Pricing an Emerging Industry: Evidence from Internet Subsidiary Carve-outs Michael J.Schill and Chunsheng Zhou* We examine price behavior in the emerging Internet industry by comparing investor valuation of Internet subsidiary curve-outs with that of the parent.We provide examples of parent firms whose Internet carve-out holdings exceed the market value of the entire parent by a large umount and over an extended period of time.The results suggest thut an important clientele of investors place greater value on direct internet asset holdings than indirect holdings via the parent.and that arbitrage costs accommodate prolonged mispricing.We find that such price behavior is not exclusively an Internet sector result.but occurs in other emerging industries. In the late 1990s,popular opinion held that equity in the emerging Internet industry was richly priced.Economists face some difficulty testing such an assertion using the standard "no- arbitrage principle"because of the difficulty in obtaining well-priced asset comparables.In our paper,we use the development of the Internet equity carve-out transaction to provide the dual- asset features required for testing the pricing characteristics of Internet equity. In an equity carve-out,a parent company raises money by selling stock in a fraction of a previously wholly owned subsidiary.The attractive feature of the carve-out is that we can use it to compare how investors value two parallel assets,the value of the subsidiary directly traded in the market,and the value of the subsidiary embedded in the consolidated firm.By the law of one price,assets with identical payouts maintain identical prices,and assets with inferior payouts maintain inferior prices.Notwithstanding the various value gains or losses created by such structural ownership changes,the law of one price prescribes a particular pricing relation for equity carve-outs.That is,in a world without market frictions and agency costs,the market value of a parent's stake in a carve-out must not exceed the total market value of the parent. The universe of Internet-related carve-outs in the United States is examined through June 2000.A parent company's Internet subsidiary generally contributes a disproportionate amount of wealth to the parent.An example is provided in which the implied value of the parent's holdings in the Internet subsidiary is twice the total market capitalization of the parent.In fact, for four of the 12 Internet subsidiary carve-outs in our study,the value of the parent's holdings exceeds the total value of the parent company.We find that these striking valuation relations hold over extended periods of time (i.e.,several months). The parent-to-subsidiary value relation in Internet carve-outs is similar to the fund-to-net- We are gruteful to Randy Beatty.Cary Collins.Wayne Ferson.Larr Hurris,Rocky Higgins.Jaemin Kim,Owen Lumont.Paul Malaresta.David Mavers.Ed Miller.Mark Mitchell.Jeffrey Pontiff.Raghavendra Rau.Ed Rice. Sergei Sarkissian.Jim Sewurd.Mark Stohs,an anonymous referee.und seminar participants at the 2000 Berkeley Program in Finance.California State University-Fullerton:Universin of Virginia:University of Wushington:2000 annual meetings of the European Finance Asxociation and Southern Finance Association:and the 2001 meelings of the American Finance Association for useful comments.We a.so thank Daniel Burke.Jason Burnett.Ruslana Devkun.Vladimir Kolchin,Duvid Mao.Wilma Suen.and Amher Zhuo for research assistance. 'Michael J.Schill is an Assistant Professor at the University of Virginia.Chunsheng Zhou is a Professor at Peking Universitv.This resaarch was conducted while hoth authors were ut the University of California at Riverside. Financial Management.Autumn 2001.pages 5-33

