裢勇牛经降贸多大是 公司理财 PART V 1.The Stowe Manufacturing Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable securities $887 Accounts payable $724 Accounts receivable 2,075 Accrued liabilities (salaries and benefits) 332 Inventories' 2,120 Other current liabilities 1.665 Other current assets 300 Total current liabilities 2,721 Total current assets $5,382 Long-term debt and other 1,677 liabilities Plant and equipment(net) 3,707 296 Other assets 687 Common stock 5.082 Total assets $9.776 Retained earnings $5,378 Total stockholders'equity $9.776 Total liabilities and equity "Assume that average inventory over the year was $2,120 million,i.e.,the same as ending inventory. Income Statement (in Millions of Dollars) Net sales $11,990 Cost of sales 6,946 Selling,general, and administrative 2,394 expenses 581 Other expenses $9,921 Total expenses 2,069 Earnings before taxes 825 Taxes $1244 Earnings after taxes(net income) Determine the length of Stowe's a.Inventory conversion period. b.Receivables conversion period. c.Operating cycle d.Payables deferral period. e.Cash conversion cycle. 第1页共5页

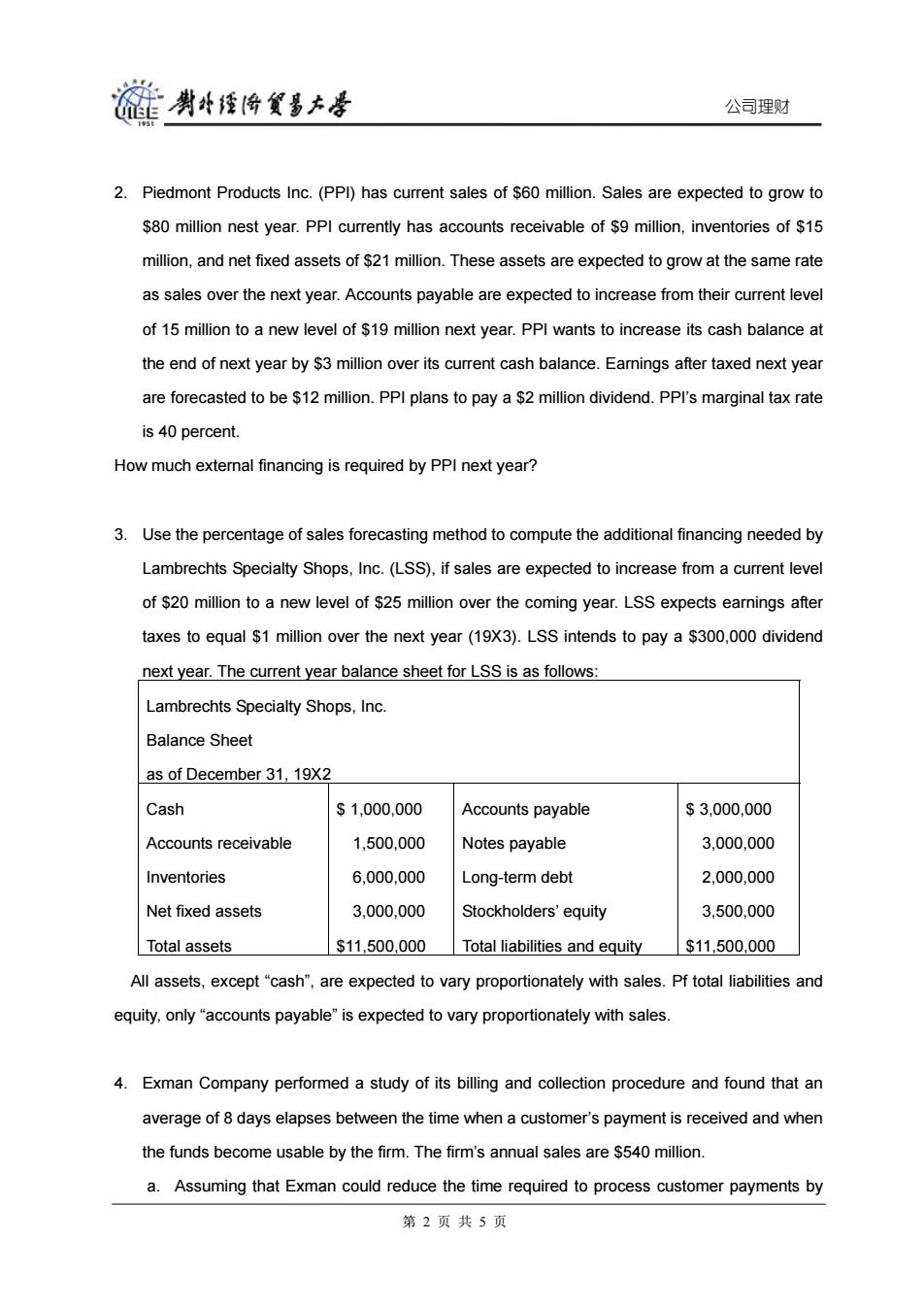

公司理财 PART V 1. The Stowe Manufacturing Company’s balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable securities Accounts receivable Inventories* Other current assets Total current assets Plant and equipment (net) Other assets Total assets $ 887 2,075 2,120 300 $5,382 3,707 687 $9,776 Accounts payable Accrued liabilities (salaries and benefits) Other current liabilities Total current liabilities Long-term debt and other liabilities Common stock Retained earnings Total stockholders’ equity Total liabilities and equity $ 724 332 1,665 2,721 1,677 296 5,082 $5,378 $9,776 *Assume that average inventory over the year was $2,120 million, i.e., the same as ending inventory. Income Statement (in Millions of Dollars) Net sales* Cost of sales Selling, general, and administrative expenses Other expenses Total expenses Earnings before taxes Taxes Earnings after taxes (net income) $11,990 6,946 2,394 581 $ 9,921 2,069 825 $ 1,244 Determine the length of Stowe’s a. Inventory conversion period. b. Receivables conversion period. c. Operating cycle. d. Payables deferral period. e. Cash conversion cycle. 第 1 页 共 5 页

