CORPOR∫E FINANCIA小D MANA©EMEN」 PART II DETERMINANTS OF VALUATION (chapter 4-7) 州经怡贸易大号 UNW原s方C等NTE3风制U方男0G0Cs

CORPORATE FINANCIAL CORPORATE FINANCIAL MANAGEMENT MANAGEMENT PART II DETERMINANTS OF VALUATION (chapter 4-7)

Chapter 4 The Time Value of Money 渊外经价货多方是 YO年NEB证事00003

Chapter 4 Chapter 4 The Time Value of Money

Introduction Interest 2.Future Value and Present Value 3.Annuity 4.Uneven payment 剥外楂价贸多方号 YO年NEB证事00003

Introduction Introduction 1. Interest 2. Future Value and Present Value 3. Annuity 4. Uneven payment

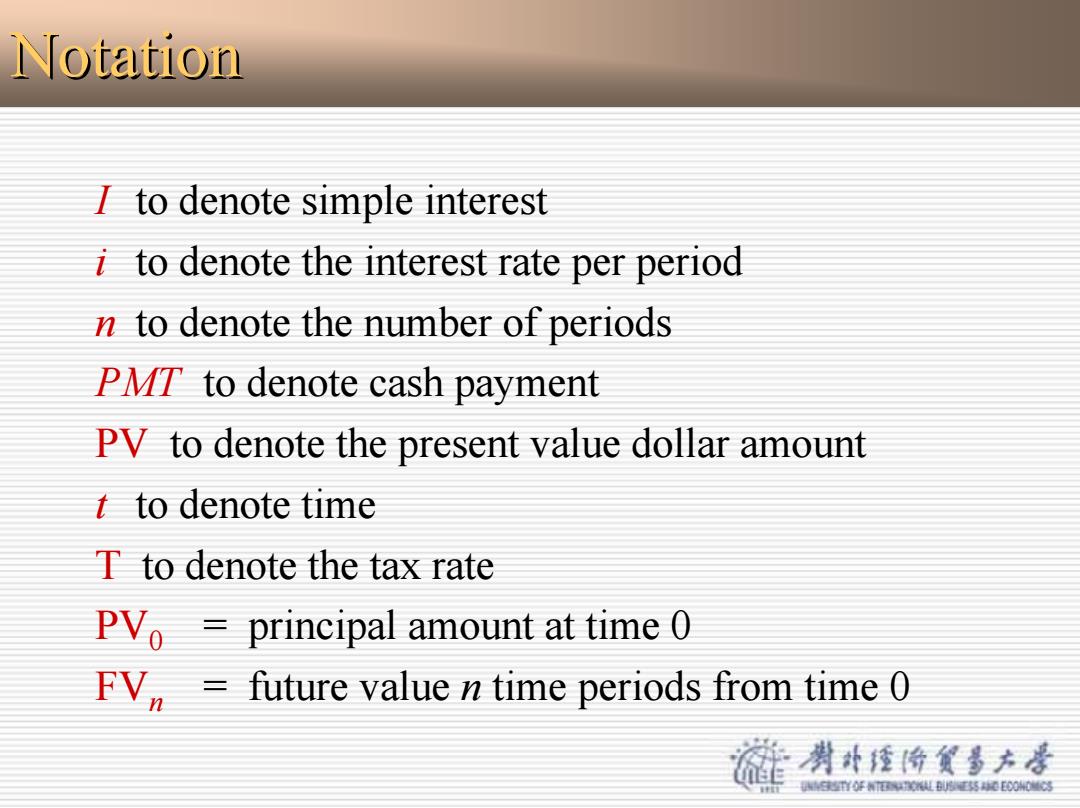

Notation I to denote simple interest i to denote the interest rate per period n to denote the number of periods PMT to denote cash payment PV to denote the present value dollar amount t to denote time T to denote the tax rate PVo principal amount at time 0 FV=future value n time periods from time 0 渊外经价货多方是 A50年0LB50E00hN

Notation Notation I to denote simple interest i to denote the interest rate per period n to denote the number of periods PMT to denote cash payment PV to denote the present value dollar amount t to denote time T to denote the tax rate PV0 = principal amount at time 0 FVn = future value n time periods from time 0