6 Financial Management.Autumn 2001 asset-value relation characteristic of closed-end funds.In both cases,the indirect holdings of the traded assets sell at a discount to the direct holdings.The application of traditional closed-end-fund discount explanations to the Internet carve-out pricing phenomenon is evaluated.Taxes,dilution,illiquidity discounts,and agency costs do not fully explain the magnitude and time-series characteristics of the pricing relation.Internet carve-outs tend to be held by individual investors with aggressive trading behavior and arbitrage in these shares is constrained.We conclude that an important clientele of investors places a greater value on direct asset holdings of emerging industries,such as the Internet industry,than it does on indirect holdings via the parent.Similar price behavior among non-Internet carve- outs from other emerging industries is also observed.Such findings corroborate those of Lee, Shleifer,and Thaler(1991)for closed-end funds:bullishly biased investor clientele and sufficiently large arbitrage constraints allow indirect holdings to trade at substantial discounts to direct holdings. Our findings also have strong managerial implications.The evidence supports Nanda's (1991)hypothesis of opportunistic carve-out behavior,in which parent companies choose carve-out transactions when the subsidiary is priced richly relative to the parent.In an asymmetric information setting,Nanda's firms prefer carve-outs when the subsidiary is overvalued and the parent is undervalued,and vice-versa for parent equity.Miller (1977, 1995)emphasizes that arbitrage constraints allow such opportunistic financing behavior to persist in equilibrium.Evidence by Slovin,Sushka,and Ferraro(1995)also supports findings that firms conduct carve-outs when outside investors attach higher values to the subsidiary than do managers. This paper illustrates the potential magnitude of valuation discrepancies available to managers in Nanda's setting.The evidence from our small sample does not support the much broader generalization of Vijh(1999),who uses long-run performance to argue that carve-outs are fairly priced.Vijh suggests that reputational effects may discourage parents from selling overpriced subsidiary equity,since carve-outs generally represent a small fraction of parent market value.Perhaps for emerging industries in which the potential mispricing is particularly large,the reputational effects are dominated by the immediate wealth gains to parents The paper proceeds as follows.Section I provides an overview of Internet subsidiary carve-outs in the 1990s.In Section Il,empirical tests of various traditional explanations for carve-out pricing behavior are examined.Section IlI examines in detail opportunistic timing as an explanation for the observed pricing.In Section IV,we compare the Internet industry evidence to that of other industries.Section V summarizes and concludes. I.Internet Subsidiary Carve-outs An equity carve-out is defined as an event in which the parent sells equity claims in a subsidiary through a public cash offering,but retains a majority holding in the carved out subsidiary for financial reporting,tax,or control considerations.The