Overconfidence and Speculative Bubbles Jose A Scheinkman;Wei Xiong The Journal of Political Economy:Dec 2003;111,6;ABI/INFORM Global Pg1183 Overconfidence and Speculative Bubbles Jose A.Scheinkman and Wei Xiong Princeton University Motivated by the behavior of asset prices,trading volume,and price volatility during episodes of asset price bubbles,we present a contin- uous-time equilibrium model in which overconfidence generates dis- agreements among agents regarding asset fundamentals.With short- sale constraints,an asset buyer acquires an option to sell the asset to other agents when those agents have more optimistic beliefs.As in a paper by Harrison and Kreps,agents pay prices that exceed their own valuation of future dividends because they believe that in the future they will find a buyer willing to pay even more.This causes a significant bubble component in asset prices even when small differences of beliefs are sufficient to generate a trade.In equilibrium,bubbles are accompanied by large trading volume and high price volatility.Our analysis shows that while Tobin's tax can substantially reduce specu- lative trading when transaction costs arc small,it has only a limited impact on the size of the bubble or on price volatility. I. Introduction The behavior of market prices and trading volumes of assets during historical episodes of price bubbles presents a challenge to asset pricing theories.A common feature of these episodes,including the recent This paper was previously circulated under the title"Overconfidence,Short-Sale Con- straints and Bubbles."Scheinkman's research was supported by the Chaire Blaise Pascal and the National Science Foundation,and partially done while he was visiting the Uni- versite Paris-Dauphine.We would like to thank Patrick Bolton,Markus Brunnermeier, John Cochrane,George Constantinides,Darrell Duffie,Ivar Ekeland,Edward Glaeser,Ravi Jagannathan,Pete Kyle.Owen Lamont,Marcelo Pinheiro,Chris Rogers,Tano Santos, Walter Schachermayer,Harald Uhlig,Dimitri Vayanos,two anonymous referces,and sem- inar participants at various institutions and conferences for comments. gC28Anlwmy2/1IwoinSioe时 1183 Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission. Overconfidence and Speculative Bubbles Jose A Scheinkman; Wei Xiong The Journal of Political Economy; Dec 2003; 111, 6; ABI/INFORM Global pg. 1183

1184 JOURNAL OF POLITICAL ECONOMY Internet stock boom,is the coexistence of high prices and high trading volume.'In addition,high price volatility is frequently observed.? In this paper,we propose a model of asset trading,based on hetero- geneous beliefs generated by agents'overconfidence,with equilibria that broadly fit these observations.We also provide explicit links between parameter values in the model,such as trading cost and information, and the behavior of equilibrium prices and trading volume.More gen- erally,our model provides a flexible framework to study speculative trading that can be used to analyze links between asset prices,trading volume,and price volatility. In the model,the ownership of a share of stock provides an oppor- tunity (option)to profit from other investors'overvaluation.For this option to have value,it is necessary that some restrictions apply to short selling.In reality,these restrictions arise from many distinct sources. First,in many markets,short selling requires borrowing a security,and this mechanism is costly.In particular,the default risk if the asset price goes up is priced by lenders of the security.Second,the risk associated with short selling may deter risk-averse investors.Third,limitations to the availability of capital to potential arbitrageurs may also limit short selling.For technical reasons,we do not deal with short-sale costs or risk aversion.Instead we rule out short sales,although our qualitative results would survive the presence of costly short sales as long as the asset owners can expect to make a profit when others have higher valuations. Our model follows the basic insight of Harrison and Kreps (1978) that when agents agree to disagree and short selling is not possible, asset prices may exceed their fundamental value.In their model,agents disagree about the probability distributions of dividend streams-the reason for the disagreement is not made explicit.We study overconfi- 'See Lamont and Thaler (2003)and Ofek and Richardson (2003)for the Internet boom.Cochrane (2002)emphasizes the significant correlation betwecn high prices and high turnover rates as a key characteristic of the 1929 boom and crash and of the Internet episode.Ofek and Richardson(2003)point out that between early 1998 and February 2000,pure Internet firms represented as much as 20 percent of the dollar volume in the public equity market,even though their market capitalization never exceeded 6 percent. 