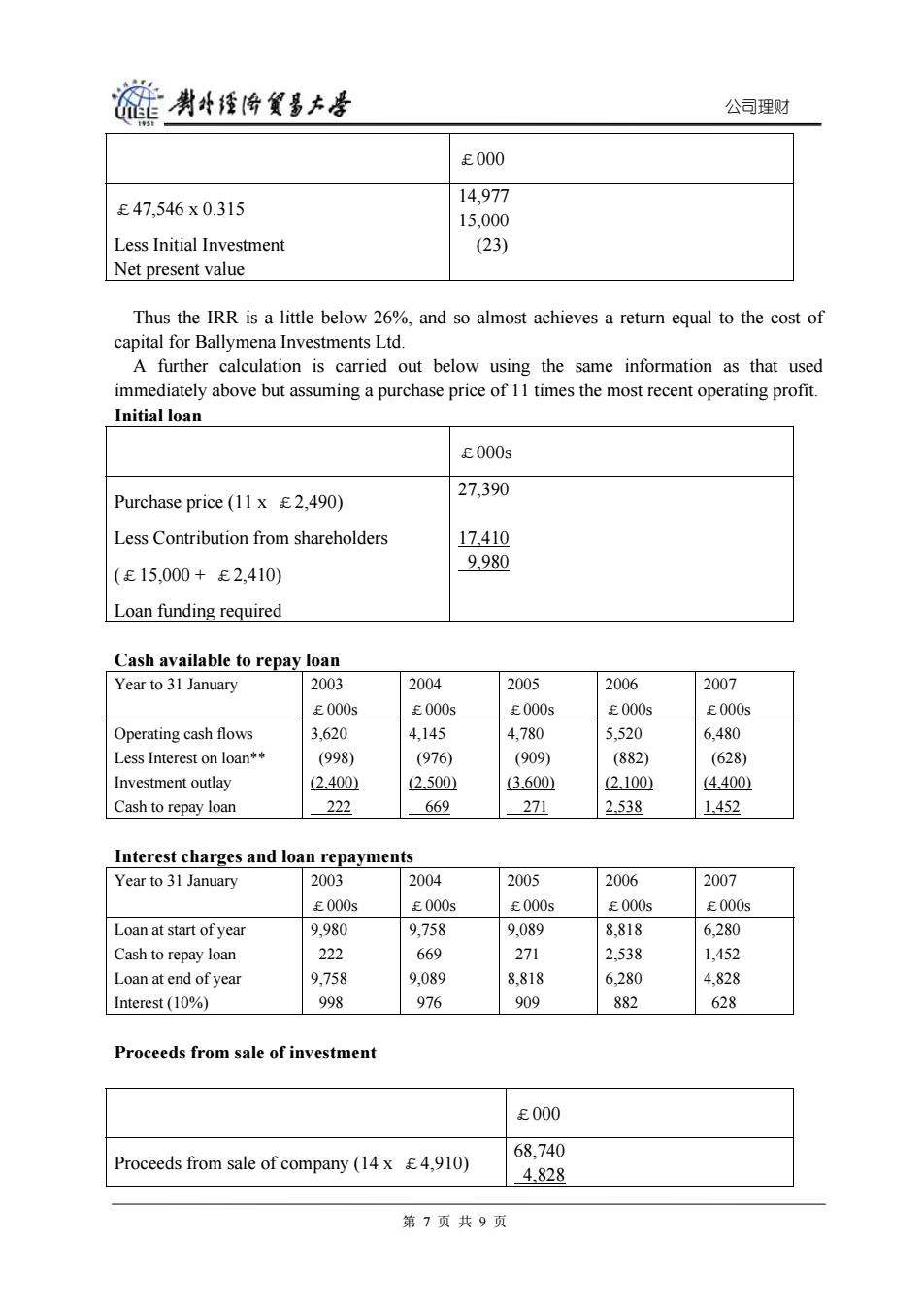

链剥矮怜氢多大泽 公司理财 £000 14,977 £47,546x0.315 15,000 Less Initial Investment (23) Net present value Thus the IRR is a little below 26%,and so almost achieves a return equal to the cost of capital for Ballymena Investments Ltd. a further calculation is carried out below using the same information as that used immediately above but assuming a purchase price of 11 times the most recent operating profit. Initial loan £000s 27,390 Purchase price(11 x E2,490) Less Contribution from shareholders 17410 9.980 (£15,000+£2,410) Loan funding required Cash available to repay loan Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Operating cash flows 3,620 4,145 4,780 5,520 6,480 Less Interest on loan** (998) (976) (909) (882) (628) Investment outlay (2.400) 2.500) (3.600 2.100 (4.400 Cash to repay loan 222 669 271 2.538 1.452 Interest charges and loan repayments Year to 31 January 2003 2004 2005 2006 2007 £000s £000s £000s £000s £000s Loan at start of year 9,980 9,758 9,089 8,818 6,280 Cash to repay loan 222 669 271 2,538 1.452 Loan at end of year 9,758 9.089 8,818 6,280 4,828 Interest(10%) 998 976 909 882 628 Proceeds from sale of investment £000 68740 Proceeds from sale of company (14 x E4,910) 4.828 第7页共9页