transaction enables the parent to raise new capital for both itself and its subsidiary by selling primary shares in the subsidiary.This process mirrors the initial public offering process of an independent company.Following the transaction,the new publicly traded subsidiary becomes a separate entity with distinct equity share certificates.Following the carve-out,investors may purchase claims on the subsidiary in two ways:directly through subsidiary shares or indirectly through the parent shares.This approach lets us test the relative pricing relation of traditional tests of"no arbitrage"pricing efficiency by comparing investor valuations of the parallel asset prices

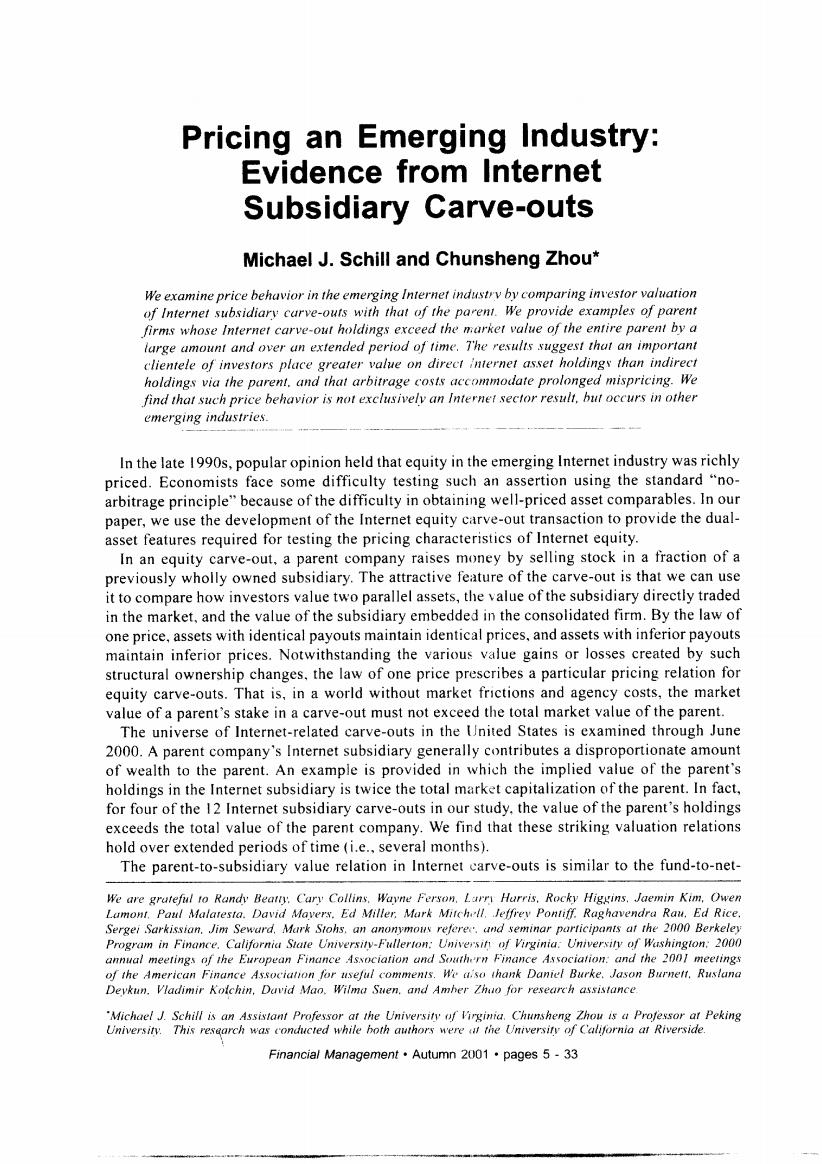

Schill Zhou.Pricing an Emerging Industry 7 The primary source for our sample is the SDC Global Corporate Financings database of Thomson Financial Securities Data,which we modify slightly for a few event omissions.For our sample.a carve-out is defined as a public sale ofiess than a 50%stake in what had been a wholly owned subsidiary by one parent company.I or our sample.both the parent and the subsidiary must be US firms.In practice.the definition of a carve-out can be much broader. Parent companies can use a number of alternative subsidiary restructuring mechanisms. such as spin-offs.private sales.joint-venture carve-outs.tracking-stock carve-outs.and divestiture offerings.' Table I presents summary data for the Internet carve-out sample.The sample of 12 observations is small.but nevertheless large enough to capture the entire universe of US Internet-related carve-outs through June 2000.'The 12 subsidiaries provide retail Internet service (Compuserve).maintain on-line retail operat:ons [Expedia (travel),iTurf(apparel). Hotel Reservations Network (accommodations).MeAfee.com (computer support). T'icketmaster Online-City Search (entertainment),and uBid(computer hardware and software)]. or provide commercial Internet products or consulting services (Digex.eFunds.PFSWeb, Retek.and Xpedior).The carve-outs'respective parent companies operate to varying degrees non-on-line operations in the same industries as the r Internet subsidiaries. The filing date (the date of the original S-I filing with the SEC.which generally corresponds to the announcement date).the offer date (the first day of public trading),and the fraction of stock ownership retained by the parent is listed.The fraction retained varies from USA Networks'(USAl)61%ownership of Ticketmaster Online-City Search to the 88 retention of eFunds by Deluxe Corp. To compare the size of the carve-out relative to its parent.we compute the fraction of total parent value comprised of by the parent's holdings in the subsidiary.The first measure is based on book values.We divide the subsidiary's book equity and debt held by the parent for the earliest date following the offering by the total consolidated book value of the parent as follows: Book Value Ratio B、S+Ds (1) BS+D where B and B,are the respective per share values of book equity for the subsidiary and parent.S.is the number of subsidiary equity shares held by the parent.S,is the number of parent shares.D.is the book value of subsidiary liabilities owed to the parent.D is the book value of total parent liabilities.Although B..S,+/)is equal to the total assets of the parent.B S+D is only equal to the total subsidiary claims to the parent. Book value ratios vary between 0.001 for Expedia to more than 0.414 for iTurf(TURF).For most of the carve-outs.the holdings of the subsidary are modest relative to the parent For a discussion of the institutional features of'these uther resiructuring transactions.see Slovin.Sushka.and Ferraro (19951.Michacly and Shaw (1995).and Logue.Seward.and Walsh (1996). 