正在加载图片...

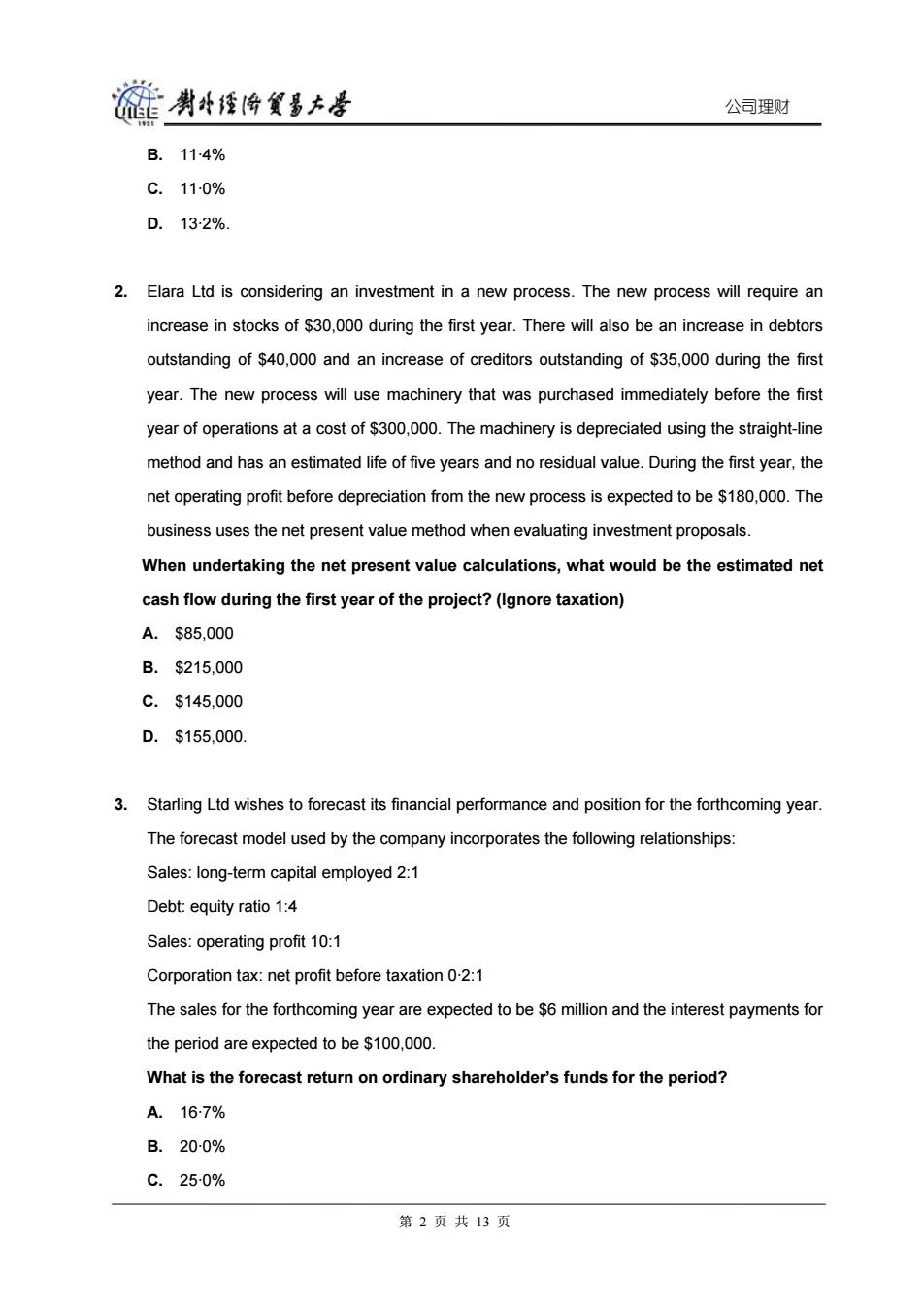

肖外径份氨多本是 公司理财 B.114% C.110% D.132%. 2. Elara Ltd is considering an investment in a new process.The new process will require an increase in stocks of $30,000 during the first year.There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year.The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000.The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value.During the first year,the net operating profit before depreciation from the new process is expected to be $180,000.The business uses the net present value method when evaluating investment proposals When undertaking the net present value calculations,what would be the estimated net cash flow during the first year of the project?(Ignore taxation) A.$85,000 B.$215,000 C.$145,000 D.$155,000. 3.Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales:long-term capital employed 2:1 Debt:equity ratio 1:4 Sales:operating profit 10:1 Corporation tax:net profit before taxation 0-2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder's funds for the period? A.167% B.200% C.25-0% 第2页共13页公司理财 B. 11·4% C. 11·0% D. 13·2%. 2. Elara Ltd is considering an investment in a new process. The new process will require an increase in stocks of $30,000 during the first year. There will also be an increase in debtors outstanding of $40,000 and an increase of creditors outstanding of $35,000 during the first year. The new process will use machinery that was purchased immediately before the first year of operations at a cost of $300,000. The machinery is depreciated using the straight-line method and has an estimated life of five years and no residual value. During the first year, the net operating profit before depreciation from the new process is expected to be $180,000. The business uses the net present value method when evaluating investment proposals. When undertaking the net present value calculations, what would be the estimated net cash flow during the first year of the project? (Ignore taxation) A. $85,000 B. $215,000 C. $145,000 D. $155,000. 3. Starling Ltd wishes to forecast its financial performance and position for the forthcoming year. The forecast model used by the company incorporates the following relationships: Sales: long-term capital employed 2:1 Debt: equity ratio 1:4 Sales: operating profit 10:1 Corporation tax: net profit before taxation 0·2:1 The sales for the forthcoming year are expected to be $6 million and the interest payments for the period are expected to be $100,000. What is the forecast return on ordinary shareholder’s funds for the period? A. 16·7% B. 20·0% C. 25·0% 第 2 页 共 13 页