能男牛语降贸多大 公司理财 PROJECT 2 The Whinchat deal Scaup plc is an international pharmaceutical company that was once seen as a safe haven for investors when stock markets became volatile.It had a reputation as a well-managed and solid, but rather unexciting,company operating within a strong industrial sector.However,a number of problems has emerged in recent years to damage its reputation.A major problem for the company has been its failure to develop new drugs to replace a generation of successful drugs, the patents of which had either already expired or were about to expire.Where patents had already expired,rival companies had developed competing generic drugs that had seriously damaged the company's sales and profits.To make matters worse,the company had recently launched two new products,amidst much publicity,which had to be swiftly withdrawn when patients taking the drugs complained of side effects.This led to a severe loss of confidence in the management of the company and it became clear that major changes had to be made Key figures and ratios relating to Scaup plc for the past five years are set out below: Year ended 31 January 1999 2000 2001 2002 2003 Sales(fm) 5426 579.9 487-2 4564 4253 Operating profits(fm) 42-1 435 27-8 243 228 P/E ratio 153 192 143 95 78 In order to restore confidence in the future of the company,the majority of members of the Board of Directors was replaced and Anne Pochard was appointed as Chief Executive Officer. The new Board agreed that the pharmaceutical sector had become fiercely competitive in recent years and it doubted whether the company had the resources or expertise to remain a successful player within the industry.The increasing costs associated with developing new drugs,along with downward pressure,exerted by governments,on prices for prescription drugs led the Board to conclude that a change of direction was needed.Hence,it was decided that the company should reposition itself in the related healthcare market where it already had a small presence.For some years,Scaup plc had been selling a range of antiseptics and disinfectants for use in hospitals and nursing homes.The mission of the company was restated as being: To maximise shareholder value by becoming a leading provider of healthcare products Whinchat Ltd is a family-owned company that produces a small range of healthcare products.The main products of the company are wound dressings and surgical gloves,which are sold to hospitals,surgeries and nursing homes throughout Europe and which enjoy a reputation for their very high quality.The most recent accounts of the company are set out below: Balance sheet as at 31 January 2003 f000 f000 f000 Fixed assets Freehold premises at cost 8,470-2 第1页共9页

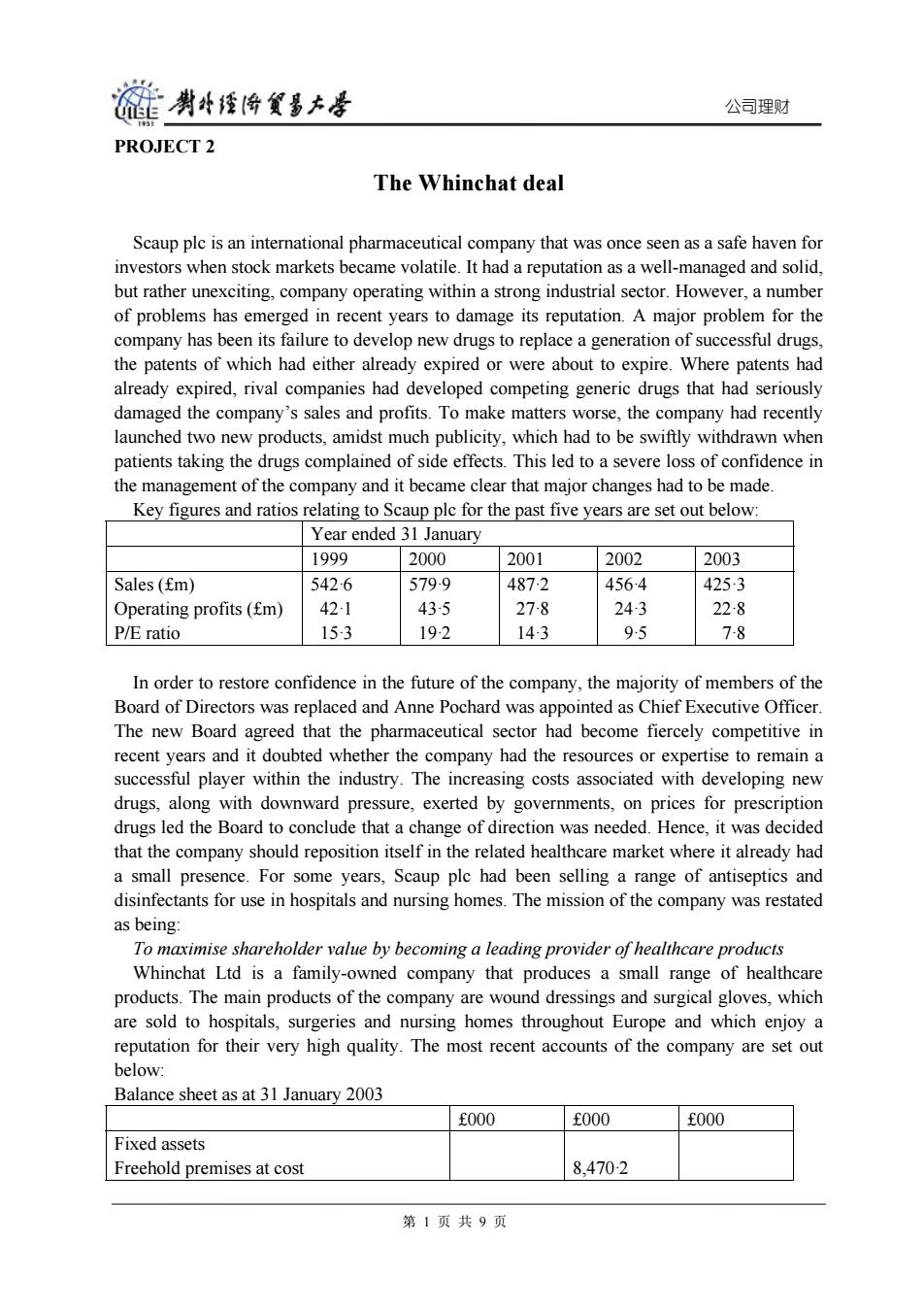

公司理财 PROJECT 2 The Whinchat deal Scaup plc is an international pharmaceutical company that was once seen as a safe haven for investors when stock markets became volatile. It had a reputation as a well-managed and solid, but rather unexciting, company operating within a strong industrial sector. However, a number of problems has emerged in recent years to damage its reputation. A major problem for the company has been its failure to develop new drugs to replace a generation of successful drugs, the patents of which had either already expired or were about to expire. Where patents had already expired, rival companies had developed competing generic drugs that had seriously damaged the company’s sales and profits. To make matters worse, the company had recently launched two new products, amidst much publicity, which had to be swiftly withdrawn when patients taking the drugs complained of side effects. This led to a severe loss of confidence in the management of the company and it became clear that major changes had to be made. Key figures and ratios relating to Scaup plc for the past five years are set out below: Year ended 31 January 1999 2000 2001 2002 2003 Sales (£m) Operating profits (£m) P/E ratio 542·6 42·1 15·3 579·9 43·5 19·2 487·2 27·8 14·3 456·4 24·3 9·5 425·3 22·8 7·8 In order to restore confidence in the future of the company, the majority of members of the Board of Directors was replaced and Anne Pochard was appointed as Chief Executive Officer. The new Board agreed that the pharmaceutical sector had become fiercely competitive in recent years and it doubted whether the company had the resources or expertise to remain a successful player within the industry. The increasing costs associated with developing new drugs, along with downward pressure, exerted by governments, on prices for prescription drugs led the Board to conclude that a change of direction was needed. Hence, it was decided that the company should reposition itself in the related healthcare market where it already had a small presence. For some years, Scaup plc had been selling a range of antiseptics and disinfectants for use in hospitals and nursing homes. The mission of the company was restated as being: To maximise shareholder value by becoming a leading provider of healthcare products Whinchat Ltd is a family-owned company that produces a small range of healthcare products. The main products of the company are wound dressings and surgical gloves, which are sold to hospitals, surgeries and nursing homes throughout Europe and which enjoy a reputation for their very high quality. The most recent accounts of the company are set out below: Balance sheet as at 31 January 2003 £000 £000 £000 Fixed assets Freehold premises at cost 8,470·2 第 1 页 共 9 页