碰剥牛挂倚多大是 公司理财 2.Piedmont Products Inc.(PPI)has current sales of $60 million.Sales are expected to grow to $80 million nest year.PPI currently has accounts receivable of $9 million,inventories of $15 million,and net fixed assets of $21 million.These assets are expected to grow at the same rate as sales over the next year.Accounts payable are expected to increase from their current level of 15 million to a new level of $19 million next year.PPI wants to increase its cash balance at the end of next year by $3 million over its current cash balance.Earnings after taxed next year are forecasted to be $12 million.PPI plans to pay a $2 million dividend.PPI's marginal tax rate is 40 percent. How much external financing is required by PPI next year? 3.Use the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops,Inc.(LSS),if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year.LSS expects earnings after taxes to equal $1 million over the next year(19X3).LSS intends to pay a $300,000 dividend next year.The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops,Inc. Balance Sheet as of December 31,19X2 Cash $1,000,000 Accounts payable $3,000,000 Accounts receivable 1,500.000 Notes payable 3,000,000 Inventories 6,000.000 Long-term debt 2,000,000 Net fixed assets 3.000.000 Stockholders'equity 3,500.000 Total assets $11,500,000 Total liabilities and equity $11,500.000 All assets,except"cash",are expected to vary proportionately with sales.Pf total liabilities and equity,only"accounts payable"is expected to vary proportionately with sales. 4.Exman Company performed a study of its billing and collection procedure and found that an average of 8 days elapses between the time when a customer's payment is received and when the funds become usable by the firm.The firm's annual sales are $540 million. a.Assuming that Exman could reduce the time required to process customer payments by 第2页共5页