公司理财 £000 £47,546 x 0.315 Less Initial Investment Net present value 14,977 15,000 (23) Thus the IRR is a little below 26%, and so almost achieves a return equal to the cost of capital for Ballymena Investments Ltd. A further calculation is carried out below using the same information as that used immediately above but assuming a purchase price of 11 times the most recent operating profit. Initial loan £000s Purchase price (11 x £2,490) Less Contribution from shareholders (£15,000 + £2,410) Loan funding required 27,390 17,410 9,980 Cash available to repay loan Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Operating cash flows Less Interest on loan** Investment outlay Cash to repay loan 3,620 (998) (2,400) 222 4,145 (976) (2,500) 669 4,780 (909) (3,600) 271 5,520 (882) (2,100) 2,538 6,480 (628) (4,400) 1,452 Interest charges and loan repayments Year to 31 January 2003 £000s 2004 £000s 2005 £000s 2006 £000s 2007 £000s Loan at start of year Cash to repay loan Loan at end of year Interest (10%) 9,980 222 9,758 998 9,758 669 9,089 976 9,089 271 8,818 909 8,818 2,538 6,280 882 6,280 1,452 4,828 628 Proceeds from sale of investment £000 Proceeds from sale of company (14 x £4,910) 68,740 4,828 第 7 页 共 9 页

