正在加载图片...

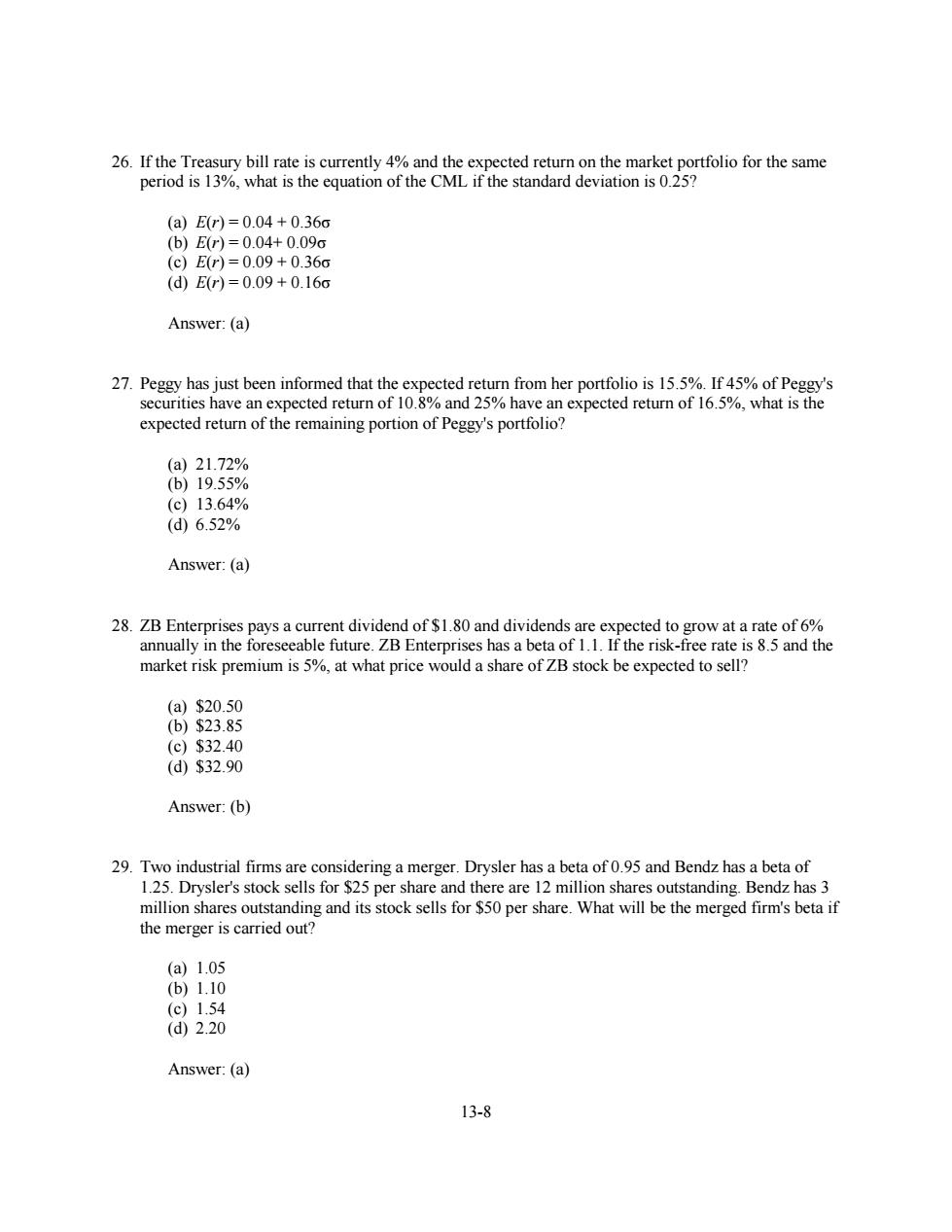

26.If the Treasury bill rate is currently 4%and the expected return on the market portfolio for the same period is 13%,what is the equation of the CML if the standard deviation is 0.25? (a)Er)=0.04+0.36o (b)Er)=0.04+0.09o (c)Er)=0.09+0.36o (dEr)=0.09+0.16o Answer:(a) 27.Peggy has just been informed that the expected return from her portfolio is 15.5%.If 45%of Peggy's securities have an expected return of 10.8%and 25%have an expected return of 16.5%,what is the expected return of the remaining portion of Peggy's portfolio? (a)21.72% (b)19.55% (c)13.64% (d6.52% Answer:(a) 28.ZB Enterprises pays a current dividend of $1.80 and dividends are expected to grow at a rate of6% annually in the foreseeable future.ZB Enterprises has a beta of 1.1.If the risk-free rate is 8.5 and the market risk premium is 5%,at what price would a share of ZB stock be expected to sell? (a)$20.50 (b)$23.85 (c)$32.40 (d)$32.90 Answer:(b) 29.Two industrial firms are considering a merger.Drysler has a beta of 0.95 and Bendz has a beta of 1.25.Drysler's stock sells for $25 per share and there are 12 million shares outstanding.Bendz has 3 million shares outstanding and its stock sells for $50 per share.What will be the merged firm's beta if the merger is carried out? (a)1.05 (b)1.10 (c)1.54 (d)2.20 Answer:(a) 13-813-8 26. If the Treasury bill rate is currently 4% and the expected return on the market portfolio for the same period is 13%, what is the equation of the CML if the standard deviation is 0.25? (a) E(r) = 0.04 + 0.36σ (b) E(r) = 0.04+ 0.09σ (c) E(r) = 0.09 + 0.36σ (d) E(r) = 0.09 + 0.16σ Answer: (a) 27. Peggy has just been informed that the expected return from her portfolio is 15.5%. If 45% of Peggy's securities have an expected return of 10.8% and 25% have an expected return of 16.5%, what is the expected return of the remaining portion of Peggy's portfolio? (a) 21.72% (b) 19.55% (c) 13.64% (d) 6.52% Answer: (a) 28. ZB Enterprises pays a current dividend of $1.80 and dividends are expected to grow at a rate of 6% annually in the foreseeable future. ZB Enterprises has a beta of 1.1. If the risk-free rate is 8.5 and the market risk premium is 5%, at what price would a share of ZB stock be expected to sell? (a) $20.50 (b) $23.85 (c) $32.40 (d) $32.90 Answer: (b) 29. Two industrial firms are considering a merger. Drysler has a beta of 0.95 and Bendz has a beta of 1.25. Drysler's stock sells for $25 per share and there are 12 million shares outstanding. Bendz has 3 million shares outstanding and its stock sells for $50 per share. What will be the merged firm's beta if the merger is carried out? (a) 1.05 (b) 1.10 (c) 1.54 (d) 2.20 Answer: (a)