2 Cochrane (2002,p.6)commented on the much-discussed Palm case:"Palm stock was also tremendously volatile during this period,with...15.4%standard deviation of 5 day returns,[which]is about the same as the volatility of the S&P500 index over an entire year." Duffic,Garleanu,and Pedersen (2002)provide a search model to analyze the actual short-sale process and its implication for asset prices.D'Avolio (2002),Geczy,Musto,and Reed (2002),and Jones and Lamont (2002)contain empirical analyses of the rclevance of short-sale costs. Shleifer and Vishny (1997)arguc that agency problems limit the capital available to arbitrageurs and may cause arbitrage to fail.See also Kyle and Xiong (2001),Xiong (2001), and Gromb and Vayanos (2002)for studies linking the dynamics of arbitrageurs'capital with asset price dynamics. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 1185 dence,the belief of an agent that his information is more accurate than it is,as a source of disagreement.Although overconfidence is only one of the many ways by which disagreement among investors may arise,it is suggested by some experimental studies of human behavior and gen- erates a mathematical framework that is relatively simple.Our model has an explicit solution,which allows us to derive several comparative statics results and restrictions on the dynamics ofobservables.The model may also be regarded as a fully worked out example of the Harrison- Kreps framework in continuous time,where computations and com- parison of solutions are particularly tractable. We study a market for a single risky asset with limited supply and many risk-neutral agents in a continuous-time model with an infinite horizon.The current dividend of the asset is a noisy observation of a fundamental variable that will determine future dividends.In addition to the dividends,there are two other sets of signals available at each instant.The information is available to all agents;however,agents are divided into two groups,and they differ in the interpretation of the signals.Each group overestimates the informativeness of a different signal and,as a consequence,has distinct forecasts of future dividends. Agents in our model know that their forecasts differ from the forecasts of agents in the other group,but behavioral limitations lead them to agree to disagree.As information flows,the forecasts by agents of the two groups oscillate,and the group of agents that is at one instant relatively more optimistic may become at a future date less optimistic than the agents in the other group.These fluctuations in relative beliefs generate trade. When evaluating an asset,agents consider their own view of funda- mentals and the fact that the owner of the asset has an option to sell the asset in the future to agents in the other group.This option can be exercised at any time by the current owner,and the new owner gets, in turn,another option to sell the asset.These characteristics make the option "American"and give it a recursive structure.The value of the option is the value function of an optimal stopping problem.Since the buyer's willingness to pay is a function of the value of the option that he acquires,the payoff from stopping is,in turn,related to the value of the option.This gives us a fixed-point problem that the option value must satisfy.This difference between the current owner's demand price and his fundamental valuation,which is exactly the resale option value, For example,Morris (1996)assumes noncommon priors,and Biais and Bossacrts (1998)examine the role of higher-order beliefs. 6"We all have the same information,and we're just making different conclusions about what the future will hold"(Henry Blodget,the former star analyst at Merrill Lynch,quoted in Lewis [2002]). Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

1186 JOURNAL OF POLITICAL.ECONOMY can be reasonably called a bubble.?Fluctuations in the value of the bubble contribute an extra component to price volatility.We emphasize that the bubble in our model is a consequence of the divergence of opinions generated by the overestimation of informativeness of the dis- tinct signals.On average,our agents are neither optimists nor pessimists. In equilibrium,an asset owner will sell the asset to agents in the other group whenever his view of the fundamental is surpassed by the view of agents in the other group by a critical amount.Passages through this critical point determine turnover.When there are no trading costs,we show that the critical point is zero:it is optimal to sell the asset im- mediately after the valuation of fundamentals is "crossed"by