CORPORA∫E FINANCI八L MANAGEMEN」 PART VI ADVANCED TOPTICS chapter 19-20) 州小经份贫易大房 UNW原s方C等NTE3风制U方男0G0Cs

CORPORATE FINANCIAL CORPORATE FINANCIAL MANAGEMENT MANAGEMENT PART VI ADVANCED TOPTICS (chapter 19-20)

Chapter 19 LEASE FINANCING 肖外楂价贸多方善 YO年NEB证事00003

Chapter 19 Chapter 19 LEASE FINANCING

Introduction Lease contracts 2.Types of lease financing 3.Advantages and disadvantages to leasing 4.Tax and Accounting Treatment of Financial Leases 5.Valuing A Financial Lease 剥动楂份货多方是 YO年NEB证事00003

Introduction Introduction 1. Lease contracts 2. Types of lease financing 3. Advantages and disadvantages to leasing 4. Tax and Accounting Treatment of Financial Leases 5. Valuing A Financial Lease

1.Lease contracts ●eases Alternative to term financing Arrangements to transfer tax benefits ●Lessee Obtains use of an asset Specific period of time Ownership to lessor Agrees to make a series of payments to lessor 渊补楂价货多方号 YO年N0l到8E事0E00h03

1. Lease contracts 1. Lease contracts zLeases – Alternative to term financing – Arrangements to transfer tax benefits zLessee – Obtains use of an asset – Specific period of time – Ownership to lessor – Agrees to make a series of payments to lessor

2.Types of lease financing Operating lease Service lease Maintenance lease Maintenance and insurance included ●Financial lease Noncancellable Lessee responsible for Maintenance/Insurance/Property taxes Direct lease Sale and leaseback Leveraged lease Three-party financial lease Lessee Lessor Lender O Lease-Back Arrangements 剥外校份贫多方号 YO年NEB证事00003

2. Types of lease financing Types of lease financing z Operating lease Service lease Maintenance lease – Maintenance and insurance included z Financial lease – Noncancellable – Lessee responsible for Maintenance/Insurance/Property taxes – Direct lease – Sale and leaseback z Leveraged lease Three-party financial lease – Lessee – Lessor – Lender z Lease-Back Arrangements