链剥将发多大是 公司理财 Less accumulated depreciation 4846 7,9856 Plant and equipment at cost 17,8543 Less accumulated depreciation 13.9062 3,9481 Motor vans at cost 3,7183 Less accumulated depreciation 1.4281 2.2902 14,223-9 Current assets Stock 1,3467 Trade debtors 1,4906 Cash at bank 2.0129 4,8502 Less Creditors:Amounts falling due within one year Trade creditors 1,5764 Proposed dividend 2.600-0 Accrued expenses 1808 4.3572 4930 14,7169 Less Creditors:Amounts falling due beyond one year 7%Debentures 7.000-0 7.7169 Capital and reserves fl Ordinary shares 2,000-0 Retained profit 5,7169 7.716.9 Profit and loss account for the year ended 31 January 2003 f000 f000 Sales 45,9248 Less Cost of sales 19.8536 Gross profit 26.0712 Selling and distribution expenses 12,5962 Administration expenses 8,8686 21,4648 Operating profit 4,6064 Finance charges 702-5 Net profit before taxation 3,9039 Corporation tax 7808 Net profit after taxation 3,123-1 Proposed dividend 2.600-0 Retained profit 5231 Francis Whinchat founded the business in 1971 and has been the Chief Executive and Chairman of the company since that date.However,ill health has recently forced him to consider his future and also to consider the future of the company.Although the founder has 第2页共9页

公司理财 Less accumulated depreciation Plant and equipment at cost Less accumulated depreciation Motor vans at cost Less accumulated depreciation 484·6 17,854·3 13,906·2 3,718·3 1,428·1 7,985·6 3,948·1 2,290·2 14,223·9 Current assets Stock Trade debtors Cash at bank 1,346·7 1,490·6 2,012·9 4,850·2 Less Creditors: Amounts falling due within one year Trade creditors Proposed dividend Accrued expenses 1,576·4 2,600·0 180·8 4,357·2 493·0 14,716·9 Less Creditors: Amounts falling due beyond one year 7% Debentures 7,000·0 7,716·9 Capital and reserves £1 Ordinary shares Retained profit 2,000·0 5,716·9 7,716.9 Profit and loss account for the year ended 31 January 2003 £000 £000 Sales Less Cost of sales Gross profit Selling and distribution expenses Administration expenses Operating profit Finance charges Net profit before taxation Corporation tax Net profit after taxation Proposed dividend Retained profit 12,596·2 8,868·6 45,924·8 19,853·6 26,071·2 21,464·8 4,606·4 702·5 3,903·9 780·8 3,123·1 2,600·0 523·1 Francis Whinchat founded the business in 1971 and has been the Chief Executive and Chairman of the company since that date. However, ill health has recently forced him to consider his future and also to consider the future of the company. Although the founder has 第 2 页 共 9 页

碰剥经悔贸多大号 公司理财 two children,neither has shown an interest in the business.The idea of allowing non-family members to manage the business was regarded by the Whinchat family as unacceptable and so the various family members,who owned all the issued shares,agreed to sell the company. When Anne Pochard discovered that Whinchat Ltd was for sale,she expressed an immediate interest in entering into negotiations with the Whinchat family.She believed that this was an outstanding opportunity to acquire a range of high quality products with a strong brand image.It provided an immediate and strong presence in markets that the Board of Directors of Scaup plc had recently identified as being of particular interest. The Finance Director of Scaup plc,David Shearwater,was the first among the new Board of Directors to express reservations concerning the possible acquisition.Although he acknowledged the possible benefits that might accrue,he argued that Scaup plc had no previous experience in acquiring companies and that the new Board of Directors had not yet developed a clear view as to how the acquisition process should be approached or managed. As a result,there was a risk that the acquisition of Whinchat Ltd would not turn out to be as successful as Anne Pochard was expecting.David also wondered whether investors would be prepared to support the deal given the recent history of Scaup plc.The Board of Directors debated the issue and,by a narrow majority,decided to support Anne's wish to enter into negotiations with the Whinchat family with a view to buying all the shares of the company. However,it was agreed that an independent firm of consultants,Bittern Associates,should be appointed to advise the Board throughout the period of negotiations. The Finance Department of Scaup plc extracted the following information as at 20 February 2003 relating to healthcare companies from a financial newspaper: 12 month High Low Company Price(p) +/ Yld P/E 6731/2 478 Curlew International 622 +2 2-3 10-5 780 460 Fieldfare 5921/2 +121/2 1-2 11-5 2791/2 1721/2 Plover UK 1941/2 + 1-2 12-5 1821/2 1171/2 Nightingale Healthcare 1171/2 -51/2 33 6-8 266 1211/2 Turnstone Health Products 2021/2 +31/2 26 83 316 164 Wigeon Group 2961/2 18 97 The Finance Department also provided the following ratios for each of the companies listed above: Market value*/Book value* Sales/Market value* Curlew International 37:1 171 Fieldfare 28:1 16:1 Plover UK 36:1 151 Nightingale Healthcare 291 191 Turnstone Health Products 32:1 23:1 Wigeon Group 27:1 14:1 These values refer to the ordinary shares of each company 第3页共9页