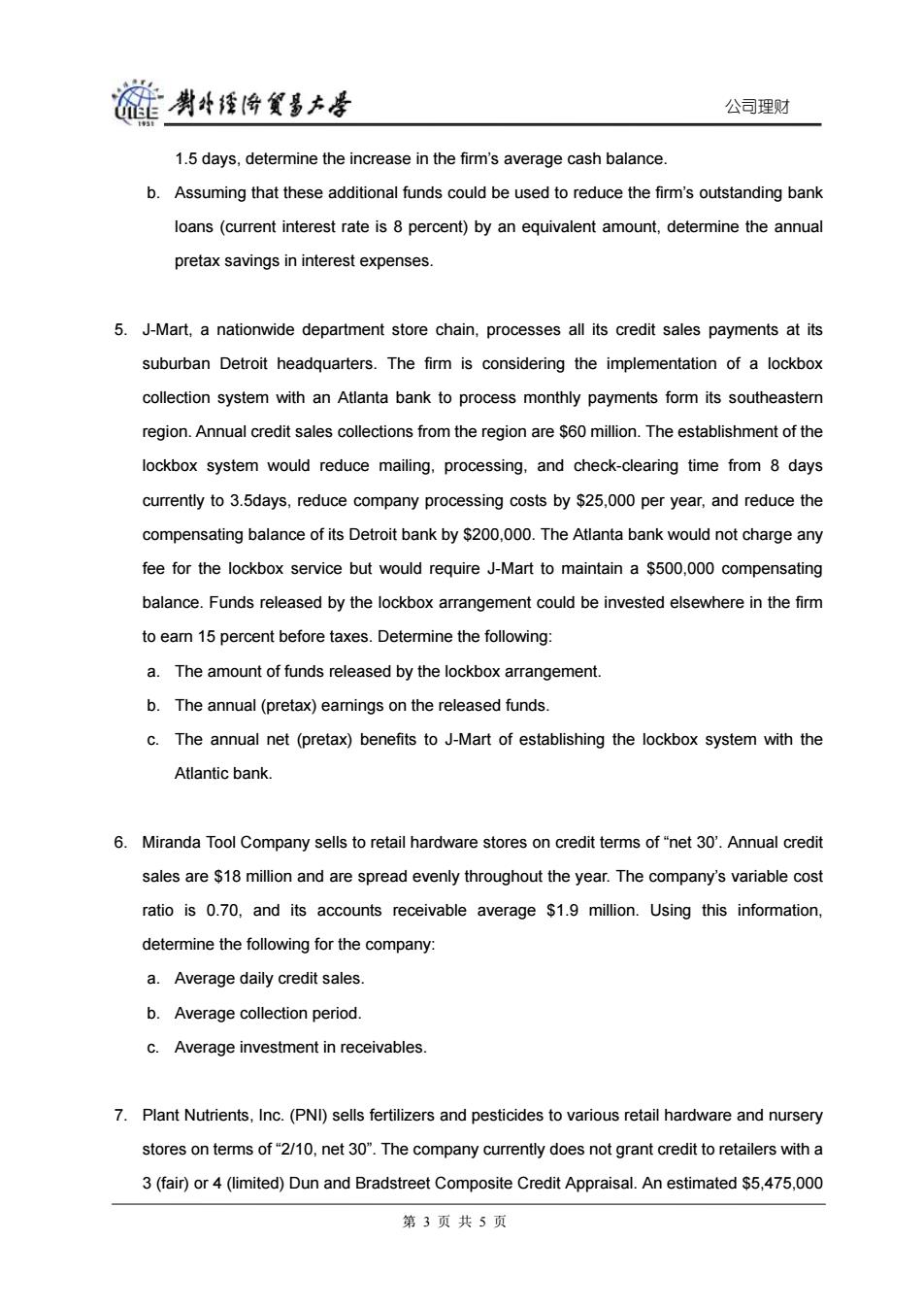

公司理财 2. Piedmont Products Inc. (PPI) has current sales of $60 million. Sales are expected to grow to $80 million nest year. PPI currently has accounts receivable of $9 million, inventories of $15 million, and net fixed assets of $21 million. These assets are expected to grow at the same rate as sales over the next year. Accounts payable are expected to increase from their current level of 15 million to a new level of $19 million next year. PPI wants to increase its cash balance at the end of next year by $3 million over its current cash balance. Earnings after taxed next year are forecasted to be $12 million. PPI plans to pay a $2 million dividend. PPI’s marginal tax rate is 40 percent. How much external financing is required by PPI next year? 3. Use the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year (19X3). LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 19X2 Cash Accounts receivable Inventories Net fixed assets Total assets $ 1,000,000 1,500,000 6,000,000 3,000,000 $11,500,000 Accounts payable Notes payable Long-term debt Stockholders’ equity Total liabilities and equity $ 3,000,000 3,000,000 2,000,000 3,500,000 $11,500,000 All assets, except “cash”, are expected to vary proportionately with sales. Pf total liabilities and equity, only “accounts payable” is expected to vary proportionately with sales. 4. Exman Company performed a study of its billing and collection procedure and found that an average of 8 days elapses between the time when a customer’s payment is received and when the funds become usable by the firm. The firm’s annual sales are $540 million. a. Assuming that Exman could reduce the time required to process customer payments by 第 2 页 共 5 页