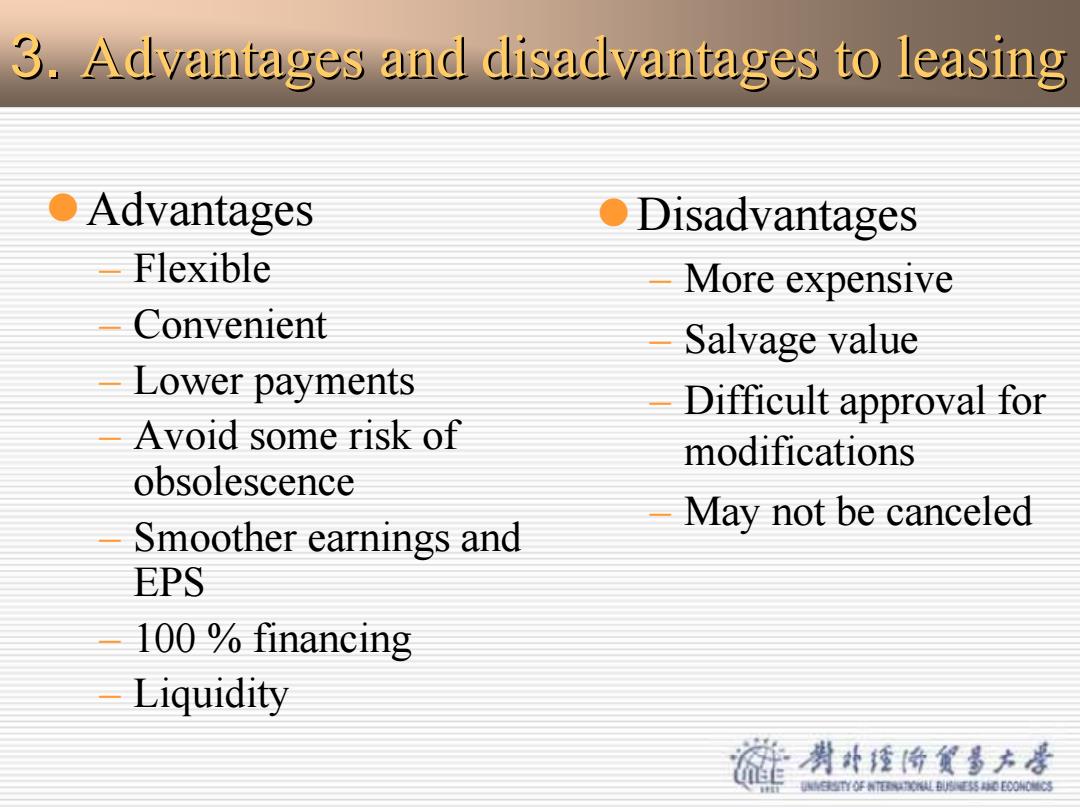

3.Advantages and disadvantages to leasing ●Advantages ●Disadvantages Flexible More expensive Convenient Salvage value Lower payments Difficult approval for Avoid some risk of modifications obsolescence May not be canceled Smoother earnings and EPS 100 financing Liquidity 剥外经价贫多方号 YO年N0事0E000

zAdvantages – Flexible – Convenient – Lower payments – Avoid some risk of obsolescence – Smoother earnings and EPS – 100 % financing – Liquidity 3. Advantages and disadvantages to leasing Advantages and disadvantages to leasing zDisadvantages – More expensive – Salvage value – Difficult approval for modifications – May not be canceled

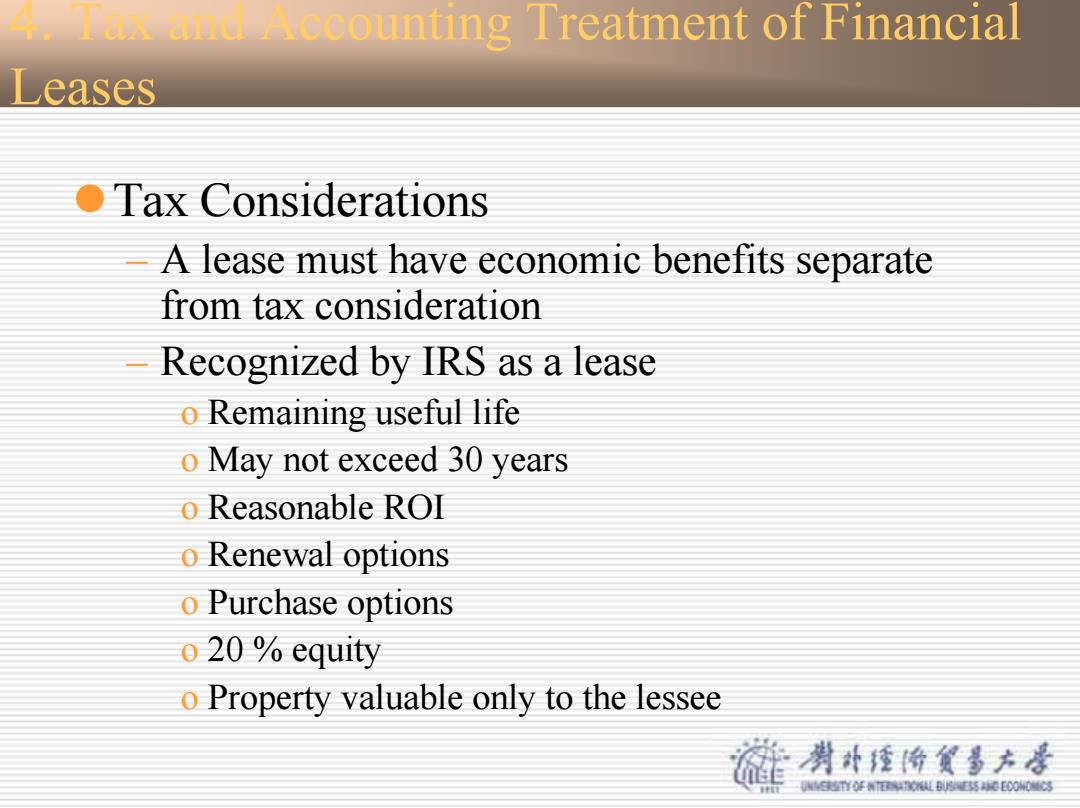

ccounting Treatment of Financial Leases ●Tax Considerations A lease must have economic benefits separate from tax consideration Recognized by IRS as a lease o Remaining useful life o May not exceed 30 years o Reasonable ROI o Renewal options o Purchase options o 20 equity o Property valuable only to the lessee 剥外校份贫多方号 YO年NEB证事0000