'We use the industry classifications of IP()Data Systems to copstruet our Internet carveout sample.All carve- outs belonging to the "Internet"industry are ineluded in our sampie IPO Data Systems classification with SEC filing and company weh site descriptions are verified.Our review resulted in the reclassification of two carve-outs: uBid.classified hy IP()Data Systems as a retailer.derives all of'its revenue from its on-line auction business and Retek,classified by IPO Data Systems as high-tech,which provides sofiware for Internet retailing.Over this period.there are also several Internet jeint-venture carve-outs IMarketwatch.com.barnesandnohle.com.and Net?Phone)and Internet tracking stock offerings (DLIdireet and /DNet)which are exeluded due to the material diflerences of ownership and risk from the standard carve-out

Financial Management·Autumn 2001 (ueaW) ISSO 152.0 1000 z000 690.0 S8E0 4101 66t:1 853.0 9190 8.20 400.0 0551 692.0 SSI'I 8850 686.0 089.0 283.0 8200 90c.0 女100 4140 280.0 1000 81T0 862.0 000.0 82-0 28.0 108.0 15V.0 8670 400.0 443.0 1008.0 095.0 L100 108.0 008.0 aled ajo 46/90h 66262/L 000/0/9 66/6/t 00062/2 66/1/tI 66/1/I 66/LI/1 86/E/ZI 86/t/I 66/sI/ ea 6ull! 6/02/2 000k0t 56/EZ/6 66/SZ/I 66/6yL 66/EZ/6 B/装C/6 660l/6 96/0016 86/C10 66981/0 (XId)axnped (IVSn)SXIOMION vSn apImplOM owBlaW (MMWN Kelpisqns (XOI)xaId (SOWD)SO (dIgn)p!gn

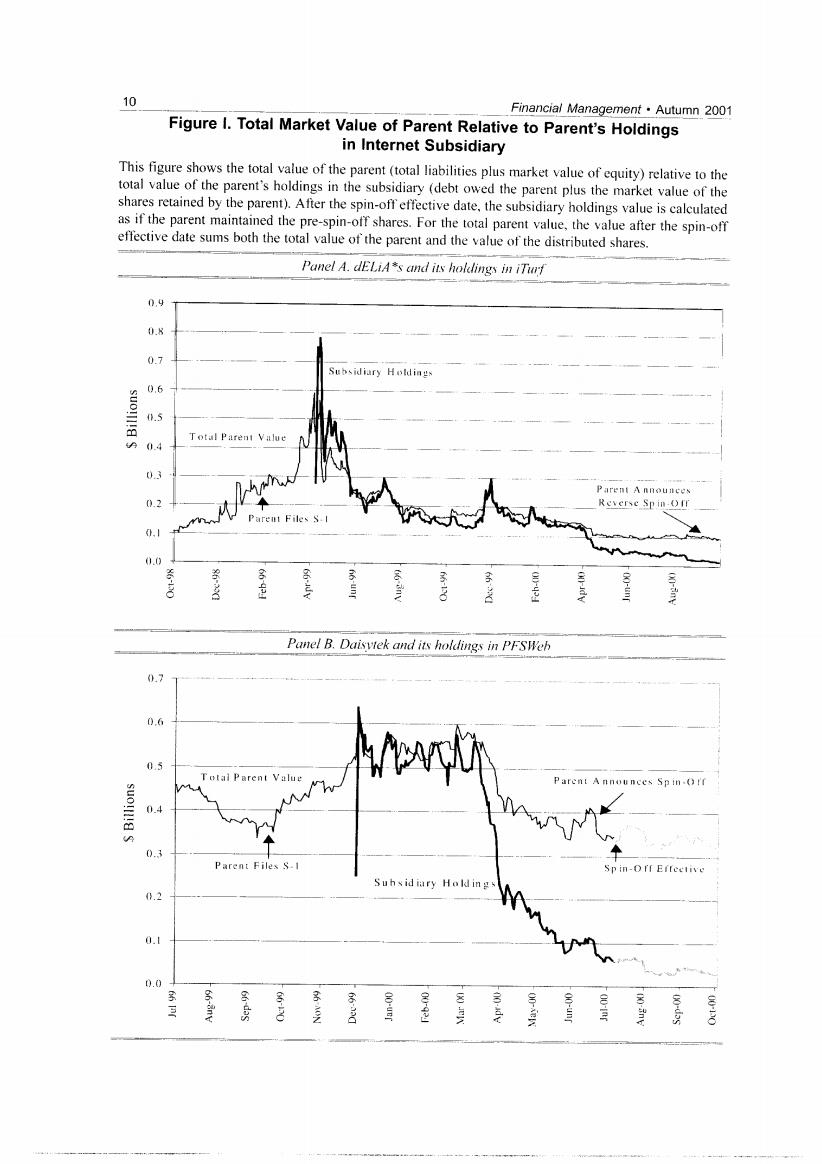

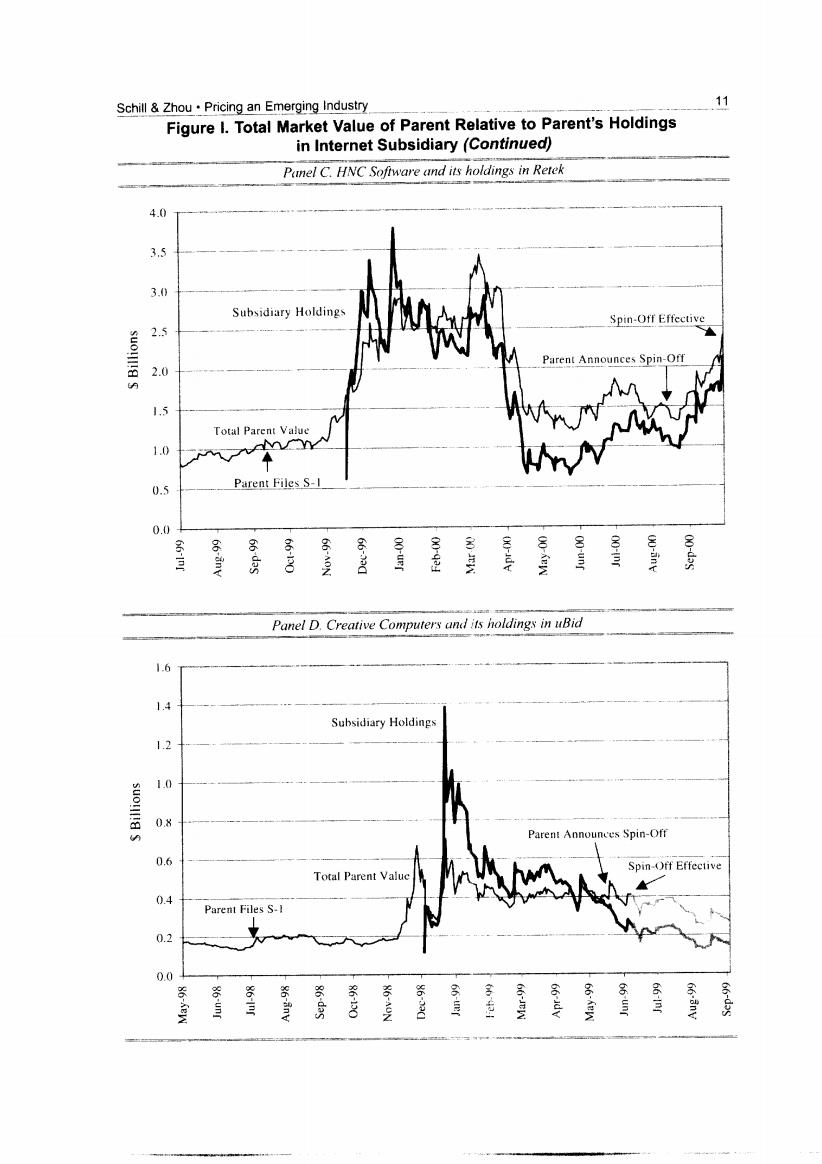

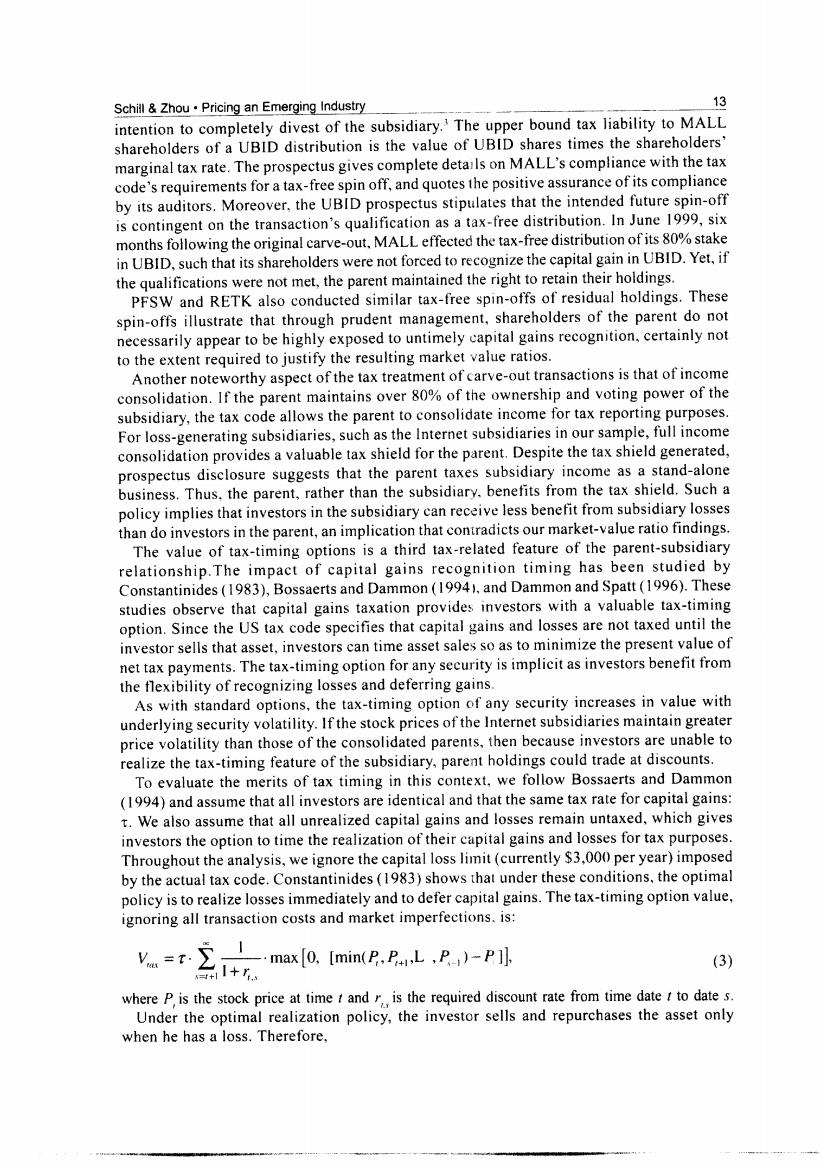

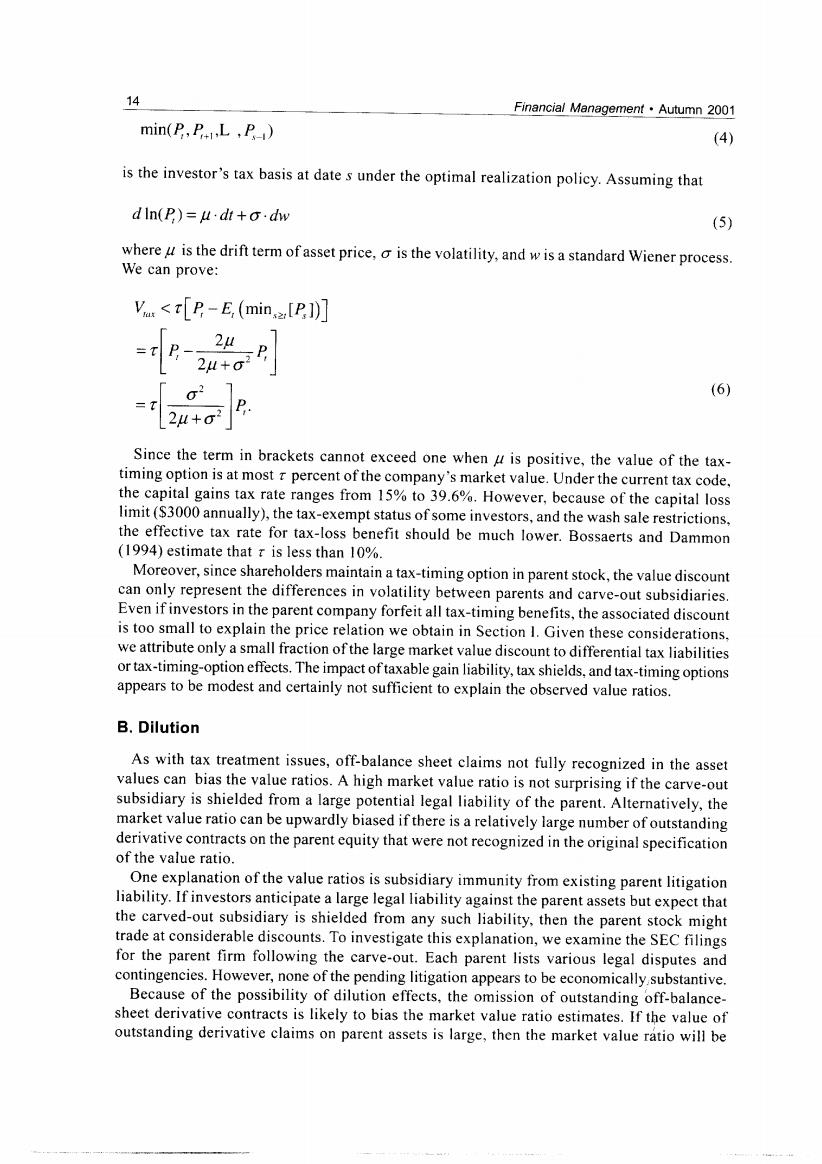

Schill Zhou.Pricing an Emerging Industry assets (book value ratios are below 0.20 for eight of the 12 carve-outs). The total market value of the parent's remaining holdings in the carve-out subsidiary relative to the parent's total market value is also compared.We compute the value of the subsidiary holdings as the product of the closing price of subsidiary shares and the number of shares held by the parent plus the debt owned the parent.Using prices at the close of the first trading day,the value of the holdings is divided by the total capitalization of the parent (including book value of liabilities).The market value ratio is computed as: Market Value Ratio PSsip+Dsr (2) P S.+D where P and P are the respective per share market prices for equity for the carve-out subsidiary and the parent. Financial statement items for days that do not correspond to a reporting date are estimated by straight-line interpolation.Since this ratio represents the fraction of a parent's value of which the carve-out subsidiary holdings is comprised,we generally expect this ratio to be well below one.Even when we assign the residual part of the business a zero value(despite the fact that in all cases it represents the majority of the parent's assets),the value of the parent firm's holdings in the subsidiary should not cxceed one.This is not the case. In Table I,we see that on the close of the first day of trading,the market value ratio for both TURF and PFSWeb(PFSW)are 1.45 and 1.16.respectively.Because such a result may be unique to the price discovery difficulties of the subsidiary's first trading day,we calculate the mean value ratio by using the closing prices