the valu- ation of agents in the other group.Our agents'beliefs satisfy simple stochastic differential equations,and it is a consequence of properties of Brownian motion that once the beliefs of agents cross,they will cross infinitely many times in any finite period of time right afterward.This results in a trading frenzy,in which the unconditional average volume in any time interval is infinite.Since the equilibria display continuity with respect to the trading cost 6 our model with small trading costs is able to capture the excessive trading observed in bubbles. When trading costs are small,the value of the bubble and the extra volatility component are maximized.We show that increases in some parameter valucs,such as the degree of overconfidence or the infor- mation content of the signals,increase these three key variables.In this way,our model provides an explanation for the cross-sectional corre- lation between price,volume,and volatility that has been observed in bubbles.However,to obtain more realistic time-series dynamics,it may be necessary to allow the parameter values to change over time.In Section VIIE,we discuss how to accommodate fluctuations in parameter values,though we do not provide a theory that explains these oscillations. In the model,increases in trading costs reduce the trading frequency, asset price volatility,and the option value.For small trading costs,the effect on trading frequency is very significant.The impact on price volatility and on the size of the bubble is much more modest.As the trading cost increases,the increase in the critical point also raises the profit of the asset owner from each trade,thus partially offsetting the decrease in the value of the resale option caused by the reduction in trading frequency.Our analysis suggests that a transaction tax,as pro- posed by Tobin (1978),would,in fact,substantially reduce the amount of speculative trading in markets with small transaction costs but would 7 An alternative would be to measure the bubble as the difference between the asset price and the fundamental valuation of the dividends by an agent that correctly weights the signals.We opted for our definition because it highlights the difference between beliefs about fundamentals and trading price. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 1187 have a limited effect on the size of the bubble or on price volatility. Since a Tobin tax will no doubt also deter trading generated by fun- damental causes that are absent from our model,the limited impact of the tax on the size of the bubble and on price volatility cannot serve as an endorsement of the Tobin tax.The limited effect of transaction costs on the size of the bubble is also compatible with the observation of Shiller (2000)that bubbles have occurred in the real estate market, where transaction costs are high. The existence of the option component in the asset price creates potential violations to the law of one price.Through a simple example, we illustrate that the bubble may cause the price of a subsidiary to be larger than that of its parent firm.The intuition behind the examplc is that if a firm has two subsidiaries with fundamentals that are perfectly negatively correlated,there will be no differences in opinion,and hence no option component on the value of the parent firm,but possibly strong differences of opinion about the value of a subsidiary.In this example,our model also predicts that trading volume on the subsidiaries would be much larger than on the parent firm.This nonlinearity of the option value may help explain the "mispricing"of carve-outs that oc- curred in the late 1990s such as the 3Com-Palm case. The paper is structured as follows.In Section Il,we present a brief literature review.Section III describes the structure of the model.Sec- tion IV derives the evolution of agents'beliefs.In Section V,we discuss the optimal stopping time problem and derive the equation for equi- librium option values.In Section VI,we solve for the equilibrium.Sec- tion VII discusses several properties of the equilibrium when trading costs are small.In Section VIII,we focus on the effect of trading costs. In Section IX,we construct an example in which the price of a subsidiary is larger than that of its parent firm.Section X concludes the paper with some discussion of implications for corporate finance.All proofs are in the Appendix. Ⅱ.Related Literature There is a large literature on the effects of heterogeneous beliefs.In a static framework,Miller (1977)and Chen,Hong,and Stein (2002)an- alyze the overvaluation generated by heterogeneous beliefs.This static framework cannot generate an option value or the dynamics of trading. In contrast,Federal Reserve Chairman Alan Greenspan seems to believe that the low turnover induced by the high costs of transactions in the housing market are an imped- iment to real estate bubbles:"While stock market turnover is more than 100 per cent annually,the turnover of home ownership is less than 10 per cent annually-scarccly tinder for speculative conflagration"(quoted in Financial Times [April 22,2002]).The results in this paper suggest otherwisc. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

