爸男4榜降餐多大学 September 13,2004/11o/ 作业习题(作业题主要由教师在教材上每章之后的“习题”内容中选择指定,下面是一部分习题范例) PART I 1.How much will $1,000 deposited in a savings account earning a compound annual interest rate of a percent be worth at the end of the follow number of years? a.3 years. b.5 years. c.10 years. 2.If you require a 9 percent return on your investments,which would you prefer? a.$5,000 today. b.$15,000 five years from today. c.$1,000 per year for 15 years. 3.You decide to purchase a building for $30,000 by paying $5,000 down and assuming a mortgage of $25,000.The bank of offers you a 15-year mortgage requiring annual end-of-year payments of $3,188 each.The bank also requires you to pay a 3 percent loan origination fee,which will reduce the effective amount the bank lends to you.Compute the annual percentage rate of interest on this loan. 4.An investment promises to pay $6,000 at the end of each year for the next 5 years and $4,000 at the end of each year for years 6 through 10. a.If you require a 12 percent rate of return on an investment of this sort,what is the maximum amount you would pay for this investment? b.Assuming that the payments are received at the beginning of each year,what is the maximum amount you would pay for this investment,given a 12 percent required rate of return? 5.Suppose that a local savings and loan association advertises a 6 percent annual(nominal)rate of interest on regular accounts,compounded monthly,what is the effective annual percentage rate of interest paid by the savings and loan association? 6.Your mother is planning to retire this year.Her firm has offered her a lump sum retirement payment of $50,000 or a $6,000 lifetime annuity---whichever she chooses.Your mother is in 第1页共8页

September 13, 2004/11o/ 作业习题(作业题主要由教师在教材上每章之后的“习题”内容中选择指定,下面是一部分习题范例) PART I 1. How much will $1,000 deposited in a savings account earning a compound annual interest rate of a percent be worth at the end of the follow number of years? a. 3 years. b. 5 years. c. 10 years. 2. If you require a 9 percent return on your investments, which would you prefer? a. $5, 000 today. b. $15, 000 five years from today. c. $1, 000 per year for 15 years. 3.You decide to purchase a building for $30, 000 by paying $5, 000 down and assuming a mortgage of $25,000. The bank of offers you a 15-year mortgage requiring annual end-of-year payments of $3,188 each. The bank also requires you to pay a 3 percent loan origination fee, which will reduce the effective amount the bank lends to you. Compute the annual percentage rate of interest on this loan. 4. An investment promises to pay $6,000 at the end of each year for the next 5 years and $4,000 at the end of each year for years 6 through 10. a. If you require a 12 percent rate of return on an investment of this sort, what is the maximum amount you would pay for this investment? b. Assuming that the payments are received at the beginning of each year, what is the maximum amount you would pay for this investment, given a 12 percent required rate of return? 5. Suppose that a local savings and loan association advertises a 6 percent annual (nominal) rate of interest on regular accounts, compounded monthly, what is the effective annual percentage rate of interest paid by the savings and loan association? 6. Your mother is planning to retire this year. Her firm has offered her a lump sum retirement payment of $50,000 or a $6,000 lifetime annuity --- whichever she chooses. Your mother is in 第 1 页 共 8 页