during the first month of trading.Mean value ratios over the first month of'trading are 1.36 for TURF,1.02 for PFSW,1.19 for Retek (RETK),and 1.30 for uBid (UBID). The relative value relation appears to persist over the first month of trading.Although. the identification of cases where the market value of a parent's holdings in a subsidiary exceeds the entire market value of the consolidated parent firm is notable;even some of the market value ratios below one are impressive.given the relative proportion of assets. Over the first month,the market value ratio of Ticketmaster Online-City Search is ten times its book value ratio;the value ratio of Xpedior is 0.86,but its book value ratio is just 0.18.Understanding the source of such unusual relative valuation provides the focus of this paper. We are not the first to observe examples of subsidiaries whose parent holdings exceed the total equity value of the parent.Laderman(1992).Holderness and Sheehan(1998),Brealey and Myers (1999).McGough(1999).and Partnoy (2000)discuss examples in which the value of a single or collection of subsidiaries exceeds the total value of the parent firm.Cornell and Liu (2000)and Lamont and Thaler (2000)provide detailed discussions of examples of subsidiary holdings in the more general technology sector that trade for more than their respective parent's value. Figure I shows the movements of the subsidiary holdings to total parent value over time for the four carve-outs whose value ratio exceeds one on the first day,or over the first month of trading.The four carve-outs are TURF,PFSW,RETK,and UBID.Each example shows immediate appreciation in the parents'holdings in the offering during the first day of trading and then continuing for extended periods of time.Nearly three weeks after UBID's carve- out.the value of the parent holdings in UBID exceeded the total value of the parent by 100%. The residual assets of Creative Computer(MALL).which comprised over 80%of the parent's

10 Financial Management.Autumn 2001 Figure I.Total Market Value of Parent Relative to Parent's Holdings in Internet Subsidiary This figure shows the total value of the parent(total liabilities plus market value of equity)relative to the total value of the parent's holdings in the subsidiary (debt owed the parent plus the market value of the shares retained by the parent).After the spin-off effective date,the subsidiary holdings value is calculated as if the parent maintained the pre-spin-off shares.For the total parent value,the value after the spin-off effective date sums both the total value of the parent and the value of the distributed shares. Panel A.dELiA*s and its holdlings in iTurf 0.9 0.8 0.7 Subsidiary Holdings 0.6 0.5 Total Parent Value 0.4 0.3 Parent A nnounces 0.2 Reverse Spin-Of Parent Files S. 01 .0 Panel B.Daisvtek and its holdings in PFSWeh 0.7 0.6 05 Total Parent Value D Parent A nnounces Spin.O!f suolll!as 0.4 0.3 Parent Files S-1 Sp in-OIf Effeetive Suhsid iary Holdin g 0.2 0.1 0.0

Schill Zhou.Pricing an Emerging Industry 11 Figure I.Total Market Value of Parent Relative to Parent's Holdings in Internet Subsidiary(Continued) Panel C.HNC Software and its holdings in Retek 4.0 3.5 3.0 Subsidiary Holdings Spin-Off Effective 2.5 Parent Announces Spin-Off 2.0 1.5 Total Parent Value 1.0 0.5 Parent Files S-1. 0.0 6 Panel D.Creative Computers and its holdings in uBid 1.6 1.4 Subsidiary Holdings 1.2 1.0 0.8 Parent Announces Spin-Off 0.6 Spin-Off Effective Total Parent Valuc 0.4 Parent Files S-】 丛以 0.2 00 6-o