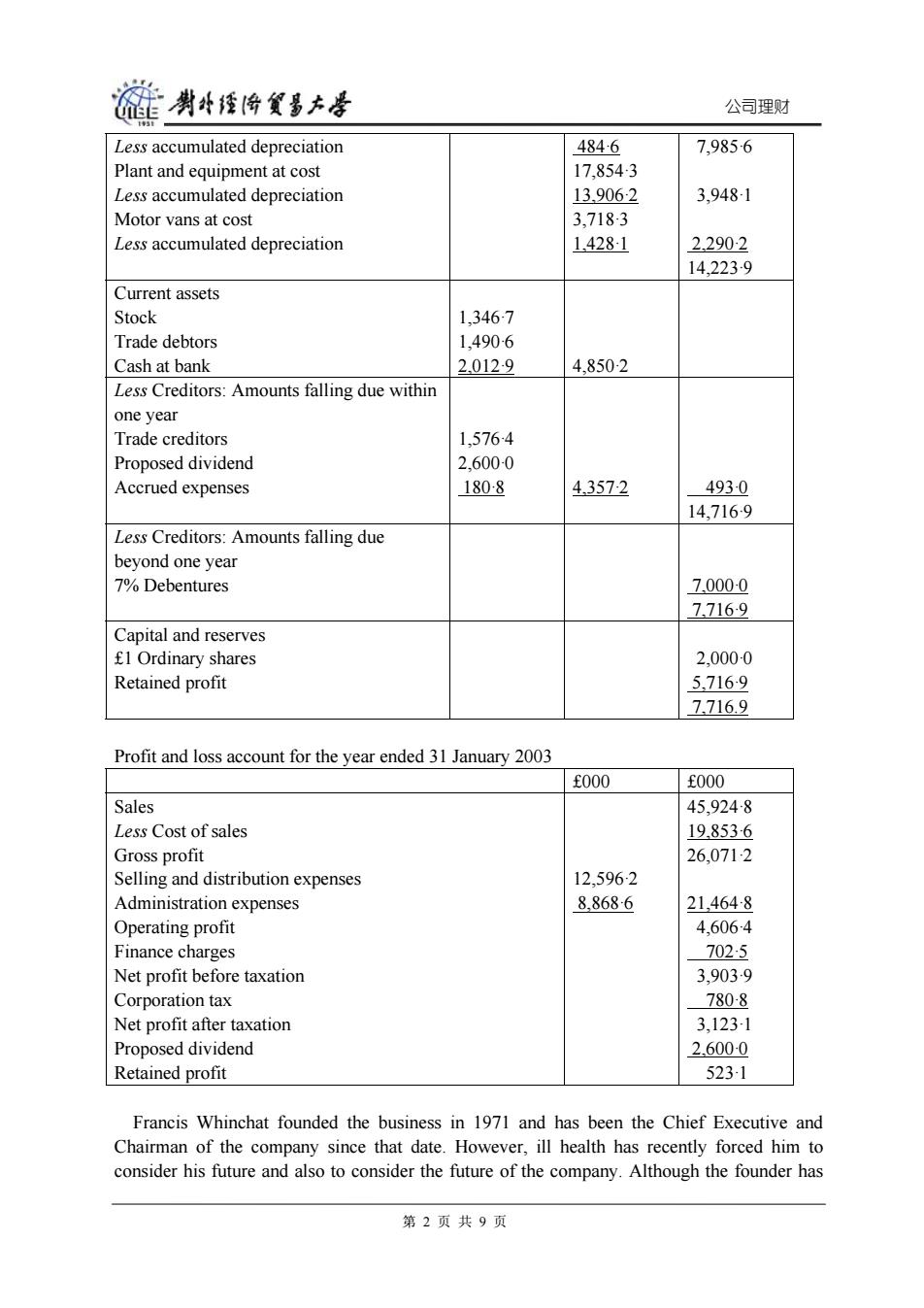

公司理财 two children, neither has shown an interest in the business. The idea of allowing non-family members to manage the business was regarded by the Whinchat family as unacceptable and so the various family members, who owned all the issued shares, agreed to sell the company. When Anne Pochard discovered that Whinchat Ltd was for sale, she expressed an immediate interest in entering into negotiations with the Whinchat family. She believed that this was an outstanding opportunity to acquire a range of high quality products with a strong brand image. It provided an immediate and strong presence in markets that the Board of Directors of Scaup plc had recently identified as being of particular interest. The Finance Director of Scaup plc, David Shearwater, was the first among the new Board of Directors to express reservations concerning the possible acquisition. Although he acknowledged the possible benefits that might accrue, he argued that Scaup plc had no previous experience in acquiring companies and that the new Board of Directors had not yet developed a clear view as to how the acquisition process should be approached or managed. As a result, there was a risk that the acquisition of Whinchat Ltd would not turn out to be as successful as Anne Pochard was expecting. David also wondered whether investors would be prepared to support the deal given the recent history of Scaup plc. The Board of Directors debated the issue and, by a narrow majority, decided to support Anne’s wish to enter into negotiations with the Whinchat family with a view to buying all the shares of the company. However, it was agreed that an independent firm of consultants, Bittern Associates, should be appointed to advise the Board throughout the period of negotiations. The Finance Department of Scaup plc extracted the following information as at 20 February 2003 relating to healthcare companies from a financial newspaper: 12 month High Low Company Price(p) +/- Yld % P/E 6731/2 780 2791/2 1821/2 266 316 478 460 1721/2 1171/2 1211/2 164 Curlew International Fieldfare Plover UK Nightingale Healthcare Turnstone Health Products Wigeon Group 622 5921/2 1941/2 1171/2 2021/2 2961/2 + 2 + 121/2 ..... – 51/2 + 31/2 ..... 2·3 1·2 1·2 3·3 2·6 1·8 10·5 11·5 12·5 6·8 8·3 9·7 The Finance Department also provided the following ratios for each of the companies listed above: Market value*/ Book value* Sales/ Market value* Curlew International Fieldfare Plover UK Nightingale Healthcare Turnstone Health Products Wigeon Group 3·7:1 2·8:1 3·6:1 2·9:1 3·2:1 2·7:1 1·7:1 1·6:1 1·5:1 1·9:1 2·3:1 1·4:1 * These values refer to the ordinary shares of each company 第 3 页 共 9 页

碰男华经海贸墨大号 公司理财 In the early stages of negotiation between the two companies,the following information was provided by Francis Whinchat: The market value of the freehold premises of Whinchat Ltd was estimated to be between f32 million and f33 million. The sales of Whinchat Ltd are expected to grow at about 2 or 3 per cent each year over the next five years.The market is fairly competitive and there is little prospect of improved growth rate over this period.Thereafter,sales are likely to stabilise. Operating profit margins are likely to remain at their historic levels,which are between 10 per cent and 12 per cent for the foreseeable future. Replacement costs of fixed assets will be more or less in line with the annual depreciation charge.In addition,however,the company is committed to a major upgrade of plant and equipment costing fl-8 million over the next three years.The cost of this upgrade would be spread evenly over the three-year period. Additional working capital over the next five years will be 20 per cent of sales growth. An exceptional dividend had been paid during the year to 31 January 2003.In previous years,the dividend paidhad varied between f220,000 and f260,000. Following the initial negotiations,the Directors of Scaup plc decided that,in the event of a price being agreed for the shares in Whinchat Ltd: The total after-tax savings in operating expenses from merging the sales and distribution channels of each company would be between f100,000-f120,000 per year.These figures are not included in the operating profit margin estimates mentioned above. The shares in Whinchat Ltd will be paid for in cash,which would be raised by a rights issue of ordinary shares. Scaup plc has an estimated cost of capital of 8 per cent.It has 10 million ordinary shares in issue and the current market value of a share is f10-64. Assume a corporation tax rate of 20 per cent on operating profits(payable in the current year)and a lower rate of income tax on dividends of 10 per cent. Required: Assume that you are a consultant with Bittern Associates. You are required to write a report for the Board of Directors of Scaup plc that: (a)suggests with reasons: (i)a reserve price per share in Whinchat Ltd that is appropriate for the Whinchat family; (ii)a reserve price per share in Whinchat Ltd that is appropriate for the shareholders of Scaup plc for use in negotiations concerning the acquisition of the ordinary shares in Whinchat Ltd. (25 marks) (b)sets out recommendations for a systematic approach to the identification,evaluation and management of future company acquisitions. (15 marks) (c)sets out recommendations concerning: (i)the number of rights shares that should be issued; (ii)the price at which each rights share should be issued to finance the deal;and (iii)the likely value of an ordinary share in Scaup plc following the rights issue. 第4页共9页

公司理财 In the early stages of negotiation between the two companies, the following information was provided by Francis Whinchat: – The market value of the freehold premises of Whinchat Ltd was estimated to be between £32 million and £33 million. – The sales of Whinchat Ltd are expected to grow at about 2 or 3 per cent each year over the next five years. The market is fairly competitive and there is little prospect of improved growth rate over this period. Thereafter, sales are likely to stabilise. – Operating profit margins are likely to remain at their historic levels, which are between 10 per cent and 12 per cent for the foreseeable future. – Replacement costs of fixed assets will be more or less in line with the annual depreciation charge. In addition, however, the company is committed to a major upgrade of plant and equipment costing £1·8 million over the next three years. The cost of this upgrade would be spread evenly over the three-year period. – Additional working capital over the next five years will be 20 per cent of sales growth. – An exceptional dividend had been paid during the year to 31 January 2003. In previous years, the dividend paidhad varied between £220,000 and £260,000. Following the initial negotiations, the Directors of Scaup plc decided that, in the event of a price being agreed for the shares in Whinchat Ltd: – The total after-tax savings in operating expenses from merging the sales and distribution channels of each company would be between £100,000 – £120,000 per year. These figures are not included in the operating profit margin estimates mentioned above. – The shares in Whinchat Ltd will be paid for in cash, which would be raised by a rights issue of ordinary shares. Scaup plc has an estimated cost of capital of 8 per cent. It has 10 million ordinary shares in issue and the current market value of a share is £10·64. Assume a corporation tax rate of 20 per cent on operating profits (payable in the current year) and a lower rate of income tax on dividends of 10 per cent. Required: Assume that you are a consultant with Bittern Associates. You are required to write a report for the Board of Directors of Scaup plc that: (a) suggests with reasons: (i) a reserve price per share in Whinchat Ltd that is appropriate for the Whinchat family; (ii) a reserve price per share in Whinchat Ltd that is appropriate for the shareholders of Scaup plc for use in negotiations concerning the acquisition of the ordinary shares in Whinchat Ltd. (25 marks) (b) sets out recommendations for a systematic approach to the identification, evaluation and management of future company acquisitions. (15 marks) (c) sets out recommendations concerning: (i) the number of rights shares that should be issued; (ii) the price at which each rights share should be issued to finance the deal; and (iii) the likely value of an ordinary share in Scaup plc following the rights issue. 第 4 页 共 9 页