1.Interest Simple Interest Interest paid on the principal sum only Compound Interest Interest paid on the principal and on prior interest that has not been paid or withdrawn O In Finance,Compound Interest is more important 渊补楂价贸多方号 YO年N0事0E000

5 1. Interest 1. Interest zSimple Interest – Interest paid on the principal sum only zCompound Interest – Interest paid on the principal and on prior interest that has not been paid or withdrawn zIn Finance, Compound Interest is more important

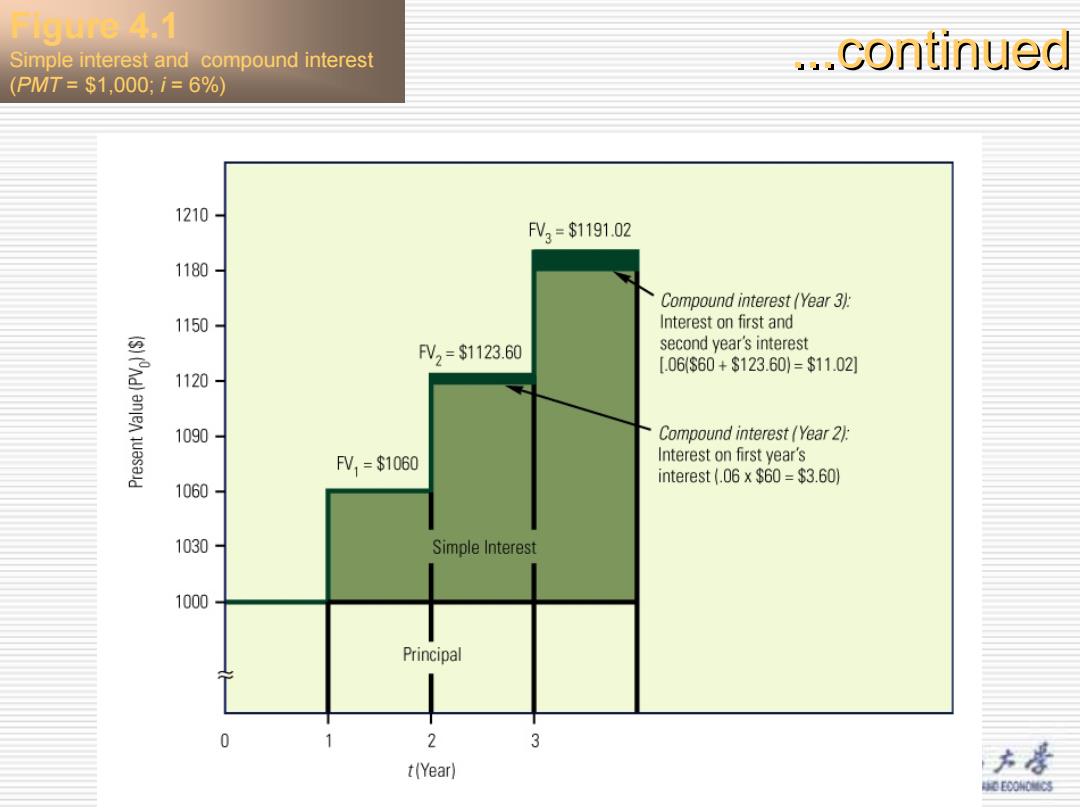

Iigure 4.1 Simple interest and compound interest ...continued (PMT=$1,000:i=6%) 1210 FV2=$1191.02 1180 Compound interest (Year 3): 1150 Interest on first and V2=$1123.60 second year's interest [.06$60+$123.60)=$11.02 1120 1090 Compound interest(Year 2): FV1=$1060 Interest on first year's interest(.06x$60=$3.60】 1060 1030 Simple Interest 1000 Principal 0 2 3 t(Year) 六是 0E00h03

Figure 4.1 Simple interest and compound interest (PMT = $1,000; i = 6%) ...continued ...continued

igure 4.2 Growth of a $100 Investment at 650 ...continued Various Compound Interest Rates 600 550 i=10% 500 450 400 i=5% 350 300 250 200 1=2% 150 PV0=100 5 1015 202530 35 40 价货多方号 (Year) B到E事0O003

7 ...continued ...continued Figure 4.2 Growth of a $100 Investment at Various Compound Interest Rates

