正在加载图片...

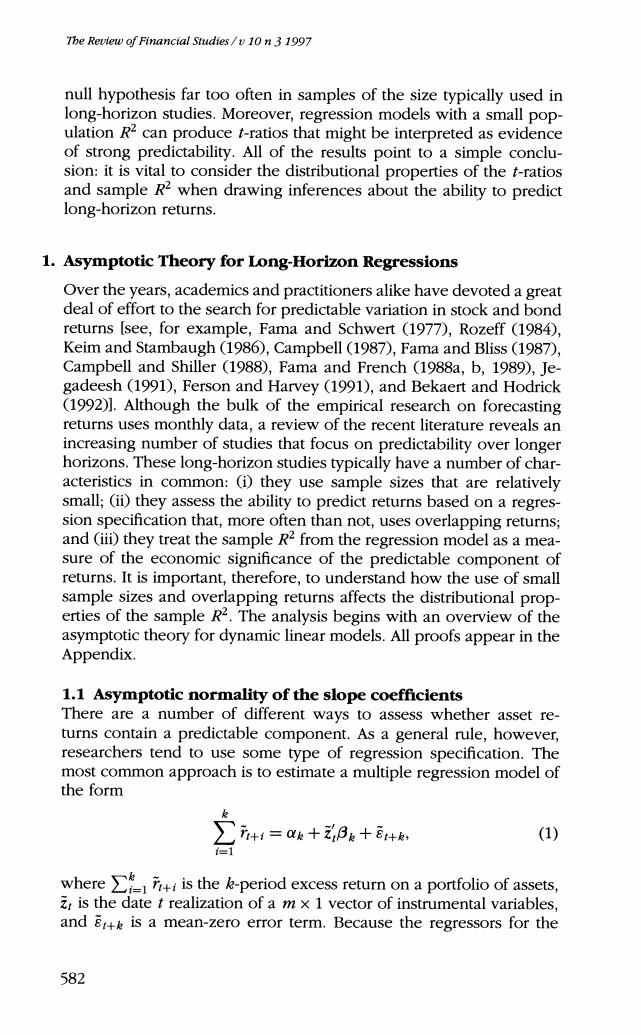

The Review of Financial Studies/v 10 n 3 1997 null hypothesis far too often in samples of the size typically used in long-horizon studies.Moreover,regression models with a small pop- ulation R2can produce t-ratios that might be interpreted as evidence of strong predictability.All of the results point to a simple conclu- sion:it is vital to consider the distributional properties of the t-ratios and sample R2 when drawing inferences about the ability to predict long-horizon returns. 1.Asymptotic Theory for Long-Horizon Regressions Over the years,academics and practitioners alike have devoted a great deal of effort to the search for predictable variation in stock and bond returns [see,for example,Fama and Schwert (1977),Rozeff (1984), Keim and Stambaugh (1986),Campbell (1987),Fama and Bliss(1987), Campbell and Shiller (1988),Fama and French (1988a,b,1989),Je- gadeesh(1991),Ferson and Harvey (1991),and Bekaert and Hodrick (1992)1.Although the bulk of the empirical research on forecasting returns uses monthly data,a review of the recent literature reveals an increasing number of studies that focus on predictability over longer horizons.These long-horizon studies typically have a number of char- acteristics in common:(i)they use sample sizes that are relatively small;(i)they assess the ability to predict returns based on a regres- sion specification that,more often than not,uses overlapping returns; and (iii)they treat the sample R2from the regression model as a mea- sure of the economic significance of the predictable component of returns.It is important,therefore,to understand how the use of small sample sizes and overlapping returns affects the distributional prop- erties of the sample R2.The analysis begins with an overview of the asymptotic theory for dynamic linear models.All proofs appear in the Appendix. 1.1 Asymptotic normality of the slope coefficients There are a number of different ways to assess whether asset re- turns contain a predictable component.As a general rule,however, researchers tend to use some type of regression specification.The most common approach is to estimate a multiple regression model of the form 元+i=十B6十8+k, (1) whereis the -period excess return ona portfolio of assets, E is the date t realization of a m x 1 vector of instrumental variables, and is a mean-zero error term.Because the regressors for the 582