4. Tax and Accounting Treatment of Financial Leases zTax Considerations – A lease must have economic benefits separate from tax consideration – Recognized by IRS as a lease o Remaining useful life o May not exceed 30 years o Reasonable ROI o Renewal options o Purchase options o 20 % equity o Property valuable only to the lessee

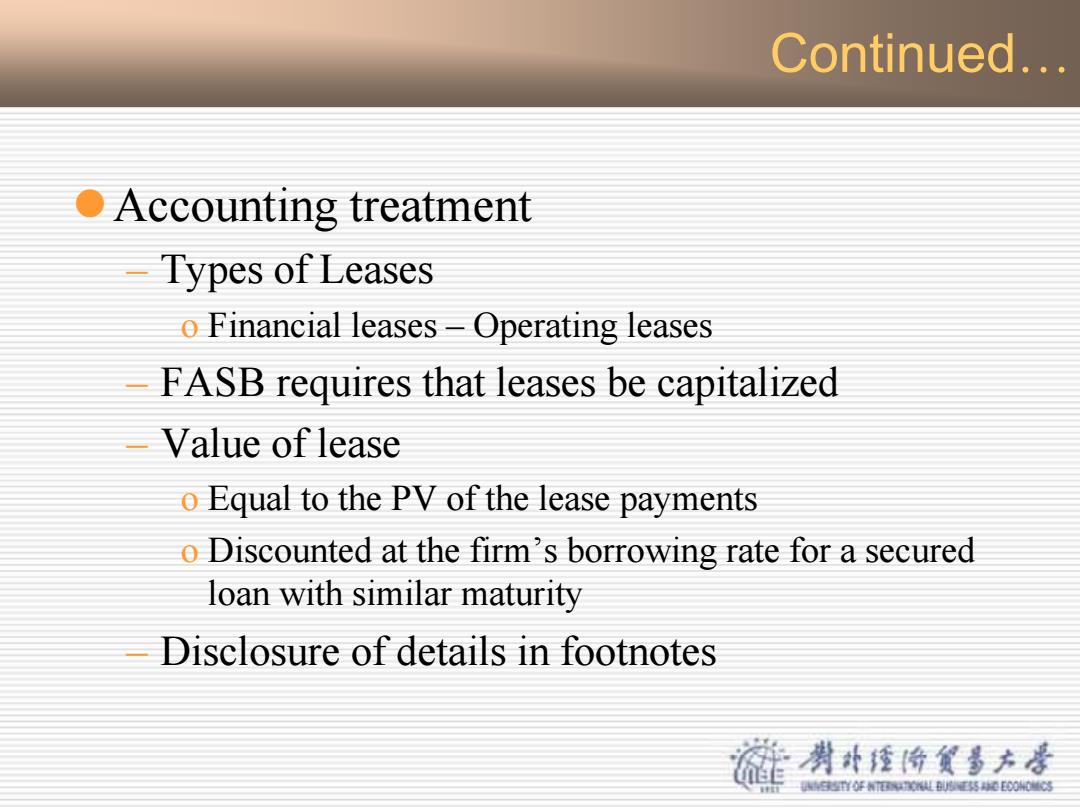

Continued... O Accounting treatment Types of Leases o Financial leases -Operating leases FASB requires that leases be capitalized Value of lease o Equal to the PV of the lease payments o Discounted at the firm's borrowing rate for a secured loan with similar maturity Disclosure of details in footnotes 渊外经价货多方是 YO年N0事0E0003

Continued… zAccounting treatment – Types of Leases o Financial leases – Operating leases – FASB requires that leases be capitalized – Value of lease o Equal to the PV of the lease payments o Discounted at the firm’s borrowing rate for a secured loan with similar maturity – Disclosure of details in footnotes