链勇4桂降食多大量 公司理财 1.5 days,determine the increase in the firm's average cash balance. b.Assuming that these additional funds could be used to reduce the firm's outstanding bank loans(current interest rate is 8 percent)by an equivalent amount,determine the annual pretax savings in interest expenses. 5.J-Mart,a nationwide department store chain,processes all its credit sales payments at its suburban Detroit headquarters.The firm is considering the implementation of a lockbox collection system with an Atlanta bank to process monthly payments form its southeastern region.Annual credit sales collections from the region are $60 million.The establishment of the lockbox system would reduce mailing,processing,and check-clearing time from 8 days currently to 3.5days,reduce company processing costs by $25,000 per year,and reduce the compensating balance of its Detroit bank by $200,000.The Atlanta bank would not charge any fee for the lockbox service but would require J-Mart to maintain a $500,000 compensating balance.Funds released by the lockbox arrangement could be invested elsewhere in the firm to earn 15 percent before taxes.Determine the following: a.The amount of funds released by the lockbox arrangement. b.The annual(pretax)earnings on the released funds c.The annual net (pretax)benefits to J-Mart of establishing the lockbox system with the Atlantic bank. 6.Miranda Tool Company sells to retail hardware stores on credit terms of"net 30'.Annual credit sales are $18 million and are spread evenly throughout the year.The company's variable cost ratio is 0.70,and its accounts receivable average $1.9 million.Using this information, determine the following for the company: a.Average daily credit sales. b.Average collection period. c.Average investment in receivables. 7.Plant Nutrients,Inc.(PNI)sells fertilizers and pesticides to various retail hardware and nursery stores on terms of"2/10,net 30".The company currently does not grant credit to retailers with a 3(fair)or 4(limited)Dun and Bradstreet Composite Credit Appraisal.An estimated $5,475,000 第3页共5页

公司理财 1.5 days, determine the increase in the firm’s average cash balance. b. Assuming that these additional funds could be used to reduce the firm’s outstanding bank loans (current interest rate is 8 percent) by an equivalent amount, determine the annual pretax savings in interest expenses. 5. J-Mart, a nationwide department store chain, processes all its credit sales payments at its suburban Detroit headquarters. The firm is considering the implementation of a lockbox collection system with an Atlanta bank to process monthly payments form its southeastern region. Annual credit sales collections from the region are $60 million. The establishment of the lockbox system would reduce mailing, processing, and check-clearing time from 8 days currently to 3.5days, reduce company processing costs by $25,000 per year, and reduce the compensating balance of its Detroit bank by $200,000. The Atlanta bank would not charge any fee for the lockbox service but would require J-Mart to maintain a $500,000 compensating balance. Funds released by the lockbox arrangement could be invested elsewhere in the firm to earn 15 percent before taxes. Determine the following: a. The amount of funds released by the lockbox arrangement. b. The annual (pretax) earnings on the released funds. c. The annual net (pretax) benefits to J-Mart of establishing the lockbox system with the Atlantic bank. 6. Miranda Tool Company sells to retail hardware stores on credit terms of “net 30’. Annual credit sales are $18 million and are spread evenly throughout the year. The company’s variable cost ratio is 0.70, and its accounts receivable average $1.9 million. Using this information, determine the following for the company: a. Average daily credit sales. b. Average collection period. c. Average investment in receivables. 7. Plant Nutrients, Inc. (PNI) sells fertilizers and pesticides to various retail hardware and nursery stores on terms of “2/10, net 30”. The company currently does not grant credit to retailers with a 3 (fair) or 4 (limited) Dun and Bradstreet Composite Credit Appraisal. An estimated $5,475,000 第 3 页 共 5 页