12 Financial Management Autumn 2001 total assets,appear to have traded at an implied value of less than-$750 million relative to the value for the consolidated parent company of only S600 million.The pricing patterns emphasize that the subsidiary premium is not a short-run,transitional phenomenon,but one which can and does persist for months following the offering. Coincidental with the severe drop of Internet stocks in April 2000,the three subsidiaries still trading through April 2000(UBID was subsequently acquired by CMGI)show a substantial reduction in the value of the subsidiary holdings.The April 2000 value decline is unique to the subsidiary holdings.The consolidated parent values show much less (if any) decrease in value over the April 2000 period.This pattern appears to ignore the substantial drop in value of the parent's most valuable portfolio holding Il.Internet Carve-outs and Traditional Explanations The parent-holding-value-to-total-parent-value relations of Internet carve-outs is similar to the net-asset-value-to-fund-value relations of closed-end mutual funds.In both cases, the indirect holdings of the traded assets sell at a sizeable discount in the market.Because the closed-end fund puzzle has been extensively studied,a review of the closed-fund puzzle literature can shed some light on the puzzle of Internet carve-out pricing.The related nature of Internet carve-out pricing and the closed-end fund discount provides a forum to better understand both phenomena. A.Taxes Subsidiary holding values could be greater than parent values due to tax treatment.For closed-end funds,fund prices might trade at a discount to net asset value because capital gains tax must be paid by the fund if positions within the fund are unwound(Pratt,1966). The tax liability for assets that have appreciated in value reduces the liquidation value of the funds'assets. The parent of a carve-out subsidiary might also trade at a substantial discount to the subsidiary if investors anticipate a large tax liability against the parent upon the sale or distribution of the subsidiary holdings.Since the market value of the subsidiary relative to its tax basis can be large,possible recognition of the capital gain exposes the parent shareholders to a large tax liability. However,the US tax code allows subsidiaries to be spun off to shareholders without capital gain recognition.To avoid capital gain recognition,Section 355 of the US Internal Revenue Code of 1986 requires that the transaction have a valid business purpose rather than merely a tax avoidance motivation,that the parent and subsidiary continue in their respective business operations,that the distribution be sufficiently great so that the parent no longer retains control of the subsidiary,and that the majority of the voting or ownership rights of the parent or subsidiary not be later acquired by a single entity.These qualifications do not appear to be binding for our sample subsidiaries.Parent companies that anticipate a future sale and are exposed to such tax liability are generally careful to follow the tax code provisions. The UBID carve-out is a case in point.UBID's prospectus fully reveals the parent's "The Parent has announced that,subject to certain conditions,the Parent intends to consummate the Offering. to separatc the Company.which owns and operates the Parent's online auction business,from the Parent's other operations and businesses and to distribute to its shareholders all of the Common Stock owned by the Parent in no-event prior to 180 days after consummation of the Offering."uBid Prospectus,1998,page 23