链喇倚餐多方孝 公司理财 In answering part (c),you should assume that shareholders in Scaup plc have been made aware of the impending purchase of Whinchat Ltd and that the agreed price to acquire the shares in Whinchat Ltd is the reserve price identified in your answer to (a)(ii) above. (10 marks) When answering parts (a)and (c),you should clearly state any assumptions and reasoning that you have made and you should show key workings.Possible options available should be examined and any suggestions or decisions that are made must be supported by appropriate arguments. (50 marks) SUGGESTED ANSWERS FOR PROJECTS The Whinchat deal The case study can be approached in various ways.Below are some calculations and points that may have been made by students.However,they should only be regarded as indicative. (a)Book value of ordinary shares The book value of an ordinary share in Whinchat Ltd is: f000 f000 Fixed assets 14,223-9 Current assets 4.8502 19,0741 Less Creditors -falling due within 1 year 4,357-2 -falling due after 1 year 7.000-0 113572 Book value of net assets 7,7169 Book value per share f7,7169/2,000 f386 Market value/book value The mean market value/book value ratio of similar companies is 3.15:1.Using this as a guide,the market value of a share in Whinchat Ltd is 3.15 x f3-86=f12.16. Sales/market value The mean sales/market value ratio of similar companies is 1-73:1.Using this as a guide,the market value of a share in Whinchat Ltd is [(f45,924-8/173)/2,000]=f13-27. Market value The market value measure is based on the assumption that all assets,other than the freehold premises,are valued at book value and that the lowest market price stated is valid for the freehold premises: f000 f000 Fixed assets 第5页共9页

