正在加载图片...

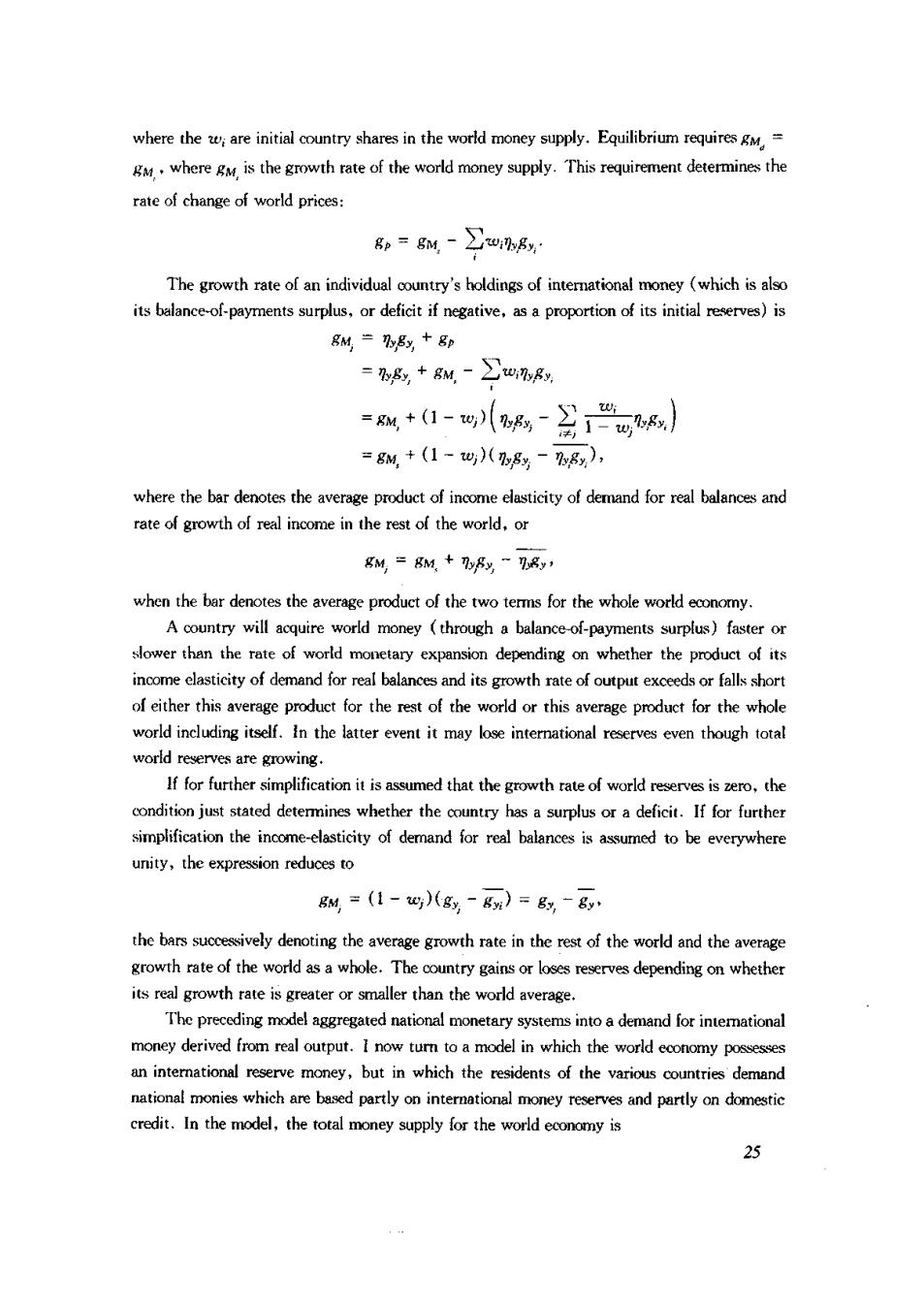

where theare shares in the world money supply.Equilibriumrequires where is the growth rate of the world money supply.This requirement determines the rate of change of world prices: 8=gM-∑awg The growth rateofn individual ouny's holdings of intemational money(which is als its balance-of-payments surplus,or deficit if negative,as a proportion of its initial reserves)is 8制=乃5影+8n =%8+g8别-∑ug %+1,多6小 =g别+(1-四(%5-w品), where the bar denotes the average product of inme elasticity of demand for real balances and rate of growth of real income in the rest of the world,or g8M=8M+75y7, A counry will acquire world money (through a balance-of-payments surplus)fasteror slower than the rate of world monetary expansion depending on whether the product of its income clasticity of demnd for real baances and its growthrate of output ofther thisverdct for the etofe ord or this averngefor thewhole world including itself.In the latter event it may lose international reserves even though total world reserves are growing. If for further simplification it is assumed that the growth rate of world reserves is zero,the ondition ust stated determines whether the coury has a surplusor a deficit.If for further simplification the inme-elasticity of demand for real balances tobe everywhere unity,the expression reduces to 8别=(1-q(8影-8对)=6-8、 the bars successively denoting the average growth rate in the rest of the world and the average growthrateof the world as a whole.dependingon whether its real growth rate is greater or smaller than the world average. The preceding model aggregated national monetary systems into a demand for interational an international reserve money,but in which the residents of the various countries demand national monies which are based partly on interational money reserves and partly on domestic credit.In the model,the total money supplyfor the 25