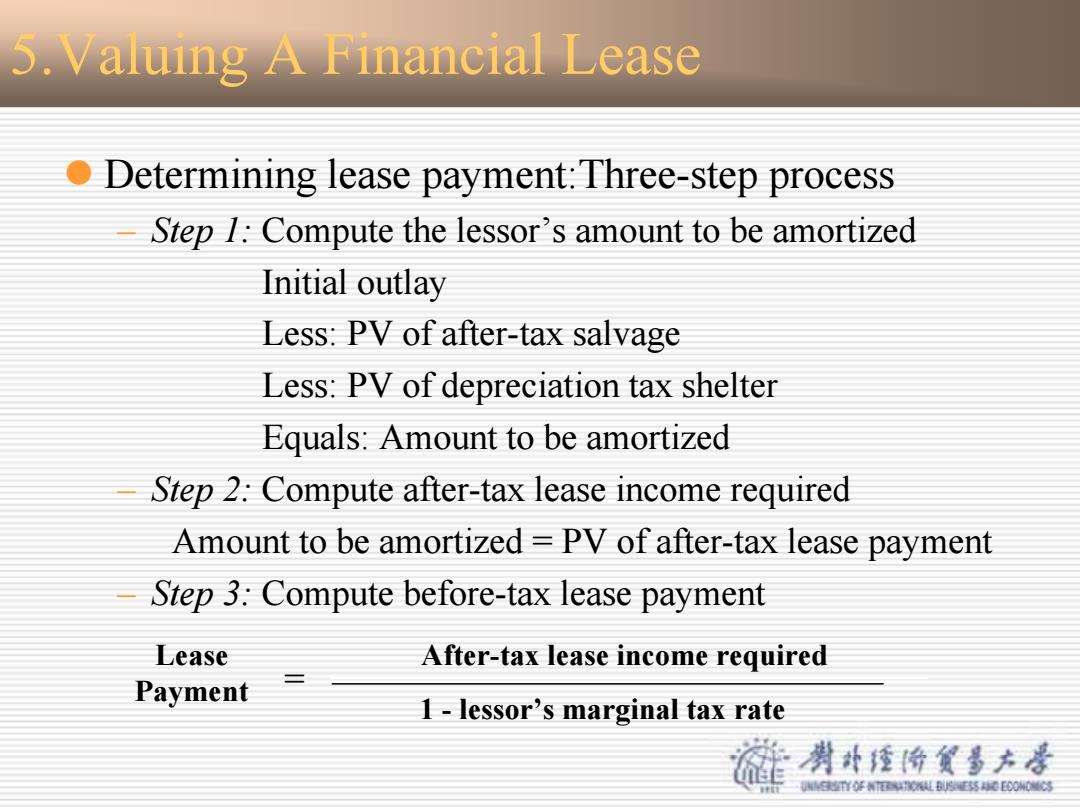

5.Valuing A Financial Lease o Determining lease payment:Three-step process Step 1:Compute the lessor's amount to be amortized Initial outlay Less:PV of after-tax salvage Less:PV of depreciation tax shelter Equals:Amount to be amortized Step 2:Compute after-tax lease income required Amount to be amortized PV of after-tax lease payment Step 3:Compute before-tax lease payment Lease After-tax lease income required Payment 1 lessor's marginal tax rate 剥外经价贫多方房 YO年NEB证事0000

5.Valuing A Financial Lease z Determining lease payment:Three-step process – Step 1: Compute the lessor’s amount to be amortized Initial outlay Less: PV of after-tax salvage Less: PV of depreciation tax shelter Equals: Amount to be amortized – Step 2: Compute after-tax lease income required Amount to be amortized = PV of after-tax lease payment – Step 3: Compute before-tax lease payment Lease Payment = After-tax lease income required 1 - lessor’s marginal tax rate

Continued... Lease-Buy Analysis-the lessee's perspective Compute the NAL o If NAL is positive,it is cheaper to lease o If NAL is negative,it is cheaper to own Considerations o Installed costs o PV of after-tax lease payment o Annual dep tax shield o Savings o Salvage value lessee's weighted cost of capital 渊外校价货多方居 YO年NEB证事0000

Continued… zLease-Buy Analysis—the lessee’s perspective – Compute the NAL o If NAL is positive, it is cheaper to lease o If NAL is negative, it is cheaper to own – Considerations o Installed costs o PV of after-tax lease payment o Annual dep tax shield o Savings o Salvage value lessee’s weighted cost of capital