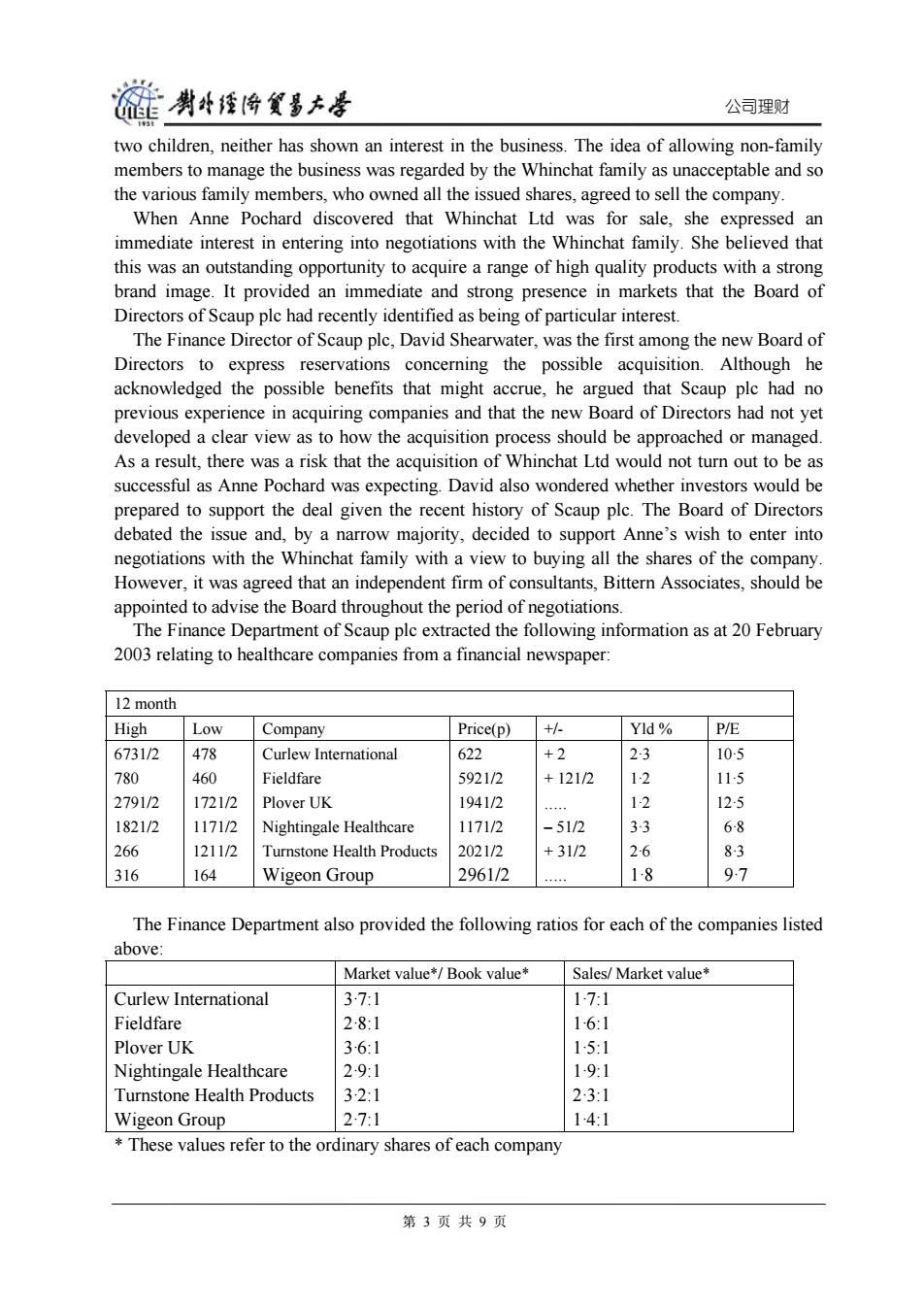

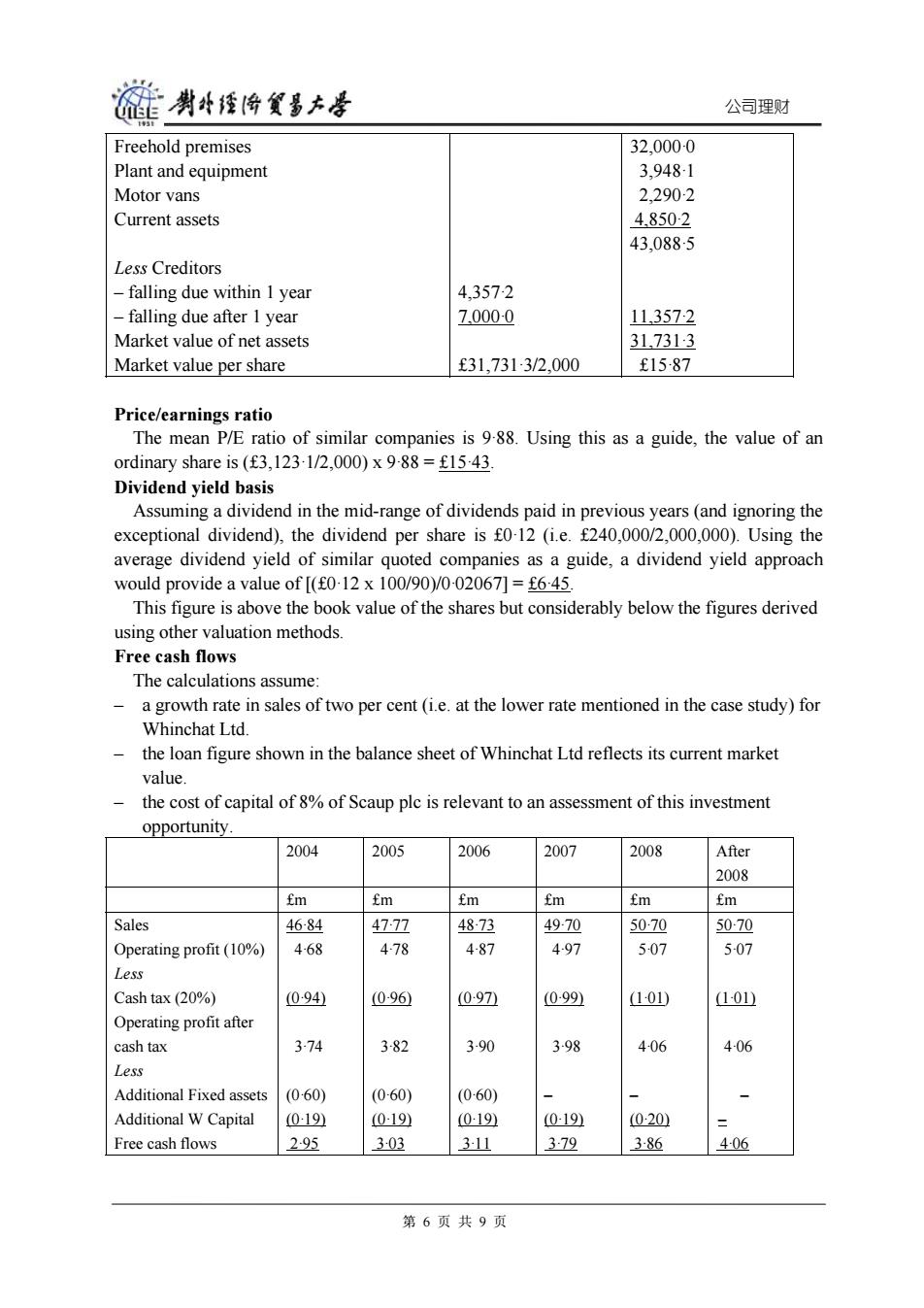

公司理财 In answering part (c), you should assume that shareholders in Scaup plc have been made aware of the impending purchase of Whinchat Ltd and that the agreed price to acquire the shares in Whinchat Ltd is the reserve price identified in your answer to (a)(ii) above. (10 marks) When answering parts (a) and (c), you should clearly state any assumptions and reasoning that you have made and you should show key workings. Possible options available should be examined and any suggestions or decisions that are made must be supported by appropriate arguments. (50 marks) SUGGESTED ANSWERS FOR PROJECTS The Whinchat deal The case study can be approached in various ways. Below are some calculations and points that may have been made by students. However, they should only be regarded as indicative. (a) Book value of ordinary shares The book value of an ordinary share in Whinchat Ltd is: £000 £000 Fixed assets Current assets Less Creditors – falling due within 1 year – falling due after 1 year Book value of net assets Book value per share 4,357·2 7,000·0 £7,716·9/2,000 14,223·9 4,850·2 19,074·1 11,357·2 7,716·9 £3·86 Market value/book value The mean market value/book value ratio of similar companies is 3·15:1. Using this as a guide, the market value of a share in Whinchat Ltd is 3·15 x £3·86 = £12·16. Sales/market value The mean sales/market value ratio of similar companies is 1·73:1. Using this as a guide, the market value of a share in Whinchat Ltd is [(£45,924·8/1·73)/2,000] = £13·27. Market value The market value measure is based on the assumption that all assets, other than the freehold premises, are valued at book value and that the lowest market price stated is valid for the freehold premises: £000 £000 Fixed assets 第 5 页 共 9 页

链黄科特倚食事大香 公司理财 Freehold premises 32.0000 Plant and equipment 3,9481 Motor vans 2,290-2 Current assets 4.850-2 43,0885 Less Creditors -falling due within 1 year 4,357-2 -falling due after 1 year 7.000-0 113572 Market value of net assets 31.7313 Market value per share f31,7313/2,000 f1587 Price/earnings ratio The mean P/E ratio of similar companies is 9-88.Using this as a guide,the value of an ordinary share is(f3,123-1/2,000)x 988=f1543 Dividend yield basis Assuming a dividend in the mid-range of dividends paid in previous years(and ignoring the exceptional dividend),the dividend per share is f0-12 (i.e.f240,000/2,000,000).Using the average dividend yield of similar quoted companies as a guide,a dividend yield approach would provide a value of [(f0-12 x 100/90)/0-02067]=f6-45. This figure is above the book value of the shares but considerably below the figures derived using other valuation methods. Free cash flows The calculations assume: a growth rate in sales of two per cent (i.e.at the lower rate mentioned in the case study)for Whinchat Ltd. the loan figure shown in the balance sheet of Whinchat Ltd reflects its current market value. the cost of capital of 8%of Scaup plc is relevant to an assessment of this investment opportunity. 2004 2005 2006 2007 2008 After 2008 fm fm fm fm fm fm Sales 4684 47·77 4873 49-70 5070 5070 Operating profit(10%) 4-68 478 487 497 507 507 Less Cash tax(20%) 094 0-96 09☑ 099 1-01 101山 Operating profit after cash tax 374 3-82 3-90 398 406 406 Less Additional Fixed assets (0-60) (0-60) (0-60) Additional W Capital (019 019) 019 (019) 020 Free cash flows 2.95 303 3-11 3·79 3-86 406 第6页共9页

公司理财 Freehold premises Plant and equipment Motor vans Current assets Less Creditors – falling due within 1 year – falling due after 1 year Market value of net assets Market value per share 4,357·2 7,000·0 £31,731·3/2,000 32,000·0 3,948·1 2,290·2 4,850·2 43,088·5 11,357·2 31,731·3 £15·87 Price/earnings ratio The mean P/E ratio of similar companies is 9·88. Using this as a guide, the value of an ordinary share is (£3,123·1/2,000) x 9·88 = £15·43. Dividend yield basis Assuming a dividend in the mid-range of dividends paid in previous years (and ignoring the exceptional dividend), the dividend per share is £0·12 (i.e. £240,000/2,000,000). Using the average dividend yield of similar quoted companies as a guide, a dividend yield approach would provide a value of [(£0·12 x 100/90)/0·02067] = £6·45. This figure is above the book value of the shares but considerably below the figures derived using other valuation methods. Free cash flows The calculations assume: – a growth rate in sales of two per cent (i.e. at the lower rate mentioned in the case study) for Whinchat Ltd. – the loan figure shown in the balance sheet of Whinchat Ltd reflects its current market value. – the cost of capital of 8% of Scaup plc is relevant to an assessment of this investment opportunity. 2004 2005 2006 2007 2008 After 2008 £m £m £m £m £m £m Sales Operating profit (10%) Less Cash tax (20%) Operating profit after cash tax Less Additional Fixed assets Additional W Capital Free cash flows 46·84 4·68 (0·94) 3·74 (0·60) (0·19) 2·95 47·77 4·78 (0·96) 3·82 (0·60) (0·19) 3·03 48·73 4·87 (0·97) 3·90 (0·60) (0·19) 3·11 49·70 4·97 (0·99) 3·98 – (0·19) 3·79 50·70 5·07 (1·01) 4·06 – (0·20) 3·86 50·70 5·07 (1·01) 4·06 – – 4·06 第 6 页 共 9 页