Schill Zhou.Pricing an Emerging Industry 9 intention to completely divest of the subsidiary.The upper bound tax liability to MALL shareholders of a UBID distribution is the value of UBID shares times the shareholders marginal tax rate.The prospectus gives complete details on MALL's compliance with the tax code's requirements for a tax-free spin off,and quotes the positive assurance of its compliance by its auditors.Moreover,the UBID prospectus stipulates that the intended future spin-off is contingent on the transaction's qualification as a tax-free distribution.In June 1999,six months following the original carve-out,MALL effected the tax-free distribution of its 80%stake in UBID,such that its shareholders were not forced to recognize the capital gain in UBID.Yet,if the qualifications were not met,the parent maintained the right to retain their holdings PFSW and RETK also conducted similar tax-free spin-offs of residual holdings.These spin-offs illustrate that through prudent management,shareholders of the parent do not necessarily appear to be highly exposed to untimely capital gains recognition,certainly not to the extent required to justify the resulting market value ratios. Another noteworthy aspect of the tax treatment of carve-out transactions is that of income consolidation.If the parent maintains over 80%of the ownership and voting power of the subsidiary,the tax code allows the parent to consolidate income for tax reporting purposes. For loss-generating subsidiaries,such as the Internet subsidiaries in our sample,full income consolidation provides a valuable tax shield for the parent.Despite the tax shield generated, prospectus disclosure suggests that the parent taxes subsidiary income as a stand-alone business.Thus,the parent,rather than the subsidiary.benefits from the tax shield.Such a policy implies that investors in the subsidiary can receive less benefit from subsidiary losses than do investors in the parent,an implication that contradicts our market-value ratio findings. The value of tax-timing options is a third tax-related feature of the parent-subsidiary relationship.The impact of capital gains recognition timing has been studied by Constantinides(1983),Bossaerts and Dammon(1994),and Dammon and Spatt(1996).These studies observe that capital gains taxation provides investors with a valuable tax-timing option.Since the US tax code specifies that capital gains and losses are not taxed until the investor sells that asset,investors can time asset sales so as to minimize the present value of net tax payments.The tax-timing option for any security is implicit as investors benefit from the flexibility of recognizing losses and deferring gains. As with standard options,the tax-timing option of any security increases in value with underlying security volatility.If the stock prices of the Internet subsidiaries maintain greater price volatility than those of the consolidated parents,then because investors are unable to realize the tax-timing feature of the subsidiary,parent holdings could trade at discounts. To evaluate the merits of tax timing in this context,we follow Bossaerts and Dammon (1994)and assume that all investors are identical and that the same tax rate for capital gains: t.We also assume that all unrealized capital gains and losses remain untaxed,which gives investors the option to time the realization of their capital gains and losses for tax purposes. Throughout the analysis,we ignore the capital loss limit(currently $3,000 per year)imposed by the actual tax code.Constantinides(1983)shows that under these conditions,the optimal policy is to realize losses immediately and to defer capital gains.The tax-timing option value, ignoring all transaction costs and market imperfections.is: vmax[9.