2.Future value O "How much is a dollar worth later?" At the end of year n for a sum compounded at interest rate i is FV=PVo(1+i Formula In Table I in the text,(FVIF)shows the future value of $1 invested for n years at interest rate i: FVIFn=(1+i Table I When using the table,FV=PVo(FVIF) ·补楂价货参方居 YO年NEB证事0000

8 2. Future value 2. Future value z “How much is a dollar worth later?” At the end of year n for a sum compounded at interest rate i is FV n = PV 0 (1 + i ) n Formula In Table I in the text, (FVIFi,n) shows the future value of $1 invested for n years at interest rate i: FVIFi,n = (1 + i ) n Table I When using the table, FV n = PV 0(FVIFi,n )

...continued Interest factors(IF) Time periods(n) Interest rates per period (i) If you know any two,you can solve algebraically for the third variable. 0色E 渊补楂价贸多方号 YO年N0事0E000

...continued continued Interest factors (IF) Time periods (n) Interest rates per period (i) If you know any two, you can solve algebraically for the third variable

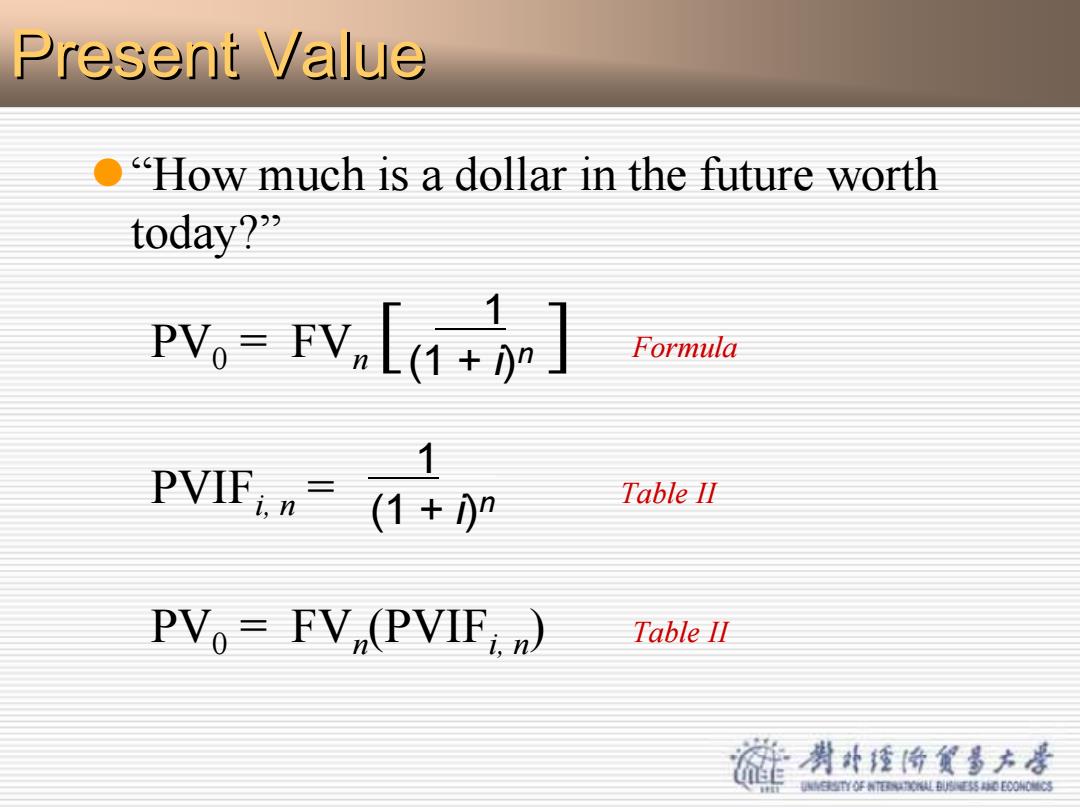

Present Value O"How much is a dollar in the future worth today?" PV=FV,L(] Formula 1 PVIFn (1+1) Table II PVo=FV(PVIF Table II 剥外经价贫多方号 YO年NEB证事0000

z“How much is a dollar in the future worth today?” PV0 = FVn [ ] Formula PVIFi, n = Table II PV0 = FVn(PVIFi, n) Table II 1 (1 + i)n 1 (1 + i)n Present Value Present Value