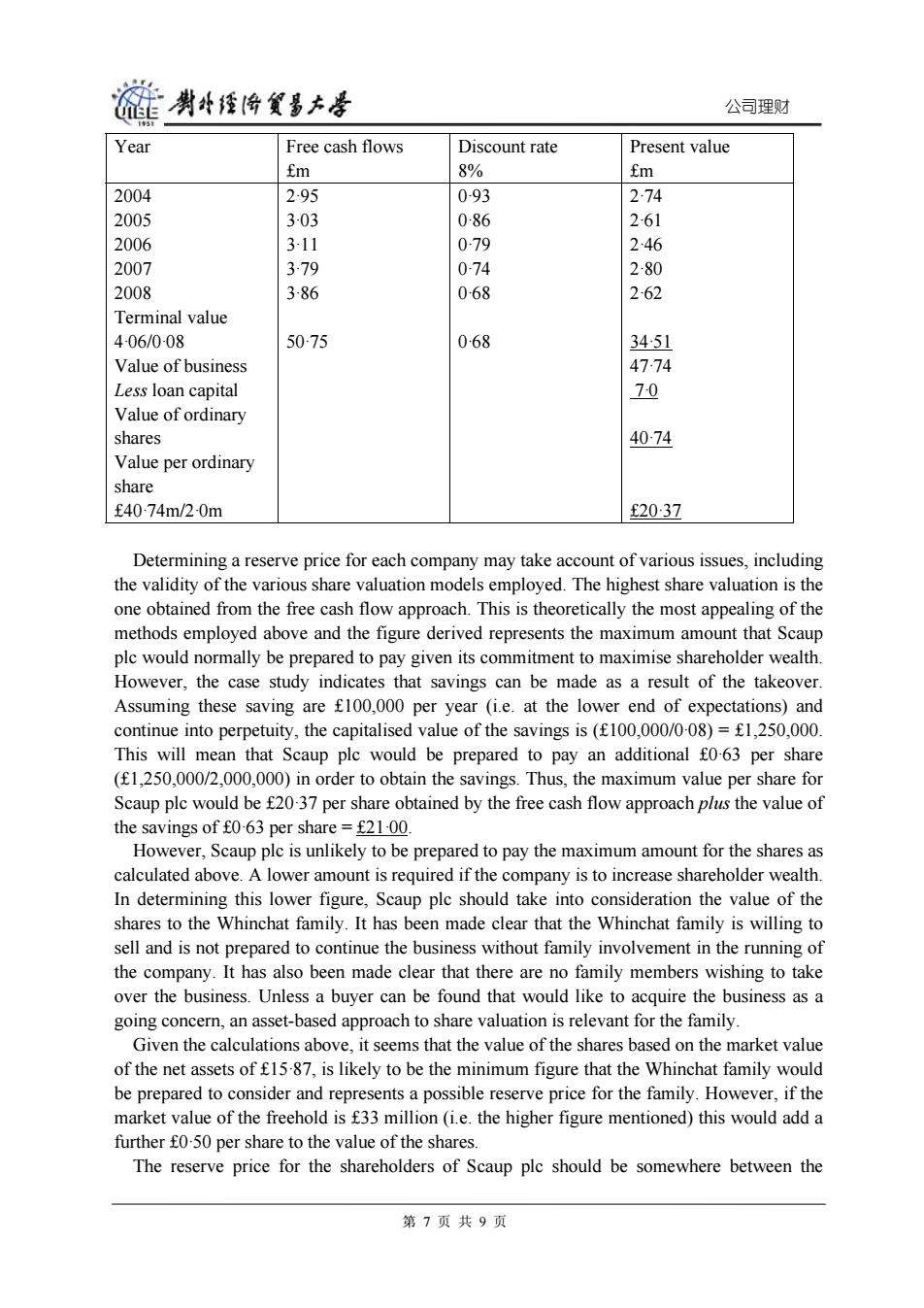

莲喇外烧跨餐多大是 公司理财 Year Free cash flows Discount rate Present value fm 8% fm 2004 295 093 274 2005 3-03 086 261 2006 311 079 246 2007 379 074 2-80 2008 3-86 0-68 262 Terminal value 4-06/0-08 5075 0-68 3451 Value of business 4774 Less loan capital 70 Value of ordinary shares 4074 Value per ordinary share £40·74m/2-0m f2037 Determining a reserve price for each company may take account of various issues,including the validity of the various share valuation models employed.The highest share valuation is the one obtained from the free cash flow approach.This is theoretically the most appealing of the methods employed above and the figure derived represents the maximum amount that Scaup plc would normally be prepared to pay given its commitment to maximise shareholder wealth. However,the case study indicates that savings can be made as a result of the takeover. Assuming these saving are f100,000 per year (i.e.at the lower end of expectations)and continue into perpetuity,the capitalised value of the savings is(f100,000/0-08)=f1,250,000. This will mean that Scaup plc would be prepared to pay an additional f0-63 per share (f1,250,000/2,000,000)in order to obtain the savings.Thus,the maximum value per share for Scaup plc would be f20-37 per share obtained by the free cash flow approach plus the value of the savings of f0-63 per share=f21-00. However,Scaup plc is unlikely to be prepared to pay the maximum amount for the shares as calculated above.A lower amount is required if the company is to increase shareholder wealth. In determining this lower figure,Scaup plc should take into consideration the value of the shares to the Whinchat family.It has been made clear that the Whinchat family is willing to sell and is not prepared to continue the business without family involvement in the running of the company.It has also been made clear that there are no family members wishing to take over the business.Unless a buyer can be found that would like to acquire the business as a going concern,an asset-based approach to share valuation is relevant for the family. Given the calculations above,it seems that the value of the shares based on the market value of the net assets of f1587,is likely to be the minimum figure that the Whinchat family would be prepared to consider and represents a possible reserve price for the family.However,if the market value of the freehold is f33 million (i.e.the higher figure mentioned)this would add a further f0-50 per share to the value of the shares. The reserve price for the shareholders of Scaup plc should be somewhere between the 第7页共9页