1188 JOURNAI.OF POLITICAL ECONOMY Harris and Raviv (1993),Kandel and Pearson (1995),and Kyle and Lin (2002)study models in which trading is generated by heterogeneous beliefs.However,in all these models there is no speculative component in prices. Psychology studies suggest that people overestimate the precision of their knowledge in some circumstances,especially for challenging judg- ment tasks (see Alpert and Raiffa 1982;Lichtenstein,Fischhoff,and Phillips 1982).Camerer (1995)argues that even experts can display overconfidence.A similar phenomenon is illusion of knowledge,the fact that persons who do not agree become more polarized when given arguments that serve both sides (Lord,Ross,and Lepper 1979)(see Barber and Odean [2001]and Hirshleifer [2001]for reviews of this literature).In finance,researchers have developed theoretical models to analyze the implications of overconfidence on financial markets (see, e.g.,Kyle and Wang 1997;Daniel,Hirshleifer,and Subrahmanyam 1998; Odean 1998;Bernardo and Welch 2001).In these papers,overconfi- dence is typically modeled as an overestimation of the precision of one's information.We follow a similar approach but emphasize the speculative motive generated by overconfidence. The bubble in our model,based on the recursive expectations of traders to take advantage of mistakes by others,is quite different from "rational bubbles"(see Blanchard and Watson 1982;Santos and Wood- ford 1997).In contrast to our setup,rational bubble models are inca- pable of connecting bubbles with turnover.In addition,in these models, assets must have (potentially)infinite maturity to generate bubbles.Al- though,for mathematical simplicity,we treat the infinite horizon case, the bubble in our model does not require infinite maturity.If an asset has a finite maturity,the bubble will tend to diminish as maturity ap- proaches,but it would nonetheless exist in equilibrium. Other mechanisms have been proposed to generate asset price bub- bles (e.g.,Allen and Gorton 1993;Allen,Morris,and Postlewaite 1993; Horst 2001;Duffie et al.2002).None of these models emphasize the joint properties of bubble and trading volume observed in historical episodes. III.The Model There exists a single risky asset with a dividend process that is the sum of two components.The first component is a fundamental variable that determines future dividends.The second is "noise."The cumulative dividend process D,satisfies dD,fdt+opdz, (1) where Z"is a standard Brownian motion and op is a constant volatility Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 118g parameter.The fundamental variable fis not observable.However,it sarisfies 乐=-λ(f-f)du+o,d% (2) where A>0 is the mean reversion parameter,fis the long-run mean of f o>0 is a constant volatility parameter,and Z/is a standard Brownian motion.The asset is in finite supply,and we normalize the total supply to unity. There are two sets of risk-neutral agents.The assumption of risk neu- trality not only simplifies many calculations but also serves to highlight the role of information in the model.Since our agents are risk-neutral, the dividend noise in equation(1)has no direct impact in the valuation of the asset.However,the presence of dividend noise makes it impossible to infer fperfectly from observations of the cumulative dividend process. Agents use the observations of Dand any other signals that are correlated with fto infer current fand to value the asset.In addition to the cu- mulative dividend process,all agents observe a vector of signals s4 and sthat satisfy ds fdt +odz (3) and ds "fidt +odz", (4) where Z4 and Z"are standard Brownian motions,and o >0 is the com- mon volatility of the signals.We assume that all four processes Z,Z, Z,and Z"are mutually independent. Agents in group A (B)think of s(s)as their own signal,although they can also observe s"(s4).Heterogeneous beliefs arise because each agent believes that the informativeness of his own signal is larger than its true informativeness.Agents of group A(B)believe that innovations dz4 (dz")in the signal s4(s")are correlated with the innovations dz in the fundamental process,with (0<<1)as the correlation pa- rameter.Specifically,agents in group A believe that the process for s4 is ds,=fd+o,φdZ+oN1-ΦdZ Although agents in group A perceive the correct unconditional volatility of the signal s",the correlation that they attribute to innovations causes them to overreact to signal s4.Similarly,agents in group B believe that the process for s"is ds,“=fdt+o,dZ+o,v1-中dZ On the other hand,agents in group A (B)believe (correctly)that in- Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