链勇4桂降食多大量 公司理财 in additional sales per year could be generated if PNI extended credit to retailers in the "fair" category.The estimated average collection period for these customers is 75days,and the expected bad-debt loss ratio is 5 percent,The company also estimates that an additional inventory investment of $800,000 is required for the anticipated sales increase.Approximately 10 percent of these customers are expected to take the cash discount.PNI's variable cost ratio is 0.75,and its required pretax rate of return on investments in current assets is 18 percent. Determine the following: a.Marginal profitability of additional sales. b.Cost of additional investment in receivables. c.Additional bad-debt loss. d.Cost of additional investment in inventory. e.Net change in pretax profits. 8.Jenkins Supply Corporation sells $120 million of its products to wholesalers on terms of"net 50".Currently,the form's average collection period is 65 days.In order to speed up the collection of receivables,Jenkins is considering offering a 1 percent cash discount if customers pay their bills within 15 days.The firm expects 40 percent of its customers to take the discount and its average collection period to decline to 40 days.The firm's required pretax return on receivables investments is 20 percent.Determine the net effect on Jenkins'pretax profits of offering a 1 percent cash discount. 9.General Cereal Company purchases various grains (e.g.,wheat and corn)that it processes into ready-to eat cereals.Its annual demand for wheat is 250,000 bushels.Assume that demand is uniform throughout the year.The average price of wheat is $3.0625 per bushel (delivered).Annual inventory carrying costs are 16 percent of inventory value.The costs of placing and receiving an order are $98.Assume that inventory replenishment occurs virtually instantaneously.Determine the following: a.Economic order quantity. b.Total annual inventory costs of this policy. c.Optimal ordering frequency. 第4页共5页

公司理财 in additional sales per year could be generated if PNI extended credit to retailers in the “fair” category. The estimated average collection period for these customers is 75days, and the expected bad-debt loss ratio is 5 percent, The company also estimates that an additional inventory investment of $800,000 is required for the anticipated sales increase. Approximately 10 percent of these customers are expected to take the cash discount. PNI’s variable cost ratio is 0.75, and its required pretax rate of return on investments in current assets is 18 percent. Determine the following: a. Marginal profitability of additional sales. b. Cost of additional investment in receivables. c. Additional bad-debt loss. d. Cost of additional investment in inventory. e. Net change in pretax profits. 8. Jenkins Supply Corporation sells $120 million of its products to wholesalers on terms of “net 50”. Currently, the form’s average collection period is 65 days. In order to speed up the collection of receivables, Jenkins is considering offering a 1 percent cash discount if customers pay their bills within 15 days. The firm expects 40 percent of its customers to take the discount and its average collection period to decline to 40 days. The firm’s required pretax return on receivables investments is 20 percent. Determine the net effect on Jenkins’ pretax profits of offering a 1 percent cash discount. 9. General Cereal Company purchases various grains (e.g., wheat and corn) that it processes into ready-to eat cereals. Its annual demand for wheat is 250,000 bushels. Assume that demand is uniform throughout the year. The average price of wheat is $3.0625 per bushel (delivered). Annual inventory carrying costs are 16 percent of inventory value. The costs of placing and receiving an order are $98. Assume that inventory replenishment occurs virtually instantaneously. Determine the following: a. Economic order quantity. b. Total annual inventory costs of this policy. c. Optimal ordering frequency. 第 4 页 共 5 页

链剥将发多大是 公司理财 10.Allstar Shoe Company produces a wide variety of athletic-type shoes for tennis,basketball,and running.Although sales are somewhat seasonal,production is uniform throughout the year. Allstar's production and dales average 1.92 million pairs of shoes per year.The company purchases shoelaces for its entire product line.Shoelaces are brought in lots of 10,000 pairs at a price of $800 per lot.Ordering costs are $20,including the cost of preparing the purchase order and inspecting the shipment when it arrives at the company's warehouse.Annual inventory carrying costs average 15 percent of the inventory value.Assuming that the shoelace manufacture is located nearby and that orders are filled on the same day they are placed(that is,virtually instantaneously),determine the following: a.The EOQ for shoelaces. b.The total annual inventory costs of this policy. c.The frequency with which Allstar should place its orders for shoelaces. 第5页共5页

公司理财 10. Allstar Shoe Company produces a wide variety of athletic-type shoes for tennis, basketball, and running. Although sales are somewhat seasonal, production is uniform throughout the year. Allstar’s production and dales average 1.92 million pairs of shoes per year. The company purchases shoelaces for its entire product line. Shoelaces are brought in lots of 10,000 pairs at a price of $800 per lot. Ordering costs are $20, including the cost of preparing the purchase order and inspecting the shipment when it arrives at the company’s warehouse. Annual inventory carrying costs average 15 percent of the inventory value. Assuming that the shoelace manufacture is located nearby and that orders are filled on the same day they are placed (that is, virtually instantaneously), determine the following: a. The EOQ for shoelaces. b. The total annual inventory costs of this policy. c. The frequency with which Allstar should place its orders for shoelaces. 第 5 页 共 5 页