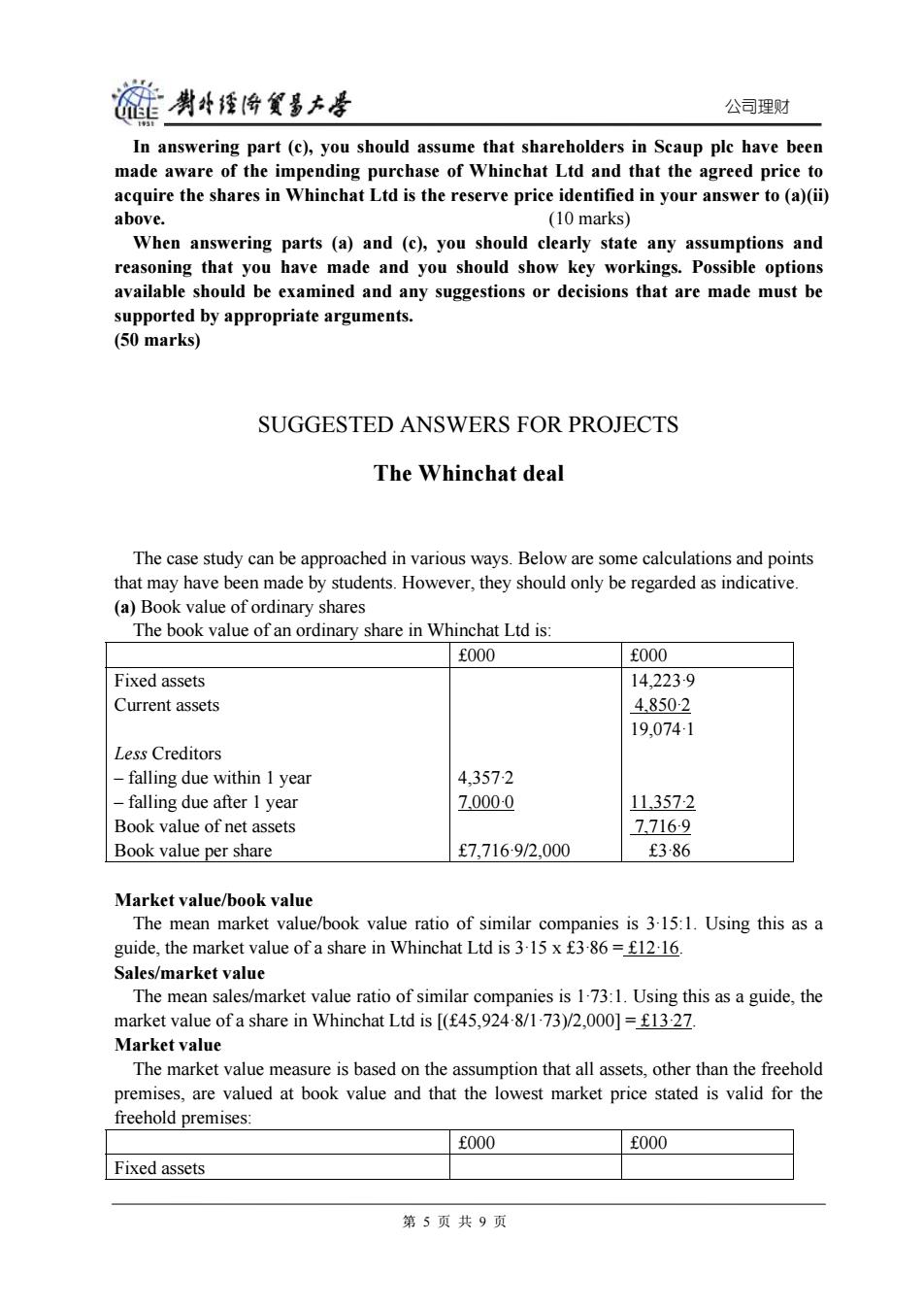

公司理财 Year Free cash flows £m Discount rate 8% Present value £m 2004 2005 2006 2007 2008 Terminal value 4·06/0·08 Value of business Less loan capital Value of ordinary shares Value per ordinary share £40·74m/2·0m 2·95 3·03 3·11 3·79 3·86 50·75 0·93 0·86 0·79 0·74 0·68 0·68 2·74 2·61 2·46 2·80 2·62 34·51 47·74 7·0 40·74 £20·37 Determining a reserve price for each company may take account of various issues, including the validity of the various share valuation models employed. The highest share valuation is the one obtained from the free cash flow approach. This is theoretically the most appealing of the methods employed above and the figure derived represents the maximum amount that Scaup plc would normally be prepared to pay given its commitment to maximise shareholder wealth. However, the case study indicates that savings can be made as a result of the takeover. Assuming these saving are £100,000 per year (i.e. at the lower end of expectations) and continue into perpetuity, the capitalised value of the savings is (£100,000/0·08) = £1,250,000. This will mean that Scaup plc would be prepared to pay an additional £0·63 per share (£1,250,000/2,000,000) in order to obtain the savings. Thus, the maximum value per share for Scaup plc would be £20·37 per share obtained by the free cash flow approach plus the value of the savings of £0·63 per share = £21·00. However, Scaup plc is unlikely to be prepared to pay the maximum amount for the shares as calculated above. A lower amount is required if the company is to increase shareholder wealth. In determining this lower figure, Scaup plc should take into consideration the value of the shares to the Whinchat family. It has been made clear that the Whinchat family is willing to sell and is not prepared to continue the business without family involvement in the running of the company. It has also been made clear that there are no family members wishing to take over the business. Unless a buyer can be found that would like to acquire the business as a going concern, an asset-based approach to share valuation is relevant for the family. Given the calculations above, it seems that the value of the shares based on the market value of the net assets of £15·87, is likely to be the minimum figure that the Whinchat family would be prepared to consider and represents a possible reserve price for the family. However, if the market value of the freehold is £33 million (i.e. the higher figure mentioned) this would add a further £0·50 per share to the value of the shares. The reserve price for the shareholders of Scaup plc should be somewhere between the 第 7 页 共 9 页

莲剥4将发多大号 公司理财 reserve price for the Whinchat family (f1587)and the maximum value per share to Scaup plc that was calculated earlier (f2100).Although the Whinchat family is anxious to sell,there may be another suitor waiting in the wings.A figure of around f18-00 per share(which would allow for the market value of the freehold premises being at the higher end of the range mentioned and provide a premium to the Whinchat family as an incentive to sell to Scaup plc) might be an appropriate reserve price for Scaup plc.This figure would provide Scaup plc with a profit of f3-00 for each share acquired in Whinchat Ltd,assuming the free cash flow and savings estimates are correct.(25 marks) (b)There are various steps that should be taken in ensuring a successful acquisition programme.These may include the following: developing a clear understanding of the nature of the business Scaup plc is in(with the aid of strategic models such as PEST analysis,SWOT analysis,Porter's five forces etc).This will help to identify how value may be added through acquisition (e.g.economies of scale, acquiring expertise in strategically important areas etc). identifying possible acquisition targets.Scaup plc appears to be interested in acquiring more companies and so the identification of targets should be regarded as a continuous process that should be undertaken by a dedicated business unit.Appropriate criteria for the identification of possible targets such as size,nature of the industry,location etc should be agreed and possible targets should be ranked according to the agreed criteria. undertaking due diligence.An examination of all the key features of the target company should be carried out including legal obligations,integrity of the financial accounts,future prospects,condition of assets,profiling of key personnel etc. agreeing a negotiating price range for possible candidates.This range should be based on the use of appropriate valuation models.In addition there should be some assessment of the position of the seller and the likelihood of competition for the acquisition target in order to derive a suitable reserve valuation figure.When carrying out the valuation process, possible synergies should be taken into account as well as opportunities for restructuring. developing a negotiating strategy.An experienced negotiating team is often an important ingredient to a successful deal.This will usually help in ensuring the agreed reserve price is not exceeded and that information gained concerning the target company and the threat of competitive bidders is properly taken into account so that no more is paid than is necessary. structuring the deal.The form of bid consideration and the advantages and disadvantages of each form of bid consideration to each party involved in the negotiations must be clearly understood. managing the integration of the takeover company.Once a deal has been agreed there should be a clear plan as to how the target company will be successfully integrated.This will usually involve establishing a senior management team to ensure good communications between the two companies,to develop team building across the two companies,and to reach agreement concerning key organizational issues.(15 marks) (c)Assuming the reserve price of f18 is paid,the amount to be raised is f36 million(2m x f18).If the free cash flow calculations provide the best estimate of the value of the ordinary shares in the business,the net present value of the deal will be: 第8页共9页

公司理财 reserve price for the Whinchat family (£15·87) and the maximum value per share to Scaup plc that was calculated earlier (£21·00). Although the Whinchat family is anxious to sell, there may be another suitor waiting in the wings. A figure of around £18·00 per share (which would allow for the market value of the freehold premises being at the higher end of the range mentioned and provide a premium to the Whinchat family as an incentive to sell to Scaup plc) might be an appropriate reserve price for Scaup plc. This figure would provide Scaup plc with a profit of £3·00 for each share acquired in Whinchat Ltd, assuming the free cash flow and savings estimates are correct. (25 marks) (b) There are various steps that should be taken in ensuring a successful acquisition programme. These may include the following: – developing a clear understanding of the nature of the business Scaup plc is in (with the aid of strategic models such as PEST analysis, SWOT analysis, Porter’s five forces etc). This will help to identify how value may be added through acquisition (e.g. economies of scale, acquiring expertise in strategically important areas etc). – identifying possible acquisition targets. Scaup plc appears to be interested in acquiring more companies and so the identification of targets should be regarded as a continuous process that should be undertaken by a dedicated business unit. Appropriate criteria for the identification of possible targets such as size, nature of the industry, location etc should be agreed and possible targets should be ranked according to the agreed criteria. – undertaking due diligence. An examination of all the key features of the target company should be carried out including legal obligations, integrity of the financial accounts, future prospects, condition of assets, profiling of key personnel etc. – agreeing a negotiating price range for possible candidates. This range should be based on the use of appropriate valuation models. In addition there should be some assessment of the position of the seller and the likelihood of competition for the acquisition target in order to derive a suitable reserve valuation figure. When carrying out the valuation process, possible synergies should be taken into account as well as opportunities for restructuring. – developing a negotiating strategy. An experienced negotiating team is often an important ingredient to a successful deal.This will usually help in ensuring the agreed reserve price is not exceeded and that information gained concerning the target company and the threat of competitive bidders is properly taken into account so that no more is paid than is necessary. – structuring the deal. The form of bid consideration and the advantages and disadvantages of each form of bid consideration to each party involved in the negotiations must be clearly understood. – managing the integration of the takeover company. Once a deal has been agreed there should be a clear plan as to how the target company will be successfully integrated. This will usually involve establishing a senior management team to ensure good communications between the two companies, to develop team building across the two companies, and to reach agreement concerning key organizational issues. (15 marks) (c) Assuming the reserve price of £18 is paid, the amount to be raised is £36 million (2m x £18). If the free cash flow calculations provide the best estimate of the value of the ordinary shares in the business, the net present value of the deal will be: 第 8 页 共 9 页