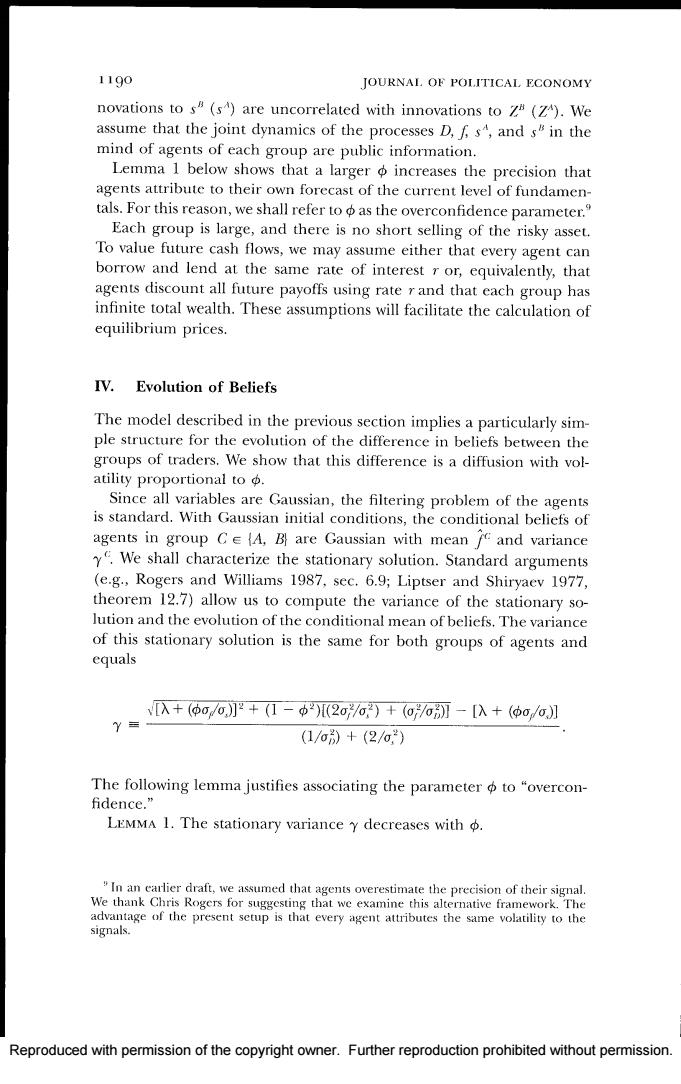

1190 JOURNAL.OF POLITICAL ECONOMY novations to s(s)are uncorrelated with innovations to z(Z).We assume that the joint dynamics of the processes D,fs",and s"in the mind of agents of each group are public information. Lemma 1 below shows that a larger o increases the precision that agents attribute to their own forecast of the current level of fundamen- tals.For this reason,we shall refer toas the overconfidence parameter. Each group is large,and there is no short selling of the risky asset. To value future cash flows,we may assume either that every agent can borrow and lend at the same rate of interest r or,equivalently,that agents discount all future payoffs using rate r and that each group has infinite total wealth.These assumptions will facilitate the calculation of equilibrium prices. IV.Evolution of Beliefs The model described in the previous section implies a particularly sim- ple structure for the evolution of the difference in beliefs between the groups of traders.We show that this difference is a diffusion with vol- atility proportional to o. Since all variables are Gaussian,the filtering problem of the agents is standard.With Gaussian initial conditions,the conditional beliefs of agents in group Ce(A,B are Gaussian with mean f and variance y.We shall characterize the stationary solution.Standard arguments (e.g.,Rogers and Williams 1987,sec.6.9;Liptser and Shiryaev 1977, theorem 12.7)allow us to compute the variance of the stationary so- lution and the evolution of the conditional mean of beliefs.The variance of this stationary solution is the same for both groups of agents and equals 入+(Φ0ōJ2+(I-中)[2oo)+(o/6别-[入+(φ0/6] (1/o)+(2/a,) The following lemma justifies associating the parameter o to "overcon- fidence." LEMMA 1.The stationary variance y decreases with "In an carlier draft,we assumed that agents overestimate the precision of their signal. We thank Chris Rogers for suggesting that we examine this alternative framework.The advantage of the present setup is that every agent attributes the same volatility to the signals. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

OVERCONFIDENCE 1191 In addition,the conditional mean of the beliefs of agents in group A satisfies r=-A-刀d+o+Yd4-ra0 09 +au-了40+品d0-了a. (5) Since fmean-reverts,the conditional beliefs also mean-revert.The other three terms represent the effects of "surprises."These surprises can be represented as standard mutually independent Brownian motions for agents in group A: dw (as"-pdo. (6) 0 dwg=(ds"-了d0, (7) and wg=上aD-r0. (8) Op Note that these processes are only Wiener processes in the mind of group A agents.Because of overconfidence (>0),agents in group A overreact to surprises in s4. Similarly,the conditional mean of the beliefs of agents in group B satisfies 少=-0-刀l+品k-j0 +-a0. (9) Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission

1192 JOURNAL.OF POLITICAL ECONOMY and the surprise terms can be represented as mutually independent Wiener processes: dw"=-(ds"-fdt), 0 dWg=二(ds“-0, 0 dw=三(dD-0. Op These processes are a standard three-dimensional Brownian motion only for agents in group B. Since the beliefs of all agents have constant variance,we shall refer to the conditional mean of the beliefs as their beliefs.We let ga and g"denote the differences in beliefs: g1=-,g"=1- The next proposition describes the evolution of these differences in beliefs. PROPOSITION 1. dg=-pg'dt+odw., where +o+0-(层+》 0=200, and wa is a standard Wicner process for agents in group A,with in- novations that are orthogonal to the innovations of f. Proposition 1 implies that the difference in beliefs g*follows a simple mean-reverting diffusion process in the mind of group A agents.In particular,the volatility of the difference in beliefs is zero in the absence of overconfidence.A larger leads to greater volatility.In addition, -p/202 measures the pull toward the origin.A simple calculation shows that this mean reversion"decreases with o.A higher causes an increase in fluctuations of opinions and a slower mean reversion. In an analogous fashion,for agents in group B,gasatisfies dg"=一pgh+oW, "Conley et al.(1997)arguc that this is the correct measure of mean reversion. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission