正在加载图片...

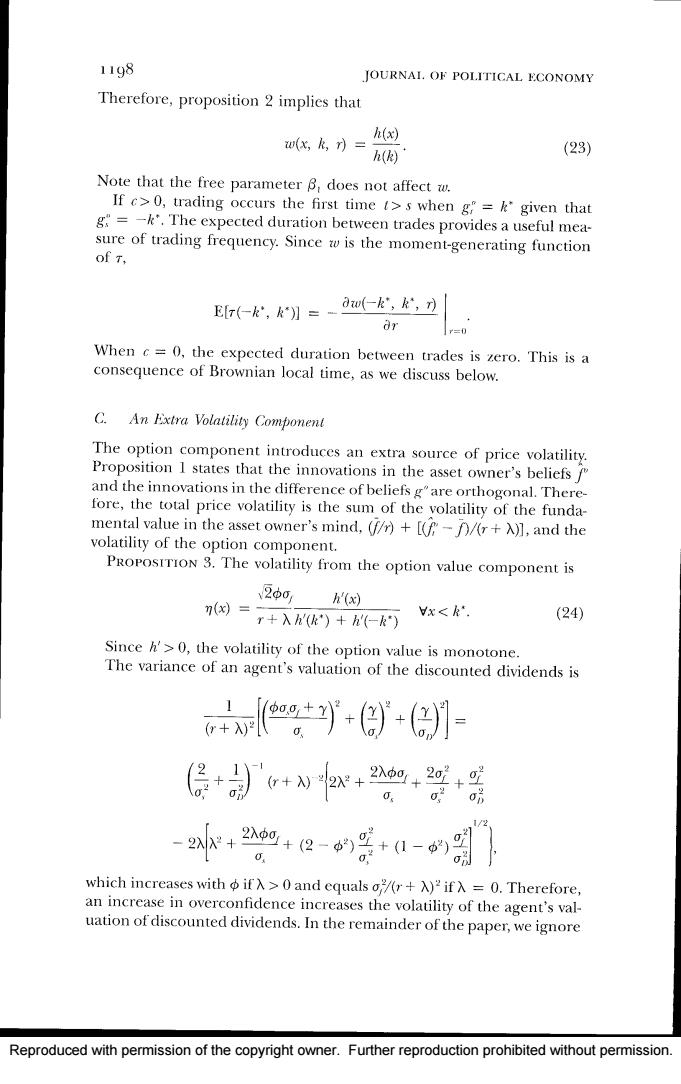

1198 JOURNAI.OF POLITICAL ECONOMY Therefore,proposition 2 implies that w(,k,)= () h() (23) Note that the free parameter B does not affect w. If c>0,trading occurs the first time t>s when g"=k'given that g=-k'.The expected duration between trades provides a useful mea- sure of trading frequency.Since w is the moment-generating function of T, E7(-,k'】=- aw(-k,k,t) or When c=0,the expected duration between trades is zero.This is a consequence of Brownian local time,as we discuss below. C.An Extra Volatility Component The option component introduces an extra source of price volatility. Proposition 1 states that the innovations in the asset owner's beliefs f and the innovations in the difference of beliefs g"are orthogonal.There- fore,the total price volatility is the sum of the volatility of the funda- mental value in the asset owner's mind,(fr)+[(f-A)/(r+A)],and the volatility of the option component. PRoPOSTTIoN 3.The volatility from the option value component is 201 (x) n(x)= r+入z(k)+h'(-k) Vx<k'. (24) Since h'>0,the volatility of the option value is monotone. The variance of an agent's valuation of the discounted dividends is wy+月+(g- +月'+2x+2+2g+ 0 2g+2-g三+1- 0别 which increases with o if入>0 and equals o,/r+入)ifλ=0.Therefore, an increase in overconfidence increases the volatility of the agent's val- uation of discounted dividends.In the remainder of the paper,we ignore Reproduced with permission of the copyright owner.Further reproduction prohibited without permission.Reproduced with permission of the copyright owner. Further reproduction prohibited without permission