正在加载图片...

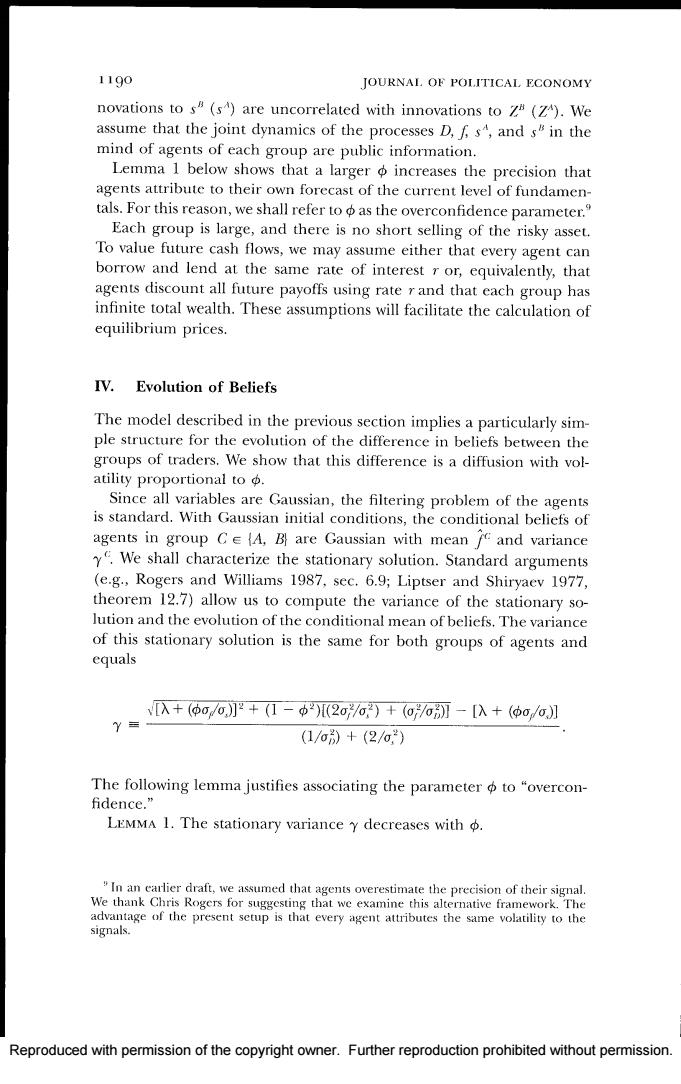

1190 JOURNAL.OF POLITICAL ECONOMY novations to s(s)are uncorrelated with innovations to z(Z).We assume that the joint dynamics of the processes D,fs",and s"in the mind of agents of each group are public information. Lemma 1 below shows that a larger o increases the precision that agents attribute to their own forecast of the current level of fundamen- tals.For this reason,we shall refer toas the overconfidence parameter. Each group is large,and there is no short selling of the risky asset. To value future cash flows,we may assume either that every agent can borrow and lend at the same rate of interest r or,equivalently,that agents discount all future payoffs using rate r and that each group has infinite total wealth.These assumptions will facilitate the calculation of equilibrium prices. IV.Evolution of Beliefs The model described in the previous section implies a particularly sim- ple structure for the evolution of the difference in beliefs between the groups of traders.We show that this difference is a diffusion with vol- atility proportional to o. Since all variables are Gaussian,the filtering problem of the agents is standard.With Gaussian initial conditions,the conditional beliefs of agents in group Ce(A,B are Gaussian with mean f and variance y.We shall characterize the stationary solution.Standard arguments (e.g.,Rogers and Williams 1987,sec.6.9;Liptser and Shiryaev 1977, theorem 12.7)allow us to compute the variance of the stationary so- lution and the evolution of the conditional mean of beliefs.The variance of this stationary solution is the same for both groups of agents and equals 入+(Φ0ōJ2+(I-中)[2oo)+(o/6别-[入+(φ0/6] (1/o)+(2/a,) The following lemma justifies associating the parameter o to "overcon- fidence." LEMMA 1.The stationary variance y decreases with "In an carlier draft,we assumed that agents overestimate the precision of their signal. We thank Chris Rogers for suggesting that we examine this alternative framework.The advantage of the present setup is that every agent attributes the same volatility to the signals. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission.Reproduced with permission of the copyright owner. Further reproduction prohibited without permission