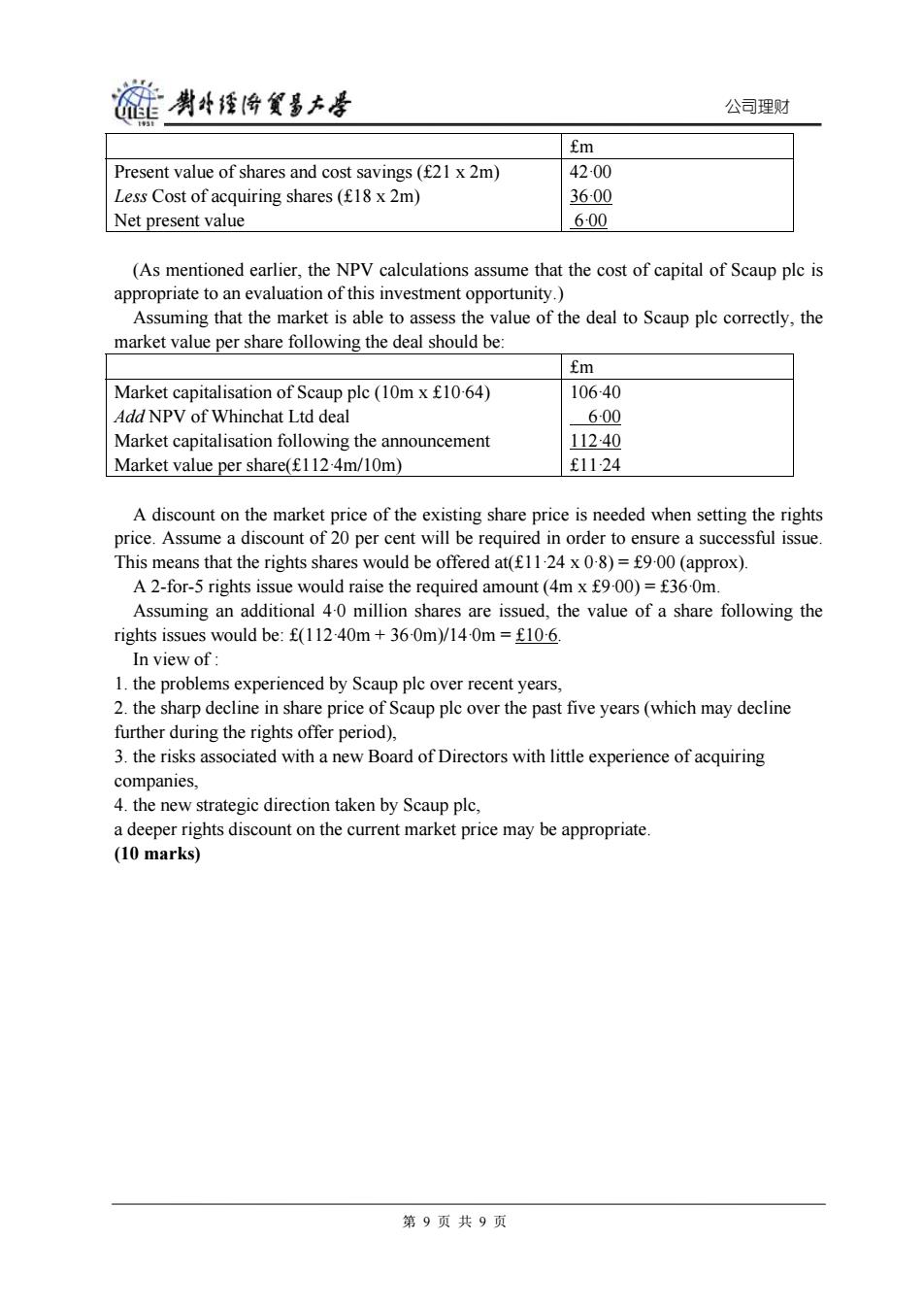

链黄科特倚食事大香 公司理财 fm Present value of shares and cost savings (f21 x 2m) 42-00 Less Cost of acquiring shares(f18 x 2m) 36-00 Net present value 600 (As mentioned earlier,the NPV calculations assume that the cost of capital of Scaup plc is appropriate to an evaluation of this investment opportunity. Assuming that the market is able to assess the value of the deal to Scaup plc correctly,the market value per share following the deal should be: fm Market capitalisation of Scaup plc(10m x f10-64) 10640 Add NPV of Whinchat Ltd deal 600 Market capitalisation following the announcement 11240 Market value per share(f112.4m/10m) £1124 A discount on the market price of the existing share price is needed when setting the rights price.Assume a discount of 20 per cent will be required in order to ensure a successful issue. This means that the rights shares would be offered at(f11 24 x 0-8)=f9-00(approx). A 2-for-5 rights issue would raise the required amount(4m x f9-00)=f36-0m. Assuming an additional 4-0 million shares are issued,the value of a share following the rights issues would be:f(112-40m+36-0m)/14-0m=f10-6. In view of: 1.the problems experienced by Scaup plc over recent years, 2.the sharp decline in share price of Scaup plc over the past five years(which may decline further during the rights offer period), 3.the risks associated with a new Board of Directors with little experience of acquiring companies, 4.the new strategic direction taken by Scaup plc, a deeper rights discount on the current market price may be appropriate (10 marks) 第9页共9页

公司理财 £m Present value of shares and cost savings (£21 x 2m) Less Cost of acquiring shares (£18 x 2m) Net present value 42·00 36·00 6·00 (As mentioned earlier, the NPV calculations assume that the cost of capital of Scaup plc is appropriate to an evaluation of this investment opportunity.) Assuming that the market is able to assess the value of the deal to Scaup plc correctly, the market value per share following the deal should be: £m Market capitalisation of Scaup plc (10m x £10·64) Add NPV of Whinchat Ltd deal Market capitalisation following the announcement Market value per share(£112·4m/10m) 106·40 6·00 112·40 £11·24 A discount on the market price of the existing share price is needed when setting the rights price. Assume a discount of 20 per cent will be required in order to ensure a successful issue. This means that the rights shares would be offered at(£11·24 x 0·8) = £9·00 (approx). A 2-for-5 rights issue would raise the required amount (4m x £9·00) = £36·0m. Assuming an additional 4·0 million shares are issued, the value of a share following the rights issues would be: £(112·40m + 36·0m)/14·0m = £10·6. In view of : 1. the problems experienced by Scaup plc over recent years, 2. the sharp decline in share price of Scaup plc over the past five years (which may decline further during the rights offer period), 3. the risks associated with a new Board of Directors with little experience of acquiring companies, 4. the new strategic direction taken by Scaup plc, a deeper rights discount on the current market price may be appropriate. (10 marks) 第 9 页 共 9 页