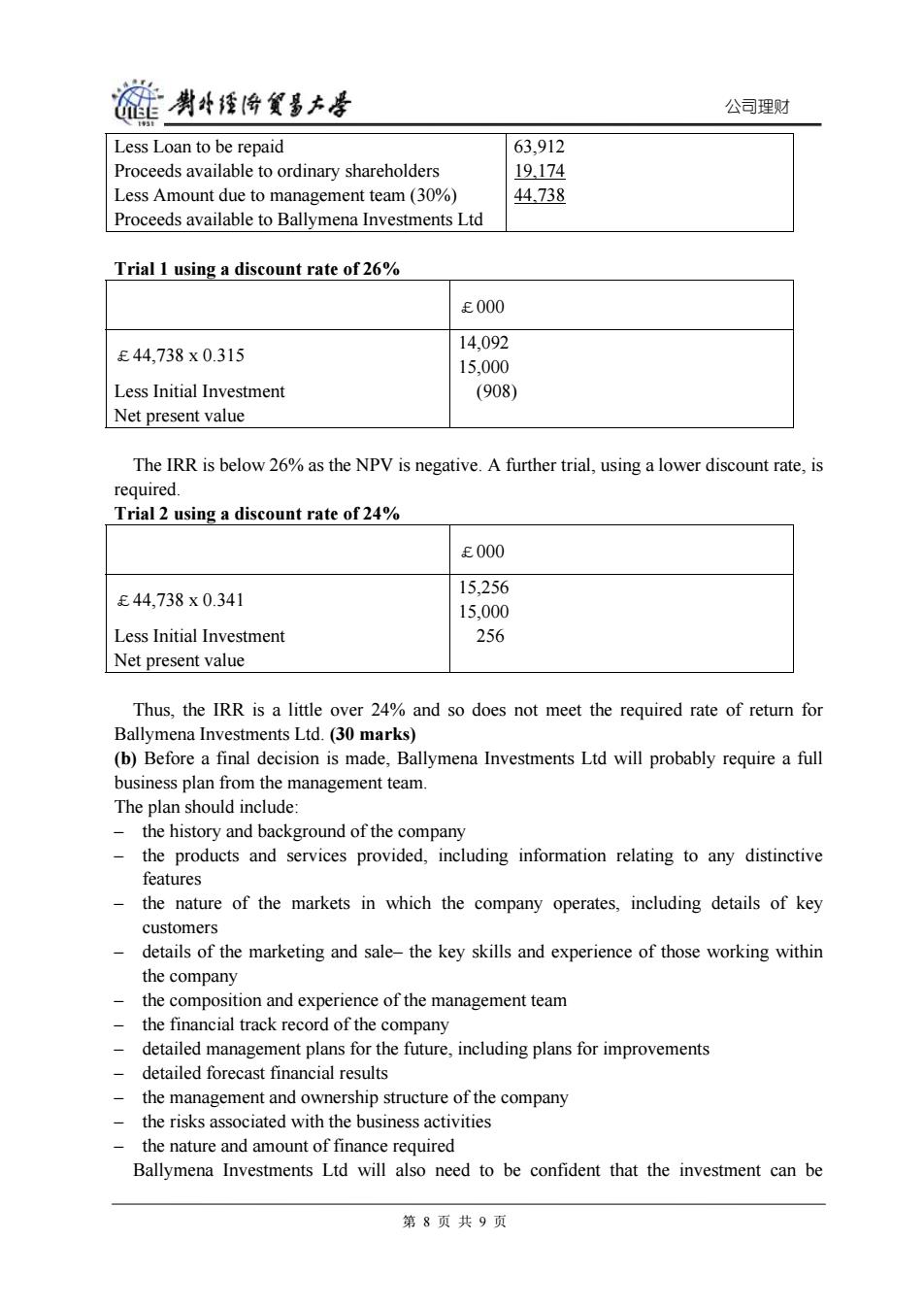

链剥将发多大是 公司理财 Less Loan to be repaid 63.912 Proceeds available to ordinary shareholders 19.174 Less Amount due to management team(30%) 44.738 Proceeds available to Ballymena Investments Ltd Trial 1 using a discount rate of 26% £000 14,092 £44,738x0.315 15,000 Less Initial Investment (908) Net present value The IRR is below 26%as the NPV is negative.A further trial,using a lower discount rate,is required. Trial 2 using a discount rate of 24% £000 15,256 £44,738x0.341 15,000 Less Initial Investment 256 Net present value Thus,the IRR is a little over 24%and so does not meet the required rate of return for Ballymena Investments Ltd.(30 marks) (b)Before a final decision is made,Ballymena Investments Ltd will probably require a full business plan from the management team. The plan should include: the history and background of the company -the products and services provided,including information relating to any distinctive features the nature of the markets in which the company operates,including details of key customers details of the marketing and sale-the key skills and experience of those working within the company the composition and experience of the management team the financial track record of the company detailed management plans for the future,including plans for improvements detailed forecast financial results the management and ownership structure of the company the risks associated with the business activities the nature and amount of finance required Ballymena Investments Ltd will also need to be confident that the investment can be 第8页共9页

公司理财 Less Loan to be repaid Proceeds available to ordinary shareholders Less Amount due to management team (30%) Proceeds available to Ballymena Investments Ltd 63,912 19,174 44,738 Trial 1 using a discount rate of 26% £000 £44,738 x 0.315 Less Initial Investment Net present value 14,092 15,000 (908) The IRR is below 26% as the NPV is negative. A further trial, using a lower discount rate, is required. Trial 2 using a discount rate of 24% £000 £44,738 x 0.341 Less Initial Investment Net present value 15,256 15,000 256 Thus, the IRR is a little over 24% and so does not meet the required rate of return for Ballymena Investments Ltd. (30 marks) (b) Before a final decision is made, Ballymena Investments Ltd will probably require a full business plan from the management team. The plan should include: – the history and background of the company – the products and services provided, including information relating to any distinctive features – the nature of the markets in which the company operates, including details of key customers – details of the marketing and sale– the key skills and experience of those working within the company – the composition and experience of the management team – the financial track record of the company – detailed management plans for the future, including plans for improvements – detailed forecast financial results – the management and ownership structure of the company – the risks associated with the business activities – the nature and amount of finance required Ballymena Investments Ltd will also need to be confident that the investment can be 第 8 页 共 9 页

碰男华经海贸多大学 公司理财 realised at the appropriate time. The information already provided by the management team needs to be examined carefully Key issues include: the extent to which the forecast revenue figures are in line with expected growth within the industry the assumption that sales can be increased significantly compared to previous years - the likely impact of changes in technology,the markets or the industry on forecast results the likelihood of maintaining a similar operating profit margin to previous years given the increased level of investment and sales that are predicted the extent to which the proposed investment plans are adequate to support the expected level of sales (10 marks) (c)The attributes that a management team should possess include: a good track record in delivering results a balance of skills and experience necessary to undertake the venture an ability to work successfully as a team a commitment to the venture,including a willingness to make a significant financial commitment an ability to work with the venture capitalist 一 a willingness to accept the typical deal structures offered by venture capitalists the ability to pursue clearly-stated goals but also to maintain flexibility a set of realistic expectations about likely future outcomes.(5 marks) (d)The evaluation of the investment proposal should include: a discussion of the calculations undertaken a discussion of the key assumptions underpinning the calculations identification of the key areas where additional information is required identification of key areas where the venture capitalist may wish to make changes or require improvements(e.g.the proposed equity split and relative contributions of the venture capitalist and management team)(5 marks) 第9页共9页

公司理财 realised at the appropriate time. The information already provided by the management team needs to be examined carefully. Key issues include: – the extent to which the forecast revenue figures are in line with expected growth within the industry – the assumption that sales can be increased significantly compared to previous years – the likely impact of changes in technology, the markets or the industry on forecast results – the likelihood of maintaining a similar operating profit margin to previous years given the increased level of investment and sales that are predicted – the extent to which the proposed investment plans are adequate to support the expected level of sales (10 marks) (c) The attributes that a management team should possess include: – a good track record in delivering results – a balance of skills and experience necessary to undertake the venture – an ability to work successfully as a team – a commitment to the venture, including a willingness to make a significant financial commitment – an ability to work with the venture capitalist – a willingness to accept the typical deal structures offered by venture capitalists – the ability to pursue clearly-stated goals but also to maintain flexibility – a set of realistic expectations about likely future outcomes. (5 marks) (d) The evaluation of the investment proposal should include: – a discussion of the calculations undertaken – a discussion of the key assumptions underpinning the calculations – identification of the key areas where additional information is required – identification of key areas where the venture capitalist may wish to make changes or require improvements (e.g. the proposed equity split and relative contributions of the venture capitalist and management team) (5 marks) 第 9 页 共 9 页