正在加载图片...

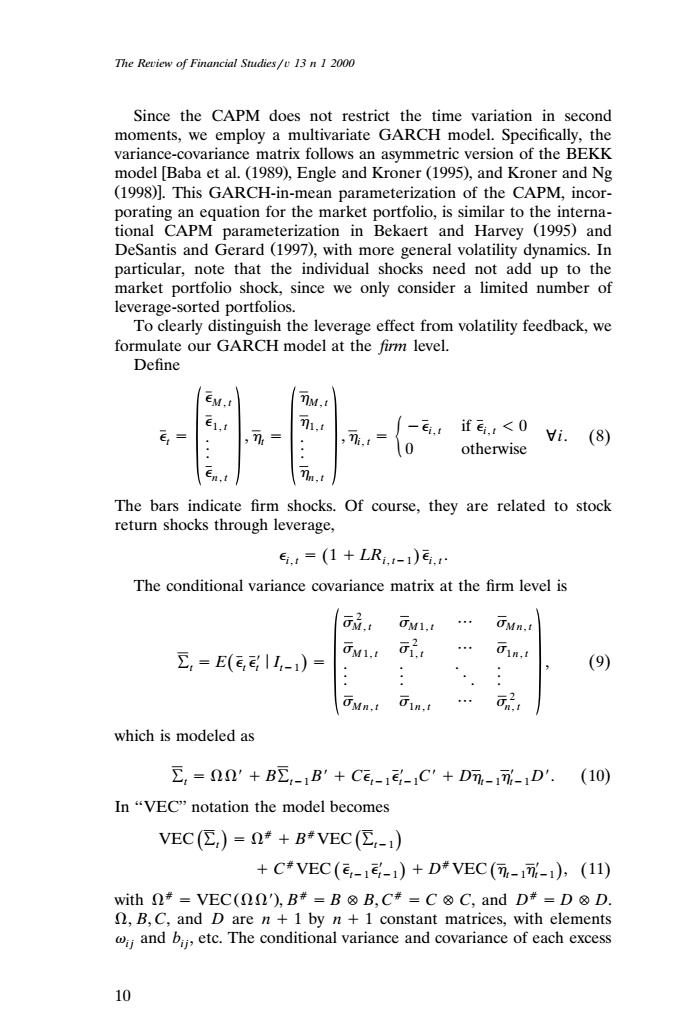

The Review of Financial Studies/v 13 n 1 2000 Since the CAPM does not restrict the time variation in second moments,we employ a multivariate GARCH model.Specifically,the variance-covariance matrix follows an asymmetric version of the BEKK model [Baba et al.(1989),Engle and Kroner (1995),and Kroner and Ng (1998)].This GARCH-in-mean parameterization of the CAPM,incor- porating an equation for the market portfolio,is similar to the interna- tional CAPM parameterization in Bekaert and Harvey (1995)and DeSantis and Gerard (1997),with more general volatility dynamics.In particular,note that the individual shocks need not add up to the market portfolio shock,since we only consider a limited number of leverage-sorted portfolios. To clearly distinguish the leverage effect from volatility feedback,we formulate our GARCH model at the firm level. Define EM.t MM.t e1,1 1,t ,7 .if,<0 7.t i.(8) otherwise en.t 门h,t The bars indicate firm shocks.Of course,they are related to stock return shocks through leverage, e,4=(1+LR,1-i)e. The conditional variance covariance matrix at the firm level is 最: 0M1,t OMn.! E,=E(e,|1,-)= UM1.I 品, 1, (9) 0Mn,1 01n,i which is modeled as E,=20'+BE-1B'+CE,-1(-1C+Dm-1-1D'. (10) In "VEC"notation the model becomes VEC(E)=#+B#VEC(-1) +C*VEC(E-1(-)+D#VEC(--1),(11) with#=VEC(2'),B*=B⑧B,C#=C⑧C,andD*=D⑧D. A,B,C,and D are n+1 by n+1 constant matrices,with elements j and bij,etc.The conditional variance and covariance of each excess 10The Reiew of Financial Studies 13 n 1 2000 Since the CAPM does not restrict the time variation in second moments, we employ a multivariate GARCH model. Specifically, the variance-covariance matrix follows an asymmetric version of the BEKK model Baba et al. 1989 , Engle and Kroner 1995 , and Kroner and Ng Ž. Ž. Ž . 1998 . This GARCH-in-mean parameterization of the CAPM, incor- porating an equation for the market portfolio, is similar to the international CAPM parameterization in Bekaert and Harvey 1995 and Ž . DeSantis and Gerard 1997 , with more general volatility dynamics. In Ž . particular, note that the individual shocks need not add up to the market portfolio shock, since we only consider a limited number of leverage-sorted portfolios. To clearly distinguish the leverage effect from volatility feedback, we formulate our GARCH model at the firm level. Define M , t M , t 1, t 1, t i, t i if , t 0 . . , , i. 8Ž . tt i . . , t ½ 0 otherwise . . 0 0 n, t n, t The bars indicate firm shocks. Of course, they are related to stock return shocks through leverage, Ž . 1 LR . i, t i, t1 i, t The conditional variance covariance matrix at the firm level is 2 M , t M 1, t Mn , t 2 M 1, t 1, t 1n, t Ý EŽ . I . . .. , 9Ž . t tt t1 . . .. . . .. 0 2 M n, t 1n, t n , t which is modeled as Ý BÝ B C C D D . 10 Ž . t t1 t1 t1 t1 t1 In ‘‘VEC’’ notation the model becomes VEC Ž. Ž . Ýt t B VEC Ý 1 C VEC Ž. Ž. D VEC , 11 Ž . t1 t1 t1 t1 Ž . with VEC , B B

B, C C

C, and D D

D. , B, C, and D are n 1 by n 1 constant matrices, with elements

and b , etc. The conditional variance and covariance of each excess ij ij 10��������������������������