碰男降贸多大是 September 13,2004/220/ reasonably good health and expected to live for at last 15 more years.Which option should she choose,assuming that an 8 percent interest rate is appropriate to evaluate the annuity? 7.Determine the value of a $1,000 Canadian Pacific Limited perpetual 4 percent debenture(bond) at the following required rates of return: a.4 percent b.5 percent. c.6 percent. 8.Consider Allied Corporation's 9 percent debentures that mature on April 1,2000.Assume that the interest on these bonds is paid annually.Determine the value of a $1,000 denomination Allied Corporation bond as of April 1,1988 to an investor who holds the bond until maturity and whose required rate of return is: a.7 percent b.9 percent c.11 percent 9.What would be the value of the Allied Corporation bonds (see problem 8)at an 8 percent required rate of return if the interest were paid and compounded semiannually? 10.What is the value of a share of Litton Industries Series B $2.00 cumulative preferred stock to an investor who requires the following rate of return? a.9 percent b.10 percent c.12 percent 11.The common stock of General Land Development Company (GLDC)is expected to pay a dividend of $1.25 next year and currently sells for $25.Assume that the firm's future dividend payments are expected to grow at a constant rate for the foreseeable future.Determine the implied growth rate for GLDC's dividends (and earnings)assuming that the required rate of return by investors is 12 percent. 12.The chairman of Haller Industries told a meeting of financial analysts that he expects the firm's earning and dividends to double over the next 6 years.The firm's current(that is,as of year 0) earnings and dividends per share are $4.00 and $2.00 respectively. a.Estimate the compound annual dividend growth rate over the 6-year period to the nearest whole percent). 第2页共8页

September 13, 2004/22o/ reasonably good health and expected to live for at last 15 more years. Which option should she choose, assuming that an 8 percent interest rate is appropriate to evaluate the annuity? 7. Determine the value of a $1,000 Canadian Pacific Limited perpetual 4 percent debenture (bond) at the following required rates of return: a. 4 percent b. 5 percent. c. 6 percent. 8. Consider Allied Corporation’s 9 percent debentures that mature on April 1, 2000. Assume that the interest on these bonds is paid annually. Determine the value of a $1,000 denomination Allied Corporation bond as of April 1, 1988 to an investor who holds the bond until maturity and whose required rate of return is: a. 7 percent b. 9 percent c. 11 percent 9. What would be the value of the Allied Corporation bonds (see problem 8) at an 8 percent required rate of return if the interest were paid and compounded semiannually? 10. What is the value of a share of Litton Industries Series B $2.00 cumulative preferred stock to an investor who requires the following rate of return? a. 9 percent b. 10 percent c. 12 percent 11. The common stock of General Land Development Company (GLDC) is expected to pay a dividend of $1.25 next year and currently sells for $25. Assume that the firm’s future dividend payments are expected to grow at a constant rate for the foreseeable future. Determine the implied growth rate for GLDC’s dividends (and earnings) assuming that the required rate of return by investors is 12 percent. 12. The chairman of Haller Industries told a meeting of financial analysts that he expects the firm’s earning and dividends to double over the next 6 years. The firm’s current (that is, as of year 0) earnings and dividends per share are $4.00 and $2.00 respectively. a. Estimate the compound annual dividend growth rate over the 6-year period ( to the nearest whole percent). 第 2 页 共 8 页

碰男华经海贸多大学 September 13,2004/330/ b.Forecast Heller's earnings and dividend per share for each of the next 6 years,assuming that they grow at the rate determined in Part a. c.Based on the constant growth dividend valuation model,determine the current value of a share of Heller Industries common stock to an investor who requires an 18 percent rate of return. 13.Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000.The bonds scheduled to mature at the end of 14 years.The company has the option to call the bonds in 8 years at a premium of 12 percent above the maturity value.You believe the company will exercise its option to call the bonds at that time.If you require a pretax return of 10 percent on bonds of this risk,how much would you pay for one of these bonds today? 14.The Groth Corporation is considering three possible capital projects for next year.Each project has a 1-year life,and project returns depend on next year's state of the economy.The estimated rate of return ate shown in the table Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B g Recession 0.25 10% 9% 14% Average 0.50 14 13 12 Boom 0.25 16 18 10 a.Find each project's expected rate of return,variance,standard deviation,and coefficient of variation. b.Rank the alternatives on the basis of(1)expected return and(2)risk.Which alternative would you choose? 15.Refer to the three alternative projects contained in Problem 14.Assume that the Groth Corporation is going to invest one-third of its available funds in each project.That is,Groth will create a portfolio of three equally weighted projects a.What is the expected rate of return on the portfolio? b.What are the variance and standard deviation of the portfolio? 第3页共8页