(min(.1 1+r (3) where P is the stock price at time t and r is the required discount rate from time date t to date s. Under the optimal realization policy,the investor sells and repurchases the asset only when he has a loss.Therefore

14 Financial Management.Autumn 2001 min(P,PLP) (4) is the investor's tax basis at date s under the optimal realization policy.Assuming that dln(P)=·dt+o·dhw (5) where u is the drift term of asset price,o is the volatility,and w is a standard Wiener process. We can prove: V<[P-E (min,[P1)] n-zui H+02 02 (6) =T 24+σ Since the term in brackets cannot exceed one when u is positive,the value of the tax- timing option is at most r percent of the company's market value.Under the current tax code, the capital gains tax rate ranges from 15%to 39.6%.However,because of the capital loss limit($3000 annually),the tax-exempt status of some investors,and the wash sale restrictions, the effective tax rate for tax-loss benefit should be much lower.Bossaerts and Dammon (1994)estimate that r is less than 10%. Moreover,since shareholders maintain a tax-timing option in parent stock,the value discount can only represent the differences in volatility between parents and carve-out subsidiaries. Even if investors in the parent company forfeit all tax-timing benefits,the associated discount is too small to explain the price relation we obtain in Section I.Given these considerations, we attribute only a small fraction of the large market value discount to differential tax liabilities or tax-timing-option effects.The impact of taxable gain liability,tax shields,and tax-timing options appears to be modest and certainly not sufficient to explain the observed value ratios. B.Dilution As with tax treatment issues,off-balance sheet claims not fully recognized in the asset values can bias the value ratios.A high market value ratio is not surprising if the carve-out subsidiary is shielded from a large potential legal liability of the parent.Alternatively,the market value ratio can be upwardly biased if there is a relatively large number of outstanding derivative contracts on the parent equity that were not recognized in the original specification of the value ratio. One explanation of the value ratios is subsidiary immunity from existing parent litigation liability.If investors anticipate a large legal liability against the parent assets but expect that the carved-out subsidiary is shielded from any such liability,then the parent stock might trade at considerable discounts.To investigate this explanation,we examine the SEC filings for the parent firm following the carve-out.Each parent lists various legal disputes and contingencies.However,none of the pending litigation appears to be economically substantive. Because of the possibility of dilution effects,the omission of outstanding off-balance- sheet derivative contracts is likely to bias the market value ratio estimates.If the value of outstanding derivative claims on parent assets is large,then the market value ratio will be