September 13, 2004/33o/ b. Forecast Heller’s earnings and dividend per share for each of the next 6 years, assuming that they grow at the rate determined in Part a. c. Based on the constant growth dividend valuation model, determine the current value of a share of Heller Industries common stock to an investor who requires an 18 percent rate of return. 13. Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000. The bonds scheduled to mature at the end of 14 years. The company has the option to call the bonds in 8 years at a premium of 12 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time. If you require a pretax return of 10 percent on bonds of this risk, how much would you pay for one of these bonds today? 14. The Groth Corporation is considering three possible capital projects for next year. Each project has a 1-year life, and project returns depend on next year’s state of the economy. The estimated rate of return ate shown in the table Probability of Rate of Return If State Occurs State of the Economy Each State Occurring A B C Recession 0.25 10% 9% 14% Average 0.50 14 13 12 Boom 0.25 16 18 10 a. Find each project’s expected rate of return, variance, standard deviation, and coefficient of variation. b. Rank the alternatives on the basis of (1) expected return and (2) risk. Which alternative would you choose? 15. Refer to the three alternative projects contained in Problem 14. Assume that the Groth Corporation is going to invest one-third of its available funds in each project. That is, Groth will create a portfolio of three equally weighted projects. a. What is the expected rate of return on the portfolio? b. What are the variance and standard deviation of the portfolio? 第 3 页 共 8 页

碰肖经海食昌大是 September 13,2004/44o/ c.What are the covariance and correlation coefficient between project A and B?Between Projects Aand C? 16.McGee Corporation has fixed operating costs of $10 million and a variable cost ratio of 0.65. The firm has a $20 million,10 percent bank loan and a $6 million,12 percent bond issue outstanding.The firm has 1 million shares of $5(dividend)preferred stock and 2 million shares of common stock($1 par).McGee's marginal tax rate is 40 percent.Sales are expected to be $80 million. a.Compute McGee's degree of operating leverage at an $80 million sales level. b.Compute McGee's degree of financial leverage at an $80 million sales level. c.If sales decline to $70 million,forecast McGee's earnings per share. 17.A junior executive is fed up with the operating policies of his boss.Before leaving the office of his angered superior,the young man suggests that a well-trained monkey could handle the trivia assigned to him.Pausing a moment to consider the import of this closing statement,the boss is seized by the thought that this must have been in the back of her own mind ever since she hired the junior executive.She decides to consider seriously replacing the executive with a bright young baboon.She figures that she could argue strongly to the board that such"capital deepening"is necessary for the cost-conscious firm.Two days later,a feasibility study is completed,and the following data are presented to the president: It would cost $12,000 to purchase and train a reasonably alert baboon with a life expectancy of 20 years. Annual expenses of feeding and housing the baboon would be $4,000 The junior executive's annual salary is $7,000(a potential saving if the baboon is hired) The baboon will be depreciated on a straight-line basis over 20 years to an estimated salvage value of $400. *The firm's marginal tax rate is 40 percent. The firm's current cost of capital is estimated to be 11 percent. Should the monkey be hired(and the junior executive fired?) 18.The following financial information is available on Fargo Fabrics Inc.: 第4页共8页

September 13, 2004/44o/ c. What are the covariance and correlation coefficient between project A and B? Between Projects A and C? 16. McGee Corporation has fixed operating costs of $10 million and a variable cost ratio of 0.65. The firm has a $20 million, 10 percent bank loan and a $6 million, 12 percent bond issue outstanding. The firm has 1 million shares of $5 (dividend) preferred stock and 2 million shares of common stock ($1 par). McGee’s marginal tax rate is 40 percent. Sales are expected to be $80 million. a. Compute McGee’s degree of operating leverage at an $80 million sales level. b. Compute McGee’s degree of financial leverage at an $80 million sales level. c. If sales decline to $70 million, forecast McGee’s earnings per share. 17. A junior executive is fed up with the operating policies of his boss. Before leaving the office of his angered superior, the young man suggests that a well-trained monkey could handle the trivia assigned to him. Pausing a moment to consider the import of this closing statement, the boss is seized by the thought that this must have been in the back of her own mind ever since she hired the junior executive. She decides to consider seriously replacing the executive with a bright young baboon. She figures that she could argue strongly to the board that such “capital deepening” is necessary for the cost-conscious firm. Two days later, a feasibility study is completed, and the following data are presented to the president: * It would cost $12,000 to purchase and train a reasonably alert baboon with a life expectancy of 20 years. * Annual expenses of feeding and housing the baboon would be $4,000. * The junior executive’s annual salary is $7,000 (a potential saving if the baboon is hired) * The baboon will be depreciated on a straight-line basis over 20 years to an estimated salvage value of $400. * The firm’s marginal tax rate is 40 percent. * The firm’s current cost of capital is estimated to be 11 percent. Should the monkey be hired (and the junior executive fired?) 18. The following financial information is available on Fargo Fabrics Inc.: 第 4 页 共 8 页

链喇4经降发事大培 September 13,2004/550/ Current per-share market price $20.25 Current per-share dividend $1.12 Current per-share earnings $2.48 Beta 0.90 Expected market risk premium 8.3% Risk-free rate (treasury bills) 5.2% Past 10 years eamnings per share: 19X1 $1.39 19X6 $1.95 19X2 1.48 19X7 2.12 19X3 1.60 19X8 2.26 19X4 1.68 19X9 2.40 19X5 1.79 19X0 2.48 This past earning growth trend is expected to continue for the foreseeable future.The dividend payout ratio has remained approximately constant over the past 9 years and is expected to remain at current levels for the foreseeable future. Calculate the cost of equity capital using the following methods: a.The dividend capitalization model approach. b.The Capital Asset Pricing Model approach. 19.Colbyco Industries has a target capital structure of 60 percent common equity,30 percent debt,and 10 percent preferred stock.The cost of retained earnings is 15 percent,and the cost of new equity (external)is 16 percent.Colbyco anticipates having $20 million of new retained earnings available over the coming year.Colbyco can sell $15 million of first-mortgage bonds with an after-tax cost of 9 percent.Its investment bankers feel the company could sell $10 million of debentures with a 9.5 percent after-tax cost.Additional debt would cost 10 percent after tax and be in the form of subordinated debentures.The after-tax cost of preferred stock financing is estimated to be 14 percent. Compute the marginal cost of capital schedule for Colbyco,and determine the break points in the schedule 第5页共8页

September 13, 2004/55o/ Current per-share market price $20.25 Current per-share dividend $1.12 Current per-share earnings $2.48 Beta 0.90 Expected market risk premium 8.3% Risk-free rate (treasury bills) 5.2% Past 10 years earnings per share: 19X1 $1.39 19X6 $ 1.95 19X2 1.48 19X7 2.12 19X3 1.60 19X8 2.26 19X4 1.68 19X9 2.40 19X5 1.79 19X0 2.48 This past earning growth trend is expected to continue for the foreseeable future. The dividend payout ratio has remained approximately constant over the past 9 years and is expected to remain at current levels for the foreseeable future. Calculate the cost of equity capital using the following methods: a. The dividend capitalization model approach. b. The Capital Asset Pricing Model approach. 19. Colbyco Industries has a target capital structure of 60 percent common equity, 30 percent debt, and 10 percent preferred stock. The cost of retained earnings is 15 percent, and the cost of new equity (external) is 16 percent. Colbyco anticipates having $20 million of new retained earnings available over the coming year. Colbyco can sell $15 million of first-mortgage bonds with an after-tax cost of 9 percent. Its investment bankers feel the company could sell $10 million of debentures with a 9.5 percent after-tax cost. Additional debt would cost 10 percent after tax and be in the form of subordinated debentures. The after-tax cost of preferred stock financing is estimated to be 14 percent. Compute the marginal cost of capital schedule for Colbyco, and determine the break points in the schedule. 第 5 页 共 8 页

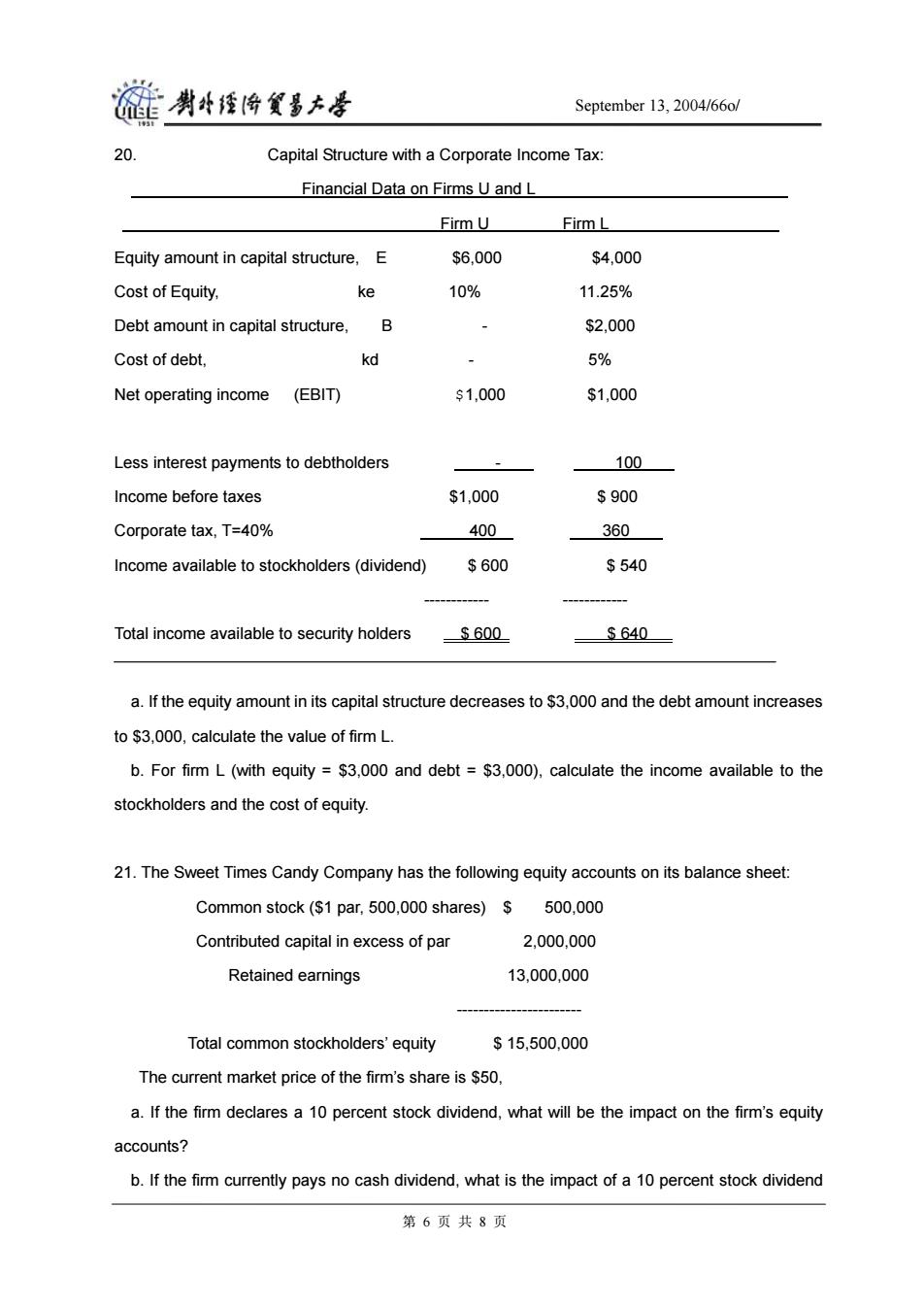

碰肖4经哈食多大是 September 13,2004/66o/ 20 Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L Firm U Firm L Equity amount in capital structure, E $6.000 $4,000 Cost of Equity, ke 10% 11.25% Debt amount in capital structure, B $2,000 Cost of debt, kd 5% Net operating income (EBIT) $1.000 $1,000 Less interest payments to debtholders 100 Income before taxes $1,000 $900 Corporate tax,T=40% 400 360 Income available to stockholders(dividend) $600 $540 Total income available to security holders $600 $640= a.If the equity amount in its capital structure decreases to $3,000 and the debt amount increases to $3.000,calculate the value of firm L. b.For firm L(with equity $3,000 and debt =$3,000),calculate the income available to the stockholders and the cost of equity. 21.The Sweet Times Candy Company has the following equity accounts on its balance sheet: Common stock($1 par,500,000 shares) 500,000 Contributed capital in excess of par 2,000,000 Retained earnings 13.000.000 Total common stockholders'equity $15,500,000 The current market price of the firm's share is $50, a.If the firm declares a 10 percent stock dividend,what will be the impact on the firm's equity accounts? b.If the firm currently pays no cash dividend,what is the impact of a 10 percent stock dividend 第6页共8页

September 13, 2004/66o/ 20. Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L Firm U Firm L Equity amount in capital structure, E $6,000 $4,000 Cost of Equity, ke 10% 11.25% Debt amount in capital structure, B - $2,000 Cost of debt, kd - 5% Net operating income (EBIT) $1,000 $1,000 Less interest payments to debtholders - 100 Income before taxes $1,000 $ 900 Corporate tax, T=40% 400 360 Income available to stockholders (dividend) $ 600 $ 540 ------------ ------------ Total income available to security holders $ 600 $ 640 a. If the equity amount in its capital structure decreases to $3,000 and the debt amount increases to $3,000, calculate the value of firm L. b. For firm L (with equity = $3,000 and debt = $3,000), calculate the income available to the stockholders and the cost of equity. 21. The Sweet Times Candy Company has the following equity accounts on its balance sheet: Common stock ($1 par, 500,000 shares) $ 500,000 Contributed capital in excess of par 2,000,000 Retained earnings 13,000,000 ----------------------- Total common stockholders’ equity $ 15,500,000 The current market price of the firm’s share is $50, a. If the firm declares a 10 percent stock dividend, what will be the impact on the firm’s equity accounts? b. If the firm currently pays no cash dividend, what is the impact of a 10 percent stock dividend 第 6 页 共 8 页

碰男华经海贸多大学 September 13,2004/770/ on the wealth position of the firm'existing stockholders? c.If the firm currently pays a cash dividend of $1 per share and this per-share dividend rate does not change after the 10 percent stock dividend,what impact would you expect the stock dividend to have on the wealth position of existing shareholders? 22.The BWS Corporation stock is selling at $50 a share today. a.Calculate the value of a BWS call option if its exercise price is $40 and it expires today. b.What can you say about the value of a BWS call option if its exercise price is $40 and it expires in 6 months? c.Calculate the value of a BWS call option if its exercise price is $60 and it expires today. d.What can you say about the value of a BWS call option if its exercises price is $60 and it expires in 6 months? 23.The BWS Corporation stock is selling at $50 a share today. a.Calculate the value of a BWS put option if its exercise price is $40 and it expires today. b.What can you say about the value of a BWS put option if its exercise price is $40 and it expires in 6 months? c.Calculate the value of a BWS put option if its exercise price is $60 and it expires today. d.What can you say about the value of a BWS put option if its exercises price is $60 and it expires in 6 months. 24.Horizon Corporation has warrants to purchase common stock outstanding.Each warrant entitles the holder to purchase 1 share of the company's common stock at an exercise price of $20 a share.Suppose the warrants expire on September 1,1995.One month ago,when the company's common stock was trading at about $21.50 a share,the warrants were trading at $5 each. a.What was the formula value of the warrants 1 month ago? b.What was the premium over the formula value 1 month ago? c.What are the reasons investors were willing to pay more than the formula value for these warrants 1 month ago? d.Suppose that in August 1995,the Horizon common stock is still trading at $21.50 a share. What do you think the warrant price would be then?why? 第7页共8页

September 13, 2004/77o/ on the wealth position of the firm’ existing stockholders? c. If the firm currently pays a cash dividend of $1 per share and this per-share dividend rate does not change after the 10 percent stock dividend, what impact would you expect the stock dividend to have on the wealth position of existing shareholders? 22. The BWS Corporation stock is selling at $50 a share today. a. Calculate the value of a BWS call option if its exercise price is $40 and it expires today. b. What can you say about the value of a BWS call option if its exercise price is $40 and it expires in 6 months? c. Calculate the value of a BWS call option if its exercise price is $60 and it expires today. d. What can you say about the value of a BWS call option if its exercises price is $60 and it expires in 6 months? 23. The BWS Corporation stock is selling at $50 a share today. a. Calculate the value of a BWS put option if its exercise price is $40 and it expires today. b. What can you say about the value of a BWS put option if its exercise price is $40 and it expires in 6 months? c. Calculate the value of a BWS put option if its exercise price is $60 and it expires today. d. What can you say about the value of a BWS put option if its exercises price is $60 and it expires in 6 months. 24. Horizon Corporation has warrants to purchase common stock outstanding. Each warrant entitles the holder to purchase 1 share of the company’s common stock at an exercise price of $20 a share. Suppose the warrants expire on September 1, 1995. One month ago, when the company’s common stock was trading at about $21.50 a share, the warrants were trading at $5 each. a. What was the formula value of the warrants 1 month ago? b. What was the premium over the formula value 1 month ago? c. What are the reasons investors were willing to pay more than the formula value for these warrants 1 month ago? d. Suppose that in August 1995, the Horizon common stock is still trading at $21.50 a share. What do you think the warrant price would be then? why? 第 7 页 共 8 页

碰男经将贸多大是 September 13,2004/88o/ e.Horizon paid an annual dividend of $1 a share,as of one month ago,to its common shareholders.Do warrant holders receive dividends? 25.The Wolverine Corporation has a convertible preferred stock outstanding.The par value of this preferred stock is $100,and it pays a $10 dividend.The preferred stock is callable at 103 percent of par value.The preferred stock has 10 years remaining until maturity.The preferred stock is convertible into 2.5 shares of common stock.The current common stock price is $42.Similar (quality and maturity)nonconvertible preferred stock sells at a price to yield 9 percent. a.What is the conversion value of this preferred stock? b.What is the straight(nonconvertible preferred stock value of this preferred stock? c.If interest rate decline such that similar(quality and maturity)nonconvertible preferred stock sells at a price to yield 7 percent and the price of Wolverine's common stock increases to $44,for how much will this convertible preferred stock sell? 第8页共8页

September 13, 2004/88o/ e. Horizon paid an annual dividend of $1 a share, as of one month ago, to its common shareholders. Do warrant holders receive dividends? 25. The Wolverine Corporation has a convertible preferred stock outstanding. The par value of this preferred stock is $100, and it pays a $10 dividend. The preferred stock is callable at 103 percent of par value. The preferred stock has 10 years remaining until maturity. The preferred stock is convertible into 2.5 shares of common stock. The current common stock price is $42. Similar (quality and maturity) nonconvertible preferred stock sells at a price to yield 9 percent. a. What is the conversion value of this preferred stock? b. What is the straight (nonconvertible preferred stock value of this preferred stock? c. If interest rate decline such that similar (quality and maturity) nonconvertible preferred stock sells at a price to yield 7 percent and the price of Wolverine’s common stock increases to $44, for how much will this convertible preferred stock sell? 第 8 页 共 8 页